UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

ANNUAL REPORT

PURSUANT TO SECTION 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. [NO FEE REQUIRED].

|

For the fiscal year ended

April 30, 2017

.

OR

|

|

|

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. [NO FEE REQUIRED].

|

For the transition period from

to

Commission File Number 1-13666

|

|

|

|

|

|

A.

|

Full title of the plan and the address of the plan, if different from that of the issuer named below:

|

Darden Savings Plan

|

|

|

|

|

|

B.

|

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

DARDEN RESTAURANTS, INC.

1000 Darden Center Drive

Orlando, Florida 32837

DARDEN SAVINGS PLAN

Table of Contents

|

|

|

|

|

|

|

|

Page

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

1

|

|

|

|

|

|

Statements of Net Assets Available for Benefits

|

2

|

|

|

|

|

|

Statements of Changes in Net Assets Available for Benefits

|

4

|

|

|

|

|

|

Notes to Financial Statements

|

6

|

|

|

|

|

|

Supplemental Schedules

|

|

|

|

|

|

Schedule H, Line 4a – Schedule of Delinquent Participant Contributions

|

16

|

|

|

|

|

|

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

|

17

|

|

Report of Independent Registered Public Accounting Firm

The Benefit Plans Committee as Administrator of the

Darden Savings Plan:

We have audited the accompanying statements of net assets available for benefits of the Darden Savings Plan (the Plan) as of April 30, 2017 and 2016, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of April 30, 2017 and 2016, and the changes in net assets available for benefits for the years then ended in conformity with U.S. generally accepted accounting principles.

The supplemental information in the accompanying schedules of Schedule H, Line 4a - Schedule of Delinquent Participant Contributions for the year ended April 30, 2017 and Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of April 30, 2017 have been subjected to audit procedures performed in conjunction with the audit of the Plan’s 2017 financial statements. The supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but includes supplemental information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedules, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedules of Schedule H, Line 4a - Schedule of Delinquent Participant Contributions for the year ended April 30, 2017 and Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of April 30, 2017 are fairly stated in all material respects in relation to the 2017 financial statements as a whole.

/s/ KPMG LLP

Orlando, Florida

October 23, 2017

Certified Public Accountants

DARDEN SAVINGS PLAN

Statement of Net Assets Available for Benefits

April 30, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participant

directed

funds

|

|

ESOP Funds

(Note 7)

|

|

Total

|

|

Assets:

|

|

|

|

|

|

|

|

Investments:

|

|

|

|

|

|

|

|

Investments, at fair value

|

|

$

|

463,171,104

|

|

|

$

|

1,243,853

|

|

|

$

|

464,414,957

|

|

|

Common stock of Darden Restaurants, Inc. – allocated

|

|

61,369,087

|

|

|

173,222,875

|

|

|

234,591,962

|

|

|

Common stock of Darden Restaurants, Inc. – unallocated

|

|

—

|

|

|

28,123,861

|

|

|

28,123,861

|

|

|

Total investments

|

|

524,540,191

|

|

|

202,590,589

|

|

|

727,130,780

|

|

|

Receivables:

|

|

|

|

|

|

|

|

Employer contributions

|

|

1,798,740

|

|

|

—

|

|

|

1,798,740

|

|

|

Accrued dividends and interest

|

|

404,457

|

|

|

1,339,425

|

|

|

1,743,882

|

|

|

Notes receivable from Participants

|

|

16,275,100

|

|

|

—

|

|

|

16,275,100

|

|

|

Total receivables

|

|

18,478,297

|

|

|

1,339,425

|

|

|

19,817,722

|

|

|

Total assets

|

|

543,018,488

|

|

|

203,930,014

|

|

|

746,948,502

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

ESOP loans

|

|

—

|

|

|

2,480,314

|

|

|

2,480,314

|

|

|

Interest payable

|

|

—

|

|

|

1,242

|

|

|

1,242

|

|

|

Total liabilities

|

|

—

|

|

|

2,481,556

|

|

|

2,481,556

|

|

|

Net assets available for benefits

|

|

$

|

543,018,488

|

|

|

$

|

201,448,458

|

|

|

$

|

744,466,946

|

|

|

|

|

|

|

|

|

|

See accompanying notes to financial statements.

DARDEN SAVINGS PLAN

Statement of Net Assets Available for Benefits

April 30, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participant

directed

funds

|

|

ESOP Funds

(Note 7)

|

|

Total

|

|

Assets:

|

|

|

|

|

|

|

|

Investments:

|

|

|

|

|

|

|

|

Investments, at fair value

|

|

$

|

370,934,242

|

|

|

$

|

1,344,552

|

|

|

$

|

372,278,794

|

|

|

Common stock of Darden Restaurants, Inc. – allocated

|

|

45,251,144

|

|

|

136,212,960

|

|

|

181,464,104

|

|

|

Common stock of Darden Restaurants, Inc. – unallocated

|

|

—

|

|

|

31,687,865

|

|

|

31,687,865

|

|

|

Common stock of Four Corners Property Trust, Inc. – allocated

|

|

5,641,287

|

|

|

18,528,657

|

|

|

24,169,944

|

|

|

Total investments

|

|

421,826,673

|

|

|

187,774,034

|

|

|

609,600,707

|

|

|

Receivables:

|

|

|

|

|

|

|

|

Employer contributions

|

|

1,042,327

|

|

|

—

|

|

|

1,042,327

|

|

|

Accrued dividends and interest

|

|

364,519

|

|

|

1,370,356

|

|

|

1,734,875

|

|

|

Notes receivable from Participants

|

|

15,082,974

|

|

|

—

|

|

|

15,082,974

|

|

|

Total receivables

|

|

16,489,820

|

|

|

1,370,356

|

|

|

17,860,176

|

|

|

Total assets

|

|

438,316,493

|

|

|

189,144,390

|

|

|

627,460,883

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

ESOP loans

|

|

—

|

|

|

3,423,854

|

|

|

3,423,854

|

|

|

Interest payable

|

|

—

|

|

|

759

|

|

|

759

|

|

|

Total liabilities

|

|

—

|

|

|

3,424,613

|

|

|

3,424,613

|

|

|

Net assets available for benefits

|

|

$

|

438,316,493

|

|

|

$

|

185,719,777

|

|

|

$

|

624,036,270

|

|

See accompanying notes to financial statements.

DARDEN SAVINGS PLAN

Statement of Changes in Net Assets Available for Benefits

Year ended

April 30, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participant

directed

funds

|

|

ESOP Funds

(Note 7)

|

|

Total

|

|

Additions to net assets attributed to:

|

|

|

|

|

|

|

|

Investment income:

|

|

|

|

|

|

|

|

Net appreciation in fair value of investments

|

|

$

|

63,147,325

|

|

|

$

|

58,149,738

|

|

|

$

|

121,297,063

|

|

|

Dividends and interest

|

|

9,402,643

|

|

|

5,686,939

|

|

|

15,089,582

|

|

|

Net investment income

|

|

72,549,968

|

|

|

63,836,677

|

|

|

136,386,645

|

|

|

Notes receivable from Participants activity during the year:

|

|

|

|

|

|

|

|

Interest

|

|

643,414

|

|

|

—

|

|

|

643,414

|

|

|

Total notes receivable from Participants activity

|

|

643,414

|

|

|

—

|

|

|

643,414

|

|

|

Contributions:

|

|

|

|

|

|

|

|

Participants

|

|

39,141,363

|

|

|

—

|

|

|

39,141,363

|

|

|

Employer

|

|

12,012,787

|

|

|

—

|

|

|

12,012,787

|

|

|

Total contributions

|

|

51,154,150

|

|

|

—

|

|

|

51,154,150

|

|

|

Total additions

|

|

124,347,532

|

|

|

63,836,677

|

|

|

188,184,209

|

|

|

Deductions from net assets attributed to:

|

|

|

|

|

|

|

|

Benefits paid to participants

|

|

(51,472,760

|

)

|

|

(14,908,360

|

)

|

|

(66,381,120

|

)

|

|

Interest expense

|

|

—

|

|

|

(21,013

|

)

|

|

(21,013

|

)

|

|

Administrative expenses

|

|

(1,187,380

|

)

|

|

(164,020

|

)

|

|

(1,351,400

|

)

|

|

Transfers between funds

|

|

33,014,603

|

|

|

(33,014,603

|

)

|

|

—

|

|

|

Total deductions

|

|

(19,645,537

|

)

|

|

(48,107,996

|

)

|

|

(67,753,533

|

)

|

|

|

|

|

|

|

|

|

|

Net increase

|

|

$

|

104,701,995

|

|

|

$

|

15,728,681

|

|

|

$

|

120,430,676

|

|

|

Net assets available for benefits:

|

|

|

|

|

|

|

|

Beginning of year

|

|

438,316,493

|

|

|

185,719,777

|

|

|

624,036,270

|

|

|

End of year

|

|

$

|

543,018,488

|

|

|

$

|

201,448,458

|

|

|

$

|

744,466,946

|

|

See accompanying notes to financial statements.

DARDEN SAVINGS PLAN

Statement of Changes in Net Assets Available for Benefits

Year ended

April 30, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participant

directed

funds

|

|

ESOP Funds

(Note 7)

|

|

Total

|

|

Additions to net assets attributed to:

|

|

|

|

|

|

|

|

Investment income:

|

|

|

|

|

|

|

|

Net (depreciation) appreciation in fair value of investments

|

|

$

|

(8,698,279

|

)

|

|

$

|

12,514,038

|

|

|

$

|

3,815,759

|

|

|

Dividends and interest

|

|

10,361,759

|

|

|

11,927,746

|

|

|

22,289,505

|

|

|

Net investment income

|

|

1,663,480

|

|

|

24,441,784

|

|

|

26,105,264

|

|

|

Notes receivable from Participants activity during the year:

|

|

|

|

|

|

|

|

Interest

|

|

634,268

|

|

|

—

|

|

|

634,268

|

|

|

Total notes receivable from Participants activity

|

|

634,268

|

|

|

—

|

|

|

634,268

|

|

|

Contributions:

|

|

|

|

|

|

|

|

Participants

|

|

34,896,222

|

|

|

—

|

|

|

34,896,222

|

|

|

Employer

|

|

20,289,206

|

|

|

—

|

|

|

20,289,206

|

|

|

Total contributions

|

|

55,185,428

|

|

|

—

|

|

|

55,185,428

|

|

|

Total additions

|

|

57,483,176

|

|

|

24,441,784

|

|

|

81,924,960

|

|

|

Deductions from net assets attributed to:

|

|

|

|

|

|

|

|

Benefits paid to participants

|

|

(48,375,046

|

)

|

|

(17,004,176

|

)

|

|

(65,379,222

|

)

|

|

Interest expense

|

|

—

|

|

|

(12,076

|

)

|

|

(12,076

|

)

|

|

Administrative expenses

|

|

(972,506

|

)

|

|

(136,049

|

)

|

|

(1,108,555

|

)

|

|

Transfers between funds

|

|

10,729,819

|

|

|

(10,729,819

|

)

|

|

—

|

|

|

Total deductions

|

|

(38,617,733

|

)

|

|

(27,882,120

|

)

|

|

(66,499,853

|

)

|

|

|

|

|

|

|

|

|

|

Net increase (decrease)

|

|

$

|

18,865,443

|

|

|

$

|

(3,440,336

|

)

|

|

$

|

15,425,107

|

|

|

Net assets available for benefits:

|

|

|

|

|

|

|

|

Beginning of year

|

|

419,451,050

|

|

|

189,160,113

|

|

|

608,611,163

|

|

|

End of year

|

|

$

|

438,316,493

|

|

|

$

|

185,719,777

|

|

|

$

|

624,036,270

|

|

See accompanying notes to financial statements.

DARDEN SAVINGS PLAN

Notes to Financial Statements

April 30, 2017 and 2016

|

|

|

|

(1)

|

Description of the Plan

|

The following description of the Darden Savings Plan (the Plan) provides only general information. Participants should refer to official Plan documents and the summary plan description for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution plan sponsored by Darden Restaurants, Inc. (Company or Darden). The Plan was originally effective as of June 1, 1973, but was most recently amended and restated effective as of January 1, 2016 and has been subsequently amended. The Plan is subject to applicable provisions of the Employee Retirement Income Security Act of 1974 (ERISA). The assets of the Plan are held and invested through the Darden Savings Plan Trust (the Trust). The Plan covers certain employees of the Company’s operating and administrative subsidiaries, and their divisions and affiliates who meet the Plan’s age and service requirements.

Participants are permitted to defer into the Plan on both an “after-tax” and “before-tax” basis. The Internal Revenue Code (the Code) limits the amount of before-tax contributions that can be made to the Plan each year. The limit for Plan participants under age 50 was $18,000 in

2017

and

2016

. Participants who were at least age 50 or older during the year were permitted to make an additional “catch-up contribution” of $6,000 in

2017

and

2016

.

On November 9, 2015, the Company spun off select real estate and restaurant assets to create Four Corners Property Trust, Inc. (FCPT), an independent publicly traded company. As a result of the spin off, Plan participants who maintained a balance under the Darden Company Stock Fund and/or the Darden Employee Stock Ownership Plan (ESOP) Stock Fund received a pro rata distribution of FCPT common stock, which pro rata distribution remained invested in the Plan. The FCPT Company Stock Fund held shares distributed from the Darden Company Stock Fund. The FCPT ESOP Fund held shares distributed from the Darden ESOP Fund. The FCPT Company Stock Fund and FCPT ESOP Fund were immediately frozen to new contributions and new investments, but participants were generally allowed to transfer funds out of these investment options at any time. Liquidation of the FCPT Company Stock Fund and the FCPT ESOP Fund commenced on May 6, 2016. At this date, any residual shares of FCPT stock within the Plan were systematically liquidated over a period of time, and the proceeds from the liquidation, to the extent allocable to participants, were invested in accordance with Plan participants' investment elections applicable to their pre-tax or after-tax contributions to the Plan as of that date. As of the Plan year ended April 30, 2017, the Plan does not hold a balance in the FCPT Company Stock Fund or FCPT ESOP Fund or offer either of them as an investment option.

These recent events do not imply a Company decision to terminate the plan, as a result, the financial statement presentation remains consistent with Accounting Standards Codification (ASC) Topic 962-205, Plan Accounting-Defined Contribution Pension Plans-Presentation of Financial Statements, and does not need to be prepared on the liquidation basis of accounting, as described in paragraph ASC 962-40-35-1.

Employee Contributions

Qualified employees who are at least 21 years of age may immediately begin making before-tax and after-tax contributions to the Plan upon commencement of employment. Generally, qualified employees may contribute 1% to 25% of eligible compensation to the Plan. Plan participants age 50 or older, who make maximum before-tax contributions to the Plan, may generally make an additional catch-up contribution.

Employer Contributions

Generally, qualified employees who are at least age 21 and complete a year of service are eligible for Company Matching Contributions. The following groups of salaried qualified employees are generally eligible for a Retirement Plus Contribution (RPC): (i) employees hired on or after June 1, 2008 who are at least age 21 and complete a year of service; (ii) employees hired before June 1, 2008 who made a one-time irrevocable election under the Retirement Income Plan for Darden Restaurants, Inc. (RIP) to forego accruing cash balance benefits as of October 1, 2008; and (iii) employees who were actively accruing benefits under the RIP on December 31, 2014.

Company Matching Contributions

The Company will make a variable matching contribution ranging from 25% to 120% of an employee’s contributions, up to the first 6% of eligible compensation contributed to the Plan. Company Matching Contributions are contributed to the Plan on a quarterly basis and are invested in Darden common stock through the ESOP portion of the Plan. Effective July 1, 2015, Company Matching Contributions can be funded through the ESOP component of the Plan, the non-ESOP component of the Plan, or a combination of both. Company Matching Contributions funded through the non-ESOP component of the Plan are invested in accordance with participant investment elections.

DARDEN SAVINGS PLAN

Notes to Financial Statements

April 30, 2017 and 2016

DSP Advantage Bonus and DSP Advantage Matching Allocations

Prior to January 1, 2009, the Plan made DSP Advantage Bonus and DSP Advantage Matching Allocations to certain restaurant management and Restaurant Support Center administrative employees that had at least five years of service with the Company. Contributions were made in the form of Darden common stock through the ESOP portion of the Plan.

DSP Retirement Plus Contribution

The Company amended the Plan to allow for an additional non-elective Company contribution to eligible employees hired or rehired on or after June 1, 2008. The DSP RPC was originally intended to take the place of the cash balance portion of the RIP, which was closed to new hires effective June 1, 2008. Eligible employees who were participants in the cash balance formula of the RIP had a one-time irrevocable election to move to the Plan effective October 1, 2008 and receive the RPC. Accruals under the RIP were frozen effective December 31, 2014. In conjunction with this freeze, the Company expanded the RPC eligibility to include each employee who was actively accruing benefits under the RIP on December 31, 2014. Eligible employees are automatically enrolled in the Plan and need not make contributions to the Plan to be eligible to receive the RPC. Retirement Plus Contributions are made on a quarterly basis, and equal 1.5% of eligible compensation. The Plan was amended, effective December 31, 2008, to provide that dividends on unallocated shares of Company Stock that are in excess of ESOP loan requirements and Plan expenses may be used to fund RPC. The Plan was further amended, effective January 1, 2015, to provide for funding of the RPC through the ESOP component of the DSP, the non-ESOP component of the DSP, or a combination of both.

Distributions and In-Service Withdrawals

Active employees may take regular, hardship and DSP Advantage withdrawals from the Plan, subject to certain limitations prescribed by the Plan.

Upon termination of employment, participants are entitled to receive a distribution of their entire vested account balance. The vested portion of a participant’s account will automatically be distributed in a lump sum distribution at termination if the vested balance of a participant’s account is $1,000 or less. Terminated participants who have a vested account balance greater than $1,000 may elect either to receive a lump sum distribution or to leave their account in the Plan until attainment of age 65. The Plan charges a quarterly fee to terminated participants who leave their accounts in the Plan.

Vesting

Each participant is 100% vested in all employee contributions to the Plan and DSP Advantage Allocations, including earnings on all such amounts. Company Matching Contributions and RPC allocations are vested at a rate of 5% for each fiscal quarter beginning with the participant’s fifth quarter of service. An employee is fully vested after completion of 24 fiscal quarters of vesting service (except in the event of retirement, severance, divestiture or death) based on a participant’s years of service and is forfeited if a participant leaves prior to completing such vesting service requirements.

Employee Stock Ownership Plan (ESOP) Fund

The Plan purchased Company stock held in the Darden ESOP Fund (Note 7) using the proceeds of the ESOP loans. There are currently two ESOP loans outstanding payable to the Company to fund such purchases. These ESOP loans are secured by a pledge of the purchased Company stock. As ESOP loan repayments are made, the ESOP Trustee releases the leveraged shares. The Plan then uses these released shares to fund certain Company Matching Contributions and certain Retirement Plus Contributions, which are then allocated to eligible participants’ ESOP accounts.

Dividends are also automatically reinvested in participants’ ESOP accounts unless a participant has elected to receive such dividends in cash. Cash dividends on unallocated shares of Company stock can be used to repay promissory notes, pay Plan expenses, or fund the DSP-Retirement Plus Contributions. Participants are able to immediately transfer ESOP funds credited to their ESOP accounts to any of the Plan’s other investment funds. However, amounts may not be transferred from any of the other investment funds into the ESOP Fund.

Plan Administration

Wells Fargo Institutional Retirement and Trust (Trustee), a business unit of Wells Fargo Bank, N.A., serves as trustee and recordkeeper of the Plan. Wells Fargo Bank, N.A. is wholly-owned by Wells Fargo & Company.

Each participant is entitled to exercise voting rights attributable to the common stock of the Company shares allocated to his or her account and is notified prior to the time that such rights are to be exercised. The Trustee will vote any allocated shares for which instructions have not been given by a participant and any unallocated shares in the same proportion as votes received.

DARDEN SAVINGS PLAN

Notes to Financial Statements

April 30, 2017 and 2016

Additionally, as of March 19, 2015, Evercore Trust was appointed as the independent fiduciary and investment manager for the Company Stock Fund held in the plan. Evercore Trust will act as a fiduciary within the meaning of Section 3(21) of ERISA and an investment manager within the meaning of Section 3(38) of ERISA.

|

|

|

|

(2)

|

Summary of Significant Accounting Policies

|

(a)

Basis of Presentation

The financial statements of the Plan are prepared under the accrual-basis method of accounting in accordance with U.S. generally accepted accounting principles.

During the year ended April 30, 2017, Plan management re-evaluated the measurement inputs that are available for the Plan’s interests in collective trust funds. Plan management determined that these investments do not qualify for the use of net asset value as a practical expedient as these investments have a readily determinable fair value and has concluded that they should be included in the fair value hierarchy table. Plan management has reclassified these investments within the fair value hierarchy as of April 30, 2016. The reclassification did not affect recorded values.

(b)

Investments

The Plan’s investments include funds that invest in various types of investment securities and in various companies within various markets. Investment securities are exposed to several risks, such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the Plan’s financial statements and schedule.

As of

April 30, 2017

, 36% of the Plan’s investments are in the common stock of the Company. Accordingly, changes in the value of the Company’s common stock could have a greater effect on the Plan’s financial statements than other Plan investments.

(c)

Notes receivable from Participants

Notes receivable from Participants are recorded at their unpaid principal balance plus any accrued but unpaid interest. Participants may borrow from their vested account as follows: a minimum of $1,000 up to a maximum equal to the lesser of $50,000, minus the highest outstanding loan balance in the preceding 12 months even if repaid; 50% of their vested account balance; or the vested balance in the participant’s account excluding Retirement Plus Contribution amounts, amounts in the Darden ESOP Fund originally made as Retirement Plus Contributions. The loan amount may not result in loan repayments that exceed 50% of the participant’s 13 week average net take-home pay. Loan repayment terms generally may not exceed 5 years. The loans are secured by the balance in the participant’s account and bear market rates of interest. Principal and interest are paid through payroll deductions and may be repaid in full at any time without penalty. As of

April 30, 2017

, interest rates ranged from 4.25% to 9.50% and loans mature through April 07, 2032.

(d)

Use of Estimates

The preparation of financial statements, in accordance with U.S. generally accepted accounting principles, requires the Plan administrator to make estimates and assumptions that affect the reported amounts of net assets available for benefits at the date of the financial statements and the reported amounts of additions to and deductions from those net assets during the reporting period. Actual results could differ from those estimates.

DARDEN SAVINGS PLAN

Notes to Financial Statements

April 30, 2017 and 2016

(e) Application of New Accounting Standards

In June 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2015-10, Technical Corrections and Improvements, which amended the definition of Readily Determinable Fair Value (RDFV) to include equity securities in structures that are similar to mutual funds. According to the ASU, these types of investments have a RDFV if the fair value per share is determined and published and is the basis for current transactions. Additionally, the ASU states that if these types of investments are determined to have a RDFV based on the updated definition then the net asset value per share practical expedient cannot be applied. As a result, these types of investments would still need to be included in the fair value hierarchy table disclosure required by FASB ASC 820,

Fair Value Measurements

, in connection with the adoption of ASU 2015-07, Disclosures for Investments in Certain Entities that Calculate Net Asset Value per Share (or its Equivalent). ASU 2015-10 is effective is effective upon issuance of the update. We have adopted the provisions of this update for the Plan year ended April 30, 2017. See note 5 for additional information.

The Plan has not adopted any other new accounting standards in the current plan year. Other applicable accounting standards that have been issued by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the financial statements upon adoption.

Forfeitures of nonvested Company contributions to the Plan can be used in the following order of priority, to: (i) pay Plan expenses, (ii) reinstate previously forfeited amounts to rehired employees, (iii) be applied to Company Matching Contributions, (iv) to correct errors or resolve Plan claims, or (v) be allocated to participants’ Plan accounts. During the

2017

and

2016

Plan years, $1,032,327 and $858,933, respectively, of forfeitures were used to pay administrative expenses of the Plan. Forfeited funds were not used for any other reason during Plan years

2017

and

2016

. Additionally, as of

April 30, 2017

and

2016

forfeitures available for future use totaled $16,404 and $101,019, respectively.

|

|

|

|

(4)

|

Choice of Investments

|

As of

April 30, 2017

, participant contributions and RPC to the Plan may be directed to 20 basic investment alternatives: Columbia Trust Stable Government I-0 Fund, DFA US Small Cap Portfolio, American Funds EuroPacific Growth (R6), Vanguard Institutional Index Fund, Vanguard Target Retirement 2060 Fund, Vanguard Target Retirement 2055 Fund, Vanguard Target Retirement 2050 Fund, Vanguard Target Retirement 2045 Fund, Vanguard Target Retirement 2040 Fund, Vanguard Target Retirement 2035 Fund, Vanguard Target Retirement 2030 Fund, Vanguard Target Retirement 2025 Fund, Vanguard Target Retirement 2020 Fund, Vanguard Target Retirement 2015 Fund, Vanguard Target Retirement 2010 Fund, Vanguard Institutional Target Retirement Income Fund, Vanguard Total Bond Market Index, Vanguard Extended Market Index Fund, Vanguard Total International Stock Index, and Company Common Stock. Certain Company Matching Contributions and certain RPC are initially invested in the Darden ESOP Fund; however, participants may set up a separate automatic investment fund election to diversify their Company match (or RPC if applicable) to other investment options in the Plan.

|

|

|

|

(5)

|

Fair Value Measurement

|

Plan investments are recorded at fair value. Short-term investments are stated at cost, which approximates fair value. Shares of common stock are valued at closing market prices and shares of mutual funds are valued at quoted market prices, which represent the net asset value of shares held by the mutual fund at year end.

Investments in common collective trusts are valued using a RDFV based on the fair value of the underlying securities in which the account is invested. The RDFV is used if the fair value per share is determined and published and is the basis for current transactions. There are currently no redemption restrictions or unfunded commitments on these investments.

Purchases and sales of securities are recorded on a trade-date basis. Dividend income is recorded on the ex-dividend date. Interest income, net realized and unrealized gains or losses, and administrative expenses are recorded on the accrual basis. The cost of investment securities sold is determined on the weighted average basis. Deposits and withdrawals are made at fair value determined as of the end of the business day of the transaction. The ESOP loan is stated at cost, which approximates fair value because the loan bears interest at rates commensurate with loans of similar credit quality and duration as of year-end. The fair values of receivables and interest payable approximate their carrying amounts due to their short duration.

DARDEN SAVINGS PLAN

Notes to Financial Statements

April 30, 2017 and 2016

The following table summarizes the fair values of financial instruments measured at fair value on a recurring basis at

April 30, 2017

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair value

of assets

at April 30,

2017

|

|

Quoted prices

in active

markets for

identical assets

(Level 1)

|

|

Significant

other

observable

inputs

(Level 2)

|

|

Significant

unobservable

inputs

(Level 3)

|

|

Darden common stock

|

|

$

|

262,715,823

|

|

|

$

|

262,715,823

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Short-term investments

|

|

2,967,626

|

|

|

2,967,626

|

|

|

—

|

|

|

—

|

|

|

Mutual funds

|

|

415,532,476

|

|

|

415,532,476

|

|

|

—

|

|

|

—

|

|

|

Common collective trust

|

|

45,914,855

|

|

|

—

|

|

|

45,914,855

|

|

|

—

|

|

|

Total

|

|

$

|

727,130,780

|

|

|

$

|

681,215,925

|

|

|

$

|

45,914,855

|

|

|

$

|

—

|

|

The following table summarizes the fair values of financial instruments measured at fair value on a recurring basis at

April 30, 2016

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair value

of assets

at April 30,

2016

|

|

Quoted prices

in active

markets for

identical assets

(Level 1)

|

|

Significant

other

observable

inputs

(Level 2)

|

|

Significant

unobservable

inputs

(Level 3)

|

|

Darden common stock

|

|

$

|

213,151,969

|

|

|

$

|

213,151,969

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

FCPT common stock

|

|

24,169,944

|

|

|

24,169,944

|

|

|

—

|

|

|

—

|

|

|

Short-term investments

|

|

3,793,556

|

|

|

3,793,556

|

|

|

—

|

|

|

—

|

|

|

Mutual funds

|

|

328,219,249

|

|

|

328,219,249

|

|

|

—

|

|

|

—

|

|

|

Common collective trust

|

|

40,265,989

|

|

|

—

|

|

|

40,265,989

|

|

|

—

|

|

|

Total

|

|

$

|

609,600,707

|

|

|

$

|

569,334,718

|

|

|

$

|

40,265,989

|

|

|

$

|

—

|

|

For the years ended April 30, 2017 and 2016, there were no investments classified as level 3 nor were there any transfers in or out of levels 1, 2, or 3.

|

|

|

|

(6)

|

Common Stock of Darden Restaurants, Inc.

|

At

April 30, 2017

and

2016

, the fair value of the shares held in non ESOP Fund participant directed accounts was

$61,369,087

(

720,379

shares) and $

45,251,144

(726,926 shares), respectively. For further information on the Company, participants should refer to the Company’s consolidated financial statements included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission.

DARDEN SAVINGS PLAN

Notes to Financial Statements

April 30, 2017 and 2016

The Plan previously entered into several ESOP loan transactions and borrowed money from the Company to purchase shares of Company stock. These ESOP loans are secured by pledges of the purchased Company stock. The ESOP Trustee holds the purchased shares (also referred to as leveraged shares) in a designated ESOP Fund, along with some cash held in short-term investments. As ESOP loan repayments are made, the ESOP Trustee releases these shares. The Plan may use these released shares to fund Company matching contributions and Retirement Plus Contributions, which are then allocated to eligible participants’ ESOP accounts. Dividends are also automatically reinvested in participants’ ESOP accounts unless a participant has elected to receive such dividends in cash. Participants are able to immediately transfer ESOP funds credited to their ESOP accounts to any of the Plan’s other investment funds. However, amounts may not be transferred from any of the other investment funds into the ESOP Fund. Shares used to fund Company contributions reduce the net assets of the non-participant directed portion of the ESOP fund and increase the net assets of the participant directed funds. These contributions are included as transfers between funds on the accompanying statements of changes in net assets available for benefits. Additionally, as a result of the real estate spun off in November 2015, the Darden ESOP fund received a pro rata distribution of FCPT common shares which remained in the FCPT ESOP Fund. The FCPT ESOP Fund was immediately frozen to new contributions and new investments, but participants were generally allowed to transfer funds out of the FCPT ESOP Fund at any time. At

April 30, 2016

, the fair value of the 1,043,868 allocated FCPT shares was $18,528,657. Starting May 6, 2016, any residual shares of FCPT stock within the Plan were systematically liquidated over a period of time, and the proceeds from the liquidation, to the extent allocable to participants, were invested in accordance with plan participants' investment elections applicable to their pre-tax or after-tax contributions to the Plan as of that date. Of the total transfers between funds of $33,014,603 on the accompanying statements of changes in net assets available for benefits, $20,603,434 is attributable to the FCPT ESOP liquidation. As of the Plan year ended April 30, 2017, the Plan does not hold a balance in the FCPT ESOP Fund or offer it as an investment option.

At

April 30, 2017

and

2016

, the Darden ESOP Fund consists of

2,363,502

and 2,697,202 shares, respectively, of Darden's common stock. Of the total shares held by the Darden ESOP Fund,

2,033,371

shares at

April 30, 2017

and 2,188,160 shares at April 30,

2016

of Darden's common stock have been allocated to individual participant accounts. The remaining

330,131

shares at

April 30, 2017

and 509,042 shares at

April 30, 2016

of Darden's common stock, which are held by the ESOP Trustee, are unallocated (suspense) shares reserved for future Company matching contributions or Retirement Plus Contributions. At

April 30, 2017

, the fair value of the

330,131

unallocated Company shares was $

28,123,861

and the fair value of the

2,033,371

allocated shares was $

173,222,875

. At

April 30, 2016

, the fair value of the 509,042 unallocated Company shares was $31,687,865 and the fair value of the 2,188,160 allocated shares was $136,212,960. Cash dividends on unallocated shares of Company stock can be used to repay promissory notes, pay Plan expenses, or fund the DSP-Retirement Plus Contributions.

The Darden ESOP Fund has two promissory notes payable to the Company, with outstanding principal balances of $1,424,360 (Original Loan) and $1,055,954 (Additional Loan) as of

April 30, 2017

and $2,267,900 and $1,155,954 as of

April 30, 2016

. The notes bear interest at variable rates payable on a monthly, bi-monthly, or quarterly basis at the discretion of the Company. As of

April 30, 2017

, the interest rates on the notes were 0.9122% and 1.13122%, respectively. As of

April 30, 2016

, the interest rates on the notes were 0.4362% and 0.63385%, respectively. The Original Loan has no required principal payments on the remaining note balance until its maturity date on December 15, 2019. The Additional Loan requires a $100,000 annual principal payment over three years starting December 15, 2015, a $200,000 principal payment due on December 15, 2018 and the remaining outstanding balance is due at maturity on December 31, 2018. Any or all of the principal may be prepaid at any time. For the years ended

April 30, 2017

and

2016

, the Darden ESOP Fund made principal payments of $943,540 and $835,000, respectively.

DARDEN SAVINGS PLAN

Notes to Financial Statements

April 30, 2017 and 2016

Information about the net assets and significant components of the changes in net assets relating to the ESOP Funds as of and for the years ended

April 30, 2017

and

2016

is presented in the following tables:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESOP Funds Statement of Net Assets Available for Benefits

|

|

April 30, 2017

|

|

|

|

Non-participant

Directed

|

|

Participant

Directed

|

|

Total

|

|

Assets:

|

|

|

|

|

|

|

|

Investments:

|

|

|

|

|

|

|

|

Investments, at fair value

|

|

$

|

188

|

|

|

$

|

1,243,665

|

|

|

$

|

1,243,853

|

|

|

Common stock of Darden Restaurants, Inc – allocated

|

|

—

|

|

|

173,222,875

|

|

|

173,222,875

|

|

|

Common stock of Darden Restaurants, Inc. – unallocated

|

|

28,123,861

|

|

|

—

|

|

|

28,123,861

|

|

|

Total investments

|

|

28,124,049

|

|

|

174,466,540

|

|

|

202,590,589

|

|

|

Receivables:

|

|

|

|

|

|

|

|

Accrued dividends and interest

|

|

184,998

|

|

|

1,154,427

|

|

|

1,339,425

|

|

|

Total receivables

|

|

184,998

|

|

|

1,154,427

|

|

|

1,339,425

|

|

|

Total assets

|

|

28,309,047

|

|

|

175,620,967

|

|

|

203,930,014

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

ESOP loans

|

|

2,480,314

|

|

|

—

|

|

|

2,480,314

|

|

|

Interest payable

|

|

1,242

|

|

|

—

|

|

|

1,242

|

|

|

Total liabilities

|

|

2,481,556

|

|

|

—

|

|

|

2,481,556

|

|

|

Net assets available for benefits

|

|

$

|

25,827,491

|

|

|

$

|

175,620,967

|

|

|

$

|

201,448,458

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESOP Funds Statement of Net Assets Available for Benefits

|

|

April 30, 2016

|

|

|

|

Non-participant

Directed

|

|

Participant

Directed

|

|

Total

|

|

Assets:

|

|

|

|

|

|

|

|

Investments:

|

|

|

|

|

|

|

|

Investments, at fair value

|

|

$

|

566

|

|

|

$

|

1,343,986

|

|

|

$

|

1,344,552

|

|

|

Common stock of Darden Restaurants, Inc. – allocated

|

|

—

|

|

|

136,212,960

|

|

|

136,212,960

|

|

|

Common stock of Darden Restaurants, Inc. – unallocated

|

|

31,687,865

|

|

|

—

|

|

|

31,687,865

|

|

|

Common stock of Four Corners Property Trust, Inc – allocated

|

|

—

|

|

|

18,528,657

|

|

|

18,528,657

|

|

|

Total investments

|

|

31,688,431

|

|

|

156,085,603

|

|

|

187,774,034

|

|

|

Receivables:

|

|

|

|

|

|

|

|

Accrued dividends and interest

|

|

254,571

|

|

|

1,115,785

|

|

|

1,370,356

|

|

|

Total receivables

|

|

254,571

|

|

|

1,115,785

|

|

|

1,370,356

|

|

|

Total assets

|

|

31,943,002

|

|

|

157,201,388

|

|

|

189,144,390

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

ESOP loans

|

|

3,423,854

|

|

|

—

|

|

|

3,423,854

|

|

|

Interest payable

|

|

759

|

|

|

—

|

|

|

759

|

|

|

Total liabilities

|

|

3,424,613

|

|

|

—

|

|

|

3,424,613

|

|

|

Net assets available for benefits

|

|

$

|

28,518,389

|

|

|

$

|

157,201,388

|

|

|

$

|

185,719,777

|

|

|

|

|

|

|

|

|

|

|

DARDEN SAVINGS PLAN

Notes to Financial Statements

April 30, 2017 and 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESOP Funds Statement of Changes in Net Assets Available for Benefits

|

|

Year ended April 30, 2017

|

|

|

|

Non-participant

Directed

|

|

Participant

Directed

|

|

Total

|

|

Additions to net assets attributed to:

|

|

|

|

|

|

|

|

Net appreciation in fair value of investments

|

|

$

|

8,518,456

|

|

|

$

|

49,631,282

|

|

|

$

|

58,149,738

|

|

|

Dividends and interest

|

|

984,973

|

|

|

4,701,966

|

|

|

5,686,939

|

|

|

Total additions

|

|

9,503,429

|

|

|

54,333,248

|

|

|

63,836,677

|

|

|

|

|

|

|

|

|

|

|

Deductions from net assets attributed to:

|

|

|

|

|

|

|

|

Benefits paid to participants

|

|

—

|

|

|

(14,908,360

|

)

|

|

(14,908,360

|

)

|

|

Interest expense

|

|

(21,013

|

)

|

|

—

|

|

|

(21,013

|

)

|

|

Administrative expenses

|

|

(19,011

|

)

|

|

(145,009

|

)

|

|

(164,020

|

)

|

|

Transfers between funds

|

|

(12,154,303

|

)

|

|

(20,860,300

|

)

|

|

(33,014,603

|

)

|

|

Total deductions

|

|

(12,194,327

|

)

|

|

(35,913,669

|

)

|

|

(48,107,996

|

)

|

|

|

|

|

|

|

|

|

|

Net (decrease) increase

|

|

$

|

(2,690,898

|

)

|

|

$

|

18,419,579

|

|

|

$

|

15,728,681

|

|

|

Net assets available for benefits:

|

|

|

|

|

|

|

|

Beginning of year

|

|

28,518,389

|

|

|

157,201,388

|

|

|

185,719,777

|

|

|

End of year

|

|

$

|

25,827,491

|

|

|

$

|

175,620,967

|

|

|

$

|

201,448,458

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESOP Funds Statement of Changes in Net Assets Available for Benefits

|

|

Year ended April 30, 2016

|

|

|

|

Non-participant

Directed

|

|

Participant

Directed

|

|

Total

|

|

Additions to net assets attributed to:

|

|

|

|

|

|

|

|

Net appreciation in fair value of investments

|

|

$

|

3,888,580

|

|

|

$

|

8,625,458

|

|

|

$

|

12,514,038

|

|

|

Dividends and interest

|

|

1,167,786

|

|

|

10,759,960

|

|

|

11,927,746

|

|

|

Total additions

|

|

5,056,366

|

|

|

19,385,418

|

|

|

24,441,784

|

|

|

|

|

|

|

|

|

|

|

Deductions from net assets attributed to:

|

|

|

|

|

|

|

|

Benefits paid to participants

|

|

—

|

|

|

(17,004,176

|

)

|

|

(17,004,176

|

)

|

|

Interest expense

|

|

(12,076

|

)

|

|

—

|

|

|

(12,076

|

)

|

|

Administrative expenses

|

|

(47,638

|

)

|

|

(88,411

|

)

|

|

(136,049

|

)

|

|

Transfers between funds

|

|

(10,823,045

|

)

|

|

93,226

|

|

|

(10,729,819

|

)

|

|

Total deductions

|

|

(10,882,759

|

)

|

|

(16,999,361

|

)

|

|

(27,882,120

|

)

|

|

|

|

|

|

|

|

|

|

Net (decrease) increase

|

|

$

|

(5,826,393

|

)

|

|

$

|

2,386,057

|

|

|

$

|

(3,440,336

|

)

|

|

Net assets available for benefits:

|

|

|

|

|

|

|

|

Beginning of year

|

|

34,344,782

|

|

|

154,815,331

|

|

|

189,160,113

|

|

|

End of year

|

|

$

|

28,518,389

|

|

|

$

|

157,201,388

|

|

|

$

|

185,719,777

|

|

|

|

|

|

(8)

|

Party-in-Interest Transactions

|

Certain Plan investments are in common stock of the Company and money market funds managed by the Trustee, and therefore, these transactions qualify as party-in-interest transactions. However, such transactions qualify for prohibited transaction exemptions. The Company pays the Trustee’s administrative and trustee fees. Such fees, inclusive of fees paid by plan forfeitures and fees paid by terminated participants used to cover plan expenses, were $1,032,327 and $858,933 for the years ended

April 30, 2017

and

2016

, respectively.

Certain Plan assets are loans to participants who are employees of the Company; therefore, these transactions qualify as party-in-interest transactions. However, such transactions qualify for prohibited transaction exemptions. Terminated participants that elect to leave their accounts in the Plan are required to pay quarterly fees; therefore, these transactions also qualify as party-in-interest transactions. However, such transactions qualify for prohibited transaction exemptions. Fees paid by terminated participants were $191,345 and $178,780 for the years ended

April 30, 2017

and

2016

, respectively.

|

|

|

|

(9)

|

Reconciliation of Financial Statements to Form 5500

|

The following is a reconciliation of net assets available for plan benefits per the accompanying financial statements to Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2017

|

|

2016

|

|

Net assets available for benefits per the accompanying financial statements

|

|

$

|

744,466,946

|

|

|

$

|

624,036,270

|

|

|

Notes receivable from Participants – deemed distributions

|

|

(576,629

|

)

|

|

(532,765

|

)

|

|

Net assets available for benefits per Form 5500

|

|

$

|

743,890,317

|

|

|

$

|

623,503,505

|

|

The following is a reconciliation of total deductions to net assets, net, per the accompanying financial statements to Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2017

|

|

2016

|

|

Total deductions per the accompanying financial statements

|

|

$

|

67,753,533

|

|

|

$

|

66,499,853

|

|

|

Deemed distributed notes receivable from Participants offset by total distributions

|

|

43,864

|

|

|

50,796

|

|

|

Total deductions per Form 5500

|

|

$

|

67,797,397

|

|

|

$

|

66,550,649

|

|

Amounts allocated to deemed distributions of notes receivable from Participants are recorded as a receivable in the accompanying financial statements and recorded as an expense on Form 5500.

A note receivable from a Participant is deemed distributed during the plan year for the Form 5500 under the provisions of the Code section 72(p) and the Treasury Regulation section 1.72(p) if the note receivable is treated as a note receivable solely of the participant’s individual account and the participant has discontinued payment of the note receivable as of the end of the year. However, in accordance with U.S. generally accepted accounting principles, for the accompanying financial statements the note receivable balance is still considered an outstanding note receivable until the note receivable obligation has been satisfied and is not treated as an actual distribution until such time the participant separates from employment and the participant’s vested account balance is fully distributed.

The Plan obtained a determination letter on March 23, 2017, in which the Internal Revenue Service (IRS) stated that the Plan, as restated effective January 1, 2016, was in compliance with the applicable requirements of the Code. Although the Plan has been amended since receiving the determination letter, the Company believes that the Plan currently is designed and being operated in compliance with the applicable requirements of the Code, and therefore, the Plan qualifies under Sections 401(a) and 4975(e)(7) and the related Trust is tax exempt as of

April 30, 2017

. Therefore, no provision for income taxes has been included in the Plan’s financial statements.

U.S. generally accepted accounting principles require Plan management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of

April 30, 2017

there were no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are no audits for any tax periods in progress. The Plan Administrator believes it is no longer subject to income tax examinations for plan years ended through April 30, 2014.

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of the Employee Retirement Income Security Act of 1974. In the event of Plan termination, no further contributions shall be made to the Plan by either the Company or the

participants, participants would become fully vested in their employer contributions and the related Plan Trust would be used exclusively for the benefit of participants and beneficiaries after the payment of liquidation expenses. Any unallocated leveraged shares in the ESOP Fund would be sold to the Company or on the open market. The proceeds of such sale would be used to satisfy any outstanding acquisition loan and the balance of any funds remaining would be allocated to each participant's ESOP account based on the proportion that each such participant's ESOP account balance bears in relation to the total of all ESOP account balances.

On June 23, 2017, the Plan obtained a corrected determination letter, which supersedes the determination letter dated March 23, 2017. In the updated letter the IRS stated that the Plan, as restated effective January 1, 2016, was in compliance with the applicable requirements of the Code.

There have been no other subsequent events through the issuance of these financial statements on

October 23, 2017

.

DARDEN SAVINGS PLAN

Schedule H, Line 4a – Schedule of Delinquent Participant Contributions

Year Ended

April 30, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participant Contributions Transferred Late to Plan *

|

|

Total That Constitute Nonexempt Prohibited Transactions

|

|

Total Fully Corrected under VFCP and PTE 2002-51 *

|

|

Check here if late participant loan contributions are included:

x

|

Contributions Not Corrected

|

Contributions Corrected Outside VFCP

|

Contributions Pending Correction in VFCP

|

|

|

$

|

706,949

|

|

—

|

|

—

|

|

—

|

|

|

$

|

706,949

|

|

|

|

|

|

|

|

*

|

The amount represents delinquent participant contributions and loan repayments corrected through VFCP. In calculating this amount, Darden subtracted $184.12 in participant loan repayments that were included in the VFCP filing but were subsequently discovered to apply to loans previously paid off by participants before the applicable payroll posted and thus were not required to be remitted to the plan’s trust. The Company also remitted lost earnings of $310.47 to the Plan on August 26, 2016 in connection with the VFCP filing.

|

See accompanying report of independent registered public accounting firm.

DARDEN SAVINGS PLAN

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

April 30, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuer

|

|

Face amount

or number

of units

|

|

Cost

|

|

Current

value

|

|

Darden common stock *, **

|

|

3,083,881

|

|

|

$

|

45,819,062

|

|

|

$

|

262,715,823

|

|

|

Columbia Trust Stable Government I-0 Fund

|

|

4,117,924

|

|

|

45,309,548

|

|

|

45,914,855

|

|

|

DFA US Small Cap Portfolio

|

|

1,127,707

|

|

|

35,998,310

|

|

|

38,793,113

|

|

|

American Funds EuroPacific Growth (R6)

|

|

586,233

|

|

|

25,293,000

|

|

|

29,792,362

|

|

|

Vanguard Institutional Index Fund

|

|

457,848

|

|

|

69,144,772

|

|

|

99,508,596

|

|

|

Vanguard Target Retirement 2060 Fund

|

|

87,160

|

|

|

1,712,485

|

|

|

1,876,558

|

|

|

Vanguard Target Retirement 2055 Fund

|

|

342,141

|

|

|

6,689,439

|

|

|

7,373,142

|

|

|

Vanguard Target Retirement 2050 Fund

|

|

1,018,241

|

|

|

19,468,960

|

|

|

21,912,556

|

|

|

Vanguard Target Retirement 2045 Fund

|

|

1,728,644

|

|

|

32,744,768

|

|

|

37,183,137

|

|

|

Vanguard Target Retirement 2040 Fund

|

|

957,521

|

|

|

18,221,019

|

|

|

20,529,254

|

|

|

Vanguard Target Retirement 2035 Fund

|

|

1,680,092

|

|

|

31,927,077

|

|

|

35,953,969

|

|

|

Vanguard Target Retirement 2030 Fund

|

|

749,042

|

|

|

14,428,584

|

|

|

15,984,552

|

|

|

Vanguard Target Retirement 2025 Fund

|

|

1,284,317

|

|

|

24,771,510

|

|

|

27,355,951

|

|

|

Vanguard Target Retirement 2020 Fund

|

|

517,876

|

|

|

10,139,666

|

|

|

10,978,968

|

|

|

Vanguard Target Retirement 2015 Fund

|

|

324,829

|

|

|

6,350,645

|

|

|

6,834,405

|

|

|

Vanguard Target Retirement 2010 Fund

|

|

39,498

|

|

|

784,804

|

|

|

825,106

|

|

|

Vanguard Institutional Target Retirement Income Fund

|

|

160,442

|

|

|

3,176,728

|

|

|

3,342,011

|

|

|

Vanguard Total Bond Market Index

|

|

2,090,662

|

|

|

22,772,103

|

|

|

22,453,708

|

|

|

Vanguard Extended Market Index

|

|

405,762

|

|

|

25,720,062

|

|

|

31,109,788

|

|

|

Vanguard Total International Stock Index

|

|

136,859

|

|

|

3,540,947

|

|

|

3,725,300

|

|

|

Short-term Investment Fund*

|

|

2,967,626

|

|

|

2,967,626

|

|

|

2,967,626

|

|

|

Notes receivable from Participants outstanding – interest rates ranging from 4.25% – 9.50% with varying maturities*

|

|

3,291

|

|

|

—

|

|

|

16,275,100

|

|

|

Total

|

|

|

|

|

|

|

$

|

743,405,880

|

|

|

|

|

|

|

|

**

|

Includes unallocated shares held in the Darden ESOP Fund as collateral for the promissory notes

|

See accompanying report of independent registered public accounting firm.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Darden Savings Plan has duly caused this Annual Report to be signed on its behalf by the Benefit Plans Committee (as Plan Fiduciary and administrator of the financial aspects of the Darden Savings Plan), by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

Benefit Plans Committee,

|

|

|

|

|

|

as Plan Fiduciary and administrator

|

|

|

|

|

|

of the financial aspects of

|

|

|

|

|

|

the Darden Savings Plan

|

|

|

|

|

|

|

Dated:

|

October 23, 2017

|

|

By:

|

/s/ Julie Griffin

|

|

|

|

|

|

Julie Griffin, Chairperson

|

|

|

|

|

|

Benefit Plans Committee

|

|

|

|

|

|

Darden Restaurants, Inc.

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description of Exhibit

|

|

23

|

|

|

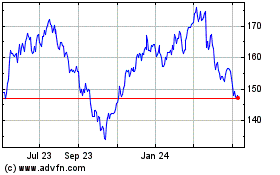

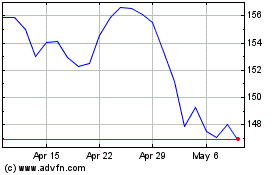

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From Apr 2023 to Apr 2024