Navios Maritime Containers Inc. ("Navios Containers") (N-OTC:NMCI),

a growth vehicle dedicated to the container sector of the maritime

industry, today reported financial results for the three month

period ended September 30, 2017 and for the period from April 28,

2017 (date of inception) through September 30, 2017.

Angeliki Frangou, Chairman and Chief Executive Officer, stated,

"We are pleased with our financial performance in our first full

quarter of operation for which we reported adjusted EBITDA of $7.0

million and adjusted net income of $531 thousand. "

Angeliki Frangou continued: "We believe the container market

continues to offer attractive acquisition candidates. We are

actively pursuing opportunities while this favorable market

persists."

HIGHLIGHTS -- RECENT DEVELOPMENTS

Fleet Acquisition

Navios Containers continued to pursue fleet size

expansion by executing Memorandums of Agreement (“MoAs”) in

September and October 2017 to acquire two 2009-built 4,250 TEU

containerships for an aggregate purchase price of $19.8 million.

The containerships are expected to be delivered to Navios

Containers' owned fleet in early November 2017.

The acquisition of these two vessels is expected to be financed

initially with cash on hand while Navios Containers explores

potential debt financing on terms consistent with its existing

credit facilities.

Private Placement

On August 29, 2017, Navios Containers closed a

private placement of 10,000,000 shares at a subscription price of

$5.00 per share, resulting in gross proceeds of $50.0 million.

Navios Maritime Partners L.P. (“Navios Partners”) invested $10.0

million and received 2,000,000 shares. Navios Partners and Navios

Maritime Holdings Inc. (“Navios Holdings”) also received warrants,

with a five-year term, for 6.8% and 1.7% of the newly issued

equity, respectively.

As of September 30, 2017, Navios Partners holds

8,000,000 common shares representing 39.9% of the equity, and

Navios Holdings holds 1,000,000 common shares representing 5.0% of

the equity of Navios Containers. Both Navios Partners and Navios

Holdings hold warrants, with a five-year term, for 6.8% and 1.7% of

the total equity of Navios Containers, respectively.

Credit Facility

On July 27, 2017, Navios Containers entered into

a loan facility with a commercial bank for an amount of $21.0

million to partially finance the acquisition of seven

containerships previously acquired. The facility is repayable in

five consecutive quarterly instalments of $0.8 million each, plus a

balloon payment on the last repayment date. The facility matures in

November 2018 and bears interest at LIBOR plus 400 bps per annum.

As of September 30, 2017, the outstanding principal amount under

this facility was $21.0 million.

Fleet Development

Navios Containers controls 16 vessels, totaling

65,600 TEU and with an average age of 9.7 years. Two of these

vessels are expected to be delivered during the fourth quarter of

2017.

As of October 30, 2017, Navios Containers has

chartered-out 89.3% and 25.7% of available days for 2017 and 2018,

respectively, which are expected to generate revenue of $35.3

million and $36.2 million, respectively. The average expected daily

charter-out rate for the fleet is $16,422 and $24,177 for 2017 and

2018, respectively.

Earnings Highlights

EBITDA, Adjusted EBITDA, Adjusted Net Income and Adjusted Basic

Earnings per Share are non-U.S. GAAP financial measures and should

not be used in isolation or as substitutes for Navios Containers’

results calculated in accordance with U.S. GAAP.

See Exhibit I under the heading, “Disclosure of Non-GAAP

Financial Measures,” for a discussion of EBITDA, Adjusted EBITDA,

Adjusted Net Income and Adjusted Basic Earnings per Share of Navios

Containers and a reconciliation of such measures to the most

comparable measures calculated under U.S. GAAP.

Third Quarter of 2017 and period from April 28, 2017

(date of inception) to September 30, 2017 Results (in thousands of

U.S. dollars, except per share data and unless otherwise

stated):

The third quarter 2017 and the period from April 28, 2017 (date

of inception) to September 30, 2017 information presented below was

derived from the unaudited condensed consolidated financial

statements for the respective period.

| |

|

Three Month Period Ended September 30,

2017 |

|

Period from April 28, 2017 (date of inception)

to September 30, 2017 |

| |

|

(unaudited) |

|

(unaudited) |

| Revenue |

|

$ |

14,757 |

|

$ |

17,859 |

|

| Net income |

|

$ |

84 |

|

$ |

965 |

|

| Adjusted Net Income

(1) |

|

$ |

531 |

|

$ |

1,412 |

|

| Net cash provided

by/(used in) operating activities |

|

$ |

255 |

|

$ |

(1,236 |

) |

| EBITDA |

|

$ |

6,511 |

|

$ |

8,792 |

|

| Adjusted EBITDA

(1) |

|

$ |

6,958 |

|

$ |

9,239 |

|

| Basic Earnings per

Share |

|

$ |

0.01 |

|

$ |

0.08 |

|

| Adjusted Basic Earnings

per Share (1) |

|

$ |

0.04 |

|

$ |

0.11 |

|

(1) Adjusted EBITDA, Adjusted Net Income and Adjusted Earnings

per Share for the three month period ended September 30, 2017 and

for the period from April 28, 2017 (date of inception) to September

30, 2017 exclude $0.4 million relating to the reactivation costs of

four laid-up vessels.Fleet Summary Data:

The following table reflects certain key indicators indicative

of the performance of the Navios Containers' operations and its

fleet performance for the three month period ended September 30,

2017 and for the period from which the vessels were delivered, June

8, 2017 through September 30, 2017.

| |

|

Three Month Period Ended September 30,

2017 |

|

Period from June 8, 2017 to September 30,

2017 |

| |

|

|

|

|

| Available Days (1) |

|

862 |

|

|

977 |

|

| Operating Days (2) |

|

801 |

|

|

916 |

|

| Fleet Utilization

(3) |

|

92.9 |

% |

|

93.8 |

% |

| Vessels operating at

period end |

|

14 |

|

|

14 |

|

| TCE (4) |

$ |

16,724 |

|

$ |

17,930 |

|

|

(1 |

) |

Available

days for the fleet are total calendar days the vessels were in

Navios Containers' possession for the relevant period after

subtracting off-hire days associated with major repairs, drydocking

or special surveys. The shipping industry uses available days to

measure the number of days in a relevant period during which

vessels should be capable of generating revenues. |

|

|

(2 |

) |

Operating

days are the number of available days in the relevant period less

the aggregate number of days that the vessels are off-hire due to

any reason, including unforeseen circumstances. The shipping

industry uses operating days to measure the aggregate number of

days in a relevant period during which vessels actually generate

revenues. |

|

|

(3 |

) |

Fleet

utilization is the percentage of time that Navios Containers'

vessels were available for generating revenue, and is determined by

dividing the number of operating days during a relevant period by

the number of available days during that period. The shipping

industry uses fleet utilization to measure a company's efficiency

in finding suitable employment for its vessels. |

|

|

(4 |

) |

TCE is

defined as voyage and time charter revenues less voyage expenses

during a relevant period divided by the number of available days

during the period. |

|

About Navios Maritime Containers Inc.

Navios Maritime Containers Inc. (N-OTC:NMCI) is a growth vehicle

dedicated to the container sector of the maritime industry. For

more information, please visit its website at

www.navios-containers.com.

About Navios Maritime Holdings Inc.

Navios Maritime Holdings Inc. (NYSE:NM) is a global, vertically

integrated seaborne shipping and logistics company focused on the

transport and transshipment of dry bulk commodities including iron

ore, coal and grain. For more information about Navios Holdings

please visit our website: www.navios.com.

About Navios Maritime Partners L.P.

Navios Partners (NYSE:NMM) is a publicly traded master limited

partnership which owns and operates container and dry bulk vessels.

For more information, please visit its website at

www.navios-mlp.com.

Forward Looking Statements - Safe Harbor

This press release contains forward-looking statements

concerning future events, including Navios Containers’ cash flow

generation for the remainder of 2017, future contracted revenues

and rates, future financial performance of the fleet, timing of

vessel deliveries, opportunities to reinvest cash accretively, to

take advantage of the market and Navios Containers' growth strategy

and measures to implement such strategy; including future vessel

acquisitions and the ability to secure related financing, the

further growth of our containership fleet, and entering into

further time charters. Words such as “may,” “expects,” “intends,”

“plans,” “believes,” “anticipates,” “hopes,” “estimates,” and

variations of such words and similar expressions are intended to

identify forward-looking statements. Such statements include

comments regarding expected revenue and time charters. These

forward-looking statements are based on the information available

to, and the expectations and assumptions deemed reasonable by

Navios Containers at the time these statements were made. Although

Navios Containers believes that the expectations reflected in such

forward-looking statements are reasonable, no assurance can be

given that such expectations will prove to have been correct. These

statements involve known and unknown risks and are based upon a

number of assumptions and estimates which are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the control of Navios Containers. Actual results may differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to, risks relating to the

future vessel acquisitions and the quality of the fleet, the

uncertainty relating to global trade, including prices of seaborne

commodities and continuing issues related to seaborne volume and

ton miles, our continued ability to enter into long-term time

charters, our ability to maximize the use of our vessels, expected

demand in the container shipping sector in general, fluctuations in

charter rates for container carrier vessels, the aging of our fleet

and resultant increases in operations costs, the loss of any

customer or charter or vessel, the financial condition of our

customers, changes in the availability and costs of funding due to

conditions in the bank market, capital markets and other factors,

increases in costs and expenses, including but not limited to: crew

wages, insurance, provisions, port expenses, lube oil, bunkers,

repairs, maintenance, and general and administrative expenses, the

expected cost of, and our ability to comply with, governmental

regulations and maritime self-regulatory organization standards, as

well as standard regulations imposed by our charterers applicable

to our business, general domestic and international political

conditions, competitive factors in the market in which Navios

Containers operates, and risks associated with global operations;

and other factors listed from time to time in Navios Containers’

public disclosures. Navios Containers expressly disclaims any

obligations or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in Navios Containers' expectations with respect

thereto or any change in events, conditions or circumstances on

which any statement is based. Navios Containers makes no prediction

or statement about the performance of its common stock.

Contact:

Navios Maritime Containers

Inc.+1.212.906.8648investors@navios-containers.com

NAVIOS MARITIME CONTAINERS

INC.CONDENSED CONSOLIDATED STATEMENTS OF

INCOME(Expressed in thousands of U.S. dollars -

except for share and per share data)

| |

|

|

Three Month Period Ended September 30, 2017

(unaudited) |

|

Period from April 28,

2017(date of inception) to September

30, 2017(unaudited) |

|

| Revenue |

|

|

|

14,757 |

|

|

|

17,859 |

|

| Time charter and

voyage expenses |

|

|

|

(343 |

) |

|

|

(343 |

) |

| Direct vessel

expenses |

|

|

|

(515 |

) |

|

|

(515 |

) |

| Management fees

(entirely through related parties transactions) |

|

|

|

(6,576 |

) |

|

|

(7,277 |

) |

| General and

administrative expenses |

|

|

|

(870 |

) |

|

|

(987 |

) |

| Depreciation and

amortization |

|

|

|

(5,351 |

) |

|

|

(6,671 |

) |

| Interest expense

and finance cost, net |

|

|

|

(1,007 |

) |

|

|

(1,088 |

) |

| Other expense,

net |

|

|

|

(11 |

) |

|

|

(13 |

) |

|

Net income |

|

|

$ |

84 |

|

|

$ |

965 |

|

|

|

|

|

|

|

|

|

|

| Net income

attributable to common stockholders |

|

|

$ |

84 |

|

|

$ |

965 |

|

|

|

|

|

|

|

|

|

|

| Net earnings per share,

basic and diluted |

|

|

$ |

0.01 |

|

|

$ |

0.08 |

|

|

|

|

|

|

|

|

|

|

| Weighted average number

of shares, basic and diluted |

|

|

|

13,535,906 |

|

|

|

12,864,663 |

|

NAVIOS MARITIME CONTAINERS

INC.CONDENSED CONSOLIDATED BALANCE

SHEET(Expressed in thousands of U.S. dollars – except for

share data)

| |

|

|

|

|

|

September 30,2017(unaudited) |

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

| Cash and cash

equivalents |

|

|

|

|

$ |

29,932 |

|

|

| Restricted Cash |

|

|

|

|

|

468 |

|

|

| Accounts receivable,

net |

|

|

|

|

|

1,286 |

|

|

| Amounts due from

related companies |

|

|

|

|

|

3,618 |

|

|

| Inventories |

|

|

|

|

|

330 |

|

|

| Prepaid and other

current assets |

|

|

|

|

|

55 |

|

|

| Total current

assets |

|

|

|

|

|

35,689 |

|

|

| |

|

|

|

|

|

|

|

|

| Vessels, net |

|

|

|

|

|

93,681 |

|

|

| Favorable lease

terms |

|

|

|

|

|

20,162 |

|

|

| Deferred dry dock and

special survey costs, net |

|

|

|

|

|

2,267 |

|

|

| Long-term receivable

from related companies |

|

|

|

|

|

6,163 |

|

|

| Total

non-current assets |

|

|

|

|

|

122,273 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

assets |

|

|

|

|

$ |

157,962 |

|

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

| Accounts payable |

|

|

|

|

$ |

1,868 |

|

|

| Accrued expenses |

|

|

|

|

|

4,789 |

|

|

| Deferred income and

cash received in advance |

|

|

|

|

|

1,792 |

|

|

| Amounts due to related

companies |

|

|

|

|

|

1,254 |

|

|

| Current portion

of long-term debt, net |

|

|

|

|

|

17,651 |

|

|

| Total current

liabilities |

|

|

|

|

|

27,354 |

|

|

| |

|

|

|

|

|

|

|

|

| Long-term debt, net of

current portion |

|

|

|

|

|

38,763 |

|

|

| Total

non-current liabilities |

|

|

|

|

|

38,763 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

liabilities |

|

|

|

|

$ |

66,117 |

|

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Stockholders’

equity |

|

|

|

|

|

|

|

|

|

Common stock — $0.0001 par value, 75,000,000 authorized registered

ordinary shares, 20,057,645 issued and outstanding as of September

30, 2017. |

|

|

|

|

|

2 |

|

|

| Additional paid-in

capital |

|

|

|

|

|

90,878 |

|

|

| Retained earnings |

|

|

|

|

|

965 |

|

|

| Total

stockholders’ equity |

|

|

|

|

|

91,845 |

|

|

| Total

liabilities and stockholders’ equity |

|

|

|

|

$ |

157,962 |

|

|

| |

|

|

|

|

|

|

|

|

NAVIOS MARITIME CONTAINERS

INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(Expressed in thousands of U.S. dollars – except for

share data)

| |

|

|

Period from April 28,

2017(date of inception) to September

30, 2017

(unaudited) |

|

| OPERATING

ACTIVITIES: |

|

|

|

|

|

|

| Net income |

|

|

$ |

965 |

|

|

| Adjustments to

reconcile net income to net cash used in operating

activities: |

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

|

6,671 |

|

|

| Amortization of

deferred financing costs |

|

|

|

199 |

|

|

| Amortization of

deferred drydock and special survey costs |

|

|

|

68 |

|

|

| Changes in

operating assets and liabilities: |

|

|

|

|

|

|

| Increase in restricted

cash |

|

|

|

(188 |

) |

|

| Increase in accounts

receivable |

|

|

|

(1,286 |

) |

|

| Increase in due from

related companies |

|

|

|

(3,169 |

) |

|

| Increase in

inventories |

|

|

|

(330 |

) |

|

| Increase in prepaid and

other current assets |

|

|

|

(9 |

) |

|

| Increase in long-term

receivable from affiliate companies |

|

|

|

(6,163 |

) |

|

| Increase in accounts

payable |

|

|

|

1,822 |

|

|

| Increase in accrued

expenses |

|

|

|

3,398 |

|

|

| Decrease in due to

related companies |

|

|

|

(420 |

) |

|

| Decrease in deferred

income and cash received in advance |

|

|

|

(458 |

) |

|

| Payments for dry dock

and special survey costs |

|

|

|

(2,336 |

) |

|

| Net cash used

in operating activities |

|

|

$ |

(1,236 |

) |

|

|

|

|

|

|

|

|

|

| INVESTING

ACTIVITIES: |

|

|

|

|

|

|

| Cash acquired through

asset acquisition |

|

|

|

5,433 |

|

|

| Acquisition of vessels

and favorable lease terms |

|

|

|

(125,503 |

) |

|

| Net cash used

in investing activities |

|

|

$ |

(120,070 |

) |

|

|

|

|

|

|

|

|

|

| FINANCING

ACTIVITIES: |

|

|

|

|

|

|

| Proceeds from long-term

borrowings, net of loan discount |

|

|

|

60,685 |

|

|

| Repayment of long term

debt |

|

|

|

(3,750 |

) |

|

| Debt issuance

costs |

|

|

|

(720 |

) |

|

| Increase in restricted

cash |

|

|

|

(280 |

) |

|

| Proceeds from issuance

of common shares, net of offering costs |

|

|

|

95,303 |

|

|

| Net cash

provided by financing activities |

|

|

|

151,238 |

|

|

|

|

|

|

|

|

|

|

| Increase in

cash and cash equivalents |

|

|

|

29,932 |

|

|

| Cash and cash

equivalents, beginning of period |

|

|

|

- |

|

|

| Cash and cash

equivalents, end of period |

|

|

$ |

29,932 |

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW

INFORMATION

| Non-cash

investing and financing activities |

|

|

|

|

|

|

| Cash paid for interest,

net |

|

|

$ |

502 |

|

NAVIOS MARITIME CONTAINERS

INC.CONDENSED CONSOLIDATED STATEMENTS OF CHANGES

IN EQUITY(Expressed in thousands of U.S. dollars — except

for share data)

For the period from April 28, 2017 (date of inception)

to September 30, 2017

| |

|

|

Number of

Common Shares |

|

|

Common Stock |

|

|

|

|

|

|

Additional

Paid-in Capital |

|

Retained Earnings |

|

Total Stockholders’ Equity |

|

| Balance April

28, 2017 (date of inception) |

|

|

|

- |

|

|

$ |

- |

|

|

|

$ |

|

|

- |

|

|

$ |

- |

|

$ |

- |

|

|

| Issuance of common

stock, net of offering expenses |

|

|

|

20,057,645 |

|

|

|

2 |

|

|

|

|

|

|

95,301 |

|

|

|

- |

|

|

95,303 |

|

|

| Deemed distribution to

controlling stockholders |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

(4,423 |

) |

|

|

- |

|

|

(4,423 |

) |

|

| Net income |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

- |

|

|

|

965 |

|

|

965 |

|

|

|

Balance September 30, 2017 (unaudited) |

|

|

|

20,057,645 |

|

|

$ |

2 |

|

|

|

|

|

|

|

|

$ |

965 |

|

$ |

91,845 |

|

|

|

|

|

$ |

90,878 |

|

Disclosure of Non-GAAP Financial Measures

EBITDA, Adjusted EBITDA, Adjusted Net Income and Adjusted Basic

Earnings per Share are “non-U.S. GAAP financial measure” and should

not be used in isolation or considered a substitute for net income/

(loss), cash flow from operating activities and other operations or

cash flow statement data prepared in accordance with generally

accepted accounting principles in the United States.

EBITDA represents net income/(loss) before interest and finance

costs, before depreciation and amortization. Adjusted EBITDA

represents EBITDA, excluding the item as described under “Earnings

Highlights”. Adjusted Income and Adjusted Basic Earnings per Share

represent Net Income and Basic Earnings per Share, excluding the

item as described under “Earnings Highlights”. We use EBITDA and

Adjusted EBITDA as liquidity measures and reconcile EBITDA and

Adjusted EBITDA to net cash provided by/(used in) operating

activities, the most comparable U.S. GAAP liquidity measure. EBITDA

is calculated as follows: net cash provided by operating activities

adding back, when applicable and as the case may be, the effect of

(i) net increase/(decrease) in operating assets, (ii) net

(increase)/decrease in operating liabilities, (iii) net interest

cost, (iv) deferred finance charges and (v) payments for drydock

and special survey costs. Navios Containers believes that EBITDA

and Adjusted EBITDA are a basis upon which liquidity can be

assessed and represents useful information to investors regarding

Navios Containers’ ability to service and/or incur indebtedness,

pay capital expenditures, meet working capital requirements and pay

dividends. Navios Containers also believes that EBITDA and Adjusted

EBITDA are used (i) by prospective and current lessors as well as

potential lenders to evaluate potential transactions; (ii) to

evaluate and price potential acquisition candidates; and (iii) by

securities analysts, investors and other interested parties in the

evaluation of companies in our industry.

EBITDA and Adjusted EBITDA are presented to provide additional

information with respect to the ability of Navios Containers to

satisfy its respective obligations, including debt service, capital

expenditures, working capital requirements and pay dividends. While

EBITDA and Adjusted EBITDA are frequently used as a measure of

operating results and the ability to meet debt service

requirements, the definition of EBITDA and Adjusted EBITDA used

here may not be comparable to those used by other companies due to

differences in methods of calculation.

EBITDA and Adjusted EBITDA has limitations as an analytical

tool, and therefore, should not be considered in isolation or as a

substitute for the analysis of Navios Containers’ results as

reported under U.S. GAAP. Some of these limitations are: (i) EBITDA

and Adjusted EBITDA does not reflect changes in, or cash

requirements for, working capital needs; (ii) EBITDA and Adjusted

EBITDA does not reflect the amounts necessary to service interest

or principal payments on our debt and other financing arrangements;

and (iii) although depreciation and amortization are non-cash

charges, the assets being depreciated and amortized may have to be

replaced in the future. EBITDA and Adjusted EBITDA do not reflect

any cash requirements for such capital expenditures. Because of

these limitations, among others, EBITDA and Adjusted EBITDA should

not be considered as a principal indicator of Navios Containers’

performance. Furthermore, our calculation of EBITDA and Adjusted

EBITDA may not be comparable to that reported by other companies

due to differences in methods of calculation.

Navios Containers Reconciliation of EBITDA to Cash from

Operations

| |

|

Three Month Period Ended September,

2017 |

|

|

Period from April 28, 2017 (date of

inception) to September, 2017 |

| |

|

|

|

| (in thousands

of U.S. dollars) |

|

(unaudited) |

|

|

(unaudited) |

| |

|

|

|

|

|

|

|

| Net cash provided

by/(used in) operating activities |

|

$ |

255 |

|

|

|

$ |

(1,236 |

) |

| Net increase in

operating assets |

|

|

6,935 |

|

|

|

|

11,145 |

|

| Net increase in

operating liabilities |

|

|

(3,824 |

) |

|

|

|

(4,342 |

) |

| Payments for drydock

and special survey |

|

|

2,336 |

|

|

|

|

2,336 |

|

| Deferred finance

charges |

|

|

(199 |

) |

|

|

|

(199 |

) |

| Net interest cost |

|

|

1,008 |

|

|

|

|

1,088 |

|

|

EBITDA(1) |

|

$ |

6,511 |

|

|

|

$ |

8,792 |

|

| |

|

|

|

|

|

|

|

| Re-activation cost |

|

|

447 |

|

|

|

|

447 |

|

| |

|

|

|

|

|

|

|

| Adjusted

EBITDA |

|

$ |

6,958 |

|

|

|

$ |

9,239 |

|

| (1) |

|

Three Month Period Ended September,

2017 |

|

Period from April 28, 2017 (date of

inception) to September 30, 2017 |

| |

|

|

| (in

thousands of U.S. dollars) |

|

(unaudited) |

|

(unaudited) |

| |

|

|

|

|

|

|

| Net cash

provided by/(used in) operating activities |

|

$ |

255 |

|

|

$ |

(1,236 |

) |

| Net cash

used in investing activities |

|

$ |

(75,503 |

) |

|

$ |

(120,070 |

) |

| Net cash

provided by financing activities |

|

$ |

70,244 |

|

|

$ |

151,238 |

|

|

|

|

|

|

|

|

EXHIBIT

II |

| Owned

Vessels |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Vessel Name |

|

TEU |

|

Year Built |

|

|

| Navios Summer |

|

3,450 |

|

2006 |

|

|

| Navios Verano |

|

3,450 |

|

2006 |

|

|

| Navios Spring |

|

3,450 |

|

2007 |

|

|

| Navios Amaranth |

|

4,250 |

|

2007 |

|

|

| Navios Indigo |

|

4,250 |

|

2007 |

|

|

| Navios Vermilion |

|

4,250 |

|

2007 |

|

|

| Navios Verde |

|

4,250 |

|

2007 |

|

|

| Navios Amarillo |

|

4,250 |

|

2007 |

|

|

| Navios Azure |

|

4,250 |

|

2007 |

|

|

| MOL Dominance |

|

4,250 |

|

2008 |

|

|

| MOL Delight |

|

4,250 |

|

2008 |

|

|

| MOL Dedication |

|

4,250 |

|

2008 |

|

|

| MOL Devotion |

|

4,250 |

|

2009 |

|

|

| MOL Destiny |

|

4,250 |

|

2009 |

|

|

|

|

|

|

|

|

|

|

|

|

Vessels to be Delivered

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Vessel Name |

|

TEU |

|

Year Built |

|

Delivery Date |

|

| Navios Lapis |

|

4,250 |

|

2009 |

|

11/2017 |

|

| Navios Tempo |

|

4,250 |

|

2009 |

|

11/2017 |

|

| |

|

|

|

|

|

|

|

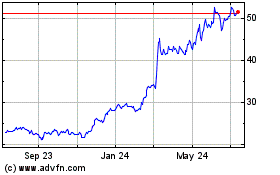

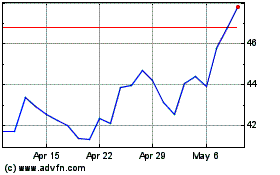

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Apr 2023 to Apr 2024