RioCan Real Estate Investment Trust Announces Future Redevelopment of Centre RioCan Kirkland

October 26 2017 - 4:00PM

RioCan Real Estate Investment Trust (“RioCan”) (TSX:REI.UN) has

been the owner of Centre RioCan Kirkland (situated in the West

Island of Montreal) since the site was developed in 1999. It

currently consists of 39 acres of land occupied by a new format

retail centre of approximately 320,000 square feet that was at the

end of the previous quarter, 80 % occupied.

RioCan has now received a notice of expropriation from the

Ministry of Transportation of Quebec related to roughly 7 acres of

the site in order to accommodate a major station and parking

facilities as part of Montreal’s Reseau Electrique Metropolitain

(“REM”). Upon estimated completion in 2020, REM will provide

easy and fast access to Montreal’s downtown core, Montreal’s North

and South Shores, West Island and Trudeau Airport. With the

simultaneous road improvements to be undertaken by the City of

Kirkland, the remaining 32 acre parcel will present significant

opportunities for redevelopment and intensification.

In order to ensure that the property is redeveloped to its

highest and best uses, RioCan has entered into an agreement with

Broccolini Real Estate Group Inc. (“Broccolini”), a noted Montreal

based developer, to form a Joint Venture for the purpose of

redeveloping the property over time to become a mixed-use

residential, retail and office complex as part of our focus to

optimize the value of our existing properties to deliver value to

our unitholders and tenants, and meet the evolving needs of the

communities we serve. As part of this agreement, Broccolini

will purchase a 50% interest in the remainder of the Centre

RioCan Kirkland lands and will act as the development manager.

While plans for the new development are still in the process of

discussion between RioCan, Broccolini and the City of Kirkland, it

is expected that the eventual development will contain many times

the existing density on the site.

"This is a prime example of how our locations in Canada’s major

markets are becoming increasingly in demand as municipalities add

new transit infrastructure. Centre RioCan Kirkland is yet another

one of these properties in major market locations that are becoming

sites for, or located near major transit hubs," said Edward

Sonshine CEO of RioCan.

About RioCan

RioCan is Canada’s largest real estate investment trust with a

total enterprise value of approximately $13.9 billion as at June

30, 2017. RioCan owns, manages and develops retail-focused,

increasingly mixed-use properties located in prime, high-density

transit-oriented areas where Canadians want to shop, live and work.

Our portfolio is comprised of 299 properties, including 15

development properties, with an aggregate net leasable area of

approximately 45 million square feet. To learn more about how we

deliver real vision on solid ground, visit www.riocan.com.

About Broccolini

Broccolini is a leading single-source provider of construction,

development and real-estate services, catering to the industrial,

commercial, institutional and residential markets in Canada. Our

organization provides a range of services, acting variously as a

general contractor, construction manager, project manager, property

manager and developer. Broccolini is a 3rd generation family owned

business founded in 1949 with offices in Montreal, Ottawa and

Toronto.

FORWARD LOOKING INFORMATION

This news release contains forward-looking information within

the meaning of applicable Canadian securities laws. This

information includes, but is not limited to, statements concerning

future development potential at Centre RioCan Kirkland, as well as

statements with respect to management’s beliefs, plans, estimates,

and intentions, and similar statements concerning anticipated

future events or expectations that are not historical facts.

Forward-looking information generally can be identified by the use

of forward-looking terminology such as “may”, “will”, “would”,

“expect”, “intend”, “estimate”, “anticipate”, “believe”, “plan”, or

similar expressions suggesting future outcomes or events. Such

forward-looking information reflects management’s current beliefs

and is based on information currently available to management. All

forward-looking information in this News Release is qualified by

these cautionary statements.

Forward-looking information is not a guarantee of future events

or performance and, by its nature, is based on RioCan’s current

estimates and assumptions, which are subject to numerous risks and

uncertainties, as described under “Risks and Uncertainties” in

RioCan's Management's Discussion and Analysis for the period ended

June 30, 2017 ("MD&A") and the Trust’s most recent Annual

Information Form, and including that the transactions contemplated

herein are completed, which could cause actual events or results to

differ materially from the forward-looking information contained in

this News Release. Although the forward looking information

contained in this News Release is based upon what management

believes are reasonable assumptions, there can be no assurance that

actual results will be consistent with these forward-looking

statements. Certain statements included in this News Release may be

considered "financial outlook" for purposes of applicable

securities laws, and such financial outlook may not be appropriate

for purposes other than this News Release.

Except as required by applicable law, RioCan undertakes no

obligation to publicly update or revise any forward-looking

information, whether as a result of new information, future events

or otherwise.

Information Contact:

RioCan Real Estate Investment TrustQi TangSenior Vice President

and Chief Financial Officer416-866-3033

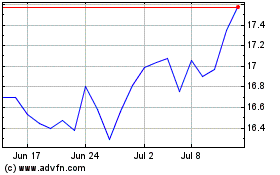

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

From Mar 2024 to Apr 2024

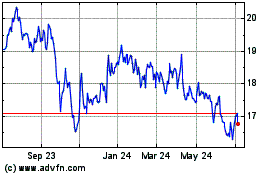

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

From Apr 2023 to Apr 2024