Current Report Filing (8-k)

October 19 2017 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported)

October 11, 2017

INNERSCOPE HEARING TECHNOLOGIES, INC.

(Exact Name of Registrant as Specified

in Charter)

|

Nevada

|

|

(State or Other Jurisdiction of Incorporation)

|

|

333-209341

|

|

46-3096516

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

2151 Professional Drive, 2

nd

Floor

Roseville, CA

|

|

95661

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

|

(916) 218-4100

|

|

(Registrant’s telephone number, including area code)

|

|

Not applicable

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following p

rovisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☑

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On October 11, 2017, the Company completed

the closing of a private placement financing transaction (the “Transaction”) with Power Up Lending Group, LTD (“Power

Up”), pursuant to a Securities Purchase Agreement (the “Purchase Agreement”) dated October 5, 2017. Pursuant

to the Purchase Agreement, Power Up purchased a 12% Convertible Promissory Note (the “Note”), dated October 5, 2017,

in the principal amount of $48,000.00. On October 11, 2017, the Company received proceeds of $45,000.00 which excluded transaction

costs, fees, and expenses of $3,000.

Principal and interest is due and payable

July 15, 2018, and the Note is convertible into shares of the Company’s common stock at any time after one hundred eighty

(180) days, at the average of the two lowest closing bid prices during the ten (10) prior trading days from which a notice of conversion

is received by the Company multiplied by sixty-five percent (65%), representing a thirty-five percent (35%) discount.

The foregoing description of the Purchase

Agreement and the Note does not purport to be complete and is qualified in its entirety by reference to the full text of each document,

which are filed as Exhibits 10.1 and 10.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

|

ITEM 2.03

|

CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT.

|

The information provided in response

to Item 1.01 of this report is incorporated by reference into this Item 2.03.

|

ITEM 3.02

|

UNREGISTERED SALES OF EQUITY SECURITIES

.

|

The information provided in response

to Item 1.01 of this report is incorporated by reference into this Item 3.02. The securities were issued in a private placement

under Section 4(a)(2) of the Securities Act of 1933, as amended. The investor represented that it was an accredited investor, as

defined in Rule 501 of Regulation D, and that it was acquiring the securities for its own account, not as nominee or agent, and

not with a view to the resale or distribution of any part thereof in violation of the Act.

|

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

The exhibits listed in the following Exhibit Index are filed

as part of this Current Report on Form 8-K.

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Securities Purchase Agreement

dated October 5, 2017 by and between InnerScope Hearing Technologies, Inc. and Power Up Lending Group, LTD.

|

|

|

|

|

|

10.2

|

|

Convertible Promissory Note dated October

5, 2017, by and between InnerScope Hearing Technologies, Inc. and Power Up Lending Group, LTD.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

Dated: October 18, 2017

|

INNERSCOPE HEARING TECHNOLOGIES, INC.

f/k/a

INNERSCOPE ADVERTISING AGENCY, INC.

|

|

|

|

|

|

|

By:

|

/s/Matthew Moore

|

|

|

|

Matthew Moore

Chief Executive Officer

|

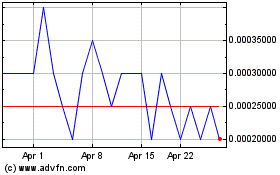

Innerscope Hearing Techn... (PK) (USOTC:INND)

Historical Stock Chart

From Mar 2024 to Apr 2024

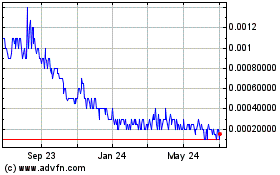

Innerscope Hearing Techn... (PK) (USOTC:INND)

Historical Stock Chart

From Apr 2023 to Apr 2024