Virtu Financial, Inc. (NASDAQ:VIRT), a leading technology-enabled

market maker and liquidity provider to the global financial

markets, today reported results for the third quarter ended

September 30, 2017.

Third Quarter Highlights

Reported results include KCG from July 20 through September 30,

2017

- Net loss of $40.0 million, burdened by costs associated with

the KCG acquisition and amortization of purchased intangibles;

Normalized Adjusted Net Income* of $22.2 million

- Basic and Diluted loss per share of $0.17; Normalized Adjusted

EPS* of $0.08

- Total revenues of $271.3 million; Adjusted Net Trading Income*

of $159.8 million

- Adjusted EBITDA* of $58.9 million; Adjusted EBITDA Margin* of

36.8%

- KCG integration on track; Expense and Capital Synergy progress

ahead of plan

- Made total to-date voluntary pre-payments of $200 million on

the $1.15B term loan debt incurred in connection with KCG

acquisition

- Quarterly cash dividend of $0.24 per share payable on December

15, 2017

* Non-GAAP financial measures. Please see "Non-GAAP Financial

Measures and Other Items" for more information.

The Virtu Financial, Inc. Board of Directors

declared a quarterly cash dividend of $0.24 per share. This

dividend is payable on December 15, 2017 to shareholders of record

as of December 1, 2017.

“The integration of Virtu and KCG is going extraordinarily

well. After a very slow start in July, and despite the

continued extremely challenging environment, we generated $3.1

million per day in Adjusted Net Trading Income for the combined

company for the months of August, September and October.

Barely four months in to the acquisition, we have identified cost

savings in excess of our original estimates and have a clear view

of the run-rate expenses of the combined organization.” Mr.

Cifu continued, “The market making businesses of legacy Virtu and

KCG are quite complimentary, and the trading efficiencies we have

begun to realize and pass on to our clients are real and

tangible.”

Third Quarter Financial Results

Total revenues increased 64.6% to $271.3 million

for this quarter, compared to $164.8 million for the same period in

2016. Trading income, net, increased 30.1% to $203.9 million for

this quarter, compared to $156.7 million for the same period in

2016. Net income (loss) decreased to $(40.0) million for this

quarter, compared to $33.0 million for the same period in 2016.

Basic and Diluted earnings (loss) per share for this quarter

were both $(0.17), compared to $0.18 each for the same period in

2016.

Adjusted Net Trading Income increased 64.4% to

$159.8 million for this quarter, compared to $97.2 million for the

same period in 2016. Adjusted EBITDA increased 3.5% to $58.9

million for this quarter, compared to $56.9 million for the same

period in 2016. Normalized Adjusted Net Income decreased 47.6% to

$22.2 million for this quarter, compared to $42.4 million for the

same period in 2016.

Assuming all non-controlling interests had been

exchanged for common stock, and the Company’s Normalized Adjusted

Net Income before income taxes was subject to corporation taxation,

Normalized Adjusted EPS was $0.08 for this quarter and $0.20 for

the same period in 2016.

Operating Segment

Information

Prior to the acquisition of KCG, the Company was

managed and operated as one business, and, accordingly, operated

under one reportable segment. As a result of the acquisition

of KCG, beginning in the third quarter of 2017 the Company has

three operating segments: (i) Market Making; (ii) Execution

Services; and (iii) Corporate.

Market Making principally consists of market

making in the cash, futures and options markets across global

equities, options, fixed income, currencies and commodities. As a

market maker, the Company commits capital on a principal basis by

offering to buy securities from, or sell securities to, broker

dealers, banks and institutions.

Execution Services comprises agency-based

trading and trading venues, offering execution services in global

equities, options, futures and fixed income on behalf of

institutions, banks and broker dealers.

Corporate contains the Company's investments, principally in

strategic trading-related opportunities maintains corporate

overhead expenses.

The following tables show the reconciliations

from trading income, net; to Adjusted Net Trading Income for the

three and nine months ended September 30, 2017 and 2016 (in

thousands, except percentages).

| |

|

| |

Three Months Ended September 30,

2017 |

| Reconciliation

of Trading income, net to |

Market |

|

Execution |

|

|

|

|

| Adjusted Net

Trading Income |

Making |

|

Services |

|

Corporate |

|

Total |

| |

|

|

|

|

|

|

|

| Trading income,

net |

$ |

206,543 |

|

|

$ |

(3,341 |

) |

|

$ |

705 |

|

|

$ |

203,907 |

|

| Commissions, net and

technology services |

|

1,563 |

|

|

|

41,788 |

|

|

|

- |

|

|

|

43,351 |

|

| Interest and dividends

income |

|

20,056 |

|

|

|

103 |

|

|

|

271 |

|

|

|

20,430 |

|

| Brokerage, exchange and

clearance fees, net |

|

(52,321 |

) |

|

|

(12,263 |

) |

|

|

- |

|

|

|

(64,584 |

) |

| Payments for order

flow |

|

(12,452 |

) |

|

|

381 |

|

|

|

- |

|

|

|

(12,071 |

) |

| Interest and dividends

expense |

|

(31,360 |

) |

|

|

1,561 |

|

|

|

(1,443 |

) |

|

|

(31,242 |

) |

| Adjusted Net

Trading Income |

$ |

132,029 |

|

|

$ |

28,229 |

|

|

$ |

(467 |

) |

|

$ |

159,791 |

|

| |

|

|

|

|

|

|

|

| |

Nine Months Ended September 30,

2017 |

| Reconciliation

of Trading income, net to |

Market |

|

Execution |

|

|

|

|

| Adjusted Net

Trading Income |

Making |

|

Services |

|

Corporate |

|

Total |

| |

|

|

|

|

|

|

|

| Trading income,

net |

$ |

482,281 |

|

|

$ |

(3,342 |

) |

|

$ |

705 |

|

|

$ |

479,644 |

|

| Commissions, net and

technology services |

|

1,563 |

|

|

|

47,674 |

|

|

|

- |

|

|

|

49,237 |

|

| Interest and dividends

income |

|

30,558 |

|

|

|

104 |

|

|

|

271 |

|

|

|

30,933 |

|

| Brokerage, exchange and

clearance fees, net |

|

(157,991 |

) |

|

|

(12,262 |

) |

|

|

- |

|

|

|

(170,253 |

) |

| Payments for order

flow |

|

(12,452 |

) |

|

|

381 |

|

|

|

- |

|

|

|

(12,071 |

) |

| Interest and dividends

expense |

|

(58,575 |

) |

|

|

1,562 |

|

|

|

(1,443 |

) |

|

|

(58,456 |

) |

| Adjusted Net

Trading Income |

$ |

285,384 |

|

|

$ |

34,117 |

|

|

$ |

(467 |

) |

|

$ |

319,034 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following tables show our Adjusted Net Trading Income,

average daily Adjusted Net Trading Income by category for the three

and nine months ended September 30, 2017 and 2016 (in thousands,

except percentages).

| |

|

| |

Three Months Ended September 30, |

| Adjusted Net

Trading Income by Category: |

|

2017 |

|

|

|

2016 |

|

|

% Change |

| |

|

|

|

|

|

| Market Making: |

|

|

|

|

|

| Americas

Equities |

$ |

82,588 |

|

|

$ |

24,738 |

|

|

233.9 |

% |

| ROW

Equities |

|

16,995 |

|

|

|

20,790 |

|

|

-18.3 |

% |

| Global

FICC, Options and Other |

|

32,204 |

|

|

|

45,327 |

|

|

-29.0 |

% |

|

Unallocated1 |

|

242 |

|

|

|

3,390 |

|

|

NM |

|

| Total

market making |

$ |

132,029 |

|

|

$ |

94,245 |

|

|

40.1 |

% |

| |

|

|

|

|

|

| Execution Services |

|

28,229 |

|

|

|

2,931 |

|

|

863.1 |

% |

| |

|

|

|

|

|

| Corporate |

|

(467 |

) |

|

|

- |

|

|

NM |

|

| |

|

|

|

|

|

| Adjusted Net

Trading Income |

$ |

159,791 |

|

|

$ |

97,176 |

|

|

64.4 |

% |

| |

|

|

|

|

|

| |

Three Months Ended September 30, |

| Average Daily

Adjusted Net Trading Income by Category: |

|

2017 |

|

|

|

2016 |

|

|

% Change |

| |

|

|

|

|

|

| Market Making: |

|

|

|

|

|

| Americas

Equities |

$ |

1,311 |

|

|

$ |

387 |

|

|

239.1 |

% |

| ROW

Equities |

|

270 |

|

|

|

325 |

|

|

-17.0 |

% |

| Global

FICC, Options and Other |

|

511 |

|

|

|

708 |

|

|

-27.8 |

% |

|

Unallocated1 |

|

4 |

|

|

|

53 |

|

|

NM |

|

| Total

market making |

$ |

2,096 |

|

|

$ |

1,473 |

|

|

42.3 |

% |

| |

|

|

|

|

|

| Execution Services |

|

448 |

|

|

|

46 |

|

|

878.4 |

% |

| |

|

|

|

|

|

| Corporate |

|

(7 |

) |

|

|

- |

|

|

NM |

|

| |

|

|

|

|

|

| Adjusted Net

Trading Income |

$ |

2,536 |

|

|

$ |

1,518 |

|

|

67.0 |

% |

| |

|

|

|

|

|

| |

Nine Months Ended September 30, |

| Adjusted Net

Trading Income by Category: |

|

2017 |

|

|

|

2016 |

|

|

% Change |

| |

|

|

|

|

|

| Market Making: |

|

|

|

|

|

| Americas

Equities |

$ |

134,590 |

|

|

$ |

92,837 |

|

|

45.0 |

% |

| ROW

Equities |

|

57,443 |

|

|

|

73,536 |

|

|

-21.9 |

% |

| Global

FICC, Options and Other |

|

97,145 |

|

|

|

151,319 |

|

|

-35.8 |

% |

|

Unallocated1 |

|

(3,794 |

) |

|

|

(3,854 |

) |

|

NM |

|

| Total

market making |

$ |

285,384 |

|

|

$ |

313,838 |

|

|

-9.1 |

% |

| |

|

|

|

|

|

| Execution Services |

|

34,117 |

|

|

|

7,224 |

|

|

372.3 |

% |

| |

|

|

|

|

|

| Corporate |

|

(467 |

) |

|

|

- |

|

|

NM |

|

| |

|

|

|

|

|

| Adjusted Net

Trading Income |

$ |

319,034 |

|

|

$ |

321,062 |

|

|

-0.6 |

% |

| |

|

|

|

|

|

| |

Nine Months Ended September 30, |

| Average Daily

Adjusted Net Trading Income by Category: |

|

2017 |

|

|

|

2016 |

|

|

% Change |

| |

|

|

|

|

|

| Market Making: |

|

|

|

|

|

| Americas

Equities |

$ |

716 |

|

|

$ |

491 |

|

|

45.7 |

% |

| ROW

Equities |

|

306 |

|

|

|

389 |

|

|

-21.5 |

% |

| Global

FICC, Options and Other |

|

517 |

|

|

|

801 |

|

|

-35.5 |

% |

|

Unallocated1 |

|

(20 |

) |

|

|

(20 |

) |

|

NM |

|

| Total

market making |

$ |

1,518 |

|

|

$ |

1,661 |

|

|

-8.6 |

% |

| |

|

|

|

|

|

| Execution Services |

|

181 |

|

|

|

38 |

|

|

374.8 |

% |

| |

|

|

|

|

|

| Corporate |

|

(2 |

) |

|

|

- |

|

|

NM |

|

| |

|

|

|

|

|

| Adjusted Net

Trading Income |

$ |

1,697 |

|

|

$ |

1,699 |

|

|

-0.1 |

% |

| 1 Under our methodology

for recording ‘‘trading income, net’’ in our condensed consolidated

statements of comprehensive income, we recognize revenues

based on the exit price of assets in accordance with applicable

U.S. GAAP rules, and when we calculate Adjusted Net

Trading Income for corresponding reporting periods, we start

with trading income, net. By contrast, when we calculate Adjusted

Net Trading Income by category, we recognize revenues on a

daily basis, and as a result prices used in recognizing revenues

may differ. Because we provide liquidity on a global basis,

across asset classes and time zones, the timing of any particular

Adjusted Net Trading Income calculation can defer or

accelerate the amount in a particular asset class from one day to

another, and, at the end of a reporting period, from

one reporting period to another. The purpose of the

Unallocated category is to ensure that ANTI by category sums to

total Adjusted Net Trading Income, which can be reconciled to

Trading Income, Net, calculated in accordance with GAAP. We do not

allocate any resulting differences based on the timing of

revenue recognition. |

KCG Acquisition Update

On July 20, 2017 (the “Closing Date”), the Company completed the

acquisition (the “Acquisition”) of KCG Holdings, Inc.

(“KCG”). Pursuant to the terms of the Agreement and Plan of

Merger, dated as of April 20, 2017 (the “Merger Agreement”), by and

among the Company, Orchestra Merger Sub, Inc., a Delaware

corporation and an indirect wholly-owned subsidiary of the Company

(“Merger Sub”), and KCG, Merger Sub merged with and into KCG (the

“Merger”), with KCG surviving the Merger as a wholly-owned

subsidiary of the Company, in a cash transaction valued at $20.00

per KCG share, or a total of approximately $1.4 billion.

BondPoint Sale

On October 24, 2017, the Company announced that it has entered

into a definitive agreement to sell Virtu’s fixed income trading

venue, BondPoint, to Intercontinental Exchange (NYSE: ICE) for $400

million in cash. The transaction is expected to be completed in the

first quarter of 2018, and the closing is subject to the

satisfaction of customary closing conditions and receipt of certain

regulatory clearances.

BondPoint is a leading provider of electronic fixed income

trading solutions for the buy-side and sell-side offering access to

centralized liquidity and automated trade execution services

through its ATS, linking more than 500 financial services

firms.

Financial Condition

As of September 30, 2017, Virtu had $558.0

million in cash and cash equivalents, and total long-term debt

outstanding in an aggregate principal amount of $1,481.1

million.

Non-GAAP Financial Measures and Other

Items

To supplement our unaudited condensed

consolidated financial statements presented in accordance with

generally accepted accounting principles ("GAAP"), we use the

following non-GAAP measures of financial performance:

- "Adjusted Net Trading Income", which is the amount of revenue

we generate from our market making activities, or trading income,

net, plus commissions, net and technology services, plus interest

and dividends income and expense, net, less direct costs associated

with those revenues, including brokerage, exchange and clearance

fees, net and payments for order flow. Management believes that

this measurement is useful for comparing general operating

performance from period to period. Although we use Adjusted Net

Trading Income as a financial measure to assess the performance of

our business, the use of Adjusted Net Trading Income is limited

because it does not include certain material costs that are

necessary to operate our business. Our presentation of Adjusted Net

Trading Income should not be construed as an indication that our

future results will be unaffected by revenues or expenses that are

not directly associated with our market making activities.

- "EBITDA", which measures our operating performance by adjusting

Net Income to exclude financing interest expense on our senior

secured credit facility, debt issue cost related to debt

refinancing, depreciation and amortization, amortization of

purchased intangibles and acquired capitalized software, and income

tax expense, and "Adjusted EBITDA", which measures our operating

performance by further adjusting EBITDA to exclude severance,

reserve for legal matter, transaction advisory fees and expenses,

termination of office leases, other losses (revenues) net,

equipment write-off, share based compensation, charges related to

share based compensation at IPO, 2015 Management Incentive Plan,

and charges related to share based compensation at IPO.

- “Normalized Adjusted Net Income”, “Normalized Adjusted Net

Income before income taxes”, “Normalized provision for income

taxes”, and “Normalized Adjusted EPS”, which we calculate by

adjusting Net Income to exclude certain items including IPO-related

adjustments and other non-cash items, assuming that all vested and

unvested Virtu Financial LLC units have been exchanged for Class A

Common Stock, and applying a corporate tax rate between 35.5% and

37%.

Total Adjusted Net Trading Income, EBITDA,

Adjusted EBITDA, Normalized Adjusted Net Income, Normalized

Adjusted Net Income before income taxes, Normalized provision for

income taxes and Normalized Adjusted EPS are non-GAAP financial

measures used by management in evaluating operating performance and

in making strategic decisions. Additional information provided

regarding the breakdown of Total Adjusted Net Trading Income by

category is also a non-GAAP financial measure but is not used by

the Company in evaluating operating performance and in making

strategic decisions. In addition, these non-GAAP financial measures

or similar non-GAAP measures are used by research analysts,

investment bankers and lenders to assess our operating performance.

Management believes that the presentation of Adjusted Net Trading

Income, EBITDA, Adjusted EBITDA, Normalized Adjusted Net Income,

Normalized Adjusted Net Income before income taxes, Normalized

provision for income taxes and Normalized Adjusted EPS provide

useful information to investors regarding our results of operations

because they assist both investors and management in analyzing and

benchmarking the performance and value of our business. Adjusted

Net Trading Income, EBITDA, Adjusted EBITDA, Normalized Adjusted

Net Income, Normalized Adjusted Net Income before income taxes,

Normalized provision for income taxes and Normalized Adjusted EPS

provide indicators of general economic performance that are not

affected by fluctuations in certain costs or other items.

Accordingly, management believes that these measurements are useful

for comparing general operating performance from period to period.

Furthermore, our credit agreement contains covenants and other

tests based on metrics similar to Adjusted EBITDA. Other companies

may define Adjusted Net Trading Income, Adjusted EBITDA, Normalized

Adjusted Net Income, Normalized Adjusted Net Income before income

taxes, Normalized provision for income taxes and Normalized

Adjusted EPS differently, and as a result our measures of Adjusted

Net Trading Income, Adjusted EBITDA, Normalized Adjusted Net

Income, Normalized Adjusted Net Income before income taxes,

Normalized provision for income taxes and Normalized Adjusted EPS

may not be directly comparable to those of other companies.

Although we use these non-GAAP financial measures as financial

measures to assess the performance of our business, such use is

limited because they do not include certain material costs

necessary to operate our business.

Adjusted Net Trading Income, EBITDA, Adjusted EBITDA and Normalized

Adjusted Net Income should be considered in addition to, and not as

a substitute for, Net Income in accordance with U.S. GAAP as a

measure of performance. Our presentation of Adjusted Net Trading

Income, EBITDA, Adjusted EBITDA, Normalized Adjusted Net Income,

Normalized Adjusted Net Income before income taxes, Normalized

provision for income taxes and Normalized Adjusted EPS should not

be construed as an indication that our future results will be

unaffected by unusual or nonrecurring items. Adjusted Net Trading

Income, Normalized Adjusted Net Income, Normalized Adjusted Net

Income before income taxes, Normalized provision for income taxes,

Normalized Adjusted EPS and our EBITDA-based measures have

limitations as analytical tools, and you should not consider them

in isolation or as substitutes for analysis of our results as

reported under U.S. GAAP. Some of these limitations are:

- they do not reflect every cash expenditure, future requirements

for capital expenditures or contractual commitments;

- our EBITDA-based measures do not reflect the significant

interest expense or the cash requirements necessary to service

interest or principal payment on our debt;

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized will often have to be

replaced or require improvements in the future, and our

EBITDA-based measures do not reflect any cash requirement for such

replacements or improvements;

- they are not adjusted for all non-cash income or expense items

that are reflected in our statements of cash flows;

- they do not reflect the impact of earnings or charges resulting

from matters we consider not to be indicative of our ongoing

operations; and

- they do not reflect limitations on our costs related to

transferring earnings from our subsidiaries to us.

Because of these limitations, Adjusted Net

Trading Income, EBITDA, Adjusted EBITDA and Normalized Adjusted Net

Income are not intended as alternatives to Net Income as indicators

of our operating performance and should not be considered as

measures of discretionary cash available to us to invest in the

growth of our business or as measures of cash that will be

available to us to meet our obligations. We compensate for these

limitations by using Adjusted Net Trading Income, EBITDA, Adjusted

EBITDA and Normalized Adjusted Net Income along with other

comparative tools, together with U.S. GAAP measurements, to

assist in the evaluation of operating performance. These

U.S. GAAP measurements include Net Income (loss), cash flows

from operations and cash flow data. See below a reconciliation of

each non-GAAP measure to the most directly comparable GAAP

measure.

| |

|

|

|

| Virtu Financial, Inc. and

Subsidiaries |

| Condensed Consolidated Statements of

Comprehensive Income (Unaudited) |

| |

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| |

(in thousands, except share and per share

data) |

|

Revenues: |

|

|

|

|

|

|

|

| Trading

income, net |

$ |

203,907 |

|

|

$ |

156,706 |

|

|

$ |

479,644 |

|

|

$ |

509,542 |

|

|

Commissions and technology services |

|

43,351 |

|

|

|

2,931 |

|

|

|

30,933 |

|

|

|

7,224 |

|

| Interest

and dividends income |

|

20,430 |

|

|

|

5,271 |

|

|

|

49,237 |

|

|

|

14,961 |

|

| Other,

net |

|

3,598 |

|

|

|

(102 |

) |

|

|

3,647 |

|

|

|

(102 |

) |

| Total

revenues |

|

271,286 |

|

|

|

164,806 |

|

|

|

563,461 |

|

|

|

531,625 |

|

| |

|

|

|

|

|

|

|

| Operating

Expenses: |

|

|

|

|

|

|

|

|

Brokerage, exchange and clearance fees, net |

|

64,584 |

|

|

|

52,118 |

|

|

|

170,253 |

|

|

|

167,416 |

|

|

Communication and data processing |

|

45,998 |

|

|

|

17,903 |

|

|

|

83,190 |

|

|

|

53,578 |

|

| Employee

compensation and payroll taxes |

|

72,341 |

|

|

|

20,816 |

|

|

|

111,053 |

|

|

|

64,182 |

|

| Payments

for order flow |

|

12,071 |

|

|

|

- |

|

|

|

12,071 |

|

|

|

- |

|

| Interest

and dividends expense |

|

31,242 |

|

|

|

15,615 |

|

|

|

58,456 |

|

|

|

43,249 |

|

|

Operations and administrative |

|

24,183 |

|

|

|

5,543 |

|

|

|

38,107 |

|

|

|

16,353 |

|

|

Depreciation and amortization |

|

15,602 |

|

|

|

7,158 |

|

|

|

29,157 |

|

|

|

22,685 |

|

|

Amortization of purchased intangibles and |

|

|

|

|

|

|

|

|

acquired capitalized software |

|

6,440 |

|

|

|

53 |

|

|

|

6,546 |

|

|

|

159 |

|

| Debt

issue cost related to debt refinancing |

|

4,869 |

|

|

|

- |

|

|

|

9,351 |

|

|

|

- |

|

|

Transaction advisory fees and expenses |

|

15,677 |

|

|

|

- |

|

|

|

24,188 |

|

|

|

- |

|

| Reserve

for legal matter |

|

- |

|

|

|

- |

|

|

|

(2,176 |

) |

|

|

- |

|

| Charges

related to share based compensation at IPO |

|

181 |

|

|

|

333 |

|

|

|

545 |

|

|

|

1,444 |

|

| Financing

interest expense on long-term borrowings |

|

24,593 |

|

|

|

7,393 |

|

|

|

40,141 |

|

|

|

21,569 |

|

| Total

operating expenses |

|

317,781 |

|

|

|

126,932 |

|

|

|

580,882 |

|

|

|

390,635 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income

before income taxes and noncontrolling interest |

|

(46,495 |

) |

|

|

37,874 |

|

|

|

(17,421 |

) |

|

|

140,990 |

|

| Provision

(benefit) for income taxes |

|

(6,505 |

) |

|

|

4,851 |

|

|

|

(2,918 |

) |

|

|

17,325 |

|

| Net

income (loss) |

$ |

(39,990 |

) |

|

$ |

33,023 |

|

|

$ |

(14,503 |

) |

|

$ |

123,665 |

|

| |

|

|

|

|

|

|

|

|

Noncontrolling interest |

|

26,472 |

|

|

|

(25,997 |

) |

|

|

6,466 |

|

|

|

(97,913 |

) |

| |

|

|

|

|

|

|

|

| Net

income (loss) available for common stockholders |

$ |

(13,518 |

) |

|

$ |

7,026 |

|

|

$ |

(8,037 |

) |

|

$ |

25,752 |

|

| |

|

|

|

|

|

|

|

| Earnings per

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.17 |

) |

|

$ |

0.18 |

|

|

$ |

(0.17 |

) |

|

$ |

0.66 |

|

|

Diluted |

$ |

(0.17 |

) |

|

$ |

0.18 |

|

|

$ |

(0.17 |

) |

|

$ |

0.66 |

|

| |

|

|

|

|

|

|

|

| Weighted

average common shares outstanding |

|

|

|

|

|

|

|

|

Basic |

|

79,199,142 |

|

|

|

38,230,684 |

|

|

|

53,520,346 |

|

|

|

38,264,139 |

|

|

Diluted |

|

79,199,142 |

|

|

|

38,230,684 |

|

|

|

53,520,346 |

|

|

|

38,264,139 |

|

| |

|

|

|

|

|

|

|

| Comprehensive

income: |

|

|

|

|

|

|

|

| Net

income |

$ |

(39,990 |

) |

|

$ |

33,023 |

|

|

$ |

(14,503 |

) |

|

$ |

123,665 |

|

| Other

comprehensive income (loss) |

|

|

|

|

|

|

|

|

Foreign exchange translation adjustment, net of taxes |

|

2,558 |

|

|

|

519 |

|

|

|

8,300 |

|

|

|

1,783 |

|

| Comprehensive

income |

$ |

(37,432 |

) |

|

$ |

33,542 |

|

|

$ |

(6,203 |

) |

|

$ |

125,448 |

|

| Less:

Comprehensive income attributable to noncontrolling interest |

|

25,122 |

|

|

|

(26,370 |

) |

|

|

1,014 |

|

|

|

(99,195 |

) |

| Comprehensive income

available for common stockholders |

$ |

(12,310 |

) |

|

$ |

7,172 |

|

|

$ |

(5,189 |

) |

|

$ |

26,253 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Virtu Financial, Inc. and

Subsidiaries |

| Reconciliation to Non-GAAP Operating Data

(Unaudited) |

| |

| The

following tables reconcile Condensed Consolidated Statements of

Comprehensive Income to arrive at Adjusted Net Trading Income,

EBITDA, Adjusted EBITDA, and selected Operating Margins. |

| |

|

|

| |

Three Months Ended September 30, |

Nine Months Ended September 30, |

| |

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| |

(in thousands, except

percentages) |

| Reconciliation

of Trading income, net to Adjusted Net Trading Income |

|

|

|

|

|

|

|

| Trading

income, net |

$ |

203,907 |

|

|

$ |

156,706 |

|

|

$ |

479,644 |

|

|

$ |

509,542 |

|

|

Commissions and technology services |

|

43,351 |

|

|

|

2,931 |

|

|

|

30,933 |

|

|

|

7,224 |

|

| Interest

and dividends income |

|

20,430 |

|

|

|

5,271 |

|

|

|

49,237 |

|

|

|

14,961 |

|

|

Brokerage, exchange and clearance fees, net |

|

(64,584 |

) |

|

|

(52,118 |

) |

|

|

(170,253 |

) |

|

|

(167,416 |

) |

| Payments

for order flow |

|

(12,071 |

) |

|

|

- |

|

|

|

(12,071 |

) |

|

|

- |

|

| Interest

and dividends expense |

|

(31,242 |

) |

|

|

(15,615 |

) |

|

|

(58,456 |

) |

|

|

(43,249 |

) |

| Adjusted Net

Trading Income |

$ |

159,791 |

|

|

$ |

97,175 |

|

|

$ |

319,034 |

|

|

$ |

321,062 |

|

| |

|

|

|

|

|

|

|

| Reconciliation

of Net Income to EBITDA and Adjusted EBITDA |

|

|

|

|

|

|

|

| Net

income |

$ |

(39,990 |

) |

|

$ |

33,023 |

|

|

$ |

(14,503 |

) |

|

$ |

123,665 |

|

| Financing

interest expense on senior secured credit facility |

|

24,593 |

|

|

|

7,393 |

|

|

|

40,141 |

|

|

|

21,569 |

|

| Debt

issue cost related to debt refinancing |

|

4,869 |

|

|

|

- |

|

|

|

9,351 |

|

|

|

- |

|

|

Depreciation and amortization |

|

15,602 |

|

|

|

7,158 |

|

|

|

29,157 |

|

|

|

22,685 |

|

|

Amortization of purchased intangibles and acquired capitalized

software |

|

6,440 |

|

|

|

53 |

|

|

|

6,546 |

|

|

|

159 |

|

| Provision

for income taxes |

|

(6,505 |

) |

|

|

4,851 |

|

|

|

(2,918 |

) |

|

|

17,325 |

|

|

EBITDA |

$ |

5,009 |

|

|

$ |

52,478 |

|

|

$ |

67,774 |

|

|

$ |

185,403 |

|

| |

|

|

|

|

|

|

|

|

Severance |

|

9,295 |

|

|

|

77 |

|

|

|

10,172 |

|

|

|

270 |

|

| Reserve

for legal matter |

|

- |

|

|

|

- |

|

|

|

(2,176 |

) |

|

|

- |

|

|

Transaction advisory fees and expenses |

|

15,677 |

|

|

|

521 |

|

|

|

24,188 |

|

|

|

676 |

|

|

Termination of office leases |

|

1,811 |

|

|

|

- |

|

|

|

1,811 |

|

|

|

(319 |

) |

|

Acquisition related retention bonus |

|

23,050 |

|

|

|

- |

|

|

|

23,050 |

|

|

|

- |

|

| Trading

related settlement income |

|

- |

|

|

|

(2,975 |

) |

|

|

- |

|

|

|

(2,975 |

) |

| Other,

net |

|

(300 |

) |

|

|

102 |

|

|

|

(289 |

) |

|

|

102 |

|

| Equipment

write-off |

|

544 |

|

|

|

- |

|

|

|

544 |

|

|

|

428 |

|

| Share

based compensation |

|

2,270 |

|

|

|

4,892 |

|

|

|

17,102 |

|

|

|

14,587 |

|

| Charges

related to share based compensation at IPO, 2015 Management

Incentive Plan |

|

1,336 |

|

|

|

1,512 |

|

|

|

4,134 |

|

|

|

4,212 |

|

| Charges

related to share based compensation awards at IPO |

|

181 |

|

|

|

333 |

|

|

|

545 |

|

|

|

1,444 |

|

| Adjusted

EBITDA |

$ |

58,873 |

|

|

$ |

56,940 |

|

|

$ |

146,855 |

|

|

$ |

203,828 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Selected

Operating Margins |

|

|

|

|

|

|

|

| Net

Income Margin1 |

|

-25.0 |

% |

|

|

34.0 |

% |

|

|

-4.5 |

% |

|

|

38.5 |

% |

| EBITDA

Margin2 |

|

3.1 |

% |

|

|

54.0 |

% |

|

|

21.2 |

% |

|

|

57.7 |

% |

| Adjusted

EBITDA Margin3 |

|

36.8 |

% |

|

|

58.6 |

% |

|

|

46.0 |

% |

|

|

63.5 |

% |

| |

|

|

|

|

|

|

|

| 1 Calculated by

dividing net income by Adjusted Net Trading Income. |

|

|

|

|

|

|

|

| 2 Calculated by

dividing EBITDA by Adjusted Net Trading Income. |

|

|

|

|

|

|

|

| 3 Calculated by

dividing Adjusted EBITDA by Adjusted Net Trading Income. |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

| Virtu Financial, Inc. and

Subsidiaries |

| Reconciliation to Non-GAAP Operating Data

(Unaudited) |

| (Continued) |

|

|

| The

following tables reconcile Condensed Consolidated Statements of

Comprehensive Income to arrive at Normalized Adjusted Net Income

before income taxes, Normalized provision for income taxes,

Normalized Adjusted Net Income and Normalized Adjusted EPS. |

| |

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| |

(in thousands, except share and per share

data) |

| Reconciliation

of Net Income to Normalized Adjusted Net Income |

|

|

|

|

|

|

|

| Net

income |

$ |

(39,990 |

) |

|

$ |

33,023 |

|

|

$ |

(14,503 |

) |

|

$ |

123,665 |

|

| Provision

for income taxes |

|

(6,505 |

) |

|

|

4,851 |

|

|

|

(2,918 |

) |

|

|

17,325 |

|

| Income

before income taxes |

$ |

(46,495 |

) |

|

$ |

37,874 |

|

|

$ |

(17,421 |

) |

|

$ |

140,990 |

|

|

Amortization of purchased intangibles and acquired capitalized

software |

|

6,440 |

|

|

|

53 |

|

|

|

6,546 |

|

|

|

159 |

|

| Financing

interest expense related to KCG transaction |

|

3,010 |

|

|

|

- |

|

|

|

4,626 |

|

|

|

- |

|

| Debt

issue cost related to debt refinancing |

|

4,869 |

|

|

|

- |

|

|

|

9,351 |

|

|

|

- |

|

|

Severance |

|

9,295 |

|

|

|

77 |

|

|

|

10,172 |

|

|

|

270 |

|

| Reserve

for legal matter |

|

- |

|

|

|

- |

|

|

|

(2,176 |

) |

|

|

- |

|

|

Transaction advisory fees and expenses |

|

15,677 |

|

|

|

521 |

|

|

|

24,188 |

|

|

|

676 |

|

|

Termination of office leases |

|

1,811 |

|

|

|

- |

|

|

|

1,811 |

|

|

|

(319 |

) |

| Equipment

write-off |

|

1,075 |

|

|

|

- |

|

|

|

2,177 |

|

|

|

428 |

|

|

Acquisition related retention bonus |

|

23,050 |

|

|

|

- |

|

|

|

23,050 |

|

|

|

- |

|

| Trading

related settlement income |

|

- |

|

|

|

(2,975 |

) |

|

|

- |

|

|

|

(2,975 |

) |

| Other

losses (revenues) |

|

(300 |

) |

|

|

102 |

|

|

|

(289 |

) |

|

|

102 |

|

| Share

based compensation |

|

2,270 |

|

|

|

4,892 |

|

|

|

17,102 |

|

|

|

14,587 |

|

| Charges

related to share based compensation at IPO, 2015 Management

Incentive Plan |

|

1,336 |

|

|

|

1,512 |

|

|

|

4,134 |

|

|

|

4,212 |

|

| Charges

related to share based compensation awards at IPO |

|

181 |

|

|

|

333 |

|

|

|

545 |

|

|

|

1,444 |

|

|

Normalized Adjusted Net Income before income taxes |

$ |

22,219 |

|

|

$ |

42,389 |

|

|

$ |

83,816 |

|

|

$ |

159,574 |

|

|

Normalized provision for income taxes1 |

|

8,221 |

|

|

|

15,048 |

|

|

|

31,012 |

|

|

|

56,649 |

|

| Normalized

Adjusted Net Income |

$ |

13,998 |

|

|

$ |

27,341 |

|

|

$ |

52,804 |

|

|

$ |

102,925 |

|

| |

|

|

|

|

|

|

|

| Weighted Average

Adjusted shares outstanding2 |

|

178,490,856 |

|

|

|

139,687,848 |

|

|

|

152,812,060 |

|

|

|

139,685,124 |

|

| |

|

|

|

|

|

|

|

| Normalized

Adjusted EPS |

$ |

0.08 |

|

|

$ |

0.20 |

|

|

$ |

0.35 |

|

|

$ |

0.74 |

|

| |

|

|

|

|

|

|

|

| 1 Reflects

U.S. federal, state, and local income tax rate applicable to

corporations of approximately 37%. |

| 2 Assumes

that (1) holders of all vested and unvested Virtu Financial LLC

Units (together with corresponding shares of Class C common

stock), have exercised their right to exchange such Virtu

Financial LLC Units for shares of Class A common stock on a

one-for-one basis, (2) holders of all Virtu Financial

LLC Units (together with corresponding shares of Class D common

stock), have exercised their right to exchange such Virtu

Financial LLC Units for shares of Class B common stock on a

one-for-one basis, and subsequently exercised their right to

convert the shares of Class B common stock into shares of

Class A common stock on a one-for-one basis. Includes

additional shares from dilutive impact of options and restricted

stock units outstanding under the 2015 Management Incentive

Plan during the three and nine months ended September 30, 2017

and 2016. |

| |

|

|

|

|

|

| Virtu Financial, Inc. and

Subsidiaries |

| Condensed Consolidated Statements of Financial

Condition (Unaudited)

|

| |

|

|

|

| |

September 30, |

|

December 31, |

| |

|

2017 |

|

|

2016 |

|

| |

|

|

|

| |

(in thousands, except share data) |

|

Assets |

|

|

|

| Cash and

cash equivalents |

$ |

557,990 |

|

$ |

181,415 |

|

| Cash and

securities segregated under federal and other regulations |

|

3,000 |

|

|

- |

|

|

Securities borrowed |

|

1,525,403 |

|

|

220,005 |

|

|

Securities purchased under agreements to resell |

|

8,249 |

|

|

- |

|

|

Receivables from broker-dealers and

clearing organizations |

|

980,518 |

|

|

448,728 |

|

| Trading

assets, at fair value |

|

2,902,400 |

|

|

1,827,882 |

|

| Property,

equipment and capitalized software, net |

|

144,686 |

|

|

29,660 |

|

|

Goodwill |

|

859,598 |

|

|

715,379 |

|

|

Intangibles (net of accumulated amortization) |

|

152,748 |

|

|

992 |

|

| Deferred

taxes |

|

224,804 |

|

|

193,859 |

|

| Current

taxes receivable |

|

111,204 |

|

|

5,796 |

|

| Other

assets |

|

268,745 |

|

|

68,674 |

|

| Total

assets |

$ |

7,739,345 |

|

$ |

3,692,390 |

|

| |

|

|

|

| Liabilities and

equity |

|

|

|

| Liabilities |

|

|

|

|

Short-term borrowings |

$ |

15,000 |

|

$ |

25,000 |

|

|

Securities loaned |

|

582,915 |

|

|

222,203 |

|

|

Securities sold under agreements to repurchase |

|

620,887 |

|

|

- |

|

| Payables

to broker-dealers and clearing organizations |

|

839,067 |

|

|

695,978 |

|

| Payables

to customers |

|

25,550 |

|

|

- |

|

| Trading

liabilities, at fair value |

|

2,535,891 |

|

|

1,349,155 |

|

| Tax

receivable agreement obligations |

|

232,552 |

|

|

231,404 |

|

| Accounts

payable and accrued expenses and other liabilities |

|

287,327 |

|

|

69,281 |

|

| Long-term

borrowings, net |

|

1,434,629 |

|

|

564,957 |

|

| Total

liabilities |

$ |

6,573,818 |

|

$ |

3,157,978 |

|

| |

|

|

|

| Total

equity |

|

1,165,527 |

|

|

534,412 |

|

| |

|

|

|

| Total

liabilities and equity |

$ |

7,739,345 |

|

$ |

3,692,390 |

|

| |

|

|

|

| |

As of September 30, 2017 |

| Ownership of

Virtu Financial LLC Interests: |

Interests |

|

% |

| |

|

|

|

| Virtu

Financial, Inc. - Class A Common Stock |

|

90,593,964 |

|

|

48.0 |

% |

|

Non-controlling Interests (Virtu Financial LLC) |

|

97,954,713 |

|

|

52.0 |

% |

| Total

Virtu Financial LLC Interests |

|

188,548,677 |

|

|

100.0 |

% |

| |

|

|

|

|

|

|

About Virtu Financial, Inc.

Virtu is a leading financial firm that leverages

cutting edge technology to deliver liquidity to the global markets

and innovative, transparent trading solutions to our clients. As a

market maker, Virtu provides deep liquidity that helps to create

more efficient markets around the world. Our market structure

expertise, broad diversification, and execution technology enables

us to provide competitive bids and offers in over 19,000

securities, at over 235 venues, in 36 countries worldwide.

Cautionary Note Regarding

Forward-Looking Statements The foregoing information and

certain oral statements made from time to time by representatives

of the Company contain certain forward-looking statements that

reflect the company's current views with respect to certain current

and future events and financial performance, including with respect

to integration of KCG and synergy realization. These

forward-looking statements are and will be, as the case may be,

subject to many risks, uncertainties and factors relating to the

Company's operations and business environment which may cause the

company's actual results to be materially different from any future

results, expressed or implied, in these forward-looking statements.

Any forward-looking statements in this release are based upon

information available to the company on the date of this release.

The Company does not undertake to publicly update or revise its

forward-looking statements even if experience or future changes

make it clear that any statements expressed or implied therein will

not be realized. Additional information on risk factors that could

potentially affect the Company's financial results may be found in

the Company's filings with the Securities and Exchange

Commission.

CONTACT

Investor RelationsAndrew SmithVirtu Financial,

Inc.(212) 418-0195investor_relations@virtu.com

Media Relationsmedia@virtu.com

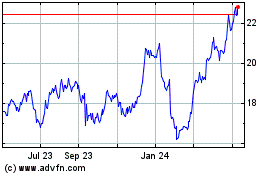

Virtu Financial (NASDAQ:VIRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

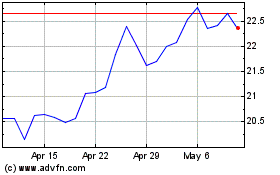

Virtu Financial (NASDAQ:VIRT)

Historical Stock Chart

From Apr 2023 to Apr 2024