Filed Pursuant to Rule 424(b)(3)

Registration No. 333-204209

The information in this preliminary prospectus supplement is

not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities, and we are not soliciting an offer to buy these securities, in any jurisdiction where the offer or

sale is not permitted.

SUBJECT

TO COMPLETION

PRELIMINARY PROSPECTUS SUPPLEMENT DATED NOVEMBER 7, 2017

P R E L I M I N A R Y P R O S P E C T U

S S U P P L E M E N T

(To Prospectus Dated May 15, 2015)

17,000,000 Shares

Allegheny Technologies Incorporated

Common Stock

We are offering

17,000,000 shares of our common stock, par value $0.10 per share (“common stock”). We have granted the underwriter the option to purchase up to 2,550,000 additional shares of common stock from us. See the section of this prospectus

supplement entitled “Underwriting” beginning on page

S-25

of this prospectus supplement.

We intend to use the net proceeds of this offering to redeem our 9.375% Senior Notes due 2019 (the “2019 Notes”) and for general

corporate purposes.

Our common stock, par value $0.10 per share, is listed on the New York Stock Exchange under the trading symbol

“ATI.” The last reported sale price of our common stock on the New York Stock Exchange on November 6, 2017 was $25.84 per share.

Investing in

shares of common stock involves certain risks. See “

Risk Factors

” beginning on page

S-9

of this prospectus supplement and the reports we file with the Securities and

Exchange Commission pursuant to the Securities Exchange Act of 1934 incorporated by reference in this prospectus supplement and the accompanying prospectus to read about factors you should consider before making an investment in the shares of common

stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the

shares of common stock or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Public offering

price

|

|

|

Underwriting

discount(1)

|

|

|

Proceeds, before

expenses, to us

|

|

|

Per share

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

(1)

|

We refer you to “Underwriting” beginning on page

S-25

of this prospectus supplement for additional information regarding total underwriting compensation.

|

The underwriter expects to deliver the shares to purchasers on or about November , 2017.

Sole Bookrunning Manager

Goldman Sachs & Co. LLC

November , 2017

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes certain matters relating to us and this offering.

The second part, the accompanying prospectus dated May 15, 2015, gives more general information about securities we may offer from time to time, some of which may not apply to the shares of common stock offered by this prospectus supplement and

the accompanying prospectus. For information about our common stock, see “Description of Common Stock” in this prospectus supplement and “Description of Capital Stock — Common Stock” in the accompanying prospectus.

We are responsible for the information contained and incorporated by reference into this prospectus supplement and the accompanying prospectus

and in any related free writing prospectus we prepare or authorize. We have not authorized anyone to give you any other information, and we take no responsibility for any other information that others may give you. We are not, and the underwriter is

not, making an offer of our common stock in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus supplement, the accompanying prospectus or the documents incorporated by

reference into this prospectus supplement or the accompanying prospectus is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

Before you invest in our common stock, you should carefully read this prospectus supplement and the accompanying prospectus. You should also

read the documents we have referred you to under “Where You Can Find More Information” for information about us. The shelf registration statement described in the accompanying prospectus, including the exhibits thereto, can be read at the

Securities and Exchange Commission’s (the “SEC”) web site or at the SEC’s Public Reference Room as described under “Where You Can Find More Information.”

If the information set forth in this prospectus supplement varies in any way from the information set forth in the accompanying prospectus, you

should rely on the information contained in this prospectus supplement. If the information set forth in this prospectus supplement varies in any way from the information set forth in a document we have incorporated by reference, you should rely on

the information in the more recent document.

Unless indicated otherwise, or the context otherwise requires, references in this document to

“Allegheny Technologies,” “ATI,” “the Company,” “we,” “us” and “our” are to Allegheny Technologies Incorporated and its consolidated subsidiaries, and references to “dollars” and

“$” are to United States dollars.

This prospectus supplement and accompanying prospectus include registered trademarks, trade

names and service marks of the Company and its subsidiaries.

S-ii

WHERE YOU CAN FIND MORE INFORMATION

Available Information

We file reports,

proxy statements and other information with the SEC. These reports, proxy statements and other information that we file with the SEC can be read and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please

call the SEC at

1-800-SEC-0330

to obtain further information on the operation of the Public Reference Room. The SEC maintains a

web site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC, including us. The SEC’s web site is http://www.sec.gov. In addition, our common stock is listed on

the New York Stock Exchange, and our reports and other information can be inspected at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005. Our web site is www.atimetals.com. Information contained on our web site is

not part of, and should not be construed as being incorporated by reference into, this prospectus supplement and the accompanying prospectus.

Incorporation by Reference

The SEC allows

us to “incorporate by reference” information that we file with it. This means that we can disclose important information to you by referring you to other documents. Any information we incorporate in this manner is considered part of this

prospectus supplement and the accompanying prospectus except to the extent updated and superseded by information contained in this prospectus supplement and the accompanying prospectus. Some information that we file with the SEC after the date of

this prospectus supplement and until we sell all of the securities covered by this prospectus supplement will automatically update and supersede the information contained in this prospectus supplement and the accompanying prospectus.

We incorporate by reference the following documents that we have filed with the SEC and any filings that we make with the SEC in the future

under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), until we sell all of the securities covered by this prospectus supplement, including between the date of this prospectus

supplement and the date on which the offering of the securities under this prospectus supplement is terminated, except as noted in the paragraph below:

|

|

|

|

|

Our SEC Filings (File

No. 1-12001)

|

|

Period for or Date of Filing

|

|

|

|

|

Annual Report on Form

10-K

|

|

Year Ended December 31, 2016

|

|

Quarterly Reports on Form

10-Q

|

|

Quarters Ended March 31, 2017, June 30, 2017 and September 30, 2017

|

|

Current Reports on Form

8-K

|

|

May 15, 2017, June 27, 2017, October 27, 2017, November 2, 2017 and November 7, 2017

|

|

Registration Statement on Form

8-A

|

|

July 30, 1996

|

Pursuant to General Instruction B of Form

8-K,

any information

submitted under Item 2.02, Results of Operations and Financial Condition, or Item 7.01, Regulation FD Disclosure, of Form

8-K

is not deemed to be “filed” for the purpose of Section 18 of the

Exchange Act, and we are not subject to the liabilities of Section 18 with respect to information deemed furnished (and not filed) in accordance with SEC rules, including information submitted under Item 2.02 or Item 7.01 of Form

8-K.

We are not incorporating by reference any information deemed furnished (and not filed) in accordance with SEC rules, including information submitted under Item 2.02 or Item 7.01 of Form

8-K,

into any filing

S-iii

under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act or into this prospectus supplement or the accompanying prospectus.

Statements contained in this prospectus supplement or the accompanying prospectus as to the contents of any contract, agreement or other

document referred to in this prospectus supplement or the accompanying prospectus do not purport to be complete, and where reference is made to the particular provisions of that contract, agreement or other document, those references are qualified

in all respects by reference to all of the provisions contained in that contract or other document. For a more complete understanding and description of each such contract, agreement or other document, we urge you to read the documents contained in

the exhibits to the registration statement of which the accompanying prospectus is a part.

Any statement contained in a document

incorporated by reference, or deemed to be incorporated by reference, into this prospectus supplement and the accompanying prospectus will be deemed to be modified or superseded for purposes of this prospectus supplement and the accompanying

prospectus to the extent that a statement contained herein, therein or in any other subsequently filed document which also is incorporated by reference into this prospectus supplement and the accompanying prospectus modifies or supersedes that

statement. Any such statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement and the accompanying prospectus.

We will provide without charge, upon written or oral request, a copy of any or all of the documents that are incorporated by reference into

this prospectus supplement and the accompanying prospectus and a copy of any or all other contracts, agreements or documents which are referred to in this prospectus supplement or the accompanying prospectus. Requests should be directed to:

Allegheny Technologies Incorporated, 1000 Six PPG Place, Pittsburgh, PA 15222-5479, Attention: Corporate Secretary; telephone number: (412)

394-2800.

You also may review a copy of the registration statement,

its exhibits and the documents that are incorporated by reference into this prospectus supplement and the accompanying prospectus at the SEC’s Public Reference Room in Washington, D.C., as well as through the SEC’s web site.

S-iv

FORWARD-LOOKING STATEMENTS

You should carefully review the information contained in or incorporated by reference into this prospectus supplement and the accompanying

prospectus. In this prospectus supplement and the accompanying prospectus, statements that are not reported financial results or other historical information are “forward-looking statements.” Forward-looking statements give current

expectations or forecasts of future events and are not guarantees of future performance. They are based on our management’s expectations that involve a number of business risks and uncertainties, any of which could cause actual results to

differ materially from those expressed in or implied by the forward-looking statements.

You can identify these forward-looking statements

by the fact that they do not relate strictly to historic or current facts. They use words such as “anticipates,” “believes,” “estimates,” “expects,” “would,” “should,” “will,”

“will likely result,” “forecast,” “outlook,” “projects,” and similar expressions in connection with any discussion of future operating or financial performance.

We cannot guarantee that any forward-looking statements will be realized, although we believe that we have been prudent in our plans and

assumptions. Achievement of future results is subject to risks, uncertainties and assumptions that may prove to be inaccurate. Among others, the factors discussed in the “Risk Factors” section of our Annual Report on Form

10-K

for our fiscal year ended December 31, 2016, as updated by the section entitled “Part II – Item 1A Risk Factors” in our Quarterly Reports on Form

10-Q

for the quarters ended March 31, 2017, June 30, 2017, and September 30, 2017 or under “Risk Factors” in this prospectus supplement could cause actual results to differ from those in forward-looking statements included in or

incorporated by reference into this prospectus supplement and the accompanying prospectus or that we otherwise make. Important factors that could cause actual results to differ materially from those in the forward-looking statements include:

(a) material adverse changes in economic or industry conditions generally, including global supply and demand conditions and prices for our specialty metals; (b) material adverse changes in the markets we serve; (c) our inability to

achieve the level of cost savings, productivity improvements, synergies, growth or other benefits anticipated by management from strategic investments and the integration of acquired businesses; (d) volatility in the price and availability of

the raw materials that are critical to the manufacture of our products; (e) declines in the value of our defined benefit pension plan assets or unfavorable changes in laws or regulations that govern pension plan funding; (f) labor disputes

or work stoppages; (g) equipment outages and (h) other risk factors summarized in our Annual Report on Form

10-K

for the year ended December 31, 2016, as updated by the section entitled

“Part II – Item 1A Risk Factors” in our Quarterly Reports on Form

10-Q

for the quarters ended March 31, 2017, June 30, 2017, and September 30, 2017, and in other reports filed

with the Securities and Exchange Commission. Should known or unknown risks or uncertainties materialize, or should underlying assumptions prove to be inaccurate, actual results could vary materially from those anticipated, estimated or projected.

You should bear this in mind as you consider any forward-looking statements.

We undertake no obligation to publicly update

forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. You are advised, however, to consider any additional disclosures that we may make on related subjects in future filings

with the SEC. You should understand that it is not possible to predict or identify all factors that could cause our actual results to differ. Consequently, you should not consider any list of factors to be a complete set of all potential risks or

uncertainties.

S-v

SUMMARY

This summary highlights information about us and the common stock being offered by this prospectus supplement and the accompanying

prospectus. This summary is not complete and may not contain all of the information that you should consider prior to investing in our common stock. For a more complete understanding of our company, we encourage you to read this entire document,

including the information incorporated by reference into this document.

Our Company

We are a global manufacturer of technically advanced specialty materials and complex components. Approximately 50% of our sales are to the

aerospace & defense market, particularly jet engines, and we have a strong presence in the oil & gas, electrical energy, medical, automotive and other industrial markets. We are a market leader in manufacturing differentiated

products that require our unique manufacturing and precision machining capabilities as well as our innovative new product development competence. Our capabilities range from alloy development through final production of highly engineered finished

components. We are a leader in producing powders for use in next-generation jet engine forgings and

3D-printed

aerospace products.

Our strategic vision is to be an aligned and integrated specialty materials and components company. Our strategies target the products and

global growth markets that require and value our technical and manufacturing capability leadership. These differentiated products serve key global markets including aerospace & defense, oil & gas, electrical energy, medical and

automotive, and sales to these key global markets represented approximately 80% of our total sales in both the year ended December 31, 2016 and the nine months ended September 30, 2017.

We operate in two business segments: High Performance Materials & Components (“HPMC”), and Flat Rolled Products

(“FRP”). Our HPMC segment produces, converts and distributes a wide range of high performance materials, including titanium and titanium-based alloys, nickel- and cobalt-based alloys and superalloys, zirconium and related alloys including

hafnium and niobium, advanced powder alloys and other specialty materials, in long product forms such as ingot, billet, bar, rod, wire, shapes and rectangles, and seamless tubes, plus precision forgings, castings, components and machined parts.

These products are designed for the high performance requirements of major end markets such as aerospace & defense, oil & gas, electrical energy and medical. We are integrated across these alloy systems in melt, remelt, mill

product forging, finishing, investment casting and machining processes. Most of the products in this segment are sold directly to

end-use

customers, and a significant portion of our HPMC segment products are

sold under multi-year agreements.

Approximately 75% of our HPMC segment’s sales in both the year ended December 31, 2016 and the

nine months ended September 30, 2017 were to the aerospace & defense market, led by products for commercial aerospace jet engines. Through acquisitions, alloy development, internal growth strategies and long-term supply agreements on

current and next-generation aero-engines and airframes, we are well positioned with a fully qualified asset base to meet the expected multi-year growth in demand from the commercial aerospace market. Our HPMC segment’s isothermal and

hot-die

forge press utilization continues to improve to meet aerospace demand growth, including new market share gains.

Our FRP segment produces, converts and distributes stainless steel, nickel-based alloys, specialty alloys and titanium and titanium-based

alloys, in a variety of product forms including plate,

S-1

sheet, engineered strip and Precision Rolled Strip

®

products. The major end markets for our flat-rolled products are oil & gas,

automotive, aerospace & defense, food processing equipment and appliances, construction and mining, electronics, communication equipment and computers. We expect sales in the oil & gas end market to recover in the next several years.

The operations in this segment are ATI Flat Rolled Products and the Chinese joint venture company known as Shanghai STAL Precision Stainless Steel Company Limited (“STAL”), in which we hold a 60% interest. Segment results also include our

50% interest in the industrial titanium joint venture known as Uniti LLC.

Additionally, on November 2, 2017, we announced our definitive

agreement with the vertically-integrated, multi-national stainless steel producer, Tsingshan Holding Group Co., Ltd. (“Tsingshan”), to form a new,

50-50

joint venture, Allegheny & Tsingshan

Stainless, for the manufacture and sale of 60 inch-wide flat-rolled stainless steel products in North America. ATI’s FRP segment will

hot-roll

stainless steel slab produced by Tsingshan into coils on our

Hot Rolling and Processing Facility (“HRPF”) under a conversion agreement with the new joint venture, which then will finish the coils into stainless steel sheet using our previously-idled Direct Roll Anneal and Pickle (“DRAP”)

facility in Midland, Pennsylvania, the ownership of which will be transferred to the new joint venture in connection with its formation. Beginning in 2018, FRP segment results will also include the results of our 50% interest in Allegheny &

Tsingshan Stainless, as well as conversion services to the joint venture utilizing our innovative,

low-cost

HRPF, assuming formation of the new joint venture as planned, which remains subject to customary

closing conditions, including regulatory and anti-trust clearances.

Our common stock is quoted on the New York Stock Exchange under the

symbol “ATI.”

Our Strengths

We believe that we are well-positioned for long-term growth, profitability and cash flow generation as a result of numerous factors,

including:

Leading Diversified Specialty Materials and Components Producer

.

We are a world leader in the

manufacture of both high-value and commodity specialty materials and component products and have one of the most diversified product offerings in the specialty metals industry. We believe that our size, market position and technical and

manufacturing capabilities, including operating the HRPF, which is one of the world’s most powerful hot-rolling mills for steel and specialty metals, enable us to more effectively serve the needs of our customers, further improve our cost

structure through economies of scale, and position us to profitably grow our business on a long-term basis.

Diverse End

Markets

.

Our differentiated products serve key global markets, including aerospace and defense, oil & gas, electrical energy, medical and automotive. In the aerospace industry, we are a world leader in the production

of premium titanium alloys, nickel-based and cobalt-based alloys and superalloys, and vacuum-melted specialty alloys used in the manufacture of components for both commercial and military jet engines, as well as replacement parts for those engines.

We also produce titanium alloys, vacuum-melted specialty alloys, and high-strength stainless alloys for use in commercial and military airframes, airframe components and missiles. Both of our business segments produce specialty materials that are

widely used in the oil & gas industry including chemical & hydrocarbon processing. Our specialty materials are also widely used in the automotive and global electrical power generation industries, as well as in various medical

device products.

High Value-Added Product Offering and Strong Competitive Position

.

Our specialty materials are

produced in a wide range of alloys and product forms and are selected for use in

S-2

applications that demand materials having exceptional hardness, toughness, strength, resistance to heat, corrosion or abrasion, or a combination of these characteristics. We have continued our

strategic focus on high-value, differentiated products, which accounted for approximately 85% and 83% of our sales in the year ended December 31, 2016 and the nine months ended September 30, 2017, respectively.

Close, Long Standing Relationships with Blue-Chip Customers

.

We believe that our focus on providing high quality

products to our customers has led to long standing relationships with many of the industry leaders in the end markets we serve. We believe that we have an excellent reputation with our customers for providing high quality products and customer

service, as well as for timely delivery. In the past several years, we have entered into long-term agreements (“LTAs”) with certain of our customers for our specialty materials, in the form of mill products and components, to reduce their

supply uncertainty, including several LTAs with aerospace market original equipment manufacturers. These LTAs are for our specialty materials mill products, forgings and investment castings required for both next-generation and legacy aircraft

platforms. Our aerospace customers include, among others, The Boeing Company, Airbus S.A.S. (an Airbus Group company), Bombardier Aerospace (a division of Bombardier Inc.), and Embraer (Empresa Brasileira de Aeronáutica S.A.) for airframes,

and GE Aviation (a division of General Electric Company), Rolls-Royce plc, Pratt & Whitney (a division of United Technologies Corporation), Snecma (SAFRAN Group) and various joint ventures that manufacture jet engines.

Experienced, Committed Management Team

.

Our business is managed by an experienced team of executive officers led by

Richard J. Harshman, our Chairman, President and Chief Executive Officer. Our management team includes many other experienced officers in key functional areas, including technical, operations, sales, marketing, accounting, finance and legal. Our

executive officers and other members of our management team are committed to growing our business, reducing costs, and pursuing other initiatives to deliver sustained growth in earnings and cash flow generation.

Business Strategy

We

intend to build upon our competitive strengths to continue our growth through the execution of our focused business strategy.

Capitalize on Future Growth in Our Key End Markets

.

We define the key markets in which we operate as the aerospace

and defense, oil & gas, electrical energy, automotive and medical industries. Our participation in the aerospace and defense industry has expanded significantly in recent years, from approximately 25% of our sales in 2010 to over 50% in

2016, as we believe we are a strategic supplier to the airframe and engine original equipment manufacturers with deep product and technological knowledge. We have LTAs that secure significant growth on both legacy and next-generation models. The

commercial aerospace market is transitioning to the next generation of single aisle and large twin aisle aircrafts, and next-generation jet engines. New airframe designs contain a larger percentage of titanium alloys, and the jet engines that power

them use newer nickel-based alloys and titanium-based alloys, in both cases for improved performance and more economical operating costs, compared to legacy airframe and engine designs. Approximately 40% of our HPMC segment’s sales to the jet

engine market for the nine months ended September 30, 2017 were products for next-generation commercial jet engines.

Continuously

Seek to Innovate and Develop

.

We maintain our commitment to develop innovative alloys to better serve the needs of our end market users. ATI’s 718Plus

®

nickel-based

superalloy, Rene 65 near-powder superalloy (developed with GE), and our powder alloys have won

S-3

significant share in the current and next-generation engines for the aerospace and defense market. Additionally, both of our business segments produce specialty materials that are widely used in

to the oil & gas industry. Our specialty materials, including titanium and titanium alloys, nickel-based alloys, zirconium alloys, stainless and duplex alloys and other specialty alloys, have the strength and wear corrosion-resistant

properties necessary for difficult environments.

Maintain Emphasis on Continuous Operational Improvement

.

We

have made significant operational progress in qualifying and fully integrating long-term strategic capital projects that we believe will position us to grow our high-value product offerings, including most recently the ongoing qualifications at our

new nickel-alloy powder production facility in Bakers, North Carolina. Additionally, our recent rightsizing and restructuring initiatives are showing positive impacts in improving future financial performance in both the HPMC and FRP business

segments. Our 2016 actions in the HPMC segment included restructuring our titanium operations to improve cost competitiveness, which involved, among other measures, the indefinite idling of the Rowley, Utah titanium sponge production facility. In

our FRP segment, our focus on value, not volume, including the exit from the grain-oriented electrical steel market has had a positive impact on that business, as we focus on the products and global markets that value our technical leadership and

manufacturing capability.

Expand Our Global Presence

.

Approximately 41% of our sales in both the year ended

December 31, 2016 and the nine months ended September 30, 2017 came from markets outside the United States in which we believe we have attractive growth prospects. Additionally, we believe that at least 50% of our sales in the these

periods were driven by global markets when we consider exports of our customers. Our HPMC segment has manufacturing capabilities for melting, remelting, forging and finishing nickel-based alloys and specialty alloys in the United Kingdom, and

manufacturing capabilities for precision forging and machining in Poland, primarily serving the construction, transportation and aerospace and oil & gas markets. Within our FRP segment, our STAL joint venture in the People’s Republic

of China produces Precision Rolled Strip

®

products, which enables us to offer these products more effectively to markets in China and other Asian countries. Our Uniti LLC joint venture allows

us to offer titanium products to industrial markets more effectively worldwide, and our recently-announced joint venture with multi-national producer Tsingshan is expected to be a cost-competitive supplier of commodity stainless products for the

North American market.

Preserve Liquidity Position and Engage in Proactive Liability Management

.

We seek to

maintain a conservative balance sheet and believe that we have sufficient liquidity to fully support our daily operations. As of September 30, 2017, we had approximately $125 million of cash and cash equivalents, and we have available

liquidity of approximately $280 million under our existing senior secured credit facility (the “Credit Facility”). After giving effect to this offering and the application of the proceeds from this offering as described under the

caption “Use of Proceeds”, we will have no significant debt maturities until 2021. In 2016, we issued $287.5 million aggregate principal amount of

six-year

convertible senior notes and

subsequently contributed $250.0 million to the ATI Pension Plan, our U.S. qualified defined benefit pension plan. From 2014 to 2016, we made several significant changes to our retirement benefit programs, including a 2016 labor agreement with a

majority of employees represented by the USW, which includes important changes to retirement benefit programs, including a freeze to new entrants to the ATI Pension Plan and the elimination of retiree medical benefits for new employees.

Additionally, we implemented a hard freeze to all future pension benefit accruals to the ATI Pension Plan for all

non-represented

employees at the end of 2014. In 2016, we

S-4

divested approximately 3,700 retirees from the ATI Pension Plan through an annuity buyout. We believe that these benefit changes and liability management actions will favorably impact our results

of operations in future years.

S-5

The Offering

The following summary is provided solely for your convenience and is not intended to be complete. You should read the full text and more

specific details contained elsewhere in this prospectus supplement and the accompanying prospectus. For purposes of this “offering summary,” references to “Allegheny Technologies Incorporated,” “we,” “our” and

“us” refer only to Allegheny Technologies Incorporated and not its subsidiaries. For a more detailed description of our common stock, see “Description of Common Stock” in this prospectus supplement and “Description of

Capital Stock — Common Stock” in the accompanying prospectus.

|

Issuer

|

Allegheny Technologies Incorporated, a Delaware corporation

|

|

Securities Offered

|

17,000,000 shares of common stock

|

|

Common stock outstanding after the offering

|

125,863,099 shares (or 128,413,099 shares if the underwriter exercises its option to purchase additional shares in full).

|

|

Underwriter’s option

|

We have granted the underwriter a

30-day

option to purchase up to an additional 2,550,000 shares of common stock at the public offering price, less the underwriting discounts and commissions.

|

|

Use of Proceeds

|

We intend to use the net proceeds from this offering to redeem the 2019 Notes, including the payment of the associated redemption premium, and for general corporate purposes. See “Use of Proceeds.”

|

|

Trading Symbol for Our Common Stock

|

Our common stock is listed on the New York Stock Exchange, or NYSE, under the symbol “ATI.”

|

|

Risk Factors

|

You should carefully consider the information set forth in the section entitled “Risk Factors” and the other information included or incorporated by reference into this prospectus supplement and the accompanying prospectus in deciding

whether to purchase the notes.

|

|

Transfer Agent and Registrar

|

Computershare Investor Services

|

S-6

Summary Consolidated Financial Data

We derived the summary consolidated financial data shown below as of December 31, 2014, 2015 and 2016 and for each of the years then ended

from our audited consolidated financial statements. We derived the summary consolidated financial data as of September 30, 2017 and 2016 and for each of the nine month periods then ended from our unaudited consolidated financial statements. The

unaudited financial statements from which we derived this data were prepared on the same basis as the audited consolidated financial data and include all adjustments, consisting only of normal recurring adjustments, necessary to present fairly our

results of operations and financial condition as of the periods presented. The results of operations for interim periods are not necessarily indicative of the operating results for any future period. You should read the following financial

information in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes in our Annual Report on Form

10-K

for the fiscal year ended December 31, 2016 and our Quarterly Report on Form

10-Q

for the fiscal quarter ended September 30, 2017, which are incorporated by

reference into this prospectus supplement and the accompanying prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

|

Nine Months Ended

September 30,

|

|

|

|

|

2014

|

|

|

2015

|

|

|

2016

|

|

|

2016

|

|

|

2017

|

|

|

|

|

(In millions except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

Statement of income data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$

|

4,223.4

|

|

|

$

|

3,719.6

|

|

|

$

|

3,134.6

|

|

|

$

|

2,338.5

|

|

|

$

|

2,615.2

|

|

|

Cost of sales

|

|

|

3,844.8

|

|

|

|

3,659.3

|

|

|

|

2,972.1

|

|

|

|

2,273.3

|

|

|

|

2,296.8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

378.6

|

|

|

|

60.3

|

|

|

|

162.5

|

|

|

|

65.2

|

|

|

|

318.4

|

|

|

Income (loss) from continuing operations

|

|

|

10.2

|

|

|

|

(365.9)

|

|

|

|

(627.1)

|

|

|

|

(640.8)

|

|

|

|

(84.9)

|

|

|

Income (loss) from discontinued operations, net of tax

|

|

|

(0.6)

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

|

9.6

|

|

|

|

(365.9)

|

|

|

|

(627.1)

|

|

|

|

(640.8)

|

|

|

|

(84.9)

|

|

|

Less: Net income attributable to noncontrolling interests

|

|

|

12.2

|

|

|

|

12.0

|

|

|

|

13.8

|

|

|

|

10.0

|

|

|

|

8.7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to ATI

|

|

$

|

(2.6)

|

|

|

$

|

(377.9)

|

|

|

$

|

(640.9)

|

|

|

|

(650.8)

|

|

|

$

|

(93.6)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income (loss) attributable to ATI per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations per common share

|

|

$

|

(0.02)

|

|

|

$

|

(3.53)

|

|

|

$

|

(5.97)

|

|

|

$

|

(6.07)

|

|

|

$

|

(0.87)

|

|

|

Discontinued operations per common share

|

|

|

(0.01)

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

(0.03)

|

|

|

$

|

(3.53)

|

|

|

$

|

(5.97)

|

|

|

$

|

(6.07)

|

|

|

$

|

(0.87)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in computing net income (loss) attributable to ATI per common share,

basic

|

|

|

107.1

|

|

|

|

107.3

|

|

|

|

107.3

|

|

|

|

107.3

|

|

|

|

107.7

|

|

|

|

|

|

|

|

|

|

Diluted net income (loss) attributable to ATI per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations per common share

|

|

$

|

(0.02)

|

|

|

$

|

(3.53)

|

|

|

$

|

(5.97)

|

|

|

$

|

(6.07)

|

|

|

$

|

(0.87)

|

|

|

Discontinued operations per common share

|

|

|

(0.01)

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

(0.03)

|

|

|

$

|

(3.53)

|

|

|

$

|

(5.97)

|

|

|

$

|

(6.07)

|

|

|

$

|

(0.87)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in computing net income (loss) attributable to ATI per common share,

diluted

|

|

|

107.1

|

|

|

|

107.3

|

|

|

|

107.3

|

|

|

|

107.3

|

|

|

|

107.7

|

|

|

|

|

|

|

|

|

|

Other data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA (unaudited) (1)

|

|

$

|

287.0

|

|

|

$

|

(177.9)

|

|

|

$

|

(439.7)

|

|

|

$

|

(483.8)

|

|

|

$

|

136.0

|

|

|

Adjusted EBITDA (unaudited) (1)

|

|

$

|

262.0

|

|

|

$

|

3.2

|

|

|

$

|

31.6

|

|

|

$

|

(12.5)

|

|

|

$

|

250.4

|

|

S-7

|

(1)

|

We define EBITDA as income (loss) from continuing operations before interest and income taxes, plus depreciation and amortization. We define Adjusted EBITDA as EBITDA excluding significant

non-cash

charges or credits, including goodwill impairment charges, restructuring charges including long-lived asset impairments, and OPEB/pension curtailment and settlement gains and losses. EBITDA and

Adjusted EBITDA are not measures of financial performance under U.S. generally accepted accounting principles. EBITDA and Adjusted EBITDA are not calculated in the same manner by all companies and, accordingly, are not necessarily comparable to

similarly titled measures of other companies and may not be an appropriate measure of performance relative to other companies. We have presented EBITDA and Adjusted EBITDA in this prospectus supplement solely as a supplemental disclosure because we

believe it allows for a more complete analysis of our results of operations. We believe that EBITDA and Adjusted EBITDA are useful to investors because these measures are commonly used to analyze companies on the basis of operating performance,

leverage and liquidity. Furthermore, analogous measures are used by industry analysts to evaluate operating performance. EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow for management’s discretionary use, as they do

not consider certain cash requirements such as interest payments, tax payments and capital expenditures. EBITDA and Adjusted EBITDA are not intended to represent, and should not be considered more meaningful than, or as an alternatives to, a measure

of operating performance as determined in accordance with U.S. generally accepted accounting principles. The definitions of EBITDA and Adjusted EBITDA will differ from the amounts calculated under the definition of Consolidated EBITDA that is

contained in the Credit Facility.

We do not intend to provide EBITDA or Adjusted EBITDA information for future periods in earnings press releases, filings with the SEC or in response to inquiries.

EBITDA and Adjusted EBITDA are calculated as

follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

|

Nine Months Ended

September 30,

|

|

|

|

|

2014

|

|

|

2015

|

|

|

2016

|

|

|

2016

|

|

|

2017

|

|

|

|

|

(Dollars in Millions)

|

|

|

|

|

(Unaudited)

|

|

|

Income (loss) from continuing operations before interest and income taxes

|

|

$

|

110.2

|

|

|

$

|

(367.8)

|

|

|

$

|

(610.0)

|

|

|

$

|

(614.0)

|

|

|

$

|

15.3

|

|

|

Depreciation and amortization

|

|

|

176.8

|

|

|

|

189.9

|

|

|

|

170.3

|

|

|

|

130.2

|

|

|

|

120.7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

|

|

$

|

287.0

|

|

|

$

|

(177.9)

|

|

|

$

|

(439.7)

|

|

|

$

|

(483.8)

|

|

|

$

|

136.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impairment of goodwill

(a)

|

|

|

—

|

|

|

|

126.6

|

|

|

|

—

|

|

|

|

—

|

|

|

|

114.4

|

|

|

Restructuring charges

(b)

|

|

|

—

|

|

|

|

54.5

|

|

|

|

471.3

|

|

|

|

471.3

|

|

|

|

—

|

|

|

OPEB/pension curtailment gain

(c)

|

|

|

(25.0)

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

|

|

$

|

262.0

|

|

|

$

|

3.2

|

|

|

$

|

31.6

|

|

|

$

|

(12.5)

|

|

|

$

|

250.4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

Goodwill impairment for the year ended December 31, 2015 was $126.6 million for the Flat Rolled Products business in the FRP segment, as disclosed in Note 6 to our audited consolidated financial statements in

the 2016 Annual Report on Form 10-K. In the nine months ended September 30, 2017, goodwill impairment was $114.4 million for the Cast Products business in the HPMC segment, as disclosed in Note 4 to our unaudited consolidated

financial statements in the Third Quarter 2017 Quarterly Report on Form 10-Q.

|

|

(b)

|

Restructuring charges for the year ended December 31, 2015 were $54.5 million for long-lived asset impairments in the FRP segment, including the Midland, PA standard stainless melt shop and sheet finishing

operations, and the grain-oriented electrical steel operations including the Bagdad, PA facility, as disclosed in Note 17 to our audited consolidated financial statements in the 2016 Annual Report on Form 10-K. Restructuring charges for

nine months ended September 30, 2016 and the year ended December 31, 2016 were $471.3 million for long-lived asset impairment of the Rowley, UT titanium sponge production facility of the HPMC segment, as disclosed in Note 17

to our audited consolidated financial statements in the 2016 Annual Report on Form 10-K.

|

|

(c)

|

OPEB/pension curtailment gain of $(25.0) million for 2014 relates to the elimination of all Company-provided salaried retiree life insurance benefits and all remaining Company-provided salaried retiree medical

benefits, as disclosed in Note 12 to our audited consolidated financial statements in the 2016 Annual Report on Form 10-K.

|

S-8

RISK FACTORS

Investing in our common stock involves risks. You should carefully read and consider the risks described below as well as the risks

described in the sections entitled “Item 1. Business” and “Item 1A. Risk Factors” in our Annual Report on Form

10-K

for the year ended December 31, 2016, as updated by the section

entitled “Part II – Item 1A Risk Factors” in our Quarterly Reports on Form

10-Q

for the quarters ended March 31, 2017, June 30, 2017 and September 30, 2017, which are incorporated

by reference into this prospectus supplement and the accompanying prospectus. You should also carefully read and consider the other information contained in or incorporated by reference into this prospectus supplement and the accompanying

prospectus, including risks described above in “Forward-Looking Statements,” before making a decision to invest our common stock. Each of these risks could materially and adversely affect our business, financial condition, results of

operations, liquidity and prospects, and could result in a partial or complete loss of your investment.

Risks Relating to this Offering

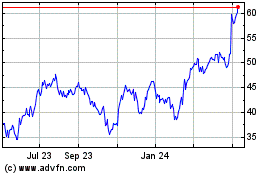

The market price of our common stock may continue to be volatile and will be affected by factors beyond our control, which could affect

the short-term value of your investment.

The market price of our common stock has been and may continue to be subject to

significant fluctuations due not only to general stock market conditions but also to changes in sentiment in the market regarding our operations, business prospects, liquidity or this offering. During the period from January 1, 2016 to

October 31, 2017, our common stock has fluctuated from a high of $25.62 per share to a low of $7.08 per share. The market price of our common stock will likely continue to fluctuate in response to, among other things, the factors discussed

under “Item 1. Business” and “Item 1A. Risk Factors” in our Annual Report on Form

10-K

for the year ended December 31, 2016 as updated by “Part II – Item 1A Risk Factors” in

our Quarterly Reports on Form

10-Q

for the quarters ended March 31, 2017, June 30, 2017 and September 30, 2017, which is incorporated by reference into this prospectus supplement and the

accompanying prospectus.

Our substantial indebtedness could adversely affect our business, financial condition or results of

operations and prevent us from fulfilling our obligations under our outstanding indebtedness.

We currently have and, after this

offering, will continue to have a significant amount of indebtedness. As of September 30, 2017, after giving effect to this offering and the application of the proceeds from this offering as described under the caption “Use of

Proceeds”, our total consolidated indebtedness would have been approximately $1.6 billion (excluding accounts payable, accrued expenses, other liabilities and unfunded commitments). This substantial level of indebtedness increases the risk

that we may be unable to generate enough cash to pay amounts due in respect of our indebtedness.

Our substantial indebtedness could have

important consequences to you and significant effects on our business. For example, it could:

|

|

•

|

|

make it more difficult for us to satisfy our obligations with respect to our outstanding indebtedness;

|

|

|

•

|

|

increase our vulnerability to general adverse economic and industry conditions;

|

|

|

•

|

|

require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, our

strategic growth initiatives and development efforts and other general corporate purposes;

|

S-9

|

|

•

|

|

limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

|

|

|

•

|

|

restrict us from exploiting business opportunities;

|

|

|

•

|

|

place us at a competitive disadvantage compared to our competitors that have less indebtedness; and

|

|

|

•

|

|

limit our ability to borrow additional funds for working capital, capital expenditures, acquisitions, debt service requirements, execution of our business strategy or other general corporate purposes.

|

In addition, the agreements that govern our current indebtedness contain, and the agreements that may govern any future indebtedness that we

may incur may contain, financial and other restrictive covenants that will limit our ability to engage in activities that may be in our long-term best interests. Our failure to comply with those covenants could result in an event of default that, if

not cured or waived, could result in the acceleration of all of our debt.

Despite our substantial current indebtedness, we and our

subsidiaries may still be able to incur substantially more indebtedness. This could further exacerbate the risks associated with our substantial leverage.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future, including pursuant to a capital markets

transaction such as a notes offering, as well as additional secured indebtedness, each of which would have priority in a liquidation, dissolution or winding up over our shares of common stock. Adding new indebtedness to current debt levels could

make it more difficult for us to satisfy our obligations to holders of our indebtedness.

Rights of any future preferred

stockholders may dilute the voting power or reduce the value of our common shares.

Our Restated Certificate of Incorporation

authorizes us to issue, without the approval of our stockholders, one or more classes or series of preferred shares having such designation, powers, preferences and relative, participating, optional and other special rights, including preferences

over our common shares respecting dividends and voting rights, as our board of directors generally may determine. The terms of one or more classes or series of preferred shares could dilute the voting power or reduce the value of our common shares.

For example, we could grant holders of preferred shares the right to veto specified transactions on the happening of specified events. Similarly, the repurchase or redemption rights or liquidation preferences we could assign to holders of preferred

shares could affect the residual value of the common shares. As of the date of this prospectus supplement, we do not have any outstanding shares of preferred stock.

All of our debt obligations, and any future indebtedness we may incur, will have priority over our shares with respect to payment in the

event of a liquidation, dissolution or winding up.

In any liquidation, dissolution or winding up of the Company, our shares of

common stock would rank below all debt claims against us. In addition, any convertible or exchangeable securities or other equity securities (including preferred shares) that we may issue in the future may have rights, preferences and privileges

more favorable than those of our shares of common stock. Our share capital includes 50,000,000 authorized (but currently unissued) shares of preferred stock. As a result, holders of shares of our common stock will not be entitled to receive any

payment or other distribution of assets upon the liquidation or dissolution until after our obligations to our debt holders and holders of equity securities that rank senior to shares of our common stock have been satisfied.

S-10

Sales of a substantial amount of shares of our common stock in the public market,

particularly sales by our directors, executive officers and significant stockholders, or the perception that these sales could occur, could cause the market price of our common stock to decline and may make it more difficult for you to sell your

common stock at a time and price that you deem appropriate.

As of September 30, 2017, after giving effect to this offering

(without giving effect to any additional shares issuable if the underwriter’s option to purchase additional shares is exercised), there would have been 125,863,099 shares of our common stock outstanding, which will be freely transferable

without restriction or further registration under the federal securities laws, except for any shares held by our affiliates, sales of which will may limited by Rule 144 under the Securities Act.

We and our executive officers and directors have entered into

lock-up

agreements with the underwriter

under which we and they have agreed, subject to specific exceptions, not to sell, contract to sell or otherwise dispose of any of our common shares or securities that are convertible or exchange for our common shares or entering into any arrangement

that transfers the economic consequences of ownership of our common shares without the permission of Goldman Sachs & Co. LLC for a period of 90 days following the date of this prospectus. We refer to such period as the

lock-up

period. When the

lock-up

period expires, we and our securityholders subject to a

lock-up

agreement will be able to sell our

shares in the public market. In addition, Goldman Sachs & Co. LLC may, in its sole discretion, release all or some portion of the shares subject to

lock-up

agreements at any time and for any reason.

Sales of a substantial number of such shares upon expiration of the

lock-up

agreements, the perception that such sales may occur, or early release of these agreements, could cause our market price to fall or

make it more difficult for you to sell your common stock at a time and price that you deem appropriate.

We may issue additional

shares of our common stock or instruments convertible into our common stock, including in connection with conversions of notes, and thereby materially and adversely affect the price of our common stock.

Subject to

lock-up

provisions described under “Underwriting,” we are not restricted from

issuing additional shares of our common stock or other instruments convertible into our common stock. See “Underwriting.” We cannot predict the size of future issuances or the effect, if any, that they may have on the market price for our

common stock. If we issue additional shares of our common stock or instruments convertible into our common stock, it may materially and adversely affect the price of our common stock. Furthermore, the conversion of some or all of our existing

convertible notes may dilute the ownership interests of existing stockholders, and any sales in the public market of shares of our common stock issuable upon any such conversion could adversely affect prevailing market prices of our common stock. In

addition, the anticipated issuance and sale of substantial amounts of common stock or the anticipated conversion or exercise of securities into shares of our common stock could depress the price of our common stock.

If securities analysts or industry analysts publish negative research or reports, or do not publish reports about our business, our

share price and trading volume could decline.

The trading market for our common shares is influenced by the research and reports

that industry or securities analysts publish about us, our business and our industry. If one or more analysts adversely change their recommendation regarding our shares or our competitors’ stock, our share price would likely decline. If one or

more analysts cease coverage of us or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our share price or trading volume to decline.

S-11

Provisions in our corporate documents and Delaware law could have the effect of delaying,

deferring or preventing a change in control of us, even if that change may be considered beneficial by some of our stockholders.

The existence of some provisions of our Restated Certificate of Incorporation, our Third Amended and Restated Bylaws and Delaware law could

have the effect of delaying, deferring or preventing a change in control of us that a stockholder may consider favorable. These provisions are more fully described under “Description of Capital Stock” in the accompanying prospectus.

We believe these provisions protect our stockholders from coercive or otherwise unfair takeover tactics by requiring potential acquirors to

negotiate with our board of directors and by providing our board of directors with more time to assess any acquisition proposal, and are not intended to make our company immune from takeovers. However, these provisions apply even if the offer may be

considered beneficial by some stockholders and could delay, defer or prevent an acquisition that our board of directors determines is not in the best interests of our company and our stockholders.

Our actual operating results may differ significantly from our guidance.

From time to time, we release guidance regarding our future performance. This guidance, which consists of forward-looking statements, is

prepared by our management and is qualified by, and subject to, the assumptions and the other information included in or incorporated by reference into this prospectus supplement and the accompanying prospectus and included in our Annual Report on

Form

10-K

for the year ended December 31, 2016, as updated by the section entitled “Part II – Item 1A Risk Factors” in our Quarterly Reports on Form

10-Q

for the quarters ended March 31, 2017, June 30, 2017, and September 30, 2017, as well as the factors described under “Forward-Looking Statements” in this prospectus supplement.

Neither our independent registered public accounting firm nor any other independent or outside party compiles or examines the guidance, and, accordingly, no such person expresses any opinion or any other form of assurance with respect thereto.

Guidance is based upon a number of assumptions and estimates that, while presented with numerical specificity, are inherently subject to

business, economic and competitive uncertainties and contingencies, many of which are beyond our control and are based upon specific assumptions with respect to future business decisions, some of which will change. The principal reason that we

release this data is to provide a basis for our management to discuss our business outlook with analysts and investors. We do not accept any responsibility for any projections or reports published by any such persons.

Guidance is necessarily speculative in nature, and it can be expected that some or all of the assumptions of the guidance furnished by us will

not materialize or will vary significantly from actual results. Accordingly, our guidance is only an estimate of what management believes is realizable as of the date of release. Actual results will vary from the guidance. Investors should also

recognize that the reliability of any forecasted financial data diminishes the farther in the future that the data is forecast. In light of the foregoing, investors are urged to put the guidance in context and not to place undue reliance on it.

Any failure to successfully implement our operating strategy or the occurrence of any of the events or circumstances set forth in, or

incorporated by reference into, this prospectus supplement could result in actual operating results being different than the guidance, and such differences may be adverse and material.

S-12

As a new investor, you will experience immediate and substantial dilution in the net

tangible book value of your shares.

The offering price of our common stock in this offering is considerably more than the net

tangible book value per share of our outstanding common stock. Accordingly, investors purchasing shares of our common stock in this offering will pay a price per share that substantially exceeds the book value of our assets after subtracting

liabilities. In addition, to the extent that we issue additional shares in the future pursuant to stock options or otherwise, you may experience further dilution.

S-13

USE OF PROCEEDS

We estimate that the net proceeds from this offering will be approximately $ million (or

approximately $ million if the underwriter exercises its option to purchase additional shares in this offering in full), after deducting the underwriting discounts and commissions and estimated offering

expenses payable by us. We intend to use the net proceeds from this offering to fund a redemption of all of the outstanding 2019 Notes, which were issued in 2009 and of which $350.0 million aggregate principal amount is outstanding as of the

date of this prospectus supplement, in accordance with the terms of the indenture governing the 2019 Notes.

We may redeem the 2019 Notes,

at our option, at any time in whole, or from time to time in part, at a price equal to the greater of (i) 100% of the principal amount of the 2019 Notes to be redeemed, plus accrued interest to the date of redemption; or (ii) the sum of the

present values of the remaining scheduled payments of principal and interest on the 2019 Notes to be redeemed, exclusive of interest accrued to the date of redemption, discounted to the date of redemption on a semiannual basis (assuming a

360-day

year consisting of twelve

30-day

months) at the applicable U.S. Treasury rate plus 50 basis points, plus accrued interest to the date of redemption. The 2019 Notes

mature on June 1, 2019, and interest on the 2019 Notes accrues at a rate of 9.375%, payable semi-annually on June 1 and December 1 of each year, resulting in a redemption premium of approximately $40.0 million in connection with

our intended redemption of all of the outstanding 2019 Notes. The

pre-tax

annual cash interest expense on the 2019 Notes is approximately $32.8 million. The indenture governing the 2019 Notes more fully

describes the terms of the 2019 Notes. That indenture is an exhibit to our Annual Report on Form

10-K

for our fiscal year ended December 31, 2016, which is incorporated by reference into this prospectus

supplement and the accompanying prospectus.

Any net proceeds from this offering that are not used to fund a redemption of all of the

outstanding 2019 Notes will be used for general corporate purposes.

Until the net proceeds from this offering are applied as described

above, we may invest proceeds in short-term, investment grade interest-bearing securities or in obligations of, or guaranteed by, the U.S. government.

Affiliates of Goldman Sachs & Co. LLC are holders of the 2019 Notes, and accordingly, may receive a portion of the net proceeds of

this offering. See the section entitled “Underwriting” below.

S-14

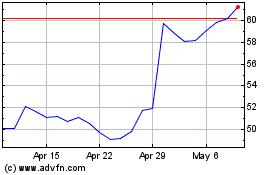

COMMON STOCK PRICE RANGE AND DIVIDEND POLICY

Our common stock is listed on the New York Stock Exchange under the symbol “ATI.” The following table sets forth, for the periods

indicated, the high and low sales prices per share of our common stock as reported on the NYSE and the dividends declared per share of our common stock.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price Range of Common Stock

|

|

|

Cash

Dividend

Per Share

|

|

|

|

|

High

|

|

|

Low

|

|

|

|

2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

|

$35.10

|

|

|

|

$27.12

|

|

|

$

|

0.18

|

|

|

Second Quarter

|

|

|

$37.76

|

|

|

|

$29.05

|

|

|

$

|

0.18

|

|

|

Third Quarter

|

|

|

$31.02

|

|

|

|

$13.66

|

|

|

$

|

0.18

|

|

|

Fourth Quarter

|

|

|

$19.10

|

|

|

|

$10.15

|

|

|

$

|

0.08

|

|

|

|

|

|

|

|

2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

|

$18.38

|

|

|

|

$7.08

|

|

|

$

|

0.08

|

|

|

Second Quarter

|

|

|

$18.03

|

|

|

|

$10.93

|

|

|

$

|

0.08

|

|

|

Third Quarter

|

|

|

$18.67

|

|

|

|

$12.27

|

|

|

$

|

0.08

|

|

|

Fourth Quarter

|

|

|

$19.20

|

|

|

|

$13.15

|

|

|

|

—

|

|

|

|

|

|

|

|

2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

|

$23.69

|

|

|

|

$15.61

|

|

|

|

—

|

|

|

Second Quarter

|

|

|

$20.11

|

|

|

|

$14.54

|

|

|

|

—

|

|

|

Third Quarter

|

|

|

$24.00

|

|

|

|

$16.51

|

|

|

|

—

|

|

|

Fourth Quarter (through November 6, 2017)

|

|

|

$26.59

|

|

|

|

$22.72

|

|

|

|

—

|

|

The last reported sale price of our common stock on the New York Stock Exchange on November 6, 2017 was $25.84 per share. As of

October 31, 2017, there were 108,863,099 shares of our common stock outstanding, held by approximately 3,364 registered holders.

The

payment of dividends, if any, and the amount of such dividends depends upon matters deemed relevant by our Board of Directors on a quarterly basis, such as our results of operations, financial condition, cash requirements, future prospects, any

limitations imposed by law, credit agreements or debt securities and other factors deemed relevant and appropriate. Under the Credit Facility, there is no limit on dividend declarations or payments provided that the undrawn availability, after

giving effect to a particular dividend payment, is at least the greater of $100 million and 25% of the sum of the maximum revolving advance amount under the Credit Facility and the outstanding principal amount under the term loan component of

the Credit Facility (the “Term Loan”), and no event of default under the Credit Facility has occurred and is continuing or would result from paying the dividend. In addition, there is no limit on dividend declarations or payments if the

undrawn availability is less than the greater of $100.0 million and 25% of the sum of the maximum revolving advance amount under the Credit Facility and the outstanding principal amount under the Term Loan, but more than the greater of

$60.0 million and 15% of the sum of the maximum revolving advance amount under the Credit Facility and the outstanding principal amount under the Term Loan, if (i) no event of default has occurred and is continuing or would result from

paying the dividend, (ii) we demonstrate to the administrative agent that, prior to and after giving effect to the payment of the

S-15

dividend (A) the undrawn availability, as measured both at the time of the dividend payment and as an average for the 60 consecutive day period immediately preceding the dividend payment, is

at least the greater of $60.0 million and 15% of the sum of the maximum revolving advance amount under the Credit Facility and the outstanding principal amount under the Term Loan, and (B) we demonstrate that prior to and after such