- 3Q Net Sales of $1.80 Billion Increased

2%; GAAP EPS of $0.55 Increased 22%; Adjusted EPS of $0.60

Increased 7%

- Year-to-Date Net Cash From Operations

Increased 59% to $331 Million

- Company to Increase Marketing and Brand

Growth Investment in 4Q and Updates Full-Year 2017 Guidance for Net

Sales, Operating Profit, EPS and Cash from Operations

HanesBrands (NYSE: HBI), a leading global marketer of everyday

basic apparel under world-class brands, today announced

third-quarter 2017 net sales and earnings growth in line with

company guidance and strong year-to-date net cash from

operations.

For the third quarter ended Sept. 30, 2017, net sales of $1.80

billion increased 2 percent, driven by double-digit International

segment growth. Domestic sales were affected by apparel’s

weaker-than-expected back-to-school retail environment, although

the company held share for Innerwear basics.

On a GAAP basis, third-quarter operating profit of $253 million

increased 11 percent and diluted EPS of $0.55 increased 22 percent.

When excluding pretax acquisition-related and integration charges,

adjusted operating profit of $270 million was comparable to a year

ago, and adjusted EPS of $0.60 increased 7 percent. (See Note on

Adjusted Measures and Reconciliation to GAAP Measures later in this

news release for additional discussion and details.)

Year-to-date net cash from operations of $331 million increased

$123 million, or 59 percent.

“We returned to organic growth in the quarter as International

results were stronger than expected, and we are tracking to the

midpoint or higher of our cash flow guidance for the year,” said

Hanes Chief Executive Officer Gerald W. Evans Jr. “The value of

diversifying our portfolio with international and activewear

acquisitions is evident, and we are making progress on several

initiatives to adapt to the evolving and challenging retail

environment in the United States.”

With one quarter remaining in the fiscal year, Hanes has updated

its full-year guidance to reflect year-to-date results and factors

related to the fourth-quarter, including additional incremental

marketing investment to drive growth, the expected adverse effect

of the Sears Canada bankruptcy, and the recently announced

acquisition of Alternative Apparel. (See full guidance details in

the 2017 Financial Guidance section later in this news

release.)

“In the fourth quarter, we expect to once again achieve organic

sales growth,” Evans said. “We are continuing to drive strong

double-digit online sales growth across businesses and geographies.

We are making progress on our goal to use our brands, innovations,

acquisitions and online investment to create shareholder value and

drive sustainable growth.”

Key Callouts for Third-Quarter 2017

Results

Company Returns to Organic Sales Growth. Hanes generated

organic sales growth – as reported and in constant currency – for

the first time in eight quarters. The company benefitted from

increasing geographic diversification as International sales growth

more than offset sluggish domestic sales. International sales,

bolstered by Hanes Europe Innerwear, Champion Europe, and Hanes

Australasia, accounted for 31 percent of sales in the third

quarter. Global Champion sales increased 16 percent in the

quarter.

Year-to-Date Cash Flow Growth Accelerates. Hanes

generated $297 million in cash from operations in the third quarter

and has generated $331 million year to date, up 59 percent from a

year ago. Cash flow is benefitting from working capital

improvements and increased profitability.

Double-Digit Online Sales Growth Continues. The growth

percentage of third-quarter sales in the online channel globally

was in the high 20s, and online sales represented approximately 9

percent of total sales. Online sales increased in every geography

across product categories.

Business Segment Highlights

Innerwear Sales Affected by Difficult Back-to-School

Environment. Innerwear net sales and operating profit each

decreased 5 percent in the third quarter and were lower than

expected as a result of a particularly challenging back-to-school

retail season for the apparel sector. The company maintained market

share in basics, while online sales, including those through

traditional retailer websites, increased by more than 20

percent.

Activewear Results Benefit from Acquisition

Contributions. Activewear net sales increased 1 percent and

operating profit increased 8 percent. The acquisition of GTM

Sportswear contributed approximately $15 million of sales in the

quarter. The segment was affected by the muted back-to-school

season at retail, but online sales increased by more than 30

percent and Champion sales in the midtier, sporting goods and

college bookstore channels achieved double-digit growth.

International Segment Growth. Net sales increased 16

percent and operating profit increased 25 percent for the

International segment in the third quarter. In constant currency,

International net sales increased 14 percent and operating profit

increased 23 percent. Champion growth in Europe and Asia, underwear

and intimate apparel growth in Australia and Latin America, and

widespread online growth drove results.

2017 Financial Guidance

Hanes has updated its full-year guidance, including narrowing

the range for net sales and EPS, and revised operating profit

guidance. The company now expects net cash from operations to meet

or exceed the midpoint of its original guidance range.

For 2017, the company expects net sales of approximately $6.450

billion to $6.475 billion, GAAP operating profit of $830 million to

$840 million, adjusted operating profit excluding actions of $925

million to $935 million, GAAP EPS for continuing operations of

$1.68 to $1.70, adjusted EPS for continuing operations excluding

actions of $1.93 to $1.95, and net cash from operations of $625

million to $725 million.

Implied Fourth-Quarter Guidance. Based on year-to-date

results and full-year guidance, the company expects total net sales

of approximately $1.625 billion to $1.650 billion in the fourth

quarter, which represents organic growth of approximately 3 percent

at the midpoint.

The sales guidance reflects several factors, including: a

cautious outlook for the U.S. sales environment; an estimated $15

million in sales expected from the acquisition of Alternative

Apparel; and the expected adverse effect of the Sears Canada

bankruptcy.

GAAP EPS for the fourth quarter is expected to be $0.47 to

$0.49, and adjusted EPS is expected to be $0.51 to $0.53. The

guidance for both measures reflects an estimated $0.05 effect of

increased marketing investment to drive organic growth, a higher

mix of International segment sales than earlier expectations, and

the estimated impact from the Sears Canada bankruptcy, partially

offset by higher-than-expected acquisition synergies.

Other fourth-quarter implied guidance includes expectations for

GAAP operating profit of $227 million to $237 million, and adjusted

operating profit of $241 million to $251 million. The company

expects a tax rate of roughly 5 percent and approximately 369

million weighted average diluted shares outstanding.

Additional Full-Year Guidance. The company expects more

than $20 million in synergy cost benefits in 2017.

Including the acquisition of Alternative Apparel, the company

expects to incur an estimated $95 million of pretax charges for

acquisition and integration-related actions.

The company expects capital expenditures of approximately $90

million in 2017. The company is not required to make a pension

contribution in 2017 and does not anticipate making a voluntary

contribution.

Hanes expects interest expense and other expenses to be

approximately $180 million combined.

Hanes has updated its quarterly frequently-asked-questions

document, which is available at www.Hanes.com/faq.

Note on Adjusted Measures and

Reconciliation to GAAP Measures

To supplement our financial guidance prepared in accordance with

generally accepted accounting principles, we provide quarterly and

full-year results and guidance concerning certain non‐GAAP

financial measures, including adjusted EPS, adjusted net income,

adjusted operating profit (and margin), adjusted SG&A, adjusted

gross profit (and margin) and EBITDA. The company also discusses

organic sales, defined as net sales excluding contributions from

acquisitions until the closest period end to the acquisition’s

anniversary date.

Adjusted EPS is defined as diluted EPS from continuing

operations excluding actions and the tax effect on actions.

Adjusted net income is defined as net income from continuing

operations excluding actions and the tax effect on actions.

Adjusted operating profit is defined as operating profit excluding

actions. Adjusted gross profit is defined as gross profit excluding

actions. Adjusted SG&A is defined as selling, general and

administrative expenses excluding actions.

Actions during the periods presented include adjustments for

acquisition-related and integration costs. These costs include

legal fees, consulting fees, bank fees, severance costs, certain

purchase accounting items, facility closures, inventory write-offs,

information technology integration costs, and similar charges.

While these costs are not operational in nature and are not

expected to continue for any singular transaction on an ongoing

basis, similar types of costs, expenses and charges have occurred

in prior periods and may recur in the future as the company

continues to integrate prior acquisitions and pursues any future

acquisitions.

Hanes has chosen to present these non‐GAAP measures, as well as

organic sales, to investors to enable additional analyses of past,

present and future operating performance and as a supplemental

means of evaluating operations absent the effect of acquisitions

and other actions. Hanes believes these non-GAAP measures provide

management and investors with valuable supplemental information for

analyzing the operating performance of the company’s ongoing

business during each period presented without giving effect to

costs associated with the execution and integration of any of the

aforementioned actions taken.

In addition, the company has chosen to present EBITDA to

investors because it considers that measure to be an important

supplemental means of evaluating operating performance. EBITDA is

defined as earnings before interest, taxes, depreciation and

amortization.

Hanes believes that EBITDA is frequently used by securities

analysts, investors and other interested parties in the evaluation

of companies in the industry, and management uses EBITDA for

planning purposes in connection with setting its capital allocation

strategy. EBITDA should not, however, be considered as a measure of

discretionary cash available to invest in the growth of the

business.

Non‐GAAP financial measures have limitations as analytical tools

and should not be considered in isolation or as an alternative to,

or substitute for, financial results prepared in accordance with

GAAP. Further, the non-GAAP measures presented may be different

from non-GAAP measures with similar or identical names presented by

other companies.

Hanes expects to incur approximately $95 million in pretax

charges in 2017 related to acquisition integrations of Hanes Europe

Innerwear, Hanes Australasia, Champion Europe, Knights Apparel, and

Alternative Apparel, along with an effective tax rate of

approximately 5 percent. In the fourth quarter of 2017, Hanes

expects approximately $14 million in pretax charges related to

acquisition integrations, along with an effective tax rate of

roughly 5 percent.

The company expects approximately 369 million and approximately

370 million weighted average diluted shares outstanding for the

fourth quarter and full-year 2017, respectively.

To calculate organic sales for the third quarter, net sales were

reduced by the approximately $15 million contributed by the

acquisition of GTM Sportswear. For the fourth quarter, organic

sales will exclude the contributions of Alternative Apparel, which

is expected to be approximately $15 million. With the third-quarter

anniversary of the GTM acquisition, GTM sales in the fourth quarter

will be considered organic.

Webcast Conference Call

Hanes will host an internet webcast of its quarterly investor

conference call at 4:30 p.m. EDT today. The broadcast, which will

consist of prepared remarks followed by a question-and-answer

session, may be accessed at www.Hanes.com/investors. The call is

expected to conclude by 5:30 p.m.

An archived replay of the conference call webcast will be

available at www.Hanes.com/investors. A telephone playback will be

available from approximately 7:30 p.m. EDT today through midnight

EST Nov. 8, 2017. The replay will be available by calling toll-free

(855) 859-2056, or by toll call at (404) 537-3406. The replay pass

code is 2460422.

Cautionary Statement Concerning Forward-Looking

Statements

This press release contains certain forward-looking statements,

as defined under U.S. federal securities laws, with respect to our

long-term goals and trends associated with our business, as well as

guidance as to future performance. In particular, among others,

statements following the heading 2017 Financial Guidance, as well

as statements about the benefits anticipated from the acquisitions

of GTM Sportswear and Alternative Apparel and assumptions regarding

organic growth and fourth-quarter financial performance. These

forward-looking statements are based on our current intent,

beliefs, plans and expectations. Readers are cautioned not to place

any undue reliance on any forward-looking statements.

Forward-looking statements necessarily involve risks and

uncertainties, many of which are outside of our control, that could

cause actual results to differ materially from such statements and

from our historical results and experience. These risks and

uncertainties include such things as: the highly competitive and

evolving nature of the industry in which we compete; any

inadequacy, interruption, integration failure or security failure

with respect to our information technology; significant

fluctuations in foreign exchange rates; the rapidly changing retail

environment; our complex multinational tax structure; our ability

to properly manage strategic projects; our ability to attract and

retain a senior management team with the core competencies needed

to support our growth in global markets; risks related to our

international operations, including the impact to our business as a

result of the United Kingdom’s recent referendum to leave the

European Union; the impact of significant fluctuations and

volatility in various input costs, such as cotton and oil-related

materials, utilities, freight and wages; our ability to access

sufficient capital at reasonable rates or commercially reasonable

terms or to maintain sufficient liquidity in the amounts and at the

times needed; and other risks identified from time to time in our

most recent Securities and Exchange Commission reports, including

our annual report on Form 10-K and quarterly reports on Form 10-Q.

Since it is not possible to predict or identify all of the risks,

uncertainties and other factors that may affect future results, the

above list should not be considered a complete list. Any

forward-looking statement speaks only as of the date on which such

statement is made, and HanesBrands undertakes no obligation to

update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise, other than as

required by law.

HanesBrands

HanesBrands, based in Winston-Salem, N.C., is a socially

responsible leading marketer of everyday basic innerwear and

activewear apparel in the Americas, Europe, Australia and

Asia-Pacific. The company sells its products under some of the

world’s strongest apparel brands, including Hanes, Champion,

Maidenform, DIM, Bali, Playtex, Bonds, JMS/Just My Size, Nur

Die/Nur Der, L’eggs, Lovable, Wonderbra, Berlei, Alternative, and

Gear for Sports. The company sells T-shirts, bras, panties,

shapewear, underwear, socks, hosiery, and activewear produced in

the company’s low-cost global supply chain. A member of the S&P

500 stock index, Hanes has approximately 68,000 employees in more

than 40 countries and is ranked No. 432 on the Fortune 500 list of

America’s largest companies by sales. Hanes takes pride in its

strong reputation for ethical business practices. The company is

the only apparel producer to ever be honored by the Great Place to

Work Institute for its workplace practices in Central America and

the Caribbean, and is ranked No. 110 on the Forbes magazine list of

America’s Best Large Employers. For eight consecutive years, Hanes

has won the U.S. Environmental Protection Agency Energy Star

sustained excellence/partner of the year award – the only apparel

company to earn sustained excellence honors. The company ranks No.

172 on Newsweek magazine’s green list of 500 largest U.S. companies

for environmental achievement. More information about the company

and its corporate social responsibility initiatives, including

environmental, social compliance and community improvement

achievements, may be found at www.Hanes.com/corporate. Connect with

HanesBrands via social media on Twitter (@hanesbrands) and Facebook

(www.facebook.com/hanesbrandsinc).

TABLE 1

HANESBRANDS INC.

Condensed Consolidated Statements of

Income

(Amounts in thousands, except per-share

amounts)

(Unaudited)

Quarter Ended Nine Months Ended

September 30, 2017 October 1, 2016 %

Change September 30, 2017 October 1, 2016

% Change Net sales $ 1,799,270 $ 1,761,019 2.2 % $ 4,826,235

$ 4,452,890 8.4 % Cost of sales 1,120,813 1,111,653

2,962,345 2,788,977 Gross profit 678,457 649,366 4.5

% 1,863,890 1,663,913 12.0 % As a % of net sales

37.7

% 36.9 % 38.6 % 37.4

% Selling, general and administrative expenses 425,153

421,014 1,260,641 1,091,946 As a % of net sales

23.6

% 23.9 % 26.1 % 24.5

% Operating profit 253,304 228,352 10.9 % 603,249 571,967

5.5 % As a % of net sales

14.1 % 13.0 %

12.5 % 12.8 % Other expenses 1,881

1,559 4,659 50,533 Interest expense, net 43,917 43,433

130,184 111,539 Income from continuing

operations before income tax expense 207,506 183,360 468,406

409,895 Income tax expense 4,150 10,570 19,804

28,693 Income from continuing operations 203,356 172,790

17.7 % 448,602 381,202 17.7 % Income (loss) from discontinued

operations, net of tax — 1,068 (2,097 ) 1,068

Net income $ 203,356 $ 173,858 17.0 % $

446,505 $ 382,270 16.8 % Earnings per share -

basic: Continuing operations $ 0.56 $ 0.46 $ 1.22 $ 1.00

Discontinued operations — — (0.01 ) — Net

income $ 0.56 $ 0.46 21.7 % $ 1.21 $ 1.00

21.0 % Earnings per share - diluted: Continuing

operations $ 0.55 $ 0.45 $ 1.21 $ 0.99 Discontinued operations —

— (0.01 ) — Net income $ 0.55 $ 0.45

22.2 % $ 1.20 $ 0.99 21.2 % Weighted

average shares outstanding: Basic 366,083 379,368 368,885 382,235

Diluted 368,160 382,558 370,947 385,478

TABLE 2

HANESBRANDS INC.

Supplemental Financial

Information

(Dollars in thousands)

(Unaudited)

Quarter Ended Nine Months Ended

September 30, 2017 October 1, 2016 %

Change September 30, 2017 October 1, 2016

% Change Segment net sales1: Innerwear $ 644,059 $ 679,096

(5.2 )% $ 1,868,255 $ 1,953,807 (4.4 )% Activewear 519,496 516,713

0.5 % 1,226,595 1,207,767 1.6 % International 556,730 478,122 16.4

% 1,509,370 1,026,871 47.0 % Other 78,985 87,088 (9.3

)% 222,015 264,445 (16.0 )% Total net sales $

1,799,270 $ 1,761,019 2.2 % $ 4,826,235 $

4,452,890 8.4 % Segment operating profit1: Innerwear

$ 141,002 $ 147,902 (4.7 )% $ 407,982 $ 435,660 (6.4 )% Activewear

79,015 72,962 8.3 % 162,053 160,076 1.2 % International 76,414

61,312 24.6 % 185,216 109,184 69.6 % Other 10,162 9,199 10.5 %

16,250 27,408 (40.7 )% General corporate expenses/other (36,415 )

(20,436 ) 78.2 % (86,949 ) (68,710 ) 26.5 % Acquisition-related and

integration charges (16,874 ) (42,587 ) (60.4 )% (81,303 ) (91,651

) (11.3 )% Total operating profit $ 253,304 $ 228,352

10.9 % $ 603,249 $ 571,967 5.5 % EBITDA2: Net

income from continuing operations $ 203,356 $ 172,790 17.7 % $

448,602 $ 381,202 17.7 % Interest expense, net 43,917 43,433 1.1 %

130,184 111,539 16.7 % Income tax expense 4,150 10,570 (60.7 )%

19,804 28,693 (31.0 )% Depreciation and amortization 31,667

26,888 17.8 % 89,762 73,715 21.8 % Total

EBITDA $ 283,090 $ 253,681 11.6 % $ 688,352 $

595,149 15.7 %

1

In the first quarter of 2017, the Company realigned its

reporting segments to reflect the new model under which the

business will be managed and results will be reviewed by the chief

executive officer, who is the Company’s chief operating decision

maker. The former Direct to Consumer segment, which consisted of

the Company’s U.S. value-based (“outlet”) stores, legacy catalog

business and U.S. retail Internet operations, was eliminated. The

Company’s U.S. retail Internet operations, which sells products

directly to consumers, is now reported in the respective Innerwear

and Activewear segments. The Other category consists of the

Company’s U.S. value-based (“outlet”) stores, U.S. hosiery business

(previously reported in the Innerwear segment) and legacy catalog

operations. Prior year segment sales and operating profit results

have been revised to conform to the current year presentation.

2

Earnings from continuing operations before interest, taxes,

depreciation and amortization (EBITDA) is a non-GAAP financial

measure.

TABLE 3

HANESBRANDS INC.

Condensed Consolidated Balance

Sheets

(Dollars in thousands)

(Unaudited)

September 30, 2017 December 31, 2016

Assets Cash and cash equivalents $ 400,045 $ 460,245 Trade

accounts receivable, net 1,009,188 836,924 Inventories 1,953,918

1,840,565 Other current assets 196,875 137,535 Current assets of

discontinued operations — 45,897 Total current assets

3,560,026 3,321,166 Property, net 624,602 692,464

Trademarks and other identifiable intangibles, net 1,371,007

1,285,458 Goodwill 1,141,942 1,098,540 Deferred tax assets 504,059

464,872 Other noncurrent assets 79,087 67,980 Total assets $

7,280,723 $ 6,930,480

Liabilities Accounts

payable and accrued liabilities $ 1,467,270 $ 1,381,442 Notes

payable 23,969 56,396 Accounts Receivable Securitization Facility

250,995 44,521 Current portion of long-term debt 154,395 133,843

Current liabilities of discontinued operations — 9,466 Total

current liabilities 1,896,629 1,625,668 Long-term

debt 3,566,547 3,507,685 Pension and postretirement benefits

378,573 371,612 Other noncurrent liabilities 207,807 201,601

Total liabilities 6,049,556 5,706,566

Equity

1,231,167 1,223,914 Total liabilities and equity $ 7,280,723

$ 6,930,480

TABLE 4

HANESBRANDS INC.

Condensed Consolidated Statements of

Cash Flows

(Dollars in thousands)

(Unaudited)

Nine Months Ended September 30, 2017

October 1, 2016 Operating Activities: Net income $

446,505 $ 382,270 Depreciation and amortization 89,762 73,715 Other

noncash items 3,703 51,046 Changes in assets and liabilities, net

(208,880 ) (298,740 ) Net cash from operating activities 331,090

208,291

Investing Activities:

Purchases/sales of property and equipment, net, and other (56,020 )

3,262 Acquisition of businesses, net of cash acquired (524 )

(963,127 ) Disposition of businesses 40,285 — Net

cash from investing activities (16,259 ) (959,865 )

Financing Activities: Cash dividends paid (165,211 )

(125,798 ) Share repurchases (299,919 ) (379,901 ) Net borrowings

on notes payable, debt and other 97,532 1,385,624 Net

cash from financing activities (367,598 ) 879,925 Effect of

changes in foreign currency exchange rates on cash (7,433 ) 2,693

Change in cash and cash equivalents (60,200 ) 131,044 Cash

and cash equivalents at beginning of year 460,245 319,169

Cash and cash equivalents at end of period $ 400,045

$ 450,213

TABLE 5

HANESBRANDS INC.

Supplemental Financial

Information

Reconciliation of Select GAAP Measures

to Non-GAAP Measures

(Amounts in thousands, except per-share

amounts)

(Unaudited)

Quarter Ended Nine Months Ended September

30, 2017 October 1, 2016 September 30,

2017 October 1, 2016 Gross profit, as reported

under GAAP $ 678,457 $ 649,366 $ 1,863,890 $ 1,663,913

Acquisition-related and integration charges 2,230 13,563

21,989 27,732 Gross profit, as adjusted $

680,687 $ 662,929 $ 1,885,879 $ 1,691,645

As a % of net sales

37.8 % 37.6

% 39.1 % 38.0 % Selling,

general and administrative expenses, as reported under GAAP $

425,153 $ 421,014 $ 1,260,641 $ 1,091,946 Acquisition-related and

integration charges (14,644 ) (29,024 ) (59,314 ) (63,919 )

Selling, general and administrative expenses, as adjusted $ 410,509

$ 391,990 $ 1,201,327 $ 1,028,027 As a

% of net sales

22.8 % 22.3 %

24.9 % 23.1 % Operating profit,

as reported under GAAP $ 253,304 $ 228,352 $ 603,249 $ 571,967

Acquisition-related and integration charges included in gross

profit 2,230 13,563 21,989 27,732 Acquisition-related and

integration charges included in SG&A 14,644 29,024

59,314 63,919 Operating profit, as adjusted $

270,178 $ 270,939 $ 684,552 $ 663,618

As a % of net sales

15.0 % 15.4 %

14.2 % 14.9 % Net income from

continuing operations, as reported under GAAP $ 203,356 $ 172,790 $

448,602 $ 381,202 Acquisition-related and integration charges

included in gross profit 2,230 13,563 21,989 27,732

Acquisition-related and integration charges included in SG&A

14,644 29,024 59,314 63,919 Debt refinance charges included in

other expenses — — — 47,291 Tax effect on actions (338 ) (2,017 )

(4,204 ) (9,726 ) Net income from continuing operations, as

adjusted $ 219,892 $ 213,360 $ 525,701 $

510,418 Diluted earnings per share from continuing

operations, as reported under GAAP $ 0.55 $ 0.45 $ 1.21 $ 0.99

Acquisition-related and integration charges 0.04 0.11

0.21 0.34 Diluted earnings per share from continuing

operations, as adjusted $ 0.60 $ 0.56 $ 1.42 $

1.32

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171101006775/en/

HanesBrandsNews Media:Matt Hall, 336-519-3386orAnalysts and

Investors:T.C. Robillard, 336-519-2115

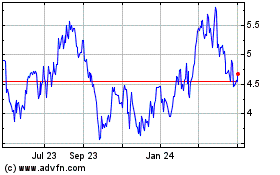

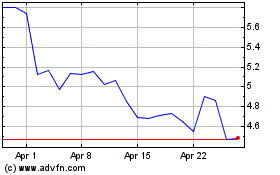

Hanesbrands (NYSE:HBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hanesbrands (NYSE:HBI)

Historical Stock Chart

From Apr 2023 to Apr 2024