Filed by Midland States Bancorp, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule l4a-12

under the Securities Exchange Act of 1934

Subject Company: Alpine Bancorporation, Inc.

Commission File Number: 001-35272

CORPORATE PARTICIPANTS

Allyson Pooley

Financial Profiles, Inc. - SVP

Jeffrey G. Ludwig

Midland States Bancorp, Inc. - EVP and President of Midland States Bank

Leon J. Holschbach

Midland States Bancorp, Inc. - Vice Chairman, CEO, President, Vice Chairman of Midland States Bank and CEO of Midland States Bank

CONFERENCE CALL PARTICIPANTS

Andrew Brian Liesch

Sandler O’Neill + Partners, L.P., Research Division - Director, Equity Research

Kevin Kennedy Reevey

D.A. Davidson & Co., Research Division - Senior VP & Senior Research Analyst

Michael Anthony Perito

Keefe, Bruyette, & Woods, Inc., Research Division - Analyst

Terence James McEvoy

Stephens Inc., Research Division - MD and Research Analyst

PRESENTATION

Operator

Good day, ladies and gentlemen, and welcome to the Midland States Bancorp Conference Call.

(Operator Instructions)

And as a reminder, this conference is being recorded. I would now like to introduce your host for today’s conference, Miss Allyson Pooley. Ma’am, you may begin.

Allyson Pooley

- Financial Profiles, Inc. - SVP

Thank you, Amanda. Good morning, everyone, and thank you for joining us today to discuss Midland’s acquisition of Alpine Bancorporation.

Joining us from Midland’s management team are Leon Holschbach, President and Chief Executive Officer; and Jeff Ludwig, Executive Vice President.

We will be giving a slide presentation as part of our discussion this morning. If he’s not done so already, please visit the Webcasts and Presentations page at Midland Investor Relations website to download a copy of the presentation.

Leon will provide an overview of the Alpine Bancorporation acquisition and then we’ll open the call for questions.

Before we begin, we’d like to remind you that this conference call contains forward-looking statements with respect to the future performance and financial conditions of Midland States Bancorp that involve risks and uncertainties. Various factors could cause actual results to be materially different from future results expressed or implied by such forward-looking statements. These factors are discussed in the company’s SEC filings, which are available on the company’s website. The company disclaims any obligation to update any forward-looking statements made during the call.

With that, I’d like to turn the call over to Leon.

Leon J. Holschbach

- Midland States Bancorp, Inc. - Vice Chairman, CEO, President, Vice Chairman of Midland States Bank and CEO of Midland States Bank

Thanks, Allyson. Good morning, everyone. Welcome to Midland. We are very excited about the news we have to share this morning.

Coming on the heels of our acquisition of Centrue, we are very pleased that we are able to quickly identify and execute on another attractive acquisition opportunity that we believe will significantly enhance the value of our franchise. One of the things that we emphasized on our IPO road show last year was the favorable M&A landscape in our target markets and the opportunities that we had to profitably deploy our capital through accretive value enhancing acquisitions.

With the Centrue deal and now the acquisition of Alpine Bancorp, we will have doubled the size of the company in under 2 years with 2 in-market deals and position ourselves to see a significant increase in our earnings power and the level of returns that we can generate.

I’m going to begin our discussion today on Slide 2 with an overview of the transaction. Alpine is a $1.3 billion bank that has operated in Northern Illinois for more than 100 years and have the #1 market share in the Rockford, Illinois MSA. This combination will make Midland the fourth largest community bank in Illinois with approximately $6 billion in assets. They bring a very liquid balance sheet to us with a loan-to-deposit ratio of 73%. As a result of their strong commitment to relationship banking and customer service, Alpine has built an attractive core deposit base consisting of 30% noninterest-bearing deposits with the cost of deposits of just 19 basis points.

They also have a sizable wealth management business with nearly $1 billion in assets under management. This is a financially attractive deal for our shareholders and our assumptions don’t include any revenue enhancements. We are projecting approximately 10% EPS accretion in ‘19, our first full year of combined operations. The tangible book value per share dilution will be less than 6% and the payback period will be approximately 3.5 years using the crossover method. We are projecting an internal rate of return of greater than 25%.

We will also continue to have a strong capital position following the acquisition, which will support our continued organic and acquisitive growth strategies. As I go through the

presentation, you’ll notice a lot of similarities between Midland and Alpine, which makes us very comfortable with the level of risk in this transaction.

I’ve known their Chairman, Rob Funderburg, for more than a decade, and during that time, we’ve had an opportunity to work with Alpine on a number of projects and that has allowed us to become familiar with their franchise. We operate with a similar approach to relationship banking and being deeply involved in the communities we serve.

Although we don’t have any branch overlap, we have competed in the Rockford area through our offices in nearby markets for years, and we’re familiar with the customer base and the competitive environment in that part of Northern Illinois. I also worked for a bank in Rockford earlier in my career for many years and have always thought that Rockford would be a good fit for Midland.

We are planning to retain the key personnel that are essential to ensuring a smooth integration. And with the experience we’ve gained by doing 9 acquisitions and integrations over the past 10 years, we believe we have an excellent process in place for ensuring that we successfully capture all the synergies that we’re projecting for the transaction.

Turning to Slide 3 and providing a little bit more information on Alpine. They are a full-service community bank offering commercial, retail, mortgage banking and wealth management services. They have 19 branches and have built a dominant market share in Rockford, which is the third-largest city in the state. They have attractive low-cost deposit franchise and a growing healthy loan portfolio with nonperforming assets accounting for just 47 basis points of total assets. We’ve also built a significant wealth management business consisting of more than 1,600 accounts and approximately $1 billion in assets under management.

Moving to Slide 4. You can see how this transaction will further increase our presence in Northern Illinois. The combined franchise will have nearly $6 billion in assets and our wealth management business with approximately $3 billion in assets under administration. With the additional scale and deposit market share, we will become the #1 bank in Rockford, the second-largest institution in the state operating outside of the Chicago area and the fourth-largest community bank based in Illinois. And importantly, with the excess liquidity under balance sheet, our loan-to-deposit ratio will be around 90%.

Turning to Slide 5. I will take a closer look at Alpine’s loan portfolio, which you’ll note is very similar to ours. There will be almost no change in the overall loan mix once the 2 portfolios are combined, but our ratio of commercial real estate to total risk-based capital will be brought down to 233%, which gives us a little bit more headroom in this area.

Looking at Slide 6. As I mentioned earlier, Alpine’s deposit base is very attractive. Core deposits comprise 94% of their total deposits. On a pro forma basis, the addition of this deposit base will reduce our overall cost to deposits to 35 basis points using the second quarter of ‘17 as the reference period.

Moving to Slide 7. I’ll quickly summarize some of the key deal terms. The total consideration is $181 million with 82% being paid in stock and 18% in cash. The pricing makes economic sense, particularly when factoring in the cost savings and the impact on our 2018 and ‘19 earnings. At

about 8x the last 12 months earnings plus the projected cost savings, we believe this is a very fair price for our shareholders, and we expect to close the transaction in the first quarter of 2018.

Turning to Slide 8. We’ll look at the financial impact and assumptions we’ve made in the transaction. Excluding transaction expenses, we expect this transaction to be approximately 5% accretive to EPS in 2018, 10% accretive in 2019. We are projecting 36% cost savings, which will be 75% phased during 2018 and 100% thereafter. The loan portfolio is in good shape. We’re projecting a loan mark of 1.5%.

In connection with this transaction, we just completed the private placement of $40 million of subordinated debt. This debt issuance will help us maintain strong capital ratios following the acquisition, so that we can continue to execute on our organic and acquisitive growth opportunities.

Moving to Slide 9. This will be our 12th announced acquisition since 2008, so we have a very good process in place for evaluating, negotiating and integrating the acquisitions that add value to our franchise. We know the Rockford market very well, and the similarity between Midland and Alpine should lead to a smooth transition for both the customers and the employees. We’ve used our established process for conducting our due diligence on Alpine, which has included an extensive credit review, covering 50% -- 57% of their total loan portfolio, 100% of the criticized and classified loans and 100% of their other real estate owned. We just went through the same process with Centrue, and our credit admin team is very good at identifying potential issues with asset quality, particularly in this case, where the customer base and the loans are so familiar to our own business model. We’ve also spent a great deal of time analyzing their cost structure, and we feel very comfortable with our projected cost savings.

I’ll wrap up on Slide 9 -- excuse me, Slide 10 then with a quick summary. The acquisition of Alpine fits the criteria that we love in a merger partner. It’s low risk, given our familiarity with the markets and their business mix; it’s significant in scale, it will drive further improvement in our overall efficiencies; it has a low-cost deposit base that is a great match for the strong asset generation platform that we already have in place; it’s highly accretive, with an expectation of more than 10% EPS accretion in ‘19; and it accelerates the growth of our wealth management business. This last point is particularly meaningful in that this deal will make the steady recurring revenue of wealth management a larger contributor to our overall revenue mix. As another benefit of this combination, with the increase in our size, the impact of any one particular business line on our overall financial results will be reduced, which we believe will result in a more consistent level of performance.

In summary, we’re very excited about the deal. We feel it’s an extremely attractive acquisition with a compelling strategic and economic rationale, and I believe it will be very good for our shareholders.

And with that, we’ll be happy to answer any questions that you might have. Operator, if you want to open the line for calls.

QUESTIONS AND ANSWERS

Operator

(Operator Instructions) And our first question comes from the line of Terry McEvoy, Stephens.

Terence James McEvoy

- Stephens Inc., Research Division - MD and Research Analyst

As I look at Alpine’s loan growth, it’s been very strong, 18% in ‘15, 11% in ‘16. Could you just talk about what was behind that loan growth? Is all of that in-market? And are there any industry concentrations within that loan portfolio or that market for that matter?

Leon J. Holschbach

- Midland States Bancorp, Inc. - Vice Chairman, CEO, President, Vice Chairman of Midland States Bank and CEO of Midland States Bank

Yes. So -- Terry, this is Leon. So Rockford, as many of you know, is positioned right on the state line. They have enjoyed opportunity to do business, both in Northern Illinois and Southern Wisconsin in that triangle that goes from Rockford North to Madison and over to Milwaukee. So they have enjoyed some expansion in those markets in the last few years. A fair amount of commercial real estate and yet, as I pointed out earlier, still a lower percentage than we have in our core bank, so that, that’s still a net reduction in concentration for the combined company. But they’re positioned really nicely geographically, if you look at that sort of Rockford up to James Lake to Madison over to Milwaukee and back. That is a really nice triangle in addition to the core Rockford MSA.

Terence James McEvoy

- Stephens Inc., Research Division - MD and Research Analyst

And then on the cost saves, I think Centrue was 40% and this deal, 36%. Is it simply just the lack of branch overlap that’s the lower cost savings? And I’m just surprised, given Alpine’s efficiency ratio over 70% of that, that that cost savings number isn’t a bit larger.

Jeffrey G. Ludwig

- Midland States Bancorp, Inc. - EVP and President of Midland States Bank

Yes. I think that’s right, Terry. There’s no branch consolidation opportunity in here. We have some offices around Rockford, Freeport, Dixon, Sterling, but we have no overlap in Centrue. We consolidated 25% of the -- their branches. That’s not there. That’s the primary difference. And as we get in and we look, maybe there’ll be some more. But we want to -- we make sure that whatever number on the cost saves that we’re going to put out there, we feel real comfortable with what we can get to.

Terence James McEvoy

- Stephens Inc., Research Division - MD and Research Analyst

And then just lastly, you’re issuing $148 million of stock. Could you just talk about the number of shareholders? And maybe more importantly, their commitment to being longer-term shareholders of MSBI?

Leon J. Holschbach

- Midland States Bancorp, Inc. - Vice Chairman, CEO, President, Vice Chairman of Midland States Bank and CEO of Midland States Bank

Yes. This is Leon again, Terry. So they have about 400 shareholders, I believe. But the ownership interest is concentrated in the Funderburg family, who owns 70% to 80% of the company. Rob Funderburg, presuming that we can coax him to do it, we hope will be joining our

Board of Directors, representing both the market and his family’s interest in the stock. We’ve provided for no binding commitment that restricts their ability to sell the stock, but we believe that they appreciate the value of remaining long-term shareholders.

Operator

And our next question is from the line of Michael Perito of KBW.

Michael Anthony Perito

- Keefe, Bruyette, & Woods, Inc., Research Division - Analyst

A few questions from me. I want to maybe start on the margin because there seems to be a couple things going on. I mean, obviously, we’ll have the debt outstanding starting this -- today, it sounds like. But then, obviously, with the lower loan-to-deposit, it seems like Alpine has a larger investing cash position, which has kept their margin below your -- where your level is. I’m just curious if you guys have any kind of high-level commentary that could help us out in terms of where you ultimately think that the margin could shake out once the institutions are combined pro forma.

Jeffrey G. Ludwig

- Midland States Bancorp, Inc. - EVP and President of Midland States Bank

Yes. So I think we like the fact that there’s liquidity on their balance sheet and there’s an opportunity, which we’ve not projected in any of these numbers to remix, if you will, their balance sheet out of investment to loans. So there’s an opportunity there. We did borrow $40 million to fund the cash portion of the consideration, so that will be a drag. And we did that as of Friday, so it’s on the balance sheet today. It was important for us to have the cash on balance sheet, so it will be a drag for a couple of quarters until we get the Alpine acquisition closed. But that’s a risk that we do not want to take on a go-forward basis, so we felt that it was prudent to take the debt early. So I think we’ll continue to give more color as we move forward, but there’s an opportunity to enhance their margin by remixing part of investments into loans.

Michael Anthony Perito

- Keefe, Bruyette, & Woods, Inc., Research Division - Analyst

But -- so it sounds like, of -- I guess using a more conservative-based case scenario that the debt and the deal, at least upfront, will both kind of be a little dilutive to the overall margin of the combined company, at least out of the gate?

Jeffrey G. Ludwig

- Midland States Bancorp, Inc. - EVP and President of Midland States Bank

Yes, it will. Similar to Centrue, Centrue’s margin was lower and will initially pull ours down and then will begin their kind of rebuild there going forward.

Michael Anthony Perito

- Keefe, Bruyette, & Woods, Inc., Research Division - Analyst

Okay. And then just a quick question on the loan mix. I noticed there’s about 13% of Alpine’s book is in other category. I was just curious if you can give us any clarity on what is in that?

Jeffrey G. Ludwig

- Midland States Bancorp, Inc. - EVP and President of Midland States Bank

I don’t have the detail in front of me, Mike. Maybe we can kind of take that off-line. I can’t speak to that right this second.

Michael Anthony Perito

- Keefe, Bruyette, & Woods, Inc., Research Division - Analyst

Okay. Yes. No problem if you guys don’t mind following up. And then just lastly for me, Leon, you mentioned in your opening remarks that you guys are still interested in future M&A. Obviously, pro forma capital levels are -- look good post to closing of this transaction, but in the context of maybe doing another deal, it seems like there couldn’t -- need to be some additional common equity. And just any thoughts about how you’re thinking about future capital and future M&A and what kind of your approach to both those items will be?

Leon J. Holschbach

- Midland States Bancorp, Inc. - Vice Chairman, CEO, President, Vice Chairman of Midland States Bank and CEO of Midland States Bank

Sure. Just some real high level because obviously, we’re focused on -- excuse me, on this deal now. Excuse my voice. I had said to my assistant this morning, “My body woke up at 6. My voice will be waking up anytime here.” So sure, at the highest level, we’ll be focusing on this deal for -- clearly, for sometime in the near horizon. But the earnings -- and you’ll be able to model us out easily. The earnings stream on this is going to be very powerful. The retained earnings, the capital building aspect of the deal will be very strong. And frankly, the stronger our stock price gets, the more likely we’ll look at opportunities to boost capital with equity raise.

Jeffrey G. Ludwig

- Midland States Bancorp, Inc. - EVP and President of Midland States Bank

Yes. But I -- maybe to add to that, I mean, we’re going to be real focused for the next 12 months on -- we just closed Centrue in June, integrated Labor Day. That went really well. They gave us a lot of confidence to kind of get into the next one with Alpine and spending the next 9 to 12 months real focused on getting both these in and running very well and to continue to build organic capital. And then at the time, when we’re looking to grow it post getting those integrated, then maybe we’ll look to the capital markets to raise more capital.

Operator

Our next question comes from the line of Kevin Reevey of D. A. Davidson.

Kevin Kennedy Reevey

- D.A. Davidson & Co., Research Division - Senior VP & Senior Research Analyst

So just going back to the cost saves. Since there’s no branch overlap and between your franchise and Alpine’s and the fact that you’re keeping key personnel, where do you see the greatest opportunity for cost savings?

Leon J. Holschbach

- Midland States Bancorp, Inc. - Vice Chairman, CEO, President, Vice Chairman of Midland States Bank and CEO of Midland States Bank

Yes. I mean, it’s -- as you know, it’s more of the corporate support areas where the cost is. System overlaps where we’ll consolidate into -- our systems. We have a better buying power on

some of these contracts, which produces some better cost saves on our end. So mostly in the corporate support areas. Yes, and we’ve done a lot of work around the cost saves. So we’ve -- line item. Essentially, line item by line item rolled our number up. So we feel pretty good about the 36%.

Kevin Kennedy Reevey

- D.A. Davidson & Co., Research Division - Senior VP & Senior Research Analyst

Okay. And then as you step back and look at your different lines of businesses and your lending geographic footprint, where do you see the greatest opportunity to deploy the deposits of Alpine and Centrue?

Leon J. Holschbach

- Midland States Bancorp, Inc. - Vice Chairman, CEO, President, Vice Chairman of Midland States Bank and CEO of Midland States Bank

Well, sure. So we’ve had -- probably those in the largest areas of commercial in terms of loan categories. Commercial real estate continues to be opportunities in most of our markets, the Denver market continues very strong, aspects of our Northeastern Illinois region. So I would say, generally, commercial real estate. And we have the space for it on our balance sheet and in our regulatory ratios.

Kevin Kennedy Reevey

- D.A. Davidson & Co., Research Division - Senior VP & Senior Research Analyst

And then lastly, as we look at the different opportunities, obviously, the wealth management is the biggest opportunity. Can you talk about opportunities on the -- and other fee-based businesses that you see that could -- that are clearly not in the numbers?

Jeffrey G. Ludwig

- Midland States Bancorp, Inc. - EVP and President of Midland States Bank

They do have a pretty good mortgage business in Rockford. I believe their #1 market share in mortgage in the Rockford MSA, so that’ll be a nice add-in, but that’s in the numbers. There’s a leasing opportunity as we think about leasing and getting that rolled out in the commercial banker hands. But a lot of the core pieces of commercial retail wealth, they’re doing a lot of that in mortgage. So I think it’s pretty full. We’re not projecting, as we said, revenue enhancements from trying to bring other product lines. We think we can enhance some product offerings but not projecting any of those in the deal.

Kevin Kennedy Reevey

- D.A. Davidson & Co., Research Division - Senior VP & Senior Research Analyst

And then my last question, I’ll let someone jump on. How asset sensitive is Alpine’s balance sheet relative to your balance sheet?

Jeffrey G. Ludwig

- Midland States Bancorp, Inc. - EVP and President of Midland States Bank

It’s similar. It’s slightly asset sensitive.

Operator

(Operator Instructions) And our next question comes from the line of Andrew Liesch of Sandler O’Neill.

Andrew Brian Liesch

- Sandler O’Neill + Partners, L.P., Research Division - Director, Equity Research

Looks like a nice deal here, but just one question on the cost saves again. And I know you guys don’t have any branches in Rockford, but I mean, they have 19. Is that the right number? Or there -- could there be some opportunities there to maybe some -- consolidate some nearby locations?

Jeffrey G. Ludwig

- Midland States Bancorp, Inc. - EVP and President of Midland States Bank

Yes. I don’t think that’s something we’re going to look at initially. I mean, they have the #1 market share in Rockford. It’s not -- the last thing I think we want to go in and do is try to do any -- they know their market very well. They believe that they’ve got an appropriate branch structure. I will say, we didn’t mention it, but our -- we have a wealth office in Rockford that we will consolidate our folks into their office. So there’s a little bit of real estate rent pick up there, but it’s not material to the big numbers. But as we continue to operate our company long term and look at branches and the relevance of branches going forward, as you know in the last 12 months, we’ve consolidated, I think, 13 branches, 7 in the fourth quarter. We announced them in the fourth quarter last year, and then 5 because that’d be 12 in the acquisition of Centrue. So I think that’s an ongoing operating item that we’ll continue to look at.

Leon J. Holschbach

- Midland States Bancorp, Inc. - Vice Chairman, CEO, President, Vice Chairman of Midland States Bank and CEO of Midland States Bank

Sure. And then -- and especially for those who aren’t familiar with the Rockford area. When we talk about the Rockford MSA, there are distinct communities inside of that, that have to be considered when you look at branch count. Belvidere, where the company is officially headquartered and began, is in the Rockford MSA but a distinct community. And there are 2 or 3 smaller communities in the Rockford area, smaller municipal -- distinct municipal communities, Machesney Park and others. So we say a Rockford MSA, but it’s a handful of communities that need to be served. And so that’s an important part of the branch count there as well.

Operator

And we do have a follow-up question from the line of Michael Perito of KBW.

Michael Anthony Perito

- Keefe, Bruyette, & Woods, Inc., Research Division - Analyst

Leon, in the prepared remarks, you mentioned how with this deal and Centrue now, I guess, 2. The earnings volatility going forward should be lower. There’s more from wealth, from the core bank. And overall, obviously, I think we all think that’s a positive. Just curious though, I can’t miss an opportunity to ask if there’s any updated thoughts around kind of the residential mortgage servicing book specifically and maybe trying to continue to drive the earnings volatility down going forward? And I would appreciate any updated thoughts there.

Leon J. Holschbach

- Midland States Bancorp, Inc. - Vice Chairman, CEO, President, Vice Chairman of Midland States Bank and CEO of Midland States Bank

Yes. So we are as -- and we’ve communicated this, and I think what I’d like to do, Mike, is more in about 1.5 weeks on third quarter earnings call. So we’ll have some additional information on the call then on where we’re at.

Operator

And at this time, I’m showing no further questions. I’d like to turn the call back over to management for any closing remarks.

Leon J. Holschbach

- Midland States Bancorp, Inc. - Vice Chairman, CEO, President, Vice Chairman of Midland States Bank and CEO of Midland States Bank

All right. Thank you very much, everyone, for joining us and stay tuned. As Jeff suggested, we’re just about 10 days away from the third quarter earnings call. We look forward to talking to all of you then. Thanks. Thanks very much.

Operator

Ladies and gentlemen, thank you for your participation in today’s conference. This does conclude the program. You may now disconnect. Everybody, have a great day.

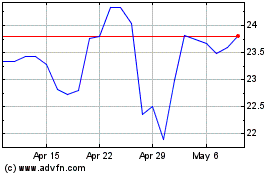

Midland States Bancorp (NASDAQ:MSBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Midland States Bancorp (NASDAQ:MSBI)

Historical Stock Chart

From Apr 2023 to Apr 2024