Western Alliance Bancorporation (NYSE:WAL):

THIRD QUARTER 2017 FINANCIAL

RESULTS

Net income

Earnings per share

Net interest margin

Efficiency ratio

Book value per

common share

$82.9 million $0.79 4.65% 40.0%

$20.34

40.0%, excluding non-

operating adjustments1

$17.53, excluding

intangible assets1

CEO COMMENTARY:

Robert Sarver, Chairman and CEO, commented, “The economy

continues to steadily expand and our clients are growing their

businesses. Our highly experienced bankers have deep local roots

and are among the best and brightest in our markets. This quarter

was marked by continued momentum in key financial metrics and

reaffirms our outstanding 2017 results for shareholders. Tangible

book value per share increased 5% to $17.531 from the prior

quarter. Robust loan growth of $532 million and deposit growth of

$874 million during the quarter has us well-positioned for future

success. Our quarterly operating results, with net income of $82.9

million, EPS of $0.79 and an operating efficiency ratio of 40%1

reflect our strong fundamentals.”

LINKED-QUARTER

BASIS

YEAR-OVER-YEAR

FINANCIAL HIGHLIGHTS

▪

Net income and earnings per share of $82.9 million

and $0.79, compared to $80.0 million and $0.76, respectively

▪

Net income of $82.9 million and earnings per share of $0.79,

compared to $67.1 million and $0.64, respectively

▪

Net operating revenue of $211.5 million,

an increase of 4.1%, or $8.3 million, and an increase in operating

non-interest expenses of $0.8 million 1

▪

Net operating revenue of $211.5 million, an increase of 15.4%, or

$28.3 million, and an increase in operating non-interest expenses

of 7.8%, or $6.4 million1

▪

Operating pre-provision net revenue of $122.7 million, up $7.5

million from $115.2 million 1

▪

Operating pre-provision net revenue of $122.7 million, up $21.9

million from $100.8 million 1

FINANCIAL POSITION RESULTS

▪

Total loans of $14.52 billion, up $532 million

▪

Increase in total loans of $1.49 billion

▪

Total deposits of $16.90 billion, up $874 million

▪

Increase in total deposits of $2.46 billion

▪

Stockholders' equity of $2.15 billion, up $87 million

▪

Increase in stockholders' equity of $288 million

LOANS AND ASSET QUALITY

▪

Nonperforming assets (nonaccrual loans and

repossessed assets) to total assets of 0.42% 2, compared to

0.32%

▪

Nonperforming assets to total assets of

0.42% 2, compared to 0.53%

▪

Annualized net charge-offs (recoveries) to average loans

outstanding of 0.01%, compared to (0.03)%

▪

Annualized net charge-offs (recoveries) to average loans

outstanding of 0.01%, compared to 0.04%

KEY PERFORMANCE METRICS

▪

Net interest margin of 4.65%, compared to 4.61%

▪

Net interest margin of 4.65%, compared to 4.55%

▪

Return on average assets and return on tangible common equity1 of

1.71% and 18.18%, compared to 1.71% and 18.42%, respectively

▪

Return on average assets and return on tangible common equity1 of

1.70% and 18.15%, compared to 1.61% and 17.74%, respectively

▪

Tangible common equity ratio of 9.4%, compared to 9.5% 1

▪

Tangible common equity ratio of 9.4%, compared to 9.3% 1

▪

Tangible book value per share, net of tax, of $17.53, an increase

of 4.9% from $16.71 1

▪

Tangible book value per share, net of tax, of $17.53, an increase

of 18.1% from $14.84 1

▪

Operating efficiency ratio of 40.0%, compared to 41.2% 1

▪

Operating efficiency ratio of 40.0%, compared to 43.0% 1 1

See reconciliation of Non-GAAP Financial

Measures.

2 Includes one loan with a net balance of $23 million, which the

Company sold subsequent to quarter-end.

Income Statement

Net interest income was $201.6 million in the third quarter

2017, an increase of $8.8 million from $192.7 million in the second

quarter 2017 and an increase of $29.0 million, or 16.8%, compared

to the third quarter 2016. Net interest income in the third quarter

2017 includes $7.5 million of accretion income from acquired loans,

compared to $7.1 million in the second quarter 2017, and $8.8

million in the third quarter 2016.

The Company’s net interest margin in the third quarter 2017 was

4.65%, an increase from 4.61% in the second quarter 2017, and from

4.55% in the third quarter 2016. The increase in net interest

margin from the second quarter 2017 and the third quarter 2016 is

attributable to higher yields on loans as a result of rising

interest rates, as well as an increase in yields from investment

securities.

Operating non-interest income was $9.9 million for the third

quarter 2017, compared to $10.5 million for the second quarter

2017, and $10.7 million for the third quarter 2016.1 The decrease

in operating non-interest income from the prior quarter primarily

relates to a decrease in income from equity investments. The

decrease in operating non-interest income from the third quarter

2016 is due primarily to a decrease in lending related income,

resulting from decreased SBA income.

Net operating revenue was $211.5 million for the third quarter

2017, an increase of $8.3 million, or 4.1%, compared to $203.2

million for the second quarter 2017, and an increase of $28.3

million, or 15.4%, compared to $183.2 million for the third quarter

2016.1

Operating non-interest expense was $88.8 million for the third

quarter 2017, compared to $88.0 million for the second quarter

2017, and $82.4 million for the third quarter 2016.1 Operating

non-interest expense held relatively flat from the prior quarter as

the decrease in legal, professional and directors' fees resulting

from vesting of director restricted stock awards at the end of the

second quarter 2017 was offset by increases in deposit costs and

charitable contributions during the quarter. The increase in

operating non-interest expense from the third quarter 2016 relates

primarily to higher compensation costs resulting from an increase

in the number of employees to support growth, as well as higher

incentive compensation related to achievement of performance

targets. The Company’s operating efficiency ratio1 on a tax

equivalent basis was 40.0% for the third quarter 2017, compared to

41.2% for the second quarter 2017, and 43.0% for the third quarter

2016.

Net income was $82.9 million for the third quarter 2017, an

increase of $2.9 million, or 3.6%, from $80.0 million for the

second quarter 2017, and an increase of $15.8 million, or 23.6%,

from $67.1 million for the third quarter 2016. Earnings per share

was $0.79 for the third quarter 2017, compared to $0.76 for the

second quarter 2017, and $0.64 for the third quarter 2016.

The Company views its operating pre-provision net revenue

("PPNR") as a key metric for assessing the Company’s earnings

power, which it defines as net operating revenue less operating

non-interest expense. For the third quarter 2017, the Company’s

operating PPNR was $122.7 million, up 6.5% from $115.2 million in

the second quarter 2017, and up 21.7% from $100.8 million in the

third quarter 2016.1 The non-operating items1 for the third quarter

2017 consisted primarily of a net gain on sales of investment

securities of $0.3 million, offset by a net loss on sales /

valuations of repossessed and other assets of $0.3 million. The

non-operating items1 for the third quarter 2016 consisted primarily

of acquisition / restructure expenses of $2.7 million related to

the HFF and system conversion costs.

The Company had 1,673 full-time equivalent employees and 47

offices at September 30, 2017, compared to 1,628 employees and

46 offices at June 30, 2017 and 1,520 employees and 48 offices

at September 30, 2016.

Balance Sheet

Gross loans totaled $14.52 billion at September 30, 2017,

an increase of $532 million from $13.99 billion at June 30,

2017, and an increase of $1.49 billion from $13.03 billion at

September 30, 2016. The increase from both the prior quarter

and from September 30, 2016 is due to organic loan growth. At

September 30, 2017, the allowance for credit losses to gross

loans held for investment was 0.94%, compared to 0.94% at

June 30, 2017, and 0.94% at September 30, 2016. At

September 30, 2017, the allowance for credit losses to total

organic loans was 1.06%, compared to 1.08% at June 30, 2017,

and 1.13% at September 30, 2016. The Company defines its

organic loans as those loans that have not been acquired in a

transaction accounted for as a business combination.

Consistent with accounting principles generally accepted in the

United States ("GAAP"), the allowance for credit losses is not

carried over in an acquisition because acquired loans are recorded

at fair value, which discounts the loans based on expected future

cash flows. Credit discounts on acquired loans are included as a

reduction to gross loans. These discounts totaled $32.7 million at

September 30, 2017, compared to $37.8 million at June 30,

2017, and $56.1 million at September 30, 2016.

Deposits totaled $16.90 billion at September 30, 2017, an

increase of $874 million from $16.03 billion at June 30, 2017,

and an increase of $2.46 billion from $14.44 billion at

September 30, 2016. The increase from both the prior quarter

and from September 30, 2016 is the result of organic deposit

growth. Non-interest bearing deposits were $7.61 billion at

September 30, 2017, compared to $6.86 billion at June 30,

2017, and $5.62 billion at September 30, 2016. Non-interest

bearing deposits comprised 45.0% of total deposits at

September 30, 2017, compared to 42.8% at June 30, 2017,

and 38.9% at September 30, 2016. The proportion of savings and

money market balances to total deposits decreased to 37.3% from

38.1% at June 30, 2017, and from 41.3% at September 30,

2016. Certificates of deposit as a percentage of total deposits

were 9.4% at September 30, 2017, compared to 9.9% at

June 30, 2017, and 11.0% at September 30, 2016. The

Company’s ratio of loans to deposits was 85.9% at

September 30, 2017, compared to 87.3% at June 30, 2017,

and 90.2% at September 30, 2016.

Qualifying debt totaled $373 million at September 30, 2017,

compared to $375 million at June 30, 2017, and $383 million at

September 30, 2016.

Stockholders’ equity at September 30, 2017 was $2.15

billion, compared to $2.06 billion at June 30, 2017, and $1.86

billion at September 30, 2016. The increase from the prior

quarter and prior year relates primarily to net income for the

respective period.

At September 30, 2017, tangible common equity, net of tax,

was 9.4% of tangible assets1 and total capital was 13.3% of

risk-weighted assets. The Company’s tangible book value per share1

was $17.53 at September 30, 2017, up 18.1% from

September 30, 2016.

Total assets increased 5.7% to $19.92 billion at

September 30, 2017, from $18.84 billion at June 30, 2017,

and increased 16.9% from $17.04 billion at September 30, 2016.

The increase in total assets from the prior quarter and prior year

relates primarily to loan growth of $532 million and $1.49 billion,

respectively.

Asset Quality

The provision for credit losses was $5.0 million for the third

quarter 2017, compared to $3.0 million for the second quarter 2017,

and $2.0 million for the third quarter 2016. Net charge-offs

(recoveries) in the third quarter 2017 were $0.4 million, or 0.01%

of average loans (annualized), compared to $(1.2) million in net

recoveries, or (0.03)%, in the second quarter 2017 and $1.2 million

in net charge-offs, or 0.04%, in the third quarter 2016.

Nonaccrual loans increased $24.9 million to $55.0 million during

the quarter, which primarily relates to one loan with a net balance

of $23 million, which the Company sold subsequent to quarter end.

The Company incurred a loss of $1.4 million on the sale of the

loan, which was recognized as a charge-off during the quarter.

Loans past due 90 days and still accruing interest totaled less

than $0.1 million at September 30, 2017, compared to $4.0

million at June 30, 2017, and $2.8 million at

September 30, 2016. Loans past due 30-89 days and still

accruing interest totaled $5.2 million at quarter end, an increase

from $4.1 million at June 30, 2017, and a decrease from $18.4

million at September 30, 2016.

Repossessed assets totaled $29.0 million at quarter end, a

decrease of $2.0 million from $31.0 million at June 30, 2017,

and a decrease of $20.6 million from $49.6 million at

September 30, 2016. Adversely graded loans and non-performing

assets totaled $406.2 million at quarter end, an increase of $38.4

million from $367.8 million at June 30, 2017, and an increase

of $71.3 million from $334.9 million at September 30, 2016.

The increase in non-performing assets during the quarter primarily

relates to the $23 million loan discussed above.

As the Company’s asset quality and capital remain strong, the

ratio of classified assets to Tier I capital plus the allowance for

credit losses, a common regulatory measure of asset quality, was

10.7% at September 30, 2017, compared to 12.7% at

June 30, 2017, and 12.3% at September 30, 2016.1

1

See reconciliation of Non-GAAP Financial

Measures.

Segment Highlights

The Company's reportable segments are aggregated primarily based

on geographic location, services offered, and markets served. The

Company's regional segments, which include Arizona, Nevada,

Southern California, and Northern California, provide full service

banking and related services to their respective markets. The

operations from the regional segments correspond to the following

banking divisions: Alliance Bank of Arizona, Bank of Nevada and

First Independent Bank, Torrey Pines Bank, and Bridge Bank.

The Company's National Business Lines ("NBL") segment provides

specialized banking services to niche markets. The Company's NBL

reportable segments include Homeowner Associations ("HOA")

Services, Hotel Franchise Finance ("HFF"), Public & Nonprofit

Finance, Technology & Innovation, and Other NBLs. These NBLs

are managed centrally and are broader in geographic scope than our

other segments, though still predominately located within our core

market areas. The HOA Services NBL corresponds to the Alliance

Association Bank division. The HFF NBL includes the hotel franchise

loan portfolio purchased from GE Capital on April 20, 2016. The

operations of Public and Nonprofit Finance are combined into one

reportable segment. The Technology & Innovation NBL includes

the operations of Equity Fund Resources, the Life Sciences Group,

the Renewable Resource Group, and Technology Finance. The Other

NBLs segment consists of the operations of Corporate Finance,

Mortgage Warehouse Lending, and Resort Finance.

The Corporate & Other segment consists of corporate-related

items, income and expense items not allocated to our other

reportable segments, and inter-segment eliminations.

Key management metrics for evaluating the performance of the

Company's Arizona, Nevada, Southern California, Northern

California, and NBL segments include loan and deposit growth, asset

quality, and pre-tax income.

The regional segments reported gross loan balances of $7.95

billion at September 30, 2017, an increase of $121 million

during the quarter, and an increase of $410 million during the last

twelve months. All regional segments, with the exception of Nevada,

had loan growth during the quarter, with Northern California

contributing the largest growth of $88 million, followed by Arizona

and Southern California with growth of $41 million and $35 million,

respectively. The growth in loans during the last twelve months was

primarily driven by increases of $193 million in Arizona, $189

million in Northern California, and $40 million in Southern

California. Total deposits for the regional segments were $13.20

billion, an increase of $693 million during the quarter, and an

increase of $1.79 billion during the last twelve months. Arizona

and Southern California generated increased deposits during the

quarter of $420 million and $261 million, respectively, which was

partially offset by a decrease of $12 million in Northern

California. During the last twelve months, each regional segment

generated increased deposits, with Arizona, Southern California,

and Nevada contributing increases of $1.27 billion, $257 million,

and $239 million, respectively.

Pre-tax income for the regional segments was $86.1 million for

the three months ended September 30, 2017, an increase of $1.4

million from the three months ended June 30, 2017, and an

increase of $5.4 million from the three months ended

September 30, 2016. Arizona generated the largest increase in

pre-tax income of $3.2 million, compared to the three months ended

June 30, 2017, which was partially offset by a decrease in

Southern California of $1.5 million. Arizona and Nevada had

increases in pre-tax income from the three months ended

September 30, 2016 of $7.1 million and $1.5 million,

respectively, which were offset by decreases in Northern California

and Southern California of $3.0 million and $0.2 million,

respectively. For the nine months ended September 30, 2017,

the regional segments reported total pre-tax income of $243.1

million, an increase of $22.6 million compared to the nine months

ended September 30, 2016. All regional segments with the

exception of Northern California had increases in pre-tax income

with Arizona and Nevada contributing the largest increases of $18.9

million and $6.9 million, respectively.

The NBL segments reported gross loan balances of $6.57 billion

at September 30, 2017, an increase of $414 million during the

quarter, and an increase of $1.09 billion during the last twelve

months. All NBL segments had loan growth during the quarter, with

the Other NBLs segment contributing the largest growth of $340

million, followed by increases in HFF and Public & Nonprofit

Finance of $34 million and $29 million, respectively. The increase

in loans for the NBL segments over the last twelve months relates

primarily to the Other NBLs, Public & Nonprofit Finance, and

Technology & Innovation segments, which increased loans by $839

million, $127 million, and $115 million, respectively. Total

deposits for the NBL segments were $3.61 billion, an increase of

$154 million during the quarter, and an increase of $732 million

during the last twelve months. During the quarter, the Technology

& Innovation segment increased deposits by $187 million, which

was partially offset by a decrease of $34 million in HOA Services.

The increase of $732 million during the last twelve months is the

result of growth in the Technology & Innovation and HOA

Services segments of $393 million and $339 million,

respectively.

Pre-tax income for the NBL segments was $45.6 million for the

three months ended September 30, 2017, an increase of $3.0

million from the three months ended June 30, 2017, and an

increase of $7.6 million from the three months ended

September 30, 2016. The increase in pre-tax income from the

prior quarter relates primarily to the HFF segment as it had an

increase in pre-tax income of $3.8 million. This increase was

offset by a decrease in pre-tax income from the Other NBLs segment

of $1.3 million. The increase in pre-tax income compared to the

three months ended September 30, 2016 was driven by increases

across all NBL segments. The largest increases were generated by

HFF, Public & Nonprofit Finance, and Technology &

Innovation with increases of $2.2 million, $2.0 million, and $1.8

million, respectively. Pre-tax income for the NBL segments for the

nine months ended September 30, 2017 totaled $125.8 million,

an increase of $26.2 million compared to the nine months ended

September 30, 2016. The largest increases in pre-tax income

compared to the nine months ended September 30, 2016 were in

the HFF, HOA Services, and Public & Nonprofit Finance segments,

which increased $11.8 million, $6.3 million, and $4.5 million,

respectively.

Conference Call and Webcast

Western Alliance Bancorporation will host a conference call and

live webcast to discuss its third quarter 2017 financial results at

12:00 p.m. ET on Friday, October 20, 2017. Participants may

access the call by dialing 1-888-317-6003 and using passcode

0722330 or via live audio webcast using the website link

https://services.choruscall.com/links/wal171020.html.

The webcast is also available via the Company’s website at

www.westernalliancebancorporation.com.

Participants should log in at least 15 minutes early to receive

instructions. The call will be recorded and made available for

replay after 2:00 p.m. ET October 20th through 9:00 a.m. ET

November 20th by dialing 1-877-344-7529, passcode: 10112871.

Reclassifications

Certain amounts in the Consolidated Income Statements for the

prior periods have been reclassified to conform to the current

presentation. The reclassifications have no effect on net income or

stockholders’ equity as previously reported.

Use of Non-GAAP Financial Information

This press release contains both financial measures based on

GAAP and non-GAAP based financial measures, which are used where

management believes them to be helpful in understanding the

Company’s results of operations or financial position. Where

non-GAAP financial measures are used, the comparable GAAP financial

measure, as well as the reconciliation to the comparable GAAP

financial measure, can be found in this press release. These

disclosures should not be viewed as a substitute for operating

results determined in accordance with GAAP, nor are they

necessarily comparable to non-GAAP performance measures that may be

presented by other companies.

Cautionary Note Regarding Forward-Looking Statements

This release contains forward-looking statements that relate to

expectations, beliefs, projections, future plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. Examples of forward-looking

statements include, among others, statements we make regarding our

expectations with regard to our business, financial and operating

results, and future economic performance. The forward-looking

statements contained herein reflect our current views about future

events and financial performance and are subject to risks,

uncertainties, assumptions and changes in circumstances that may

cause our actual results to differ significantly from historical

results and those expressed in any forward-looking statement. Some

factors that could cause actual results to differ materially from

historical or expected results include, among others: the risk

factors discussed in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2016 as filed with the Securities

and Exchange Commission; changes in general economic conditions,

either nationally or locally in the areas in which we conduct or

will conduct our business; inflation, interest rate, market and

monetary fluctuations; increases in competitive pressures among

financial institutions and businesses offering similar products and

services; higher defaults on our loan portfolio than we expect;

changes in management’s estimate of the adequacy of the allowance

for credit losses; legislative or regulatory changes or changes in

accounting principles, policies or guidelines; supervisory actions

by regulatory agencies which may limit our ability to pursue

certain growth opportunities, including expansion through

acquisitions; additional regulatory requirements resulting from our

continued growth; management’s estimates and projections of

interest rates and interest rate policy; the execution of our

business plan; and other factors affecting the financial services

industry generally or the banking industry in particular.

Any forward-looking statement made by us in this release is

based only on information currently available to us and speaks only

as of the date on which it is made. We do not intend and disclaim

any duty or obligation to update or revise any industry information

or forward-looking statements, whether written or oral, that may be

made from time to time, set forth in this press release to reflect

new information, future events or otherwise.

About Western Alliance Bancorporation

With more than $19 billion in assets, Western Alliance

Bancorporation (NYSE:WAL) is one of the country’s top-performing

banking companies and is ranked #4 on the Forbes 2017 “Best Banks

in America” list. Its primary subsidiary, Western Alliance Bank, is

the go-to bank for business and succeeds with local teams of

experienced bankers who deliver superior service and a full

spectrum of deposit, lending, treasury management, international

banking and online banking products and services. Western Alliance

Bank operates full-service banking divisions: Alliance Bank of

Arizona, Bank of Nevada and First Independent Bank, Torrey Pines

Bank and Bridge Bank. The bank also serves business customers

through a robust national platform of specialized financial

services including Corporate Finance, Equity Fund Resources, Hotel

Franchise Finance, Life Sciences Group, Mortgage Warehouse Lending,

Public and Nonprofit Finance, Renewable Resource Group, Resort

Finance, Technology Finance and Alliance Association Bank. For more

information, visit westernalliancebancorporation.com.

Western Alliance Bancorporation and Subsidiaries

Summary Consolidated Financial Data Unaudited

Selected Balance Sheet Data: As of

September 30, 2017 2016 Change % (in

millions) Total assets $ 19,922.2 $ 17,042.6 16.9 % Total loans,

net 14,521.9 13,033.6 11.4 Securities and money market investments

3,773.6 2,778.1 35.8 Total deposits 16,904.8 14,443.2 17.0

Qualifying debt 372.9 382.9 (2.6 ) Stockholders' equity 2,145.6

1,857.4 15.5 Tangible common equity, net of tax (1) 1,848.8 1,559.1

18.6

Selected Income Statement Data: For the Three

Months Ended September 30, For the Nine Months Ended

September 30, 2017 2016 Change %

2017 2016 Change % (in thousands, except per

share data) (in thousands, except per share data) Interest income $

217,836 $ 184,750 17.9 % $ 617,054 $ 513,095 20.3 % Interest

expense 16,253 12,203 33.2 43,419 31,151

39.4 Net interest income 201,583 172,547 16.8 573,635

481,944 19.0 Provision for credit losses 5,000 2,000

NM 12,250 7,000 75.0 Net interest income after

provision for credit losses 196,583 170,547 15.3 561,385 474,944

18.2 Non-interest income 10,288 10,683 (3.7 ) 31,281 32,375 (3.4 )

Non-interest expense 89,114 85,007 4.8 265,128

242,304 9.4 Income before income taxes 117,757 96,223 22.4

327,538 265,015 23.6 Income tax expense 34,899 29,171

19.6 91,352 75,017 21.8 Net income $ 82,858 $

67,052 23.6 $ 236,186 $ 189,998 24.3 Diluted

earnings per share $ 0.79 $ 0.64 23.4 $ 2.25 $

1.84 22.3 (1) See Reconciliation of Non-GAAP

Financial Measures. NM: Changes +/- 100% are not meaningful.

Western Alliance Bancorporation and

Subsidiaries Summary Consolidated Financial Data

Unaudited Common Share Data:

For the Three Months Ended September 30, For the Nine

Months Ended September 30, 2017 2016 Change

% 2017 2016 Change % Diluted earnings per

share $ 0.79 $ 0.64 23.4 % $ 2.25 $ 1.84 22.3 % Book value per

common share 20.34 17.68 15.0 Tangible book value per share, net of

tax (1) 17.53 14.84 18.1

Average shares outstanding (in

thousands):

Basic 104,221 103,768 0.4 104,124 102,791 1.3 Diluted 104,942

104,564 0.4 104,941 103,532 1.4 Common shares outstanding 105,493

105,071 0.4

Selected Performance Ratios: Return on

average assets (2) 1.71 % 1.58 % 8.2 % 1.70 % 1.61 % 5.6 % Return

on average tangible common equity (1, 2) 18.18 17.50 3.9 18.15

17.74 2.3 Net interest margin (2) 4.65 4.55 2.2 4.63 4.58 1.1

Operating efficiency ratio - tax equivalent basis (1) 39.95 42.97

(7.0 ) 41.76 43.78 (4.6 ) Loan to deposit ratio 85.90 90.24 (4.8 )

Asset Quality Ratios: Net charge-offs (recoveries) to

average loans outstanding (2) 0.01 % 0.04 % (75.0 )% 0.01 % 0.04 %

(75.0 )% Nonaccrual loans to gross loans 0.38 0.31 22.6 Nonaccrual

loans and repossessed assets to total assets 0.42 0.53 (20.8 )

Loans past due 90 days and still accruing to gross loans — 0.02

(100.0 ) Allowance for credit losses to gross organic loans 1.06

1.13 (6.2 ) Allowance for credit losses to nonaccrual loans 248.07

302.61 (18.0 )

Capital Ratios:

Sep 30, 2017 Jun 30, 2017 Sep 30, 2016

Tangible common equity (1) 9.4 % 9.5 % 9.3 % Common Equity Tier 1

(1), (3) 10.4 10.3 9.8 Tier 1 Leverage ratio (1), (3) 10.1 9.9 9.6

Tier 1 Capital (1), (3) 10.8 10.8 10.3 Total Capital (1), (3) 13.3

13.4 13.1 (1) See Reconciliation of Non-GAAP

Financial Measures. (2) Annualized for the three month periods

ended September 30, 2017 and 2016. (3) Capital ratios for September

30, 2017 are preliminary until the Call Report is filed. NM Changes

+/- 100% are not meaningful.

Western

Alliance Bancorporation and Subsidiaries Condensed

Consolidated Income Statements Unaudited

Three Months Ended September 30,

Nine Months Ended September 30, 2017

2016 2017

2016 (dollars in thousands, except per share data) Interest

income: Loans $ 191,096 $ 167,914 $ 547,306 $ 467,715 Investment

securities 23,584 15,436 62,327 41,815 Other 3,156 1,400

7,421 3,565

Total interest income

217,836 184,750 617,054 513,095

Interest expense: Deposits 11,449 8,072 29,506 21,993 Qualifying

debt 4,708 4,048 13,539 8,746 Borrowings 96 83 374

412

Total interest expense 16,253

12,203 43,419 31,151

Net interest

income 201,583 172,547 573,635 481,944 Provision for credit

losses 5,000 2,000 12,250 7,000

Net

interest income after provision for credit losses 196,583

170,547 561,385 474,944 Non-interest

income: Service charges 5,248 4,916 15,189 13,958 Card income 1,344

1,381 4,146 3,844 Income from equity investments 950 1,208 2,933

1,610 Income from bank owned life insurance 975 899 2,896 2,858

Foreign currency income 756 888 2,630 2,672 Lending related income

and gains (losses) on sale of loans, net 97 708 746 4,509 Gain

(loss) on sales of investment securities, net 319 — 907 1,001 Other

income 599 683 1,834 1,923

Total

non-interest income 10,288 10,683 31,281

32,375 Non-interest expenses: Salaries and employee benefits

52,730 49,542 156,596 139,108 Legal, professional and directors'

fees 6,038 5,691 23,324 17,010 Occupancy 7,507 6,856 21,328 20,359

Data processing 4,524 5,266 14,163 15,028 Insurance 3,538 3,144

10,355 9,430 Deposit costs 2,904 1,363 6,778 3,121 Marketing 776

678 2,628 2,432 Loan and repossessed asset expenses 1,263 788 3,639

2,522 Card expense 801 252 2,187 1,376 Intangible amortization 489

697 1,666 2,091 Net loss (gain) on sales and valuations of

repossessed and other assets 266 (146 ) (46 ) (91 ) Acquisition /

restructure expense — 2,729 — 6,391 Other 8,278 8,147

22,510 23,527

Total non-interest expense

89,114 85,007 265,128 242,304 Income

before income taxes 117,757 96,223 327,538 265,015 Income tax

expense 34,899 29,171 91,352 75,017

Net income $ 82,858 $ 67,052 $ 236,186

$ 189,998

Earnings per share: Diluted shares

104,942 104,564 104,941 103,532 Diluted earnings per share $ 0.79 $

0.64 $ 2.25 $ 1.84

Western Alliance Bancorporation and

Subsidiaries Five Quarter Condensed Consolidated Income

Statements Unaudited Three

Months Ended Sep 30, 2017 Jun 30, 2017 Mar 31,

2017 Dec 31, 2016 Sep 30, 2016 (in thousands,

except per share data) Interest income: Loans $ 191,096 $ 183,657 $

172,553 $ 168,881 $ 167,914 Investment securities 23,584 20,629

18,114 16,725 15,436 Other 3,156 2,667 1,598

1,805 1,400

Total interest income 217,836

206,953 192,265 187,411 184,750

Interest expense: Deposits 11,449 9,645 8,412 7,729 8,072

Qualifying debt 4,708 4,493 4,338 4,252 4,048 Borrowings 96

72 206 161 83

Total interest

expense 16,253 14,210 12,956 12,142

12,203

Net interest income 201,583 192,743 179,309

175,269 172,547 Provision for credit losses 5,000 3,000

4,250 1,000 2,000

Net interest

income after provision for credit losses 196,583 189,743

175,059 174,269 170,547 Non-interest

income: Service charges and fees 5,248 5,203 4,738 4,865 4,916 Card

income 1,344 1,380 1,422 1,381 1,381 Income from equity investments

950 1,291 692 1,054 1,208 Income from bank owned life insurance 975

973 948 904 899 Foreign currency income 756 832 1,042 747 888

Lending related income and gains (losses) on sale of loans, net 97

227 422 488 708 Gain (loss) on sales of investment securities, net

319 (47 ) 635 58 — Other income 599 590 645

1,043 683

Total non-interest income 10,288

10,449 10,544 10,540 10,683

Non-interest expenses: Salaries and employee benefits 52,730 52,246

51,620 49,702 49,542 Legal, professional, and directors' fees 6,038

8,483 8,803 7,600 5,691 Occupancy 7,507 6,927 6,894 6,944 6,856

Data processing 4,524 4,375 5,264 4,504 5,266 Insurance 3,538 3,589

3,228 3,468 3,144 Deposit costs 2,904 2,133 1,741 1,862 1,363

Marketing 776 1,131 721 1,164 678 Loan and repossessed asset

expenses 1,263 1,098 1,278 477 788 Card expense 801 725 661 689 252

Intangible amortization 489 488 689 697 697 Net loss (gain) on

sales and valuations of repossessed and other assets 266 231 (543 )

(34 ) (146 ) Acquisition / restructure expense — — — 6,021 2,729

Other 8,278 6,831 7,401 5,551 8,147

Total non-interest expense 89,114 88,257

87,757 88,645 85,007 Income before

income taxes 117,757 111,935 97,846 96,164 96,223 Income tax

expense 34,899 31,964 24,489 26,364

29,171

Net income $ 82,858 $ 79,971 $

73,357 $ 69,800 $ 67,052

Earnings

per share: Diluted shares 104,942 105,045 104,836 104,765

104,564 Diluted earnings per share $ 0.79 $ 0.76 $ 0.70 $ 0.67 $

0.64

Western Alliance Bancorporation and Subsidiaries

Five Quarter Condensed Consolidated Balance Sheets

Unaudited Sep 30, 2017

Jun 30, 2017 Mar 31, 2017 Dec 31, 2016 Sep

30, 2016 (in millions, except per share data)

Assets:

Cash and due from banks $ 650.4 $ 606.7 $ 647.0 $ 284.5 $ 356.1

Securities and money market investments 3,773.6 3,283.0 2,869.1

2,767.8 2,778.1 Loans held for sale 16.3 16.7 17.8 18.9 21.3 Loans

held for investment: Commercial 6,735.9 6,318.5 6,039.1 5,855.8

5,715.0 Commercial real estate - non-owner occupied 3,628.4 3,649.1

3,607.8 3,544.0 3,623.4 Commercial real estate - owner occupied

2,047.5 2,021.2 2,043.4 2,013.3 1,984.0 Construction and land

development 1,666.4 1,601.7 1,601.7 1,478.1 1,379.7 Residential

real estate 376.7 334.8 309.9 259.4 271.8 Consumer 50.7 47.9

43.0 39.0 38.4

Gross loans and

deferred fees, net 14,505.6 13,973.2 13,644.9 13,189.6 13,012.3

Allowance for credit losses (136.4 ) (131.8 ) (127.6 ) (124.7 )

(122.9 )

Loans, net 14,369.2 13,841.4 13,517.3

13,064.9 12,889.4 Premises and equipment, net

120.1 120.5 120.0 119.8 121.3 Other assets acquired through

foreclosure, net 29.0 31.0 45.2 47.8 49.6 Bank owned life insurance

166.8 166.4 165.5 164.5 163.6 Goodwill and other intangibles, net

301.2 301.6 302.1 302.9 303.6 Other assets 495.6 477.4

438.5 429.7 359.6

Total assets $

19,922.2 $ 18,844.7 $ 18,122.5 $ 17,200.8

$ 17,042.6

Liabilities and Stockholders'

Equity: Liabilities: Deposits Non-interest bearing demand

deposits $ 7,608.7 $ 6,859.4 $ 6,114.1 $ 5,632.9 $ 5,624.8 Interest

bearing: Demand 1,406.4 1,480.8 1,449.3 1,346.7 1,256.7 Savings and

money market 6,300.2 6,104.0 6,253.8 6,120.9 5,969.6 Time

certificates 1,589.5 1,586.9 1,538.8 1,449.3

1,592.1

Total deposits 16,904.8 16,031.1

15,356.0 14,549.8 14,443.2 Customer repurchase agreements 26.1

32.7 35.7 41.7 44.4

Total

customer funds 16,930.9 16,063.8 15,391.7 14,591.5 14,487.6

Borrowings — — — 80.0 — Qualifying debt 372.9 375.4 366.9 367.9

382.9 Accrued interest payable and other liabilities 472.8

346.8 394.9 269.9 314.7

Total

liabilities 17,776.6 16,786.0 16,153.5

15,309.3 15,185.2 Stockholders' Equity: Common stock

and additional paid-in capital 1,378.8 1,376.4 1,370.3 1,373.8

1,368.4 Retained earnings 758.6 675.8 595.8 522.4 452.6 Accumulated

other comprehensive income (loss) 8.2 6.5 2.9

(4.7 ) 36.4

Total stockholders' equity 2,145.6

2,058.7 1,969.0 1,891.5 1,857.4

Total liabilities and stockholders' equity $ 19,922.2

$ 18,844.7 $ 18,122.5 $ 17,200.8 $ 17,042.6

Western Alliance Bancorporation and

Subsidiaries Changes in the Allowance For Credit Losses

Unaudited Three Months

Ended Sep 30, 2017 Jun 30, 2017 Mar 31,

2017 Dec 31, 2016 Sep 30, 2016 (in thousands)

Balance, beginning of period $ 131,811 $ 127,649 $ 124,704 $

122,884 $ 122,104 Provision for credit losses 5,000 3,000 4,250

1,000 2,000 Recoveries of loans previously charged-off: Commercial

and industrial 619 1,759 328 1,144 466 Commercial real estate -

non-owner occupied 1,168 360 355 691 230 Commercial real estate -

owner occupied 613 46 178 45 291 Construction and land development

226 508 277 30 302 Residential real estate 108 1,299 251 287 179

Consumer 33 — 49 11 21 Total

recoveries 2,767 3,972 1,438 2,208 1,489 Loans charged-off:

Commercial and industrial 2,921 651 2,595 1,267 2,558 Commercial

real estate - non-owner occupied 175 1,808 — 1 — Commercial real

estate - owner occupied — 11 — 1 72 Construction and land

development — — — 18 — Residential real estate — 332 115 60 79

Consumer 61 8 33 41 — Total

loans charged-off 3,157 2,810 2,743 1,388 2,709 Net charge-offs

(recoveries) 390 (1,162 ) 1,305 (820 ) 1,220

Balance, end of period $ 136,421 $ 131,811 $ 127,649

$ 124,704 $ 122,884 Net charge-offs

(recoveries) to average loans- annualized 0.01 % (0.03 )% 0.04 %

(0.03 )% 0.04 % Allowance for credit losses to gross loans

0.94 % 0.94 % 0.94 % 0.95 % 0.94 % Allowance for credit losses to

gross organic loans 1.06 1.08 1.08 1.11 1.13 Allowance for credit

losses to nonaccrual loans 248.07 438.33 370.45 309.65 302.61

Nonaccrual loans1 $ 54,994 $ 30,071 $ 34,458 $ 40,272 $

40,608 Nonaccrual loans to gross loans 0.38 % 0.22 % 0.25 % 0.31 %

0.31 % Repossessed assets $ 28,992 $ 30,988 $ 45,200 $ 47,815 $

49,619 Nonaccrual loans and repossessed assets to total assets 0.42

% 0.32 % 0.44 % 0.51 % 0.53 % Loans past due 90 days, still

accruing $ 44 $ 4,021 $ 3,659 $ 1,067 $ 2,817 Loans past due 90

days and still accruing to gross loans — % 0.03 % 0.03 % 0.01 %

0.02 % Loans past due 30 to 89 days, still accruing $ 5,179 $ 4,071

$ 10,764 $ 6,294 $ 18,446 Loans past due 30 to 89 days, still

accruing to gross loans 0.04 % 0.03 % 0.08 % 0.05 % 0.14 %

Special mention loans $ 199,965 $ 141,036 $ 175,080 $ 148,144 $

134,018 Special mention loans to gross loans 1.38 % 1.01 % 1.28 %

1.12 % 1.03 % Classified loans on accrual $

122,264

$ 165,715 $ 133,483 $ 106,644 $ 110,650 Classified loans on accrual

to gross loans

0.84

% 1.19 % 0.98 % 0.81 % 0.85 % Classified assets $ 221,803 $ 249,491

$ 236,786 $ 211,782 $ 212,286 Classified assets to total assets

1.11 % 1.32 % 1.31 % 1.23 % 1.25 % 1 Includes

one loan with a net balance of $23 million, which the Company sold

subsequent to quarter-end.

Western

Alliance Bancorporation and Subsidiaries Analysis of Average

Balances, Yields and Rates Unaudited

Three Months Ended September 30, 2017

June 30, 2017 AverageBalance Interest

Average Yield /Cost AverageBalance

Interest Average Yield /Cost ($ in millions)

($ in thousands) ($ in millions) ($ in thousands)

Interest

earning assets Loans: Commercial $ 6,328.5 $ 80,617 5.59 % $

6,054.3 $ 75,857 5.52 % CRE - non-owner occupied 3,595.3 54,250

6.04 3,606.8 52,416 5.81 CRE - owner occupied 2,032.7 25,238 4.97

2,019.5 25,931 5.14 Construction and land development 1,633.4

25,897 6.34 1,605.6 24,965 6.22 Residential real estate 351.5 4,151

4.72 322.2 3,950 4.90 Consumer 52.2 729 5.59 44.7 395 3.53 Loans

held for sale 16.5 214 5.19 17.3 143

3.31

Total loans (1), (2), (3) 14,010.1

191,096 5.68 13,670.4 183,657 5.60 Securities: Securities - taxable

2,778.4 17,399 2.50 2,446.5 14,847 2.43 Securities - tax-exempt

657.1 6,185 5.61 628.0 5,782

5.48

Total securities (1) 3,435.5 23,584 3.10 3,074.5

20,629 3.05 Cash and other 845.8 3,156 1.49

903.3 2,667 1.18

Total interest earning assets

18,291.4 217,836 5.00 17,648.2 206,953 4.93

Non-interest earning

assets Cash and due from banks 132.3 140.3 Allowance for credit

losses (133.6 ) (130.0 ) Bank owned life insurance 166.4 165.8

Other assets 930.7 919.6

Total assets $

19,387.2 $ 18,743.9

Interest-bearing

liabilities Interest-bearing deposits: Interest-bearing

transaction accounts $ 1,476.5 $ 1,066 0.29 % $ 1,492.7 $ 986 0.26

% Savings and money market 6,282.4 7,135 0.45 6,155.8 5,831 0.38

Time certificates of deposit 1,585.7 3,248 0.82

1,576.0 2,828 0.72

Total

interest-bearing deposits 9,344.6 11,449 0.49 9,224.5 9,645

0.42 Short-term borrowings 31.7 96 1.21 34.6 72 0.83 Qualifying

debt 375.3 4,708 5.02 359.3 4,493

5.00

Total interest-bearing liabilities

9,751.6 16,253 0.67 9,618.4 14,210 0.59

Non-interest-bearing

liabilities Non-interest-bearing demand deposits 7,174.5

6,735.3 Other liabilities 336.9 351.7 Stockholders’ equity 2,124.2

2,038.5

Total liabilities and stockholders'

equity $ 19,387.2 $ 18,743.9 Net interest income

and margin (4) $ 201,583 4.65 % $ 192,743 4.61 %

(1)

Yields on loans and securities have been

adjusted to a tax-equivalent basis. The taxable-equivalent

adjustment was $10.8 million and $10.4 million for the three months

ended September 30, 2017 and June 30, 2017, respectively.

(2)

Included in the yield computation are net

loan fees of $9.4 million and accretion on acquired loans of $7.5

million for the three months ended September 30, 2017, compared to

$10.0 million and $7.1 million for the three months ended June 30,

2017, respectively.

(3)

Includes non-accrual loans.

(4)

Net interest margin is computed by

dividing net interest income by total average earning assets.

Western Alliance Bancorporation and

Subsidiaries Analysis of Average Balances, Yields and

Rates Unaudited Three Months

Ended September 30, 2017 2016

AverageBalance Interest Average Yield

/Cost AverageBalance Interest

Average Yield /Cost ($ in millions) ($ in thousands)

($ in millions) ($ in thousands)

Interest earning assets

Loans: Commercial $ 6,328.5 $ 80,617 5.59 % $ 5,503.0 $ 65,447 5.24

% CRE - non-owner occupied 3,595.3 54,250 6.04 3,655.6 51,708 5.66

CRE - owner occupied 2,032.7 25,238 4.97 1,999.5 26,620 5.33

Construction and land development 1,633.4 25,897 6.34 1,338.2

19,793 5.92 Residential real estate 351.5 4,151 4.72 281.4 3,557

5.06 Consumer 52.2 729 5.59 40.0 475 4.75 Loans held for sale 16.5

214 5.19 21.9 314 5.74

Total loans (1), (2), (3) 14,010.1 191,096 5.68 12,839.6

167,914 5.44 Securities: Securities - taxable 2,778.4 17,399 2.50

1,895.5 10,438 2.20 Securities - tax-exempt 657.1 6,185

5.61 511.8 4,998 5.46

Total

securities (1) 3,435.5 23,584 3.10 2,407.3 15,436 2.90 Cash and

other 845.8 3,156 1.49 684.7 1,400

0.82

Total interest earning assets 18,291.4

217,836 5.00 15,931.6 184,750 4.85

Non-interest earning

assets Cash and due from banks 132.3 146.1

Allowance for

credit losses (133.6 ) (123.6 ) Bank owned life insurance 166.4

164.0 Other assets 930.7 834.9

Total assets $

19,387.2 $ 16,953.0

Interest-bearing

liabilities Interest-bearing deposits: Interest-bearing

transaction accounts $ 1,476.5 $ 1,066 0.29 % $ 1,286.1 $ 612 0.19

% Savings and money market 6,282.4 7,135 0.45 6,129.2 5,314 0.35

Time certificates of deposit 1,585.7 3,248 0.82

1,637.3 2,146 0.52

Total

interest-bearing deposits 9,344.6 11,449 0.49 9,052.6 8,072

0.36 Short-term borrowings 31.7 96 1.21 39.1 83 0.85 Qualifying

debt 375.3 4,708 5.02 369.1 4,048

4.39

Total interest-bearing liabilities

9,751.6 16,253 0.67 9,460.8 12,203 0.52

Non-interest-bearing

liabilities Non-interest-bearing demand deposits 7,174.5

5,363.7 Other liabilities 336.9 292.2 Stockholders’ equity 2,124.2

1,836.3

Total liabilities and stockholders'

equity $ 19,387.2 $ 16,953.0 Net interest income

and margin (4) $ 201,583 4.65 % $ 172,547 4.55 %

(1)

Yields on loans and securities have been

adjusted to a tax-equivalent basis. The taxable-equivalent

adjustment was $10.8 million and $8.6 million for the three months

ended September 30, 2017 and 2016, respectively.

(2)

Included in the yield computation are net

loan fees of $9.4 million and accretion on acquired loans of $7.5

million for the three months ended September 30, 2017, compared to

$7.2 million and $8.8 million for the three months ended September

30, 2016, respectively.

(3)

Includes non-accrual loans.

(4)

Net interest margin is computed by

dividing net interest income by total average earning assets.

Western Alliance Bancorporation and

Subsidiaries Analysis of Average Balances, Yields and

Rates Unaudited Nine Months

Ended September 30, 2017 2016

AverageBalance Interest Average Yield

/Cost AverageBalance Interest

Average Yield /Cost ($ in millions) ($ in thousands)

($ in millions) ($ in thousands)

Interest earning assets

Loans: Commercial $ 6,047.6 $ 224,876 5.45 % $ 5,343.5 $ 189,994

5.24 % CRE - non-owner occupied 3,579.2 160,172 5.97 3,064.1

130,113 5.66 CRE - owner occupied 2,016.8 75,895 5.02 2,024.4

78,521 5.17 Construction and land development 1,583.7 72,965 6.14

1,266.3 56,382 5.94 Residential real estate 315.5 11,125 4.70 297.5

10,449 4.68 Consumer 45.2 1,617 4.77 34.8 1,268 4.86 Loans held for

sale 17.5 656 5.00 22.9 988 5.75

Total loans (1) 13,605.5 547,306 5.58 12,053.5

467,715 5.39 Securities: Securities - taxable (1) 2,445.8 44,684

2.44 1,671.4 28,290 2.26 Securities - tax-exempt 630.0

17,643 5.55 478.8 13,525 5.38

Total securities 3,075.8 62,327 3.07 2,150.2 41,815 2.95

Cash and other 745.0 7,421 1.33 567.0

3,565 0.84

Total interest earning assets

17,426.3 617,054 4.96 14,770.7 513,095 4.86

Non-interest earning

assets Cash and due from banks 138.4 140.4

Allowance for

credit losses (129.8 ) (121.8 ) Bank owned life insurance 165.7

163.5 Other assets 917.1 830.0

Total assets $

18,517.7 $ 15,782.8

Interest-bearing

liabilities Interest-bearing deposits: Interest-bearing

transaction accounts $ 1,468.2 $ 2,858 0.26 % $ 1,191.1 $ 1,571

0.18 % Savings and money market accounts 6,169.9 18,277 0.39

5,768.2 14,326 0.33 Time certificates of deposit 1,549.2

8,371 0.72 1,651.9 6,096 0.49

Total interest-bearing deposits 9,187.3 29,506 0.43 8,611.2

21,993 0.34 Short-term borrowings 58.7 374 0.85 81.5 412 0.67

Qualifying debt 370.8 13,539 4.87 265.7

8,746 4.39

Total interest-bearing liabilities

9,616.8 43,419 0.60 8,958.4 31,151 0.46

Non-interest-bearing

liabilities Non-interest-bearing demand deposits 6,548.4

4,830.7 Other liabilities 315.3 261.3 Stockholders’ equity 2,037.2

1,732.4

Total liabilities and stockholders'

equity $ 18,517.7 $ 15,782.8 Net interest income

and margin (4) $ 573,635 4.63 % $ 481,944 4.58 %

(1)

Yields on loans and securities have been

adjusted to a tax-equivalent basis. The taxable-equivalent

adjustment was $31.0 million and $25.7 million for the nine months

ended September 30, 2017 and 2016, respectively.

(2)

Included in the yield computation are net

loan fees of $26.0 million and accretion on acquired loans of $21.0

million for the nine months ended September 30, 2017, compared to

$20.3 million and $22.3 million for the nine months ended September

30, 2016, respectively.

(3)

Includes non-accrual loans.

(4)

Net interest margin is computed by

dividing net interest income by total average earning assets.

Western Alliance Bancorporation and Subsidiaries

Operating Segment Results Unaudited

Balance Sheet: Regional Segments

Consolidated

Company

Arizona Nevada

Southern

California

Northern

California

At September 30, 2017 (dollars in millions)

Assets:

Cash, cash equivalents, and investment securities $ 4,424.0 $ 1.9 $

7.7 $ 1.9 $ 1.7 Loans, net of deferred loan fees and costs 14,521.9

3,131.2 1,685.6 1,873.5 1,260.7 Less: allowance for credit losses

(136.4 ) (30.7 ) (16.8 ) (20.4 ) (12.6 ) Total loans 14,385.5

3,100.5 1,668.8 1,853.1 1,248.1

Other assets acquired through foreclosure, net 29.0 2.3 13.7 — 0.2

Goodwill and other intangible assets, net 301.2 — 23.2 — 156.8

Other assets 782.5 45.8 58.4 13.9 17.4

Total assets $ 19,922.2 $ 3,150.5 $ 1,771.8

$ 1,868.9 $ 1,424.2

Liabilities:

Deposits $ 16,904.8 $ 5,198.1 $ 3,950.5 $ 2,512.2 $ 1,535.6

Borrowings and qualifying debt 372.9 — — — — Other liabilities

498.9 13.4 23.3 3.6 11.1 Total

liabilities 17,776.6 5,211.5 3,973.8 2,515.8

1,546.7

Allocated equity: 2,145.6 390.4

251.5 216.6 299.2

Total liabilities

and stockholders' equity $ 19,922.2 $ 5,601.9 $

4,225.3 $ 2,732.4 $ 1,845.9 Excess funds

provided (used) — 2,451.4 2,453.5 863.5 421.7 No. of offices

47 10 16 9 3 No. of full-time equivalent employees 1,673 167 218

180 167

Income Statement: Three

Months Ended September 30, 2017: (in thousands) Net interest

income (expense) $ 201,583 $ 52,637 $ 36,310 $ 26,811 $ 21,932

Provision for credit losses 5,000 (289 ) (2,044 ) (58 )

3,144 Net interest income (expense) after provision for

credit losses 196,583 52,926 38,354 26,869 18,788 Non-interest

income 10,288 1,265 2,354 971 1,796 Non-interest expense (89,114 )

(18,844 ) (14,748 ) (12,340 ) (11,317 ) Income (loss) before income

taxes 117,757 35,347 25,960 15,500 9,267 Income tax expense

(benefit) 34,899 13,857 9,086 6,517

3,897

Net income (loss) $ 82,858 $ 21,490

$ 16,874 $ 8,983 $ 5,370

Nine Months Ended September 30, 2017: (in thousands) Net

interest income (expense) $ 573,635 $ 145,839 $ 108,028 $ 81,087 $

63,686 Provision for (recovery of) credit losses 12,250 109

(5,378 ) (20 ) 4,238 Net interest income (expense)

after provision for credit losses 561,385 145,730 113,406 81,107

59,448 Non-interest income 31,281 3,567 6,800 2,602 5,839

Non-interest expense (265,128 ) (55,388 ) (45,733 ) (38,063 )

(36,188 ) Income (loss) before income taxes 327,538 93,909 74,473

45,646 29,099 Income tax expense (benefit) 91,352 36,831

26,066 19,194 12,236

Net income

(loss) $ 236,186 $ 57,078 $ 48,407 $

26,452 $ 16,863

Western

Alliance Bancorporation and Subsidiaries Operating Segment

Results Unaudited Balance

Sheet: National Business Lines

HOA

Services

Public &

Nonprofit

Finance

Technology &

Innovation

Hotel

Franchise

Finance

Other NBLs

Corporate &

Other

At September 30, 2017 (dollars in millions)

Assets:

Cash, cash equivalents, and investment securities $ — $ — $ — $ — $

— $ 4,410.8 Loans, net of deferred loan fees and costs 157.3

1,574.5 1,049.2 1,272.5 2,513.0 4.4 Less: allowance for credit

losses (1.6 ) (16.1 ) (9.9 ) (2.7 ) (25.5 ) (0.1 ) Total loans

155.7 1,558.4 1,039.3 1,269.8 2,487.5

4.3 Other assets acquired through foreclosure, net —

— — — — 12.8 Goodwill and other intangible assets, net — — 121.1

0.1 — — Other assets 0.4 12.2 5.3 5.2

10.1 613.8 Total assets $ 156.1 $ 1,570.6

$ 1,165.7 $ 1,275.1 $ 2,497.6 $ 5,041.7

Liabilities: Deposits $ 2,153.3 $ — $ 1,459.5 $ — $ —

$ 95.6 Borrowings and qualifying debt — — — — — 372.9 Other

liabilities 1.1 46.4 0.7 0.4 136.1

262.8 Total liabilities 2,154.4 46.4

1,460.2 0.4 136.1 731.3

Allocated

equity: 57.4 126.0 234.6 104.3

207.2 258.4

Total liabilities and stockholders'

equity $ 2,211.8 $ 172.4 $ 1,694.8 $ 104.7

$ 343.3 $ 989.7 Excess funds provided (used)

2,055.7 (1,398.2 ) 529.1 (1,170.4 ) (2,154.3 ) (4,052.0 )

No. of offices 1 1 9 1 4 (7 ) No. of full-time equivalent employees

64 10 61 9 38 759

Income Statement:

Three Months Ended September 30, 2017: (in thousands) Net

interest income (expense) $ 13,746 $ 7,269 $ 20,415 $ 15,346 $

16,933 $ (9,816 ) Provision for credit losses 40 91

(83 ) 1,116 4,416 (1,333 ) Net interest income

(expense) after provision for credit losses 13,706 7,178 20,498

14,230 12,517 (8,483 ) Non-interest income 136 15 1,855 — 379 1,517

Non-interest expense (7,011 ) (1,871 ) (8,824 ) (1,905 ) (5,286 )

(6,968 ) Income (loss) before income taxes 6,831 5,322 13,529

12,325 7,610 (13,934 ) Income tax expense (benefit) 2,562

1,028 5,075 4,622 2,853 (14,598 )

Net income (loss) $ 4,269 $ 4,294 $ 8,454

$ 7,703 $ 4,757 $ 664

Nine Months Ended September 30, 2017: (in thousands) Net

interest income (expense) $ 40,275 $ 21,242 $ 59,610 $ 42,337 $

46,380 $ (34,849 ) Provision for (recovery of) credit losses 332

796 816 2,924 10,265

(1,832 ) Net interest income (expense) after provision for credit

losses 39,943 20,446 58,794 39,413 36,115 (33,017 ) Non-interest

income 417 40 5,689 — 1,632 4,695 Non-interest expense (21,416 )

(6,107 ) (26,685 ) (7,949 ) (14,573 ) (13,026 ) Income

(loss) before income taxes 18,944 14,379 37,798 31,464 23,174

(41,348 ) Income tax expense (benefit) 7,104 4,424

14,175 11,799 8,690 (49,167 )

Net income

(loss) $ 11,840 $ 9,955 $ 23,623 $ 19,665

$ 14,484 $ 7,819

Western Alliance

Bancorporation and Subsidiaries Operating Segment

Results Unaudited Balance

Sheet: Regional Segments

Consolidated

Company

Arizona Nevada

Southern

California

Northern

California

At December 31, 2016 (dollars in millions)

Assets:

Cash, cash equivalents, and investment securities $ 3,052.3 $ 1.9 $

10.1 $ 2.1 $ 1.9 Loans, net of deferred loan fees and costs

13,208.5 2,955.9 1,725.5 1,766.8 1,095.4 Less: allowance for credit

losses (124.7 ) (30.1 ) (18.5 ) (19.4 ) (8.8 ) Total loans 13,083.8

2,925.8 1,707.0 1,747.4 1,086.6

Other assets acquired through foreclosure, net 47.8 6.2 18.0 — 0.3

Goodwill and other intangible assets, net 302.9 — 23.7 — 157.5

Other assets 714.0 42.9 58.8 14.5 14.3

Total assets $ 17,200.8 $ 2,976.8 $ 1,817.6

$ 1,764.0 $ 1,260.6

Liabilities:

Deposits $ 14,549.8 $ 3,843.4 $ 3,731.5 $ 2,382.6 $ 1,543.6

Borrowings and qualifying debt 447.9 — — — — Other liabilities

311.6 12.8 28.3 12.9 12.4 Total

liabilities 15,309.3 3,856.2 3,759.8 2,395.5

1,556.0

Allocated equity: 1,891.5 346.6

250.7 201.6 283.7

Total liabilities

and stockholders' equity $ 17,200.8 $ 4,202.8 $

4,010.5 $ 2,597.1 $ 1,839.7 Excess funds

provided (used) — 1,226.0 2,192.9 833.1 579.1 No. of offices

48 10 18 9 3 No. of full-time equivalent employees 1,514 169 228 57

275

Income Statements: Three Months

Ended September 30, 2016: (in thousands) Net interest income

(expense) $ 172,547 $ 45,531 $ 35,977 $ 26,488 $ 22,181 Provision

for (recovery of) credit losses 2,000 2,399 (1,009 )

(105 ) 144 Net interest income (expense) after provision for

credit losses 170,547 43,132 36,986 26,593 22,037 Non-interest

income 10,683 1,180 2,264 686 2,916 Non-interest expense (85,007 )

(16,084 ) (14,801 ) (11,532 ) (12,706 ) Income (loss) before income

taxes 96,223 28,228 24,449 15,747 12,247 Income tax expense

(benefit) 29,171 11,074 8,557 6,621

5,150

Net income (loss) $ 67,052 $ 17,154

$ 15,892 $ 9,126 $ 7,097

Nine Months Ended September 30, 2016: (in thousands) Net

interest income (expense) $ 481,944 $ 125,191 $ 102,016 $ 76,719 $

67,272 Provision for (recovery of) credit losses 7,000

10,875 (3,526 ) 145 2,112 Net interest income

(expense) after provision for credit losses 474,944 114,316 105,542

76,574 65,160 Non-interest income 32,375 5,749 6,420 1,907 7,858

Non-interest expense (242,304 ) (45,090 ) (44,371 ) (33,401 )

(40,154 ) Income (loss) before income taxes 265,015 74,975 67,591

45,080 32,864 Income tax expense (benefit) 75,017 29,413

23,657 18,956 13,819

Net income

(loss) $ 189,998 $ 45,562 $ 43,934 $

26,124 $ 19,045

Western

Alliance Bancorporation and Subsidiaries Operating Segment

Results Unaudited Balance

Sheet: National Business Lines

HOA

Services

Public &

Nonprofit

Finance

Technology &

Innovation

Hotel

Franchise

Finance

Other NBLs

Corporate &

Other

At December 31, 2016 (dollars in millions)

Assets:

Cash, cash equivalents, and investment securities $ — $ — $ — $ — $

— $ 3,036.3 Loans, net of deferred loan fees and costs 116.8

1,454.3 1,011.4 1,292.1 1,776.9 13.4 Less: allowance for credit

losses (1.3 ) (15.6 ) (10.6 ) (0.8 ) (19.0 ) (0.6 ) Total loans

115.5 1,438.7 1,000.8 1,291.3 1,757.9

12.8 Other assets acquired through foreclosure, net —

— — — — 23.3 Goodwill and other intangible assets, net — — 121.5

0.2 — — Other assets 0.3 15.6 7.2 5.3

11.1 544.0 Total assets $ 115.8 $ 1,454.3

$ 1,129.5 $ 1,296.8 $ 1,769.0 $ 3,616.4

Liabilities: Deposits $ 1,890.3 $ — $ 1,038.2 $ — $ —

$ 120.2 Borrowings and qualifying debt — — — — — 447.9 Other

liabilities 0.7 50.5 2.0 1.4 17.5

173.1 Total liabilities 1,891.0 50.5

1,040.2 1.4 17.5 741.2

Allocated

equity: 65.6 117.1 224.1 107.1

145.5 149.5

Total liabilities and stockholders'

equity $ 1,956.6 $ 167.6 $ 1,264.3 $ 108.5

$ 163.0 $ 890.7 Excess funds provided (used)

1,840.8 (1,286.7 ) 134.8 (1,188.3 ) (1,606.0 ) (2,725.7 )

No. of offices 1 1 8 1 4 (7 ) No. of full-time equivalent employees

55 7 59 21 32 611

Income Statement:

Three Months Ended September 30, 2016: (in thousands) Net

interest income (expense) $ 11,312 $ 5,012 $ 18,143 $ 13,370 $

12,060 $ (17,527 ) Provision for (recovery of) credit losses 72

(315 ) (557 ) — 1,372 (1 ) Net interest income

(expense) after provision for credit losses 11,240 5,327 18,700

13,370 10,688 (17,526 ) Non-interest income 125 19 1,871 — 728 894

Non-interest expense (6,062 ) (1,974 ) (8,837 ) (3,207 ) (3,972 )

(5,832 ) Income (loss) before income taxes 5,303 3,372 11,734

10,163 7,444 (22,464 ) Income tax expense (benefit) 1,989

1,265 4,400 3,811 2,791 (16,487 )

Net income (loss) $ 3,314 $ 2,107 $ 7,334

$ 6,352 $ 4,653 $ (5,977 )

Nine Months Ended September 30, 2016: (in thousands) Net

interest income (expense) $ 29,853 $ 15,259 $ 51,083 $ 25,438 $

35,220 $ (46,107 ) Provision for (recovery of) credit losses 160

(509 ) (2,336 ) — 3,309 (3,230 ) Net interest

income (expense) after provision for credit losses 29,693 15,768

53,419 25,438 31,911 (42,877 ) Non-interest income 340 22 4,623 —

1,598 3,858 Non-interest expense (17,423 ) (5,927 ) (23,177 )

(5,764 ) (11,007 ) (15,990 ) Income (loss) before income taxes

12,610 9,863 34,865 19,674 22,502 (55,009 ) Income tax expense

(benefit) 4,729 3,699 13,074 7,378

8,438 (48,146 )

Net income (loss) $ 7,881 $

6,164 $ 21,791 $ 12,296 $ 14,064 $

(6,863 )

Western Alliance Bancorporation and

Subsidiaries Reconciliation of Non-GAAP Financial

Measures Unaudited Operating

Pre-Provision Net Revenue by Quarter: Three Months Ended

Sep 30, 2017 Jun 30, 2017 Mar 31, 2017 Dec

31, 2016 Sep 30, 2016 (in thousands) Total non-interest

income $ 10,288 $ 10,449 $ 10,544 $ 10,540 $ 10,683 Less: Gains

(losses) on sales of investment securities, net 319 (47 ) 635 58 —

Unrealized gains (losses) on assets and liabilities measured at

fair value, net 14 11 14 37 7

Total operating non-interest income 9,955 10,485 9,895

10,445 10,676 Plus: net interest income 201,583 192,743

179,309 175,269 172,547

Net

operating revenue (1) $ 211,538 $ 203,228

$ 189,204 $ 185,714 $ 183,223 Total

non-interest expense $ 89,114 $ 88,257 $ 87,757 $ 88,645 $ 85,007

Less: Net loss (gain) on sales and valuations of repossessed and

other assets 266 231 (543 ) (34 ) (146 ) Acquisition / restructure

expense — — — 6,021 2,729

Total operating non-interest expense (1) $ 88,848

$ 88,026 $ 88,300 $ 82,658 $ 82,424

Operating

pre-provision net revenue (2) $ 122,690 $ 115,202

$ 100,904 $ 103,056 $ 100,799

Plus: Non-operating revenue adjustments 333 (36 ) 649 95 7 Less:

Provision for credit losses 5,000 3,000 4,250 1,000 2,000

Non-operating expense adjustments 266 231 (543 ) 5,987 2,583 Income

tax expense 34,899 31,964 24,489 26,364

29,171 Net income $ 82,858 $ 79,971 $ 73,357

$ 69,800 $ 67,052 (1), (2)

See Non-GAAP Financial Measures

footnotes.

Western Alliance Bancorporation and

Subsidiaries Reconciliation of Non-GAAP Financial

Measures Unaudited Tangible Common Equity:

Sep 30, 2017 Jun 30, 2017 Mar 31,

2017 Dec 31, 2016 Sep 30, 2016 (dollars and

shares in thousands) Total stockholders' equity $ 2,145,627 $

2,058,674 $ 1,968,992 $ 1,891,529 $ 1,857,354 Less: goodwill and

intangible assets 301,157 301,645 302,133

302,894 303,592

Total tangible common equity

1,844,470 1,757,029 1,666,859 1,588,635 1,553,762 Plus: deferred

tax - attributed to intangible assets 4,341 4,550

4,759 4,949 5,304

Total tangible common

equity, net of tax $ 1,848,811 $ 1,761,579 $

1,671,618 $ 1,593,584 $ 1,559,066 Total assets

$ 19,922,221 $ 18,844,745 $ 18,122,506 $ 17,200,842 $ 17,042,602

Less: goodwill and intangible assets, net 301,157 301,645

302,133 302,894 303,592 Tangible assets

19,621,064 18,543,100 17,820,373 16,897,948 16,739,010 Plus:

deferred tax - attributed to intangible assets 4,341 4,550

4,759 4,949 5,304

Total tangible

assets, net of tax $ 19,625,405 $ 18,547,650 $

17,825,132 $ 16,902,897 $ 16,744,314 Tangible

common equity ratio (3) 9.4 % 9.5 % 9.4 % 9.4 % 9.3 % Common shares

outstanding 105,493 105,429 105,428 105,071 105,071 Tangible book

value per share, net of tax (4) $ 17.53 $ 16.71 $ 15.86 $ 15.17 $

14.84

Operating Efficiency Ratio by Quarter:

Three Months Ended Sep 30, 2017 Jun 30, 2017

Mar 31, 2017 Dec 31, 2016 Sep 30, 2016 (in

thousands) Total operating non-interest expense $ 88,848 $ 88,026 $

88,300 $ 82,658 $ 82,424 Divided by: Total net interest income

201,583 192,743 179,309 175,269 172,547 Plus: Tax equivalent

interest adjustment 10,837 10,453 9,676 9,165 8,599 Operating

non-interest income 9,955 10,485 9,895 10,445

10,676 $ 222,375 $ 213,681 $ 198,880

$ 194,879 $ 191,822

Operating efficiency ratio - tax

equivalent basis (5)

40.0 % 41.2 % 44.4 % 42.4 % 43.0 % (3), (4), (5)

See Non-GAAP Financial Measures

footnotes.

Western Alliance Bancorporation and

Subsidiaries Reconciliation of Non-GAAP Financial

Measures Unaudited

Regulatory Capital:

Sep 30,

2017 Dec 31, 2016 (in

thousands)

Common Equity Tier 1: Common equity $ 2,145,627 $

1,891,529 Less: Non-qualifying goodwill and intangibles 295,432

294,754 Disallowed deferred tax asset 2 1,400 AOCI related

adjustments 886 (13,460 ) Unrealized gain on changes in fair value

liabilities 8,566 8,118

Common equity Tier 1

(regulatory) (6) (9) $ 1,840,741 $ 1,600,717

Divided by: estimated risk-weighted assets

(regulatory) (7) (9) $ 17,759,899 $ 15,980,092

Common

equity Tier 1 ratio (7) (9) 10.4 % 10.0 % Common

equity Tier 1 (regulatory) (6) (9) 1,840,741 1,600,717 Plus: Trust

preferred securities 81,500 81,500 Less: Disallowed deferred tax

asset — 934 Unrealized gain on changes in fair value of liabilities

2,142 5,412

Tier 1 capital (7) (9) $

1,920,099 $ 1,675,871

Divided by: Tangible average

assets $ 19,082,108 $ 16,868,674

Tier 1 leverage ratio

10.1 % 9.9 %

Total Capital: Tier 1 capital

(regulatory) (6) (9) $ 1,920,099 $ 1,675,871 Plus:

Subordinated debt 299,316 299,927 Qualifying allowance for credit

losses 136,421 124,704 Other 5,595 6,978 Less: Tier 2 qualifying

capital deductions — —

Tier 2 capital $

441,332 $ 431,609

Total capital

$ 2,361,431 $ 2,107,480

Total capital

ratio 13.3 % 13.2 %

Classified assets to Tier 1

capital plus allowance: Classified assets $ 220,567 $ 211,782

Divided by:

Tier 1 capital (7) (9) 1,920,099

1,675,871 Plus: Allowance for credit losses 136,421 124,704

Total Tier 1 capital plus allowance for credit losses

$ 2,056,520 $ 1,800,575

Classified assets

to Tier 1 capital plus allowance (8) (9) 10.7 % 11.8 %

(6), (7), (8), (9)

See Non-GAAP Financial Measures

footnotes.

Non-GAAP Financial Measures Footnotes

(1) We believe these non-GAAP measurements provide a useful

indication of the cash generating capacity of the Company. (2) We

believe this non-GAAP measurement is a key indicator of the

earnings power of the Company. (3) We believe this non-GAAP ratio

provides an important metric with which to analyze and evaluate

financial condition and capital strength. (4) We believe this

non-GAAP measurement improves the comparability to other

institutions that have not engaged in acquisitions that resulted in

recorded goodwill and other intangibles. (5) We believe this

non-GAAP ratio provides a useful metric to measure the operating

efficiency of the Company. (6) Under the current guidelines of the

Federal Reserve and the Federal Deposit Insurance Corporation,

common equity Tier 1 capital consists of common stock, retained

earnings, and minority interests in certain subsidiaries, less most

other intangible assets. (7) Common equity Tier 1 is often

expressed as a percentage of risk-weighted assets. Under the

risk-based capital framework, a bank's balance sheet assets and

credit equivalent amounts of off-balance sheet items are assigned

to one of the risk categories defined under new capital guidelines.

The aggregated dollar amount in each category is then multiplied by

the risk weighting assigned to that category. The resulting

weighted values from each category are added together and this sum

is the risk-weighted assets total that, as adjusted, comprises the

denominator (risk-weighted assets) to determine the common equity

Tier 1 ratio. Common equity Tier 1 is divided by the risk-weighted

assets to determine the common equity Tier 1 ratio. We believe this

non-GAAP ratio provides an important metric with which to analyze

and evaluate financial condition and capital strength. (8) We

believe this non-GAAP ratio provides an important regulatory metric

to analyze asset quality. (9) Current quarter is preliminary until

Call Report is filed.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171019006565/en/

Western Alliance BancorporationDale Gibbons, 602-952-5476

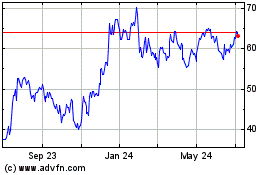

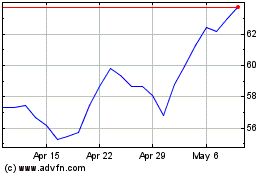

Western Alliance Bancorp... (NYSE:WAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Western Alliance Bancorp... (NYSE:WAL)

Historical Stock Chart

From Apr 2023 to Apr 2024