-Strengthens Diversity and Leadership of

Board with Addition of Two New Independent

Trustees--Reaffirms Full Year 2017

Guidance-

Whitestone REIT (NYSE:WSR) (“Whitestone” or the “Company”) today

announced operating and financial results for the third quarter

ended September 30, 2017. Whitestone acquires, owns, manages,

develops and redevelops high quality “e-commerce resistant”

neighborhood, community and lifestyle retail centers principally

located in the largest, fastest-growing and most affluent markets

in the Sunbelt. Whitestone’s national, regional and local tenants

provide daily necessities, needed services and entertainment not

readily available online to the communities they serve.

Highlights

- Strengthens Board of Trustees (the “Board”) by adding two

independent trustees, increasing cognitive and gender

diversity

- Inclusion into the S&P SmallCap 600 Index on September 8,

2017

- Operating Portfolio occupancy climbs above 90%

- Reaffirms full year 2017 guidance

Third Quarter 2017 Compared to Third

Quarter 2016:All per share amounts presented in this news

release are on a diluted per common share and operating partnership

(“OP”) unit basis unless stated otherwise.

- Net Income Attributable to Whitestone REIT (“Net Income”) of

$3.0 million

- 133% growth in Net Income per share to $0.07

- 60% growth in Funds from Operations (“FFO”) to $10.1

million

- 19% growth in FFO per share to $0.25

- 33% growth in FFO Core to $13.1 million. FFO Core per

share of $0.33 in both periods

- 32% growth in revenues to $33.7 million

- 30% growth in Net Operating Income (“NOI”)

- 4.7% same store NOI growth in wholly owned properties.

2.9% same store growth in all properties, including consolidated

partnership properties (“non-core” legacy assets)

- 20.3% increase in annualized base rent per square foot for

wholly owned properties to $18.84

- 7.6% rental rate increase on new and renewal leases executed in

wholly owned properties (GAAP Basis, Trailing Twelve Months)

- Increase in Operating Portfolio occupancy to 90.1% from

87.6%

“We continue to see strong results from our

neighborhood centers located in targeted communities with high

household incomes, educated workforces, and positive household

growth projections, as evidenced by our 4.7% same store NOI growth

and Operating Portfolio occupancy climbing above 90%,” commented

Jim Mastandrea, Chairman and Chief Executive Officer. “With a

heightened focus on driving efficiencies throughout our operating

platform and overall cost structure, Whitestone increased year over

year gross real estate assets by more than $225 million and

revenues by 32%. We also took steps to enhance our corporate

governance and ensure that our practices align with our culture by

adding two new trustees who bring independence, diversity and

leadership experience to our Board. Our commitment to serving

e-commerce resistant retailers and providing daily essential

services is what differentiates Whitestone from our peers, and

positions the Company to continue delivering strong results and

driving shareholder value.”

Real Estate Portfolio

Update

Community Centered Properties® Portfolio

Statistics:

As of September 30, 2017, Whitestone wholly owned 58 Community

Centered Properties® with 5.0 million square feet of gross leasable

area ("GLA"). The portfolio comprises 30 properties in Texas, 27 in

Arizona and one in Illinois. Whitestone’s retail Community Centered

Properties® are located in Austin (4), San Antonio (3), Dallas-Fort

Worth (6), Houston (17) and the greater Phoenix metropolitan area

(27). In addition to being business friendly, these are five of the

top markets in the country in terms of size, economic strength and

population growth. Between 2000 and 2014, all of these cities

experienced double-digit growth in population, with Austin at

+35.8%, San Antonio at +23.4%, Dallas-Fort Worth at +20.5%, Phoenix

at +15.8% and Houston at +13.2%.

The Company’s properties in these markets are

located on the best retail corners embedded in affluent

communities. The Company also owns a majority interest in and

manages 14 properties containing 1.5 million square feet of GLA

through its investment in Pillarstone Capital REIT Operating

Partnership L.P.

At the end of the third quarter of 2017, the

Company's diversified tenant base comprised approximately 1,649

tenants, with the largest tenant accounting for only 2.6% of

annualized base rental revenues. Lease terms range from less

than one year for smaller tenants to more than 15 years for larger

tenants. In addition to minimum monthly rent payments, the leases

generally include reimbursements for payment of taxes, insurance

and maintenance, and typically exclude restrictive lease

clauses.

Leasing Activity:

During the third quarter, the leasing team

signed 92 leases totaling 276,000 square feet of new, expansion and

renewal leases, compared to 113 leases totaling 270,000 square feet

in the third quarter of 2016. The total lease value added

during the quarter was $19.2 million compared to $16.3 million

during the same period last year. The Company's total

Operating Portfolio occupancy stood at 90.1% at quarter end.

Balance Sheet and Liquidity

Balance Sheet:

Reflecting the Company's activities over the last twelve months,

the Company’s undepreciated cost basis real estate assets grew by

$226.0 million to $1.14 billion at September 30, 2017, compared to

$918.6 million at September 30, 2016.

Liquidity, Debt and Credit

Facility:

At September 30, 2017, 48 of the Company’s

wholly-owned 58 properties were unencumbered by mortgage debt, with

an aggregate undepreciated cost basis of $732.9

million. The Company had total real estate debt, net of cash,

of $656.1 million, of which approximately 66%, was subject to fixed

interest rates. The Company's weighted average interest rate

on all fixed rate debt as of the end of the third quarter was 3.9%

and the weighted average remaining term was 5.4 years.

At quarter end, Whitestone had $6.3 million of

cash available on its balance sheet and $72.8 million of available

capacity under its credit facility, not including a $200 million

accordion option.

Dividend

On September 13, 2017, the Company declared a

quarterly cash distribution of $0.285 per common share and OP unit

for the fourth quarter of 2017, to be paid in three equal

installments of $0.095 in October, November, and December 2017.

Board of Trustees

During the third quarter, the Company expanded the size of its

Board to seven, adding Nandita Berry and Najeeb A. Khan.

Ms. Berry previously served as the 109th Secretary of State for

Texas and was recently inducted into the Texas Women’s Hall of Fame

in recognition of her exceptional business achievements. With a

distinguished record as a civil servant and previously as a legal

advisor in the private sector, Ms. Berry brings substantial

experience overseeing financial and strategic planning, leading

government and international relations and engaging with key

stakeholders.

Mr. Khan is the President and Chief Executive Officer of

Interlogic Outsourcing Inc., a company he founded in 2001 and

helped grow into one of the nation’s leading cloud-based payroll

and human resources management solutions providers. Mr. Khan is a

technology and human resources veteran with a proven track record

of entrepreneurial success as well as extensive venture and real

estate investment experience.

Each of Ms. Berry and Mr. Khan has been determined by the Board

to meet the independence standards of the New York Stock Exchange

and the Securities and Exchange Commission. Ms. Berry has

been appointed to the Audit Committee of the Board. Mr. Khan has

been appointed to the Nominating and Governance Committee of the

Board.

About Nandita BerryMs. Berry recently served as the 109th

Secretary of State of Texas. In that capacity, her many roles and

responsibilities included Economic Ambassador, Chief Elections

Officer, Border Commerce Coordinator and Chief International

Protocol Officer. Prior to her position as Secretary of State, Ms.

Berry served on the University of Houston System Board of Regents,

including as Vice Chairman of The Board of Regents, as well as

Chairman of the Audit and Compliance Committee. Additionally, she

was a member of both the Finance and Administration Committee and

the Academic and Student Success Committee. Previously, Ms. Berry

was Senior Counsel for Locke Lord LLP, a full-service international

law firm, and for El Paso Energy Corporation, a Fortune 500 natural

gas company. In addition to being inducted into the Texas Women’s

Hall of Fame in 2014 for exceptional business achievement and being

recognized as one of Houston’s 50 Most Influential Women by Houston

Woman Magazine, she has also served as a member of the Board of

Directors for the Houston Zoo, Inc., South Asian Chamber of

Commerce, and Community Family Center of Houston. Ms. Berry holds a

Bachelor’s Degree in Economics and Political Science from both the

University of Houston and Mt. Carmel College, Bangalore, India. In

addition, she holds a Juris Doctorate from the University of

Houston Law Center.

About Najeeb KhanMr. Khan is President and Chief Executive

Officer of Interlogic Outsourcing Inc. (IOI), a company he founded

in 2001 that succeeds Interlogic Systems, Inc. (ISI), a company

that Mr. Khan established in 1987. Under his leadership, IOI has

grown from a local operation to one of the nation’s leading, award

winning cloud-based payroll and human resources management

solutions providers. Prior to founding ISI, Mr. Khan served as Vice

President of Commercial Services for Midwest Commerce Data

Corporation, a wholly owned subsidiary of NBD Midwest Commerce

Bank, where he was responsible for the commercial services division

that provided outsourcing solutions for payroll, accounting and

inventory controls to diverse businesses. Mr. Khan currently serves

as a Director of 1st Source Bank (SRCE), where he is a member of

the Audit Committee and chairs the Loan and Fund Committee. Mr.

Khan previously served as a Trustee of Memorial Health Foundation,

on the Investment Committee of Community Foundation of St. Joseph

County, Studebaker Museum and as a member of the Finance Committees

for WNIT Public Television, and Holy Cross College. He holds a

Bachelor of Science Degree in Mathematics and Computer Science from

Grand Valley State University.

2017 Guidance

The Company reaffirms its previously released guidance for 2017

and expects net income attributable to Whitestone REIT for 2017 to

range from $0.26 to $0.31 per share and FFO and FFO Core to range

from $0.97 to $1.02 and $1.29 to $1.34 per share, respectively.

This guidance reflects the Board’s and management’s view of current

and future market conditions, as well as the earnings impact of

events referenced elsewhere in this release and during the

Company’s conference call. This guidance does not include the

operational or capital impact of any future unannounced acquisition

or disposition activity. Please refer to the “2017 Financial

Guidance” and “Reconciliation of Non-GAAP Measures - 2017 Financial

Guidance” sections of the supplemental data package for the full

list of guidance information.

Conference Call InformationIn

conjunction with the issuance of its financial results, you are

invited to listen to the Company’s earnings release conference call

to be broadcast live on Thursday, November 2, 2017 at 10:00 A.M.

Central Time. The call will be led by James C. Mastandrea,

Chairman and Chief Executive Officer, and David K. Holeman, Chief

Financial Officer. Conference call access information is as

follows:

| Dial-in number for

domestic participants: |

(888) 471-3843 |

| Dial-in number for

international participants: |

(719) 325-4748 |

The conference call will be recorded and a telephone replay will

be available through Thursday, November 16, 2017. Replay

access information is as follows:

| Replay number for

domestic participants: |

(844) 512-2921 |

| Replay number for

international participants: |

(412) 317-6671 |

| Passcode (for all

participants): |

6378678 |

To listen to a live webcast of the conference call, click on the

Investor Relations tab of the Company’s website,

www.whitestonereit.com, and then click on the webcast link. A

replay of the call will be available on Whitestone’s website via

the webcast link until the Company’s next earnings release.

Additional information about Whitestone can be found on the

Company’s website.

The third quarter earnings release and

supplemental data package will be located in the Investor Relations

section of the Company’s website. For those without internet

access, the earnings release and supplemental data package will be

available by mail upon request. To receive a copy, please

call the Company’s Investor Relations line at (713) 435-2219.

Supplemental Financial

Information

Supplemental materials and details regarding

Whitestone's results of operations, communities and tenants are

available on the Company's website at www.whitestonereit.com.

About Whitestone REIT

Whitestone is a pure-play community-centered

retail REIT that acquires, owns, manages, develops and redevelops

high quality “e-commerce resistant” neighborhood, community and

lifestyle retail centers principally located in the largest,

fastest-growing and most affluent markets in the Sunbelt.

Whitestone’s optimal mix of national, regional and local tenants

provides daily necessities, needed services and entertainment to

the community which are not readily available on the internet.

Whitestone’s properties are primarily located in business-friendly

Phoenix, Austin, Dallas-Fort Worth, Houston and San Antonio, which

are among the fastest-growing U.S. population centers with highly

educated workforces, high household incomes and strong job

growth. As of October 31, 2017, Whitestone's total

shareholder return ranks #1 of 17, #4 of 17, and #4 of 14, of the

U.S. public shopping center REITs for the one-year, three-year, and

five-year periods, respectively. Visit

www.whitestonereit.com for additional information.

Forward-Looking Statements

Certain statements contained in this press

release constitute forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”) and Section 21E of the Securities Exchange Act of

1934, as amended (the “Exchange Act”). The Company intends for all

such forward-looking statements to be covered by the safe-harbor

provisions for forward-looking statements contained in Section 27A

of the Securities Act and Section 21E of the Exchange Act, as

applicable. Such information is subject to certain risks and

uncertainties, as well as known and unknown risks, which could

cause actual results to differ materially from those projected or

anticipated. Therefore, such statements are not intended to be a

guarantee of our performance in future periods. Such

forward-looking statements can generally be identified by the

Company's use of forward-looking terminology, such as “may,”

“will,” “plan,” “expect,” “intend,” “anticipate,” “believe,”

“continue” or similar words or phrases that are predictions of

future events or trends and which do not relate solely to

historical matters.

The following are some of the factors that could

cause the Company's actual results and its expectations to differ

materially from those described in the Company's forward-looking

statements: the Company's ability to meet its assumptions regarding

its earnings guidance, including its ability to execute effectively

its acquisition and disposition strategy, to continue to execute

its development pipeline on schedule and at the expected costs, and

its ability to grow its NOI as expected, which could be impacted by

a number of factors, including, among other things, its ability to

continue to renew leases or re-let space on attractive terms and to

otherwise address its leasing rollover; its ability to successfully

identify, finance and consummate suitable acquisitions, and the

impact of such acquisitions, including financing developments,

capitalization rates and internal rate of return; current adverse

market and economic conditions; lease terminations or lease

defaults; the impact of competition on the Company's efforts to

renew existing leases; changes in the economies and other

conditions of the specific markets in which the Company operates;

economic and regulatory changes; the success of the Company's real

estate strategies and investment objectives; the Company's ability

to continue to qualify as a REIT under the Internal Revenue Code;

and other factors detailed in the Company's most recent Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and other

documents the Company files with the Securities and Exchange

Commission.

Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date of this press release. The Company cannot guarantee the

accuracy of any such forward-looking statements contained in this

press release, and the Company does not intend to publicly update

or revise any forward-looking statements, whether as a result of

new information, future events, or otherwise.

Non-GAAP Financial Measures

This release contains supplemental financial

measures that are not calculated pursuant to U.S. generally

accepted accounting principles (“GAAP”) including FFO, FFO Core,

and NOI. Following are explanations and reconciliations of these

metrics to their most comparable GAAP metric.

FFO: Management believes that FFO is a useful

measure of the Company's operating performance. The Company

computes FFO as defined by NAREIT, which states that FFO should

represent net income available to common shareholders (computed in

accordance with GAAP) excluding gains or losses from sales of

operating assets, impairment charges and extraordinary items, plus

depreciation and amortization of operating properties, including

the Company's share of unconsolidated real estate joint ventures

and partnerships. FFO does not represent cash flows from operating

activities determined in accordance with GAAP and should not be

considered an alternative to net income as an indication of the

Company's performance or to cash flow from operations as a measure

of liquidity or ability to make distributions and service debt.

Management considers FFO a useful additional

measure of performance for an equity REIT because it facilitates an

understanding of the operating performance of its properties

without giving effect to real estate depreciation and amortization,

which assumes that the value of real estate assets diminishes

predictably over time. Since real estate values have historically

risen or fallen with market conditions, management believes that

FFO provides a more meaningful and accurate indication of the

Company's performance and useful information for the investment

community to compare Whitestone to other REITs since FFO is

generally recognized as the industry standard for reporting the

operations of REITs.

Other REITs may use different methodologies for

calculating FFO, and accordingly, the Company's FFO may not be

comparable to other REITs. The Company presents FFO per diluted

share calculations that are based on the outstanding dilutive

common shares plus the outstanding OP units for the periods

presented.

FFO Core: Management believes that the

computation of FFO in accordance with NAREIT's definition includes

certain non-cash and non-comparable items that affect the Company's

period-over-period performance. These items include, but are not

limited to, legal settlements, non-cash share-based compensation

expense, rent support agreement payments received from sellers on

acquired assets and acquisition costs. In addition, the Company

believes that FFO Core is a useful supplemental measure for the

investing community to use in comparing the Company to other REITs

as many REITs provide some form of adjusted or modified FFO.

However, other REITs may use different adjustments, and the

Company's FFO Core may not be comparable to the adjusted or

modified FFO of other REITs.

NOI: Management believes that NOI is a useful

measure of the Company's property operating performance. The

Company defines NOI as operating revenues (rental and other

revenues) less property and related expenses (property operation

and maintenance and real estate taxes). Because NOI excludes

general and administrative expenses, depreciation and amortization,

involuntary conversion, interest expense, interest income,

provision for income taxes, gain or loss on sale or disposition of

assets and capital expenditures and leasing costs, it provides a

performance measure that, when compared year over year, reflects

the revenues and expenses directly associated with owning and

operating commercial real estate properties and the impact to

operations from trends in occupancy rates, rental rates and

operating costs, providing perspective not immediately apparent

from net income. The Company uses NOI to evaluate its operating

performance since NOI allows the Company to evaluate the impact of

factors, such as occupancy levels, lease structure, lease rates and

tenant base, have on the Company's results, margins and returns. In

addition, management believes that NOI provides useful information

to the investment community about the Company's property and

operating performance when compared to other REITs since NOI is

generally recognized as a standard measure of property performance

in the real estate industry. However, NOI should not be viewed as a

measure of the Company's overall financial performance since it

does not reflect general and administrative expenses, depreciation

and amortization, involuntary conversion, interest expense,

interest income, provision for income taxes, gain or loss on sale

or disposition of assets, and the level of capital expenditures and

leasing costs necessary to maintain the operating performance of

the Company's properties. Other REITs may use different

methodologies for calculating NOI, and accordingly, the Company's

NOI may not be comparable to that of other REITs.

| Whitestone REIT and Subsidiaries |

|

| CONSOLIDATED BALANCE SHEETS |

|

| (in thousands, except share and per share

data) |

|

| |

|

|

| |

September 30, 2017 |

|

December 31, 2016 |

|

|

|

|

(unaudited) |

|

|

|

| ASSETS |

|

| Real estate assets, at

cost |

|

|

|

|

|

|

Property |

|

$ |

1,144,558 |

|

|

$ |

920,310 |

|

|

|

Accumulated depreciation |

|

|

(124,268 |

) |

|

|

(107,258 |

) |

|

| Total

real estate assets |

|

|

1,020,290 |

|

|

|

813,052 |

|

|

| Cash and cash

equivalents |

|

|

6,338 |

|

|

|

4,168 |

|

|

| Restricted cash |

|

|

105 |

|

|

|

56 |

|

|

| Marketable

securities |

|

|

242 |

|

|

|

517 |

|

|

| Escrows and acquisition

deposits |

|

|

9,116 |

|

|

|

6,620 |

|

|

| Accrued rents and

accounts receivable, net of allowance for doubtful accounts |

|

|

22,212 |

|

|

|

19,951 |

|

|

| Unamortized lease

commissions and loan costs |

|

|

8,397 |

|

|

|

8,083 |

|

|

| Prepaid expenses and

other assets |

|

|

3,448 |

|

|

|

2,762 |

|

|

| Total

assets |

|

$ |

1,070,148 |

|

|

$ |

855,209 |

|

|

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

| Liabilities: |

|

|

|

|

|

| Notes

payable |

|

$ |

662,675 |

|

|

$ |

544,020 |

|

|

| Accounts

payable and accrued expenses |

|

|

35,041 |

|

|

|

28,692 |

|

|

| Tenants'

security deposits |

|

|

6,746 |

|

|

|

6,125 |

|

|

| Dividends

and distributions payable |

|

|

11,401 |

|

|

|

8,729 |

|

|

| Total

liabilities |

|

|

715,863 |

|

|

|

587,566 |

|

|

| Commitments and

contingencies: |

|

|

— |

|

|

|

— |

|

|

| Equity: |

|

|

|

|

|

| Preferred

shares, $0.001 par value per share; 50,000,000 shares authorized;

none issued and outstanding as ofSeptember 30, 2017 and December

31, 2016, respectively |

|

|

— |

|

|

|

— |

|

|

| Common

shares, $0.001 par value per share; 400,000,000 shares authorized;

38,524,480 and 29,468,563 issued andoutstanding as of September 30,

2017 and December 31, 2016, respectively |

|

|

38 |

|

|

|

29 |

|

|

|

Additional paid-in capital |

|

|

509,774 |

|

|

|

396,494 |

|

|

|

Accumulated deficit |

|

|

(167,397 |

) |

|

|

(141,695 |

) |

|

|

Accumulated other comprehensive gain |

|

|

1,004 |

|

|

|

859 |

|

|

| Total

Whitestone REIT shareholders' equity |

|

|

343,419 |

|

|

|

255,687 |

|

|

| Noncontrolling

interests: |

|

|

|

|

|

|

Redeemable operating partnership units |

|

|

11,002 |

|

|

|

11,941 |

|

|

|

Noncontrolling interest in Consolidated Partnership |

|

|

(136 |

) |

|

|

15 |

|

|

| Total

noncontrolling interests |

|

|

10,866 |

|

|

|

11,956 |

|

|

| Total

equity |

|

|

354,285 |

|

|

|

267,643 |

|

|

| Total

liabilities and equity |

|

$ |

1,070,148 |

|

|

$ |

855,209 |

|

|

| Whitestone REIT and Subsidiaries |

|

| CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME |

|

| (unaudited) |

|

| (in thousands, except per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

| Property

revenues |

|

|

|

|

|

|

|

|

|

| Rental

revenues |

|

$ |

24,891 |

|

|

$ |

19,844 |

|

|

$ |

69,197 |

|

|

$ |

58,915 |

|

|

| Other

revenues |

|

|

8,762 |

|

|

|

5,664 |

|

|

|

22,931 |

|

|

|

17,157 |

|

|

| Total

property revenues |

|

|

33,653 |

|

|

|

25,508 |

|

|

|

92,128 |

|

|

|

76,072 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property

expenses |

|

|

|

|

|

|

|

|

|

| Property

operation and maintenance |

|

|

6,104 |

|

|

|

4,904 |

|

|

|

16,973 |

|

|

|

14,381 |

|

|

| Real

estate taxes |

|

|

5,181 |

|

|

|

3,414 |

|

|

|

13,588 |

|

|

|

10,072 |

|

|

| Total

property expenses |

|

|

11,285 |

|

|

|

8,318 |

|

|

|

30,561 |

|

|

|

24,453 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other expenses

(income) |

|

|

|

|

|

|

|

|

|

| General

and administrative |

|

|

5,581 |

|

|

|

6,218 |

|

|

|

17,598 |

|

|

|

16,467 |

|

|

|

Depreciation and amortization |

|

|

7,247 |

|

|

|

5,449 |

|

|

|

19,936 |

|

|

|

16,362 |

|

|

| Interest

expense |

|

|

6,376 |

|

|

|

4,669 |

|

|

|

17,158 |

|

|

|

14,221 |

|

|

| Interest,

dividend and other investment income |

|

|

(142 |

) |

|

|

(164 |

) |

|

|

(381 |

) |

|

|

(339 |

) |

|

| Total

other expense |

|

|

19,062 |

|

|

|

16,172 |

|

|

|

54,311 |

|

|

|

46,711 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before

gain (loss) on sale or disposal of properties or assets and income

taxes |

|

|

3,306 |

|

|

|

1,018 |

|

|

|

7,256 |

|

|

|

4,908 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision

for income taxes |

|

|

(126 |

) |

|

|

(80 |

) |

|

|

(296 |

) |

|

|

(247 |

) |

|

| Gain on

sale of properties |

|

|

— |

|

|

|

— |

|

|

|

16 |

|

|

|

2,890 |

|

|

| Gain

(loss) on sale or disposal of assets |

|

|

(40 |

) |

|

|

26 |

|

|

|

(135 |

) |

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

|

3,140 |

|

|

|

964 |

|

|

|

6,841 |

|

|

|

7,561 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redeemable operating partnership units |

|

|

84 |

|

|

|

15 |

|

|

|

201 |

|

|

|

131 |

|

|

|

Non-controlling interests in Consolidated Partnership |

|

|

63 |

|

|

|

— |

|

|

|

228 |

|

|

|

— |

|

|

| Less: Net

income attributable to noncontrolling interests |

|

|

147 |

|

|

|

15 |

|

|

|

429 |

|

|

|

131 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

attributable to Whitestone REIT |

|

$ |

2,993 |

|

|

$ |

949 |

|

|

$ |

6,412 |

|

|

$ |

7,430 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Whitestone REIT and Subsidiaries |

|

| CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME |

|

| (unaudited) |

|

| (in thousands, except per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

| Basic Earnings

Per Share: |

|

|

|

|

|

|

|

|

|

| Net income attributable

to common shareholders excluding amounts attributable to unvested

restrictedshares |

|

$ |

0.07 |

|

|

$ |

0.03 |

|

|

$ |

0.18 |

|

|

$ |

0.25 |

|

|

| Diluted

Earnings Per Share: |

|

|

|

|

|

|

|

|

|

| Net income attributable

to common shareholders excluding amounts attributable to unvested

restrictedshares |

|

$ |

0.07 |

|

|

$ |

0.03 |

|

|

$ |

0.17 |

|

|

$ |

0.25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

37,992 |

|

|

|

28,195 |

|

|

|

34,406 |

|

|

|

27,210 |

|

|

|

Diluted |

|

|

38,589 |

|

|

|

29,024 |

|

|

|

35,211 |

|

|

|

28,013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions

declared per common share / OP unit |

|

$ |

0.2850 |

|

|

$ |

0.2850 |

|

|

$ |

0.8550 |

|

|

$ |

0.8550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated

Statements of Comprehensive Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

$ |

3,140 |

|

|

$ |

964 |

|

|

$ |

6,841 |

|

|

$ |

7,561 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

comprehensive gain (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on cash flow hedging activities |

|

|

172 |

|

|

|

1,529 |

|

|

|

124 |

|

|

|

(6,962 |

) |

|

|

Unrealized gain (loss) on available-for-sale marketable

securities |

|

|

(7 |

) |

|

|

(11 |

) |

|

|

26 |

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive

income |

|

|

3,305 |

|

|

|

2,482 |

|

|

|

6,991 |

|

|

|

619 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: Net

income attributable to noncontrolling interests |

|

|

147 |

|

|

|

15 |

|

|

|

429 |

|

|

|

131 |

|

|

| Less:

Comprehensive gain attributable to noncontrolling interests |

|

|

5 |

|

|

|

26 |

|

|

|

5 |

|

|

|

(120 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive

income attributable to Whitestone REIT |

|

$ |

3,153 |

|

|

$ |

2,441 |

|

|

$ |

6,557 |

|

|

$ |

608 |

|

|

| Whitestone REIT and Subsidiaries |

|

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

| (unaudited) |

|

| (in thousands) |

|

|

|

|

Nine Months Ended |

|

| |

|

September 30, |

|

| |

|

|

2017 |

|

|

|

2016 |

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

| Net

income |

|

$ |

6,841 |

|

|

$ |

7,561 |

|

|

| Adjustments to

reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

19,936 |

|

|

|

16,362 |

|

|

|

Amortization of deferred loan costs |

|

|

953 |

|

|

|

1,202 |

|

|

|

Amortization of notes payable discount |

|

|

447 |

|

|

|

241 |

|

|

| Gain on

sale of marketable securities |

|

|

(5 |

) |

|

|

— |

|

|

| Loss

(gain) on sale or disposal of assets and properties |

|

|

119 |

|

|

|

(2,900 |

) |

|

| Bad debt

expense |

|

|

1,442 |

|

|

|

1,298 |

|

|

|

Share-based compensation |

|

|

7,347 |

|

|

|

6,874 |

|

|

| Changes

in operating assets and liabilities: |

|

|

|

|

|

| Escrows

and acquisition deposits |

|

|

(2,496 |

) |

|

|

485 |

|

|

| Accrued

rent and accounts receivable |

|

|

(3,703 |

) |

|

|

(2,802 |

) |

|

|

Unamortized lease commissions |

|

|

(2,196 |

) |

|

|

(2,126 |

) |

|

| Prepaid

expenses and other assets |

|

|

411 |

|

|

|

725 |

|

|

| Accounts

payable and accrued expenses |

|

|

(1,718 |

) |

|

|

261 |

|

|

| Tenants'

security deposits |

|

|

621 |

|

|

|

812 |

|

|

| Net cash

provided by operating activities |

|

|

27,999 |

|

|

|

27,993 |

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

Acquisitions of real estate |

|

|

(124,557 |

) |

|

|

(60,616 |

) |

|

| Additions

to real estate |

|

|

(13,499 |

) |

|

|

(15,362 |

) |

|

| Proceeds

from sales of properties |

|

|

26 |

|

|

|

3,957 |

|

|

| Proceeds

from sales of marketable securities |

|

|

306 |

|

|

|

— |

|

|

| Net cash

used in investing activities |

|

|

(137,724 |

) |

|

|

(72,021 |

) |

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

Distributions paid to common shareholders |

|

|

(29,494 |

) |

|

|

(23,606 |

) |

|

|

Distributions paid to OP unit holders |

|

|

(932 |

) |

|

|

(415 |

) |

|

|

Distributions paid to noncontrolling interest in Consolidated

Partnership |

|

|

(379 |

) |

|

|

— |

|

|

| Proceeds

from issuance of common shares, net of offering costs |

|

|

107,619 |

|

|

|

26,686 |

|

|

| Net

proceeds from credit facility |

|

|

40,600 |

|

|

|

64,000 |

|

|

|

Repayments of notes payable |

|

|

(2,788 |

) |

|

|

(13,552 |

) |

|

| Payments

of loan origination costs |

|

|

(695 |

) |

|

|

— |

|

|

| Change in

restricted cash |

|

|

(49 |

) |

|

|

18 |

|

|

|

Repurchase of common shares |

|

|

(1,987 |

) |

|

|

(2,904 |

) |

|

| Net cash

provided by financing activities |

|

|

111,895 |

|

|

|

50,227 |

|

|

|

|

|

|

|

|

|

| Net increase in cash

and cash equivalents |

|

|

2,170 |

|

|

|

6,199 |

|

|

| Cash and cash

equivalents at beginning of period |

|

|

4,168 |

|

|

|

2,587 |

|

|

| Cash and cash

equivalents at end of period |

|

$ |

6,338 |

|

|

$ |

8,786 |

|

|

|

|

|

|

|

|

|

| Whitestone REIT and Subsidiaries |

|

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

| Supplemental Disclosure |

|

| (unaudited) |

|

| (in thousands) |

|

|

|

|

Nine Months Ended |

|

|

|

|

September 30, |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

| Supplemental

disclosure of cash flow information: |

|

|

|

|

|

| Cash paid

for interest |

|

$ |

16,311 |

|

|

$ |

13,700 |

|

|

| Cash paid

for taxes |

|

|

329 |

|

|

|

284 |

|

|

| Non cash

investing and financing activities: |

|

|

|

|

|

| Disposal

of fully depreciated real estate |

|

$ |

995 |

|

|

$ |

544 |

|

|

| Financed

insurance premiums |

|

$ |

1,115 |

|

|

$ |

1,060 |

|

|

| Value of

shares issued under dividend reinvestment plan |

|

$ |

95 |

|

|

$ |

83 |

|

|

| Value of

common shares exchanged for OP units |

|

$ |

206 |

|

|

$ |

125 |

|

|

| Change in

fair value of available-for-sale securities |

|

$ |

26 |

|

|

$ |

20 |

|

|

| Change in

fair value of cash flow hedge |

|

$ |

124 |

|

|

$ |

(6,962 |

) |

|

|

Acquisition of real estate in exchange for OP units |

|

$ |

— |

|

|

$ |

8,738 |

|

|

|

Reallocation of ownership percentage between parent and

subsidiary |

|

$ |

9 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

| Whitestone REIT and Subsidiaries |

|

| RECONCILIATION OF NON-GAAP

MEASURES |

|

| (in thousands, except per share and per unit

data) |

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

| |

|

September 30, |

|

September 30, |

|

|

FFO AND FFO CORE |

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

| Net income attributable

to Whitestone REIT |

|

$ |

2,993 |

|

|

$ |

949 |

|

|

$ |

6,412 |

|

|

$ |

7,430 |

|

|

|

Adjustments to reconcile to FFO:(1) |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization of real estate assets |

|

|

7,015 |

|

|

|

5,405 |

|

|

|

19,255 |

|

|

|

16,195 |

|

|

| (Gain)

loss on sale or disposal of assets and properties |

|

|

37 |

|

|

|

(26 |

) |

|

|

114 |

|

|

|

(2,900 |

) |

|

| Net

income attributable to exchangeable operating partnership

units |

|

|

84 |

|

|

|

15 |

|

|

|

201 |

|

|

|

131 |

|

|

| FFO |

|

|

10,129 |

|

|

|

6,343 |

|

|

|

25,982 |

|

|

|

20,856 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjustments to

reconcile to FFO Core: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

|

2,704 |

|

|

|

3,042 |

|

|

|

7,545 |

|

|

|

6,886 |

|

|

|

Acquisition costs |

|

|

264 |

|

|

|

427 |

|

|

|

1,398 |

|

|

|

990 |

|

|

| FFO Core |

|

$ |

13,097 |

|

|

$ |

9,812 |

|

|

$ |

34,925 |

|

|

$ |

28,732 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO PER SHARE AND OP UNIT CALCULATION |

|

|

|

|

|

|

|

|

|

|

Numerator: |

|

|

|

|

|

|

|

|

|

| FFO |

|

$ |

10,129 |

|

|

$ |

6,343 |

|

|

$ |

25,982 |

|

|

$ |

20,856 |

|

|

|

Distributions paid on unvested restricted common shares |

|

|

(148 |

) |

|

|

(146 |

) |

|

|

(344 |

) |

|

|

(498 |

) |

|

| FFO

excluding amounts attributable to unvested restricted common

shares |

|

$ |

9,981 |

|

|

$ |

6,197 |

|

|

$ |

25,638 |

|

|

$ |

20,358 |

|

|

| FFO Core

excluding amounts attributable to unvested restricted common

shares |

|

$ |

12,949 |

|

|

$ |

9,666 |

|

|

$ |

34,581 |

|

|

$ |

28,234 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Denominator: |

|

|

|

|

|

|

|

|

|

| Weighted

average number of total common shares - basic |

|

|

37,992 |

|

|

|

28,195 |

|

|

|

34,406 |

|

|

|

27,210 |

|

|

| Weighted

average number of total noncontrolling OP units - basic |

|

|

1,084 |

|

|

|

487 |

|

|

|

1,090 |

|

|

|

488 |

|

|

| Weighted

average number of total common shares and noncontrolling OP units -

basic |

|

|

39,076 |

|

|

|

28,682 |

|

|

|

35,496 |

|

|

|

27,698 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of

dilutive securities: |

|

|

|

|

|

|

|

|

|

| Unvested

restricted shares |

|

|

597 |

|

|

|

829 |

|

|

|

805 |

|

|

|

803 |

|

|

| Weighted

average number of total common shares and noncontrolling OP units -

diluted |

|

|

39,673 |

|

|

|

29,511 |

|

|

|

36,301 |

|

|

|

28,501 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| FFO per common share

and OP unit - basic |

|

$ |

0.26 |

|

|

$ |

0.22 |

|

|

$ |

0.72 |

|

|

$ |

0.73 |

|

|

| FFO per common share

and OP unit - diluted |

|

$ |

0.25 |

|

|

$ |

0.21 |

|

|

$ |

0.71 |

|

|

$ |

0.71 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| FFO Core per common

share and OP unit - basic |

|

$ |

0.33 |

|

|

$ |

0.34 |

|

|

$ |

0.97 |

|

|

$ |

1.02 |

|

|

| FFO Core per common

share and OP unit - diluted |

|

$ |

0.33 |

|

|

$ |

0.33 |

|

|

$ |

0.95 |

|

|

$ |

0.99 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Includes pro-rata

share attributable to Pillarstone OP in 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Whitestone REIT and Subsidiaries |

|

| RECONCILIATION OF NON-GAAP

MEASURES |

|

| (in thousands, except per share and per unit

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

| |

|

September 30, |

|

September 30, |

|

| |

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

PROPERTY NET OPERATING INCOME |

|

|

|

|

|

|

|

|

|

| Net income attributable

to Whitestone REIT |

|

$ |

2,993 |

|

|

$ |

949 |

|

|

$ |

6,412 |

|

|

$ |

7,430 |

|

|

| General

and administrative expenses |

|

|

5,581 |

|

|

|

6,218 |

|

|

|

17,598 |

|

|

|

16,467 |

|

|

|

Depreciation and amortization |

|

|

7,247 |

|

|

|

5,449 |

|

|

|

19,936 |

|

|

|

16,362 |

|

|

| Interest

expense |

|

|

6,376 |

|

|

|

4,669 |

|

|

|

17,158 |

|

|

|

14,221 |

|

|

| Interest,

dividend and other investment income |

|

|

(142 |

) |

|

|

(164 |

) |

|

|

(381 |

) |

|

|

(339 |

) |

|

| Provision

for income taxes |

|

|

126 |

|

|

|

80 |

|

|

|

296 |

|

|

|

247 |

|

|

| Gain on

sale of properties |

|

|

— |

|

|

|

— |

|

|

|

(16 |

) |

|

|

(2,890 |

) |

|

| (Gain)

loss on disposal of assets |

|

|

40 |

|

|

|

(26 |

) |

|

|

135 |

|

|

|

(10 |

) |

|

| Net

income attributable to noncontrolling interests |

|

|

147 |

|

|

|

15 |

|

|

|

429 |

|

|

|

131 |

|

|

| NOI |

|

$ |

22,368 |

|

|

$ |

17,190 |

|

|

$ |

61,567 |

|

|

$ |

51,619 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact Whitestone REIT:Kevin

ReedDirector of Investor Relations(713)

435-2219kreed@whitestonereit.com

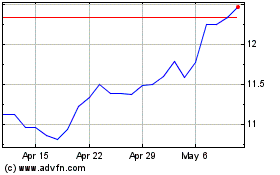

Whitestone REIT (NYSE:WSR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Whitestone REIT (NYSE:WSR)

Historical Stock Chart

From Apr 2023 to Apr 2024