AnaptysBio Announces Third Quarter 2017 Financial Results and Provides Pipeline Updates

November 07 2017 - 6:00AM

Announced Positive Proof-of-Concept Data for

ANB020 in Atopic Dermatitis

AnaptysBio, Inc. (Nasdaq:ANAB), a clinical-stage biotechnology

company developing first-in-class antibody product candidates

focused on unmet medical needs in inflammation, today provided

pipeline updates and reported third quarter 2017 financial results.

“Throughout 2017, we are continuing to execute on our strategy

of developing first-in-class antibody therapeutics for patients

with severe inflammatory diseases and have recently announced

positive proof-of-concept data for our wholly-owned ANB020 program

in adults with moderate-to-severe atopic dermatitis,”

said Hamza Suria, president and chief executive officer of

AnaptysBio. “We are on track to report top-line data from our

on-going ANB020 Phase 2a studies in severe adult peanut allergy,

and severe adult eosinophilic asthma during the first and second

quarters of 2018, respectively. Our wholly-owned ANB019 program

generated positive top-line Phase 1 healthy volunteer data and we

plan to advance this program into Phase 2 orphan inflammatory

disease patients studies during 2018.”

Pipeline and Business Highlights

ANB020 (Anti-IL-33 Program)

- In October, the company reported positive proof-of-concept data

for ANB020, its investigational anti-IL-33 therapeutic antibody, in

an ongoing Phase 2a clinical trial in adult patients with

moderate-to-severe atopic dermatitis. After a single dose of

ANB020, 75 percent of patients achieved an Eczema Area Severity

Index (EASI) score improvement of 50 percent relative to enrollment

baseline (EASI-50) at day 15, 83 percent of patients achieved

EASI-50 at day 29 and 75 percent of patients achieved EASI-50 at

day 57. All 12 patients achieved EASI-50 at one or more time points

through Day 57 post-ANB020 administration. ANB020 was generally

well tolerated in all patients as of this interim analysis. During

the first half of 2018, AnaptysBio plans to initiate a Phase 2b

randomized, double-blinded, placebo-controlled study in 200-300

adult patients with moderate-to-severe atopic dermatitis to

evaluate multi-dose subcutaneous administration of ANB020, with

data expected in 2019.

- Enrollment continued in the company’s ongoing Phase 2a

double-blinded, placebo-controlled trial assessing the tolerance of

oral food challenge before and after administration of a single

dose of ANB020 or placebo in a total of 20 adult patients with

severe peanut allergy. As of October 31, 2017, 75 percent of the

study has been enrolled and top-line data are expected in the first

quarter of 2018.

- Enrollment was initiated in the company’s an ongoing

double-blinded, placebo-controlled Phase 2a trial in 24 adult

patients with severe eosinophilic asthma, with top-line results,

including a Forced Expiratory Volume in One Second (FEV1)

assessment of patients administered a single dose of ANB020 or

placebo, with top-line data expected in the second quarter of

2018.

ANB019 (Anti-IL-36 Receptor Program)

- The Company announced positive top-line results from an interim

analysis of an ongoing single and multiple ascending dose healthy

volunteer Phase 1 trial of ANB019, its investigational

anti-interleukin-36 receptor (IL-36R) therapeutic antibody.

Top-line data showed favorable safety, pharmacokinetics and

pharmacodynamic properties that support advancement of ANB019 into

Phase 2 studies for generalized pustular psoriasis and

palmo-plantar pustular psoriasis during 2018.

Business Update

- On Oct. 17, 2017, the company completed an underwritten public

offering selling 3,000,000 shares of common stock at a price to the

public of $68.50 per share. The aggregate net proceeds received by

the company from the offering were $194.7 million, net of

underwriting discounts and commissions.

- In August, the company announced the appointment of J. Anthony

Ware, M.D. to its board of directors. Dr. Ware currently

serves as the senior vice president of product development of Lilly

Bio-Medicines at Eli Lilly and Company, where he is responsible for

the clinical development and regulatory approval of new medicines

in multiple therapeutic areas.

Financial Results and Financial Guidance

- Cash, cash equivalents and investments totaled $116.7 million

as of September 30, 2017, which includes net proceeds of $80.2

million from the company’s initial public offering completed in

January 2017, compared to $51.2 million as of December 31, 2016.

Including the net proceeds from the company’s follow-on offering in

October 2017, of approximately $194.7 million, the company

expects that it has sufficient capital to fund its

operating plan through the end of 2019.

- Revenue was zero and $7.0 million for the three and nine months

ended September 30, 2017, respectively as compared to $3.2

million and $13.9 million for the three and nine months ended

September 30, 2016, respectively. The nine months ended

September 30, 2017 included revenue related to two milestones

earned from the company’s partnership with TESARO. The three and

nine months ended September 30, 2016 included revenue of

related to the amortization of the upfront payment from TESARO,

research and development services with TESARO and milestone-related

revenues from TESARO and Celgene. The upfront payment was fully

recognized and the research and development services were completed

as of December 31, 2016.

- Research and development expenses were $6.7 million and $21.8

million, respectively, for the three and nine months ended

September 30, 2017, as compared to $3.3 million and $10.4

million, respectively, for the three and nine months ended

September 30, 2016. The increase was primarily due to an

increase in preclinical and clinical trial expenses as well as the

recognition of higher research and development tax incentives in

the three and nine months ended September 30, 2016.

- General and administrative expenses were $2.4 million and $6.8

million, respectively, for the three and nine months ended

September 30, 2017, as compared to $1.0 million and $3.4

million, respectively, for the three and six months ended

September 30, 2016. The increase was attributable to

additional personnel-related expenses, including non-cash

stock-based compensation, and an increase in public company related

expenses.

About AnaptysBioAnaptysBio is a clinical-stage

biotechnology company developing first-in-class antibody product

candidates focused on unmet medical needs in inflammation. The

company’s proprietary anti-inflammatory pipeline includes its

anti-IL-33 antibody (ANB020) for the treatment of

moderate-to-severe adult atopic dermatitis, severe adult peanut

allergy and severe adult eosinophilic asthma; its anti-IL-36R

antibody (ANB019) for the treatment of rare inflammatory diseases,

including generalized pustular psoriasis and palmo-plantar pustular

psoriasis; and a portfolio of checkpoint receptor agonist

antibodies for the treatment of certain autoimmune diseases where

immune checkpoint receptors are insufficiently activated, which

have demonstrated efficacy in an animal model of graft-versus-host

disease. AnaptysBio’s antibody pipeline has been developed using

its proprietary somatic hypermutation (SHM) platform, which uses in

vitro SHM for antibody discovery and is designed to replicate key

features of the human immune system to overcome the limitations of

competing antibody discovery technologies. AnaptysBio has also

developed multiple therapeutic antibodies in an immuno-oncology

partnership with TESARO and an inflammation partnership with

Celgene, including an anti-PD-1 antagonist antibody (TSR-042), an

anti-TIM-3 antagonist antibody (TSR-022) and an anti-LAG-3

antagonist antibody (TSR-033), which are currently under clinical

development with TESARO, and an anti-PD-1 checkpoint agonist

antibody (CC-90006) currently in the clinic with Celgene.

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of the "safe

harbor" provisions of the Private Securities Litigation Reform Act

of 1995, including, but not limited to: the timing of the release

of data from our clinical trials, including ANB020’s Phase 2a and

Phase 2b clinical trials in adults with moderate-to-severe atopic

dermatitis, Phase 2a clinical trials for the treatment of severe

peanut allergy and severe adult eosinophilic asthma and Phase 1

clinical trial of ANB019; our ability to launch a Phase 2b clinical

trial of ANB020 in adults with moderate-to-severe atopic dermatitis

and Phase 2 clinical trials of ANB019; and the success of our

partnership with TESARO. Statements including words such as “plan,”

“continue,” “expect,” or “ongoing” and statements in the future

tense are forward-looking statements. These forward-looking

statements involve risks and uncertainties, as well as assumptions,

which, if they do not fully materialize or prove incorrect, could

cause our results to differ materially from those expressed or

implied by such forward-looking statements. Forward-looking

statements are subject to risks and uncertainties that may cause

the company’s actual activities or results to differ significantly

from those expressed in any forward-looking statement, including

risks and uncertainties related to the company’s ability to advance

its product candidates, obtain regulatory approval of and

ultimately commercialize its product candidates, the timing and

results of preclinical and clinical trials, the company’s ability

to fund development activities and achieve development goals, the

company’s ability to protect intellectual property and other risks

and uncertainties described under the heading “Risk Factors” in

documents the company files from time to time with the Securities

and Exchange Commission. These forward-looking statements speak

only as of the date of this press release, and the company

undertakes no obligation to revise or update any forward-looking

statements to reflect events or circumstances after the date

hereof.

Contact:Chelcie ListerTHRUST Investor

Relations910.777.3049chelcie@thrustir.com

| ANAPTYSBIO, INC.CONSOLIDATED

BALANCE SHEETS(in thousands, except par value

data) |

| |

| |

September 30, 2017 |

|

December 31, 2016 |

| |

(unaudited) |

|

|

| ASSETS |

| Current assets: |

|

|

|

| Cash and cash

equivalents |

$ |

26,669 |

|

|

$ |

51,232 |

|

| Receivable from

collaborative partners |

— |

|

|

1,225 |

|

| Australian tax

incentive receivable |

1,486 |

|

|

4,118 |

|

| Short-term

investments |

89,053 |

|

|

— |

|

| Prepaid expenses and

other current assets |

3,119 |

|

|

1,633 |

|

| Total

current assets |

120,327 |

|

|

58,208 |

|

| Property and equipment,

net |

513 |

|

|

471 |

|

| Long-term

investments |

999 |

|

|

— |

|

| Long-term vendor

deposits |

46 |

|

|

— |

|

| Restricted cash |

60 |

|

|

60 |

|

| Deferred financing

costs |

— |

|

|

3,441 |

|

| Total

assets |

$ |

121,945 |

|

|

$ |

62,180 |

|

| LIABILITIES, CONVERTIBLE PREFERRED STOCK AND

STOCKHOLDERS’ EQUITY (DEFICIT) |

| Current

liabilities: |

|

|

|

| Accounts payable |

$ |

2,557 |

|

|

$ |

2,278 |

|

| Accrued expenses |

3,604 |

|

|

3,429 |

|

| Notes payable, current

portion |

5,000 |

|

|

— |

|

| Other current

liabilities |

13 |

|

|

1 |

|

| Total

current liabilities |

11,174 |

|

|

5,708 |

|

| Notes payable, net of

current portion |

9,269 |

|

|

13,809 |

|

| Deferred rent |

147 |

|

|

154 |

|

| Preferred stock warrant

liabilities |

— |

|

|

3,241 |

|

| Commitments and

contingencies |

|

|

|

| Series B convertible

preferred stock, $0.001 par value, no shares and 3,963 authorized,

issued and outstanding at September 30, 2017 and December 31,

2016, respectively |

— |

|

|

28,220 |

|

| Series C convertible

preferred stock, $0.001 par value, no shares and 1,887 shares

authorized, no shares and 1,593 shares issued and outstanding

at September 30, 2017 and December 31, 2016, respectively |

— |

|

|

6,452 |

|

| Series C-1 convertible

preferred stock, $0.001 par value, no shares and 474 shares

authorized, issued and outstanding at September 30, 2017 and

December 31, 2016, respectively |

— |

|

|

2,156 |

|

| Series D convertible

preferred stock, $0.001 par value, no shares and 5,491 shares

authorized, issued and outstanding at September 30, 2017 and

December 31, 2016, respectively |

— |

|

|

40,688 |

|

| Stockholders’ equity

(deficit): |

|

|

|

| Preferred stock, $0.001

par value, 10,000 shares and no shares authorized, issued or

outstanding at September 30, 2017 and December 31, 2016,

respectively |

— |

|

|

— |

|

| Common stock, $0.001

par value, 500,000 and 17,214 authorized, 20,496 shares and 2,651

shares issued and outstanding at September 30, 2017 and

December 31, 2016, respectively |

20 |

|

|

3 |

|

| Additional paid in

capital |

179,551 |

|

|

16,672 |

|

| Accumulated other

comprehensive loss |

(43 |

) |

|

— |

|

| Accumulated

deficit |

(78,173 |

) |

|

(54,923 |

) |

| Total

stockholders’ equity (deficit) |

101,355 |

|

|

(38,248 |

) |

|

Total liabilities, convertible preferred stock and

stockholders’ equity (deficit) |

$ |

121,945 |

|

|

$ |

62,180 |

|

|

|

|

|

|

|

|

|

|

| ANAPTYSBIO, INC.CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS(in

thousands, except per share

data)(unaudited) |

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Collaboration

revenue |

$ |

— |

|

|

$ |

3,214 |

|

|

$ |

7,000 |

|

|

$ |

13,930 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Research

and development |

6,697 |

|

|

3,282 |

|

|

21,837 |

|

|

10,403 |

|

| General

and administrative |

2,390 |

|

|

1,007 |

|

|

6,793 |

|

|

3,378 |

|

| Total

operating expenses |

9,087 |

|

|

4,289 |

|

|

28,630 |

|

|

13,781 |

|

|

Income (loss) from operations |

(9,087 |

) |

|

(1,075 |

) |

|

(21,630 |

) |

|

149 |

|

| Other income (expense),

net |

|

|

|

|

|

|

|

| Interest

expense |

(452 |

) |

|

(116 |

) |

|

(1,319 |

) |

|

(347 |

) |

| Change in

fair value of liability for preferred stock warrants |

— |

|

|

(47 |

) |

|

(1,366 |

) |

|

335 |

|

| Other

income, net |

449 |

|

|

123 |

|

|

1,106 |

|

|

182 |

|

| Total

other income (expense), net |

(3 |

) |

|

(40 |

) |

|

(1,579 |

) |

|

170 |

|

| Net

income (loss) |

(9,090 |

) |

|

(1,115 |

) |

|

(23,209 |

) |

|

319 |

|

| Net income attributed

to participating securities |

— |

|

|

— |

|

|

— |

|

|

(319 |

) |

| Net loss attributed to

common stockholders |

(9,090 |

) |

|

(1,115 |

) |

|

(23,209 |

) |

|

— |

|

|

Unrealized income (loss) on available for sale securities |

16 |

|

|

— |

|

|

(43 |

) |

|

— |

|

| Other

comprehensive income (loss) |

16 |

|

|

— |

|

|

(43 |

) |

|

— |

|

|

Comprehensive loss |

$ |

(9,074 |

) |

|

$ |

(1,115 |

) |

|

$ |

(23,252 |

) |

|

$ |

— |

|

| Net loss

per common share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.45 |

) |

|

$ |

(0.42 |

) |

|

$ |

(1.24 |

) |

|

$ |

— |

|

|

Diluted |

$ |

(0.45 |

) |

|

$ |

(0.42 |

) |

|

$ |

(1.24 |

) |

|

$ |

— |

|

|

Weighted-average number of shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

20,382 |

|

|

2,636 |

|

|

18,668 |

|

|

2,633 |

|

|

Diluted |

20,382 |

|

|

2,636 |

|

|

18,668 |

|

|

3,467 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

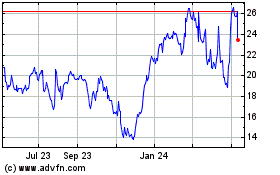

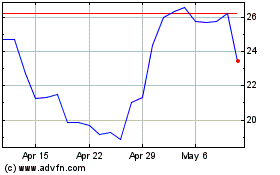

AnaptysBio (NASDAQ:ANAB)

Historical Stock Chart

From Mar 2024 to Apr 2024

AnaptysBio (NASDAQ:ANAB)

Historical Stock Chart

From Apr 2023 to Apr 2024