Smith Micro Software, Inc. (NASDAQ: SMSI), today reported

financial results for its third quarter ended September 30,

2017.

“The launch of our SafePath® Family platform by a Tier 1

wireless operator in the U.S. announced earlier this month marked a

significant milestone on our path back to growth and

profitability,” said William W. Smith, Jr., President and CEO of

Smith Micro Software. “We expect to see a positive impact from this

deployment on our revenue starting in the fourth quarter and

building into fiscal 2018, as their user base converts and

scales.

“I am pleased with the current strength of the Company, which

reflects the restructuring we undertook earlier this year and our

recent financings that significantly improved our balance sheet. We

are focused on building upon this success, and remain excited and

confident as we execute on the opportunities in front of us.”

Fiscal Third Quarter 2017 Financial Results:

Smith Micro Software reported revenue of $5.8 million for the

third quarter ended September 30, 2017, compared to $6.5 million

reported in the third quarter ended September 30, 2016.

Third quarter 2017 gross profit was $4.6 million, compared to

$4.7 million reported in the third quarter of 2016.

GAAP gross profit as a percentage of revenue was 80 percent for

the third quarter of 2017, compared to 72 percent for the third

quarter of 2016.

GAAP net loss for the third quarter of 2017 was $1.7 million, or

$0.12 loss per share, compared to a GAAP net loss of $4.6 million,

or $0.38 loss per share, for the third quarter of 2016.

Non-GAAP net loss (which excludes non-cash stock-based

compensation, amortization of intangibles, loss on debt

extinguishment, debt issuance and discount costs, and a normalized

tax benefit) for the third quarter of 2017 was $0.6 million, or

$0.04 loss per share, compared to a non-GAAP net loss of $2.5

million, or $0.21 loss per share, for the third quarter of

2016.

Fiscal September Year-To-Date 2017 Financial Results:

For the nine months ended September 30, 2017, the Company

reported revenue of $17.2 million, compared to $21.2 million for

the nine months ended September 30, 2016.

GAAP gross profit was $13.5 million for the nine months ended

September 30, 2017, compared to $15.3 million for the nine months

ended September 30, 2016.

GAAP gross profit as a percentage of revenue was 78 percent for

the nine months ended September 30, 2017, compared to 73 percent

for the same period last year.

GAAP net loss for the nine months ended September 30, 2017 was

$6.5 million, or $0.49 loss per share, compared to a GAAP net loss

for the nine months ended September 30, 2016 of $11.6 million, or

$0.98 loss per share.

Non-GAAP net loss (which excludes non-cash stock-based

compensation, amortization of intangibles, loss on debt

extinguishment, debt issuance and discount costs, and a normalized

tax benefit) for the nine months ended September 30, 2017 was $2.8

million, or $0.21 loss per share, compared to a non-GAAP net loss

of $6.3 million, or $0.54 loss per share, for the nine months ended

September 30, 2016.

Total cash and cash equivalents at September 30, 2017 were $3.9

million.

To supplement our financial information presented in accordance

with generally accepted accounting principles in the United States

(“GAAP”), the Company considers and has included in this press

release certain non-GAAP financial measures, including a non-GAAP

reconciliation of gross profit, income (loss) before taxes, net

income (loss), and earnings (loss) per share in the presentation of

financial results in this press release. Management believes this

non-GAAP presentation may be more meaningful in analyzing our

income generation and therefore has excluded the following non-cash

items from GAAP earnings calculations: stock-based compensation,

amortization of intangible assets, fair value adjustments, and debt

issuance and discount costs. Additionally, since we are in a

cumulative loss position, a non-GAAP income tax benefit was

computed using a 38 percent tax rate using the Company’s normalized

combined U.S. federal, state, and foreign statutory tax rates less

various tax adjustments. This presentation may be considered more

indicative of our ongoing operational performance. The table below

presents the differences between non-GAAP earnings and net loss on

an absolute and per-share basis. Non-GAAP financial measures should

not be considered in isolation from, or as a substitute for,

financial information presented in compliance with GAAP, and the

non-financial measures as reported by Smith Micro Software may not

be comparable to similarly titled amounts reported by other

companies.

Investor Conference Call:

Smith Micro Software will hold an investor conference call today

to discuss the Company’s third quarter 2017 results at 4:30 p.m.

ET, October 25, 2017. To access the call, dial 1-877-270-2148;

international participants can call 1-412-902-6510. A passcode is

not required to join the call; ask the operator to be placed into

the Smith Micro conference. Participants are asked to call the

assigned number approximately 10 minutes before the conference call

begins. In addition, the conference call will be available on the

Smith Micro website in the Investor Relations section.

About Smith Micro Software, Inc.:

Smith Micro develops software to simplify and enhance the mobile

experience, providing solutions to some of the leading wireless

service providers, device manufacturers, and enterprise businesses

around the world. From optimizing wireless networks to uncovering

customer experience insights, and from streamlining Wi-Fi access to

ensuring family safety, our solutions enrich today’s connected

lifestyles while creating new opportunities to engage consumers via

smartphones. Our portfolio also includes a wide range of products

for creating, sharing and monetizing rich content, such as visual

messaging and 2D/3D graphics applications. For more information,

visit smithmicro.com.

Forward-Looking Statements:

Certain statements in this press release are, and certain

statements on the related teleconference call may be,

forward-looking statements regarding future events or results,

including without limitation, statements relating to our financial

prospects and other projections of our performance, the existence

of new sales opportunities and interest in our products and

solutions, and our ability to increase our revenue by capitalizing

on new opportunities, and other statements using such words as

“expect,” “anticipate,” “believe,” “plan,” “intend,” “could,” and

other similar expressions. Forward-looking statements involve risks

and uncertainties, which could cause actual results to differ

materially from those expressed or implied in the forward-looking

statements. Among the important factors that could cause or

contribute to such differences are our ability to continue as a

going concern, our ability to raise more funds to meet our capital

needs, changes in demand for our products from our customers and

their end-users, customer concentration, given that the majority of

our sales depend on a few large customer relationships, new and

changing technologies, customer acceptance and timing of deployment

of those technologies, and our ability to compete effectively with

other software and technology companies. These and other factors

discussed in our filings with the Securities and Exchange

Commission, including our filings on Forms 10-K and 10-Q, could

cause actual results to differ materially from those expressed or

implied in any forward-looking statements. The forward-looking

statements contained in this release and on the related

teleconference call are made on the basis of the views and

assumptions of management regarding future events and business

performance as of the date of this release, and we do not undertake

any obligation to update these statements to reflect events or

circumstances occurring after the date of this release.

Smith Micro and the Smith Micro logo are registered trademarks

or trademarks of Smith Micro Software, Inc. All other trademarks

and product names are the property of their respective owners.

Smith Micro

Software, Inc. Reconciliation of GAAP to Non-GAAP

Results (in thousands, except per share amounts) - unaudited

Loss on Note Stock Intangibles Debt Issue/ Non-

GAAP

Compensation Amortization

Extinguishment* Discount *

Taxes GAAP Three Months Ended 9/30/17:

Gross profit $4,645 $- $- $- $- $- $4,645 Loss before provision for

income taxes ($1,664 ) $167 $65 $405 $133 $- ($894 ) Net loss

($1,670 ) $167 $65 $405 $133 $345 ($554 ) Loss per share: basic and

diluted ($0.12 ) $0.01 $0.00 $0.03 $0.01 $0.02 ($0.04 )

Three Months Ended 9/30/16: Gross profit $4,680 $1 $- $- $- $-

$4,681 Loss before provision for income taxes ($4,621 ) $408 $85 $-

$52 $- ($4,076 ) Net loss ($4,632 ) $408 $85 $- $52 $1,560 ($2,527

) Loss per share: basic and diluted ($0.38 ) $0.03 $0.01 $0.00

$0.00 $0.13 ($0.21 ) Nine Months Ended 9/30/17: Gross profit

$13,515 $- $- $- $- $- $13,515 Loss before provision for income

taxes ($6,482 ) $1,001 $195 $405 $394 $- ($4,487 ) Net loss ($6,501

) $1,001 $195 $405 $394 $1,724 ($2,782 ) Loss per share: basic and

diluted ($0.49 ) $0.08 $0.01 $0.03 $0.03 $0.13 ($0.21 ) Nine

Months Ended 9/30/16: Gross profit $15,327 $3 $- $- $- $- $15,330

Loss before provision for income taxes ($11,570 ) $1,175 $112 $-

$52 $- ($10,231 ) Net loss ($11,618 ) $1,175 $112 $- $52 $3,936

($6,343 ) Loss per share: basic and diluted ($0.98 ) $0.10 $0.01

$0.00 $0.00 $0.33 ($0.54 ) Note: Loss per share: basic and

diluted - may be impacted by rounding to allow rows to calculate.

* - Includes impact of current and

retrospective adjustment for the adoption of ASU 2017-11 for

periods presented

Smith Micro Software, Inc. Statements of

Operations and Comprehensive Loss for the Three and Nine Months

Ended September 30, 2017 and 2016 (in thousands, except per

share amounts) - unaudited For the Three

Months For the Nine Months Ended September 30, Ended September 30,

2017 2016

2017 2016

Revenues $ 5,804 $ 6,478 $ 17,242 $ 21,151 Cost of revenues

1,159 1,798 3,727 5,824

Gross profit 4,645 4,680 13,515 15,327 Operating

expenses: Selling and marketing 1,413 2,541 4,667 7,389 Research

and development 2,100 4,174 6,771 12,204 General and administrative

2,220 2,522 6,648 7,878 Restructuring expense (146 )

- 568 - Total operating expenses

5,587 9,237 18,654

27,471 Operating loss (942 ) (4,557 ) (5,139 ) (12,144 )

Non-operating income: Change in carrying value of contingent

liability - 11 - 668 Loss on extinguishment of debt * (405 ) - (405

) - Interest income (expense), net * (315 ) (66 ) (928 ) (68 )

Other income (expense), net (2 ) (9 ) (10 )

(26 ) Loss before provision for income taxes (1,664 )

(4,621 ) (6,482 ) (11,570 ) Provision for

income tax expense 6 11 19

48 Net loss $ (1,670 ) $ (4,632 ) $ (6,501 ) $

(11,618 ) Other comprehensive income, before tax: Unrealized

holding gains on available-for-sale securities -

- - 2 Other comprehensive

income, net of tax - - -

2 Comprehensive loss $ (1,670 ) $ (4,632 ) $ (6,501 )

$ (11,616 ) Loss per share: Basic and diluted $ (0.12 ) $

(0.38 ) $ (0.49 ) $ (0.98 ) Weighted average shares

outstanding: Basic and diluted 14,397 12,209 13,221 11,826

* - Includes impact of current and

retrospective adjustment for the adoption of ASU 2017-11 for

periods presented

Smith Micro Software, Inc. Consolidated

Balance Sheets (in thousands) - unaudited September 30,

December 31,

2017

2016 ASSETS Current Assets: Cash & cash

equivalents $ 3,939 $ 2,229 Accounts receivable, net 5,209 4,962

Income tax receivable 1 1 Inventory, net 16 12 Prepaid and other

assets 706 713 Total current assets

9,871 7,917 Equipment & improvements, net 1,381 1,811 Other

assets 146 149 Intangible assets, net 551 745 Goodwill 3,685

3,686 TOTAL ASSETS $ 15,634 $ 14,308

LIABILITIES & STOCKHOLDERS' EQUITY Current

Liabilities: Accounts payable $ 1,318 $ 1,907 Accrued liabilities

3,182 3,503 Related-party notes payable 2,200 - Deferred revenue

367 98 Total current liabilities 7,067

5,508 Related-party notes payable, net * - 1,295 Notes

payable, net * 1,492 1,295 Warrant liability * - - Other long-term

liabilities 2,332 2,970 Deferred tax liability 181

181 Total non-current liabilities 4,005 5,741

Stockholders' Equity: Preferred stock - - Common stock 14 12

Additional paid in capital * 237,321 229,275 Accumulated

comprehensive deficit * (232,773 ) (226,228 ) Total

stockholders' equity 4,562 3,059 TOTAL

LIABILITIES & STOCKHOLDERS' EQUITY $ 15,634 $ 14,308

* - Includes impact of current and

retrospective adjustment for the adoption of ASU 2017-11 for

periods presented

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171025006220/en/

IR INQUIRIES:Smith Micro Software, Inc.Charles

MessmanInvestor Relations949-362-5800IR@smithmicro.com

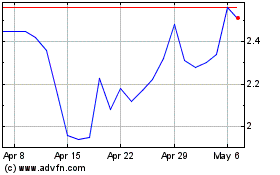

Smith Micro Software (NASDAQ:SMSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Smith Micro Software (NASDAQ:SMSI)

Historical Stock Chart

From Apr 2023 to Apr 2024