Current Report Filing (8-k)

November 02 2017 - 4:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________

FORM 8-K

_______________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 1, 2017

__________________________________________________________________________

FMC CORPORATION

(Exact name of registrant as specified in its charter)

__________________________________________________________________________

|

|

|

|

|

|

|

Delaware

|

1-2376

|

94-0479804

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

2929 Walnut Street

Philadelphia, Pennsylvania

|

|

19104

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: 215-299-6000

__________________________________________________________________________

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

o

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act.

|

|

|

o

|

|

|

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

|

ITEM 2.01. COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS.

On November 1, 2017, pursuant to the Transaction Agreement, dated as of March 31, 2017 (the “Transaction Agreement”), by and between E. I. du Pont de Nemours and Company, a Delaware corporation (“DuPont”) and FMC Corporation, a Delaware corporation (the “Company”), the Company acquired certain assets relating to the crop protection business and research and development organization of DuPont (the “Acquisition”). Additionally, DuPont acquired certain assets relating to the Company’s Health and Nutrition business segment (the “Disposition”) and received $1.2 billion in cash (collectively, the “Transactions”). The foregoing description of the Transactions and Transaction Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Transaction Agreement listed as Exhibit 2.1 hereto which is incorporated by reference into this Item 2.01.

ITEM 2.03. CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT.

On November 1, the Company borrowed $1.5 billion under the Company’s previously announced senior unsecured term loan facility. The terms of such facility were previously disclosed in the Term Loan Agreement, dated as of May 2, 2017, among the Company, certain subsidiaries of the Company party thereto, the lenders party thereto, and Citibank, N.A., as Administrative Agent for such lenders. The proceeds of the borrowing were used to finance the Transactions as well as to pay costs, fees and expenses incurred in connection with the Transactions and the term loan facility.

The foregoing description of the term loan facility does not purport to be complete and is qualified in its entirety by reference to the full text of the term Loan Agreement listed as Exhibit 10.2 hereto which is incorporated by reference into this Item 2.03.

ITEM 8.01. PRESS RELEASE.

On November 1, 2017, the Company issued a press release announcing the closing of the Transactions. A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(a) Financial statements of businesses acquired. The financial statements required by this Item 9.01(a) of this Current Report on Form 8-K have not been included with this filing and will be filed by amendment to this Current Report on Form 8-K/A not later than seventy-one (71) calendar days after the date that this Current Report on Form 8-K must be filed.

(b) Pro forma financial information. The financial information required by this Item 9.01(b) of this Current Report on Form 8-K for both the Acquisition and the Disposition has not been included with this filing and will be filed jointly by amendment to this Current Report on Form 8-K/A not later than seventy-one (71) calendar days after the date that this Current Report on Form 8-K must be filed.

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

2.1

|

|

|

|

|

|

|

|

10.2

|

|

|

|

|

|

|

|

99.1

|

|

|

* Schedules and exhibits omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company agrees to furnish supplementally a copy of any omitted schedule or exhibit to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

FMC CORPORATION

(Registrant)

|

|

|

|

|

|

|

|

|

By:

|

/s/ PAUL W. GRAVES

|

|

|

|

Paul W. Graves

Executive Vice President and

Chief Financial Officer

|

Date: November 2, 2017

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

2.1

|

|

|

|

|

|

|

|

10.2

|

|

|

|

|

|

|

|

99.1

|

|

|

* Schedules and exhibits omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company agrees to furnish supplementally a copy of any omitted schedule or exhibit to the SEC upon request.

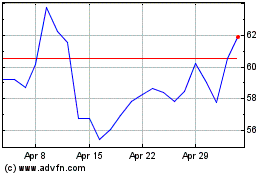

FMC (NYSE:FMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

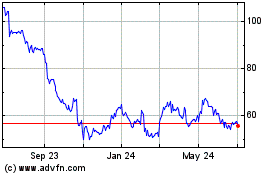

FMC (NYSE:FMC)

Historical Stock Chart

From Apr 2023 to Apr 2024