Current Report Filing (8-k)

October 20 2017 - 4:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 16, 2017

SUNOCO LP

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35653

|

|

30-0740483

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

8020 Park Lane, Suite 200

Dallas, Texas 75231

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (832)

234-3600

Check the appropriate box below if the

Form 8-K

filing is intended to simultaneously satisfy the filing

obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to

Rule 14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 14d-2(b) under

the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 13e-4(c) under

the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or

Rule 12b-2 of

the Securities Exchange Act of 1934 (17

CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Fifth Amendment to Credit Agreement

On October 16, 2017, Sunoco LP (the “Partnership”) entered into an amendment (the “Credit Agreement Amendment”) to

that certain Credit Agreement, dated as of September 25, 2014 (as amended to date, the “Credit Agreement”) with the lenders party thereto and Bank of America, N.A., in its capacity as a letter of credit issuer, as swing line lender,

and as administrative agent. The Credit Agreement Amendment amended the Credit Agreement to, among other matters:

|

|

•

|

|

permit the sale of, as previously disclosed in the Form

8-K

filed on April 6, 2017, (a) approximately 1,112 convenience stores to

7-Eleven,

Inc. and (b) approximately 208 convenience stores across North and West Texas, New Mexico and Oklahoma in a separate auction process (such sales, the “Asset Sales”), in each case

subject to (i) no event of default, (ii) receipt of 100% cash consideration, (iii) receipt of at least fair market value for the disposed assets, (iv) repayment of any outstanding term loan obligations with proceeds from such

disposition, (v) pro forma liquidity of at least $150.0 million, (vi) pro forma compliance with the financial covenants, and (vii) consummation on or prior to April 6, 2018;

|

|

|

•

|

|

amend the definition of Consolidated EBITDA to include projected margins from the minimum gallons to be purchased under any fuel supply contract to be entered into in connection with the sale to

7-Eleven,

Inc.;

|

|

|

•

|

|

decrease the maximum level of the ratio of consolidated funded debt to consolidated EBITDA of the Partnership permitted under the Credit Agreement after the consummation of each of the Asset Sales to

|

|

|

|

|

|

|

|

|

|

Quarterly Testing

Date

|

|

Maximum

Leverage Ratio

(No

Disposition)

|

|

Maximum

Leverage Ratio

(Either

Disposition)

|

|

Maximum

Leverage Ratio

(Both

Dispositions)

|

|

September 30, 2017

|

|

6.75 to 1.00

|

|

6.75 to 1.00

|

|

6.75 to 1.00

|

|

December 31, 2017

|

|

6.75 to 1.00

|

|

6.00 to 1.00

|

|

5.75 to 1.00

|

|

March 31, 2018

|

|

6.50 to 1.00

|

|

5.75 to 1.00

|

|

5.75 to 1.00

|

|

June 30, 2018

|

|

6.25 to 1.00

|

|

5.50 to 1.00

|

|

5.50 to 1.00

|

|

September 30, 2018

|

|

6.00 to 1.00

|

|

5.50 to 1.00

|

|

5.50 to 1.00

|

|

December 31, 2018

|

|

5.75 to 1.00

|

|

5.50 to 1.00

|

|

5.50 to 1.00

|

|

Each Quarterly Testing Date thereafter

|

|

5.50 to 1.00

|

|

5.50 to 1.00

|

|

5.50 to 1.00

|

(in the case of any quarter for which the maximum ratio would otherwise be 5.50 to 1.00, subject to increases

to 6.0 to 1.0 in connection with certain future specified acquisitions); and

|

|

•

|

|

extend the existing minimum Interest Coverage Ratio requirement through the maturity of the Credit Agreement.

|

The discussion included herein of the Credit Agreement Amendment is qualified in its entirety by reference to Exhibit 10.1 of this report on

Form

8-K,

which is hereby incorporated into this item.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

SUNOCO LP

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

SUNOCO GP LLC, its General Partner

|

|

|

|

|

|

|

Date: October 20, 2017

|

|

|

|

By:

|

|

/s/ Thomas R. Miller

|

|

|

|

|

|

Name:

|

|

Thomas R. Miller

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

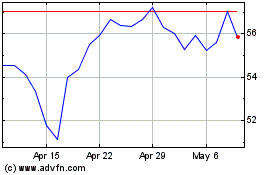

Sunoco (NYSE:SUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

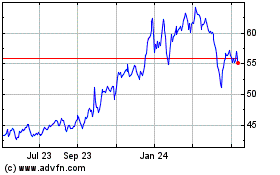

Sunoco (NYSE:SUN)

Historical Stock Chart

From Apr 2023 to Apr 2024