- Gevo to Host Conference Call Today at 4:30 p.m.

EST/2:30 MST -

Gevo, Inc. (NASDAQ:GEVO) today announced financial results for the

quarter ended September 30, 2017. Key highlights for the third

quarter of 2017 and key subsequent events include:

- On October 9, 2017, Gevo announced that the U.S. Department of

Energy’s (DOE) Chemical Catalysis for Bioenergy Consortium

(ChemCatBio) had awarded funding to Los Alamos National Laboratory,

National Renewable Energy Laboratory, Argonne National Laboratory

and Oak Ridge National Laboratory in support of two collaboration

projects with Gevo. The first project is focused on improving the

energy density of certain Gevo hydrocarbon products, such as its

alcohol-to-jet-fuel (ATJ), to meet product specifications for

tactical missile fuels, which are currently purchased by the U.S.

Department of Defense. The goal of the second project is to

fine-tune the composition of the catalyst used in Gevo’s

proprietary Ethanol-to-Olefins (ETO) process, in order to improve

performance and accelerate scale-up efforts.

- On October 3, 2017, Gevo announced that it expected to supply

its renewable ATJ to the Virgin Australia Group, a leading

Australian airline group. The Virgin Australia Group will be

responsible for coordinating the purchase, supply and blending of

the ATJ into the fuel supply system at Brisbane Airport in

Queensland, Australia. The ATJ is expected to be blended with

traditional jet fuel and supplied on flights departing Brisbane

Airport, including Virgin Australia flights. The Queensland

government is supporting the arrangement as a first step in the

development of a renewable jet fuel production industry in the

state. Queensland is looking to leverage carbohydrate-based

feedstocks, abundant to its local agricultural sector, to support

the build-out of renewable jet fuel production plants in the

future. Gevo is well positioned to play a role in this growth, as

Gevo believes its ATJ is cost advantaged in comparison to other

renewable jet alternatives derived from carbohydrate-based

feedstocks.

- In September 2017, the Board of Directors of the Company

approved voluntarily reductions of the exercise price of certain

Series M Warrants exercisable into 3,945,000 shares of the

Company’s common stock from an exercise price of $2.35 per share of

common stock to $0.60 per share of common stock. In October the

Board of Directors of the Company approved voluntarily reductions

of the exercise price of certain other Series M Warrants

exercisable into 1,185,000 shares of the Company’s common stock

from an exercise price of $2.35 per share of common stock to $0.65

per share of common stock, and Series M Warrants exercisable into

300,000 shares of the Company’s common stock from an exercise price

of $2.35 per share of common stock to $0.60 per share of common

stock. In September and October 2017, all 5,430,000 of these Series

M Warrants were exercised, resulting in proceeds to the Company of

$3.3 million.

- On July 25, 2017, Gevo announced, in conjunction with Praj

Industries Ltd. (“Praj”) that its proprietary isobutanol technology

will now be available for licensing to processors of sugar cane

juice and molasses. This follows on the back of Praj’s development

work, adapting Gevo’s technology to sugar cane and molasses

feedstocks. A Joint Development Agreement and a Development License

Agreement were entered into between Praj and Gevo in November 2015.

The goal of these agreements was for Praj to adapt Gevo’s

isobutanol technology to using non-corn based sugars and

lignocellulose feedstocks. In the first phase of development, Praj

worked with Gevo’s technology using sugar cane and molasses

feedstocks, and worked on developing a process design package to be

offered for commercialization to cane juice and molasses-based

ethanol plants, as licensees of Gevo’s isobutanol technology.

Licensing is expected to be focused on Praj plants located in

India, South America and South East Asia, with initial capacity

targeted to come on-line in the 2019/2020 timeframe.

Commenting on the Company’s most recently completed fiscal

quarter, Dr. Patrick Gruber, Chief Executive Officer of Gevo,

stated, “We are very pleased to have Virgin Australia work with us

on the project to bring renewable ATJ to the Brisbane

airport. This is expected to serve the purpose of working

through any supply chain issues, and should also bring attention to

the tremendous resources and potential of Queensland. The

demand for isobutanol-blended gasoline for the ethanol-free segment

in the Houston market continued to grow, in spite of the

disruptions in logistics caused by the hurricanes. In

Europe, isooctane sales continue to perform well through our

partner, Haltermann Carless (HCS Holding GmbH).”

“We are pleased that the DOE made several grants to their

national laboratories that should benefit our technologies and

products. The Los Alamos project that is looking to convert

our isobutanol-derived hydrocarbons to missile fuels is

particularly interesting, in that these products are high value and

not dependent on being renewable. It is strictly about

performance. They are going to attempt to make our already

higher-than-average energy density jet fuel much higher, to make is

suitable to meet the specifications for various tactical missile

fuels,” added Dr. Gruber.

Outlook for 2017

The following are the operational and financial targets and

milestones that Gevo has established for 2017:

- Restructure Gevo’s balance sheet in a manner that addresses the

debt represented by the outstanding convertible notes and that

allows Gevo to execute on its long-term strategy and business

development plan. Gevo believes that this target was met as a

result of the debt exchange that it concluded with WB Gevo, Ltd. on

June 20, 2017.

- Obtain binding supply contracts for a combination of isobutanol

and related hydrocarbon products equal to at least fifty percent

(50%) of the capacity of the anticipated expanded production

facility that Gevo plans to construct in Luverne, Minnesota (the

“Luverne Facility Expansion”). Based on the current status of

the discussions Gevo is having with potential customers, this

target is not expected to be met during 2017. However, Gevo

believes that this target may be achieved in 2018.

- Gevo plans to achieve a Projected Cash EBITDA Loss of $18.0 -

$20.0 million for the fiscal year ending December 31, 2017.

Gevo believe that it is on track to achieve this

target.3

Strategic Review

Management and the Board of Directors are reviewing the

Company’s strategic and financial options. Management and the

Board of Directors are committed to exploring all strategic and

financial options that are in the best interests of all of the

Company’s stakeholders, including our stockholders, and that are

designed to maximize the value of the Company. Specifically,

management and the Board of Directors are exploring all options to

improve the cash flow profile of the Company’s business, including

the Company’s production facility located in Luverne, Minnesota

(the “Luverne Facility”), to allow the Company sufficient time to

develop the markets and customers for its renewable isobutanol and

related hydrocarbon products.

The Company is currently engaged in discussions with several

interested strategic parties regarding transactions or investments

that would provide capital that would assist it in implementing its

business development plans. There are no assurances that the

Company will successfully complete such transactions or investments

into the Company.

In line with the Company’s desire to improve the cash flow

profile of the Luverne Facility, the Company decided to reduce its

employee base at the Luverne Facility in October 2017 to better

match industry norms in terms of staffing levels necessary to

produce solely ethanol at the plant. The Company does not believe

that this staffing reduction will impact its ability to

periodically return to the co-production of isobutanol and ethanol,

as the Company expects to temporarily shift resources from its

headquarters in Englewood, Colorado to the Luverne Facility to make

up for any shortfalls. The Company expects that this reduction in

force, as well as the focus on ethanol production, will result in a

significant decrease in controllable expenses at the Luverne

Facility.

In addition, the Company is currently reviewing other

initiatives to improve the cash flow profile of the Luverne

Facility and its headquarter operations located in Englewood,

Colorado, which it expects to undertake in the near future.

Operational Summary for the Quarter

In the third quarter of 2017, Gevo produced approximately

100,000 gallons of isobutanol at its Luverne Facility, and

approximately 200,000 gallons thus far in 2017. Consistent with

Gevo’s Luverne Facility production guidance, isobutanol production

this quarter was focused on producing sufficient volumes to provide

enough inventory to support market and customer development efforts

in the future, as well as to continue to optimize Gevo’s technology

and to generate data that is expected to help decrease operating

and capital costs associated with the Luverne Facility Expansion.

Gevo’s current isobutanol production goals are not to maximize

production, but rather to align such production with isobutanol

sales and technology efforts. As a result, during certain periods

of the third quarter of 2017, Gevo only produced ethanol at the

Luverne Facility. Given the Luverne Facility has only one

production line suitable for isobutanol, Gevo’s current isobutanol

production costs are higher than its expected sales price. As a

result, the cash flow profile of the Luverne Facility is improved

by dedicating production to ethanol, rather than co-producing

isobutanol and ethanol.

In addition, the condition of two of the Company’s oldest

fermentation vessels may limit the Company’s ability to co-produce

isobutanol and ethanol (for more information, see the Luverne

Facility Update section in the Company’s Form 10-Q for the Quarter

ended September 30, 2017). The Company does expect to produce any

more isobutanol during 2017. Going forward, the Company

expects its operating strategy will be to focus on the production

of ethanol and to produce limited volumes of isobutanol until the

completion of the Luverne Facility Expansion or until the Company

has repaired or replaced one or both of two older fermentation

vessels.

During the third quarter of 2017, the Company sold limited

quantities of isobutanol and renewable hydrocarbons (ATJ, isooctane

and isooctene). In the quarter, the Company’s isobutanol market

development efforts were focused on gaining market acceptance in

its core gasoline blendstock markets such as marinas and on-road

gasoline fueling stations, while maintaining its targeted selling

price. The Company continued to work with its distribution partners

to make investments to develop end-customer relationships, as well

as to establish value chains to deliver its isobutanol to those

end-customers. The Company believes that gasoline end users such as

boat owners and car owners remain interested in purchasing

isobutanol containing gasoline because of the improved properties

compared to ethanol containing gasoline. The demand for the

Company’s renewable isobutanol, in terms of the number of retail

pumps selling isobutanol-blended finished gasoline in Houston and

other markets, has grown rapidly during 2017. However, given the

low number of pumps that were selling isobutanol-blended gasoline

at the beginning of 2017, limited quantities of isobutanol have

been sold during 2017. The Company expects that sales of the

Company’s isobutanol will increase in 2018 as the markets for

isobutanol-blended finished gasoline further develop.

Gevo’s market development efforts related to its renewable

hydrocarbon products were mainly targeted towards entering into

binding supply agreements to underpin the economics of the Luverne

Facility Expansion that Gevo plans to construct. Gevo has been in

discussions with numerous potential ATJ and isooctane customers to

enter into long term supply agreements, with a goal of signing

contracts representing the majority of the isobutanol production

volumes to be produced at the expanded Luverne Facility.

Currently, Gevo is discussing or negotiating terms for long-term

supply agreements with two large potential customers. There can be

no assurances that these discussions or negotiations will result in

definitive binding agreements.

As Gevo develops markets for its products, there will be a

mismatch in timing between isobutanol production and sales. As a

result, at times Gevo will build isobutanol inventory levels.

At September 30, 2017, Gevo had approximately 350,000 gallons of

isobutanol and approximately 54,000 gallons of renewable

hydrocarbons in inventory.

Also, during the third quarter of 2017, Gevo produced and sold

approximately 4.2 million of ethanol.

Financial Highlights

Revenues for the third quarter of 2017 were $7.7 million

compared with $6.9 million in the same period in 2016. During the

third quarter of 2017, revenues derived at the Luverne Facility

related to ethanol sales and related products were $7.4 million, an

increase of approximately $1.0 million from the same period in

2016. This was primarily a result of higher ethanol and distiller

grain prices and production in the third quarter of 2017 versus the

same period in 2016.

During the third quarter of 2017, hydrocarbon revenues were $0.2

million, down $0.2 million as compared to the same period in 2016.

Gevo’s hydrocarbon revenues are comprised of sales of ATJ,

isooctane and isooctene.

Gevo generated grant and other revenue of $88,000 during the

third quarter of 2017, down less than $0.1 million as compared to

the same period in 2016.

Cost of goods sold was $9.7 million for the three months ended

September 30, 2017, up $0.1 million as compared to the same period

in 2016. Cost of goods sold included approximately $8.2 million

associated with the production of ethanol, isobutanol and related

products and approximately $1.5 million in depreciation

expense.

Gross loss was $2.0 million for the three months ended September

30, 2017, versus $2.7 million in the same quarter in 2016.

Research and development expense increased by $0.1 million

during the three months ended September 30, 2017, compared with the

same period in 2016, due primarily to an increase in

employee-related expenses.

Selling, general and administrative expense decreased by $0.4

million during the three months ended September 30, 2017, compared

with the same period in 2016, due primarily to a decrease in legal

expenses.

Loss from operations in the three months ended September 30,

2017 was $5.1 million, compared with $6.1 million in the same

period in 2016.

Non-GAAP Cash EBITDA Loss in the three months ended September

30, 2017 was $3.4 million, compared with $4.1 million in the same

period in 2016.

Interest expense in the three months ended September 30, 2017

was $0.8 million, down $1.3 million as compared to the same period

in 2016, due to a decrease in outstanding principal balances of our

debt.

During the three months ended September 30, 2017, the Company

incurred a $0.4 million loss on changes in the fair value of the

derivative warrant liability, primarily as a result of the

repricing of a portion of the Series M warrants at a lower strike

price.

During the three months ended September 30, 2017, the estimated

fair value of the 2020 notes embedded derivative liability

decreased, resulting in a non-cash gain of $2.2 million

primarily due to the decrease in the price of the Company’s stock

from June 30, 2017.

The net loss for the three months ended September 30, 2017 was

$4.2 million, compared with $9.8 million during the same period in

2016.

The non-GAAP Adjusted Net Loss for the three months ended

September 30, 2017 was $5.9 million, compared with $8.2 million

during the same period in 2016.

The cash position at September 30, 2017 was $14.8 million and

the total principal face value of the debt outstanding was $17.1

million.

Webcast and Conference Call Information

Hosting today’s conference call at 4:30 p.m. EST (2:30 p.m. MST)

will be Dr. Patrick Gruber, Chief Executive Officer, Mike Willis,

Chief Financial Officer, and Geoff Williams, General Counsel. They

will review Gevo’s financial results and provide an update on

recent corporate highlights.

To participate in the conference call, please dial 1 (888)

771-4371 (inside the U.S.) or 1 (847) 585-4405 (outside the U.S.)

and reference the access code 45648370. A replay of the call and

webcast will be available two hours after the conference call ends

on November 6, 2017. To access the replay, please dial

1-888-843-7419 (inside the US) or 1-630-652-3042 (outside the US)

and reference the access code 45648370#. The archived webcast will

be available in the Investor Relations section of Gevo's website at

www.gevo.com.

About Gevo

Gevo is a renewable technology, chemical products, and next

generation biofuels company. Gevo has developed proprietary

technology that uses a combination of synthetic biology, metabolic

engineering, chemistry and chemical engineering to focus primarily

on the production of isobutanol, as well as related products from

renewable feedstocks. Gevo’s strategy is to commercialize biobased

alternatives to petroleum-based products to allow for the

optimization of fermentation facilities’ assets, with the ultimate

goal of maximizing cash flows from the operation of those assets.

Gevo produces isobutanol, ethanol and high-value animal feed at its

fermentation plant in Luverne, Minnesota. Gevo has also developed

technology to produce hydrocarbon products from renewable alcohols.

Gevo currently operates a biorefinery in Silsbee, Texas, in

collaboration with South Hampton Resources Inc., to produce ATJ,

octane, and ingredients for plastics like polyester. Gevo has a

marquee list of partners including The Coca-Cola Company, Toray

Industries Inc. and Total SA, among others. Gevo is committed to a

sustainable bio-based economy that meets society’s needs for

plentiful food and clean air and water.

Forward-Looking Statements

Certain statements in this press release may constitute

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements relate to a variety of matters, including, without

limitation, statements related to the ability of Gevo to develop

markets for its products, the status of negotiations or discussions

with potential customers, Gevo’s ability to enter into binding

offtake, sales or supply agreements for its products, Gevo’s

ability to produce isobutanol or related hydrocarbon products at

its Luverne Facility, Gevo’s ability to finance, construct and

operate the contemplated expanded Luverne Facility, Gevo’s 2017

operational and financial targets and milestones, Gevo’s cash

operating and financing expectations, the supply agreement with HCS

Holding, Gevo’s financial condition, including liquidity, Gevo’s

ability to secure new customer relationships across core markets,

and other statements that are not purely statements of historical

fact. These forward-looking statements are made on the basis

of the current beliefs, expectations and assumptions of the

management of Gevo and are subject to significant risks and

uncertainty. Investors are cautioned not to place undue reliance on

any such forward-looking statements. All such forward-looking

statements speak only as of the date they are made, and Gevo

undertakes no obligation to update or revise these statements,

whether as a result of new information, future events or otherwise.

Although Gevo believes that the expectations reflected in these

forward-looking statements are reasonable, these statements involve

many risks and uncertainties that may cause actual results to

differ materially from what may be expressed or implied in these

forward-looking statements. For a further discussion of risks and

uncertainties that could cause actual results to differ from those

expressed in these forward-looking statements, as well as risks

relating to the business of Gevo in general, see the risk

disclosures in the Annual Report on Form 10-K of Gevo for the year

ended December 31, 2016, and in subsequent reports on Forms 10-Q

and 8-K and other filings made with the U.S. Securities and

Exchange Commission by Gevo.

Non-GAAP Financial Information

This press release contains financial measures that do not

comply with U.S. generally accepted accounting principles (GAAP),

including non-GAAP Cash EBITDA Loss, non-GAAP Adjusted Net Loss and

non-GAAP Adjusted Net Loss Per Share. Non-GAAP Cash EBITDA Loss

excludes non-cash items such as depreciation and stock-based

compensation. Non-GAAP Adjusted Net Loss and non-GAAP Adjusted Net

Loss Per Share excludes non-cash gains and/or losses recognized in

the quarter due to the changes in the fair value of certain of

Gevo’s financial instruments, such as warrants, convertible debt

and embedded derivatives.

Management believes these measures are useful to supplement its

GAAP financial statements with this non-GAAP information because

management uses such information internally for its operating,

budgeting and financial planning purposes. These non-GAAP financial

measures also facilitate management's internal comparisons to

Gevo’s historical performance as well as comparisons to the

operating results of other companies. In addition, Gevo believes

these non-GAAP financial measures are useful to investors because

they allow for greater transparency into the indicators used by

management as a basis for its financial and operational decision

making. Non-GAAP information is not prepared under a comprehensive

set of accounting rules and therefore, should only be read in

conjunction with financial information reported under U.S. GAAP

when understanding Gevo’s operating performance. A reconciliation

between GAAP and non-GAAP financial information is provided in the

financial statement tables below.

Reverse Stock Split

On December 21, 2016, our Board of Directors approved a reverse

split of our common stock, par value $0.01, at a ratio of

one-for-twenty. This reverse stock split became

effective on January 5, 2017 and, unless otherwise indicated, all

share amounts, per share data, share prices, exercise prices and

conversion rates set forth in this press release and the

accompanying consolidated financial statements have, where

applicable, been adjusted to reflect this reverse stock

split.

________________________1 Adjusted Net Loss Per Share is

calculated by adding back non-cash gains and/or losses recognized

in the quarter due to the changes in the fair value of certain of

our financial instruments, such as warrants, convertible debt and

embedded derivatives; a reconciliation of Adjusted Net Loss Per

Share to GAAP net loss per share is provided in the financial

statement tables following this release. 2 Cash

EBITDA Loss is calculated by adding back depreciation and non-cash

stock compensation to GAAP loss from operations; a reconciliation

of Cash EBITDA Loss to GAAP loss from operations is provided in the

financial statement tables following this release. 3

Projected Cash EBITDA Loss is calculated by adding back

depreciation and non-cash stock compensation to GAAP loss from

operations; a reconciliation of Projected Cash EBITDA Loss to GAAP

loss from operations is provided in the financial statement tables

following this release.

|

|

|

Gevo, Inc. |

|

Condensed Consolidated Statements of Operations

Information |

|

(Unaudited, in thousands, except share and per share

amounts) |

|

|

|

|

Three Months Ended September

30, |

|

Nine Months Ended September 30, |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| |

|

|

|

|

|

|

|

|

Revenue and cost of goods sold |

|

|

|

|

|

|

| Ethanol

sales and related products, net |

$ |

7,376 |

|

|

$ |

6,363 |

|

|

$ |

19,709 |

|

|

$ |

19,288 |

|

|

Hydrocarbon revenue |

|

235 |

|

|

|

451 |

|

|

|

984 |

|

|

|

1,462 |

|

| Grant and

other revenue |

|

88 |

|

|

|

130 |

|

|

|

163 |

|

|

|

627 |

|

| Total revenues |

|

7,699 |

|

|

|

6,944 |

|

|

|

20,856 |

|

|

|

21,377 |

|

| |

|

|

|

|

|

|

|

| Cost of goods

sold |

|

9,709 |

|

|

|

9,650 |

|

|

|

28,822 |

|

|

|

28,862 |

|

| |

|

|

|

|

|

|

|

|

|

| Gross

loss |

|

(2,010 |

) |

|

|

(2,706 |

) |

|

|

(7,966 |

) |

|

|

(7,485 |

) |

| |

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

| Research

and development expense |

|

1,210 |

|

|

|

1,156 |

|

|

|

4,318 |

|

|

|

3,670 |

|

| Selling,

general and administrative expense |

|

1,893 |

|

|

|

2,273 |

|

|

|

6,190 |

|

|

|

6,337 |

|

| Total operating

expenses |

|

3,103 |

|

|

|

3,429 |

|

|

|

10,508 |

|

|

|

10,007 |

|

| |

|

|

|

|

|

|

|

| Loss from

operations |

|

(5,113 |

) |

|

|

(6,135 |

) |

|

|

(18,474 |

) |

|

|

(17,492 |

) |

| |

|

|

|

|

|

|

|

| Other (expense)

income |

|

|

|

|

|

|

|

| Interest

expense |

|

(811 |

) |

|

|

(2,100 |

) |

|

|

(2,152 |

) |

|

|

(6,497 |

) |

| (Loss) on

exchange of debt |

|

- |

|

|

|

(920 |

) |

|

|

(4,933 |

) |

|

|

(920 |

) |

|

(Loss)/Gain on extinguishment of warrant liability |

|

- |

|

|

|

5 |

|

|

|

- |

|

|

|

(918 |

) |

| (Loss)

from change in fair value of the 2017 Notes |

|

- |

|

|

|

(1,854 |

) |

|

|

(339 |

) |

|

|

(3,629 |

) |

|

(Loss)/Gain from change in fair value of derivative warrant

liability |

|

(413 |

) |

|

|

1,154 |

|

|

|

5,106 |

|

|

|

(4,171 |

) |

| Gain from

change in fair value of 2020 notes embedded derivative |

|

2,184 |

|

|

|

- |

|

|

|

522 |

|

|

|

- |

|

| (Loss) on

issuance of equity |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,519 |

) |

| Other

income / (expense) |

|

- |

|

|

|

1 |

|

|

|

26 |

|

|

|

207 |

|

| Total

other expense, net |

|

960 |

|

|

|

(3,714 |

) |

|

|

(1,770 |

) |

|

|

(17,447 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

loss |

|

(4,153 |

) |

|

|

(9,849 |

) |

|

|

(20,244 |

) |

|

|

(34,939 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss

per share - basic and diluted |

$ |

(0.25 |

) |

|

$ |

(2.04 |

) |

|

$ |

(1.40 |

) |

|

$ |

(12.41 |

) |

|

Weighted-average number of common shares outstanding - basic

and diluted |

|

16,508,158 |

|

|

|

4,837,698 |

|

|

|

14,506,448 |

|

|

|

2,814,266 |

|

| |

|

|

|

|

|

|

|

| |

|

Gevo, Inc. |

|

Condensed Consolidated Balance Sheet

Information |

|

(Unaudited, in thousands) |

| |

|

|

|

| |

September 30, |

|

December

31, |

| |

2017 |

|

2016 |

|

Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and

cash equivalents |

$ |

14,764 |

|

$ |

27,888 |

| Accounts

receivable |

|

1,243.0 |

|

|

1,122.0 |

|

Inventories |

|

4,331.0 |

|

|

3,458.0 |

| Prepaid

expenses and other current assets |

$ |

828 |

|

$ |

850 |

| Total

current assets |

|

21,166 |

|

|

33,318 |

| |

|

|

|

| Property,

plant and equipment, net |

|

71,917 |

|

|

75,592 |

|

Restricted Deposits |

|

- |

|

|

2,611 |

| Deposits

and other assets |

|

803 |

|

|

803 |

| Total

assets |

$ |

93,886 |

|

$ |

112,324 |

| |

|

|

|

|

Liabilities |

|

|

|

| Current

liabilities: |

|

|

|

| Accounts

payable, accrued liabilities and other current liabilities |

$ |

5,129 |

|

$ |

6,193 |

| 2017

Notes recorded at fair value |

|

- |

|

|

25,769 |

| 2020

Notes embedded derivative liability |

|

6,453 |

|

|

- |

|

Derivative warrant liability |

|

2,139 |

|

|

2,698 |

| Total

current liabilities |

|

13,721 |

|

|

34,660 |

|

|

|

|

|

| 2020

Notes, net |

|

13,108 |

|

|

- |

| 2022

Notes, net |

|

515 |

|

|

8,221 |

| Other

long-term liabilities |

|

142 |

|

|

179 |

| Total

liabilities |

|

27,486 |

|

|

43,060 |

| |

|

|

|

|

Total stockholders’ equity |

|

66,400 |

|

|

69,264 |

| Total

liabilities and stockholders' equity |

$ |

93,886 |

|

$ |

112,324 |

| |

| |

|

Gevo, Inc. |

|

Condensed Consolidated Cash Flow Information |

|

(Unaudited, in thousands) |

| |

| |

Nine Months Ended September 30, |

| |

|

2017 |

|

|

|

2016 |

|

| Operating

Activities |

|

|

|

| Net loss |

$ |

(20,244 |

) |

|

$ |

(34,939 |

) |

| Adjustments to

reconcile net loss to net cash used in operating activities: |

|

|

|

|

Loss/(Gain) from change in fair value of derivative warrant

liability |

|

(5,497 |

) |

|

|

4,171 |

|

| (Gain)

from change in fair value of 2020 embedded derivative |

|

(522 |

) |

|

|

- |

|

| Loss from

the change in fair value of the 2017 notes |

|

339 |

|

|

|

3,629 |

|

| Loss on

exchange of debt |

|

4,933 |

|

|

|

920 |

|

|

Loss/(Gain) on extinguishment of warrant liability |

|

392 |

|

|

|

918 |

|

| Loss on

issuance of equity |

|

- |

|

|

|

1,519 |

|

|

Stock-based compensation |

|

323 |

|

|

|

812 |

|

|

Depreciation and amortization |

|

4,994 |

|

|

|

5,038 |

|

| Non-cash

interest expense |

|

579 |

|

|

|

3,339 |

|

| Changes

in operating assets and liabilities: |

|

- |

|

|

|

- |

|

| Accounts

receivable |

|

(121 |

) |

|

|

312 |

|

|

Inventories |

|

(873 |

) |

|

|

284 |

|

| Prepaid

expenses and other current assets |

|

22 |

|

|

|

(113 |

) |

| Accounts

payable, accrued expenses, and long-term liabilities |

|

(766 |

) |

|

|

(2,095 |

) |

| Net cash

used in operating activities |

|

(16,441 |

) |

|

|

(16,205 |

) |

| |

|

|

|

| Investing

Activities |

|

|

|

| Acquisitions of

property, plant and equipment |

|

(1,682 |

) |

|

|

(5,520 |

) |

| Net cash

used in investing activities |

|

(1,682 |

) |

|

|

(5,520 |

) |

| |

|

|

|

| Financing

Activities |

|

|

|

|

Payments on secured debt |

|

(9,791 |

) |

|

|

(504 |

) |

|

Debt and equity offering costs |

|

(1,071 |

) |

|

|

(3,295 |

) |

|

Proceeds from issuance of common stock and common stock

warrants |

|

11,044 |

|

|

|

28,661 |

|

|

Proceeds from the exercise of warrants |

|

2,206 |

|

|

|

10,895 |

|

|

|

|

2,611 |

|

|

|

- |

|

| Net cash

provided by financing activities |

|

4,999 |

|

|

|

35,757 |

|

| |

|

|

|

| Net (decrease)/increase

in cash and cash equivalents |

|

(13,124 |

) |

|

|

14,032 |

|

|

|

|

|

|

| Cash and cash

equivalents |

|

|

|

| Beginning

of period |

|

27,888 |

|

|

|

17,031 |

|

| End of

period |

$ |

14,764 |

|

|

$ |

31,063 |

|

| |

|

|

|

Gevo, Inc. |

|

Reconciliation of GAAP to Non-GAAP Financial

Information |

|

(Unaudited, in thousands) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September

30, |

| Non-GAAP Cash

EBITDA: |

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| |

|

|

|

|

|

|

|

| Gevo

Development, LLC / Agri-Energy, LLC |

|

|

|

|

|

|

| Loss from

operations |

$ |

(2,552 |

) |

|

$ |

(3,403 |

) |

|

$ |

(9,756 |

) |

|

$ |

(9,896 |

) |

|

Depreciation and amortization |

|

1,542 |

|

|

|

1,503 |

|

|

|

4,619 |

|

|

|

4,450 |

|

| Non-cash

stock-based compensation |

|

2 |

|

|

|

5 |

|

|

|

5 |

|

|

|

10 |

|

| Non-GAAP cash

EBITDA |

$ |

(1,008 |

) |

|

$ |

(1,895 |

) |

|

$ |

(5,132 |

) |

|

$ |

(5,436 |

) |

| |

|

|

|

|

|

|

|

| Gevo, Inc. |

|

|

|

|

|

|

|

| Loss from

operations |

$ |

(2,561 |

) |

|

$ |

(2,732 |

) |

|

$ |

(8,718 |

) |

|

$ |

(7,596 |

) |

|

Depreciation and amortization |

|

111 |

|

|

|

255 |

|

|

|

375 |

|

|

|

588 |

|

| Non-cash

stock-based compensation |

|

98 |

|

|

|

265 |

|

|

|

318 |

|

|

|

802 |

|

| Non-GAAP cash

EBITDA |

$ |

(2,352 |

) |

|

$ |

(2,212 |

) |

|

$ |

(8,025 |

) |

|

$ |

(6,206 |

) |

| |

|

|

|

|

|

|

|

| Gevo Consolidated |

|

|

|

|

|

|

|

| Loss from

operations |

$ |

(5,113 |

) |

|

$ |

(6,135 |

) |

|

$ |

(18,474 |

) |

|

$ |

(17,492 |

) |

|

Depreciation and amortization |

|

1,653 |

|

|

|

1,758 |

|

|

|

4,994 |

|

|

|

5,038 |

|

| Non-cash

stock-based compensation |

|

100 |

|

|

|

270 |

|

|

|

323 |

|

|

|

812 |

|

| Non-GAAP cash

EBITDA |

$ |

(3,360 |

) |

|

$ |

(4,107 |

) |

|

$ |

(13,157 |

) |

|

$ |

(11,642 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

Adjusted Net Loss: |

|

|

|

|

|

|

|

| Gevo Consolidated |

|

|

|

|

|

|

|

| Net

Loss |

|

(4,153 |

) |

|

|

(9,849 |

) |

|

|

(20,244 |

) |

|

|

(34,939 |

) |

| (Loss) on

exchange of debt |

|

- |

|

|

|

(920 |

) |

|

|

(4,933 |

) |

- |

|

(920 |

) |

| (Loss) on

extinguishment of warrant liability |

|

- |

|

|

|

5 |

|

|

|

- |

|

|

|

(918 |

) |

| (Loss)

from change in fair value of the 2017 Notes |

|

- |

|

|

|

(1,854 |

) |

|

|

(339 |

) |

|

|

(3,629 |

) |

|

(Loss)/Gain from change in fair value of derivative warrant

liability |

|

(413 |

) |

|

|

1,154 |

|

|

|

5,106 |

|

|

|

(4,171 |

) |

| (Loss)

from change in fair value of 2020 notes embedded derivative |

|

2,184 |

|

|

|

- |

|

|

|

522 |

|

|

|

- |

|

| (Loss) on

issuance of equity |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,519 |

) |

| Non-GAAP

Net Loss |

$ |

(5,924 |

) |

|

$ |

(8,234 |

) |

|

$ |

(20,600 |

) |

|

$ |

(23,782 |

) |

| Weighted-average number

of common shares outstanding - basic and diluted |

|

16,508,158 |

|

|

|

4,837,698 |

|

|

|

14,506,448 |

|

- |

|

2,814,266 |

|

| Non-GAAP Adjusted Net

loss per share - basic and diluted |

$ |

(0.36 |

) |

|

$ |

(1.70 |

) |

|

$ |

(1.42 |

) |

|

$ |

(8.45 |

) |

| |

|

|

|

|

|

|

|

| |

|

Gevo, Inc. |

|

Reconciliation of GAAP to Non-GAAP Financial

Information |

|

(Unaudited, in thousands) |

| |

| |

Year-Ended |

| |

December 31, 2017 |

| Projected

Non-GAAP Cash EBITDA Loss |

Estimated Range |

| Gevo consolidated |

|

| Loss from

operations |

($24,000) - ($28,000) |

|

Depreciation and amortization |

5,500

- 7,000 |

| Non-cash

stock based compensation |

500 - 1,000 |

| Non-GAAP cash EBITDA

loss |

($18,000) - ($20,000) |

| |

Media ContactDavid RodewaldThe David James

Agency, LLC+1 805-494-9508gevo@davidjamesagency.com

Investor ContactShawn M. SeversonEnergyTech

Investor, LLC+1

415-233-7094gevo@energytechinvestor.com@ShawnEnergyTechwww.energytechinvestor.com

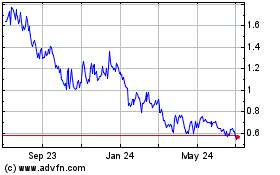

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

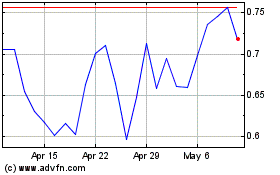

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Apr 2023 to Apr 2024