Credicorp Ltd. : Credicorp's Declaration of Special Dividends

October 25 2017 - 7:58PM

Lima, PERU,

October 25, 2017 - Credicorp Ltd. announces to its shareholders

and the market that the Board of Directors, in its session held on

October 25, 2017, approved the distribution of an special cash

dividend of S/1,481,802,376.90 for a total of 94,382,317

outstanding shares, which is equivalent to S/15.7000 per share,

establishing as registration date on Tuesday November 14, 2017.

The cash dividend will be paid out

on November 24, 2017, without withholding tax at source. The

dividend will be paid in US Dollars using the weighted exchange

rate registered by the Superintendency of Banks, Insurance and

Pension Funds (Superintendencia de Banca, Seguros y AFP) for the

transactions at the close of business on November 22, 2017. The US

Dollar dividend amount will be rounded up to four decimals.

The Board's decision to approve

the distribution of a special dividend is based on Credicorp's

financial strength and the significant capital gains it has been

making in recent years, and in virtue of the provisions set forth

in the Company's By-Laws.

The dividend shall be applied on

Credicorp's freely available optional reserves and shall be paid

with funds from the sale proceeds of non-strategic investments

performed by the company in recent months and from liquidity

surpluses currently retained by Credicorp.

Credicorp states that at the

present time it has the necessary and sufficient funds to pay the

special dividend considering the criterion established by Section

54 of the 1981 Companies Act of Bermuda and that its decision to

declare and pay such special dividend shall not affect the company

capital requirements, placing them at all times over regulatory

limits and within its Risk Appetite levels.

Credicorp shall continue to invest

in its recurring business to ensure the company long-term

profitability, thus confirming its objective of optimizing the

capital structure and, consequently, increasing capital returns for

its shareholders.

About

Credicorp

Credicorp Ltd. (NYSE: BAP) is the leading financial holding company

in Peru. It is composed of Banco de Crédito del Peru (BCP),

Atlantic Security Holding Corporation (ASHC), Grupo Pacifico

Seguros, Prima AFP, and Credicorp Capital, which are among Peru's

top-rated brands. Credicorp 's primary businesses are banking

(commercial & investment banking and retail banking, including

SME and micro-lending); insurance (including property and casualty,

life and health insurance); pension funds (private pension fund

management services); and brokerage services (including trust,

custody and securitization services, asset management and

proprietary trading and investment).

For further information please contact the IR

team:

IRCredicorp@bcp.com.pe

Investor Relations

Credicorp Ltd.

PDF doc.: Credicorp’s Declaration

of Special Dividends

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Credicorp Ltd. via Globenewswire

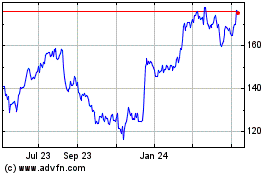

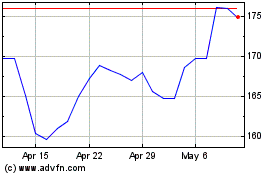

Credicorp (NYSE:BAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Credicorp (NYSE:BAP)

Historical Stock Chart

From Apr 2023 to Apr 2024