Energy Transfer Partners, L.P. (NYSE: ETP) (“ETP” or the

“Partnership”) today reported its financial results for the quarter

ended September 30, 2017. For the three months ended September

30, 2017, net income was $761 million and Adjusted EBITDA was

$1.74 billion. Adjusted EBITDA increased $354 million

compared to the three months ended September 30, 2016, reflecting

an increase of $227 million in Adjusted EBITDA from the crude

oil transportation and services segment, as well as significantly

higher results from several of the other segments, as discussed in

the segment results analysis below. Net income increased

$623 million compared to the three months ended

September 30, 2016, primarily due to increased operating

income and higher equity in earnings from unconsolidated

affiliates, as well as the impact of a non-cash impairment recorded

in the prior year on an investment in an unconsolidated affiliate.

Distributable Cash Flow attributable to partners, as adjusted, for

the three months ended September 30, 2017 totaled

$1.05 billion, an increase of $226 million compared to

the three months ended September 30, 2016 (on a pro forma basis for

the Sunoco Logistics merger completed in April 2017), primarily due

to the increase in Adjusted EBITDA.

ETP’s other recent key accomplishments include the

following:

- In October 2017, ETP announced a

quarterly distribution of $0.565 per unit ($2.26 annualized) on ETP

common units for the quarter ended September 30, 2017.

- In October 2017, ETP completed the

previously announced contribution transaction with a fund managed

by Blackstone Energy Partners and Blackstone Capital Partners,

pursuant to which ETP exchanged a 49.9% interest in the holding

company that owns 65% of the Rover pipeline.

- In August 2017, the Partnership issued

54 million ETP common units in an underwritten public

offering. Net proceeds of $997 million from the offering were

used by the Partnership to repay amounts outstanding under its

revolving credit facilities, to fund capital expenditures and for

general partnership purposes.

- In September 2017, Sunoco Logistics

Partners Operations L.P., a subsidiary of ETP, issued

$750 million aggregate principal amount of 4.00% senior notes

due 2027 and $1.50 billion aggregate principal amount of 5.40%

senior notes due 2047. The $2.22 billion net proceeds from the

offering were used to redeem all of the $500 million aggregate

principal amount of ETLP’s 6.5% senior notes due 2021, to repay

borrowings outstanding under the Sunoco Logistics Credit Facility

and for general partnership purposes. Also, in October 2017, ETP

redeemed all of the outstanding $700 million of 5.5% senior notes

due 2023 previously issued by Regency Energy Partners LP.

- As of September 30, 2017, ETP had

approximately $2.1 billion outstanding under its aggregate $6.25

billion revolving credit facilities and its leverage ratio, as

defined by the legacy Sunoco Logistics credit agreement, was

4.16x.

An analysis of ETP’s segment results and other supplementary

data is provided after the financial tables shown below. ETP has

scheduled a conference call for 8:00 a.m. Central Time, Wednesday,

November 8, 2017 to discuss the third quarter 2017 results.

The conference call will be broadcast live via an internet webcast,

which can be accessed through www.energytransfer.com and will also be available

for replay on ETP’s website for a limited time.

Energy Transfer Partners, L.P. (NYSE: ETP) is a

master limited partnership that owns and operates one of the

largest and most diversified portfolios of energy assets in the

United States. Strategically positioned in all of the major U.S.

production basins, ETP owns and operates a geographically diverse

portfolio of complementary natural gas midstream, intrastate and

interstate transportation and storage assets; crude oil, natural

gas liquids (NGL) and refined product transportation and

terminalling assets; NGL fractionation assets; and various

acquisition and marketing assets. ETP’s general partner is owned by

Energy Transfer Equity, L.P. (NYSE: ETE). For more information,

visit the Energy Transfer Partners, L.P. website at www.energytransfer.com.

Energy Transfer Equity, L.P. (NYSE:ETE) is a master

limited partnership that owns the general partner and 100% of the

incentive distribution rights (IDRs) of Energy Transfer

Partners, L.P. (NYSE: ETP) and Sunoco LP (NYSE: SUN). ETE also

owns Lake Charles LNG Company. On a consolidated basis, ETE’s

family of companies owns and operates a diverse portfolio of

natural gas, natural gas liquids, crude oil and refined products

assets, as well as retail and wholesale motor fuel operations and

LNG terminalling. For more information, visit the Energy Transfer

Equity, L.P. website at www.energytransfer.com.

Forward-Looking Statements

This news release may include certain statements concerning

expectations for the future that are forward-looking statements as

defined by federal law. Such forward-looking statements are subject

to a variety of known and unknown risks, uncertainties, and other

factors that are difficult to predict and many of which are beyond

management’s control. An extensive list of factors that can affect

future results are discussed in the Partnership’s Annual Report on

Form 10-K and other documents filed from time to time with the

Securities and Exchange Commission. The Partnership undertakes no

obligation to update or revise any forward-looking statement to

reflect new information or events.

The information contained in this press release is available on

our website at www.energytransfer.com.

ENERGY TRANSFER

PARTNERS, L.P. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(In millions)

(unaudited)

September 30, December 31, 2017

2016 (a)

ASSETS Current assets $ 5,780 $ 5,729

Property, plant and equipment, net 56,972 50,917 Advances to

and investments in unconsolidated affiliates 4,221 4,280 Other

non-current assets, net 752 672 Intangible assets, net 5,379 4,696

Goodwill 3,907 3,897 Total assets $ 77,011 $

70,191

LIABILITIES AND EQUITY Current

liabilities $ 6,886 $ 6,203 Long-term debt, less current

maturities 33,630 31,741 Long-term notes payable – related company

— 250 Non-current derivative liabilities 132 76 Deferred income

taxes 4,374 4,394 Other non-current liabilities 1,111 952

Commitments and contingencies Series A Preferred Units — 33

Redeemable noncontrolling interests 21 15 Equity: Total

partners’ capital 26,666 18,642 Noncontrolling interest

4,191 7,885 Total equity 30,857 26,527

Total liabilities and equity $ 77,011 $ 70,191

(a) The Sunoco Logistics Merger resulted in Energy Transfer

Partners, L.P. being treated as the surviving consolidated entity

from an accounting perspective, while Sunoco Logistics (prior to

changing its name to “Energy Transfer Partners, L.P.”) was the

surviving consolidated entity from a legal and reporting

perspective. Therefore, for the pre-merger periods, the

consolidated financial statements reflect the consolidated

financial statements of the legal acquiree (i.e., the entity that

was named “Energy Transfer Partners, L.P.” prior to the merger and

name changes).

The Sunoco Logistics Merger was accounted for as an equity

transaction. The Sunoco Logistics Merger did not result in any

changes to the carrying values of assets and liabilities in the

consolidated financial statements, and no gain or loss was

recognized. For the periods prior to the Sunoco Logistics Merger,

the Sunoco Logistics limited partner interests that were owned by

third parties (other than Energy Transfer Partners, L.P. or its

consolidated subsidiaries) are presented as noncontrolling interest

in these consolidated financial statements.

ENERGY TRANSFER

PARTNERS, L.P. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except per unit data)

(unaudited)

Three Months Ended Nine Months Ended

September 30, September 30, 2017

2016 (a)

2017 (a)

2016 (a)

REVENUES $ 6,973 $ 5,531 $ 20,444 $ 15,301 COSTS AND EXPENSES: Cost

of products sold 4,876 3,844 14,582 10,280 Operating expenses 571

475 1,603 1,359 Depreciation, depletion and amortization 596 503

1,713 1,469 Selling, general and administrative 105

71 335 226 Total costs

and expenses 6,148 4,893 18,233

13,334 OPERATING INCOME 825 638 2,211 1,967

OTHER INCOME (EXPENSE): Interest expense, net (367 ) (345 ) (1,052

) (981 ) Equity in earnings of unconsolidated affiliates 127 65 139

260 Impairment of investment in an unconsolidated affiliate — (308

) — (308 ) Losses on interest rate derivatives (8 ) (28 ) (28 )

(179 ) Other, net 72 52 169

96 INCOME BEFORE INCOME TAX EXPENSE (BENEFIT)

649 74 1,439 855 Income tax expense (benefit) (112 )

(64 ) 22 (131 ) NET INCOME 761 138 1,417 986

Less: Net income attributable to noncontrolling interest 110

64 243 231 NET

INCOME ATTRIBUTABLE TO PARTNERS 651 74 1,174 755 General Partner’s

interest in net income 270 220 727 740 Class H Unitholder’s

interest in net income — 93 98 257 Class I Unitholder’s interest in

net income — 2 — 6

Common Unitholders’ interest in net income (loss) $ 381

$ (241 ) $ 349 $ (248 ) NET INCOME (LOSS) PER COMMON

UNIT: (b) Basic $ 0.33 $ (0.33 ) $ 0.35 $ (0.36 ) Diluted $ 0.33 $

(0.33 ) $ 0.34 $ (0.36 ) WEIGHTED AVERAGE NUMBER OF COMMON UNITS

OUTSTANDING: (b) Basic 1,125.2 761.1 990.9 749.7 Diluted 1,128.9

761.1 995.5 749.7

(a) See note (a) to the condensed consolidated balance

sheets.

(b) The historical common units and net income (loss) per

limited partner unit amounts presented in these consolidated

financial statements have been retrospectively adjusted to reflect

the 1.5 to one unit-for-unit exchange in connection with the Sunoco

Logistics Merger.

SUPPLEMENTAL

INFORMATION

(Dollars and units in millions)

(unaudited)

Three Months Ended Nine Months

Ended September 30, September 30, 2017

2016 (a)

2017 (a)

2016 (a)

Reconciliation of net income to Adjusted EBITDA and

Distributable Cash Flow (b): Net income $ 761 $ 138 $ 1,417 $

986 Interest expense, net 367 345 1,052 981 Income tax expense

(benefit) (112 ) (64 ) 22 (131 ) Depreciation, depletion and

amortization 596 503 1,713 1,469 Non-cash unit-based compensation

expense 19 22 57 60 Losses on interest rate derivatives 8 28 28 179

Unrealized (gains) losses on commodity risk management activities

81 15 (17 ) 96 Inventory valuation adjustments (86 ) (37 ) (30 )

(143 ) Impairment of investment in an unconsolidated affiliate —

308 — 308 Equity in earnings of unconsolidated affiliates (127 )

(65 ) (139 ) (260 ) Adjusted EBITDA related to unconsolidated

affiliates 279 240 765 711 Other, net (42 ) (43 )

(111 ) (84 ) Adjusted EBITDA (consolidated) 1,744

1,390 4,757 4,172 Adjusted EBITDA related to unconsolidated

affiliates (279 ) (240 ) (765 ) (711 ) Distributable cash flow from

unconsolidated affiliates 169 124 436 384 Interest expense, net

(367 ) (345 ) (1,052 ) (981 ) Current income tax expense (9 ) (11 )

(22 ) (23 ) Maintenance capital expenditures (119 ) (97 ) (286 )

(234 ) Other, net 16 3 43

(3 ) Distributable Cash Flow (consolidated) 1,155 824 3,111

2,604 Distributable Cash Flow attributable to PennTex Midstream

Partners, LP (“PennTex”) (100%) (c) — — (19 ) — Distributions from

PennTex to ETP (c) — 8 8 8 Distributable cash flow attributable to

noncontrolling interest in other consolidated subsidiaries

(119 ) (11 ) (199 ) (28 ) Distributable Cash

Flow attributable to the partners of ETP 1,036 821 2,901 2,584

Transaction-related expenses 13 2

45 4 Distributable Cash Flow

attributable to the partners of ETP, as adjusted $ 1,049 $

823 $ 2,946 $ 2,588

Distributions to

partners (d): Limited Partners: Common Units held by public $

638 $ 530 $ 1,794 $ 1,495 Common Units held by parent 15 2 45 6

General Partner interests 4 3 12 10 Incentive Distribution Rights

(“IDRs”) held by parent 431 346 1,204 968 IDR relinquishments

(163 ) (135 ) (482 ) (278 ) Total

distributions to be paid to partners $ 925 $ 746 $

2,573 $ 2,201 Common Units outstanding – end of

period (d)(e) 1,155.5 1,019.9

1,155.5 1,019.9 Distribution coverage ratio

(f) 1.13x 1.10x 1.14x 1.18x

(a) For the nine months ended September 30, 2017 and the

three and nine months ended September 30, 2016, the

calculation of Distributable Cash Flow and the amounts reflected

for distributions to partners and common units outstanding reflect

the pro forma impacts of the Sunoco Logistics Merger as though the

merger had occurred on January 1, 2016. As a result, the prior

period amounts reported above differ from information previously

reported by legacy ETP, as follows:

- Distributable cash flow attributable to

the partners of ETP includes amounts attributable to the partners

of both legacy ETP and legacy Sunoco Logistics. Previously, the

calculation of distributable cash flow attributable to the partners

of ETP (as previously reported by legacy ETP) excluded the

distributable cash flow attributable to Sunoco Logistics and only

included distributions from legacy Sunoco Logistics to legacy

ETP.

- Distributable cash flow attributable to

noncontrolling interest in other consolidated subsidiaries includes

amounts attributable to the noncontrolling interests in the other

consolidated subsidiaries of both legacy ETP and legacy Sunoco

Logistics.

- The transaction-related expenses

adjustment in distributable cash flow attributable to the partners

of ETP, as adjusted, includes amounts incurred by both legacy ETP

and legacy Sunoco Logistics.

- Distributions to limited partners

include distributions paid on the common units of both legacy ETP

and legacy Sunoco Logistics but exclude the following distributions

in the prior periods on units that were cancelled in the merger,

which comprise the following: (i) distributions paid by legacy

Sunoco Logistics on its common units held legacy ETP and (ii)

distributions paid by legacy ETP on its Class H units held by

ETE.

- Distributions on General Partner

interests and incentive distribution rights are reflected on a pro

forma basis, based on the pro forma cash distributions to limited

partners and the current distribution waterfall per the limited

partnership agreement (i.e., the legacy Sunoco Logistics

distribution waterfall).

- Common units outstanding for the

pre-merger periods reflect (i) the legacy ETP common units

outstanding at the end of the period multiplied by a factor of 1.5x

and (ii) the legacy Sunoco Logistics common units outstanding at

the end of the period minus 67.1 million legacy Sunoco Logistics

common units held by ETP, which were cancelled in connection with

the closing of the merger.

(b) Adjusted EBITDA and Distributable Cash Flow are non-GAAP

financial measures used by industry analysts, investors, lenders,

and rating agencies to assess the financial performance and the

operating results of ETP’s fundamental business activities and

should not be considered in isolation or as a substitute for net

income, income from operations, cash flows from operating

activities, or other GAAP measures.

There are material limitations to using measures such as

Adjusted EBITDA and Distributable Cash Flow, including the

difficulty associated with using either as the sole measure to

compare the results of one company to another, and the inability to

analyze certain significant items that directly affect a company’s

net income or loss or cash flows. In addition, our calculations of

Adjusted EBITDA and Distributable Cash Flow may not be consistent

with similarly titled measures of other companies and should be

viewed in conjunction with measurements that are computed in

accordance with GAAP, such as segment margin, operating income, net

income, and cash flow from operating activities.

Definition of Adjusted EBITDA

We define Adjusted EBITDA as total partnership earnings before

interest, taxes, depreciation, depletion, amortization and other

non-cash items, such as non-cash compensation expense, gains and

losses on disposals of assets, the allowance for equity funds used

during construction, unrealized gains and losses on commodity risk

management activities, non-cash impairment charges, losses on

extinguishments of debt and other non-operating income or expense

items. Unrealized gains and losses on commodity risk management

activities include unrealized gains and losses on commodity

derivatives and inventory fair value adjustments (excluding lower

of cost or market adjustments). Adjusted EBITDA reflects amounts

for less than wholly-owned subsidiaries based on 100% of the

subsidiaries’ results of operations and for unconsolidated

affiliates based on our proportionate ownership.

Adjusted EBITDA is used by management to determine our operating

performance and, along with other financial and volumetric data, as

internal measures for setting annual operating budgets, assessing

financial performance of our numerous business locations, as a

measure for evaluating targeted businesses for acquisition and as a

measurement component of incentive compensation.

Definition of Distributable Cash Flow

We define Distributable Cash Flow as net income, adjusted for

certain non-cash items, less maintenance capital expenditures.

Non-cash items include depreciation, depletion and amortization,

non-cash compensation expense, amortization included in interest

expense, gains and losses on disposals of assets, the allowance for

equity funds used during construction, unrealized gains and losses

on commodity risk management activities, non-cash impairment

charges, losses on extinguishments of debt and deferred income

taxes. Unrealized gains and losses on commodity risk management

activities includes unrealized gains and losses on commodity

derivatives and inventory fair value adjustments (excluding lower

of cost or market adjustments). For unconsolidated affiliates,

Distributable Cash Flow reflects the Partnership’s proportionate

share of the investee’s distributable cash flow.

Distributable Cash Flow is used by management to evaluate our

overall performance. Our partnership agreement requires us to

distribute all available cash, and Distributable Cash Flow is

calculated to evaluate our ability to fund distributions through

cash generated by our operations.

On a consolidated basis, Distributable Cash Flow includes 100%

of the Distributable Cash Flow of ETP’s consolidated subsidiaries.

However, to the extent that noncontrolling interests exist among

our subsidiaries, the Distributable Cash Flow generated by our

subsidiaries may not be available to be distributed to our

partners. In order to reflect the cash flows available for

distributions to our partners, we have reported Distributable Cash

Flow attributable to partners, which is calculated by adjusting

Distributable Cash Flow (consolidated), as follows:

- For subsidiaries with publicly traded

equity interests, Distributable Cash Flow (consolidated) includes

100% of Distributable Cash Flow attributable to such subsidiary,

and Distributable Cash Flow attributable to our partners includes

distributions to be received by the parent company with respect to

the periods presented.

- For consolidated joint ventures or

similar entities, where the noncontrolling interest is not publicly

traded, Distributable Cash Flow (consolidated) includes 100% of

Distributable Cash Flow attributable to such subsidiary, but

Distributable Cash Flow attributable to partners is net of

distributions to be paid by the subsidiary to the noncontrolling

interests.

For Distributable Cash Flow attributable to partners, as

adjusted, certain transaction-related and non-recurring expenses

that are included in net income are excluded.

(c) Beginning with the second quarter of 2017, PennTex became a

wholly owned subsidiary of ETP. The amounts reflected above for

PennTex relate only to the first quarter of 2017, and no

distributable cash flow has been attributed to noncontrolling

interests in PennTex subsequent to March 31, 2017.

(d) Distributions on ETP Common Units and the number of ETP

Common Units outstanding at the end of the period, both as

reflected above, exclude amounts related to ETP Common Units held

by subsidiaries of ETP.

(e) Reflects the sum of (i) the ETP Common Units outstanding at

the end of period multiplied by a factor of 1.5x and (ii) the

Sunoco Logistics Common Units outstanding at end of period minus

67.1 million Sunoco Logistics Common Units held by ETP, which units

were cancelled in connection with the closing of the merger.

(f) Distribution coverage ratio for a period is calculated as

Distributable Cash Flow attributable to partners, as adjusted,

divided by net distributions expected to be paid to the partners of

ETP in respect of such period.

SUMMARY ANALYSIS

OF QUARTERLY RESULTS BY SEGMENT

(Tabular dollar amounts in millions)

(unaudited)

Three Months Ended September 30, 2017

2016

Segment Adjusted EBITDA: Intrastate

transportation and storage $ 163 $ 133 Interstate transportation

and storage 273 278 Midstream 356 314 NGL and refined products

transportation and services (1) 423 383 Crude oil transportation

and services (1) 396 169 All other 133 113 $ 1,744 $

1,390

(1) Subsequent to the Sunoco Logistics Merger, the Partnership’s

reportable segments were revised. Amounts reflected in prior

periods have been retrospectively adjusted to conform to the

current reportable segment presentation for NGL and refined

products transportation and services and crude oil transportation

and services.

In the following analysis of segment operating results, a

measure of segment margin is reported for segments with sales

revenues. Segment Margin is a non-GAAP financial measure and is

presented herein to assist in the analysis of segment operating

results and particularly to facilitate an understanding of the

impacts that changes in sales revenues have on the segment

performance measure of Segment Adjusted EBITDA. Segment Margin is

similar to the GAAP measure of gross margin, except that Segment

Margin excludes charges for depreciation, depletion and

amortization.

In addition, for certain segments, the sections below include

information on the components of Segment Margin by sales type,

which components are included in order to provide additional

disaggregated information to facilitate the analysis of Segment

Margin and Segment Adjusted EBITDA. For example, these components

include transportation margin, storage margin, and other margin.

These components of Segment Margin are calculated consistent with

the calculation of Segment Margin; therefore, these components also

exclude charges for depreciation, depletion and amortization.

For prior periods reported herein, certain transactions related

to the business of legacy Sunoco Logistics have been reclassified

from cost of products sold to operating expenses; these

transactions include sales between operating subsidiaries and their

marketing affiliates. These reclassifications had no impact on net

income or total equity.

Following is a reconciliation of Segment Margin to operating

income, as reported in the Partnership’s consolidated statements of

operations:

Three Months Ended September 30, 2017

2016 Intrastate transportation and

storage $ 167 $ 172 Interstate transportation and storage 224 236

Midstream 530 476 NGL and refined products transportation and

services 488 484 Crude oil transportation and services 588 266 All

other 112 79 Intersegment eliminations (12 ) (26 )

Total Segment Margin 2,097 1,687 Less: Operating expenses

571 475 Depreciation, depletion and amortization 596 503 Selling,

general and administrative 105 71

Operating income $ 825 $ 638

Intrastate Transportation and

Storage

Three Months Ended September 30, 2017

2016 Natural gas transported

(MMBtu/d) 8,942,066 8,289,826 Revenues $ 773 $ 758 Cost of products

sold 606 586 Segment margin 167 172

Unrealized (gains) losses on commodity risk management activities

22 (7 ) Operating expenses, excluding non-cash compensation expense

(40 ) (43 ) Selling, general and administrative expenses, excluding

non-cash compensation expense (6 ) (5 ) Adjusted EBITDA related to

unconsolidated affiliates 19 15 Other 1 1

Segment Adjusted EBITDA $ 163 $ 133

Distributions from unconsolidated affiliates $ 10 $ 13

Transported volumes increased primarily due to higher demand for

exports to Mexico, along with the addition of new pipes to our

intrastate pipeline system. These increases were partially offset

by lower production volumes in the Barnett Shale region.

Segment Adjusted EBITDA. For the three months ended

September 30, 2017 compared to the same period last year,

Segment Adjusted EBITDA related to our intrastate transportation

and storage segment increased due to the net impacts of the

following:

- an increase of $29 million in

natural gas sales and other (excluding net changes in unrealized

gains and losses of $13 million) primarily due to higher

realized gains from pipeline optimization activity;

- an increase of $9 million in

storage margin (excluding net changes in unrealized gains and

losses of $16 million related to fair value inventory

adjustments and unrealized gains and losses on derivatives);

- a decrease of $3 million in

operating expenses primarily due to the timing of project related

expenses of $3 million, lower allocated expenses and lower

capitalized overhead of $2 million, partially offset by higher

outside services and employee expenses of $2 million; and

- an increase of $4 million in

Adjusted EBITDA related to unconsolidated affiliates due to two new

joint venture pipelines placed in service in 2017; partially offset

by

- a decrease in transportation fees of

$14 million due to renegotiated contracts resulting in lower

billed volumes, offset by increased margin from optimization

activity recorded in natural gas sales and other.

Interstate Transportation and

Storage

Three Months Ended September 30, 2017

2016 Natural gas transported

(MMBtu/d) 6,074,783 5,385,679 Natural gas sold (MMBtu/d) 19,012

19,478 Revenues $ 224 $ 236 Operating expenses, excluding non-cash

compensation, amortization and accretion expenses (79 ) (76 )

Selling, general and administrative expenses, excluding non-cash

compensation, amortization and accretion expenses (14 ) (13 )

Adjusted EBITDA related to unconsolidated affiliates 140 131 Other

2 — Segment Adjusted EBITDA $ 273

$ 278 Distributions from unconsolidated

affiliates $ 81 $ 84

Transported volumes reflected increases of 157,060 MMBtu/d on

the Trunkline pipeline as a result of increased backhaul

deliveries, 153,401 MMBtu/d on the Tiger pipeline due to an

increase in production in the Haynesville Shale, and 142,207

MMBtu/d on the Transwestern pipeline as a result of weather driven

demand in the West and opportunities in the Texas intrastate

market. The remainder of the increase was primarily due to the

Rover pipeline, which was placed in partial service on August 31,

2017.

Segment Adjusted EBITDA. For the three months ended

September 30, 2017 compared to the same period last year,

Segment Adjusted EBITDA related to our interstate transportation

and storage segment decreased due to the net effect of the

following:

- a decrease in reservation revenues of

$16 million on the Panhandle, Trunkline and Transwestern pipelines

and a decrease of $3 million in gas parking service related

revenues on the Panhandle and Trunkline pipelines, primarily due to

lack of customer demand driven by weak spreads and mild weather. In

addition, revenues on the Tiger pipeline decreased $3 million due

to contract restructuring. These decreases were offset by $10

million of revenues from the placement in partial service of the

Rover pipeline effective August 31, 2017; and

- an increase in operating expenses of

$3 million primarily due to higher ad valorem taxes resulting

from higher valuations; offset by

- an increase in income from

unconsolidated joint ventures of $9 million primarily due to a

legal settlement and lower operating expenses on Citrus.

Midstream

Three Months Ended September 30, 2017

2016 Gathered volumes (MMBtu/d)

11,090,285 9,675,003 NGLs produced (Bbls/d) 449,454 420,877 Equity

NGLs (Bbls/d) 27,185 34,341 Revenues $ 1,765 $ 1,343 Cost of

products sold 1,235 867 Segment margin

530 476 Unrealized losses on commodity risk management activities 1

— Operating expenses, excluding non-cash compensation expense (157

) (153 ) Selling, general and administrative expenses, excluding

non-cash compensation expense (26 ) (17 ) Adjusted EBITDA related

to unconsolidated affiliates 6 7 Other 2 1

Segment Adjusted EBITDA $ 356 $ 314

Gathered volumes and NGL production increased primarily due to

recent acquisitions, including PennTex, and gains in the Permian

and Northeast regions, partially offset by basin declines in the

South Texas, North Texas, and Mid-Continent/Panhandle regions.

Segment Adjusted EBITDA. For the three months ended

September 30, 2017 compared to the same period last year,

Segment Adjusted EBITDA related to our midstream segment increased

due to the net effects of the following:

- an increase of $24 million

(excluding net changes in unrealized gains and losses of

$1 million) in non-fee based margin due to higher crude oil

and NGL prices;

- an increase of $16 million in

fee-based revenue due to minimum volume commitments in the South

Texas region, as well as volume increases in the Permian and

Northeast regions. These increases were partially offset by volume

declines in South Texas, North Texas and the

Mid-Continent/Panhandle regions; and

- an increase of $15 million in

fee-based revenue due to recent acquisitions, including PennTex;

partially offset by

- an increase of $4 million in

operating expenses primarily due to recent acquisitions, including

PennTex; and

- an increase in selling, general and

administrative expenses primarily due to an increase in shared

services allocation.

NGL and Refined Products Transportation

and Services

Three Months Ended September 30, 2017

2016 NGL transportation volumes

(MBbls/d) 836 766 Refined products transportation volumes (MBbls/d)

612 611 NGL and refined products terminal volumes (MBbls/d) 782 822

NGL fractionation volumes (MBbls/d) 390 338 Revenues $ 2,070 $

1,545 Cost of products sold 1,582 1,061

Segment margin 488 484 Unrealized losses on commodity risk

management activities 56 21 Operating expenses, excluding non-cash

compensation expense (105 ) (109 ) Selling, general and

administrative expenses, excluding non-cash compensation expense

(13 ) (12 ) Adjusted EBITDA related to unconsolidated affiliates 19

21 Inventory valuation adjustments (22 ) (22 )

Segment Adjusted EBITDA $ 423 $ 383

NGL and refined products transportation volumes increased in the

major producing regions, including the Permian, Southeast Texas,

Louisiana, Eagle Ford and North Texas. NGL and refined products

terminal volumes decreased for the three months ended

September 30, 2017 primarily due to the sale of one of our

refined product terminals in April 2017.

Average daily fractionated volumes increased 17% compared to the

same period last year primarily due to the commissioning of our

fourth fractionator at Mont Belvieu, Texas, in October 2016, which

has a capacity of 120,000 Bbls/d, as well as increased producer

volumes as mentioned above.

Segment Adjusted EBITDA. For the three months ended

September 30, 2017 compared to the same period last year,

Segment Adjusted EBITDA related to our NGL and refined products

transportation and services segment increased due to net impact of

the following:

- an increase in transportation margin of

$20 million primarily due to higher volumes on our Texas NGL

pipelines and our Mariner East system;

- an increase in fractionation and

refinery services margin of $13 million (excluding net changes

in unrealized gains and losses of $1 million) primarily due to

higher NGL volumes from most major producing regions, as noted

above;

- an increase in terminal services margin

of $7 million due to higher terminal volumes from the Mariner

NGL projects; and

- a decrease of $4 million in

operating expenses primarily due to a legal settlement of $8

million and a quarterly ad valorem tax true-up of $1 million;

partially offset by

- a decrease of $1 million in

marketing margin (excluding net changes in unrealized gains and

losses of $36 million) primarily due to the timing of the

recognition of margin from optimization activities; and

- an increase of $1 million in

selling, general and administrative expenses due to higher

allocations and lower capitalized overhead resulting from reduced

capital spending.

Crude Oil Transportation and

Services

Three Months Ended September 30, 2017

2016 Crude Transportation

Volumes (MBbls/d) 3,758 2,686 Crude Terminals Volumes (MBbls/d)

1,923 1,559 Revenues $ 2,725 $ 1,856 Cost of products sold

2,137 1,590 Segment margin 588 266 Unrealized

gains on commodity risk management activities (1 ) — Operating

expenses, excluding non-cash compensation expense (119 ) (71 )

Selling, general and administrative expenses, excluding non-cash

compensation expense (13 ) (16 ) Inventory valuation adjustments

(64 ) (15 ) Adjusted EBITDA related to unconsolidated affiliates

5 5 Segment Adjusted EBITDA $ 396

$ 169

Segment Adjusted EBITDA. For the three months ended

September 30, 2017 compared to the same period last year,

Segment Adjusted EBITDA related to our crude oil transportation and

services segment increased due to the following:

- an increase of $194 million resulting

primarily from placing our Bakken Pipeline in service in the second

quarter of 2017, as well as the acquisition of a crude oil

gathering system in West Texas;

- an increase of $28 million from

existing assets due to increased volumes throughout the system;

and

- an increase of $18 million due to the

impact of LIFO accounting; partially offset by

- additional operating expense as a

result of placing other new projects in service and costs

associated with increased volumes on our system.

All Other

Three Months Ended September 30, 2017

2016 Revenues $ 683 $ 956 Cost

of products sold 571 877 Segment margin

112 79 Unrealized losses on commodity risk management activities 3

1 Operating expenses, excluding non-cash compensation expense (34 )

(20 ) Selling, general and administrative expenses, excluding

non-cash compensation expense (34 ) (14 ) Adjusted EBITDA related

to unconsolidated affiliates 88 63 Other and eliminations (2

) 4 Segment Adjusted EBITDA $ 133 $ 113

Distributions from unconsolidated affiliates $ 39 $ 38

Amounts reflected in our all other segment primarily

include:

- our equity method investment in limited

partnership units of Sunoco LP consisting of 43.5 million

units, representing 43.7% of Sunoco LP’s total outstanding common

units;

- our natural gas marketing and

compression operations;

- a non-controlling interest in PES,

comprising 33% of PES' outstanding common units; and

- our investment in Coal Handling, an

entity that owns and operates end-user coal handling

facilities.

Segment Adjusted EBITDA. For the three months ended

September 30, 2017 compared to the same period last year,

Segment Adjusted EBITDA related to our all other segment increased

primarily due to the net impact of the following:

- an increase of $25 million in

Adjusted EBITDA related to unconsolidated affiliates, reflecting an

increase of $34 million from our investment in PES, offset by

a decrease of $9 million from our investment in Sunoco

LP;

- an increase of $7 million from

commodity trading activities; and

- an increase of $4 million from our

compression operations; partially offset by

- an increase of $11 million in

transaction related expenses; and

- an increase of $9 million in operating

expenses related to an equipment lease buyout.

SUPPLEMENTAL

INFORMATION ON CAPITAL EXPENDITURES

(In millions)

(unaudited)

The following is a summary of capital

expenditures (net of contributions in aid of construction costs)

for the nine months ended September 30, 2017:

Growth Maintenance

Total Intrastate transportation and storage $ 34 $ 22 $ 56

Interstate transportation and storage 1,704 50 1,754 Midstream 914

76 990 NGL and refined products transportation and services 2,106

53 2,159 Crude oil transportation and services 331 36 367 All other

(including eliminations) 128 49 177 Total

capital expenditures $ 5,217 $ 286 $ 5,503

SUPPLEMENTAL

INFORMATION ON LIQUIDITY

(In millions)

(unaudited)

Funds Available at

Facility Size September 30, 2017 Maturity Date Legacy ETP Revolving

Credit Facility $ 3,750 $ 1,549 November 18, 2019 Legacy Sunoco

Logistics Revolving Credit Facility 2,500 2,463 March

20, 2020 $ 6,250 $ 4,012

SUPPLEMENTAL

INFORMATION ON UNCONSOLIDATED AFFILIATES

(In millions)

(unaudited)

Three Months Ended September 30, 2017

2016

Equity in earnings (losses) of unconsolidated

affiliates: Citrus $ 35 $ 31 FEP 14 12 PES 11 (26 ) MEP 9 9 HPC

5 8 Sunoco LP 35 16 Other 18 15 Total equity

in earnings of unconsolidated affiliates $ 127 $ 65

Adjusted EBITDA related to unconsolidated affiliates: Citrus

$ 99 $ 90 FEP 18 19 PES 15 (19 ) MEP 23 22 HPC 13 15 Sunoco LP 74

83 Other 37 30 Total Adjusted EBITDA related

to unconsolidated affiliates $ 279 $ 240

Distributions received from unconsolidated affiliates:

Citrus $ 50 $ 50 FEP 18 17 MEP 13 17 HPC 9 13 Sunoco LP 36 36 Other

18 16 Total distributions received from

unconsolidated affiliates $ 144 $ 149

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171107006769/en/

Energy TransferInvestor Relations:Lyndsay Hannah, Brent

Ratliff, Helen Ryoo, 214-981-0795orMedia Relations:Vicki

Granado, 214-840-5820

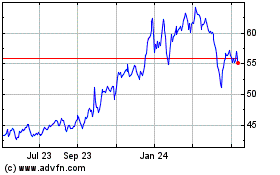

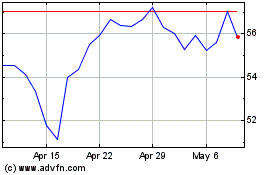

Sunoco (NYSE:SUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sunoco (NYSE:SUN)

Historical Stock Chart

From Apr 2023 to Apr 2024