iPhone 8 Posts Weak Initial Sales, Pressuring iPhone X

October 26 2017 - 5:59AM

Dow Jones News

By Tripp Mickle

Apple Inc.'s iPhone 8 posted the weakest sales of any of the

company's new smartphones in recent years, according to estimates

by two market research firms, raising the stakes for the

higher-priced iPhone X as advance orders start on Friday.

In the U.S., Apple's largest market, the iPhone 8 and its larger

8 Plus version accounted for 16% of all iPhone sales in the

September quarter, according to Consumer Intelligence Research

Partners LLC. By comparison, the iPhone 7 and 7 Plus accounted for

43% during the same period last year and the iPhone 6s and 6s Plus

accounted for 24% during the same period in 2015. Other signs

indicate similar underperformance globally.

Soft iPhone 8 sales stem partly from confusion over the trio of

phones Apple is releasing this year -- and could reflect buyers

waiting for the iPhone X, which boasts an edge-to-edge display and

facial-recognition technology. It ships Nov. 3 and starts at

$999.

The iPhone 8 and 8 Plus, which started shipping Sept. 22 and

start at $699 and $799, offer wireless charging, improved

processors and new camera capabilities over preceding models but

feature the same basic design.

Many consumers have decided the improvements in the iPhone 8 are

too incremental to justify the higher price tag and instead opted

to buy cheaper, older models or wait for the iPhone X, said Mike

Levin and Josh Lowitz, co-founders of Consumer Intelligence

Research Partners.

"They signaled to their customers: Don't buy the 8. Their

customers listened," Mr. Lowitz said.

Mr. Levin expects poor sales of the iPhone 8 to weigh on Apple's

quarterly results when it announces earnings Nov. 2. Sales of the

device may improve after consumers can compare it to the iPhone X

in stores, but he said Apple has "cornered themselves and really

have to deliver this (iPhone X) extremely well."

As of a month after it started shipping, the iPhone 8 and 8 Plus

combined accounted for 2.4% of iPhones in use world-wide, according

to market research firm Localytics, which analyzed data from more

than 70 million Apple devices. That was less than half the share

claimed by its predecessors, the iPhone 7 and 7 Plus, a month after

they started shipping, and the lowest for a new iPhone since at

least 2014, the firm said.

The iPhone 8 got less promotional support from resellers than

its predecessor. In the U.S., wireless carriers largely offered

discounts on the iPhone 8 with trade-ins of old devices rather than

the free iPhone 7 deals some offered for trade-ins last year,

according to Jefferies.

During a call with analysts last week, Rogers Communications

Inc. Chief Executive Joseph Natale said there was an "anemic

appetite for the iPhone 8" across the Canadian wireless carriers'

network and "lots of anticipation around the iPhone X."

Wall Street analysts have waived off tepid demand for the iPhone

8, saying weaker demand for it could benefit the company if it

sells more of the pricier iPhone X. Sales of more iPhone X would

boost average iPhone selling prices and potentially lift annual

revenue.

Still, Apple must prove consumers will embrace the iPhone X's

higher price tag -- and demonstrate that it can make enough of

them. The iPhone X -- which Apple is releasing six weeks later than

usual for a new iPhone -- has been dogged by production challenges,

including problems over the summer that delayed typical

manufacturing timetables by at least a month. It also had an

imbalance of components critical to its facial-recognition

hardware.

Production issues have stoked concern that iPhone X supplies

will fall short of demand until the March quarter, about a quarter

later than usual, said Gene Munster, who heads research at

venture-capital firm Loup Ventures. However, he and analysts don't

expect annual sales to suffer, so long as supply matches demand by

June.

He and other observers will be watching preorders for the iPhone

X, which begin Friday at 3 a.m. EST. If the shipment date for an

iPhone X order is within one-to-two weeks from the order date, that

would indicate weak demand, Mr. Munster said. He added that if it

slips to eight-to-12 weeks from the order date, that could indicate

strong demand or major production issues.

Apple Chief Executive Tim Cook is expected to speak about

preorder demand and iPhone X supply during a Nov. 2 call with

analysts, Mr. Munster said. More preorders of the iPhone X than the

iPhone 8 would be a good sign for investors, he added, but if Mr.

Cook doesn't say anything then investors "will fear the worst."

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

October 26, 2017 05:44 ET (09:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

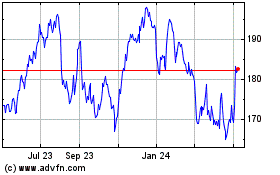

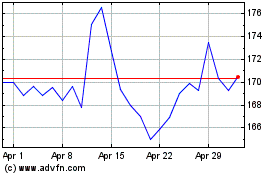

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024