Raises Full-Year 2017 Guidance

United Rentals, Inc. (NYSE:URI) today announced financial

results for the third quarter 2017. Total revenue was $1.766

billion and rental revenue was $1.536 billion for the third

quarter, compared with $1.508 billion and $1.322 billion,

respectively, for the same period last year. On a GAAP basis, the

company reported third quarter net income of $199 million, or $2.33

per diluted share, compared with $187 million, or $2.16 per diluted

share, for the same period last year.

Adjusted EPS1 for the quarter was $3.25 per diluted share,

compared with $2.58 per diluted share for the same period last

year. Adjusted EBITDA1 was $879 million and adjusted EBITDA margin1

was 49.8%, reflecting increases of $132 million and 30 basis

points, respectively, from the same period last year.

Third Quarter 2017 Highlights

- Rental revenue2 increased 16.2%

year-over-year. Within rental revenue, owned equipment rental

revenue increased 15.8%, reflecting increases of 18.2% in the

volume of equipment on rent and 0.1% in rental rates.

- Pro forma3 rental revenue increased

8.9% year-over-year, reflecting growth of 7.6% in the volume of

equipment on rent and a 0.9% increase in rental rates.

- Time utilization increased 160 basis

points year-over-year to 71.9%, a third quarter record, with each

month in the quarter also establishing a new monthly record. On a

pro forma basis, time utilization increased 180 basis points

year-over-year.

- The company’s Trench, Power and

Pump specialty segment's rental revenue increased by 32.9%

year-over-year, primarily on a same store basis, while the

segment’s rental gross margin improved by 280 basis points to

54.8%.

- The company generated $139 million of

proceeds from used equipment sales at a GAAP gross margin of 39.6%

and an adjusted gross margin of 56.8%, compared with $112 million

at a GAAP gross margin of 39.3% and an adjusted gross margin of

46.4% for the same period last year. The year-over-year increase in

adjusted gross margin primarily reflected the impact of sales of

NES equipment.4

_______________ 1. Adjusted EPS (earnings per share) and

adjusted EBITDA (earnings before interest, taxes, depreciation and

amortization) are non-GAAP measures that exclude the impact of the

items noted in the tables below. See the tables below for amounts

and reconciliations to the most comparable GAAP measures. Adjusted

EBITDA margin represents adjusted EBITDA divided by total revenue.

2. Rental revenue includes owned equipment rental revenue, re-rent

revenue and ancillary revenue. 3. Pro forma results reflect the

combination of United Rentals and NES Rentals ("NES") for all

periods presented. The NES acquisition closed on April 3, 2017. 4.

Used equipment sales adjusted gross margin excludes the impact of

the fair value mark-up of acquired RSC and NES fleet that was sold.

Acquisition of Neff Corporation

Subsequent to the third quarter, on October 2, the company

completed its previously announced acquisition of Neff Corporation

(“Neff”) for approximately $1.3 billion. The acquisition will

augment the company’s earthmoving capabilities and efficiencies of

scale in key market areas, particularly fast-growing southern

geographies. The assets acquired included approximately $860

million of fleet based on original equipment cost ("OEC"), and 69

branch facilities serving end markets across the infrastructure,

non-residential, energy, municipal and residential construction

sectors.

CEO Comments

Michael Kneeland, chief executive officer of United Rentals,

said, "We’re very pleased with the gains we reported for the third

quarter. These include significantly higher volume and time

utilization, margin growth, and strong cash flow. Importantly, we

delivered positive rental rates both sequentially and

year-over-year for every month in the quarter. Our U.S. end

markets are driving robust demand for our fleet, and Canada is

continuing to rebound. Given these many positive

dynamics, and the extended hurricane recoveries, we’ve raised

our 2017 gross capex plan by up to $200 million to best serve the

current and anticipated needs of our customers."

Kneeland continued, "Looking at the balance of 2017,

our updated guidance reflects the combination of a

fundamentally strong market and the contributions from our

acquisitions this year. The integration of Neff is well underway,

with all locations on our operating system. We expect fourth

quarter market activity to exceed normal seasonality, and

based on everything we see, we have confidence in the operating

environment for 2018."

Nine Months 2017 Highlights

- Rental revenue increased 11.7%

year-over-year. Within rental revenue, owned equipment rental

revenue increased 11.3%, reflecting an increase of 14.5% in the

volume of equipment on rent, partially offset by a 0.7% decrease in

rental rates.

- Pro forma rental revenue increased 6.5%

year-over-year, reflecting growth of 6.9% in the volume of

equipment on rent, partially offset by a 0.2% decline in rental

rates.

- Time utilization increased 190 basis

points year-over-year on both an actual and a pro forma basis to

69.3% and 69.0%, respectively.

- The company’s Trench, Power and

Pump specialty segment's rental revenue increased by 23.6%

year-over-year, primarily on a same store basis, while the

segment’s rental gross margin improved by 280 basis points to

50.4%.

- The company generated $378 million of

proceeds from used equipment sales at a GAAP gross margin of 40.5%

and an adjusted gross margin of 53.7%, compared with $361 million

at a GAAP gross margin of 40.4% and an adjusted gross margin of

47.6% for the same period last year. The year-over-year increase in

adjusted gross margin primarily reflected the impact of sales of

NES equipment.

- The company generated $1.766 billion of

net cash provided by operating activities and $582 million of free

cash flow5, compared with $1.630 billion and $846 million,

respectively, for the same period last year. Net rental capital

expenditures were $1.107 billion, compared with $784 million for

the same period last year.

- The company issued $2.925 billion of

debt due from 2025 through 2028. The proceeds from the debt

issuances were primarily used to fund the NES and Neff

acquisitions, and to redeem $1.175 billion of debt that would have

been due in 2022 and 2023. The company additionally increased the

sizes of its ABL and AR securitization facilities by $500 million

and $50 million, respectively. The company expects to redeem the

remaining $225 million principal amount of its 7 5/8 percent Senior

Notes due 2022 in the fourth quarter of 2017.

___________ 5. Free cash flow is a non-GAAP measure. See the

table below for amounts and a reconciliation to the most comparable

GAAP measure.

2017 Outlook

The company has issued the following new full-year guidance:

Prior Outlook Current Outlook

Total revenue $6.25 billion to $6.40 billion $6.525 billion to

$6.625 billion Adjusted EBITDA6 $2.950 billion to $3.025 billion

$3.10 billion to $3.15 billion Net rental capital expenditures

after gross purchases

$1.05 billion to $1.15 billion, aftergross

purchases of $1.55 billion to $1.65 billion

$1.25 billion to $1.30 billion, after

grosspurchases of $1.75 billion to $1.80 billion

Net cash provided by operating activities $1.975 billion to $2.175

billion $2.275 billion to $2.375 billion

Free cash flow (excluding the impact

ofmerger and restructuring related costs)

$825 million to $925 million $925 million to $975 million

Free Cash Flow and Fleet Size

For the first nine months of 2017, net cash provided by

operating activities was $1.766 billion, and free cash flow was

$582 million after total rental and non-rental gross capital

expenditures of $1.572 billion. For the first nine months of 2016,

net cash provided by operating activities was $1.630 billion, and

free cash flow was $846 million after total rental and non-rental

gross capital expenditures of $1.210 billion. Free cash flow for

the first nine months of 2017 and 2016 included aggregate merger

and restructuring related payments of $52 million and $11 million,

respectively.

The size of the rental fleet was $10.76 billion of OEC at

September 30, 2017, compared with $8.99 billion at December

31, 2016. The age of the rental fleet was 46.3 months on an

OEC-weighted basis at September 30, 2017, compared with 45.2

months at December 31, 2016.

Return on Invested Capital (ROIC)

Return on invested capital was 8.6% for the 12 months ended

September 30, 2017, an increase of 30 basis points from the 12

months ended September 30, 2016. The company’s ROIC metric

uses after-tax operating income for the trailing 12 months divided

by average stockholders’ equity, debt and deferred taxes, net of

average cash. To mitigate the volatility related to fluctuations in

the company’s tax rate from period to period, the federal statutory

tax rate of 35% is used to calculate after-tax operating income.

When adjusting the denominator to also exclude average goodwill,

ROIC was 11.5% for the 12 months ended September 30, 2017, an

increase of 30 basis points from the 12 months ended

September 30, 2016.

Share Repurchase Program

The company announced that it will resume its pre-existing $1

billion program to repurchase shares of its common stock (the

“Program”). The Program commenced in November 2015 and was paused

in October 2016 as the company evaluated potential acquisition

opportunities. The company has already completed $627 million of

repurchases under the Program, and intends to complete the

remaining $373 million in 2018.

Conference Call

United Rentals will hold a conference call tomorrow, Thursday,

October 19, 2017, at 11:00 a.m. Eastern Time. The conference

call number is 855-458-4217 (international: 574-990-3605). The

conference call will also be available live by audio webcast at

unitedrentals.com, where it will be archived until the next

earnings call. The replay number for the call is 404-537-3406,

passcode is 90999400.

_____________ 6. Information reconciling forward-looking

adjusted EBITDA to the comparable GAAP financial measures is

unavailable to the company without unreasonable effort, as

discussed below.

Non-GAAP Measures

Free cash flow, earnings before interest, taxes, depreciation

and amortization (EBITDA), adjusted EBITDA, and adjusted earnings

per share (adjusted EPS) are non-GAAP financial measures as defined

under the rules of the SEC. Free cash flow represents net cash

provided by operating activities, less purchases of rental and

non-rental equipment plus proceeds from sales of rental and

non-rental equipment and excess tax benefits from share-based

payment arrangements. EBITDA represents the sum of net income,

provision for income taxes, interest expense, net, depreciation of

rental equipment and non-rental depreciation and amortization.

Adjusted EBITDA represents EBITDA plus the sum of the merger

related costs, restructuring charge, stock compensation expense,

net, and the impact of the fair value mark-up of acquired RSC and

NES fleet. Adjusted EPS represents EPS plus the sum of the merger

related costs, restructuring charge, the impact on depreciation

related to acquired RSC and NES fleet and property and equipment,

the impact of the fair value mark-up of acquired RSC and NES fleet,

the impact on interest expense related to fair value adjustment of

acquired RSC indebtedness, merger related intangible asset

amortization, asset impairment charge and the loss on

repurchase/redemption of debt securities and amendment of ABL

facility. The company believes that: (i) free cash flow provides

useful additional information concerning cash flow available to

meet future debt service obligations and working capital

requirements; (ii) EBITDA and adjusted EBITDA provide useful

information about operating performance and period-over-period

growth, and help investors gain an understanding of the factors and

trends affecting our ongoing cash earnings, from which capital

investments are made and debt is serviced; and (iii) adjusted EPS

provides useful information concerning future profitability.

However, none of these measures should be considered as

alternatives to net income, cash flows from operating activities or

earnings per share under GAAP as indicators of operating

performance or liquidity.

Information reconciling forward-looking adjusted EBITDA to GAAP

financial measures is unavailable to the company without

unreasonable effort. The company is not able to provide

reconciliations of adjusted EBITDA to GAAP financial measures

because certain items required for such reconciliations are outside

of the company’s control and/or cannot be reasonably predicted,

such as the provision for income taxes. Preparation of such

reconciliations would require a forward-looking balance sheet,

statement of income and statement of cash flow, prepared in

accordance with GAAP, and such forward-looking financial statements

are unavailable to the company without unreasonable effort. The

company provides a range for its adjusted EBITDA forecast that it

believes will be achieved, however it cannot accurately predict all

the components of the adjusted EBITDA calculation. The company

provides an adjusted EBITDA forecast because it believes that

adjusted EBITDA, when viewed with the company’s results under GAAP,

provides useful information for the reasons noted above. However,

adjusted EBITDA is not a measure of financial performance or

liquidity under GAAP and, accordingly, should not be considered as

an alternative to net income or cash flow from operating activities

as an indicator of operating performance or liquidity.

About United Rentals

United Rentals, Inc. is the largest equipment rental company in

the world. Following the acquisition of Neff, the company has an

integrated network of 1,019 rental locations in 49 states and every

Canadian province. The company’s approximately 15,000 employees

serve construction and industrial customers, utilities,

municipalities, homeowners and others. The company offers

approximately 3,300 classes of equipment for rent with a total

original cost of $11.6 billion. United Rentals is a member of the

Standard & Poor’s 500 Index, the Barron’s 400 Index and the

Russell 3000 Index® and is headquartered in Stamford, Conn.

Additional information about United Rentals is available at

unitedrentals.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of

1934, as amended, and the Private Securities Litigation Reform Act

of 1995, known as the PSLRA. These statements can generally be

identified by the use of forward-looking terminology such as

“believe,” “expect,” “may,” “will,” “should,” “seek,” “on-track,”

“plan,” “project,” “forecast,” “intend” or “anticipate,” or the

negative thereof or comparable terminology, or by discussions of

vision, strategy or outlook. These statements are based on current

plans, estimates and projections, and, therefore, you should not

place undue reliance on them. No forward-looking statement can be

guaranteed, and actual results may differ materially from those

projected. Factors that could cause actual results to differ

materially from those projected include, but are not limited to,

the following: (1) the challenges associated with past or future

acquisitions, including NES and Neff, such as undiscovered

liabilities, costs, integration issues and/or the inability to

achieve the cost and revenue synergies expected; (2) a slowdown in

North American construction and industrial activities, which

occurred during the 2008-2010 economic downturn and significantly

affected our revenues and profitability, could reduce demand for

equipment and prices that we can charge; (3) our significant

indebtedness, which requires us to use a substantial portion of our

cash flow for debt service and can constrain our flexibility in

responding to unanticipated or adverse business conditions; (4) the

inability to refinance our indebtedness at terms that are favorable

to us, or at all; (5) the incurrence of additional debt, which

could exacerbate the risks associated with our current level of

indebtedness; (6) noncompliance with covenants in our debt

agreements, which could result in termination of our credit

facilities and acceleration of outstanding borrowings; (7)

restrictive covenants and amount of borrowings permitted under our

debt agreements, which could limit our financial and operational

flexibility; (8) an overcapacity of fleet in the equipment rental

industry; (9) a decrease in levels of infrastructure spending,

including lower than expected government funding for construction

projects; (10) fluctuations in the price of our common stock and

inability to complete stock repurchases in the time frame and/or on

the terms anticipated; (11) our rates and time utilization being

less than anticipated; (12) our inability to manage credit risk

adequately or to collect on contracts with customers; (13) our

inability to access the capital that our business or growth plans

may require; (14) the incurrence of impairment charges; (15) trends

in oil and natural gas could adversely affect demand for our

services and products; (16) our dependence on distributions from

subsidiaries as a result of our holding company structure and the

fact that such distributions could be limited by contractual or

legal restrictions; (17) an increase in our loss reserves to

address business operations or other claims and any claims that

exceed our established levels of reserves; (18) the incurrence of

additional costs and expenses (including indemnification

obligations) in connection with litigation, regulatory or

investigatory matters; (19) the outcome or other potential

consequences of litigation and other claims and regulatory matters

relating to our business, including certain claims that our

insurance may not cover; (20) the effect that certain provisions in

our charter and certain debt agreements and our significant

indebtedness may have of making more difficult or otherwise

discouraging, delaying or deterring a takeover or other change of

control of us; (21) management turnover and inability to attract

and retain key personnel; (22) our costs being more than

anticipated and/or the inability to realize expected savings in the

amounts or time frames planned; (23) our dependence on key

suppliers to obtain equipment and other supplies for our business

on acceptable terms; (24) our inability to sell our new or used

fleet in the amounts, or at the prices, we expect; (25) competition

from existing and new competitors; (26) security breaches,

cybersecurity attacks and other significant disruptions in our

information technology systems; (27) the costs of complying with

environmental, safety and foreign laws and regulations, as well as

other risks associated with non-U.S. operations, including currency

exchange risk; (28) labor difficulties and labor-based legislation

affecting our labor relations and operations generally; and (29)

increases in our maintenance and replacement costs and/or decreases

in the residual value of our equipment. For a more complete

description of these and other possible risks and uncertainties,

please refer to our Annual Report on Form 10-K for the year ended

December 31, 2016, as well as to our subsequent filings with the

SEC. The forward-looking statements contained herein speak only as

of the date hereof, and we make no commitment to update or publicly

release any revisions to forward-looking statements in order to

reflect new information or subsequent events, circumstances or

changes in expectations.

UNITED RENTALS, INC.CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)(In millions,

except per share amounts)

Three Months Ended Nine

Months Ended September 30, September 30,

2017 2016 2017 2016

Revenues: Equipment rentals $ 1,536 $ 1,322 $ 4,069 $ 3,643 Sales

of rental equipment 139 112 378 361 Sales of new equipment 40 30

126 96 Contractor supplies sales 21 19 60 60 Service and other

revenues 30 25 86 79

Total

revenues 1,766 1,508 4,719

4,239 Cost of revenues: Cost of equipment

rentals, excluding depreciation 557 486 1,556 1,391 Depreciation of

rental equipment 290 250 804 735 Cost of rental equipment sales 84

68 225 215 Cost of new equipment sales 34 25 108 79 Cost of

contractor supplies sales 14 13 42 41 Cost of service and other

revenues 14 10 42 32

Total cost of

revenues 993 852 2,777

2,493 Gross profit 773

656 1,942 1,746 Selling, general and

administrative expenses 237 179 648 533 Merger related costs 16 —

32 — Restructuring charge 9 4 28 8 Non-rental depreciation and

amortization 63 61 189 192 Operating

income 448 412 1,045 1,013 Interest expense, net 131 110 338 349

Other income, net (5 ) (1 ) (5 ) (3 ) Income before provision for

income taxes 322 303 712 667 Provision for income taxes 123

116 263 254

Net income $

199 $ 187 $ 449

$ 413 Diluted earnings per share

$ 2.33 $ 2.16 $

5.26 $ 4.66

UNITED RENTALS, INC.CONDENSED

CONSOLIDATED BALANCE SHEETS (UNAUDITED)(In millions)

September 30, 2017 December

31, 2016 ASSETS Cash and cash equivalents $ 324 $ 312

Accounts receivable, net 1,151 920 Inventory 82 68 Prepaid expenses

and other assets 82 61 Total current assets 1,639

1,361 Rental equipment, net 7,391 6,189 Property and equipment, net

451 430 Goodwill 3,493 3,260 Other intangible assets, net 759 742

Other long-term assets 11 6

Total assets

$ 13,744 $ 11,988

LIABILITIES AND STOCKHOLDERS’ EQUITY Short-term debt and

current maturities of long-term debt $ 694 $ 597 Accounts payable

612 243 Accrued expenses and other liabilities 467 344

Total current liabilities 1,773 1,184 Long-term debt 7,677

7,193 Deferred taxes 2,012 1,896 Other long-term liabilities 71

67

Total liabilities 11,533

10,340 Common stock 1 1 Additional paid-in capital

2,322 2,288 Retained earnings 2,108 1,654 Treasury stock (2,077 )

(2,077 ) Accumulated other comprehensive loss (143 ) (218 )

Total stockholders’ equity 2,211 1,648

Total liabilities and stockholders’ equity $

13,744 $ 11,988

UNITED RENTALS, INC.CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)(In

millions)

Three Months Ended Nine

Months Ended September 30, September 30,

2017 2016 2017 2016

Cash Flows From Operating Activities: Net income $ 199 $ 187

$ 449 $ 413 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and amortization 353

311 993 927 Amortization of deferred financing costs and original

issue discounts 2 3 6 7 Gain on sales of rental equipment (55 ) (44

) (153 ) (146 ) Gain on sales of non-rental equipment (1 ) (2 ) (4

) (3 ) Stock compensation expense, net 24 11 64 33 Merger related

costs 16 — 32 — Restructuring charge 9 4 28 8 Loss on

repurchase/redemption of debt securities and amendment of ABL

facility 31 10 43 36 Excess tax benefits from share-based payment

arrangements (1) — — — (53 ) Increase in deferred taxes 57 21 97 90

Changes in operating assets and liabilities: (Increase) decrease in

accounts receivable (156 ) (61 ) (172 ) 7 Increase in inventory (4

) (1 ) (9 ) (3 ) Decrease (increase) in prepaid expenses and other

assets 6 11 (1 ) 75 (Decrease) increase in accounts payable (79 )

(200 ) 350 137 Increase in accrued expenses and other liabilities

27 133 43 102

Net cash provided by

operating activities 429 383 1,766

1,630 Cash Flows From Investing Activities: Purchases

of rental equipment (572 ) (423 ) (1,485 ) (1,145 ) Purchases of

non-rental equipment (32 ) (23 ) (87 ) (65 ) Proceeds from sales of

rental equipment 139 112 378 361 Proceeds from sales of non-rental

equipment 4 5 10 12 Purchases of other companies, net of cash

acquired (98 ) (14 ) (1,063 ) (28 ) Purchases of investments (1 ) —

(5 ) —

Net cash used in investing activities

(560 ) (343 ) (2,252 )

(865 ) Cash Flows From Financing Activities:

Proceeds from debt 4,759 1,848 8,702 5,812 Payments of debt (4,613

) (1,701 ) (8,156 ) (6,021 ) Payments of financing costs (37 ) —

(44 ) (12 ) Proceeds from the exercise of common stock options — —

1 — Common stock repurchased (2) (2 ) (152 ) (26 ) (488 ) Excess

tax benefits from share-based payment arrangements (1) — —

— 53

Net cash provided by (used in)

financing activities 107 (5 ) 477

(656 ) Effect of foreign exchange rates 10 (3

) 21 9

Net (decrease) increase in cash and cash

equivalents (14 ) 32 12 118

Cash and cash equivalents at beginning of period 338 265

312 179

Cash and cash equivalents at end of

period $ 324 $ 297

$ 324 $ 297

Supplemental disclosure of cash flow information: Cash paid

for income taxes, net $ 55 $ 11 $ 114 $ 14 Cash paid for interest

128 75 305 294 (1) In 2017, we adopted accounting guidance

on share-based payments, as a result of which the excess tax

benefits from share-based payment arrangements for 2017 are

presented as a component of net cash provided by operating

activities (within net income), while, for 2016, they are presented

as a component of net cash used in financing activities.

UNITED RENTALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS (UNAUDITED) (continued)

(2) The 2017 repurchases reflect shares withheld to

satisfy tax withholding obligations upon the vesting of restricted

stock unit awards, and were not acquired pursuant to any repurchase

plan or program. We have an open $1 billion share repurchase

program, under which we have purchased $627 million to date, that

we paused as we evaluated potential acquisition opportunities. We

completed the NES and Neff acquisitions in April 2017 and October

2017, respectively. In October 2017, we resumed the share

repurchase program, and we intend to complete the program in 2018.

The 2016 repurchases included i) shares repurchased pursuant to the

$1 billion share repurchase program and ii) shares withheld to

satisfy tax withholding obligations upon the vesting of restricted

stock unit awards.

UNITED RENTALS, INC.SEGMENT

PERFORMANCE($ in millions)

Three Months Ended Nine

Months Ended September 30, September 30,

2017 2016 Change 2017

2016 Change General Rentals

Reportable segment equipment rentals revenue $1,237 $1,097 12.8%

$3,357 $3,067 9.5% Reportable segment equipment rentals gross

profit 525 469 11.9% 1,350 1,243 8.6% Reportable segment equipment

rentals gross margin 42.4% 42.8% (40) bps 40.2% 40.5% (30) bps

Trench, Power and Pump Reportable segment equipment rentals

revenue $299 $225 32.9% $712 $576 23.6% Reportable segment

equipment rentals gross profit 164 117 40.2% 359 274 31.0%

Reportable segment equipment rentals gross margin 54.8% 52.0% 280

bps 50.4% 47.6% 280 bps

Total United Rentals Total equipment

rentals revenue $1,536 $1,322 16.2% $4,069 $3,643 11.7% Total

equipment rentals gross profit 689 586 17.6% 1,709 1,517 12.7%

Total equipment rentals gross margin 44.9% 44.3% 60 bps 42.0% 41.6%

40 bps

UNITED RENTALS,

INC.DILUTED EARNINGS PER SHARE CALCULATION(In

millions, except per share data)

Three Months Ended Nine

Months Ended September 30, September 30,

2017 2016 2017 2016

Numerator: Net income available to common stockholders $ 199 $ 187

$ 449 $ 413 Denominator: Denominator for basic earnings per

share—weighted-average common shares 84.7 85.9 84.6 88.2 Effect of

dilutive securities: Employee stock options 0.4 0.3 0.4 0.3

Restricted stock units 0.5 0.2 0.5 0.1

Denominator for diluted earnings per share—adjusted

weighted-average common shares 85.6 86.4

85.5 88.6 Diluted earnings per share $

2.33 $ 2.16 $ 5.26 $

4.66

UNITED RENTALS, INC.

ADJUSTED EARNINGS PER SHARE GAAP

RECONCILIATION

We define “earnings per share – adjusted” as the sum of earnings

per share – GAAP, as reported plus the impact of the following

special items: merger related costs, merger related intangible

asset amortization, impact on depreciation related to acquired RSC

and NES fleet and property and equipment, impact of the fair value

mark-up of acquired RSC and NES fleet, impact on interest expense

related to fair value adjustment of acquired RSC indebtedness,

restructuring charge, asset impairment charge and loss on

repurchase/redemption of debt securities and amendment of ABL

facility. Management believes that earnings per share - adjusted

provides useful information concerning future profitability.

However, earnings per share - adjusted is not a measure of

financial performance under GAAP. Accordingly, earnings per share -

adjusted should not be considered an alternative to GAAP earnings

per share. The table below provides a reconciliation between

earnings per share – GAAP, as reported, and earnings per share –

adjusted.

Three Months Ended Nine Months

Ended September 30, September 30, 2017

2016 2017 2016 Earnings per

share - GAAP, as reported $ 2.33 $

2.16 $ 5.26 $ 4.66 After-tax

impact of: Merger related costs (1) 0.12 — 0.23 — Merger related

intangible asset amortization (2) 0.27 0.28 0.83 0.85 Impact on

depreciation related to acquired RSC and NES fleet and property and

equipment (3) 0.07 — 0.05 — Impact of the fair value mark-up of

acquired RSC and NES fleet (4) 0.17 0.05 0.36 0.18 Impact on

interest expense related to fair value adjustment of acquired RSC

indebtedness (5) — — — (0.01 ) Restructuring charge (6) 0.07 0.02

0.21 0.05 Asset impairment charge (7) — — — 0.02 Loss on

repurchase/redemption of debt securities and amendment of ABL

facility 0.22 0.07 0.31 0.25

Earnings per share - adjusted $ 3.25

$ 2.58 $ 7.25 $

6.00 Tax rate applied to above adjustments (8) 38.5 %

38.6 % 38.5 % 38.4 % (1) Reflects transaction costs

associated with the NES and Neff acquisitions discussed above. We

have made a number of acquisitions in the past and may continue to

make acquisitions in the future. Merger related costs only include

costs associated with major acquisitions that significantly impact

our operations. The historic acquisitions that have included merger

related costs are RSC, which had annual revenues of approximately

$1.5 billion prior to the acquisition, and National Pump, which had

annual revenues of over $200 million prior to the acquisition. NES

had annual revenues of approximately $369 million, and Neff had

annual revenues of approximately $413 million. (2) Reflects the

amortization of the intangible assets acquired in the RSC, National

Pump and NES acquisitions. (3) Reflects the impact of extending the

useful lives of equipment acquired in the RSC and NES acquisitions,

net of the impact of additional depreciation associated with the

fair value mark-up of such equipment. (4) Reflects additional costs

recorded in cost of rental equipment sales associated with the fair

value mark-up of rental equipment acquired in the RSC and NES

acquisitions and subsequently sold. (5) Reflects a reduction of

interest expense associated with the fair value mark-up of debt

acquired in the RSC acquisition. (6) Primarily reflects severance

and branch closure charges associated with our closed restructuring

programs and our current restructuring program. We only include

such costs that are part of a restructuring program as

restructuring charges. Since the first such restructuring program

was initiated in 2008, we have completed three restructuring

programs. We have cumulatively incurred total restructuring charges

of $262 million under our restructuring programs. (7) Reflects

write-offs of fixed assets in connection with our restructuring

programs. (8) The tax rates applied to the adjustments reflect the

statutory rates in the applicable entity.

UNITED RENTALS, INC.

EBITDA AND ADJUSTED EBITDA GAAP

RECONCILIATIONS

(In millions)

EBITDA represents the sum of net income, provision for income

taxes, interest expense, net, depreciation of rental equipment, and

non-rental depreciation and amortization. Adjusted EBITDA

represents EBITDA plus the sum of the merger related costs,

restructuring charge, stock compensation expense, net, and the

impact of the fair value mark-up of acquired RSC and NES fleet.

These items are excluded from adjusted EBITDA internally when

evaluating our operating performance and for strategic planning and

forecasting purposes, and allow investors to make a more meaningful

comparison between our core business operating results over

different periods of time, as well as with those of other similar

companies. The EBITDA and adjusted EBITDA margins represent EBITDA

or adjusted EBITDA divided by total revenue. Management believes

that EBITDA and adjusted EBITDA, when viewed with the Company’s

results under GAAP and the accompanying reconciliation, provide

useful information about operating performance and

period-over-period growth, and provide additional information that

is useful for evaluating the operating performance of our core

business without regard to potential distortions. Additionally,

management believes that EBITDA and adjusted EBITDA help investors

gain an understanding of the factors and trends affecting our

ongoing cash earnings, from which capital investments are made and

debt is serviced.

The table below provides a reconciliation between net income and

EBITDA and adjusted EBITDA.

Three Months Ended Nine Months

Ended September 30, September 30, 2017

2016 2017 2016 Net income

$ 199 $ 187 $ 449

$ 413 Provision for income taxes 123 116 263 254

Interest expense, net 131 110 338 349 Depreciation of rental

equipment 290 250 804 735 Non-rental depreciation and amortization

63 61 189 192

EBITDA (A) $

806 $ 724 $ 2,043 $

1,943 Merger related costs (1) 16 — 32 — Restructuring

charge (2) 9 4 28 8 Stock compensation expense, net (3) 24 11 64 33

Impact of the fair value mark-up of acquired RSC and NES fleet (4)

24 8 50 26

Adjusted EBITDA (B) $

879 $ 747 $ 2,217

$ 2,010 A) Our EBITDA margin was 45.6%

and 48.0% for the three months ended September 30, 2017 and 2016,

respectively, and 43.3% and 45.8% for the nine months ended

September 30, 2017 and 2016, respectively. B) Our adjusted EBITDA

margin was 49.8% and 49.5% for the three months ended September 30,

2017 and 2016, respectively, and 47.0% and 47.4% for the nine

months ended September 30, 2017 and 2016, respectively. (1)

Reflects transaction costs associated with the NES and Neff

acquisitions discussed above. We have made a number of acquisitions

in the past and may continue to make acquisitions in the future.

Merger related costs only include costs associated with major

acquisitions that significantly impact our operations. The historic

acquisitions that have included merger related costs are RSC, which

had annual revenues of approximately $1.5 billion prior to the

acquisition, and National Pump, which had annual revenues of over

$200 million prior to the acquisition. NES had annual revenues of

approximately $369 million, and Neff had annual revenues of

approximately $413 million. (2) Primarily reflects severance and

branch closure charges associated with our closed restructuring

programs and our current restructuring program. We only include

such costs that are part of a restructuring program as

restructuring charges. Since the first such restructuring program

was initiated in 2008, we have completed three restructuring

programs. We have cumulatively incurred total restructuring charges

of $262 million under our restructuring programs. (3) Represents

non-cash, share-based payments associated with the granting of

equity instruments. (4) Reflects additional costs recorded in cost

of rental equipment sales associated with the fair value mark-up of

rental equipment acquired in the RSC and NES acquisitions and

subsequently sold.

UNITED RENTALS, INC.

EBITDA AND ADJUSTED EBITDA GAAP

RECONCILIATIONS (continued)

(In millions)

The table below provides a reconciliation between net cash

provided by operating activities and EBITDA and adjusted

EBITDA.

Three Months Ended Nine Months

Ended September 30, September 30, 2017

2016 2017 2016 Net cash

provided by operating activities $ 429 $

383 $ 1,766 $ 1,630

Adjustments for items included in net cash

provided by operating activitiesbut excluded from the calculation

of EBITDA:

Amortization of deferred financing costs and original issue

discounts (2 ) (3 ) (6 ) (7 ) Gain on sales of rental equipment 55

44 153 146 Gain on sales of non-rental equipment 1 2 4 3 Merger

related costs (1) (16 ) — (32 ) — Restructuring charge (2) (9 ) (4

) (28 ) (8 ) Stock compensation expense, net (3) (24 ) (11 ) (64 )

(33 ) Loss on repurchase/redemption of debt securities and

amendment of ABL facility (31 ) (10 ) (43 ) (36 ) Excess tax

benefits from share-based payment arrangements — — — 53 Changes in

assets and liabilities 220 237 (126 ) (113 ) Cash paid for interest

128 75 305 294 Cash paid for income taxes, net 55 11

114 14

EBITDA $ 806 $

724 $ 2,043 $ 1,943 Add back:

Merger related costs (1) 16 — 32 — Restructuring charge (2) 9 4 28

8 Stock compensation expense, net (3) 24 11 64 33 Impact of the

fair value mark-up of acquired RSC and NES fleet (4) 24 8

50 26

Adjusted EBITDA $

879 $ 747 $ 2,217

$ 2,010 (1) Reflects

transaction costs associated with the NES and Neff acquisitions

discussed above. We have made a number of acquisitions in the past

and may continue to make acquisitions in the future. Merger related

costs only include costs associated with major acquisitions that

significantly impact our operations. The historic acquisitions that

have included merger related costs are RSC, which had annual

revenues of approximately $1.5 billion prior to the acquisition,

and National Pump, which had annual revenues of over $200 million

prior to the acquisition. NES had annual revenues of approximately

$369 million, and Neff had annual revenues of approximately $413

million. (2) Primarily reflects severance and branch closure

charges associated with our closed restructuring programs and our

current restructuring program. We only include such costs that are

part of a restructuring program as restructuring charges. Since the

first such restructuring program was initiated in 2008, we have

completed three restructuring programs. We have cumulatively

incurred total restructuring charges of $262 million under our

restructuring programs. (3) Represents non-cash, share-based

payments associated with the granting of equity instruments. (4)

Reflects additional costs recorded in cost of rental equipment

sales associated with the fair value mark-up of rental equipment

acquired in the RSC and NES acquisitions and subsequently sold.

UNITED RENTALS, INC.

FREE CASH FLOW GAAP

RECONCILIATION

(In millions)

We define free cash flow as (i) net cash provided by operating

activities less (ii) purchases of rental and non-rental equipment

plus (iii) proceeds from sales of rental and non-rental equipment

and excess tax benefits from share-based payment arrangements.

Management believes that free cash flow provides useful additional

information concerning cash flow available to meet future debt

service obligations and working capital requirements. However, free

cash flow is not a measure of financial performance or liquidity

under GAAP. Accordingly, free cash flow should not be considered an

alternative to net income or cash flow from operating activities as

an indicator of operating performance or liquidity. The table below

provides a reconciliation between net cash provided by operating

activities and free cash flow.

Three Months Ended Nine Months

Ended September 30, September 30, 2017

2016 2017 2016 Net cash

provided by operating activities $ 429 $

383 $ 1,766 $ 1,630 Purchases of

rental equipment (572 ) (423 ) (1,485 ) (1,145 ) Purchases of

non-rental equipment (32 ) (23 ) (87 ) (65 ) Proceeds from sales of

rental equipment 139 112 378 361 Proceeds from sales of non-rental

equipment 4 5 10 12 Excess tax benefits from share-based payment

arrangements (1) — — — 53

Free cash

flow (2) $ (32 ) $ 54

$ 582 $ 846 (1)

The excess tax benefits from share-based payment

arrangements result from stock-based compensation windfall

deductions in excess of the amounts reported for financial

reporting purposes. We adopted accounting guidance in 2017 that

changed the cash flow presentation of excess tax benefits from

share-based payment arrangements. In the table above, the excess

tax benefits from share-based payment arrangements for 2017 are

presented as a component of net cash provided by operating

activities, while, for 2016, they are presented as a separate line

item. Because we historically included the excess tax benefits from

share-based payment arrangements in the free cash flow calculation,

the adoption of this guidance did not change the calculation of

free cash flow. (2) Free cash flow included aggregate merger and

restructuring related payments of $21 million and $5 million for

the three months ended September 30, 2017 and 2016, respectively,

and $52 million and $11 million for the nine months ended September

30, 2017 and 2016, respectively.

The table below provides a reconciliation between 2017

forecasted net cash provided by operating activities and free cash

flow.

Net cash provided by operating activities

$2,275- $2,375 Purchases of rental equipment

$(1,750)-$(1,800) Proceeds from sales of rental equipment $475-$525

Purchases of non-rental equipment, net of proceeds from sales

$(75)-$(125)

Free cash flow (excluding the impact of merger and

restructuring related costs) $925- $975

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171018006443/en/

For United Rentals, Inc.Ted Grace, 203-618-7122Cell:

203-399-8951tgrace@ur.com

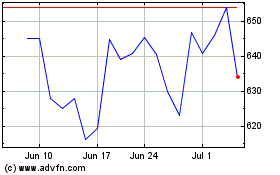

United Rentals (NYSE:URI)

Historical Stock Chart

From Mar 2024 to Apr 2024

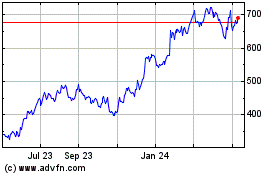

United Rentals (NYSE:URI)

Historical Stock Chart

From Apr 2023 to Apr 2024