UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant

x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

|

x

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 15a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

o

|

Soliciting Material Pursuant to §240.14a-12

|

|

IGEN NETWORKS CORPORATION

|

|

(Name of Registrant as Specified in Its Charter)

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required.

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)1 and 0-11.

|

|

|

1.

|

Title of each class of securities to which transaction applies: Common

|

|

|

2.

|

Aggregate number of securities to which transaction applies: 63,928,163

|

|

|

3.

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: N/A

|

|

|

4.

|

Proposed Maximum Aggregate Value of Transaction: N/A

|

|

|

5.

|

Total Fee Paid: N/A

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11)a_)2_ and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or Schedule and the date of its filing.

|

|

|

1.

|

Amount Previously Paid:

|

|

|

2.

|

Form, Schedule or Registration Statement No.:

|

|

|

3.

|

Filing Party:

|

|

|

4.

|

Date Filed:

|

IGEN NETWORKS CORPORATION

29970 TECHNOLOGY DRIVE, SUITE 108

MURRIETA, CA 92563

________________________________________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON WEDNESDAY, JANUARY 17, 2018

________________________________________________

Dear Shareholders:

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of IGEN Networks Corporation (the “Company”) for use at the Company's annual meeting of Shareholders, to be held at 10:00 a.m., January 17, 2018, at 29970 Technology Drive, Murrieta, CA 92563, Suite 108 – Board Room, and at any adjournment thereof (the “Meeting”). Shares of capital stock of the Company entitled to vote at the Meeting which are represented by properly executed and dated proxies returned prior to the Meeting will be voted at the meeting in accordance with the specifications thereon. If the proxy is signed without specifying choices, the proxy will be voted

FOR

the proposals contained herein. The proxy also confers discretionary authority on the persons designated therein to vote on other business, not currently contemplated, which may come before the Meeting. Any shareholder giving a proxy has the right to revoke it by giving written notice to the Secretary of the Company or by duly executing and delivering a proxy bearing a later date or by attending the Meeting and giving oral notice to the Secretary at any time prior to the voting.

A complete list of the shareholders entitled to vote at the Meeting, arranged in alphabetical order, and showing the address of each shareholder and the number of shares registered in the name of each shareholder, will be kept open at the offices of the Company at 1075 St. David Street, Victoria, BC V8S 4Y7, Canada, for examination by any shareholder during business hours for a period of ten (10) days immediately prior to the Meeting.

The cost of the solicitation of proxies for the Meeting will be paid by the Company. In addition to the solicitation of proxies by use of the mails, directors, officers, and employees of the Company may solicit proxies personally. The Company will request banks, brokerage houses and other custodians, nominees or fiduciaries holding stock in their names for others to send proxy materials to, and to obtain proxies from, their principals. The cost of preparing, printing, assembling, and mailing the Notice of Annual Meeting, this Proxy statement, the form of proxy enclosed herewith, and any additional material, the cost of forwarding solicitation material to the beneficial owners of stock, and other costs of solicitation are to be borne by the Company.

This Proxy Statement and accompanying form of proxy will first be sent to shareholders on or about November 30, 2017.

An annual meeting of shareholders of IGEN Networks Corporation, a Nevada corporation (the "Company"), will be held on January 17, 2018, at 10:00 a.m. local time, at 29970 Technology Drive, Murrieta, CA 92563, Suite 108 – Board Room, for the following purposes:

1. To elect all members of the Board of Directors.

2. To approve an amendment to the Company’s Certificate of Incorporation for the following purposes:

a) To increase the total number of authorized shares of stock to 385,000,000, for the purpose of creating a new class of preferred stock consisting of 10,000,000 shares, with rights and privileges to be determined by the Board of Directors at a later date.

3. To ratify the appointment of SATURNA GROUP, Chartered Professional Accountants, as our independent registered public accounting firm for our fiscal year ending December 31, 2017.

4. To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

Only shareholders of record at the close of business on November 20, 2017, will be entitled to receive these Proxy Materials and notice of the Annual meeting or any adjournment or postponement thereof.

|

By Order of the Board of Directors,

|

|

|

|

|

|

|

/s/ Neil Chan

|

|

|

|

|

Neil Chan, Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

Date: October 26, 2017

|

|

IGEN NETWORKS CORP.

29970 TECHNOLOGY DRIVE, SUITE 108

MURRIETA, CA 92563

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JANUARY 17, 2018

INTRODUCTION

This Proxy Statement is being furnished to the shareholders of IGEN Networks Corp, a Nevada corporation (the “Company”), to inform them of the annual meeting of shareholders. This meeting (referred to herein as the “Annual Meeting”) will be held January 17, 2018, at the Company’s corporate offices, located at 29970 Technology Drive, Murrieta, CA 92563, Suite 108 – Board Room, at 10:00 a.m. local time. Only shareholders of record at the close of business on November 20, 2017 (the “Record Date”) will be entitled to receive this Proxy Statement and to vote at the Annual Meeting. This Proxy Statement and the Notice of Annual Meeting are first being mailed to the Company’s shareholders on or about December 15, 2017.

At the Annual Meeting, holders of common stock (the “Common Stock”) of the Company will be asked:

1. To elect all members of the Board of Directors.

2. To approve an amendment to the Company’s Certificate of Incorporation for the following purposes:

a) To increase the total number of authorized shares of stock to 385,000,000, for the purpose of creating a new class of preferred stock consisting of 10,000,000 shares, with rights and privileges to be determined by the Board of Directors at a later date.

3. To ratify the appointment of SATURNA GROUP, Charter Professional Accountants, as our independent registered public accounting firm for our fiscal year ending December 31, 2017.

4. To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

The cost of printing and distributing this Proxy Statement and holding the Annual Meeting (including the reimbursement of certain parties for their expenses in forwarding this Proxy Statement to beneficial owners of the Common Stock) will be paid by the Company.

The Company’s principal executive offices are located at 29970 Technology Drive, Suite 108, Murrieta, CA 92563.

INFORMATION REGARDING THE PROPOSALS

GENERAL

The proposal to ratify the adoption of a resolution by the Company’s Board of Directors, to approve an amendment to the Company’s Articles of Incorporation to increase the authorized shares of the Company’s stock and confirm the appointment of the independent public accountants.

PROPOSAL 1

ELECTION OF THE BOARD OF DIRECTORS

As of the Record Date, the Board of Directors consists of three members: Neil Chan, Robert Nealon, and Richard Freeman. The Board of Directors is not re-nominating Richard Freeman to serve, but has nominated Mark Wells. The following names and background information are provided for all persons nominated to serve on the Company’s Board of Directors:

|

Name

|

|

Age

|

|

Position

|

|

Robert Nealon

|

|

61

|

|

Director, Chairman of the Board

|

|

Neil G. Chan

|

|

54

|

|

Director, Chief Executive Officer

|

|

Mark Wells

|

|

|

|

Director

|

Certain biographical information of our directors and officers is set forth below.

Robert Nealon, Chairman of the Board & Director

Mr. Nealon is the Principal Attorney in Nealon & Associates, P.C., which is a Washington, D.C. based law and government relations firm. He has been practicing law for twenty-seven years and has achieved an AV rating from Martindale-Hubbell, the leading rating bureau for the legal profession. Mr. Nealon has a B.A. from University of Rochester (1977) and M.B.A. from Rochester Institute of Technology (1978). He received his Juris Doctorate, magna cum laude, from the University of Bridgeport in 1982 and his Masters of Law in Taxation (L.L.M.) degree from Georgetown University in 1984. He is a member of the bar associations of New York State and Virginia, the American Bar Association and the Federal Bar Association. Mr. Nealon served as Adjunct Instructor of Corporate Law, George Washington University from 1985 until 2005. Mr. Nealon has been lead counsel on hundreds of commercial trials, including multi-million dollar derivative action lawsuits, security fraud and government contract fraud. He has been counsel to hundreds of corporations, including insurance affinity marketing, manufacturing and multiple financial institutions. Mr. Nealon has been active over the years in national politics and government relations.

Mr. Nealon was appointed to the Virginia Small Business Advisory Board by former Virginia Governor Warner and was reappointed to this state board by Governor Kaine through 2010 as its Chairman. Mr. Nealon is Chairman of the George Mason University Advisory Board for the School for Conflict Analysis and Resolution in Arlington, Virginia. He is a former Director of the Alexandria Small Business Development Corporation. He is also an active member of the National Press Club and the Democratic National Club.

Neil G. Chan, Chief Executive Officer & Director

Mr. Chan is a career technologist who has pioneered the early adoption of disruptive technologies in more than 45 countries over the last 30 years. From start-up to $400M in annual revenues, Mr. Chan has led and created the best-in-class sales, marketing, and service organizations during the development of wireless data infrastructure, mobile content, Software-as-a-Service for commercial fleets, and HFC broadband infrastructure. Mr. Chan led the first technology transfer initiative between Canada and Mainland China on behalf of Spar Aerospace and Gandalf Technologies Inc., during the mid-1980s along with training, product marketing and sales responsibilities for growing Gandalf’s export markets; shortly after Mr. Chan was recruited to Motorola Inc., to lead the product marketing of the industry’s first mobile data solutions for public safety, taxi, utility, and field service markets. Mr. Chan led Motorola’s initiative to expand into public data networks throughout the Asia Pacific region during the 1990s and subsequently was promoted to Managing Director to lead the expansion of HFC data and voice broadband networks throughout the region. In the spring of 2000, Mr. Chan joined Airvana Inc., to lead business development for the early adoption of CDMA-based broadband wireless networks which today continue to serve millions of users throughout North America and Latin America. Most recently, Mr. Chan led worldwide sales and marketing of fleet management services for WebTech Wireless Inc., which contributed five years of record growth and industry leadership across government and transportation markets. Mr. Chan has served on the Executive Review Board of Royal Roads University and continues to mentor and support early stage technology companies.

Mark Wells, Director

Mr. Wells is presently the President and CEO of Positioning Universal. During his 25 years of experience in the wireless industry, he has pioneered the development and marketing of wireless products, semiconductor technology and leading edge wireless services. Mr. Wells co-founded DriveOK, which merged with Procon and eventually became Spireon where he led the company during its exceptional growth period in becoming the industry leader of GPS vehicle tracking technologies. Prior to Procon, Mr. Wells was the co-founder and CEO of Zucotto Wireless, where he raised $60M in venture capital to develop wireless semiconductor technologies and secured customers that included Panasonic, Nokia, and Alcatel. Mr. Wells has also held marketing roles with Nokia Mobile Phones and served as Vice President, General Manager at DSP Communications where he managed the $10B revenue mobile phone products division. DSP Communications was eventually sold to Intel for $1.6B. Most recently, Mr. Wells has co-founded and mentored several dozen early-stage technology companies and served as a consultant to Fortune 500 companies.

A vote

FOR

is a vote in favor of electing the nominated Directors until the next Annual Meeting.

Compliance with Section 16(a) of the Exchange Act:

As of the Record Date, the Company is not aware of any director, officer or beneficial owner of more than ten percent of the Company’s common stock, who failed to file on a timely basis reports required by section 16(a) during the most recent fiscal year or prior years.

No Dissenters’ Rights: Pursuant to the Nevada Revised Statutes, the holders of the Company’s Common Stock are not entitled to dissenters’ rights in connection with this Election. Furthermore, the Company does not intend to independently provide those shareholders with any such rights.

PROPOSAL 2

AMENDMENT OF ARTICLES OF INCORPORATION AUTHORIZE A CLASS OF PREFERRED STOCK

The Company is seeking your approval for an amendment to our Articles of Incorporation, which we refer to as the “Stock Amendment,” to increase the number of authorized shares of capital stock that we may issue from 375,000,000 to 385,000,000. The proposed Stock Amendment to be filed with the Secretary of State of Nevada, substantially in the form of

Exhibit A

hereto, will be filed as soon as practical following the Annual Meeting, should the proposal be approved.

Increase in Authorized Shares of Capital Stock

We believe that an increase in the number of our authorized capital stock is prudent in order to assure that a sufficient number of shares of our capital stock is available for issuance in the future if our Board of Directors deems it to be in the best interest of our stockholders and the Company. Our Board of Directors has determined that a total of 385,000,000 shares of capital stock is a reasonable estimate of what might be required in this regard for the foreseeable future to: (i) issue capital stock in acquisition or strategic transactions and other proper corporate purpose that may be identified by our Board in the future; (ii) issue common stock to augment our capital and increase the ownership of our capital stock; (iii) provide incentive through the grant of stock options to employees, directors, officers, and advisors important to our business under a stock option plan.

Additionally, the Board of Directors seeks shareholder approval to designate 10,000,000 of the 385,000,000 authorized shares as Preferred Stock, $0.0001 par value per share. The Preferred Stock may be issued by the Company in the future with such rights, preferences and designations as determined by the Board, without further shareholder action. The Board’s authority to determine the terms of any such shares of Preferred Stock would include, but not be limited to: (i) the designation of each class or series and the number of shares that will constitute each such class or series; (ii) the dividend rate, if any, for each class or series; (iii) the price at which, and the terms and conditions on which the shares of each class or series may be redeemed, if such shares are redeemable; and (iv) the terms and condition, if any, upon which shares of each class or series may be converted into shares of other classes or series of shares of the Company, or other securities. The proposed Preferred Stock shall have such voting rights as determined by our Board.

Immediately following this increase, the Company will have approximately 340,163,114 shares of Common Stock authorized but unissued and available for issuance, and 10,000,000 shares of the newly authorized Preferred Stock authorized but unissued.

The remaining authorized but unissued shares of Common Stock will be available for issuance from time to time as may be deemed advisable or required for various purposes, including those noted above. Our Board of Directors will be able to authorize the issuance of shares for the foregoing purposes and other transactions without the necessity, and related costs and delays of either calling a special stockholders’ meeting or waiting for the Annual Meeting of Stockholders in order to increase the authorized capital. Adoption of the Articles of Amendment and issuance of the additional Preferred Stock authorized thereby will not affect the rights of the holders of our currently outstanding Common Stock, except for effects incidental to any Preferred Stock issued, as discussed above.

If the Preferred Stock Amendment is approved by the Company’s shareholders, the Board of Directors will have the authority to approve the issuance of all or any shares of the Preferred Stock in one or more series, to determine the number of shares constituting any series and to determine any voting powers, conversion rights, dividend rights, and other designations, preferences, limitations, restrictions and rights relating to such shares without any further authorization by the shareholders. The designations, preferences, limitations, restrictions and rights of any series of Preferred Stock designated by the Board of Directors will be set forth in an amendment to the Amended Articles filed in accordance with Nevada law.

The Board of Directors believes the authorization of the Preferred Stock is advisable and in the best interests of the Company and its shareholders in order to facilitate the Company’s ability to raise capital, if and when necessary, and to pursue corporate opportunities, including acquisitions and joint ventures, without the delay and expense associated with obtaining special shareholder approval each time an opportunity requiring the issuance of shares of Preferred Stock may arise. The ability of the Board to determine the rights, preferences and limitations of the Preferred Stock, and the ability to issue the Preferred Stock, each without the need for further shareholder action, would provide the Board with flexibility in connection with possible investment activity and other corporate purposes. The Board of Directors would make a determination as to whether to approve the terms and issuance of any shares of Preferred Stock based on its judgment as to the best interests of the Company and its shareholders.

While the Company may consider issuing Preferred Stock in the future for purposes of raising additional capital or in connection with acquisition transactions or other related corporate transactions, the Company presently has no agreements or understanding with any person to effect any such issuance, and the Company may never issue any Preferred Stock. Therefore, the terms of any Preferred Stock subject to this proposal cannot be stated. However, it is likely that the terms and conditions of any Preferred Stock, as designated in an amendment to the Restated Articles, would include preferences and rights superior to those of the holders of Common Stock. Such terms might include special voting rights, special conversion rights and redemption or other rights which may, among other things, provide the holders of Preferred Stock with a disproportionate share of earnings distributed by way of dividends or of the proceeds of a sale or liquidation of the Company as well as disproportionate rights of approval with respect to certain kinds of transactions, compared to those of the holders of Common Stock.

Potential Anti-Takeover Effect of the Proposed Stock Amendment

The Stock Amendment relating to the increase in the number of authorized shares of our capital stock is not intended to have any anti-takeover effect. However, our stockholders should note that the availability of additional authorized and unissued shares of common stock could make any attempt to gain control of the Company or the Board of Directors more difficult or time-consuming and that the availability of additional authorized and unissued shares might make it more difficult to remove management. Although the Board of Directors currently has no intention of doing so, shares of stock could be issued by the Board of Directors to dilute the percentage of stock owned by any stockholder and increase the cost of, or the number of, voting shares necessary to acquire control of the Board of Directors or to meet the voting requirements imposed by Nevada law with respect to a merger or other business combination involving us. The issuance of preferred stock with voting and conversion rights by our Board of Directors may adversely affect the voting power of the holders of Common Stock, including the loss of voting control to others.

Our Board of Directors did not propose this Stock Amendment for the purpose of discouraging mergers, tender offers, proxy contests, solicitation in opposition to management or other changes in control. We are not aware of any specific effort to accumulate our Common Stock or obtain control of us by means of a merger, tender offer, solicitation or otherwise. We have no present intention to use the increased number of authorized shares of stock for anti-takeover purposes. However, use of shares of Preferred Stock for such a purpose is possible. If shares of Preferred Stock are issued (i) in connection with a shareholder rights plan, also known as a “poison pill” plan, or (ii) to purchasers supporting the Board of Directors in opposing a specific takeover proposal, such issuance could have the effect of delaying or preventing a change of control of the Company by increasing the number of outstanding shares entitled to vote and by increasing the number of votes required to approve a change of control of the Company. In addition, the existence of authority of the Board of Directors to issue Preferred Stock, given the “blank check” authority that will be vested in the Board of Directors, may have the effect of discouraging a challenge for control or making it less likely that such a challenge, if attempted, would be successful. However, the Board of Directors does not believe that the approval of this proposal will have an anti-takeover effect and that the financial flexibility afforded by the Preferred Stock Amendment outweighs any potential disadvantages.

Potential Future Dilution

If this proposal is approved, the additional authorized shares of Preferred Stock may be issued for such consideration, cash or otherwise, at such times and in such amounts as our Board of Directors may determine without further shareholder approval, except to the extent that shareholder approval is required by applicable laws, rules or regulations.

The authorized share increase will not change the number of shares of stock outstanding, nor will it have any immediate dilutive effect or change the rights of current holders of our Common Stock. However, to the extent that the additional authorized shares are issued in the future, they may dilute the percentage equity ownership of existing shareholders, and, depending on the price at which they are issued, may also dilute earnings and book value on a per share basis.

Voting Rights

The issuance of Preferred Stock may or may not have a dilutive effect on the voting rights of shareholders owning Common Stock, depending on the rights and preferences set by the Board. If the Board sets preferred rights for a series of preferred shares that include super voting rights, where shareholders owning Preferred Stock have voting rights greater per share than those shareholders owning Common Stock, the voting rights of Common Stock shareholders will be diluted. The Board has no present plans to designate of issue Preferred Stock.

Appraisal Rights

Dissenting stockholders do not have appraisal rights under Nevada state law or under the Company’s Articles of Incorporation or Bylaws in connection with the increase of the authorized capital stock.

Effectiveness of Stock Amendment

The Stock Amendment will become effective once it is approved at the annual meeting and filed with the Secretary of State of Nevada. Upon filing the Stock Amendment with the Secretary of State of Nevada, our authorized shares of capital stock will increase from 375,000,000 to 385,000,000.

Required Vote

The approval of the Amendment authorizing the increase of our authorized capital stock and the creation of Preferred Stock will require the affirmative vote of the holders of a majority of the Company’s outstanding shares of Common Stock entitled to vote, in person or by proxy, provided a quorum is present.

A vote

FOR

is a vote in favor of amending the Company’s Articles of Incorporation to increase the authorized shares of Common Stock to 385,000,000, and to authorize the issuance of Preferred Stock.

PROPOSAL 3

NOMINATION

OF SATURNA GROUP CHARTERED PROFESSIONAL ACCOUNTANTS AS THE COMPANY’S INDEPENDENT AUDITORS FOR THE COMING YEAR

The Company’s Board of Directors has selected SATURNA GROUP Chartered Professional Accountants, to serve as the Company’s independent auditors for all audit work associated with the preparation of the Company’s financial statements during the year ending December 31, 2017. The Board of Directors has determined that the Company’s auditors for the year ending December 31, 2017, are suitably independent, and are well versed in Generally Accepted Accounting Practices and securities reporting requirements. The Company does not expect a representative of SATURNA GROUP to attend the Shareholder Meeting.

Audit Fees:

The Company was billed $33,000 CDN for the audit of its annual financial statements for the year ended December 31, 2016.

Financial Information Systems Design and Implementation Fees

: The Company has paid $0.00 for directly or indirectly operating, or supervising the operation of, the Company’s information system or managing the Company’s local area network; order signing or implementing a hardware or software system that aggregates source data underlying the financial statements or generates information that is significant to the Company’s financial statements taken as a whole.

Audit Related Fees

. The Company has paid $4500 CDN for professional services that are reasonably related to the performance of the audit or review of our financial statements, but are not reported under “Audit Fees.”

All other fees

: Fees paid for services not previously described totaled: $0.00.

No Dissenters’ Rights: Pursuant to the Nevada Revised Statutes, the holders of the Company’s Common Stock are not entitled to dissenters’ rights in connection with this Election. Furthermore, the Company does not intend to independently provide those stockholders with any such rights.

A vote

FOR

is a vote in favor of appointing SATURNA GROUP as the Company’s auditors until the next Annual Meeting.

PROPOSAL 4

OTHER BUSINESS

At the date of this Proxy Statement, the Company knows of no other matters to be brought before the Meeting. If other matters should properly come before the Meeting, discretionary authority with respect to such other matters is granted by the execution of the enclosed proxy.

DESCRIPTION OF CAPITAL STOCK

The authorized capital stock of the Company currently consists of the following:

General

The following description of the capital stock of the Company and certain provisions of the Company's Articles of Incorporation and Bylaws is a summary and is qualified in its entirety by the provisions of the Articles of Incorporation and Bylaws.

The Company's Articles of Incorporation authorize the issuance of 375,000,000 shares of common stock, with a par value of $0.001. The stockholders: (a) have equal ratable rights to dividends from funds legally available therefore, when, as, and if declared by the Board of Directors of the Company; (b) are entitled to share ratably in all of the assets of the Company available for distribution upon winding up of the affairs of the Company; (c) do not have preemptive subscription or conversion rights and there are no redemption or sinking funds applicable thereto; and (d) are entitled to one non-cumulative vote per share on all matters on which shareholders may vote at all meetings of shareholders. These securities do not have any of the following rights: (a) cumulative or special voting rights; (b) preemptive rights to purchase in new issues of shares; (c) preference as to dividends or interest; (d) preference upon liquidation; or (e) any other special rights or preferences. In addition, the Shares are not convertible into any other security. There are no restrictions on dividends under any loan, other financing arrangements or otherwise.

Non-Cumulative Voting.

iGen Networks' stockholders do not have cumulative voting rights, which means that the stockholders which hold more than 50% of such outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose. In such event, the stockholders of the remaining shares will not be able to elect any of the Company's directors.

Common Stock

The holders of Common Stock have equal ratable rights to dividends from funds legally available therefore, when, as and if declared by the Board of Directors and are entitled to share ratably in all of the assets of the Company available for distribution to the holders of shares of Common Stock upon the liquidation, dissolution or winding up of the affairs of the Company. Except as described herein, no pre-emptive, subscription, or conversion rights pertain to the Common Stock and no redemption or sinking fund provisions exist for the benefit thereof.

Preferred Stock

There are currently no preferred shares authorized or issued.

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following tables list information that is accurate as of December 31, 2016.

Securities authorized for issuance under equity compensation plans

The following details securities authorized for issuance as of December 31, 2016.

Equity Compensation Plan Information

|

|

|

Number of securities to

be issued upon exercise of

outstanding options, warrants and rights

|

|

|

Weighted-average exercise

price of outstanding options, warrants and rights

|

|

|

Number of securities remaining

available for future issuance under equity

compensation plans (excluding securities reflected in column (a))

|

|

|

Plan category

|

|

(a)

|

|

|

(a)

|

|

|

(a)

|

|

|

Equity compensation plans approved by security holders

|

|

|

4,000,000

|

|

|

|

0.16

|

|

|

|

1,830,125

|

|

|

Equity compensation plans not approved by security holders

|

|

|

0

|

|

|

|

N/A

|

|

|

|

0

|

|

|

Total

|

|

|

4,000,000

|

|

|

|

0.16

|

|

|

|

1,830,125

|

|

Security Ownership of certain beneficial owners

|

(1) Title of class

|

|

|

(2) Name and address of beneficial owner

|

|

(3) Amount and nature of beneficial ownership

|

|

|

(4) Percent of class

|

|

|

Common Shares

|

|

|

|

|

|

Nil

|

|

|

|

Nil

|

|

Security Ownership of Management

|

(1) Title of class

|

|

|

(2) Name and address

of beneficial owner

|

|

(3) Amount and nature of

beneficial ownership

|

|

|

(4) Percent

of class

|

|

|

Common Shares

|

|

|

Robert Nealon

|

|

|

|

|

|

|

|

|

|

|

|

Director, COB

|

|

|

521,571

|

|

|

1.61

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

Neil G. Chan

|

|

|

|

|

|

|

|

|

|

|

|

Director, President & CEO

|

|

|

2,478,167

|

|

|

7.65

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

Richard Freeman

|

|

|

|

|

|

|

|

|

|

|

|

Director, COO

|

|

|

474,900

|

|

|

1.47

|

%

|

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Summary Compensation Table

|

Name and principal position

|

|

Year

|

|

Salary

($)

1

|

|

|

Stock awards ($)

|

|

|

Option awards

($)

2

|

|

|

Total

($)

|

|

|

Neil G. Chan - Director, President & CEO

|

|

2016

|

|

|

120,600

|

|

|

|

0

|

|

|

|

0

|

|

|

|

120,600

|

|

|

|

|

2015

|

|

|

98,257

|

|

|

|

0

|

|

|

|

189,900

|

|

|

|

288,157

|

|

|

|

|

2014

|

|

|

74,360

|

|

|

|

0

|

|

|

|

0

|

|

|

|

74,360

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Richard Freeman - Director, COO

|

|

2016

|

|

|

120,600

|

(3)

|

|

|

0

|

|

|

|

0

|

|

|

|

120,600

|

|

|

|

|

2015

|

|

|

86,540

|

|

|

|

0

|

|

|

|

189,900

|

|

|

|

276,440

|

|

|

|

|

2014

|

|

|

65,230

|

|

|

|

|

|

|

|

|

|

|

|

65,230

|

|

______

|

(1)

|

Salary for services as an executive officer. No compensation for services as a director received in 2014, 2015 or 2016.

|

|

(2)

|

Valuation of Stock and Option awards are based on the issuance details listed in the Note 14 to the Company’s consolidated financial statements for the year ended December 31, 2016.

|

|

(3)

|

Richard Freeman is no longer COO, and his salary was pro-rated through his resignation on September 15, 2017.

|

Outstanding Equity Awards at Fiscal Year-end

|

|

|

Number of securities underlying

unexercised

options

|

|

|

Number of securities underlying

unexercised

options

|

|

|

Option

exercise price

|

|

|

Option

expiration

|

|

|

Name

|

|

(#)

|

|

|

(#)

|

|

|

($)

|

|

|

date

|

|

|

|

|

exercisable

|

|

|

un-exercisable

|

|

|

|

|

|

|

|

|

Neil Chan, CEO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,000,000

|

|

|

|

0

|

|

|

$

|

0.19

|

|

|

21-Sep-20

|

|

|

Richard Freeman, COO

|

|

|

275,000

|

|

|

|

0

|

|

|

$

|

0.09

|

|

|

31-Mar-18

|

|

|

|

|

|

1,000,000

|

|

|

|

0

|

|

|

$

|

0.19

|

|

|

21-Sep-20

|

|

The company currently has no unearned or unvested stock awards, or equity incentive plan awards of either options or stock.

Director Compensation

1

|

Name and principal position

|

|

Year

|

|

Salary

($)

|

|

|

Stock awards

($)

|

|

|

Option awards

($)

|

|

|

Total

($)

|

|

|

Robert Nealon

|

|

2016

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

Director, COB

|

|

2015

|

|

|

0

|

|

|

|

0

|

|

|

|

47,475

|

|

|

|

47,475

|

|

|

|

|

2014

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

______

|

(1)

|

Provides information on Directors not serving as executive officers only. Compensation for directors also servicing as executive officers is listed in the summary compensation table at the beginning of this Item.

|

Discussion of Executive and Director Compensation

Compensation of Directors

Directors are currently not paid any standard compensation for acting as directors. In 2013 Robert Nealon, Director and Chairman of the Board, was awarded 150,000 stock options, all of which vested in 2013 and none of which were exercised. In 2015 Mr. Nealon was awarded 250,000 stock options, all of which vested in 2015 and none of which were exercised. Mr. Nealon had 400,000 options vested and unexercised as of December 31, 2016

Compensation of Executives

The CEO of the Company, who is also a director of the Company, is paid Cdn$120,000 per annum as compensation for services in their respective capacities as executive officers of the Company. They are also paid US$30,000 per annum for services as executive offers of Nimbo LLC. In 2013 the CEO Neil Chan was granted 825,000 stock options, all of which vested in 2013, and 769,444 of which were exercised, leaving 55,556 vested and unexercised as of December 31, 2014. In 2015 Mr. Chan was granted a further 1,000,000 stock options all of which vested in 2015 and 55,556 options were exercised in January 2016, leaving a total of 1,000,000 options vested and unexercised as of December 31,2016. In 2013 COO Richard Freeman was granted 500,000 stock options, all of which vested in 2013, and of which 225,000 were exercised, leaving 275,000 vested and unexercised as of December 31, 2014. In 2015 Mr. Freeman was granted a further 1,000,000 stock options all of which vested in 2015 and none of which were exercised, leaving a total of 1,275,000 options vested and unexercised as of December 31, 2016.

There are currently no long term incentive plans or pension plans for directors or officers of the Company.

The company does not currently provide indemnity insurance coverage for directors and officers of the Company.

Compensation Committee Interlocks and Insider Participation

The Company is small and has no compensation committee. The board of directors as a whole acts in the capacity of a compensation committee. All executive officers of the Company are also directors of the Company and as such were and are able to vote on matters of compensation. Though the company is not legally obligated to establish a compensation committee, we may do so when the company reaches a critical mass and/or when deemed advisable by the board.

Compensation Committee Report

As a smaller reporting company, the Company is not required to report the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K, and as such there was no review or recommendation as to its inclusion in this report.

AVAILABLE INFORMATION

The Company is subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended, and, in accordance therewith, files reports and other information with the Commission. Such reports and other information can be inspected and copied at the public reference facilities maintained by the Commission at 100 F Street NE, Washington, D.C. 20549, at prescribed rates. Please call the Commission at (800) SEC-0330 for further information. Copies of such materials may also be accessed electronically by means of the Commission's home page on the Internet at http://www.sec.gov. Any stockholder may also receive a copy of any report by contacting the Company by mail at VStock Transfer LLC, 18 Lafayette Place, Woodmere, NY 11598, 212-828-8436, info@vstocktransfer.com. The Company will provide the documents incorporated by reference without charge upon such written or oral request.

REQUEST TO VOTE, SIGN AND RETURN PROXIES

Please vote, date and sign the enclosed Proxy and return it at your earliest convenience. Any change of your proxy once you have signed it and sent it in will require a ten (10) day change of notice to the Company. Proxies may be returned via regular mail or facsimile to the Company’s transfer agent: VStock Transfer LLC, 18 Lafayette Place, Woodmere, NY 11598, email info@vstocktransfer.com.

Voting Procedures

Quorum and Voting

In accordance with the Bylaws of the Company, the presence in person or by proxy of a majority of the total number of outstanding shares of common stock entitled to vote at the Meeting is required to constitute a quorum for the transaction of business at the Meeting. Abstentions and broker non-votes will be considered represented at the meeting for the purpose of determining a quorum.

The shares represented by each proxy will be voted in accordance with the instructions given therein. Where no instructions are indicated, the proxy will be voted for the election of the Board of Directors as presented in the Proxy Statement, at the discretion of the persons named in the proxy, on any other business that may properly come before the Meeting.

Under applicable law and the Company’s Bylaws, if a quorum is present at the Meeting, the election of the proposals will be approved if the shares voting in favor of each specified proposal exceed the shares voting against. Each stockholder will be entitled to one vote for each share of Common Stock held in the approval of each Proposal. Any other matter submitted to a vote of the stockholders at the Meeting will be approved if a majority of votes cast at the Meeting in person or by proxy vote in favor thereof.

DATED: October 26, 2017

By the Order of the Board of Directors

|

|

|

/s/ Robert Nealon

|

|

|

|

|

Chairman of the Board

|

|

PROXY

FOR THE ANNUAL MEETING OF STOCKHOLDERS OF

IGEN NETWORKS CORP

TO BE HELD JANUARY 17, 2018

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JANUARY 17, 2018

Our 2017 proxy statement and our annual report for the fiscal year ended December 31, 2017 are available at

www.igen-networks.com

.

By completing and returning this proxy to IGEN Networks Corp (the “Company”), you will be designating Neil Chan, the Chief Executive Officer of the Company, to vote all of your shares of the Company's common stock as indicated below. Proxies may be returned via regular mail or electronically to the Company’s transfer agent, VStock Transfer LLC, 18 Lafayette Place, Woodmere, NY 11598, 212-828-8436, info@vstocktransfer.com.

Please complete this proxy by clearly marking the appropriate column(s), filling out the stockholder information and dating below, and returning it to the Company.

The undersigned expressly revokes any and all proxies heretofore given or executed by the undersigned with respect to the shares of stock represented in this proxy. Please sign exactly as your name appears on your stock certificate(s). Joint owners should both sign. If signing in a representative capacity, give full titles and attach proof of authority unless already on file with the Company.

This proxy is being solicited by, and the proposals referenced in the Proxy Statement, are being proposed by the Board of Directors of the Company. The proposals to be voted on is not related to or conditioned on the approval of any other matter. You may revoke this proxy at any time prior to the vote thereon.

As of November 27, 2017, which is the record date for determining the stockholders who are entitled to notice of and to vote at the meeting, the Board of Directors of the Company is not aware of any other matters to be presented at the meeting. If no direction is indicated on a proxy that is executed and returned to the Company, it will be voted “

For

” each Proposal. Unless indicated below, by completing and signing this proxy, the stockholder grants to Neil Chan the discretion to vote in accordance with his best judgment on any other matters that may be presented and the meeting.

_____ Withhold direction to vote on any other matter presented at the meeting.

PROPOSAL 1 - ELECTION OF DIRECTORS.

Shall the following be elected to the Board of Directors until the next Annual Meeting of shareholders:

|

|

|

YES

|

|

NO

|

|

ABSTAIN

|

|

|

|

|

|

|

|

|

|

Neil Chan

|

|

_____

|

|

_____

|

|

_____

|

|

|

|

|

|

|

|

|

|

Robert Nealon

|

|

_____

|

|

_____

|

|

_____

|

|

|

|

|

|

|

|

|

|

Mark Wells

|

|

_____

|

|

_____

|

|

_____

|

PROPOSAL 2 – AMEND THE COMPANY’S ARTICLES OF INCORPORATION.

Shall the Board of Directors be authorized to amend the Articles of Incorporation to Increase the total authorized shares to 385,000,000, to include 375,000,000 common stock and 10,000,000 preferred stock.

|

|

|

YES

|

|

NO

|

|

ABSTAIN

|

|

|

|

|

|

|

|

|

|

|

|

_____

|

|

_____

|

|

_____

|

PROPOSAL 3 - APPOINTMENT OF SATURNA GROUP.

Shall SATURNA GROUP be appointed as independent auditors for the Company:

|

|

|

YES

|

|

NO

|

|

ABSTAIN

|

|

|

|

|

|

|

|

|

|

|

|

_____

|

|

_____

|

|

_____

|

|

|

|

|

|

|

Shareholder Signature

|

|

Shareholder Signature

|

|

|

Printed Name: _____________________________________

|

|

Printed Name: _____________________________________

|

|

|

Number of Shares: _________________________________

|

|

|

|

EXHIBIT A

Section 3. Capital Stock.

The aggregate number of shares that the Corporation will have authority to issue is Three Hundred Eighty-Five Million (385,000,000) of which Three Hundred Seventy-Five Million (375,000,000) shares will be common stock, with a par value of $.001 per share, and Ten Million (10,000,000) shares will be preferred stock, with a par value of $.001 per share.

The Preferred Stock may be divided into and issued in series. The Board of Directors of the Corporation is authorized to divide the authorized shares of Preferred Stock into one or more series, each of which shall be so designated as to distinguish the shares thereof from the shares of all other series and classes. The Board of Directors of the Corporation is authorized, within any limitations prescribed by law and this Article, to fix and determine the designations, rights, qualifications, preferences, limitations and terms of the shares of any series of Preferred Stock including but not limited to the following:

a. The rate of dividend, the time of payment of dividends, whether dividends are cumulative, and the date from which any dividends shall accrue;

b. Whether shares may be redeemed, and, if so, the redemption price and the terms and conditions of redemption;

c. The amount payable upon shares in the event of voluntary or involuntary liquidation;

d. Sinking fund or other provisions, if any, for the redemption or purchase of shares;

e. The terms and conditions on which shares may be converted, if the shares of any series are issued with the privilege of conversion;

f. Voting powers, if any, provided that if any of the Preferred Stock or series thereof shall have voting rights, such Preferred Stock or series shall vote only on a share for share basis with the Common Stock on any matter, including but not limited to the election of directors, for which such Preferred Stock or series has such rights; and,

g. Subject to the foregoing, such other terms, qualifications, privileges, limitations, options, restrictions, and special or relative rights and preferences, if any, of shares or such series as the Board of Directors of the Corporation may, at the time so acting, lawfully fix and determine under the laws of the State of Nevada.

The Corporation shall not declare, pay or set apart for payment any dividend or other distribution (unless payable solely in shares of Common Stock or other class of stock junior to the Preferred Stock as to dividends or upon liquidation) in respect of Common Stock, or other class of stock junior to the Preferred Stock, nor shall it redeem, purchase or otherwise acquire for consideration shares of any of the foregoing, unless dividends, if any, payable to holders of Preferred Stock for the current period (and in the case of cumulative dividends, if any, for all past periods) have been paid, are being paid or have been set aside for payment, in accordance with the terms of the Preferred Stock, as fixed by the Board of Directors.

In the event of the liquidation of the Corporation, holders of Preferred Stock shall be entitled to receive, before any payment or distribution on the Common Stock or any other class of stock junior to the Preferred Stock upon liquidation, a distribution per share in the amount of the liquidation preference, if any, fixed or determined in accordance with the terms of such Preferred Stock plus, if so provided in such terms, an amount per share equal to accumulated and unpaid dividends in respect of such Preferred Stock (whether or not earned or declared) to the date of such distribution. Neither the sale, lease or exchange of all or substantially all of the property and assets of the Corporation, nor any consolidation or merger of the Corporation, shall be deemed to be a liquidation for the purposes of this Article.

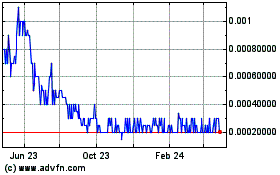

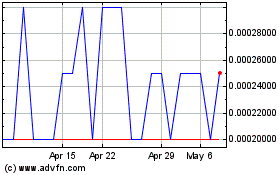

iGen Networks (PK) (USOTC:IGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

iGen Networks (PK) (USOTC:IGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024