800 South Street, Suite 230

Waltham, MA 02453

October 19, 2017

VIA EDGAR

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

|

|

|

|

Re:

|

Great Elm Capital Corp.

|

|

|

File No. 814-01211

|

|

|

Rule 17g-1(g) Fidelity Bond Filing

|

Ladies and Gentlemen:

On behalf of Great Elm Capital Corp (the

“

Company

”

), enclosed herewith for filing, pursuant to Rule 17g-1(g) under the Investment Company Act of 1940, as amended, are the following:

|

|

1.

|

a Certificate of the Secretary of the Company containing the resolutions of the Board of Directors approving the amount, type, form and coverage of the Fidelity Bond and a statement as to the period for which premiums have been paid; and

|

|

|

2.

|

a copy of the fidelity bond covering the Company (the “Fidelity Bond”), which includes a statement as to the period for which premiums have been paid.

|

If you have any questions regarding this submission, please do not hesitate to call me at (617) 375-3006.

|

|

Very truly yours,

|

|

|

|

|

|

|

|

|

GREAT ELM CAPITAL CORP

|

|

|

|

|

|

/s/ Adam Kleinman

|

|

|

|

|

|

Adam Kleinman

|

|

|

Secretary

|

Enclosures

CERTIFICATE OF SECRETARY

The undersigned, being the duly elected Secretary of Great Elm Capital Corp., a Maryland corporation (the “Corporation”), hereby certifies that the following resolutions were adopted by the board of directors of the Corporation (the “Board”) by unanimous written consent on October 16, 2017.

WHEREAS, Section 17(g) of the Investment Company Act of 1940, as amended (the “Investment Company Act”), and Rule 17g-1(a) thereunder require a company that has elected to be treated as a business development company under the Investment Company Act, such as the Corporation, to provide and maintain a bond which has been issued by a reputable fidelity insurance company authorized to do business in the place where the bond is issued, to protect the Corporation against larceny and embezzlement, covering each officer and employee of the Corporation who may singly, or jointly with others, have access to the securities or funds of the Corporation, either directly or through authority to draw upon such funds of, or to direct generally, the disposition of such securities, unless the officer or employee has such access solely through his position as an officer or employee of a bank (each, a “covered person”); and

WHEREAS, Rule 17g-1 under the Investment Company Act specifies that the bond may be in the form of (i) an individual bond for each covered person, or a schedule or blanket bond covering such persons, (ii) a blanket bond which names the Corporation as the only insured (a “single insured bond”), or (iii) a bond which names the Corporation and one or more other parties as insureds (a “joint insured bond”), as permitted by Rule 17g-1 under the Investment Company Act; and

WHEREAS, Rule 17g-1 under the Investment Company Act requires that a majority of the Non-Interested Directors, approve periodically (but not less than once every 12 months) the reasonableness of the form and amount of the bond, with due consideration to the value of the aggregate assets of the Corporation to which any covered person may have access, the type and terms of the arrangements made for the custody and safekeeping of such assets, and the nature of securities and other investments to be held by the Corporation, and pursuant to factors contained in Rule 17g-1 under the Investment Company Act, which are described in the accompanying memorandum attached hereto; and

WHEREAS, under Rule 17g-1 under the Investment Company Act, the Corporation is required to make certain filings with the SEC and give certain notices to each member of the Board in connection with the bond, and designate an officer who shall make such filings and give such notices;

NOW, THEREFORE, BE IT RESOLVED, that having considered the expected aggregate value of the securities and funds of the Corporation to which officers or employees of the Corporation may have access (either directly or through authority to draw upon such funds or to direct generally the disposition of such securities), the type and terms of the arrangements made for the custody of such securities and funds, the nature of securities and other investments to be held by the Corporation, the accounting procedures and controls of the Corporation, the nature and method of conducting the operations of the Corporation and the requirements of Section 17(g) of the Investment Company Act and Rule 17g-1 thereunder, the Board, including a majority of the Non-Interested Directors, hereby determines that the amount, type, form, premium and coverage of the fidelity bond (the “Fidelity Bond”), covering the officers and employees of the Corporation and insuring the Corporation against loss from fraudulent or dishonest acts, including larceny and embezzlement, issued by Travelers Casualty and Surety Company of America, having an aggregate coverage of $1 million are fair and reasonable and the Fidelity Bond be, and hereby is, approved by the Board, including a majority of the Non-Interested Directors; and

FURTHER RESOLVED, that the Board, including a majority of the Non-Interested Directors, hereby: (i) authorizes the Corporation to share in the payment of the total annual premium of up to $3,500 applicable to the Fidelity Bond in an amount equal to $1 million, determined based on the relative net assets of the Corporation and the other insured entities determined as of a date reasonably selected by the Authorized Officers; and (ii) determines that the portion of the premium to be paid by the Corporation is fair and reasonable, taking all relevant factors into consideration including, but not limited to, the number of the other

parties named as insureds under the Fidelity Bond, the nature of their businesses, the amount of the joint fidelity coverage and the amount of the premium

for such bond, the ratable allocation of the premium among the parties, and the extent to which the share of the premium allocated to the Corporation and the other insured entities is less than the premium the Corporation would have had to pay if it had m

aintained a separate fidelity bond; and

FURTHER RESOLVED, that the Authorized Officers be, and each of them hereby is, authorized, empowered and directed to take all appropriate actions, with the advice of legal counsel to the Corporation, to provide and maintain the Fidelity Bond on behalf of the Corporation; and

FURTHER RESOLVED, that the Chief Compliance Officer be and hereby is, designated as the party responsible for making the necessary filings and giving the notices with respect to such bond required by paragraph (g) of Rule 17g-1 under the Investment Company Act; and

FURTHER RESOLVED, that the Authorized Officers be, and each of them hereby is, authorized, empowered and directed to file a copy of the Fidelity Bond and any other related document or instrument with the Securities and Exchange Commission.

IN WITNESS WHEREOF, the undersigned, in his official capacity, has executed and delivered this Certificate of the Secretary.

|

Dated: October 19, 2017

|

GREAT ELM CAPITAL CORP.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Adam Kleinman

|

|

|

|

|

|

|

Name:

|

Adam M. Kleinman

|

|

|

|

|

|

|

Title:

|

Secretary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Courtney L Mull

|

|

|

|

One Tower Square - Bond

|

|

|

|

SH02

|

|

|

|

HARTFORD, CT 06183

|

|

|

|

Phone:

(860) 954-9593

|

|

|

|

Email:

CLMULL@travelers.com

|

October 12, 2017

Yoko Takenaka

WOODRUFF-SAWYER & CO

2 PARK PLAZA STE 500

IRVINE, CA 92614

|

|

|

|

|

RE:

|

Insured Name:

|

GREAT ELM CAPITAL CORPORATION

|

|

|

Binder Type:

|

Informational

|

|

|

Product:

|

INVESTMENT COMPANY BOND

|

|

|

|

IVBB-15001 (01-16)

|

|

|

Bond Number:

|

106621525

|

|

|

Bond Period:

|

November 03, 2017 to July 21, 2018

|

|

|

Binder Expiration Date:

|

November 11, 2017

|

Dear Yoko Takenaka:

On behalf of

Travelers Casualty and Surety Company of America

we are pleased to bind coverage for the following Insurance.

INVESTMENT COMPANY BOND:

|

Insuring Agreement

|

Single Loss

Limit of Insurance

|

Single Loss

Deductible Amount

|

|

A. FIDELITY

Coverage A.1. Larceny or Embezzlement

Coverage A.2. Restoration Expenses

|

$1,000,000

$1,000,000

|

$0

$10,000

|

|

B. ON PREMISES

|

$1,000,000

|

$10,000

|

|

C. IN TRANSIT

|

$1,000,000

|

$10,000

|

|

D. FORGERY OR ALTERATION

|

$1,000,000

|

$10,000

|

|

E. SECURITIES

|

$1,000,000

|

$10,000

|

|

F. COUNTERFEIT MONEY AND COUNTERFEIT MONEY ORDERS

|

$1,000,000

|

$10,000

|

|

G. CLAIM EXPENSE

|

$25,000

|

$5,000

|

|

H. STOP PAYMENT ORDERS OR WRONGFUL DISHONOR OF CHECKS

|

$25,000

|

$5,000

|

|

I. COMPUTER SYSTEMS

Coverage I.1. Computer Fraud

Coverage I.2. Fraudulent Instructions

Coverage I.3. Restoration Expense

|

$1,000,000

$1,000,000

$1,000,000

|

$10,000

$10,000

$10,000

|

|

J. UNCOLLECTIBLE ITEMS OF DEPOSIT

|

$25,000

|

$5,000

|

If

“Not

Covered”

is

inserted

opposite

any

specified

Insuring

Agreement

above,

or

if

no

amount

is

included,

in

the

Single

Loss

Limit

of Insurance, such Insuring Agreement and any other reference thereto is deemed to be deleted from this bond.

|

LTR-19040 Ed. 01-16

|

Page 1 of 3

|

|

© 2016 The Travelers Indemnity Company. All rights reserved.

|

|

DISCOVERY PERIOD FOR BOND COVERAGE:

|

|

|

|

|

|

Additional Premium Percentage:

|

100% of the annualized premium

|

|

|

Additional Months:

|

12 months

|

TOTAL ANNUAL PREMIUM -

$2,312.00

(Other term options listed below, if available)

PREMIUM DETAIL:

|

Term

|

Payment

Type

|

Premium

|

Taxes

|

Surcharges

|

Total

Premium

|

Total Term

Premium

|

|

Transaction

|

Prepaid

|

$1,647.00

|

$0.00

|

$0.00

|

$1,647.00

|

$1,647.00

|

BOND FORMS APPLICABLE

:

IVBB-15001-0116

Investment Company Bond Declarations

IVBB-16001-0116

Investment Company Bond

ENDORSEMENTS APPLICABLE:

IVBB-19010-0116

Unauthorized Signature Endorsement

CONTINGENCIES:

This binder is contingent on the acceptable underwriting review of the following information prior to the Binder expiration date.

None

This binder is a conditional binder, valid until November 11, 2017.

This binder will expire on the noted date, at the noted time, unless the required

underwriting

information stated in the Contingencies

section is provided

to Travelers and then reviewed

and accepted by Travelers prior to the noted expiration date and time.

This

bond

will

not

take

effect

unless

Underwriting

Information

is

received

and

satisfactorily

reviewed

by

November

11,

2017

(Binder Expiration Date).

If you do not submit the Underwriting Information on or before the Binder Expiration Date, no bond will be issued.

COMMISSION:

20.00%

NOTES:

NOTICES:

It

is the

agent's

or

broker's

responsibility

to

comply

with

any

applicable

laws

regarding

disclosure

to

the

bondholder

of

commission

or

other compensation we pay, if any, in connection with this bond or program.

Important Notice Regarding Compensation Disclosure

For

information

about

how

Travelers

compensates

independent

agents,

brokers,

or

other insurance

producers,

please

visit

this

website: http://www.travelers.com/w3c/legal/Producer_Compensation_Disclosure.html

If

you

prefer,

you

can

call

the

following

toll-free

number:

1-866-904-8348.

Or

you

can

write to

us

at

Travelers,

Agency

Compensation, One

Tower Square, Hartford, CT

06183.

Sincerely,

|

LTR-19040 Ed. 01-16

|

Page 2 of 3

|

|

© 2016 The Travelers Indemnity Company. All rights reserved.

|

|

Courtney L Mull

Travelers Bond & Specialty Insurance

|

LTR-19040 Ed. 01-16

|

Page 3 of 3

|

|

© 2016 The Travelers Indemnity Company. All rights reserved.

|

|

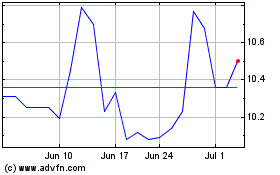

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

From Mar 2024 to Apr 2024

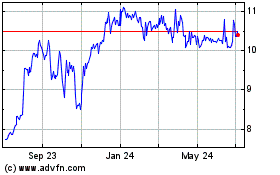

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

From Apr 2023 to Apr 2024