Report of Foreign Issuer (6-k)

October 19 2017 - 5:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

October 2017

Commission file number: 001-36288

Akari

Therapeutics, Plc

(Translation of registrant's name into English)

24 West 40

th

Street, 8

th

Floor

New York, NY 10018

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form

40-F

¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulations S-T Rule 101(b)(1): _____

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulations S-T Rule 101(b)(7): _____

CONTENTS

On

October 18, 2017, Akari Therapeutics, Plc (the “Company”) entered into an underwriting agreement (the

“Underwriting Agreement”) with Cantor Fitzgerald & Co., as representative of the several underwriters set

forth therein (collectively, the “Underwriters”), relating to an underwritten public offering (the

“Offering”) of 3,480,000 of the Company’s American Depositary Shares (“ADSs”), each

representing 100 ordinary shares, nominal value £0.01 per share, of the Company, at an offering price to the public of

$5.00 per ADS. Under the terms of the Underwriting Agreement, the Company granted the Underwriters a 30-day option to

purchase up to an additional 522,000 ADSs on the same terms and conditions.

The

ADSs will be issued pursuant to the Company’s currently effective shelf registration statement on Form F-3 (No.

333-198107) and an accompanying prospectus filed with the Securities and Exchange

Commission (the “Commission”), which was declared effective by the Commission on August 20, 2014 (the

“Registration Statement”), and a preliminary and final prospectus supplement filed with the Commission in

connection with the Offering.

A copy of the Underwriting

Agreement is attached as Exhibit 1.1 hereto and is incorporated herein by reference. The foregoing description of the Underwriting

Agreement does not purport to be complete and is qualified in its entirety by reference to such exhibit.

McDermott Will &

Emery UK LLP, counsel to the Company, has issued a legal opinion with respect to the ordinary shares represented by the ADSs sold

in the offering. A copy of the opinion, including the consent therein, is attached as Exhibit 5.1 hereto.

The

information contained in this report (including the exhibits hereto) is hereby incorporated by reference into all effective registration

statements filed by the Company under the Securities Act of 1933.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Akari Therapeutics, Plc

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

By:

|

/s/ Robert M. Shaw

|

|

|

|

Name:

|

Robert M. Shaw

|

|

|

|

General Counsel & Secretary

|

|

Date: October 19, 2017

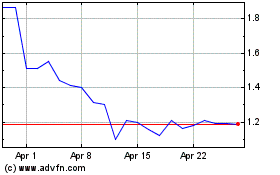

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

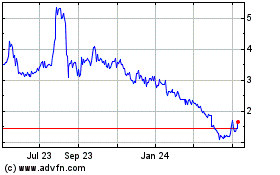

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024