Travelzoo® (NASDAQ:TZOO):

- Revenue of $24.7 million, down 9%

year-over-year in constant currencies

- Operating profit of $18,000

- Earnings (loss) per share of

$(0.05)

- Cash flow from operations of

$122,000

Travelzoo, a global publisher of exclusive deals for members,

today announced financial results for the third quarter ended

September 30, 2017, with revenue of $24.7 million and

operating profit of $18,000. In nominal terms, revenue decreased by

8% year-over-year. In constant currencies, revenue decreased by 9%

year-over-year. Net loss was $576,000, with earnings (loss) per

share of $(0.05).

"Revenues were impacted by the two large hurricanes hitting the

Caribbean and parts of the U.S. during the quarter," said Dr.

Holger Bartel, Global CEO of Travelzoo. "We intend to leverage

Travelzoo's global reach and trusted brand to improve earnings in

future periods."

Asia Pacific

Asia Pacific business segment revenue decreased 31%

year-over-year to $1.8 million. In constant currencies, revenue

decreased 28% year-over-year. Operating loss for the third quarter

was $1.7 million, compared to an operating loss of $798,000 in the

prior-year period.

Europe

Europe business segment revenue decreased 6% year-over-year to

$7.9 million. In constant currencies, revenue decreased 9%

year-over-year. Operating profit for the third quarter was

$309,000, or 4% of revenue, compared to operating income of $1.4

million, or 17% of revenue in the prior-year period.

North America

North America business segment revenue decreased 5%

year-over-year to $15.0 million. Operating profit for the third

quarter was $1.4 million, or 9% of revenue, compared to operating

income of $1.3 million, or 8% of revenue in the prior-year

period.

Members

As of September 30, 2017, Travelzoo had a worldwide

unduplicated number of members of 29.5 million. In Asia Pacific,

unduplicated number of members was 3.6 million as of

September 30, 2017, up 1% from September 30, 2016. In

Europe, unduplicated number of members was 8.5 million as of

September 30, 2017, up 4% from September 30, 2016. In

North America, unduplicated number of members remained at 17.4

million as of September 30, 2017.

Income Taxes

Income tax expense was $680,000, compared to a $748,000 income

tax expense in the prior-year period.

Asset Management

During the third quarter of 2017, Travelzoo generated $122,000

of cash for operating activities. Accounts receivable decreased by

$5.3 million over the prior-year period to $11.4 million. Accounts

payable decreased by $2.6 million over the prior-year period to

$16.0 million. Capital expenditures were $180,000, up from $155,000

in the prior-year period. As of September 30, 2017, cash and

cash equivalents were $18.8 million.

Conference Call

Travelzoo will host a conference call to discuss third quarter

results at 11:00 a.m. ET today. Please visit

http://www.travelzoo.com/earnings to

- download the management presentation

(PDF format) to be discussed in the conference call;

- access the webcast.

About Travelzoo

Travelzoo® provides our 28 million members insider deals and

one-of-a-kind experiences personally reviewed by one of our deal

experts around the globe. With more than 25 offices worldwide we

have our pulse on outstanding travel, entertainment, and lifestyle

experiences. For over 15 years we have worked in partnership with

more than 2,000 top travel suppliers—our long-standing

relationships allow us access to the very best deals.

Certain statements contained in this press release that are not

historical facts may be forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities and Exchange Act of 1934. These

forward-looking statements may include, but are not limited to,

statements about our plans, objectives, expectations, prospects and

intentions, markets in which we participate and other statements

contained in this press release that are not historical facts. When

used in this press release, the words “expect”, “predict”,

“project”, “anticipate”, “believe”, “estimate”, “intend”, “plan”,

“seek” and similar expressions are generally intended to identify

forward-looking statements. Because these forward-looking

statements involve risks and uncertainties, there are important

factors that could cause actual results to differ materially from

those expressed or implied by these forward-looking statements,

including changes in our plans, objectives, expectations, prospects

and intentions and other factors discussed in our filings with the

SEC. We cannot guarantee any future levels of activity, performance

or achievements. Travelzoo undertakes no obligation to update

forward-looking statements to reflect events or circumstances

occurring after the date of this press release.

Travelzoo and Top 20 are registered trademarks of Travelzoo. All

other names are trademarks and/or registered trademarks of their

respective owners.

Travelzoo

Condensed Consolidated Statements of

Operations

(Unaudited)

(In thousands, except per share

amounts)

Three months ended Nine months ended

September 30, September 30, 2017

2016 2017

2016 Revenues $ 24,687 $ 26,823 $ 79,527 $ 87,450

Cost of revenues 3,018 3,270 9,447 10,593

Gross profit 21,669 23,553 70,080 76,857

Operating expenses: Sales and marketing 13,973 14,075 43,542 45,060

Product development 2,315 2,230 7,016 7,019 General and

administrative 5,363 5,373 16,056 16,620 Total

operating expenses 21,651 21,678 66,614

68,699 Income from continuing operations 18 1,875 3,466 8,158 Other

income (expense), net 86 251 111 293 Income

from continuing operations before income taxes 104 2,126 3,577

8,451 Income tax expense 680 748 2,660

3,450 Income (loss) from continuing operations $ (576 ) $ 1,378 $

917 $ 5,001 Income from discontinued operations, net of income

taxes — 241 1,938 687 Net income (loss)

$ (576 ) $ 1,619 $ 2,855 $ 5,688 Income (loss)

per share—basic: Continuing operations $ (0.05 ) $ 0.10 $ 0.07 $

0.35 Discontinued operations

0.00

0.02 0.15 0.05 Net income (loss) per

share—basic $ (0.05 ) $ 0.12 $ 0.22 $ 0.40

Income (loss) per share—diluted: Continuing operations $

(0.05 ) $ 0.10 $ 0.07 $ 0.35 Discontinued operations 0.00

0.02 0.15 0.05 Net income (loss) per

share—diluted $ (0.05 ) $ 0.12 $ 0.22 $ 0.40

Weighted average shares: Basic 12,628 13,839 13,023 14,109

Diluted 12,628 13,867 13,040 14,119

Travelzoo

Condensed Consolidated Balance

Sheets

(Unaudited)

(In thousands)

September 30, 2017 December 31,

2016 Assets Current assets: Cash and cash equivalents

$ 18,822 $ 26,838 Accounts receivable, net 11,434 14,415 Income

taxes receivable 1,540 542 Deposits 396 105 Prepaid expenses and

other 1,961 1,773 Deferred tax assets — 793 Total

current assets 34,153 44,466 Deposits and other 508 702 Deferred

tax assets 1,800 1,052 Restricted cash 1,438 1,152 Property and

equipment, net 5,265 6,158 Total assets $ 43,164

$ 53,530

Liabilities and Stockholders’ Equity

Current liabilities: Accounts payable $ 15,966 $ 19,714 Accrued

expenses and other 7,932 8,699 Deferred revenue 897 719 Income tax

payable 936 691 Total current liabilities 25,731

29,823 Long-term tax liabilities 2,563 2,879 Long-term deferred

rent and other 2,721 2,764 Total liabilities 31,015

35,466 Common stock 125 135 Additional paid-in

capital — — Accumulated other comprehensive loss (3,556 ) (3,787 )

Retained earnings 15,580 21,716 Total stockholders’

equity 12,149 18,064 Total liabilities and

stockholders’ equity $ 43,164 $ 53,530

Travelzoo

Condensed Consolidated Statements of

Cash Flows

(Unaudited)

(In thousands)

Three months ended Nine months ended

September 30, September 30, 2017

2016 2017 2016 Cash flows

from operating activities: Net income (loss) $ (576 ) $ 1,619 $

2,855 $ 5,688 Adjustments to reconcile net income (loss) to net

cash provided by (used in) operating activities: Depreciation and

amortization 504 606 1,605 1,856 Discontinued operations gain on

sale of Fly.com domain name — — (2,890 ) — Deferred income taxes 97

(13 ) 28 (224 ) Stock-based compensation 206 251 686 692 Provision

for losses on accounts receivable (7 ) (28 ) (34 ) 17 Net foreign

currency effects (69 ) (71 ) (293 ) (308 ) Changes in operating

assets and liabilities: Accounts receivable 1,301 1,715 3,388 (547

) Income tax receivable (903 ) (823 ) (868 ) (299 ) Prepaid

expenses and other (199 ) (538 ) (417 ) (387 ) Accounts payable

1,359 (2,177 ) (4,695 ) (4,391 ) Accrued expenses and other (1,450

) (2,628 ) (1,009 ) (2,074 ) Income tax payable (70 ) 504 109 1,772

Other non-current liabilities (71 ) 69 (349 ) 121 Net

cash provided by (used in) operating activities 122 (1,514 )

(1,884 ) 1,916

Cash flows from investing activities:

Proceeds from sale of Fly.com domain name — — 2,890 — Purchases of

property and equipment (180 ) (155 ) (486 ) (802 ) Net cash

provided by (used in) investing activities (180 ) (155 ) 2,404

(802 )

Cash flows from financing activities:

Acquisition of the Asia Pacific business — — — 58 Payment of loan

to related party — — — (5,658 ) Repurchase of common stock, net

(2,732 ) (771 ) (9,556 ) (5,727 ) Net cash used in financing

activities (2,732 ) (771 ) (9,556 ) (11,327 ) Effect of exchange

rate on cash and cash equivalents 281 (281 ) 1,020

(76 ) Net decrease in cash and cash equivalents (2,509 ) (2,721 )

(8,016 ) (10,289 ) Cash and cash equivalents at beginning of period

21,331 27,560 26,838 35,128 Cash and

cash equivalents at end of period $ 18,822 $ 24,839 $

18,822 $ 24,839 Supplemental disclosure of cash flow

information: Cash paid for income taxes, net $ 1,628 $ 1,126 $

4,858 $ 2,198 Cash paid for interest on related party loan $ — $ —

$ — $ 110

Travelzoo

Segment Information

(Unaudited)

(In thousands)

Three months ended September 30, 2017 Asia

Pacific Europe NorthAmerica

Consolidated Revenue from unaffiliated customers $ 1,767 $

8,008 $ 14,912 $ 24,687 Intersegment revenue 6 (62 ) 56

— Total net revenues 1,773 7,946 14,968

24,687 Operating profit (loss) $ (1,679 ) $ 309 $ 1,388

$ 18

Three months ended September 30, 2016 Asia

Pacific Europe NorthAmerica

Consolidated Revenue from unaffiliated customers $ 2,521 $

8,614 $ 15,688 $ 26,823 Intersegment revenue 36 (140 ) 104

— Total net revenues 2,557 8,474 15,792

26,823 Operating profit (loss) $ (798 ) $ 1,412 $ 1,261

$ 1,875

Nine months ended September 30, 2017

Asia Pacific Europe NorthAmerica

Consolidated Revenue from unaffiliated customers $ 5,574 $

25,231 $ 48,722 $ 79,527 Intersegment revenue (38 ) (317 ) 355

— Total net revenues 5,536 24,914 49,077

79,527 Operating profit (loss) $ (4,385 ) $ 1,526 $

6,325 $ 3,466

Nine months ended September 30, 2016

Asia Pacific Europe NorthAmerica

Consolidated Revenue from unaffiliated customers $ 7,173 $

28,893 $ 51,384 $ 87,450 Intersegment revenue 78 (403 ) 325

— Total net revenues 7,251 28,490 51,709

87,450 Operating profit (loss) $ (3,080 ) $ 5,022 $

6,216 $ 8,158

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171026005477/en/

Investor Relations:TravelzooLijun Qiir@travelzoo.com

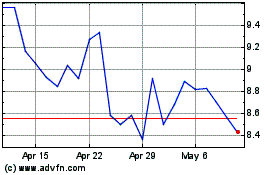

Travelzoo (NASDAQ:TZOO)

Historical Stock Chart

From Mar 2024 to Apr 2024

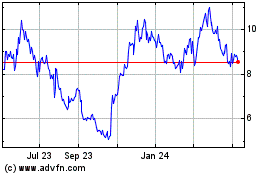

Travelzoo (NASDAQ:TZOO)

Historical Stock Chart

From Apr 2023 to Apr 2024