KNOT Offshore Partners LP Announces Pricing of Public Offering of 3,000,000 Common Units

November 07 2017 - 8:54AM

Business Wire

KNOT Offshore Partners LP (the “Partnership”) (NYSE: KNOP)

announced that it has priced its previously announced public

offering of 3,000,000 common units, representing limited partner

interests in the Partnership, for total estimated gross proceeds of

approximately $65.7 million before deducting estimated offering

expenses payable by the Partnership. The offering is expected to

close on November 9, 2017, subject to customary closing

conditions.

The Partnership intends to use the net proceeds that it receives

in the offering, and the related capital contribution by its

general partner to maintain its general partner interest, for

general partnership purposes, which may include, among other

things, acquisitions, capital expenditures, repaying indebtedness

and funding working capital.

The Partnership owns, operates and acquires shuttle tankers

under long-term charters in the offshore oil production regions of

the North Sea and Brazil. The Partnership is structured as a master

limited partnership. The Partnership’s common units trade on the

New York Stock Exchange (“NYSE”) under the symbol “KNOP.”

BofA Merrill Lynch is acting as the sole bookrunner on the

offering. The underwriter may offer the common units from time to

time for sale in one or more transactions on the NYSE, in the

over-the-counter market, through negotiated transactions or

otherwise at market prices prevailing at the time of sale, at

prices related to such prevailing market prices or at negotiated

prices.

When available, copies of the prospectus supplement and

accompanying base prospectus relating to the offering may be

obtained free of charge on the Securities and Exchange Commission’s

website at http://www.sec.gov or from the underwriter as

follows:

BofA Merrill Lynch

NC1-004-03-43

200 North College Street, 3rd floor

Charlotte, NC 28255-0001

Attn: Prospectus Department

Email: dg.prospectus_requests@baml.com

This press release does not constitute an offer to sell or a

solicitation of an offer to buy the securities described herein,

nor shall there be any sale of these securities in any state or

jurisdiction in which such an offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. The offering of the

common units is being made pursuant to an effective registration

statement on Form F-3 previously filed with the Securities and

Exchange Commission (the “SEC”) (File No. 333-218254). This

offering may be made only by means of a prospectus supplement and

accompanying base prospectus, which will be filed with the SEC.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171107006011/en/

KNOT Offshore Partners LPJohn Costain, +44 1224

618420Chief Executive Officer and Chief Financial Officer

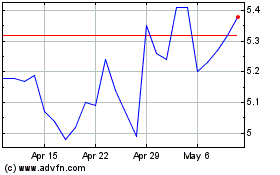

KNOT Offshore Partners (NYSE:KNOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

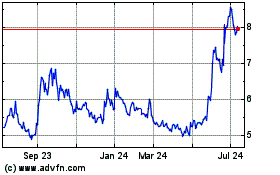

KNOT Offshore Partners (NYSE:KNOP)

Historical Stock Chart

From Apr 2023 to Apr 2024