Report of Foreign Issuer (6-k)

October 20 2017 - 6:08AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of October, 2017

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

(Exact name of registrant as specified in its charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Avenida Presidente Vargas, 409 - 13th floor,

Edifício Herm. Stoltz - Centro, CEP 20071-003,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

CENTRAIS ELETRICAS BRASILEIRAS S/A

CNPJ: 00.001.180/0001-26

PUBLIC COMPANY

Centrais Elétricas Brasileiras S/A ("Company" or "Eletrobras")

hereby informs its shareholders and the market in general that it received, on October 18, 2017, from B3 S.A. ("Brasil, Bolsa e Balcão"), the Official Letter No. 1651/17-SAE, requesting clarifications regarding the news published by Agência Estado - Broadcast, entitled “With the restructuring program in progress, Eletrobras expects leverage below 3x in 2018”, as transcribed below:

Free Translation of the Official Letter nº 1651/2017-SAE

“Subject: Official Letter 1651/2017-SAE – Eletrobras - Request for clarification on news released by press

Centrais Elétricas Brasileiras S.A. - Eletrobras

At. Mr. Armando Casado de Araújo

CFO and Investor Relations Officer

Ref.:

Request for clarification on news released by press

Dear Officers,

In a report published by Agência Estado - Broadcast on 10/18/2017, under the title “

With the restructuring program in progress, Eletrobras expects leverage below 3x in 2018”

, among other information, it is stated that:

1.

The Company’s CEO, Wilson Ferreira Junior, said that the company may reach a net debt / Ebitda ratio below 3 times next year, compared to 4.7 times registered at the end of last June;

2.

This reduction will be possible mainly due to the privatization of Eletrobras’ distribution companies that operates in the North and Northeast regions of the country and to corporate stock’s sales of Special Purpose Companies (SPE), which should be undertaken over the next few months;

3.

Last year, Eletrobras declared a potential revenue of R$ 200 million considering the sale of real state properties. Today, Ferreira Junior expects a potential earning of R$ 500 million;

4.

Eletrobras is preparing a further reduction of employees. Soon, it will launch a Voluntary Dismissal Plan, in which expects that more than 2,000 employees joining it;

5.

Eletrobras’ directors expect to keep only 12,600 employees, compared to almost 24,000 at the beginning of the year. As a result, activity and personnel expenses should decrease to approximately R$ 6 billion, compared to the initial R$ 10 billion.

That said, we request clarification on the item indicated, until 10/19/2017, with your confirmation or not, as well as other information considered important.”

In compliance with the above-mentioned Official Letter, the Company clarifies the following:

1. According to the Relevant Fact disclosed on November 17, 2016, the Company duly informed the market that its objective was to reduce the net debt/EBITDA ratio to lower than 4 times, which is progressively occurring, as may be verified in the Company’s Quarterly Financial Information for the period ended on June 30, 2017, as well as in its teleconference to the market for the second quarter of 2017, which was duly filed with the Brazilian Securities and Exchange Commission (CVM) and its website (

www.eletrobras.com/elb/ri

);

2. As widely disclosed in the Company’s Business and Management Master Plan ("PDNG") 2017/2021, some of the measures that would be adopted by the Company to reduce the Net Debt/Ebitda indicator would be the privatization of Eletrobras’ distribution companies and the divestment in some special purpose companies ("SPEs").

3. The decision of privatization of Eletrobras’ distribution companies named Companhia Energética de Alagoas (Ceal), Companhia Energética do Piauí (Cepisa), Companhia de Electricidade do Acre (Eletroacre), Amazonas Distribuidora de Energia S.A., Boa Vista Energia S.A. Elétricas de Rondônia S.A. (CERON), has already been the subject of several Relevant Facts and other Market Announcements, including the one disclosed on September 27, 2017. Consequently, the employees of these Companies will no longer be a part of the Eletrobras Companies, carrying to a staff reduction and its related expenses.

4. Regarding the SPEs’ divestment, ELetrobras has also disclosed a Market Announcement on July 21, 2017, which dicloses the equity interests held by each subsidiarie in special purpose companies ("SPE"), which will be transferred to Eletrobras holding, for intra-group debt settlement, and subsequent sale by Eletrobras.

5. In addition to the employees reduction in Eletrobras’ distribution companies, above-mentioned in item 2, through PDNG 2017-2021, properly disclosed by means of a Relevant Fact, Eletrobras announced that it intended to carry out two additional processes to reduce employee numbers, these being (i) Extraordinary Retirement Program (PAE), already performed for all Eletrobras companies, with the exception of Amazonas Geração e Transmissão S.A., which will result in a reduction of about 2,097 employees and estimated savings of R$ 874.8 million per year, according to the second quarter of 2017 teleconference, which is filed with the Brazilian Securities and Exchange Commission (CVM) and on the Company’s web site (www.eletrobras.com/elb/ri); and (ii) PID – Early Retirement Plan, to be completed until 2018, with an estimated saving of approximately R$ 600 million after the dismissals of the employees who join the Plan.

6. As well, the sale of real estate by the Company is also included in PDNG 2017-2021, as duly disclosed to the Market.

7. In view of all of foregoing, it is verified that the above-mentioned information is properly disclosed to the market through Relevant Facts, Market Announcemets and Presentations, which can be accessed in CVM website (www.cvm.gov.br) and Eletrobras’ website (www.eletrobras.com/elb/ri).

Rio de

Janeiro, October 19, 2017.

Armando Casado de Araujo

CFO and Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

|

|

|

|

|

|

By:

|

/

S

/

Armando Casado de Araujo

|

|

|

|

Armando Casado de Araujo

Chief Financial and Investor Relation Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

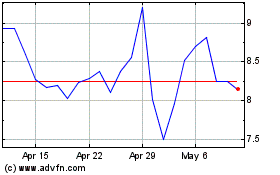

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

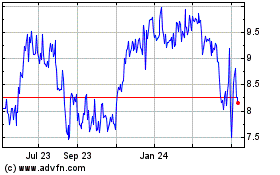

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

From Apr 2023 to Apr 2024