Report of Foreign Issuer (6-k)

October 26 2017 - 8:27AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2017

Woori Bank

(Translation of registrant’s name into English)

51,

Sogong-ro,

Jung-gu, Seoul, 04632, Korea

(Address of principal executive office)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(1): ☐

Note:

Regulation

S-T

Rule 101(b)(1) only permits the submission in paper of a Form

6-K

if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(7): ☐

Note:

Regulation

S-T

Rule 101(b)(7) only permits the submission in paper of a Form

6-K

if submission to furnish a report or other document that the registration foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the

registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and if discussing a material event, has already

been the subject of a Form

6-K

submission or other Commission filing on EDGAR.

Woori Bank’s Preliminary Financial Performance Figures

for the Third Quarter of 2017

The

preliminary financial performance figures for Woori Bank for the nine-month period ended on September 30, 2017, on a consolidated basis, are as follows.

(Units: millions of KRW, %)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

|

3Q 2017

|

|

|

2Q 2017

|

|

|

% Change

Increase

(Decrease)

|

|

|

3Q 2016

|

|

|

% Change

Increase

(Decrease)

|

|

|

Revenue*

|

|

Specified Quarter

|

|

|

4,647,096

|

|

|

|

3,596,864

|

|

|

|

29.20

|

|

|

|

6,480,046

|

|

|

|

(28.29

|

)

|

|

|

Cumulative Basis

|

|

|

16,633,960

|

|

|

|

11,986,864

|

|

|

|

38.77

|

|

|

|

18,723,120

|

|

|

|

(11.16

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income

|

|

Specified Quarter

|

|

|

317,687

|

|

|

|

604,484

|

|

|

|

(47.44

|

)

|

|

|

440,118

|

|

|

|

(27.82

|

)

|

|

|

Cumulative Basis

|

|

|

1,801,915

|

|

|

|

1,484,228

|

|

|

|

21.40

|

|

|

|

1,389,221

|

|

|

|

29.71

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before Income Tax Expense

|

|

Specified Quarter

|

|

|

371,638

|

|

|

|

601,318

|

|

|

|

(38.20

|

)

|

|

|

448,275

|

|

|

|

(17.10

|

)

|

|

|

Cumulative Basis

|

|

|

1,801,586

|

|

|

|

1,429,948

|

|

|

|

25.99

|

|

|

|

1,359,396

|

|

|

|

32.53

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

Specified Quarter

|

|

|

283,426

|

|

|

|

466,284

|

|

|

|

(39.22

|

)

|

|

|

359,392

|

|

|

|

(21.14

|

)

|

|

|

Cumulative Basis

|

|

|

1,392,441

|

|

|

|

1,109,015

|

|

|

|

25.56

|

|

|

|

1,117,179

|

|

|

|

24.64

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit to the Equity Holders of the Parent Entity

|

|

Specified Quarter

|

|

|

280,146

|

|

|

|

460,888

|

|

|

|

(39.22

|

)

|

|

|

355,649

|

|

|

|

(21.23

|

)

|

|

|

Cumulative Basis

|

|

|

1,378,507

|

|

|

|

1,098,361

|

|

|

|

25.51

|

|

|

|

1,105,915

|

|

|

|

24.65

|

|

|

*

|

Revenue represents the sum of interest income, fee and commission income, dividend income, gain on financial assets and other operating income (and excludes

non-operating

income).

|

|

*

|

The 3Q 2017 figures include the extraordinary costs associated with the ERP (Early Retirement Program) of Woori Bank. If such costs were excluded, the ‘Profit to the Equity Holders of the Parent Entity’ for 3Q

2017 would be over KRW 500 billion, and the percentage change on a QoQ basis would be about +8%, and on a YoY basis would be about +40%)

|

The above figures are prepared in accordance with Korean International Financial Reporting Standards.

The figures above are subject to adjustment as they are preliminary and have not been reviewed by our independent auditors.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Woori Bank

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Date: October 26, 2017

|

|

|

|

By:

|

|

/s/ Hyun Seok Shin

|

|

|

|

|

|

|

|

(Signature)

|

|

|

|

|

|

|

|

|

|

|

Name :

|

|

Hyun Seok Shin

|

|

|

|

|

|

Title :

|

|

Executive Vice President

|

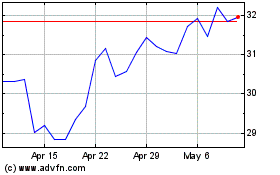

Woori Financial (NYSE:WF)

Historical Stock Chart

From Mar 2024 to Apr 2024

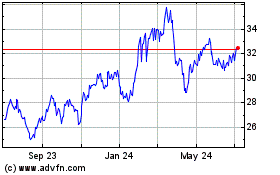

Woori Financial (NYSE:WF)

Historical Stock Chart

From Apr 2023 to Apr 2024