Current Report Filing (8-k)

October 19 2017 - 1:41PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act Of 1934

Date of Report (Date of earliest event reported): October 19, 2017 (October 13, 2017)

Comstock Holding Companies, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

1-32375

|

|

20-1164345

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

1886 METRO CENTER DRIVE, FOURTH FLOOR

RESTON, VIRGINIA 20190

(Address of principal executive offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (703) 883-1700

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (

See

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a- 12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On October 13, 2017, Comstock

Investors X, L.C. (“Investors X”), a subsidiary of Comstock Holding Companies, Inc. (the “Company”), amended its Operating Agreement to increase the amount of the aggregate capital raise to up to Nineteen Million Five Hundred

Thousand Dollars ($19,500,000) that may be drawn as needed at the request of the Company (“Private Placement”). The initial accredited investor in Investors X, an entity wholly owned by Christopher Clemente, the Chief Executive Officer of

the Company (“Purchaser”), contributed the additional capital. The investment has been made pursuant to a second amendment to the operating agreement of Investors X entered into by the Company and the Purchaser (the “Amendment to

Operating Agreement”).

The proceeds from the Private Placement provide capital primarily for the planned construction of the

Company’s Totten Mews project, consisting of forty single family attached homes in Washington, D.C., its Towns at 1333 project, consisting of eighteen single family attached homes in the City of Alexandria, Virginia, its Richmond Station

project, consisting of 158 townhomes in Manassas, Virginia, and the Marwood East project, consisting of 40 single family homes in Loudoun County, Virginia (individually or collectively, a “Project”). Proceeds of the Private Placement may

be utilized (i) to provide capital needed to complete the Projects, (ii) to pay off investors in the private capital raise of Comstock Investors IX, L.C., and (iii) for general corporate purposes of the Company.

As part of the Private Placement, the Company issued a warrant (“Warrant”) to the Purchaser to purchase shares of the Company’s

Class A Common Stock (“Class A Common Stock”). The Warrant represents the right to purchase an aggregate amount of up to 50,000 shares of Class A Common Stock. The Warrant has an initial exercise price (subject to certain

restrictions as indicated on the Warrant) equal to the average of the closing price of the Class A Common Stock over the 20 trading days preceding the issuance of the Warrant. The exercise price and number of shares of Class A Common Stock

issuable upon the exercise of the Warrant will be subject to adjustment as a result of certain events as described in the Warrant. The Warrant contains a cashless exercise provision. In the event the Purchaser exercises the Warrant on a cashless

basis, the Company will not receive any proceeds from such exercise. The Warrant may be exercised at any time in whole or in part prior to October 12, 2027.

The foregoing description of the material terms of the Amendment to the Operating Agreement and the Warrant is qualified in its entirety by

reference to the full text of the form of the Amendment to the Operating Agreement and the form of Warrant, which will be filed as exhibits to the Company’s Form 10-Q for the quarter ending September 30, 2017.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth in response to Item 1.01 of this Form 8-K is incorporated by reference in response to this Item 2.03.

|

Item 3.02

|

Unregistered Sale of Equity Securities.

|

The information set forth in response to

Item 1.01 of this Form 8-K is incorporated by reference in response to this Item 3.02. The Interests and the Warrant were offered and sold to the Purchaser in reliance upon exemptions from registration pursuant to Section 4(2) under

the Securities Act, and Rule 506(c) promulgated thereunder, and the certificates representing the securities shall bear legends to that effect. The Purchaser represented itself as an accredited investor (as defined by Rule 501 under the Securities

Act), and Investors X and the Company took reasonable steps to verify such status. The Interests, the Warrant and the shares of Class A Common Stock issuable upon the exercise of the Warrant have not been registered under the Securities Act,

and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Date: October 19, 2017

COMSTOCK HOLDING COMPANIES, INC.

|

|

|

|

|

By:

|

|

/s/ Christopher

Clemente

|

|

|

|

Christopher Clemente,

Chief Executive Officer

|

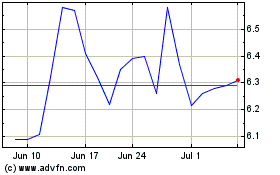

Comstock Holding Companies (NASDAQ:CHCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comstock Holding Companies (NASDAQ:CHCI)

Historical Stock Chart

From Apr 2023 to Apr 2024