Current Report Filing (8-k)

November 01 2017 - 4:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2017

GENTHERM INCORPORATED

(Exact name of registrant as specified in its charter)

|

Michigan

|

|

0-21810

|

|

95-4318554

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

21680 Haggerty Road, Northville, MI

|

|

48167

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Registrant’s telephone number, including area code: (248) 504-0500

Former name or former address, if changed since last report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

|

Item

1

.

01

|

Entry into a Material Definitive Agreement

|

Etratech Acqusition

On November 1, 2017, Gentherm Incorporated, a Michigan corporation, together with three of its subsidiaries, Gentherm Canada ULC, Gentherm GmbH and Gentherm International Holdings (Hong Kong) Limited (collectively, the “Company”), acquired (i) substantially all of the assets and assumed substantially all of the operating liabilities of Etratech Inc., an Ontario corporation (“Etratech Canada”) and (ii) all of the outstanding shares of Etratech Hong Kong Limited, an entity organized under the laws of Hong Kong (“Etratech Hong Kong”), pursuant to the terms of a Share and Asset Purchase Agreement (the “Purchase Agreement”), dated as of November 1, 2017, by and among the Company, Etratech Canada, Etratech International Inc., an Ontario corporation and the sole shareholder of Etratech Hong Kong (“Etratech International”), Etratech Enterprises Inc., an Ontario corporation and the sole shareholder of both Etratech Canada and Etratech International (“Etratech Enterprises”) and all of the shareholders of Etratech Enterprises (the “Shareholders” and, together with Etratech Canada, Etratech International and Etratech Enterprises, the “Sellers”).

The purchase price, in Canadian Dollars, consisted of C$81.325 million in cash, reduced by certain transaction expenses. The purchase price is subject to adjustments for (A) the combined net working capital (as defined in the Purchase Agreement) (i) included in the assets and liabilities of Etratech Canada as of the closing and (ii) held by Etratech Hong Kong and its subsidiaries (the “Etratech Asia Entities”) as of the closing, compared to a pre-determined consolidated working capital target, and (B) the amount of cash and cash equivalents held by the Etratech Asia Entities as of the closing. In addition, C$8.0 million of the purchase price will be held in escrow for up to 18 months to fund indemnity obligations of the Sellers and any net working capital adjustment owed by Sellers. Payment of the purchase price was funded with the Company’s cash on hand and availability under the Company’s revolving credit facility. The Company did not acquire the cash of Etratech Canada and, as a condition to the closing of the transaction, all indebtedness of Etratech Canada and the Etratech Asia Entities was discharged in full.

The Purchase Agreement contains customary indemnification obligations of each party with respect to breaches of representations, warranties and covenants and certain other specified matters. Indemnification claims by the Company will be satisfied initially (and, in some cases, solely) by setting off the amount of such claims against the portion of the purchase price held in escrow. For certain specific claims, indemnification claims by the Company in excess of the portion of the purchase price held in escrow will be paid by Sellers to the Company.

The foregoing summary of the Purchase Agreement and the transactions contemplated thereby is qualified in its entirety by reference to the Purchase Agreement attached hereto as Exhibit 2.1 and incorporated herein by reference.

No Reliance on Representations and Warranties in the Purchase Agreement

The representations and warranties in the Purchase Agreement were made for the purposes of allocating contractual risk between the parties thereto and as of the specified dates noted therein. Further, such representations and warranties may have been qualified by certain disclosures between the parties and a contractual standard of materiality different from those generally applicable to direct or indirect shareholders of the registrant, among other limitations. The registrant’s shareholders are not third party beneficiaries under the Purchase Agreement and should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or conditions of the Company and other parties thereto.

On November 1, 2017,the registrant announced that it had completed the acquisition described in Item 1.01 above. A copy of the news release is filed as Exhibit 99.1 attached hereto and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

*

|

Gentherm Incorporated agrees to furnish any omitted schedules or exhibits upon the request of the Securities and Exchange Commision.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

GENTHERM INCORPORATED

|

|

|

|

|

|

|

By:

|

|

/s/ Kenneth J. Phillips

|

|

|

|

|

Kenneth J. Phillips

|

|

|

|

|

Vice-President and General Counsel

|

|

Date: November 1, 2017

|

|

|

|

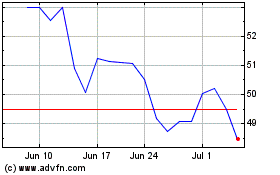

Gentherm (NASDAQ:THRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

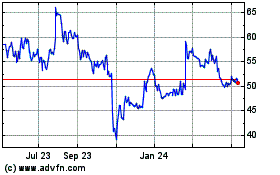

Gentherm (NASDAQ:THRM)

Historical Stock Chart

From Apr 2023 to Apr 2024