Third Quarter Highlights:

Oil States International, Inc. (NYSE:OIS) reported a net loss for

the third quarter 2017 of $15.0 million, or $0.30 per diluted

share, which included pre-tax charges of $0.4 million

($0.3 million after-tax, or $0.01 per diluted share) for

severance and other downsizing charges and $1.0 million of

additional tax expense ($0.02 per diluted share) due to the

decision to carryback 2016 net operating losses against taxable

income reported in 2014. These results compare to a reported net

loss for the third quarter of 2016 of $10.8 million, or $0.22

per diluted share, which included pre-tax charges of

$2.0 million ($1.3 million after-tax, or $0.03 per

diluted share) of severance and other downsizing charges.

During the third quarter of 2017, the Company

generated revenues of $164.0 million and Adjusted Consolidated

EBITDA (Note B) of $9.2 million (excluding $0.4 million

of severance and other downsizing charges). These results compare

to revenues of $179.0 million and Adjusted Consolidated EBITDA

of $16.2 million reported in the third quarter of 2016

(excluding $2.0 million of severance and other downsizing

charges).

Oil States’ President and Chief Executive

Officer, Cindy B. Taylor, stated, “Our third quarter results were

adversely affected by Hurricane Harvey which caused widespread

damage and logistical challenges in Houston and the surrounding

region where we operate five manufacturing facilities and employ

about 500 individuals. We were impacted by lower revenues and

under-absorption of manufacturing facility costs primarily in the

offshore/manufactured products segment but we also suffered some

field-level downtime due to employee dislocations resulting from

the storm. One of our Houston facilities experienced significant

flooding and is not yet operational but was fully insured. Project

work in that facility has been shifted to other manufacturing

locations to meet customer delivery requirements.

"Despite transitory impacts from Hurricane

Harvey, our U.S. land completion services revenues increased 6%

sequentially, in-line with growth in the third quarter average U.S.

rig count. Historically low levels of deepwater spending continued

to impact our offshore/manufactured products segment with limited

industry award activity during the third quarter. However, we were

able to maintain a quarterly book-to-bill ratio of 0.99x. ”

For the first nine months of 2017, the Company

reported revenues of $486.9 million and Adjusted Consolidated

EBITDA of $25.0 million (excluding $2.0 million of

severance and other downsizing charges). The net loss for the first

nine months of 2017 totaled $47.0 million and included

$2.0 million ($1.5 million after-tax, or $0.03 per

diluted share) of severance and other downsizing charges and

$1.0 million of additional tax expense ($0.02 per diluted

share) due to the decision to carryback 2016 net operating losses

against taxable income reported in 2014. For the first nine months

of 2016, the Company reported revenues of $524.5 million and

Adjusted Consolidated EBITDA of $41.9 million (excluding

$4.6 million of severance and other downsizing charges). The

net loss for the first nine months of 2016 totaled

$35.8 million and included $4.6 million

($2.9 million after-tax, or $0.06 per diluted share) of

severance and other downsizing charges.

BUSINESS SEGMENT RESULTS(See Segment Data

Tables)

Well Site ServicesWell site services generated

revenues of $77.2 million and Segment EBITDA of

$7.1 million in the third quarter of 2017 compared to revenues

and a Segment EBITDA loss of $46.4 million and

$3.1 million, respectively, in the third quarter of

2016. Well site services revenues and Segment EBITDA

increased 67% and 329%, respectively, due to a 31% year-over-year

increase in the number of completion services job tickets coupled

with a 20% year-over-year increase in revenue per completion

services job as a result of increased activity and a more favorable

job mix. Adjusted Segment EBITDA margins (Note A) averaged 9% and

(5)% after excluding severance and other downsizing charges in the

third quarters of 2017 and 2016, respectively. Improved utilization

in the land drilling business, which averaged 34% in the third

quarter of 2017 compared to only 15% in the third quarter of 2016,

also positively impacted the segment’s results.

Offshore/Manufactured

ProductsOffshore/manufactured products generated revenues and

Segment EBITDA of $86.9 million and $13.8 million,

respectively, in the third quarter of 2017 compared to revenues of

$132.7 million and Segment EBITDA of $29.5 million in the

third quarter of 2016. Revenues and Segment EBITDA decreased 35%

and 53% year-over-year, respectively, due to lower contributions

across most of the segment’s product and service lines,

particularly those tied to major deepwater project sanctions. Lower

major project revenues were partially offset by a 59% improvement

in sales of our shorter-cycle products (elastomer and valve

products), which continued to benefit from expanded U.S. land-based

activity. Segment EBITDA margin was 16% in the third quarter of

2017 compared to a margin of 22% realized in the third quarter of

2016. Third quarter 2016 margins benefited from the larger number

of major projects in process or nearing completion during the

period. Backlog totaled $198 million at September 30,

2017 compared to $202 million at June 30, 2017 and $199 million

reported at December 31, 2016.

Income TaxesThe Company recognized an effective

tax rate benefit of 21.1% in the third quarter of 2017 compared to

an effective tax rate benefit of 35.8% in the third quarter of

2016. The lower effective tax rate benefit in the third quarter of

2017 was primarily attributable to a shift in the mix between

domestic pre-tax losses and foreign pre-tax income compared to the

prior-year period and additional valuation allowances provided

against deferred tax assets recorded in certain domestic and

foreign jurisdictions. Further, the Company recorded

$1.0 million of additional tax expense due to the decision to

carryback 2016 net operating losses against taxable income reported

in 2014, which will result in the loss of certain previously

claimed deductions.

Financial ConditionAs of September 30, 2017,

$15.6 million was outstanding under the Company’s revolving

credit facility, while cash on hand totaled $65.9 million.

Total availability under the facility as of September 30, 2017 was

$146.5 million (net of standby letters of credit totaling

$21.6 million), which is less than the full amount of the

facility due to limitations imposed by the maintenance covenant of

3.25 times trailing twelve months Consolidated EBITDA, adjusted for

certain non-cash items.

Conference Call InformationThe call is scheduled

for Friday, October 27, 2017 at 10:30 am ET, and is being webcast

and can be accessed from the Company’s website at

www.ir.oilstatesintl.com. Participants may also join the conference

call by dialing (800) 446-1671 in the United States or by dialing

+1 847 413 3362 internationally and using the passcode 45846163. A

replay of the conference call will be available one and a half

hours after the completion of the call by dialing (888) 843-7419 in

the United States or by dialing +1 630 652 3042 internationally and

entering the passcode 45846163.

About Oil StatesOil States International, Inc.

is a global oilfield products and services company serving the

drilling, completions, subsea, production and infrastructure

sectors of the oil and gas industry. The Company’s manufactured

products include highly engineered capital equipment as well as

products consumed in the drilling, well construction and production

of oil and gas. The Company is also a leading provider of

completion services to the industry. Oil States is headquartered in

Houston, Texas with manufacturing and service facilities

strategically located across the globe. Oil States is publicly

traded on the New York Stock Exchange under the symbol “OIS”.

For more information on the Company, please

visit Oil States International’s website at

www.oilstatesintl.com.

Forward Looking StatementsThe foregoing contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. Forward-looking statements are those that do not state

historical facts and are, therefore, inherently subject to risks

and uncertainties. The forward-looking statements included therein

are based on then current expectations and entail various risks and

uncertainties that could cause actual results to differ materially

from those forward-looking statements. Such risks and uncertainties

include, among other things, risks associated with the general

nature of the energy service industry and other factors discussed

in the "Business" and "Risk Factors" sections of the Form 10-K for

the year ended December 31, 2016 filed by Oil States with the

Securities and Exchange Commission on February 17, 2017.

| OIL STATES INTERNATIONAL, INC. AND

SUBSIDIARIESUNAUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS(In Thousands, Except Per Share Amounts) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Revenues: |

|

|

|

|

|

|

|

|

Products |

$ |

67,339 |

|

|

$ |

109,312 |

|

|

$ |

223,269 |

|

|

$ |

323,566 |

|

|

Service |

96,709 |

|

|

69,694 |

|

|

263,648 |

|

|

200,944 |

|

| |

164,048 |

|

|

179,006 |

|

|

486,917 |

|

|

524,510 |

|

| |

|

|

|

|

|

|

|

| Costs and

expenses: |

|

|

|

|

|

|

|

| Product

costs |

50,593 |

|

|

75,345 |

|

|

160,252 |

|

|

227,855 |

|

| Service

costs |

78,596 |

|

|

60,421 |

|

|

219,697 |

|

|

173,125 |

|

| Selling,

general and administrative expense |

26,843 |

|

|

30,388 |

|

|

84,055 |

|

|

90,854 |

|

|

Depreciation and amortization expense |

26,788 |

|

|

29,848 |

|

|

82,552 |

|

|

89,666 |

|

| Other

operating (income) expense, net |

(589 |

) |

|

(1,370 |

) |

|

374 |

|

|

(4,098 |

) |

| |

182,231 |

|

|

194,632 |

|

|

546,930 |

|

|

577,402 |

|

| Operating loss |

(18,183 |

) |

|

(15,626 |

) |

|

(60,013 |

) |

|

(52,892 |

) |

| |

|

|

|

|

|

|

|

| Interest expense |

(1,147 |

) |

|

(1,364 |

) |

|

(3,370 |

) |

|

(4,124 |

) |

| Interest income |

73 |

|

|

119 |

|

|

243 |

|

|

321 |

|

| Other income |

207 |

|

|

32 |

|

|

477 |

|

|

462 |

|

| Loss from continuing

operations before income taxes |

(19,050 |

) |

|

(16,839 |

) |

|

(62,663 |

) |

|

(56,233 |

) |

| Income tax benefit |

4,019 |

|

|

6,021 |

|

|

15,708 |

|

|

20,474 |

|

| Net loss from

continuing operations |

(15,031 |

) |

|

(10,818 |

) |

|

(46,955 |

) |

|

(35,759 |

) |

| Net loss from

discontinued operations, net of tax |

— |

|

|

— |

|

|

— |

|

|

(4 |

) |

| Net loss attributable

to Oil States |

$ |

(15,031 |

) |

|

$ |

(10,818 |

) |

|

$ |

(46,955 |

) |

|

$ |

(35,763 |

) |

| |

|

|

|

|

|

|

|

| Basic net loss per

share attributable to Oil States from: |

|

|

|

|

|

|

|

|

Continuing operations |

$ |

(0.30 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.94 |

) |

|

$ |

(0.71 |

) |

|

Discontinued operations |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Net

loss |

$ |

(0.30 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.94 |

) |

|

$ |

(0.71 |

) |

| |

|

|

|

|

|

|

|

| Diluted net loss per

share attributable to Oil States from: |

|

|

|

|

|

|

|

|

Continuing operations |

$ |

(0.30 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.94 |

) |

|

$ |

(0.71 |

) |

|

Discontinued operations |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Net

loss |

$ |

(0.30 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.94 |

) |

|

$ |

(0.71 |

) |

| |

|

|

|

|

|

|

|

| Weighted average number

of common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

49,978 |

|

|

50,222 |

|

|

50,190 |

|

|

50,158 |

|

|

Diluted |

49,978 |

|

|

50,222 |

|

|

50,190 |

|

|

50,158 |

|

| OIL STATES INTERNATIONAL, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(In Thousands) |

| |

| |

September 30, 2017 |

|

December 31, 2016 |

| |

(Unaudited) |

|

|

|

ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and

cash equivalents |

$ |

65,864 |

|

|

$ |

68,800 |

|

| Accounts

receivable, net |

210,218 |

|

|

234,513 |

|

|

Inventories, net |

173,447 |

|

|

175,490 |

|

| Prepaid

expenses and other current assets |

26,464 |

|

|

11,174 |

|

| Total

current assets |

475,993 |

|

|

489,977 |

|

| |

|

|

|

| Property, plant, and

equipment, net |

508,743 |

|

|

553,402 |

|

| Goodwill, net |

268,917 |

|

|

263,369 |

|

| Other intangible

assets, net |

50,105 |

|

|

52,746 |

|

| Other noncurrent

assets |

25,597 |

|

|

24,404 |

|

| Total

assets |

$ |

1,329,355 |

|

|

$ |

1,383,898 |

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current

liabilities: |

|

|

|

| Current

portion of long-term debt and capitalized leases |

$ |

492 |

|

|

$ |

538 |

|

| Accounts

payable |

44,768 |

|

|

34,207 |

|

| Accrued

liabilities |

47,632 |

|

|

45,333 |

|

| Income

taxes payable |

1,031 |

|

|

5,839 |

|

| Deferred

revenue |

22,588 |

|

|

21,315 |

|

| Total

current liabilities |

116,511 |

|

|

107,232 |

|

| |

|

|

|

| Long-term debt and

capitalized leases (1) |

19,061 |

|

|

45,388 |

|

| Deferred income

taxes |

4,592 |

|

|

5,036 |

|

| Other noncurrent

liabilities |

22,914 |

|

|

21,935 |

|

| Total

liabilities |

163,078 |

|

|

179,591 |

|

| |

|

|

|

| Stockholders’

equity: |

|

|

|

| Common

stock |

627 |

|

|

623 |

|

|

Additional paid-in capital |

748,581 |

|

|

731,562 |

|

| Retained

earnings |

1,086,518 |

|

|

1,133,473 |

|

|

Accumulated other comprehensive loss |

(56,810 |

) |

|

(70,300 |

) |

| Treasury

stock |

(612,639 |

) |

|

(591,051 |

) |

| Total

stockholders’ equity |

1,166,277 |

|

|

1,204,307 |

|

| Total

liabilities and stockholders’ equity |

$ |

1,329,355 |

|

|

$ |

1,383,898 |

|

(1) As of September 30, 2017, the Company had

$146.5 million available under its revolving credit facility

(net of standby letters of credit totaling $21.6 million),

which is less than the full amount of the facility due to the

maintenance covenant of 3.25 times trailing twelve months

Consolidated EBITDA, adjusted for certain non-cash items.

| OIL STATES INTERNATIONAL, INC. AND

SUBSIDIARIESUNAUDITED CONSOLIDATED STATEMENTS OF

CASH FLOWS(In Thousands) |

| |

| |

Nine Months Ended September 30, |

| |

2017 |

|

2016 |

| Cash flows from

operating activities: |

|

|

|

| Net

loss |

$ |

(46,955 |

) |

|

$ |

(35,763 |

) |

|

Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

| Loss from

discontinued operations |

— |

|

|

4 |

|

|

Depreciation and amortization |

82,552 |

|

|

89,666 |

|

|

Stock-based compensation expense |

17,023 |

|

|

15,938 |

|

| Deferred

income tax benefit |

(2,224 |

) |

|

(28,264 |

) |

| Provision

for bad debt |

257 |

|

|

759 |

|

| Gain on

disposals of assets |

(526 |

) |

|

(445 |

) |

|

Amortization of deferred financing costs |

608 |

|

|

585 |

|

| Other,

net |

62 |

|

|

689 |

|

| Changes

in operating assets and liabilities, net of effect from acquired

businesses: |

|

|

|

| Accounts

receivable |

26,909 |

|

|

68,193 |

|

|

Inventories |

5,912 |

|

|

15,600 |

|

| Accounts

payable and accrued liabilities |

11,811 |

|

|

(18,588 |

) |

| Income

taxes payable |

(4,789 |

) |

|

(2,987 |

) |

| Other

operating assets and liabilities, net |

(14,323 |

) |

|

2,392 |

|

| Net cash

flows provided by continuing operating activities |

76,317 |

|

|

107,779 |

|

| Net cash

flows used in discontinued operating activities |

— |

|

|

3 |

|

| Net cash

flows provided by operating activities |

76,317 |

|

|

107,782 |

|

| |

|

|

|

| Cash flows from

investing activities: |

|

|

|

| Capital

expenditures |

(20,331 |

) |

|

(23,893 |

) |

|

Acquisitions of businesses |

(12,859 |

) |

|

— |

|

| Proceeds

from disposition of property, plant and equipment |

1,125 |

|

|

1,026 |

|

| Other,

net |

(631 |

) |

|

(1,534 |

) |

| Net cash

flows used in investing activities |

(32,696 |

) |

|

(24,401 |

) |

| |

|

|

|

| Cash flows from

financing activities: |

|

|

|

| Revolving

credit facility borrowings (repayments), net |

(26,578 |

) |

|

(59,731 |

) |

| Debt and

capital lease repayments |

(403 |

) |

|

(398 |

) |

| Purchase

of treasury stock |

(16,283 |

) |

|

— |

|

| Issuance

of common stock from stock-based payment arrangements |

— |

|

|

367 |

|

| Shares

added to treasury stock as a result of net share settlements due to

vesting of restricted stock |

(5,305 |

) |

|

(3,950 |

) |

| Net cash

flows used in financing activities |

(48,569 |

) |

|

(63,712 |

) |

| |

|

|

|

| Effect of exchange rate

changes on cash and cash equivalents |

2,012 |

|

|

(1,852 |

) |

| Net change in cash and

cash equivalents |

(2,936 |

) |

|

17,817 |

|

| Cash and cash

equivalents, beginning of period |

68,800 |

|

|

35,973 |

|

| |

|

|

|

| Cash and cash

equivalents, end of period |

$ |

65,864 |

|

|

$ |

53,790 |

|

| OIL STATES INTERNATIONAL, INC. AND

SUBSIDIARIESSEGMENT DATA(In

Thousands)(unaudited) |

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

|

Revenues: |

|

|

|

|

|

|

|

| Well Site

Services - |

|

|

|

|

|

|

|

|

Completion Services |

$ |

61,015 |

|

|

$ |

38,975 |

|

|

$ |

167,577 |

|

|

$ |

116,748 |

|

| Drilling

Services |

16,162 |

|

|

7,375 |

|

|

39,120 |

|

|

14,016 |

|

| Total

Well Site Services |

77,177 |

|

|

46,350 |

|

|

206,697 |

|

|

130,764 |

|

|

Offshore/Manufactured Products - |

|

|

|

|

|

|

|

|

Project-driven products |

22,698 |

|

|

76,541 |

|

|

89,615 |

|

|

234,440 |

|

|

Short-cycle products |

37,781 |

|

|

23,766 |

|

|

110,872 |

|

|

63,033 |

|

| Other

products and services |

26,392 |

|

|

32,349 |

|

|

79,733 |

|

|

96,273 |

|

| Total

Offshore/Manufactured Products |

86,871 |

|

|

132,656 |

|

|

280,220 |

|

|

393,746 |

|

| Total revenues |

$ |

164,048 |

|

|

$ |

179,006 |

|

|

$ |

486,917 |

|

|

$ |

524,510 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Operating

income (loss): |

|

|

|

|

|

|

|

| Well Site

Services - |

|

|

|

|

|

|

|

|

Completion Services (1,2) |

$ |

(9,933 |

) |

|

$ |

(20,450 |

) |

|

$ |

(38,960 |

) |

|

$ |

(66,251 |

) |

| Drilling

Services (2) |

(3,235 |

) |

|

(5,641 |

) |

|

(11,239 |

) |

|

(19,697 |

) |

| Total

Well Site Services |

(13,168 |

) |

|

(26,091 |

) |

|

(50,199 |

) |

|

(85,948 |

) |

|

Offshore/Manufactured Products (1,2) |

7,334 |

|

|

22,867 |

|

|

27,460 |

|

|

67,854 |

|

|

Corporate |

(12,349 |

) |

|

(12,402 |

) |

|

(37,274 |

) |

|

(34,798 |

) |

| Total operating

loss |

$ |

(18,183 |

) |

|

$ |

(15,626 |

) |

|

$ |

(60,013 |

) |

|

$ |

(52,892 |

) |

| OIL STATES INTERNATIONAL, INC. AND

SUBSIDIARIESRECONCILIATION OF GAAP TO NON-GAAP

FINANCIAL INFORMATION – SEGMENT EBITDA AND ADJUSTED SEGMENT EBITDA

(A)(In Thousands)(unaudited) |

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Well Site

Services: |

|

|

|

|

|

|

|

|

Completion Services: |

|

|

|

|

|

|

|

| Operating

loss |

$ |

(9,933 |

) |

|

$ |

(20,450 |

) |

|

$ |

(38,960 |

) |

|

$ |

(66,251 |

) |

|

Depreciation and amortization expense |

15,679 |

|

|

17,230 |

|

|

48,400 |

|

|

52,789 |

|

| Other

income (expense) |

133 |

|

|

107 |

|

|

412 |

|

|

618 |

|

|

EBITDA |

5,879 |

|

|

(3,113 |

) |

|

9,852 |

|

|

(12,844 |

) |

| Severance

and other downsizing charges |

175 |

|

|

683 |

|

|

1,077 |

|

|

1,833 |

|

| Adjusted

EBITDA |

$ |

6,054 |

|

|

$ |

(2,430 |

) |

|

$ |

10,929 |

|

|

$ |

(11,011 |

) |

| |

|

|

|

|

|

|

|

|

Drilling Services: |

|

|

|

|

|

|

|

| Operating

loss |

$ |

(3,235 |

) |

|

$ |

(5,641 |

) |

|

$ |

(11,239 |

) |

|

$ |

(19,697 |

) |

|

Depreciation and amortization expense |

4,454 |

|

|

5,629 |

|

|

14,283 |

|

|

18,053 |

|

| Other

income (expense) |

44 |

|

|

— |

|

|

48 |

|

|

1 |

|

|

EBITDA |

1,263 |

|

|

(12 |

) |

|

3,092 |

|

|

(1,643 |

) |

| Severance

and other downsizing charges |

— |

|

|

160 |

|

|

— |

|

|

160 |

|

| Adjusted

EBITDA |

$ |

1,263 |

|

|

$ |

148 |

|

|

$ |

3,092 |

|

|

$ |

(1,483 |

) |

| |

|

|

|

|

|

|

|

| Total Well Site

Services: |

|

|

|

|

|

|

|

| Operating

loss |

$ |

(13,168 |

) |

|

$ |

(26,091 |

) |

|

$ |

(50,199 |

) |

|

$ |

(85,948 |

) |

|

Depreciation and amortization expense |

20,133 |

|

|

22,859 |

|

|

62,683 |

|

|

70,842 |

|

| Other

income (expense) |

177 |

|

|

107 |

|

|

460 |

|

|

619 |

|

| Segment EBITDA |

7,142 |

|

|

(3,125 |

) |

|

12,944 |

|

|

(14,487 |

) |

| Severance

and other downsizing charges |

175 |

|

|

843 |

|

|

1,077 |

|

|

1,993 |

|

| Adjusted Segment

EBITDA |

$ |

7,317 |

|

|

$ |

(2,282 |

) |

|

$ |

14,021 |

|

|

$ |

(12,494 |

) |

| |

|

|

|

|

|

|

|

|

Offshore/Manufactured Products: |

|

|

|

|

|

|

|

| Operating

income |

$ |

7,334 |

|

|

$ |

22,867 |

|

|

$ |

27,460 |

|

|

$ |

67,854 |

|

|

Depreciation and amortization expense |

6,404 |

|

|

6,712 |

|

|

19,091 |

|

|

17,977 |

|

| Other

income (expense) |

30 |

|

|

(75 |

) |

|

17 |

|

|

(157 |

) |

| Segment EBITDA |

13,768 |

|

|

29,504 |

|

|

46,568 |

|

|

85,674 |

|

| Severance

and other downsizing charges |

253 |

|

|

1,104 |

|

|

946 |

|

|

2,635 |

|

| Adjusted Segment

EBITDA |

$ |

14,021 |

|

|

$ |

30,608 |

|

|

$ |

47,514 |

|

|

$ |

88,309 |

|

| |

|

|

|

|

|

|

|

|

Corporate: |

|

|

|

|

|

|

|

| Operating

loss |

$ |

(12,349 |

) |

|

$ |

(12,402 |

) |

|

$ |

(37,274 |

) |

|

$ |

(34,798 |

) |

|

Depreciation and amortization expense |

251 |

|

|

277 |

|

|

778 |

|

|

847 |

|

| Other

income (expense) |

— |

|

|

— |

|

|

— |

|

|

— |

|

| EBITDA |

(12,098 |

) |

|

(12,125 |

) |

|

(36,496 |

) |

|

(33,951 |

) |

| Severance

and other downsizing charges |

— |

|

|

5 |

|

|

— |

|

|

5 |

|

| Adjusted EBITDA |

$ |

(12,098 |

) |

|

$ |

(12,120 |

) |

|

$ |

(36,496 |

) |

|

$ |

(33,946 |

) |

| OIL STATES INTERNATIONAL, INC. AND

SUBSIDIARIESRECONCILIATION OF GAAP TO NON-GAAP

FINANCIAL INFORMATION(In Thousands)(unaudited) |

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

| Net loss from

continuing operations |

$ |

(15,031 |

) |

|

$ |

(10,818 |

) |

|

$ |

(46,955 |

) |

|

$ |

(35,759 |

) |

| Income tax benefit |

(4,019 |

) |

|

(6,021 |

) |

|

(15,708 |

) |

|

(20,474 |

) |

| Depreciation and

amortization expense |

26,788 |

|

|

29,848 |

|

|

82,552 |

|

|

89,666 |

|

| Interest income |

(73 |

) |

|

(119 |

) |

|

(243 |

) |

|

(321 |

) |

| Interest expense |

1,147 |

|

|

1,364 |

|

|

3,370 |

|

|

4,124 |

|

| Consolidated EBITDA

(B) |

8,812 |

|

|

14,254 |

|

|

23,016 |

|

|

37,236 |

|

| |

|

|

|

|

|

|

|

| Adjustments to

Consolidated EBITDA (1,2): |

|

|

|

|

|

|

|

| Severance and other

downsizing charges |

428 |

|

|

1,952 |

|

|

2,023 |

|

|

4,633 |

|

| Adjusted Consolidated

EBITDA (B) |

$ |

9,240 |

|

|

$ |

16,206 |

|

|

$ |

25,039 |

|

|

$ |

41,869 |

|

(1) Operating income (loss) and Consolidated

EBITDA for the three months ended September 30, 2017 included

severance and other downsizing charges of $0.2 million related

to the completion services business and $0.3 million related

to the offshore/manufactured products segment. Operating income

(loss) and Consolidated EBITDA for the nine months ended September

30, 2017 included severance and other downsizing charges of

$1.1 million related to the completion services business and

$0.9 million related to the offshore/manufactured products

segment.

(2) Operating income (loss) and Consolidated

EBITDA for the three months ended September 30, 2016 included

severance and other downsizing charges of $0.7 million related

to the completion services business, $0.2 million related to

the drilling services business and $1.1 million related to the

offshore/manufactured products segment. Operating income (loss) and

Consolidated EBITDA for the nine months ended September 30, 2016

included severance and other downsizing charges of

$1.8 million related to the completion services business,

$0.2 million related to the drilling services business and

$2.6 million related to the offshore/manufactured products

segment.

(A) The terms EBITDA, Adjusted EBITDA, Segment

EBITDA and Adjusted Segment EBITDA consist of operating income

(loss) plus depreciation and amortization expense, and certain

other items. EBITDA, Adjusted EBITDA, Segment EBITDA and

Adjusted Segment EBITDA are not measures of financial performance

under generally accepted accounting principles and should not be

considered in isolation from or as a substitute for operating

income (loss) or cash flow measures prepared in accordance with

generally accepted accounting principles or as a measure of

profitability or liquidity. Additionally, EBITDA, Adjusted

EBITDA, Segment EBITDA and Adjusted Segment EBITDA may not be

comparable to other similarly titled measures of other

companies. The Company has included EBITDA, Adjusted EBITDA,

Segment EBITDA and Adjusted Segment EBITDA as a supplemental

disclosure because its management believes that EBITDA, Adjusted

EBITDA, Segment EBITDA and Adjusted Segment EBITDA provide useful

information regarding its ability to service debt and to fund

capital expenditures and provides investors a helpful measure for

comparing its operating performance with the performance of other

companies that have different financing and capital structures or

tax rates. The Company uses EBITDA, Adjusted EBITDA, Segment

EBITDA and Adjusted Segment EBITDA to compare and to monitor the

performance of its business segments to other comparable public

companies and as a benchmark for the award of incentive

compensation under its annual incentive compensation plan.

The tables above set forth reconciliations of EBITDA, Adjusted

EBITDA, Segment EBITDA and Adjusted Segment EBITDA to operating

income (loss), which is the most directly comparable measure of

financial performance calculated under generally accepted

accounting principles.

(B) The terms Consolidated EBITDA and Adjusted

Consolidated EBITDA consist of net loss from continuing operations

plus net interest expense, taxes, depreciation and amortization

expense, and certain other items. Consolidated EBITDA and

Adjusted Consolidated EBITDA are not measures of financial

performance under generally accepted accounting principles and

should not be considered in isolation from or as a substitute for

net loss from continuing operations or cash flow measures prepared

in accordance with generally accepted accounting principles or as a

measure of profitability or liquidity. Additionally,

Consolidated EBITDA and Adjusted Consolidated EBITDA may not be

comparable to other similarly titled measures of other

companies. The Company has included Consolidated EBITDA and

Adjusted Consolidated EBITDA as a supplemental disclosure because

its management believes that Consolidated EBITDA and Adjusted

Consolidated EBITDA provide useful information regarding its

ability to service debt and to fund capital expenditures and

provides investors a helpful measure for comparing its operating

performance with the performance of other companies that have

different financing and capital structures or tax rates. The

Company uses Consolidated EBITDA and Adjusted Consolidated EBITDA

to compare and to monitor the performance of the Company and its

business segments to other comparable public companies and as a

benchmark for the award of incentive compensation under its annual

incentive compensation plan. The table above sets forth a

reconciliation of Consolidated EBITDA and Adjusted Consolidated

EBITDA to net loss from continuing operations, which is the most

directly comparable measure of financial performance calculated

under generally accepted accounting principles.

| OIL STATES INTERNATIONAL, INC. AND

SUBSIDIARIESADDITIONAL QUARTERLY SEGMENT AND

OPERATING DATA(unaudited) |

| |

| |

Three Months Ended September 30, |

| |

2017 |

|

2016 |

| |

|

|

|

| Supplemental operating

data: |

|

|

|

| Offshore/Manufactured

Products backlog ($ in millions) |

$ |

198.1 |

|

|

$ |

203.0 |

|

| |

|

|

|

| Completion Services job

tickets |

4,970 |

|

|

3,802 |

|

| Average revenue per

ticket ($ in thousands) |

$ |

12.3 |

|

|

$ |

10.3 |

|

| |

|

|

|

| Land drilling operating

statistics: |

|

|

|

| Average rigs

available |

34 |

|

|

34 |

|

| Utilization |

33.6 |

% |

|

15.3 |

% |

| Implied day rate ($ in

thousands per day) |

$ |

15.4 |

|

|

$ |

15.4 |

|

| Implied daily cash

margin ($ in thousands per day) |

$ |

1.6 |

|

|

$ |

0.8 |

|

| |

|

|

|

|

|

|

|

Company Contact:

Lloyd A. HajdikOil States International, Inc.Executive Vice

President, Chief Financial Officer and Treasurer713-652-0582

Patricia GilOil States International,

Inc.Director, Investor Relations713-470-4860

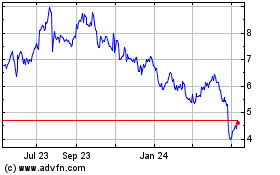

Oil States (NYSE:OIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oil States (NYSE:OIS)

Historical Stock Chart

From Apr 2023 to Apr 2024