Heidelberg, Germany, November 7, 2017 - Affimed

N.V. (Nasdaq: AFMD), a clinical stage biopharmaceutical company

focused on discovering and developing highly targeted cancer

immunotherapies, today reported financial results for the quarter

ended September 30, 2017.

"We continue to make great strides in validating

our NK cell engager programs, in particular through encouraging

data from studies of our lead candidate AFM13, which is progressing

through clinical development as a mono- and combination therapy,"

said Dr. Adi Hoess, CEO of Affimed. "Leveraging our unique NK

cell-based platform for high-affinity CD16A-targeting, we are

advancing our tetravalent bispecific antibodies with the potential

to tailor immune-engaging therapy to different indications and

settings."

Third Quarter Updates

Corporate Update

- In September 2017, Dr. Wolfgang Fischer, former Global Head of

Program and Project Management of Sandoz Biopharmaceuticals

(Novartis Group) joined Affimed as Chief Operating Officer. Dr.

Fischer has over 20 years of R&D experience with a focus on

oncology, immunology and pharmacology. With his proven track record

in drug development, he will support the Company in advancing its

unique immune cell engagers to address the existing medical need in

hematologic and solid tumor indications. In addition to his role as

COO, Dr. Fischer will assume responsibility as interim CMO, working

closely with the Company's clinical team.

NK cell engager programs

- In Affimed's Phase 1b combination study of its lead product

candidate, the CD30/CD16A-targeting NK cell engager AFM13, with

Merck's Keytruda (pembrolizumab) in Hodgkin lymphoma (HL) the dose

expansion cohort is open and recruiting. Data analysis of

three-month response rates is ongoing for the escalation phase of

the trial with analysis of 9 out of 12 patients completed to date.

Of the 3 patients enrolled into cohort 1, two experienced partial

metabolic responses, while one patient progressed. Of the 3

patients enrolled into cohort 2, one patient experienced a complete

metabolic response, one patient experienced a partial metabolic

response and one patient progressed. Out of the six patients in

dose cohort 3, three were analyzed to date, all of which

experienced partial metabolic responses at the first tumor response

assessment. The Company intends to present detailed dose escalation

data including response data of the three remaining patients in

cohort 3 at the upcoming ASH 2017 Annual Meeting in December.

- Affimed is supporting a translational Phase 1b/2a study of

AFM13 in patients with relapsed or refractory CD30-positive

lymphoma with cutaneous manifestation led by Columbia University.

The study is designed to allow for serial biopsies, thereby

enabling assessment of NK cell biology and tumor cell killing

within the tumor microenvironment. The first cohort has been fully

enrolled and recruitment into further cohorts is ongoing. The first

patient, suffering from anaplastic large-cell lymphoma (ALCL) with

cutaneous manifestation, experienced a complete response of

cutaneous lesions after the first treatment cycle. Systemic

evaluation is ongoing. This provides first evidence that NK cell

engagers are able to induce tumor regression in this

indication.

- The Company's investigator-sponsored Phase 2a monotherapy study

of AFM13 in HL led by the German Hodgkin Study Group (GHSG), is

open to recruit under the new design, which includes patients

pre-treated with both brentuximab vedotin (B.V.) and anti-PD1.

- In Affimed's collaboration with The University of Texas MD

Anderson Cancer Center (MDACC), evaluating the Company's NK cell

engager AFM13 in combination with MDACC's NK cell product,

preclinical research activities are progressing.

- The Company has developed multiple tetravalent, bispecific

antibody formats in addition to its TandAbs. These molecules confer

distinct biophysical properties aimed at tailoring PK profiles.

Based on its platform, Affimed is advancing AFM24, an

EGFR/CD16A-specific NK cell engager and AFM26, a

BCMA/CD16A-specific NK cell engager, through IND-enabling studies.

Final candidates have been selected for AFM24 and AFM26,

respectively.

- Candidates for AFM24, developed to treat solid tumors, are

based on both TandAb format and on novel proprietary antibody

formats. AFM24 molecules offer a differentiated mode of action as

compared to cetuximab. Furthermore, binding to NK cells is largely

unaffected by IgG competition, resulting in higher efficacy and

elimination of cells with low target expression. Affimed is

currently evaluating its novel format-based AFM24 molecules, which

have significantly longer half-lives, in comparison to the

Company's TandAbs, which have already shown evidence of a

beneficial safety profile.

- AFM26 is designed to eliminate malignant cells in multiple

myeloma (MM) independent of BCMA expression levels. AFM26 offers a

differentiated mode of action, targeting cells expressing very low

levels of BCMA, conferring NK cell cytotoxicity and eliciting lower

cytokine release compared to a BiTE molecule. Furthermore, binding

to NK cells is largely unaffected by IgG competition. These unique

features could position AFM26 in patients receiving autologous stem

cell transplant (ASCT)-eligible at or shortly after transplant, a

period in which no treatment is currently available.

T cell engager programs

- Affimed is conducting two clinical Phase 1 dose-escalation

trials with AFM11, a CD3/CD19-targeting tetravalent bispecific T

cell engager in patients with relapsed and refractory (r/r) acute

lymphocytic leukemia (ALL) and with r/r non-Hodgkin lymphoma (NHL),

respectively. Both studies are ongoing and recruiting.

- Recruitment is ongoing into a first-in-human Phase 1 dose

escalation trial of AMV564 conducted by Amphivena Therapeutics,

Inc. in patients with r/r acute myeloid leukemia (AML). AMV564 is a

CD33/CD3-specific antibody based on Affimed's technology platform.

Affimed owns ~18.5% of Amphivena (fully diluted).

Financial Highlights(Figures for the

third quarter and first nine months of 2017 and 2016 represent

unaudited figures)

Cash and cash equivalents and financial assets totaled €41.8

million as of September 30, 2017 compared to €44.9 million as of

December 31, 2016. Affimed's operational expenses for the nine

months ended September 30, 2017 were primarily offset by net

proceeds of €16.4 million from a public offering of common shares

in the first quarter and of €2.5 million from the drawdown of the

second tranche of the loan from Silicon Valley Bank.

Net cash used in operating activities was €20.7 million for the

nine months ended September 30, 2017 compared to €25.5 million for

the nine months ended September 30, 2016. The decrease was

primarily related to lower cash expenditure for research and

development (R&D) in connection with Affimed's development and

collaboration programs and to the expiration of the Amphivena

collaboration.

Revenue for the third quarter of 2017 was €0.5 million compared

to €0.9 million for the third quarter of 2016. Revenue in the 2017

period was derived from AbCheck services while revenue in the 2016

period related predominantly to Affimed's collaboration with

Amphivena.

R&D expenses for the third quarter of 2017 were €6.0 million

compared to €8.8 million for the third quarter of 2016. The

decrease was primarily related to lower expenses for AFM13 and our

discovery/early stage development activities.

G&A expenses for the third quarter of 2017 were €1.9 million

compared to €2.2 million for the third quarter of 2016.

Net loss for the third quarter of 2017 was €8.1 million, or

€0.18 per common share, compared to a net loss of €10.3 million, or

€0.31 per common share, for the third quarter of 2016. The decrease

of operating expenses was partially offset by lower revenue and

higher finance costs.

Note on IFRS Reporting StandardsAffimed

prepares and reports the consolidated financial statements and

financial information in accordance with International Financial

Reporting Standards (IFRS) as issued by the International

Accounting Standards Board (IASB). None of the financial statements

were prepared in accordance with Generally Accepted Accounting

Principles (GAAP) in the United States. Affimed maintains its books

and records in Euro.

Conference Call and Webcast

InformationAffimed's management will host a conference call to

discuss the company's financial results and recent corporate

developments today at 8:30 a.m. ET. A webcast of the conference

call can be accessed in the "Events" section on the "Investors

& Media" page of the Affimed website at

www.affimed.com/events.php. A replay of the webcast will be

available on Affimed's website shortly after the conclusion of the

call and will be archived on the Affimed website for 30 days

following the call.

About Affimed N.V.Affimed (Nasdaq: AFMD) engineers

targeted immunotherapies, seeking to cure patients by harnessing

the power of innate and adaptive immunity (NK and T cells). We are

developing single and combination therapies to treat cancers and

other life-threatening diseases. For more information, please visit

www.affimed.com.

FORWARD-LOOKING STATEMENTSThis press

release contains forward-looking statements. All statements other

than statements of historical fact are forward-looking statements,

which are often indicated by terms such as "anticipate," "believe,"

"could," "estimate," "expect," "goal," "intend," "look forward to",

"may," "plan," "potential," "predict," "project," "should," "will,"

"would" and similar expressions. Forward-looking statements appear

in a number of places throughout this release and include

statements regarding our intentions, beliefs, projections, outlook,

analyses and current expectations concerning, among other things,

our ongoing and planned preclinical development and clinical

trials, our collaborations and development of our products in

combination with other therapies, the timing of and our ability to

make regulatory filings and obtain and maintain regulatory

approvals for our product candidates our intellectual property

position, our collaboration activities, our ability to develop

commercial functions, expectations regarding clinical trial data,

our results of operations, cash needs, financial condition,

liquidity, prospects, future transactions, growth and strategies,

the industry in which we operate, the trends that may affect the

industry or us and the risks uncertainties and other factors

described under the heading "Risk Factors" in Affimed's filings

with the Securities and Exchange Commission. Given these risks,

uncertainties and other factors, you should not place undue

reliance on these forward-looking statements, and we assume no

obligation to update these forward-looking statements, even if new

information becomes available in the future.

Contact:Anca Alexandru, Head of

Communications, EU IRPhone: +49 6221 64793341E-Mail:

a.alexandru@affimed.com, IR@affimed.com

AFFIMED N.V.CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

Affimed N.V.Unaudited condensed

consolidated statements of comprehensive loss (in €

thousand)

| |

For the three-months ended September 30 |

|

For the nine-months ended September 30 |

| |

|

2016 |

|

2017 |

|

2016 |

|

2017 |

| Revenue |

|

938 |

|

467 |

|

4,943 |

|

1,374 |

| |

|

|

|

|

|

|

|

|

| Other income - net |

|

19 |

|

117 |

|

143 |

|

201 |

| Research and

development expenses |

|

(8,760) |

|

(6,008) |

|

(24,456) |

|

(16,881) |

| General and

administrative expenses |

|

(2,181) |

|

(1,876) |

|

(6,239) |

|

(6,091) |

| |

|

|

|

|

|

|

|

|

| Operating

loss |

|

(9,984) |

|

(7,300) |

|

(25,609) |

|

(21,397) |

| |

|

|

|

|

|

|

|

|

| Finance income /

(costs) - net |

|

(311) |

|

(800) |

|

(1,183) |

|

(2,425) |

| |

|

|

|

|

|

|

|

|

| Loss before

tax |

|

(10,295) |

|

(8,100) |

|

(26,792) |

|

(23,822) |

| |

|

|

|

|

|

|

|

|

| Income taxes |

|

0 |

|

0 |

|

(2) |

|

20 |

| |

|

|

|

|

|

|

|

|

| Loss for the

period |

|

(10,295) |

|

(8,100) |

|

(26,794) |

|

(23,802) |

| |

|

|

|

|

|

|

|

|

| Total comprehensive

loss |

|

(10,295) |

|

(8,100) |

|

(26,794) |

|

(23,802) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Loss per share in €

per share(undiluted = diluted) |

|

(0.31) |

|

(0.18) |

|

(0.81) |

|

(0.55) |

Affimed N.V.Condensed consolidated

statements of financial position (in € thousand)

|

|

December 31, 2016 |

|

September 30, 2017 |

|

|

|

|

(unaudited) |

|

|

|

|

|

|

ASSETS |

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

|

|

Intangible assets |

55 |

|

56 |

|

Leasehold improvements and equipment |

822 |

|

1,120 |

|

|

877 |

|

1,176 |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

Inventories |

197 |

|

282 |

| Trade

and other receivables |

2,255 |

|

1,583 |

| Other

assets |

516 |

|

502 |

|

Financial assets |

9,487 |

|

8,470 |

| Cash and

cash equivalents |

35,407 |

|

33,343 |

|

|

47,862 |

|

44,180 |

|

|

|

|

|

| TOTAL

ASSETS |

48,739 |

|

45,356 |

|

|

|

|

|

|

EQUITY AND LIABILITIES |

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

| Issued

capital |

333 |

|

447 |

| Capital

reserves |

190,862 |

|

209,606 |

|

Accumulated deficit |

(152,444) |

|

(176,246) |

| Total

equity |

38,751 |

|

33,807 |

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

|

Borrowings |

3,617 |

|

4,682 |

| Total

non-current liabilities |

3,617 |

|

4,682 |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

| Trade

and other payables |

5,323 |

|

4,334 |

|

Borrowings |

973 |

|

2,500 |

| Deferred

revenue |

75 |

|

33 |

| Total

current liabilities |

6,371 |

|

6,867 |

|

|

|

|

|

| TOTAL

EQUITY AND LIABILITIES |

48,739 |

|

45,356 |

Affimed N.V.Unaudited condensed

consolidated statements of cash flows (in € thousand)

| |

For the nine-months ended September 30 |

|

|

2016 |

|

2017 |

| Cash flow from

operating activities |

|

|

|

| Loss for the

period |

(26,794) |

|

(23,802) |

| Adjustments for the

period: |

|

|

|

| - Income taxes |

2 |

|

(20) |

| - Depreciation and

amortization |

293 |

|

257 |

| - Gain from disposal of

leasehold improvements and equipment |

0 |

|

(20) |

| - Share based

payments |

2,719 |

|

1,494 |

| - Finance income /

costs - net |

1,183 |

|

2,425 |

| |

(22,597) |

|

(19,666) |

| Change in trade and

other receivables |

(1,398) |

|

690 |

| Change in

inventories |

(25) |

|

(85) |

| Change in other

assets |

(151) |

|

(393) |

| Change in trade, other

payables and deferred revenue |

(1,080) |

|

(1,044) |

| Cash used in operating

activities |

(25,251) |

|

(20,498) |

| Interest received |

60 |

|

48 |

| Paid interest |

(355) |

|

(229) |

| Net cash used in

operating activities |

(25,546) |

|

(20,679) |

| |

|

|

|

| Cash flow from

investing activities |

|

|

|

| Purchase of intangible

assets |

(21) |

|

(26) |

| Purchase of leasehold

improvements and equipment |

(194) |

|

(545) |

| Cash received from the

sale of leasehold improvements and equipment |

0 |

|

35 |

| Cash paid for

investments in financial assets |

(27,088) |

|

(13,114) |

| Cash received from

maturity of financial assets |

13,536 |

|

13,425 |

| Net cash used for

investing activities |

(13,767) |

|

(225) |

| |

|

|

|

| Cash flow from

financing activities |

|

|

|

| Proceeds from issue of

common shares |

0 |

|

19,241 |

| Transaction costs

related to issue of common shares |

0 |

|

(1,524) |

| Proceeds from

borrowings |

0 |

|

2,500 |

| Transaction costs

related to borrowings |

0 |

|

(11) |

| Repayment of

borrowings |

(1,079) |

|

0 |

| Cash flow from

financing activities |

(1,079) |

|

20,206 |

| |

|

|

|

| Net changes to cash

and cash equivalents |

(40,392) |

|

(698) |

| Cash and cash

equivalents at the beginning of the period |

76,740 |

|

35,407 |

| Exchange-rate

related changes of cash and cash equivalents |

(655) |

|

(1,366) |

| Cash and cash

equivalents at the end of the period |

35,693 |

|

33,343 |

Affimed N.V.Unaudited condensed

consolidated statements of changes in equity (in €

thousand)

| |

Issued

capital |

|

Capital

reserves |

|

Accumulated deficit |

|

Total Equity |

| |

|

|

|

|

|

|

|

| Balance as of

January 1, 2016 |

333 |

|

187,169 |

|

(120,228) |

|

67,274 |

| Equity-settled share

based payment awards |

|

|

2,719 |

|

|

|

2,719 |

| Loss for the

period |

|

|

|

|

(26,794) |

|

(26,794) |

| |

|

|

|

|

|

|

|

| Balance as of

September 30, 2016 |

333 |

|

189,888 |

|

(147,022) |

|

43,199 |

| |

|

|

|

|

|

|

|

| Balance as of

January 1, 2017 |

333 |

|

190,862 |

|

(152,444) |

|

38,751 |

| Issue of common

shares |

114 |

|

17,199 |

|

|

|

17,313 |

| Equity-settled share

based payment awards |

|

|

1,494 |

|

|

|

1,494 |

| Issue of warrant note

(loan Silicon Valley Bank) |

|

|

51 |

|

|

|

51 |

| Loss for the

period |

|

|

|

|

(23,802) |

|

(23,802) |

| |

|

|

|

|

|

|

|

| Balance as of

September 30, 2017 |

447 |

|

209,606 |

|

(176,246) |

|

33,807 |

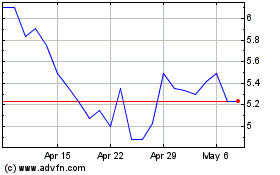

Affimed NV (NASDAQ:AFMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

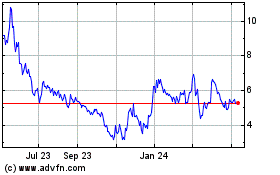

Affimed NV (NASDAQ:AFMD)

Historical Stock Chart

From Apr 2023 to Apr 2024