UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2017

Commission File Number

001-36866

SUMMIT THERAPEUTICS PLC

(Translation of registrant’s name into English)

136a Eastern

Avenue

Milton Park, Abingdon

Oxfordshire OX14 4SB

United Kingdom

(Address

of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F:

FORM

20-F ☒ FORM

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the

Commission pursuant to Rule

12g3-2(b)

under the Securities Exchange Act of 1934:

YES ☐ NO ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b):

On October 16, 2017, Summit (Oxford) Limited, a wholly owned subsidiary of Summit Therapeutics plc (the

“Company”), entered into an Equity and Revenue Sharing Agreement (the “Revenue Sharing Agreement”) with the Wellcome Trust Limited, as trustee of the Wellcome Trust (the “Wellcome Trust”), as contemplated by the terms

of the Company’s Translation Award Funding Agreement with the Wellcome Trust, dated October 19, 2012 (the “Translation Award Agreement”).

Under the Translation Award Agreement, the Wellcome Trust provided funding to the Company to support a Phase 1 and a Phase 2 clinical trial of ridinilazole

for

Clostridium difficile

infection (“CDI”) that have since been completed. The entry into the Translation Award Agreement followed a funding agreement that the Company and the Wellcome Trust had entered into in October 2009 (the

“Discovery Award Agreement”), under which the Company received funding from the Wellcome Trust to support the preclinical development of CDI antibiotics. The Wellcome Trust agreed to provide funding to the Company under each of the

Translation Award Agreement and the Discovery Award Agreement in consideration for a share of any future revenue from the product candidates being developed for CDI.

Pursuant to the terms of the Translation Award Agreement, the Company was required to enter into a revenue sharing agreement with the Wellcome Trust prior to

the further development (past the Phase 2 trial supported by the Translation Award Agreement) and commercialization (“Exploitation”) of any compound or product that is covered by intellectual property rights created under the Discovery

Award Agreement or the Translation Award Agreement, or that is covered by background intellectual property rights (together, the “Award Products”). Under such revenue sharing agreement the Wellcome Trust would be entitled to a share of the

net revenue that the Company, its affiliates, licensees or third-party collaborators receive from the Exploitation of the Award Products or any intellectual property associated with such Exploitation (the “Exploitation IP”). Under the

Revenue Sharing Agreement, the Company and the Wellcome Trust agreed that such rights to receive a share of net revenue on account of the Exploitation of Award Products and Exploitation IP pertain to ridinilazole, the Company’s product

candidate for the treatment of CDI.

Under the Revenue Sharing Agreement:

|

|

•

|

|

If the Company commercializes ridinilazole, the Wellcome Trust is eligible to receive a

low-single

digit percentage of net revenue (as defined in the Translation Award Agreement),

and a

one-time

milestone payment of a specified amount if cumulative net revenues exceeds a specified amount.

|

|

|

•

|

|

If a third party commercializes ridinilazole, the Wellcome Trust is eligible to receive a

mid-single

digit percentage of the net revenues received by the Company from commercial

sales by such third party, and a

one-time

milestone payment of a specified amount if cumulative net revenues exceeds a specified amount. In addition, following the first commercial sale by such third party,

the Wellcome Trust is eligible to receive a

one-time

milestone payment equal to a

low-single

digit percentage of the aggregate amount of any

pre-commercial

payments received by the Company from third-party licensees prior to such commercial sale.

|

|

|

•

|

|

In the event of an assignment or sale of the assets or intellectual property pertaining to ridinilazole, the net proceeds to the Company of such assignment or sale would be treated as net revenue under the Revenue

Sharing Agreement.

|

Under the Revenue Sharing Agreement, the Company and the Wellcome Trust agreed that any development funding or grant

funding received by the Company from BARDA or other third parties, including licensees, would not be classified as net revenue or as a

pre-commercial

payment.

In addition, under the Revenue Sharing Agreement, the Wellcome Trust agreed to terminate all of its rights under the Translation Award Agreement to develop or

commercialize the Award Products or the Exploitation IP in specified markets and in specified indications, in the event the Company was not developing or commercializing the Award Products or the Exploitation IP for such markets or in such

indications.

Unless earlier terminated, the Revenue Sharing Agreement will expire upon later of the expiration of the last

patent or patent application covering ridinilazole; the expiration of any agreement or payment obligations entered into by the Company with a third party relating to the Exploitation of ridinilazole; and the expiration of any payment obligations

owed to the Wellcome Trust relating to the Exploitation of ridinilazole. In addition, each party has the right to terminate the Revenue Sharing Agreement if the other party materially breaches the agreement and the breach remains uncured for a

specified period or the breach is uncurable, or if the other party experiences specified insolvency related events.

The foregoing description of certain

terms of the Revenue Sharing Agreement does not purport to be complete and is qualified in its entirety by reference to the Revenue Sharing Agreement that the Company intends to file as an exhibit to its Annual Report on Form

20-F

for the fiscal year ending January 31, 2018.

Forward-looking Statements

Any statements in this report about the Company’s future expectations, plans and prospects, including but not limited to, statements about the future

operation of the Revenue Sharing Agreement, including any potential future payments thereunder, clinical and preclinical development of the Company’s product candidates, the therapeutic potential of the Company’s product candidates, the

sufficiency of the Company’s cash resources, the timing of initiation, completion and availability of data from clinical trials, the potential submission of applications for marketing approvals and other statements containing the words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,”

“should,” “target,” “would,” and similar expressions, constitute forward looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those

indicated by such forward-looking statements as a result of various important factors, including: the uncertainties inherent in the initiation of future clinical trials, availability and timing of data from ongoing and future clinical trials and the

results of such trials, whether preliminary results from a clinical trial will be predictive of the final results of that trial or whether results of early clinical trials or preclinical studies will be indicative of the results of later clinical

trials, expectations for regulatory approvals, laws and regulations affecting government contracts, availability of funding sufficient for the Company’s foreseeable and unforeseeable operating expenses and capital expenditure requirements and

other factors discussed in the “Risk Factors” section of filings that the Company makes with the Securities and Exchange Commission including the Company’s Annual Report on Form

20-F

for the

fiscal year ended January 31, 2017. Accordingly, readers should not place undue reliance on forward-looking statements or information. In addition, any forward-looking statements included in this report represent the Company’s views only

as of the date of this report and should not be relied upon as representing the Company’s views as of any subsequent date. The Company specifically disclaims any obligation to update any forward-looking statements included in this Report on

Form

6-K.

The information in this Report on Form

6-K

shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

SUMMIT THERAPEUTICS PLC

|

|

|

|

|

By:

|

|

/s/ Erik Ostrowski

|

|

|

|

Erik Ostrowski

|

|

|

|

Chief Financial Officer

|

Date: November 6, 2017

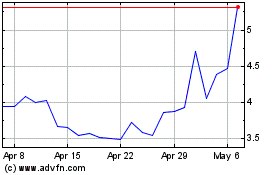

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

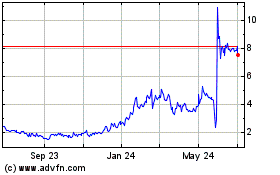

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Apr 2023 to Apr 2024