ENGlobal (NASDAQ:ENG), a leading provider of engineering and

automation services, today announced results for the third quarter

ended September 30, 2017.

ENGlobal reported a net loss of $12.1 million

for the third quarter of 2017 which was a $12.6 million decrease

over net income of $0.5 million reported for the prior year

period. The third quarter 2017 results included the effects

of a $11.3 million non-cash charge relating to a valuation

allowance that was taken against the Company’s deferred tax

assets. Net loss per diluted share was ($0.44) versus

net income per diluted share of $0.02 for the third quarter just

ended and for the third quarter of 2016, respectively.

During the second quarter of 2017, management

worked closely with a strategy consultant to perform an assessment

of the Company and both short term and long term market trends,

which in turn assisted management in updating its long term

business growth strategy. This assessment was completed in the

quarter just ended and concluded that ENGlobal’s market segments

that are expected to experience the highest future growth rates are

those relating to Industrial Controls and Automation and the

Industrial Internet of Things (IIOT).

These are both areas in which the Company has

extensive experience providing higher value products and services

to its clients but have not been the Company’s primary focus in

recent years. As a result of this strategic assessment,

management has developed a multi-year plan to invest and position

the Company as a leading provider of higher value industrial

automation and IIOT services to its extensive customer base – an

area that has historically produced higher project margins for

ENGlobal.

Additionally, through previous organic

initiatives, ENGlobal is now a vertically integrated service

provider with expertise in project related engineering, mechanical

fabrication, systems integration and automation. This positioning

has allowed the Company to differentiate itself from most of its

competitors as a full service provider - delivering benefits by

reducing its clients’ need to coordinate multiple vendors. In

addition, ENGlobal is now able to pursue larger scopes of work

focused on a wide range of modularized engineered systems.

Management believes that because of the vertical integration

strategy, an increasing amount of engineering, mechanical

fabrication and systems integration services necessary to support

the Company’s strategic growth plan will be awarded to the

Company.

Management's Assessment

William A. Coskey, P.E., Chairman and CEO of

ENGlobal stated: “Our management has been very busy - taking

actions during the quarter to begin the implementation of

ENGlobal’s strategy. These first steps included the reorganization

and refocusing of our business development personnel, the

development of relevant marketing materials and the successful

adoption of a new customer relationship management system. In

addition, during the quarter we completed the reorganization of our

operations staff resulting in a senior VP responsible for the

staffing, training, development and project execution of our

automation business and a senior VP with the same responsibilities

for our multidiscipline engineering and EPC projects business.”

Mark A. Hess, ENGlobal's Chief Financial Officer

stated: “During the quarter, we continued to work through

many projects that were awarded at the end of last year and early

this year at relatively lower margins. Combined with our low

productivity levels following hurricane Harvey, this produced lower

than expected revenue and gross margin for the quarter. While

our selling, general and administrative costs continue to be

rationalized and reduced, the reduction was not enough to offset

the reduced gross margin. In addition, during the quarter, pursuant

to standard accounting rules, we established a valuation allowance

against our deferred tax assets of $11.3 million.”

Mr. Hess continued: “While work as a result of

our strategy assessment is in its beginning phases, we have seen

encouraging early indicators that this approach is aligned with our

customers’ strategic focus and will be well received by our

clients. As one example, we have been developing our

automation pipeline over the last few quarters resulting in a 20%

increase of our automation backlog during the quarter just

ended. Proposal activity has been healthy and we are

currently awaiting client decisions on a number of significant

opportunities.”

The following is a summary of the income statement for the three

months ended September 30, 2017 and September 24, 2016:

| |

| (amounts in

thousands) |

|

Three months ended September 30,

2017 |

|

|

Three Months ended September 24,

2016 |

| Revenue |

$ |

12,896 |

|

$ |

15,968 |

| Gross Profit |

|

1,621 |

|

|

3,881 |

| General &

Administrative Expenses |

|

3,041 |

|

|

3,511 |

| Operating Income

(Loss) |

|

(1,420) |

|

|

370 |

| Net Income (Loss) |

|

(12,154) |

|

|

489 |

| |

|

|

|

|

|

The following table presents certain balance sheet items as of

September 30, 2017 and December 31, 2016:

| |

| (amounts in

thousands) |

|

As of September 30, 2017 |

|

As of December 31, 2016 |

| Cash |

$ |

10,898 |

$ |

15,687 |

| Working capital |

|

19,163 |

|

22,200 |

| |

|

|

|

|

The following table illustrates the composition of the Company's

revenue and profitability for its operations for the three and nine

months ended September 30, 2017 and September 24, 2016:

|

|

|

(amounts in thousands) |

Three months ended September 30,

2017 |

Three Months ended

September 24, 2016 |

| |

|

% of |

Gross |

Operating |

|

|

% of |

Gross |

Operating |

| |

Total |

Total |

Profit |

Profit |

|

Total |

Total |

Profit |

Profit |

|

Segment |

Revenue |

Revenue |

Margin |

Margin |

|

Revenue |

Revenue |

Margin |

Margin |

| |

|

|

|

|

|

|

|

|

|

| Engineering

& Construction |

$ |

8,573 |

66.5% |

10.5% |

0.3% |

|

$ |

8,216 |

51.5% |

17.7% |

6.6% |

| Automation |

|

4,323 |

33.5% |

16.7% |

4.4% |

|

|

7,752 |

48.5% |

31.3% |

22.5% |

|

Consolidated |

$ |

12,896 |

100.0% |

12.6% |

(11.0)% |

|

$ |

15,968 |

100.0% |

24.3% |

2.3% |

|

|

|

(amounts in thousands) |

Nine months ended September 30,

2017 |

Nine Months ended

September 24, 2016 |

| |

|

% of |

Gross |

Operating |

|

|

% of |

Gross |

Operating |

| |

Total |

Total |

Profit |

Profit |

|

Total |

Total |

Profit |

Profit |

|

Segment |

Revenue |

Revenue |

Margin |

Margin |

|

Revenue |

Revenue |

Margin |

Margin |

| |

|

|

|

|

|

|

|

|

|

| Engineering

& Construction |

$ |

26,833 |

64.9% |

13.5% |

3.5% |

|

$ |

25,000 |

56.0% |

11.5% |

1.8% |

| Automation |

|

14,503 |

35.1% |

15.5% |

4.0% |

|

|

19,622 |

44.0% |

23.1% |

11.9% |

|

Consolidated |

$ |

41,336 |

100.0% |

14.2% |

(8.8)% |

|

$ |

44,622 |

100.0% |

16.6% |

(6.3)% |

|

|

The Company's Quarterly Report on Form 10-Q for the quarterly

period ended September 30, 2017 is expected to be filed with the

Securities and Exchange Commission reflecting these results by the

end of the day on Friday, November 3, 2017.

About ENGlobalENGlobal (Nasdaq:ENG) is a

provider of engineering and automation services primarily to the

energy sector throughout the United States and

internationally. ENGlobal operates through two business

segments: Automation and Engineering. ENGlobal's Automation

segment provides services related to the design, integration and

implementation of advanced automation, information technology

process distributed control, instrumentation and process analytical

systems. The Engineering segment provides consulting services

for the development, management and execution of projects requiring

professional engineering, construction management, and related

support services and the fabrication operation. Within the

Engineering segment, ENGlobal's Government Services group provides

engineering, design, installation and operation and maintenance of

various government, public sector and international facilities, and

specializes in the turnkey installation and maintenance of

automation and instrumentation systems for the U.S. Defense

industry worldwide. Further information about the Company and

its businesses is available at www.ENGlobal.com.

Safe Harbor for Forward-Looking StatementsThe statements above

regarding the Company's expectations regarding its operations and

certain other matters discussed in this press release may

constitute forward-looking statements within the meaning of the

federal securities laws and are subject to risks and uncertainties

including, but not limited to: (1) the effect of economic downturns

and the volatility and level of oil and natural gas prices; (2) our

ability to retain existing customers and attract new customers; (3)

our ability to accurately estimate the overall risks, revenue or

costs on a contract; (4) the risk of providing services in excess

of original project scope without having an approved change order;

(5) our ability to execute our expansion into the modular solutions

market and to execute our updated business growth strategy to

position the Company as a leading provider of higher value

industrial automation and Industrial Internet of Things services to

its customer base; (6) our ability to attract and retain key

professional personnel; (7) our ability to fund our operations and

grow our business utilizing cash on hand, internally generated

funds and other working capital; (8) our ability to obtain

additional financing, including pursuant to a new credit facility,

when needed: (9) our dependence on one or a few customers; (10) the

risks of internal system failures of our information technology

systems, whether caused by us, third-party service providers,

intruders or hackers, computer viruses, natural disasters, power

shortages or terrorist attacks; (11) our ability to realize revenue

projected in our backlog and our ability to collect accounts

receivable and process accounts payable in a timely manner; (12)

the uncertainties related to the U.S. Government’s budgetary

process and their effects on our long-term U.S. Government

contracts; (13) operational and political risks in Russia and

Kazakhstan along the Caspian Sea; (14) the risk of unexpected

liability claims or poor safety performance; (15) our ability to

identify, consummate and integrate potential acquisitions; (16) our

reliance on third-party subcontractors and equipment manufacturers;

and (17) our ability to purchase shares under our stock purchase

program due to changes in stock price and other considerations.

Actual results and the timing of certain events could differ

materially from those projected in or contemplated by the

forward-looking statements due to a number of factors detailed from

time to time in ENGlobal's filings with the Securities and Exchange

Commission. In addition, reference is hereby made to cautionary

statements set forth in the Company's most recent reports on Form

10-K and 10-Q, and other SEC filings. Actual results and the timing

of certain events could differ materially from those projected in

or contemplated by the forward-looking statements due to a number

of factors detailed from time to time in ENGlobal's filings with

the Securities and Exchange Commission. In addition, reference is

hereby made to cautionary statements set forth in the Company's

most recent reports on Form 10-K and 10-Q, and other SEC

filings.

Click here to join our email list:

http://www.b2i.us/irpass.asp?BzID=702&to=ea&s=0

Contact:Mark Hess Phone: 281-878-4584E-mail: IR@ENGlobal.com

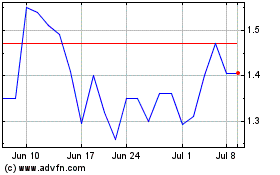

ENGlobal (NASDAQ:ENG)

Historical Stock Chart

From Mar 2024 to Apr 2024

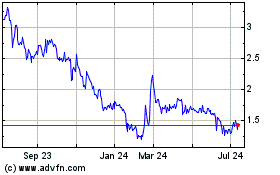

ENGlobal (NASDAQ:ENG)

Historical Stock Chart

From Apr 2023 to Apr 2024