eHealth Partners with The IHC Group & SASid Insurance Development to Offer Innovative, Affordable Alternatives to Customers D...

October 18 2017 - 9:15AM

Business Wire

eHealth, Inc. (NASDAQ:EHTH) (eHealth.com) announced today that

the company has partnered with The IHC Group and SASid Insurance

Development to offer new medical insurance packages in 39 states

and the District of Columbia for customers who cannot afford major

medical plans meeting the benefit standards of the Affordable Care

Act (the ACA or Obamacare).

In most markets eHealth will offer medical insurance packages

with monthly premiums starting below $200 for persons age 35 and

under $300 for 50-year-olds. These packages will be available

during the ACA’s open enrollment period for 2018, which is

scheduled to begin November 1, 2017.

In addition to these new packages, eHealth will also offer major

medical health insurance plans in 44 states during open

enrollment.

Obamacare’s Affordability Gap

According to a recent analysis1, 43 percent of people who buy

health insurance in the individual market (7.5 million) don’t

receive government assistance (advance premium tax credits,

commonly referred to as Obamacare subsidies) because they earn more

than 400 percent of the federal poverty level.

With premiums expected to rise by more than 20 percent in some

markets, eHealth recently published a report examining health

insurance costs for families that make too much to receive ACA

premium subsidies in 50 U.S. cities and found that a projected 10

percent increase in 2018 would make health insurance unaffordable

in 47 of those cities. The ACA defines health insurance as

“unaffordable” when the lowest-priced plan available costs more

than 8.16 percent of an individual’s or family’s yearly income

(MAGI).

eHealth also analyzed ACA health insurance premiums for

individuals that earn too much to receive ACA premium subsidies in

25 U.S. cities and found that by age 45 health insurance would be

unaffordable in the majority of those cities if premiums rise 10

percent in 2018.

eHealth’s Medical Insurance Packages Provide Affordable

Alternatives

eHealth’s medical insurance packages were developed in

partnership with The IHC Group and SASid Insurance Development to

offer a more affordable alternative to major medical health

insurance to people who cannot afford Obamacare.

“We created these packages in response to pleas from our

customers,” said eHealth CEO Scott Flanders. “Every day, people

call our customer care center and ask for help putting together a

package of benefits they can actually afford.”

"We have a great selection of products they can put together on

their own, but that's a cumbersome process – and when they need to

use their coverage, coordinating the benefits can be a hassle,”

Flanders added. "Our new packages are designed to make medical

coverage both affordable and easy to use."

These packages will be available in 39 states and the District

of Columbia and provide a single point of service when policy

holders need to use their benefits. In another 5 states, eHealth

will offer medical insurance packages that combine benefits from

multiple insurance companies.

Medical insurance packages include varying combinations of

insurance and non-insurance products such as short-term medical,

supplemental (GAP) medical, and fixed indemnity medical as well as

other benefits like telemedicine, prescription drug discounts and

medical advocacy services. Specific benefit combinations vary by

state.

eHealth will continue to refine the design of these packages to

meet varying customer needs and reasonable price points.

These packages are not designed to cover pre-existing medical

conditions and some are medically underwritten. Others are

“guaranteed issue,” meaning that a customer’s application cannot be

declined because of a pre-existing condition, although that

pre-existing condition may not be covered by the package.

Notes:

1As reported on NPR from insurance industry consultant Robert

Laszewski.

Forward-Looking Statements

This press release contains statements that are forward-looking

statements as defined within the Private Securities Litigation

Reform Act of 1995. These include statements regarding eHealth’s

partnerships with The IHC Group and SASid Insurance Development to

offer medical insurance packages; the availability of medical

insurance packages by November 1, 2017 in 44 states and the

District of Columbia, including in 39 states with packages having a

single point of service and in 5 states with packages combining

benefits from multiple insurance companies; the pricing of medical

insurance packages in most markets starting below $200 for persons

age 35 and under $300 for a 50-year-old; the features and products

contained in medical insurance packages; eHealth’s partnerships

with The IHC Group and SASid Insurance Development allowing eHealth

to creating affordable products for customers who cannot afford

major medical Obamacare coverage; eHealth continuing to refine the

design of packages; and analysis that a 10 percent projected price

increase in 2018 would make coverage unaffordable in 47 out of 50

states for families that earn too much for ACA government subsidies

and in 25 U.S. cities for individuals age 45 who earn too much for

ACA government subsidies for premiums. These forward-looking

statements are inherently subject to various risks and

uncertainties that could cause actual results to differ materially

from the statements made, including risks associated with:

eHealth’s ability to maintain and perform under the partnerships

with The IHC Group or SASid Insurance Development necessary to

offer medical insurance packages; changes in governmental policy or

regulation or other governmental or regulatory actions affecting

the health insurance market; changes in health insurance premiums;

the accuracy of eHealth’s analysis and projections; changes to the

availability, benefits, pricing, and coverages of medical insurance

packages; and other factors that could cause operating, financial,

and other results to differ, which are described in eHealth’s most

recent Annual Report on Form 10-K or Quarterly Report on Form 10-Q

filed with the Securities and Exchange Commission and

available on the investor relations page of eHealth’s website

at http://www.ehealthinsurance.com and on the Securities

and Exchange Commission’s website at www.sec.gov. eHealth

undertakes no obligation to update any forward-looking statement to

conform to actual results or changes in intentions or

expectations.

About eHealth

eHealth, Inc. (NASDAQ:EHTH) owns eHealth.com, a leading private

online health insurance exchange where individuals, families and

small businesses can compare health insurance products from

brand-name insurers side by side and purchase and enroll in

coverage online and over the phone. eHealth offers thousands of

individual, family and small business health plans underwritten by

many of the nation's leading health insurance companies. eHealth

(through its subsidiaries) is licensed to sell health insurance in

all 50 states and the District of Columbia. eHealth also offers

educational resources, exceptional telephonic support, and powerful

online and pharmacy-based tools to help Medicare beneficiaries

navigate Medicare health insurance options, choose the right plan

and enroll in select plans online or over the phone through

Medicare.com (www.Medicare.com), eHealthMedicare.com

(www.eHealthMedicare.com) and PlanPrescriber.com

(www.PlanPrescriber.com).

For more health insurance news and information, visit

eHealth's Consumer Resource Center.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171018005364/en/

DMA Communications for eHealth, Inc.Sande Drew,

916-207-7674sande.drew@ehealth.comoreHealth, Inc.Nate Purpura,

650-210-3115nate.purpura@ehealth.com

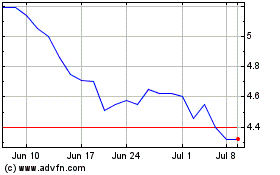

eHealth (NASDAQ:EHTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

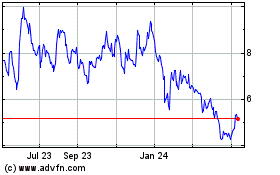

eHealth (NASDAQ:EHTH)

Historical Stock Chart

From Apr 2023 to Apr 2024