Statement of Changes in Beneficial Ownership (4)

October 18 2017 - 6:21PM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Anand Naveen

|

2. Issuer Name

and

Ticker or Trading Symbol

HALLMARK FINANCIAL SERVICES INC

[

HALL

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director

_____ 10% Owner

__

X

__ Officer (give title below)

_____ Other (specify below)

President & CEO

|

|

(Last)

(First)

(Middle)

777 MAIN STREET, SUITE 1000

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

10/18/2017

|

|

(Street)

FORT WORTH, TX 76102

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

COMMON STOCK

|

|

|

|

|

|

|

|

60300

|

D

|

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

RESTRICTED STOCK UNITS

|

(1)

(2)

|

10/18/2017

|

|

A

|

|

29412

|

|

3/31/2020

|

3/31/2020

|

COMMON STOCK

|

(1)

(2)

|

$0

|

29412

|

D

|

|

|

RESTRICTED STOCK UNITS

|

(3)

(4)

|

|

|

|

|

|

|

3/31/2019

|

3/31/2019

|

COMMON STOCK

|

(3)

(4)

|

|

26293

|

D

|

|

|

RESTRICTED STOCK UNITS

|

(5)

|

|

|

|

|

|

|

3/31/2018

|

3/31/2018

|

COMMON STOCK

|

(5)

|

|

78007

|

D

|

|

|

Explanation of Responses:

|

|

(1)

|

Each restricted stock unit represents the right to receive shares of common stock upon satisfaction of vesting requirements and performance criteria. The performance criteria for one-half of the restricted stock units are based on the compound average annual growth rate ("CAAGR") in book value per share from January 1, 2017 to December 31, 2019, and earn a percentage of a share of common stock per restricted stock unit, as follows: (i) CAAGR less than 7% earns 0%; (ii) 7% CAAGR earns 50%; (iii) 8% CAAGR earns 67%; (iv) 9% CAAGR earns 83%; (v) 10% CAAGR earns 100%; (vi) 11% CAAGR earns 117% shares; (vii) 12% CAAGR earns 133%; and (viii) 13% or greater CAAGR earns 150%.

|

|

(2)

|

Each restricted stock unit represents the right to receive shares of common stock upon satisfaction of vesting requirements and performance criteria. The performance criteria for one-half of the restricted stock units are based on the net combined ratio ("NCR") for the three year period from January 1, 2017 to December 31, 2019, and earn a percentage of a share of common stock per restricted stock unit, as follows: (a) NCR greater than 96% earns 0%; (b) NCR of 95% earns 50%; (c) NCR of 94% earns 60%; (d) NCR of 93% earns 80%; (e) NCR of 92% earns 100%; (f) NCR of 90% earns 110%; (g) NCR of 89% earns 120%; (h) NCR of 88% earns 135%; and (i) NCR less than 87% earns 150%.

|

|

(3)

|

Each restricted stock unit represents the right to receive shares of common stock upon satisfaction of vesting requirements and performance criteria. The performance criteria for one-half of the restricted stock units are based on the compound average annual growth rate ("CAAGR") in book value per share from January 1, 2016 to December 31, 2018, and earn a percentage of a share of common stock per restricted stock unit, as follows: (i) CAAGR less than 7% earns 0%; (ii) 7% CAAGR earns 50%; (iii) 8% CAAGR earns 67%; (iv) 9% CAAGR earns 83%; (v) 10% CAAGR earns 100%; (vi) 11% CAAGR earns 117% shares; (vii) 12% CAAGR earns 133%; and (viii) 13% or greater CAAGR earns 150%.

|

|

(4)

|

Each restricted stock unit represents the right to receive shares of common stock upon satisfaction of vesting requirements and performance criteria. The performance criteria for one-half of the restricted stock units are based on the net combined ratio ("NCR") for the three year period from January 1, 2016 to December 31, 2018, and earn a percentage of a share of common stock per restricted stock unit, as follows: (a) NCR greater than 96% earns 0%; (b) NCR of 95% earns 50%; (c) NCR of 94% earns 60%; (d) NCR of 93% earns 80%; (e) NCR of 92% earns 100%; (f) NCR of 90% earns 110%; (g) NCR of 89% earns 120%; (h) NCR of 88% earns 135%; and (i) NCR less than 87% earns 150%.

|

|

(5)

|

Each restricted stock unit represents the right to receive shares of common stock upon satisfaction of vesting requirements and performance criteria. The performance criteria are based on the compound average annual growth rate ("CAAGR") in book value per share from January 1, 2015 to December 31, 2017, and earn a percentage of a share of common stock per restricted stock unit, as follows: (i) CAAGR less than 9% earns 0%; (ii) 9% CAAGR earns 50%; (iii) 10% CAAGR earns 67%; (iv) 11% CAAGR earns 83%; (v) 12% CAAGR earns 100%; (vi) 13% CAAGR earns 117% shares; (vii) 14% CAAGR earns 133%; and (viii) 15% or greater CAAGR earns 150%.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Anand Naveen

777 MAIN STREET

SUITE 1000

FORT WORTH, TX 76102

|

|

|

President & CEO

|

|

Signatures

|

|

Steven D. Davidson as Attorney-In-Fact for Naveen Anand

|

|

10/18/2017

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

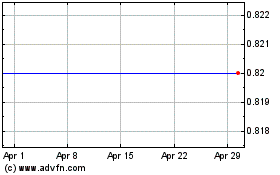

Hallmark Financial Servi... (NASDAQ:HALL)

Historical Stock Chart

From Mar 2024 to Apr 2024

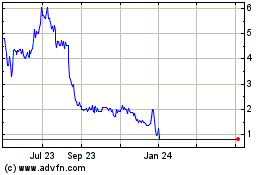

Hallmark Financial Servi... (NASDAQ:HALL)

Historical Stock Chart

From Apr 2023 to Apr 2024