Current Report Filing (8-k)

November 02 2017 - 7:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report

(Date of earliest event reported)

November 2, 2017

DHI Group, Inc.

(Exact Name of Registrant as Specified in Its Charter)

DELAWARE

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

|

|

|

|

|

|

|

001-33584

|

|

20-3179218

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

1040 AVENUE OF THE AMERICAS, 8TH FLOOR, NEW YORK, NEW YORK

|

|

10018

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(212) 725-6550

(Registrant's Telephone Number, Including Area Code)

NOT APPLICABLE

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02.

RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On

November 2, 2017

, DHI Group, Inc. (the “Company”) reported its results of operations for the fiscal quarter ended

September 30, 2017

. A copy of the press release issued by the Company concerning the foregoing is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information in this Form 8-K, including the accompanying exhibit, is being furnished under Item 2.02 and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such filing.

ITEM 5.02

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

Departure of Michael P. Durney as President, Chief Executive Officer and Director.

On November 2, 2017, the Company announced the adoption of a CEO transition plan. In connection with the plan, Michael P. Durney, President, Chief Executive Officer and a director of the Company, will no longer be the President, Chief Executive Officer or a director of the Company, effective as of March 31, 2018; provided that the Company will have the option to extend such date for up to 30 days if the search for a new Chief Executive Officer is close to being completed (the “Termination Date”). If a new Chief Executive Officer commences employment with the Company prior to March 31, 2018, then Mr. Durney shall cease to be the President, Chief Executive Officer and a director as of such date (but shall otherwise remain an employee through March 31, 2018). The Company has engaged a search firm to assist with the search process for a new Chief Executive Officer.

In connection with Mr. Durney’s departure, the Company entered into a separation agreement (the “Separation Agreement”) with Mr. Durney on November 1, 2017. Subject to his continued compliance with the Separation Agreement and his execution and non-revocation of a release of claims on the Termination Date, Mr. Durney will be entitled to (i) continued payment of Mr. Durney’s current base salary for twelve months following the Termination Date, payable in equal installments in accordance with the Company’s payroll practices; (ii) continued medical and dental benefits for the twelve-month period following the Termination Date on the same basis as provided to active employees of the Company; (iii) accelerated vesting of certain outstanding unvested equity-based awards; (iv) the continued ability of certain outstanding performance stock units to vest in accordance with their terms as if Mr. Durney had remained employed through the applicable vesting date; (v) a bonus in respect of 2017 in accordance with the bonus plan in effect; and (vi) with respect to 2018, a pro rata target bonus based on the portion of the calendar year through the Termination Date.

In addition, Mr. Durney will be entitled to payment of other accrued but unpaid compensation and benefits, including accrued but unused vacation time, under the Company’s benefit plans and programs in accordance with their terms. The Separation Agreement also provides for customary post-employment obligations including nondisclosure of confidential information, nonsolicitation of employees, noncompetition and mutual nondisparagement covenants.

The foregoing is only a summary of the Separation Agreement, does not purport to be complete and is qualified in its entirety by reference to the full text of the Separation Agreement. A copy of the press release issued by the Company concerning the foregoing is attached hereto as Exhibit 99.2.

ITEM 7.01 REGULATION FD DISCLOSURE

The Company changed its reportable segments during the third quarter of 2017 to reflect the current tech-focused operating structure, which was announced in the second quarter of 2017 and implemented in the third quarter of 2017. Accordingly, all prior periods have been recast to reflect the current segment presentation. A financial supplement, including a recast of comparative periods to reflect these changes in reporting segments, is attached to this Report as Exhibit 99.3.

ITEM 9.01.

FINANCIAL STATEMENTS AND EXHIBITS.

|

|

|

|

(a)

|

Financial Statements of Business Acquired.

|

Not applicable.

|

|

|

|

(b)

|

Pro Forma Financial Information.

|

Not applicable.

|

|

|

|

(c)

|

Shell Company Transactions.

|

Not applicable.

EXHIBIT NO.

DESCRIPTION

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DHI GROUP, INC.

|

|

|

|

|

|

|

|

|

|

Date:

|

November 2, 2017

|

By:

/S/ Luc Grégoire

|

|

|

|

|

|

Name: Luc Grégoire

|

|

|

|

|

|

Title: Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXHIBIT INDEX

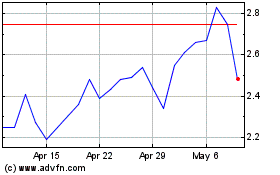

DHI (NYSE:DHX)

Historical Stock Chart

From Mar 2024 to Apr 2024

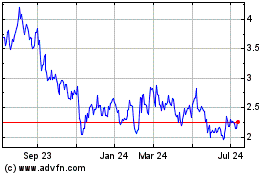

DHI (NYSE:DHX)

Historical Stock Chart

From Apr 2023 to Apr 2024