ScottsMiracle-Gro Provides Recast of Non-GAAP Historical Financial Results Related to International Divestiture

October 18 2017 - 4:00PM

The Scotts Miracle-Gro Company (NYSE:SMG), the world’s leading

marketer of branded consumer lawn and garden products, said it has

furnished recast non-GAAP financial results for the past seven

fiscal quarters to the Securities and Exchange Commission to

reflect the impact of its recent divestiture of its European and

Australian operations.

Based on the earnings dilution of approximately $0.15 per share

associated with that transaction, the Company also said it expects

to report full-year non-GAAP adjusted earnings per share between

$3.85 and $3.95 when it releases its full-year results on Nov. 7.

These results – which are consistent with the Company’s previous

guidance – exclude the impact of impairment, restructuring, and

other charges, as well as the impact of the previous divestiture of

Scotts LawnService.

“We also expect to announce next month that

ScottsMiracle-Gro delivered a record level of operating cash flow

in fiscal 2017, exceeding our original expectations,” said Jim

Hagedorn, chairman and chief executive officer. “We continue to see

this metric as the most important factor in continuing to drive our

strategy and enhancing shareholder value.”

The Company said it will announce complete full-year results

prior to the opening of the financial markets on Tuesday, Nov. 7.

Management will discuss results for 2017 and provide initial

financial guidance for fiscal 2018 during a webcast conference call

at 9:00 a.m. that same day. Conference call participants should

call 866-548-2691 (Conference Code: 8042285).

A live webcast of the call will be available on the investor

relations section of the Company's website at

http://investor.scotts.com. An archive of the webcast, as

well as any accompanying financial information regarding any

non-GAAP financial measures discussed by the Company during the

call, will remain available for at least 12 months. In addition, a

replay of the call can be heard by calling 888-203-1112. The replay

will be available for 30 days.

About ScottsMiracle-GroThe Scotts Miracle-Gro

Company is the world's largest marketer of branded consumer

products for lawn and garden care. The Company's brands are

the most recognized in the industry. In the U.S., the

Company's Scotts®, Miracle-Gro® and Ortho® brands are

market-leading in their categories, as is the consumer Roundup®

brand, which is marketed in the U.S. and certain foreign countries

by Scotts and owned by Monsanto. In the U.S., we maintain a

minority interest in TruGreen®, the largest residential lawn care

service business, and in Bonnie Plants®, the largest marketer of

edible gardening plants in retail channels. The Company’s

wholly-owned subsidiary, The Hawthorne Gardening Company, is also a

leading provider of nutrients, lighting and other materials used in

the hydroponic growing industry. For additional information, visit

us at www.scottsmiraclegro.com.

Forward Looking Non-GAAP MeasuresIn this

release, the Company provides an updated outlook for fiscal 2017

non-GAAP adjusted EPS. The Company does not provide a GAAP EPS

outlook, which is the most directly comparable GAAP measure to

non-GAAP adjusted EPS, because changes in the items that the

Company excludes from GAAP EPS to calculate non-GAAP adjusted EPS,

described above, can be dependent on future events that are less

capable of being controlled or reliably predicted by management and

are not part of the Company’s routine operating activities.

Additionally, due to their unpredictability, management does not

forecast the excluded items for internal use and therefore cannot

create or rely on a GAAP EPS outlook without unreasonable efforts.

The timing and amount of any of the excluded items could

significantly impact the Company’s GAAP EPS. As a result, the

Company does not provide a reconciliation of guidance for non-GAAP

adjusted EPS to GAAP EPS, in reliance on the unreasonable efforts

exception provided under Item 10(e)(1)(i)(B) of Regulation S-K.

Cautionary Note Regarding Forward-Looking

Statements Statements contained in this press release,

other than statements of historical fact, which address activities,

events and developments that the Company expects or anticipates

will or may occur in the future, including, but not limited to,

information regarding the future economic performance and financial

condition of the Company, the plans and objectives of the Company’s

management, and the Company’s assumptions regarding such

performance and plans are “forward-looking statements” within the

meaning of the U.S. federal securities laws that are subject to

risks and uncertainties. These forward-looking statements generally

can be identified as statements that include phrases such as

“guidance,” “outlook,” “projected,” “believe,” “target,” “predict,”

“estimate,” “forecast,” “strategy,” “may,” “goal,” “expect,”

“anticipate,” “intend,” “plan,” “foresee,” “likely,” “will,”

“should” or other similar words or phrases. Actual results could

differ materially from the forward-looking information in this

release due to a variety of factors, including, but not limited

to:

- Compliance with environmental and other public health

regulations could increase the Company’s costs of doing business or

limit the Company’s ability to market all of its products;

- Increases in the prices of raw materials and fuel costs could

adversely affect the Company’s results of operations;

- The highly competitive nature of the Company’s markets could

adversely affect its ability to maintain or grow revenues;

- Because of the concentration of the Company’s sales to a small

number of retail customers, the loss of one or more of, or

significant reduction in orders from, its top customers could

adversely affect the Company’s financial results;

- Adverse weather conditions could adversely impact financial

results;

- The Company’s international operations make the Company

susceptible to fluctuations in currency exchange rates and to other

costs and risks associated with international regulation;

- The Company may not be able to adequately protect its

intellectual property and other proprietary rights that are

material to the Company’s business;

- If Monsanto Company were to terminate the Marketing Agreement

for consumer Roundup products, the Company would lose a substantial

source of future earnings and overhead expense absorption;

- Hagedorn Partnership, L.P. beneficially owns approximately 27%

of the Company’s common shares and can significantly influence

decisions that require the approval of shareholders;

- The Company may pursue acquisitions, dispositions, investments,

dividends, share repurchases and/or other corporate transactions

that it believes will maximize equity returns of its shareholders

but may involve risks.

Additional detailed information concerning a number of the

important factors that could cause actual results to differ

materially from the forward-looking information contained in this

release is readily available in the Company’s publicly filed

quarterly, annual and other reports. The Company disclaims any

obligation to update developments of these risk factors or to

announce publicly any revision to any of the forward-looking

statements contained in this release, or to make corrections to

reflect future events or developments.

Contact:Jim KingSenior

Vice PresidentInvestor Relations & Corporate

Affairs(937) 578-5622

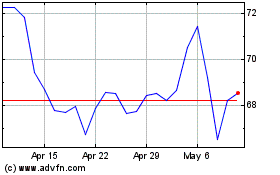

Scotts Miracle Gro (NYSE:SMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

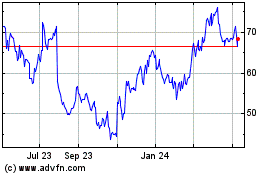

Scotts Miracle Gro (NYSE:SMG)

Historical Stock Chart

From Apr 2023 to Apr 2024