Comcast Corporation (Nasdaq:CMCSA) (“Comcast”) and NBCUniversal

Media, LLC (“NBCUniversal”) announced today the early tender

results of its private offers to exchange (the “Exchange Offer”)

certain series of existing Comcast and NBCUniversal notes (the “Old

Notes”) described in the table below for Comcast’s new notes due

November 1, 2047 (the “New 2047 Notes”), new notes due November 1,

2049 (the “New 2049 Notes”) and new notes due November 1, 2052 (the

“New 2052 Notes” and, together with the New 2047 Notes and the New

2049 Notes, the “New Notes”):

Principal

Principal Amount Acceptance Amount

CUSIP Outstanding Priority

Tendered((2)) Title of Security

Issuer((1)) Number

(millions) Level

(thousands) 6.950% Notes due 2037

Comcast 20030NAV3

$2,000 1

$1,212,275 6.550% Notes due 2039 Comcast

20030NAY7 $ 800

2 $386,332 6.400% Notes due

March 1, 2040 Comcast

20030NBB6 $1,000 3

$518,257 6.400% Notes due April 30, 2040

NBCUniversal 63946BAF7(3)

$1,000 4

$441,578 6.450% Notes due 2037 Comcast

20030NAM3 $1,850

5 $945,650 6.400% Notes due 2038

Comcast 20030NAX9

$1,000 6 $551,973

6.500% Notes due 2035 Comcast

20030NAK7 $1,000 7

$380,007 5.950% Notes due 2041

NBCUniversal 63946BAG5

$1,200 8 $526,783

5.650% Notes due 2035 Comcast

20030NAF8 $ 750 9

$229,145

Totals:

$10,600

$5,192,000 (1) The Old Notes issued by Comcast

are guaranteed by NBCUniversal and Comcast Cable Communications,

LLC. The Old Notes issued by NBCUniversal are guaranteed by Comcast

and Comcast Cable Communications, LLC. (2) The aggregate principal

amounts of each series of Old Notes that have been validly tendered

for exchange and not validly withdrawn, as of 5:00 p.m., New York

City time, on October 17, 2017 (the “Early Participation Date”),

based on information provided by the Exchange Agent to Comcast and

NBCUniversal. (3) The 6.400% Notes due April 30, 2040 also include

notes with a restrictive legend (144A CUSIP number: 62875UAD7;

Regulation S CUSIP: U63763AB9).

The Exchange Offer is being conducted upon the terms and subject

to the conditions set forth in a confidential offering memorandum

(the “Offering Memorandum”), dated October 3, 2017. The amount of

outstanding Old Notes validly tendered and not validly withdrawn as

of the Early Participation Date, as reflected in the table above,

is expected to result in satisfaction of the minimum issuance

condition for each series of New Notes in the Exchange Offer.

The Exchange Offer will expire at 11:59 p.m., New York City

time, on October 31, 2017 (the “Expiration Date”), unless extended

or earlier terminated by Comcast or NBCUniversal. In accordance

with the terms of the Exchange Offer, the withdrawal deadline

relating to the Exchange Offer occurred at 5:00 p.m. New York City

time on October 17, 2017. As a result, tendered Old Notes may no

longer be withdrawn, except in certain limited circumstances where

additional withdrawal rights are required by law (as determined by

Comcast and NBCUniversal).

If, as of the Early Participation Date, the Exchange Offer is

over-subscribed and all conditions to the Exchange Offer have been

or concurrently are satisfied or waived by us, we will have the

option but not the obligation to accept for exchange all Old Notes

validly tendered and not validly withdrawn in the Exchange Offer as

of the Early Participation Date on the second business day

following the Early Participation Date or as soon as practicable

thereafter, which is expected to be October 19, 2017 (the “Early

Settlement Date”). If we do not elect to settle the Exchange Offer

on the Early Settlement Date, then the settlement date for the

Exchange Offer will be the first business day following the

Expiration Date or as soon as practicable thereafter, which is

expected to be November 1, 2017. Such election will be determined

at the pricing time for the Exchange Offer, which is currently

scheduled at 11:00 a.m., New York City Time, on October 18, 2017,

and would be announced on October 18, 2017 after the pricing

time.

The Exchange Offer is only made and the New Notes are only being

offered and will only be issued, to holders of Old Notes either (a)

in the United States, that are “qualified institutional buyers,” as

that term is defined in Rule 144A under the Securities Act of 1933

(the “Securities Act”), in a private transaction in reliance upon

an exemption from the registration requirements of the Securities

Act or (b) (i) outside the United States, that are persons other

than “U.S. persons,” as that term is defined in Rule 902 under the

Securities Act, in offshore transactions in reliance upon

Regulation S under the Securities Act, (ii) if located or resident

in any Member State of the European Economic Area which has

implemented Directive 2003/71/EC, as amended (the “Prospectus

Directive”), who are “Qualified Investors” as defined under the

Prospectus Directive and (iii) if located or resident in Canada, is

located or resident in a province of Canada and is an “accredited

investor” as such term is defined in National Instrument 45- 106 –

Prospectus Exemptions (“NI 45-106”), and, if resident in Ontario,

section 73.3(1) of the Securities Act (Ontario) that is not an

individual unless that person is also a “permitted client” as

defined in National Instrument 31-103 - Registration Requirements,

Exemptions and Ongoing Registrant Obligations (“NI 31-103”) (each,

an “Eligible Holder”).

The New Notes have not been registered under the Securities Act

or any other applicable securities laws. Therefore, the New Notes

may not be offered or sold except pursuant to an exemption from or

in a transaction not subject to the registration requirements of

the Securities Act and the applicable state securities laws.

Comcast, NBCUniversal and Comcast Cable Communications, LLC will

enter into a registration rights agreement with respect to the New

Notes providing for certain registration rights with respect to the

New Notes as described in the Offering Memorandum.

This press release is not an offer to sell or a solicitation of

an offer to buy any of the securities described herein. The

Exchange Offer is being made solely by means of the Offering

Memorandum and only to such persons and in such jurisdictions as is

permitted under applicable law.

The Exchange Offer is only being made, and copies of the

Offering Memorandum will only be made available, to holders of the

Old Notes who have certified to Comcast in an eligibility letter

that they are Eligible Holders. Copies of the eligibility letter

are available to holders of the Old Notes through the information

agent, D.F. King & Co., Inc., at their website

http://www.dfking.com/comcast, by calling (866) 342-8290

(toll-free) or (212) 269-5550 (banks and brokers) or by email at

comcast@dfking.com.

CAUTIONARY LANGUAGE CONCERNING FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements. Readers

are cautioned that such forward-looking statements involve risks

and uncertainties that could cause actual events or our actual

results to differ materially from those expressed in any such

forward-looking statements. Readers are directed to Comcast’s and

NBCUniversal’s periodic and other reports filed with the Securities

and Exchange Commission (SEC) for a description of such risks and

uncertainties. Neither company undertakes any obligation to update

any forward-looking statements. In evaluating those statements, you

should specifically consider various factors, including the risks

and uncertainties discussed in the Offer to Purchase, under the

caption “Risk Factors” in Comcast’s and NBCUniversal’s Annual and

Quarterly Reports on Forms 10-K and 10-Q and in other reports

Comcast and NBCUniversal file with the SEC. Actual events or

Comcast’s and NBCUniversal’s actual results may differ materially

from any of Comcast’s and NBCUniversal’s forward-looking

statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171018005424/en/

Comcast CorporationInvestorsWilliam Dordelman,

215-286-7550orJennifer Daley, 215-286-7732orJim McCue,

215-286-8701orPressJohn Demming, 215-286-8011

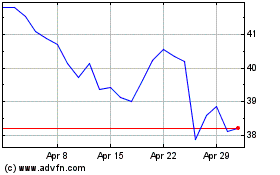

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024