Typical finance organizations can substantially narrow the gap

between their cost levels and that of top performers, and top

performers can become even better by leveraging digital

transformation, according to new world-class finance research from

The Hackett Group, Inc. (NASDAQ: HCKT).

A public version of the research, “Raising the World-Class Bar

in Finance Through Digital Transformation,” is available on a

complimentary basis, with registration, at this link:

https://www.thehackettgroup.com/research/2017/wcpafn17/.

World-class finance organizations are those that achieve

top-quartile performance in both efficiency and effectiveness

across an array of weighted metrics in The Hackett Group’s

comprehensive finance benchmark.

According to The Hackett Group’s research, typical finance

organizations can cut process costs by 35 percent by adopting

digital technologies, nearly matching the level seen today by

world-class organizations. World-class finance organizations run

their shops at 45 percent less overall cost as a percentage of

revenue than peer organizations.

While cost per revenue for world-class finance functions has

been flat for the last several years, the research found that

world-class performers continue to improve by investing in key

areas such as technology rationalization, advanced analytics,

process optimization and application modernization.

To break the cost barrier, world-class finance organizations

need to turn to digital transformation, The Hackett Group’s

research finds. World-class finance organizations can use digital

tools to cut process costs by an additional 20 percent while

substantially increasing effectiveness. For example, adopting

digital tools can increase the amount of time top performers spend

on analytics to 75 percent, reduce billing errors to 1 percent and

increase invoices paid within terms to 95 percent.

Already, technology is making a big difference in the efficiency

and effectiveness of world-class finance organizations, enabling

them to add greater value to the enterprise. Technology-enabled

world- class finance organizations see up to 66 percent lower error

rates. They also facilitate more analysis and smarter decisions by

spending 24 percent less time collecting and compiling data.

Technology advancements are also enabling top performers to

better support their companies with more advanced analytics. They

are 41 percent more likely to include both financial and

non-financial key performance indicators in their analysis, and are

85 percent more likely to rely on a mature performance scorecard to

measure finance performance.

Although world-class finance organizations owe a great deal of

their success to technology, they expect to spend 61 percent less

on it in 2017 than typical finance organizations, relying on

deliberate planning, sound governance, systems rationalization and

new tools to reshape their service delivery model and keep a lid on

costs. But The Hackett Group’s research indicates that world-class

finance organizations are planning to increase their spending on

technology over the next few years, to address digital

transformation.

“Finance has largely reached an inflection point, where legacy

approaches to automation and transformation are simply not yielding

additional performance improvements,” said Nilly Essaides, senior

EPM & finance research director at The Hackett Group “The good

news is that digital transformation technologies, including robotic

process automation, big data, advanced analytics and cloud-based

applications offer exceptional improvement opportunities for both

world-class and typical companies.”

“Typical finance organizations can virtually match world-class

process costs using digital transformation, and world-class finance

organizations can use digital transformation to break through the

cost-reduction plateau where they’ve been trapped for several

years,” said Ms. Essaides.

The Hackett Group’s research details six areas where finance

organizations can harness digital technologies to improve

efficiency and effectiveness. Digital customer engagement

tools can be used to get closer to internal and external

stakeholders -- for example by setting up portals to interact with

vendors or customizing reports for internal end users. Robotic

process automation can enable software to perform rule-based

activities previously handled by people. The savings of opportunity

of such individual activities can amount to up to 90 percent.

Depending on how many activities in a process are automatable with

RPA, total process cost savings typically range between 20 and 40

percent.

Advanced analytics can enable the finance function to use

big data and more powerful analytical models and tools to drive

greater insight and improved decision making. For example,

predictive analytics can help finance pull external data on

particular companies, plus project economic data on particular

geographies and combine it with customer payment history to make

credit decisions. Or algorithms can be used to enhance forecasting

by examining social media posts about potential trouble spots and

analyzing the intensity of discussion based on specific key words

collected in big data repositories.

Modern digital architecture includes ongoing

rationalization of the legacy finance application portfolio,

adopting cloud-based based alternatives for new functionality or

migration of existing financial application, mobile enablement,

modularization and (big data) analytics support. Digital

workforce enablement can help enhance productivity, streamline

the creation and capture of knowledge, and improve the value

contribution of individual workers and their virtual teams. One

pharmaceutical finance organization, for example, relies on Yammer,

an intracompany social media platform, to connect employees,

crowdsource answers, speed up the development of new ideas and

appeal to younger employees. Finally, cognitive computing --

self-learning systems that use data mining, pattern recognition and

natural language processing to mimic the way the human brain works

-- can augment the ability of finance staff to run models, make

predictions and analyze large data sets.

“We’ve seen many clients generate dramatic improvements in

finance using these tools, individually or in combination,” said

Richard Cardillo, The Hackett Group principal and finance

transformation practice leader. “Finance organizations must

continue to invest in digital technologies to significantly

accelerate the transformation of their service delivery model

through improving capability across organization design, process

standardization, working more effectively with third-party

providers and reinventing their talent model through deploying a

digital-ready workforce.”

Jim O’Connor, finance advisory practice leader and principal,

added that “Finance cannot ignore the digital promise or it risks

compromising its ability to compete in the fast-changing business

environment. By adopting digital technologies, finance can

substantially reduce cost and boost effectiveness resulting in

greater enterprise agility and the ability to keep pace with

external change.”

The Hackett Group’s world-class finance research is based on an

analysis of results from recent benchmarks, performance studies,

and advisory and transformation engagements at hundreds of large

global companies. Download a public version on a complimentary

basis, with registration, at this link:

https://www.thehackettgroup.com/research/2017/wcpafn17/.

About The Hackett Group

The Hackett Group (NASDAQ: HCKT) is an intellectual

property-based strategic consultancy and leading enterprise

benchmarking and best practices implementation firm to global

companies, offering digital transformation and enterprise

application approaches including robotic process automation and

cloud computing. Services include business transformation,

enterprise performance management, working capital management

and global business services. The Hackett Group also provides

dedicated expertise in business strategy, operations, finance,

human capital management, strategic sourcing, procurement and

information technology, including its award-winning Oracle EPM and

SAP practices.

The Hackett Group has completed more than 13,000 benchmarking

studies with major corporations and government agencies, including

93% of the Dow Jones Industrials, 87% of the Fortune 100, 87% of

the DAX 30 and 58% of the FTSE 100. These studies drive its Best

Practice Intelligence Center™ which includes the firm's

benchmarking metrics, best practices repository and best practice

configuration guides and process flows, which enable The Hackett

Group’s clients and partners to achieve world-class

performance.

More information on The Hackett Group is available at:

www.thehackettgroup.com, info@thehackettgroup.com, or by calling

(770) 225-3600.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171102005869/en/

The Hackett GroupGary Baker, 917-796-2391Global Communications

Directorgbaker@thehackettgroup.com

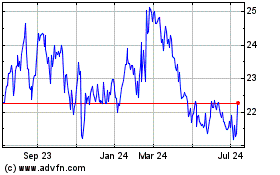

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Mar 2024 to Apr 2024

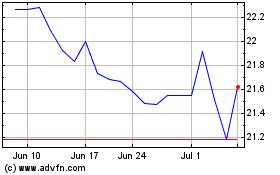

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Apr 2023 to Apr 2024