Global Ship Lease, Inc. (NYSE:GSL) (the “Company”), a containership

charter owner, announced today its unaudited results for the three

months and nine months ended September 30, 2017.

Third Quarter and Year To Date Highlights -

Reported operating revenue of $41.2 million for the third quarter

2017. Revenue for the nine months ended September 30, 2017 was

$121.1 million

- Reported net income available to common shareholders of $8.9

million for the third quarter 2017. For the nine months ended

September 30, 2017, net income was $22.5 million

- Normalized net income (1) was $8.9 million for the third

quarter 2017, the same as reported net income. Normalized net

income was $23.0 million for the nine months ended September 30,

2017

- Generated $29.3 million of Adjusted EBITDA(1) for the third

quarter 2017. Adjusted EBITDA for the nine months ended September

30, 2017 was $85.4 million

- Agreed on September 11, 2017 with CMA CGM to extend the

charters on two of our 2,207 TEU containerships, the 2002-built

Julie Delmas and the 2003-built Delmas Keta, by 12 months (plus or

minus 45 days at the charterer’s option) at a fixed rate of $7,800

per vessel per day, commencing September 11, 2017 and September 20,

2017, respectively

- Agreed on October 19, 2017 a new time charter with CMA CGM for

the 2005-built OOCL Tianjin, which will be renamed GSL Tianjin, an

8,063 TEU containership. The charter is for a period of three to

eight months (at the charterer's option) at a fixed rate of $13,000

per day, which commenced on October 25, 2017, immediately upon

re-delivery from its previous charter

- On October 31, 2017, closed the previously

announced offering of $360 million aggregate principal amount of

9.875% first priority secured notes due 2022. The net proceeds,

together with borrowings under a new $54.8 million super senior

secured term loan facility and cash on hand, are to be used to

refinance our existing 10.000% notes due 2019. In addition, all

outstanding borrowings under both the existing revolving credit

facility and the existing secured term loan have been repaid and

terminated

Ian Webber, Chief Executive Officer of Global Ship Lease,

stated, “Throughout the third quarter of 2017, we continued to

operate our fleet of 18 mid-sized and smaller containerships on

stable, fixed rate time-charter contracts with top-tier liner

companies, delivering highly consistent cash flows, as we have

throughout our history. With an excellent record of operational

performance and against a background of improving fundamentals for

mid-sized and smaller containerships, we are pleased to have

successfully extended or renewed charters on three vessels with no

down-time, thereby securing continued employment for our entire

fleet on profitable terms throughout the quieter winter

period.”

Mr. Webber continued, “We remain optimistic that a recovery in

fundamentals, albeit subject to some seasonality, will continue to

support a firming of the charter market for mid-sized and smaller

vessels. Vessel ordering in these size segments remains very

limited, scrapping activity is positive, and demand growth in the

trade lanes dependent on this tonnage is robust. With strong

indications of a cyclical recovery, we successfully refinanced all

of our existing debt on a long-term basis and on improved terms.

Our enhanced balance sheet, a high-quality fleet, multiple years of

contracted revenue, and an increasingly attractive market

environment provide us with an opportunity to create substantial

shareholder value by pursuing attractive acquisitions of vessels,

always with a charter, whilst continuing to de-lever.”

SELECTED FINANCIAL DATA – UNAUDITED (thousands

of U.S. dollars)

| |

Threemonths ended |

Threemonths ended |

|

Ninemonths ended |

Ninemonths ended |

|

| |

September 30, 2017 |

September 30, 2016 |

|

September 30, 2017 |

September 30, 2016 |

|

| |

|

|

|

|

| Operating

Revenue |

41,216 |

41,154 |

|

121,117 |

125,097 |

|

| Operating

Income (Loss) |

19,894 |

(11,884 |

) |

56,859 |

24,422 |

|

| Net Income

(Loss) for Common Shareholders |

8,878 |

(23,685 |

) |

22,496 |

(13,085 |

) |

| Adjusted

EBITDA (1) |

29,340 |

28,051 |

|

85,446 |

86,169 |

|

| Normalised

Net Income (1) |

8,878 |

5,240 |

|

23,016 |

16,301 |

|

| |

|

|

|

|

(1) Adjusted EBITDA and Normalized net income (loss) are non-US

Generally Accepted Accounting Principles (US GAAP) measures, as

explained further in this press release, and are considered by

Global Ship Lease to be useful measures of its performance.

Reconciliations of such non-GAAP measures to the interim unaudited

financial information are provided in this Earnings Release.

Revenue and Utilization The fleet generated revenue from fixed

rate, mainly long-term time charters of $41.2 million in the three

months ended September 30, 2017, the same as in the comparative

period in 2016, with a small reduction in revenue as a consequence

of the amendments to the charters of Marie Delmas and Kumasi

whereby the day rate stepped down on August 1, 2016 and again in

mid-September 2017, offset by reduced levels of offhire. There were

1,656 ownership days in the quarter, the same as in the comparable

period in 2016. In the third quarter 2017, there was no offhire,

giving an overall utilization of 100.0%. In the comparable 2016

period, there was no unplanned offhire and 38 days of planned

offhire from regulatory drydockings, giving an overall utilization

of 97.7%.

For the nine months ended September 30, 2017, revenue was $121.1

million, down $4.0 million from revenue of $125.1 million in the

comparative period of 2016, mainly due to the amendments to the

charters of Marie Delmas and Kumasi.

The table below shows fleet utilization for the three and nine

months ended September 30, 2017 and 2016, and for the years ended

December 31, 2016, 2015, 2014 and 2013.

| |

|

|

|

|

|

|

|

|

|

| |

Three months ended |

Nine months ended |

|

|

|

| |

Sept 30, |

Sept 30, |

Sept 30, |

Sept 30, |

|

Dec 31, |

Dec 31, |

Dec 31, |

Dec 31, |

| Days |

2017 |

|

2016 |

|

2017 |

|

2016 |

|

|

2016 |

|

2015 |

|

2014 |

|

2013 |

|

| |

|

|

|

|

|

|

|

|

|

| Ownership days |

1,656 |

|

1,656 |

|

4,914 |

|

4,932 |

|

|

6,588 |

|

6,893 |

|

6,270 |

|

6,205 |

|

| Planned offhire -

scheduled drydock |

0 |

|

(38 |

) |

(62 |

) |

(89 |

) |

|

(100 |

) |

(9 |

) |

(48 |

) |

(21 |

) |

| Unplanned offhire |

0 |

|

0 |

|

(30 |

) |

(2 |

) |

|

(3 |

) |

(7 |

) |

(12 |

) |

(7 |

) |

| Idle time |

0 |

|

0 |

|

0 |

|

0 |

|

|

0 |

|

(13 |

) |

(64 |

) |

0 |

|

| Operating days |

1,656 |

|

1,618 |

|

4,822 |

|

4,841 |

|

|

6,485 |

|

6,864 |

|

6,146 |

|

6,177 |

|

| |

|

|

|

|

|

|

|

|

|

| Utilization |

100.0 |

% |

97.7 |

% |

98.1 |

% |

98.2 |

% |

|

98.4 |

% |

99.6 |

% |

98.0 |

% |

99.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In the three months ended September 30, 2017, there were no

regulatory dry-dockings. There have been a total of four such

dry-dockings year to date. One further regulatory dry-docking,

previously scheduled for late 2017, has been deferred to early

2018. Three dry-dockings were completed in the three months ended

September 30, 2016. There were a total of six dry-dockings in

2016.

Vessel Operating Expenses Vessel operating expenses, which

include costs of crew, lubricating oil, spares and insurance, were

$10.6 million for the three months ended September 30, 2017,

compared to $11.8 million in the comparative period. The average

cost per ownership day in the quarter was $6,401, compared to

$7,103 for the comparative period, down $702 per day or 9.9%. The

reduction is primarily attributable to reduced cost of lubricating

oil, the timing of spend on repairs and maintenance, lower

insurance costs on renewal and lower costs incurred in dry-dockings

that are expensed rather than capitalized.

For the nine months ended September 30, 2017, vessel operating

expenses were $31.9 million or an average of $6,487 per day,

compared to $34.5 million in the comparative period or $6,991 per

day. The $504, or 7.2%, reduction in vessel operating expenses per

day is due mainly to reasons noted above.

Depreciation Depreciation for the three months ended September

30, 2017 was $9.4 million, compared to $10.6 million in the third

quarter 2016, with the reduction being due to the effect of lower

book values for a number of vessels following impairment write

downs taken in the third and fourth quarters 2016.

Depreciation for the nine months ended September 30, 2017 was

$28.6 million, compared to $32.4 million in the comparative period

of 2016, with the reduction being due to the reason noted

above.

Impairment

The Company’s accounting policies require that tangible fixed

assets such as vessels are reviewed individually for impairment in

case of trigger events or changes in circumstances to assess

whether their carrying amounts are recoverable.

In September 2017, the Company agreed with CMA CGM to extend the

charters on Julie Delmas and Delmas Keta, by 12 months (plus or

minus 45 days at the charterer’s option) at a fixed rate of $7,800

per vessel per day, commencing September 11, 2017 and September 20,

2017 respectively. These extensions triggered the performance of an

impairment test on the two vessels. No impairment was

identified.

In third quarter 2016, the Company agreed with CMA CGM to amend

and extend the charters of the Marie Delmas and Kumasi. These

amendments triggered the performance of an impairment test on the

two vessels as at August 1, 2016 resulting in a non-cash impairment

charge of $29.4 million being recognized in the quarter ended

September 30, 2016 as the sum of the expected undiscounted future

cash flows from these assets over their estimated remaining useful

lives was less than the carrying amounts. The impairment charge is

equal to the amount by which the assets’ carrying amounts exceed

their fair values. Fair value is the net present value of estimated

future cash flows discounted by an appropriate discount rate.

General and Administrative Costs General and administrative

costs were $1.3 million in the three months ended September 30,

2017, compared to $1.4 million in the third quarter of 2016.

For the nine months ended September 30, 2017, general and

administrative costs were $3.8 million, compared to $4.6 million

for the comparative period in 2016. The reduction is due to lower

staff costs and professional fees.

Other Operating Income

Other operating income in the three months ended September 30,

2017 was $2,000, compared to $32,000 in the third quarter of

2016.

For the nine months ended September 30, 2017, other operating

income was $50,000, compared to $175,000 in the comparative

period.

Adjusted EBITDA

As a result of the above, Adjusted EBITDA was $29.3 million for

the three months ended September 30, 2017, up from $28.1 million

for the three months ended September 30, 2016 as lower vessel

operating costs and general and administrative costs offset lower

revenue, mainly from the amendments to the charters of Marie Delmas

and Kumasi.

Adjusted EBITDA for the nine months ended September 30, 2017 was

$85.4 million, compared to $86.2 million for the comparative

period.

Interest Expense Debt at September 30, 2017 comprised amounts

outstanding on our 2019 notes, our revolving credit facility and

our secured term loan.

Interest expense for the three months ended September 30, 2017,

was $10.4 million, down $0.7 million on the interest expense for

the three months ended September 30, 2016 of $11.1 million. The

reduction is mainly due to reduced interest on our notes on lower

amounts outstanding.

For the nine months ended September 30, 2017, interest expense

was $32.4 million. For the nine months ended September 30, 2016,

interest expense was $35.3 million. The decrease is mainly due to

lower amounts outstanding on our notes.

Interest income for the three months ended September 30, 2017

was $152,000, up from $57,000 in the comparative period of 2016 due

to higher cash balances. Interest income for the nine months ended

September 30, 2017 was $335,000 compared to $139,000 in the

comparative period.

Re-financing

On October 31, 2017, we closed the previously

announced offering of $360.0 million aggregate principal amount of

9.875% first priority secured notes due 2022. The net proceeds,

together with cash on hand, are to be used to refinance the

existing 10.000% notes due 2019. In addition, we have agreed a new

super senior secured term loan facility of $54.8 million with a

maximum term of three years and bearing interest at LIBOR plus

3.25%, which was drawn on October 31, 2017, the net proceeds of

which, together with cash on hand, have been used to repay

outstanding borrowings under both the existing revolving credit

facility and the existing secured term loan, which have now been

terminated.

Taxation

Taxation for the three months ended September 30, 2017 was

$15,000, compared to $17,000 in the third quarter of 2016.

Taxation for the nine months ended September 30, 2017 was

$31,000, compared to $32,000 for the comparative period in

2016.

Earnings Allocated to Preferred Shares

The Series B Preferred Shares carry a coupon of 8.75%, the cost

of which for the three months ended September 30, 2017 was $0.8

million, the same as in the comparative period.

The cost in the nine months ended September 30, 2017 was $2.3

million, the same as in the comparative period.

Net Income (Loss) Available to Common Shareholders Net income

available to common shareholders for the three months ended

September 30, 2017 was $8.9 million. Net loss for the three months

ended September 30, 2016 was $23.7 million, after the non-cash

impairment charge of $29.4 million related to the Marie Delmas and

Kumasi.

Normalized net income, which excludes, where relevant, the

effect of any non-cash impairment charges, gains and losses on the

purchase of notes and accelerated amortization of deferred

financing charges and original issue discount consequent upon the

retirement of Notes, was $8.9 million for the three months ended

September 30, 2017 (the same as reported), compared to $5.2 million

for the three months ended September 30, 2016.

Net income was $22.5 million for the nine months ended September

30, 2017. Net loss was $13.1 million for the nine months ended

September 30, 2016 after the $29.4 million non-cash impairment

charge associated with Marie Delmas and Kumasi.

Normalized net income was $23.0 million for the nine months

ended September 30, 2017 and was $16.3 million for the nine months

ended September 30, 2016.

Fleet

The following table provides information about the on-the-water

fleet of 18 vessels. 16 vessels are chartered to CMA CGM, and two

to OOCL.

| |

|

|

|

Remaining |

Earliest |

Daily |

| |

|

|

|

Charter |

Charter |

Charter |

|

Vessel |

Capacity |

Year |

Purchase |

Term (2) |

Expiry |

Rate |

|

Name |

in TEUs (1) |

Built |

by GSL |

(years) |

Date |

$ |

| CMA CGM Matisse |

2,262 |

1999 |

Dec

2007 |

2.2 |

Sept

21, 2019 |

15,300 |

| CMA CGM Utrillo |

2,262 |

1999 |

Dec

2007 |

2.2 |

Sept

11, 2019 |

15,300 |

| Delmas Keta |

2,207 |

2003 |

Dec

2007 |

1.0(3) |

Aug 6,

2018 |

7,800 |

| Julie Delmas |

2,207 |

2002 |

Dec

2007 |

0.9(3) |

Jul

28, 2018 |

7,800 |

| Kumasi |

2,207 |

2002 |

Dec

2007 |

1.3 -

3.3(4) |

Nov

16, 2018 |

9,800 |

| Marie Delmas |

2,207 |

2002 |

Dec

2007 |

1.3 -

3.3(4) |

Nov

16, 2018 |

9,800 |

| CMA CGM La Tour |

2,272 |

2001 |

Dec

2007 |

2.2 |

Sept

20, 2019 |

15,300 |

| CMA CGM Manet |

2,272 |

2001 |

Dec

2007 |

2.2 |

Sept

7, 2019 |

15,300 |

| CMA CGM Alcazar |

5,089 |

2007 |

Jan

2008 |

3.3 |

Oct

18, 2020 |

33,750 |

| CMA CGM Château

d’If |

5,089 |

2007 |

Jan

2008 |

3.3 |

Oct

11, 2020 |

33,750 |

| CMA CGM Thalassa |

11,040 |

2008 |

Dec

2008 |

8.3 |

Oct 1,

2025 |

47,200 |

| CMA CGM Jamaica |

4,298 |

2006 |

Dec

2008 |

5.2 |

Sept

17, 2022 |

25,350 |

| CMA CGM Sambhar |

4,045 |

2006 |

Dec

2008 |

5.2 |

Sept

16, 2022 |

25,350 |

| CMA CGM America |

4,045 |

2006 |

Dec

2008 |

5.2 |

Sept

19, 2022 |

25,350 |

| CMA CGM Berlioz |

6,621 |

2001 |

Aug

2009 |

3.9 |

May

28, 2021 |

34,000 |

| OOCL Tianjin |

8,063 |

2005 |

Oct

2014 |

0.5(5) |

Jan

25, 2018(5) |

13,000(5) |

| OOCL Qingdao |

8,063 |

2004 |

Mar

2015 |

0.6 |

Mar

11, 2018 |

34,500 |

| OOCL Ningbo |

8,063 |

2004 |

Sep

2015 |

1.1 |

Sep

17, 2018 |

34,500 |

| |

|

|

|

|

|

| (1) Twenty-foot Equivalent Units. |

|

|

|

|

|

| |

| (2)

As at September 30, 2017 to mid-point of re-delivery period and

adjusted for OOCL Tianjin as per footnote (5) below. Plus or minus

90 days, other than (i) OOCL Tianjin (to be renamed GSL Tianjin)

which is between January 25, 2018 and June 25, 2018, (ii) OOCL

Qingdao which is between March 11, 2018 and June 11, 2018, and

(iii) OOCL Ningbo which is between September 17, 2018 and December

17, 2018, all at charterer’s option and (iv) Julie Delmas and

Delmas Keta (see note 3 below). (3) The charters for Julie

Delmas and Delmas Keta were extended in September 2017 by 12 months

(plus or minus 45 days at the charterer’s option) at a fixed rate

of $7,800 per vessel per day, commencing on September 11, 2017 and

September 20, 2017, respectively. (4) The charters for Kumasi

and Marie Delmas were amended in July 2016 to, inter alia, provide

us with three consecutive options to extend the charters at $9,800

per day. The first of these options was exercised in July 2017,

extending the charters to end 2018. The two remaining options allow

us to extend the charters to December 31, 2020 plus or minus 90

days at charterer’s option. The earliest possible re-delivery date,

not taking into account our remaining options, is shown in the

table. (5) A new time charter for OOCL Tianjin, to be renamed

GSL Tianjin, with CMA CGM commenced October 25, 2017, immediately

upon re-delivery from its previous charter to OOCL, at a fixed rate

of $13,000 per day. The vessel is chartered for a period of three

to eight months at the charterer’s option. |

| |

Conference Call and Webcast Global Ship Lease

will hold a conference call to discuss the Company's results for

the three months ended September 30, 2017 today, Thursday November

2, 2017 at 10:30 a.m. Eastern Time. There are two ways to access

the conference call:

| |

(1)

|

Dial-in:

(877) 445-2556 or (908) 982-4670; Passcode: 6299768Please dial in

at least 10 minutes prior to 10:30 a.m. Eastern Time to ensure a

prompt start to the call. |

| |

|

|

| |

(2) |

Live

Internet webcast and slide presentation:

http://www.globalshiplease.com |

| |

|

|

| |

|

If you are

unable to participate at this time, a replay of the call will be

available through Saturday, November 18, 2017 at (855) 859-2056 or

(404) 537-3406. Enter the code 6299768 to access the audio replay.

The webcast will also be archived on the Company’s website:

http://www.globalshiplease.com. |

| |

|

|

Annual Report on Form 20F

The Company’s Annual Report for 2016 is on file with the

Securities and Exchange Commission. A copy of the report can be

found under the Investor Relations section (Annual Reports) of the

Company’s website at http://www.globalshiplease.com

Shareholders may request a hard copy of the audited financial

statements free of charge by contacting the Company at

info@globalshiplease.com or by writing to Global Ship Lease, Inc,

care of Global Ship Lease Services Limited, Portland House, Stag

Place, London SW1E 5RS or by telephoning +44 (0) 207 869 8806.

About Global Ship Lease

Global Ship Lease is a containership charter owner. Incorporated

in the Marshall Islands, Global Ship Lease commenced operations in

December 2007 with a business of owning and chartering out

containerships under long-term, fixed rate charters to top tier

container liner companies.Global Ship Lease owns 18 vessels with a

total capacity of 82,312 TEU and an average age, weighted by TEU

capacity, at September 30, 2017 of 12.8 years. All 18 vessels are

currently fixed on time charters, 16 of which are with CMA CGM. The

average remaining term of the charters at September 30, 2017 is 3.0

years or 3.3 years on a weighted basis, taking into account the new

charter agreed for OOCL Tianjin.

Reconciliation of Non-U.S. GAAP Financial

Measures

A. Adjusted EBITDA

Adjusted EBITDA represents net income before interest income and

expense including amortization of deferred finance costs, earnings

allocated to preferred shares, income taxes, depreciation,

amortization and impairment. Adjusted EBITDA is a non-US GAAP

quantitative measure used to assist in the assessment of the

Company's ability to generate cash from its operations. We believe

that the presentation of Adjusted EBITDA is useful to investors

because it is frequently used by securities analysts, investors and

other interested parties in the evaluation of companies in our

industry. Adjusted EBITDA is not defined in US GAAP and should not

be considered to be an alternate to Net income or any other

financial metric required by such accounting principles.

ADJUSTED EBITDA - UNAUDITED

| (thousands of U.S.

dollars) |

|

| |

|

Three |

Three |

Nine |

Nine |

| |

|

months |

months |

months |

months |

| |

|

ended |

ended |

ended |

ended |

| |

|

Sept 30, |

Sept 30, |

Sept 30, |

Sept 30, |

| |

|

2017 |

2016 |

2017 |

2016 |

| |

|

|

|

|

|

| Net income

(loss) available to common shareholders |

8,878 |

|

(23,685 |

) |

22,496 |

|

(13,085 |

) |

| |

|

|

|

|

|

| Adjust: |

Depreciation |

9,446 |

|

10,578 |

|

28,587 |

|

32,390 |

|

| |

Impairment |

--- |

|

29,357 |

|

--- |

|

29,357 |

|

| |

Interest

income |

(152 |

) |

(57 |

) |

(335 |

) |

(139 |

) |

| |

Interest

expense |

10,387 |

|

11,075 |

|

32,370 |

|

35,317 |

|

| |

Income

tax |

15 |

|

17 |

|

31 |

|

32 |

|

| |

Earnings

allocated to preferred shares |

766 |

|

766 |

|

2,297 |

|

2,297 |

|

| |

|

|

|

|

|

| Adjusted

EBITDA |

29,340 |

|

28,051 |

|

85,446 |

|

86,169 |

|

| |

|

|

|

|

|

|

|

|

B. Normalized net income

Normalized net income represents net income adjusted for the

premium paid on the tender offer together with the related

accelerated amortization of deferred financing costs and original

issue discount. Normalized net income is a non-GAAP quantitative

measure which we believe will assist investors and analysts who

often adjust reported net income for non-operating items that do

not affect operating performance or operating cash generated.

Normalized net income is not defined in US GAAP and should not be

considered to be an alternate to net income or any other financial

metric required by such accounting principles.

Normalized net income represents Net income (loss) adjusted for

the unrealized gain (loss) on derivatives, the accelerated write

off of a portion of deferred financing costs, impairment charges

and gain of redemption of preferred shares. Normalized net income

is a non-GAAP quantitative measure which we believe will assist

investors and analysts who often adjust reported net income for

non-operating items such as change in fair value of derivatives to

eliminate the effect of non-cash non-operating items that do not

affect operating performance or cash generated. Normalized net

income is not defined in US GAAP and should not be considered to be

an alternate to Net income (loss) or any other financial metric

required by such accounting principles.

| NORMALIZED NET

INCOME - UNAUDITED |

|

|

|

| (thousands

of U.S. dollars) |

|

| |

|

Three |

Three |

Nine |

Nine |

| |

|

months |

months |

months |

months |

| |

|

ended |

ended |

ended |

ended |

| |

|

Sept

30, |

Sept 30, |

Sept

30, |

Sept 30, |

| |

|

2017 |

2016 |

2017 |

2016 |

| |

|

|

|

|

|

| Net income

(loss) available to common shareholders |

8,878 |

(23,685 |

) |

22,496 |

(13,085 |

) |

| |

|

|

|

|

|

| Adjust: |

Gain on purchase of

notes |

--- |

(475 |

) |

--- |

(927 |

) |

| |

Premium paid on tender

offer for notes |

--- |

--- |

|

390 |

533 |

|

| |

Accelerated write off

of deferred financing charges related to notes purchase and tender

offer |

--- |

10 |

|

61 |

100 |

|

| |

Accelerated write off

of original issue discount related to notes purchase and tender

offer |

--- |

33 |

|

69 |

323 |

|

| |

Impairment charge |

--- |

29,357 |

|

--- |

29,357 |

|

| |

|

|

|

|

|

| Normalized

net income |

8,878 |

5,240 |

|

23,016 |

16,301 |

|

| |

|

|

|

|

|

|

Safe Harbor Statement

This communication contains forward-looking statements.

Forward-looking statements provide Global Ship Lease's current

expectations or forecasts of future events. Forward-looking

statements include statements about Global Ship Lease's

expectations, beliefs, plans, objectives, intentions, assumptions

and other statements that are not historical facts. Words or

phrases such as "anticipate," "believe," "continue," "estimate,"

"expect," "intend," "may," "ongoing," "plan," "potential,"

"predict," "project," "will" or similar words or phrases, or the

negatives of those words or phrases, may identify forward-looking

statements, but the absence of these words does not necessarily

mean that a statement is not forward-looking. These forward-looking

statements are based on assumptions that may be incorrect, and

Global Ship Lease cannot assure you that these projections included

in these forward-looking statements will come to pass. Actual

results could differ materially from those expressed or implied by

the forward-looking statements as a result of various factors.

The risks and uncertainties include, but are not limited

to:

- future operating or financial results;

- expectations regarding the future growth of the container

shipping industry, including the rates of annual demand and supply

growth;

- the financial condition of our charterers, particularly CMA

CGM, our principal charterer and main source of operating revenue,

and their ability to pay charterhire in accordance with the

charters;

- Global Ship Lease’s financial condition and liquidity,

including its ability to obtain additional waivers which might be

necessary under the existing credit facility or obtain additional

financing to fund capital expenditures, vessel acquisitions and

other general corporate purposes;

- Global Ship Lease’s ability to meet its financial covenants and

repay its credit facilities;

- Global Ship Lease’s expectations relating to dividend payments

and forecasts of its ability to make such payments including the

availability of cash and the impact of constraints under its credit

facility;

- future acquisitions, business strategy and expected capital

spending;

- operating expenses, availability of crew, number of off-hire

days, drydocking and survey requirements and insurance costs;

- general market conditions and shipping industry trends,

including charter rates and factors affecting supply and

demand;

- assumptions regarding interest rates and inflation;

- changes in the rate of growth of global and various regional

economies;

- risks incidental to vessel operation, including piracy,

discharge of pollutants and vessel accidents and damage including

total or constructive total loss;

- estimated future capital expenditures needed to preserve its

capital base;

- Global Ship Lease’s expectations about the availability of

ships to purchase, the time that it may take to construct new

ships, or the useful lives of its ships;

- Global Ship Lease’s continued ability to enter into or renew

long-term, fixed-rate charters;

- the continued performance of existing long-term, fixed-rate

time charters;

- Global Ship Lease’s ability to capitalize on its management’s

and board of directors’ relationships and reputations in the

containership industry to its advantage;

- changes in governmental and classification societies’ rules and

regulations or actions taken by regulatory authorities;

- expectations about the availability of insurance on

commercially reasonable terms;

- unanticipated changes in laws and regulations including

taxation;

- potential liability from future litigation.

Forward-looking statements are subject to known and unknown

risks and uncertainties and are based on potentially inaccurate

assumptions that could cause actual results to differ materially

from those expected or implied by the forward-looking statements.

Global Ship Lease's actual results could differ materially from

those anticipated in forward-looking statements for many reasons

specifically as described in Global Ship Lease's filings with the

SEC. Accordingly, you should not unduly rely on these

forward-looking statements, which speak only as of the date of this

communication. Global Ship Lease undertakes no obligation to

publicly revise any forward-looking statement to reflect

circumstances or events after the date of this communication or to

reflect the occurrence of unanticipated events. You should,

however, review the factors and risks Global Ship Lease describes

in the reports it will file from time to time with the SEC after

the date of this communication.

| Global Ship Lease,

Inc.Interim Unaudited Consolidated

Statements of Income(Expressed in thousands of

U.S. dollars except share data) |

| |

|

|

|

| |

|

Three months ended September 30, |

Nine months ended September 30, |

| |

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Operating

Revenues |

|

|

|

|

|

| Time charter

revenue |

|

$ |

9,444 |

|

$ |

9,444 |

|

$ |

28,022 |

|

$ |

28,123 |

|

| Time charter revenue –

related party |

|

|

31,772 |

|

|

31,710 |

|

|

93,095 |

|

|

96,974 |

|

| |

|

|

|

|

|

| |

|

|

41,216 |

|

|

41,154 |

|

|

121,117 |

|

|

125,097 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Operating

ExpensesVessel operating expenses |

|

|

10,200 |

|

|

11,362 |

|

|

30,678 |

|

|

33,282 |

|

| Vessel operating

expenses – related party |

|

|

400 |

|

|

400 |

|

|

1,200 |

|

|

1,199 |

|

| Depreciation |

|

|

9,446 |

|

|

10,578 |

|

|

28,587 |

|

|

32,390 |

|

| Impairment of

vessels |

|

|

- |

|

|

29,357 |

|

|

- |

|

|

29,357 |

|

| General and

administrative |

|

|

1,278 |

|

|

1,373 |

|

|

3,843 |

|

|

4,622 |

|

| Other operating

income |

|

|

(2 |

) |

|

(32 |

) |

|

(50 |

) |

|

(175 |

) |

| |

|

|

|

|

|

| Total operating

expenses |

|

|

21,322 |

|

|

53,038 |

|

|

64,258 |

|

|

100,675 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Operating

Income |

|

|

19,894 |

|

|

(11,884 |

) |

|

56,859 |

|

|

24,422 |

|

| |

|

|

|

|

|

| Non Operating

Income (Expense) |

|

|

|

|

|

| Interest income |

|

|

152 |

|

|

57 |

|

|

335 |

|

|

139 |

|

| Interest expense |

|

|

(10,387 |

) |

|

(11,075 |

) |

|

(32,370 |

) |

|

(35,317 |

) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Income / (Loss)

before Income Taxes |

|

|

9,659 |

|

|

(22,902 |

) |

|

24,824 |

|

|

(10,756 |

) |

| |

|

|

|

|

|

| Income taxes |

|

|

(15 |

) |

|

(17 |

) |

|

(31 |

) |

|

(32 |

) |

| |

|

|

|

|

|

| Net

Income |

|

$ |

9,644 |

|

$ |

(22,919 |

) |

$ |

24,793 |

|

$ |

(10,788 |

) |

| |

|

|

|

|

|

| Earnings allocated to

Series B Preferred Shares |

|

|

(766 |

) |

|

(766 |

) |

|

(2,297 |

) |

|

(2,297 |

) |

| |

|

|

|

|

|

| Net Income

available to Common Shareholders |

|

$ |

8,878 |

|

$ |

(23,685 |

) |

$ |

22,496 |

|

$ |

(13,085 |

) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Earnings per

Share |

|

|

|

|

|

| |

|

|

|

|

|

| Weighted average number

of Class A common shares outstanding |

|

|

|

|

|

| Basic

(including RSUs without service conditions) |

|

47,975,609 |

|

47,858,640 |

|

47,975,609 |

|

47,850,139 |

|

|

Diluted |

|

47,975,609 |

|

47,858,640 |

|

47,975,609 |

|

47,850,139 |

|

| |

|

|

|

|

|

| Net income per Class A

common share |

|

|

|

|

|

| Basic

(including RSUs without service conditions) |

|

$ |

0.19 |

|

$ |

(0.49 |

) |

$ |

0.47 |

|

$ |

(0.27 |

) |

|

Diluted |

|

$ |

0.19 |

|

$ |

(0.49 |

) |

$ |

0.47 |

|

$ |

(0.27 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number

of Class B common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and

diluted |

|

|

7,405,956 |

|

|

7,405,956 |

|

|

7,405,956 |

|

|

7,405,956 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per Class B

common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and

diluted |

|

$ |

0.00 |

|

$ |

0.00 |

|

$ |

0.00 |

|

$ |

0.00 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Global Ship Lease, Inc.Interim

Unaudited Consolidated Balance

Sheets(Expressed in thousands of U.S. dollars) |

| |

|

|

|

|

| |

|

September

30,2017 |

|

December 31,2016 |

| |

|

|

|

|

| Assets

|

|

|

|

|

| Cash and cash

equivalents |

|

$ |

65,562 |

|

|

$ |

54,243 |

|

| Accounts

receivable |

|

|

166 |

|

|

|

29 |

|

| Due from related

party |

|

|

1,065 |

|

|

|

906 |

|

| Prepaid expenses |

|

|

2,614 |

|

|

|

1,146 |

|

| Other receivables |

|

|

191 |

|

|

|

52 |

|

| Inventory |

|

|

629 |

|

|

|

553 |

|

| |

|

|

|

|

| Total current

assets |

|

|

70,227 |

|

|

|

56,929 |

|

| |

|

|

|

|

| |

|

|

|

|

| Vessels in

operation |

|

|

694,638 |

|

|

|

719,110 |

|

| Other fixed assets |

|

|

12 |

|

|

|

7 |

|

| Intangible assets |

|

|

9 |

|

|

|

16 |

|

| Other long term

assets |

|

|

112 |

|

|

|

195 |

|

| |

|

|

|

|

| Total non-current

assets |

|

|

694,771 |

|

|

|

719,328 |

|

| |

|

|

|

|

| Total

Assets |

|

$ |

764,998 |

|

|

$ |

776,257 |

|

| |

|

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

| |

|

|

|

|

|

Liabilities |

|

|

|

|

| Current portion of long

term debt |

|

|

25,755 |

|

|

|

31,026 |

|

| Intangible liability –

charter agreements |

|

|

1,779 |

|

|

|

1,807 |

|

| Deferred revenue |

|

|

2,848 |

|

|

|

1,940 |

|

| Accounts payable |

|

|

452 |

|

|

|

963 |

|

| Due to related

party |

|

|

1,555 |

|

|

|

1,315 |

|

| Accrued expenses |

|

|

3,491 |

|

|

|

11,664 |

|

| |

|

|

|

|

| Total current

liabilities |

|

|

35,880 |

|

|

|

48,715 |

|

| |

|

|

|

|

| |

|

|

|

|

| Long term debt |

|

|

369,255 |

|

|

|

388,847 |

|

| Intangible liability –

charter agreements |

|

|

8,454 |

|

|

|

9,782 |

|

| Deferred tax

liability |

|

|

20 |

|

|

|

20 |

|

| |

|

|

|

|

| Total long term

liabilities |

|

|

377,729 |

|

|

|

398,649 |

|

| |

|

|

|

|

| |

|

|

|

|

| Total

Liabilities |

|

$ |

413,609 |

|

|

$ |

447,364 |

|

| |

|

|

|

|

| Commitments and

contingencies |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

| Stockholders’

Equity |

|

|

|

|

| Class A Common stock –

authorized 214,000,000 shares with a $0.01 par

value; 47,575,609 shares issued and outstanding

(2016 – 47,575,609) |

|

$ |

476 |

|

|

$ |

476 |

|

| Class B Common stock –

authorized 20,000,000 shares with a $0.01 par

value; 7,405,956 shares issued and outstanding

(2016 – 7,405,956) |

|

|

74 |

|

|

|

74 |

|

| Series B Preferred

shares – authorized 16,100 shares with $0.01 par

value; 14,000 shares issued and outstanding

(2016 – 14,000) |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

| Additional paid in

capital |

|

|

386,708 |

|

|

|

386,708 |

|

| (Accumulated

deficit) |

|

|

(35,869 |

) |

|

|

(58,365 |

) |

| |

|

|

|

|

| Total

Stockholders’ Equity |

|

|

351,389 |

|

|

|

328,893 |

|

| |

|

|

|

|

| Total

Liabilities and Stockholders’ Equity |

|

$ |

764,998 |

|

|

$ |

776,257 |

|

| |

|

|

|

|

| Global Ship Lease,

Inc.Interim Unaudited Consolidated Statements of

Cash Flows(Expressed in thousands of U.S. dollars) |

| |

|

|

|

| |

|

Three months ended September 30, |

Nine months ended September 30, |

| |

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Cash Flows from

Operating Activities |

|

|

|

|

|

| Net income /

(Loss) |

|

$ |

9,644 |

|

$ |

(22,919 |

) |

$ |

24,793 |

|

$ |

(10,788 |

) |

| |

|

|

|

|

|

| Adjustments to

Reconcile Net income to Net Cash Provided by Operating

Activities |

|

|

|

|

|

| Depreciation |

|

|

9,446 |

|

|

10,578 |

|

|

28,587 |

|

|

32,390 |

|

| Vessel impairment |

|

|

- |

|

|

29,357 |

|

|

- |

|

|

29,357 |

|

| Amortization of

deferred financing costs |

|

|

838 |

|

|

909 |

|

|

2,613 |

|

|

2,681 |

|

| Amortization of

original issue discount |

|

|

258 |

|

|

333 |

|

|

883 |

|

|

1,249 |

|

| Amortization of

intangible liability |

|

|

(452 |

) |

|

(530 |

) |

|

(1,356 |

) |

|

(1,589 |

) |

| Share based

compensation |

|

|

- |

|

|

85 |

|

|

- |

|

|

200 |

|

| Gain on repurchase of

secured notes |

|

|

- |

|

|

(475 |

) |

|

- |

|

|

(927 |

) |

| Decrease (increase) in

accounts receivable and other assets |

|

|

(1,706 |

) |

|

(64 |

) |

|

(1,905 |

) |

|

(462 |

) |

| Decrease (increase) in

inventory |

|

|

46 |

|

|

(54 |

) |

|

(75 |

) |

|

20 |

|

| Increase (decrease) in

accounts payable and other liabilities |

|

|

(7,747 |

) |

|

(9,796 |

) |

|

(8,495 |

) |

|

(11,081 |

) |

| (Decrease) increase in

unearned revenue |

|

|

150 |

|

|

1,119 |

|

|

908 |

|

|

911 |

|

| Increase in related

party balances |

|

|

45 |

|

|

374 |

|

|

673 |

|

|

1,437 |

|

| Unrealized foreign

exchange (gain) loss |

|

|

- |

|

|

21 |

|

|

6 |

|

|

(7 |

) |

| |

|

|

|

|

|

| Net Cash

Provided by Operating Activities |

|

|

10,522 |

|

|

8,938 |

|

|

46,632 |

|

|

43,391 |

|

| |

|

|

|

|

|

| Cash Flows from

Investing Activities |

|

|

|

|

|

| Cash paid for vessel

improvements |

|

|

- |

|

|

- |

|

|

(100 |

) |

|

- |

|

| Cash paid in respect of

sale of vessels |

|

|

- |

|

|

- |

|

|

- |

|

|

(254 |

) |

| Cash paid for other

assets |

|

|

- |

|

|

(5 |

) |

|

(8 |

) |

|

(6 |

) |

| Cash paid for

drydockings |

|

|

(701 |

) |

|

(3,220 |

) |

|

(4,632 |

) |

|

(4,168 |

) |

| |

|

|

|

|

|

| Net Cash Used

in Investing Activities |

|

|

(701 |

) |

|

(3,225 |

) |

|

(4,740 |

) |

|

(4,428 |

) |

| |

|

|

|

|

|

| Cash Flows from

Financing Activities |

|

|

|

|

|

| Repurchase of secured

notes |

|

|

- |

|

|

(4,526 |

) |

|

(19,501 |

) |

|

(34,936 |

) |

| Proceeds from drawdown

of revolving credit facility |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| Deferred financing

costs incurred |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| Repayment of credit

facilities |

|

|

(2,925 |

) |

|

(1,925 |

) |

|

(8,775 |

) |

|

(6,575 |

) |

| Series B Preferred

Shares – dividends paid |

|

|

(766 |

) |

|

(766 |

) |

|

(2,297 |

) |

|

(2,297 |

) |

| |

|

|

|

|

|

| Net Cash Used

in Financing Activities |

|

|

(3,691 |

) |

|

(7,217 |

) |

|

(30,573 |

) |

|

(43,808 |

) |

| |

|

|

|

|

|

| Net Increase

(decrease) in Cash and Cash Equivalents |

|

|

6,130 |

|

|

(1,504 |

) |

|

11,319 |

|

|

(4,845 |

) |

| Cash and Cash

Equivalents at Start of Period |

|

|

59,432 |

|

|

50,250 |

|

|

54,243 |

|

|

53,591 |

|

| |

|

|

|

|

|

| Cash and Cash

Equivalents at End of Period |

|

$ |

65,562 |

|

$ |

48,746 |

|

$ |

65,562 |

|

$ |

48,746 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Supplemental

information |

|

|

|

|

|

| |

|

|

|

|

|

| Total interest

paid |

|

$ |

18,313 |

|

$ |

20,021 |

|

$ |

37,991 |

|

$ |

42,253 |

|

| |

|

|

|

|

|

| Income tax paid |

|

$ |

12 |

|

$ |

11 |

|

$ |

36 |

|

$ |

37 |

|

| |

|

|

|

|

|

Investor and Media Contacts:The IGB GroupBryan

Degnan646-673-9701orLeon Berman212-477-8438

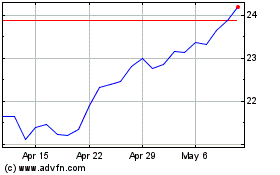

Global Ship Lease (NYSE:GSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

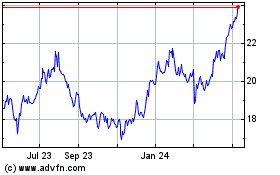

Global Ship Lease (NYSE:GSL)

Historical Stock Chart

From Apr 2023 to Apr 2024