If any of the securities being registered

on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the

following box.

x

If this form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering.

¨

If this form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

¨

If this form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

¨

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an

emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934. (Check one):

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act.

x

This Post-Effective Amendment is being filed

to update the registration statement (the “Registration Statement”) filed by Moleculin Biotech, Inc. (the “Company”,

“we”, “our” or “us”) on December 2, 2016 and declared effective by the Securities and Exchange

Commission on February 8, 2017, which registered 3,710,000 units of the Company, with each unit consisting of (i) one share of

common stock of the Company, (ii) three series of warrants to purchase common stock, and (iii) the shares of common stock underlying

such warrants. This Post-Effective amendment updates the prospectus dated February 9, 2017. All applicable registration fees were

paid at the time of the original filing of the Registration Statement.

This prospectus relates to (i) 187,574

shares of our common stock, issuable upon the exercise of outstanding five-year Series A warrants at an exercise price of $1.50

per share originally issued on February 14, 2017 in an underwritten public offering of our securities, and (ii) 259,700 shares

of common stock issuable upon the exercise of the five-year warrant at an exercise price of $1.35 per share issued to the representative

of the underwriters in the aforementioned offering originally issued on February 14, 2017, which we refer to as the Representative’s

Warrant.

Our common stock is listed on the NASDAQ

Capital Market under the symbol “MBRX.” On October 12, 2017, the last sale price for our common stock as reported on

the NASDAQ Capital Market was $2.28 per share. There is no established public trading market for the warrants, and we do not expect

a market to develop. In addition, we do not intend to apply for a listing of the warrants on any national securities exchange.

We are an “emerging growth company”

as defined in Section 2(a) of the Securities Act of 1933, as amended, and we have elected to comply with certain reduced public

company reporting requirements.

Table

of Contents

ABOUT THIS PROSPECTUS

You should rely only on the information

contained in or incorporated by reference into this prospectus. We have not authorized anyone to provide you with information different

from that contained in this prospectus or incorporated by reference herein. No dealer, salesperson or other person is authorized

to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information

or representation.

This prospectus is an offer to sell only

the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume

that the information in this prospectus is accurate only as of the date on the front of the document and that any information we

have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time

of delivery of this prospectus or any sale of a security.

The distribution of this prospectus and

the issuance of the securities in certain jurisdictions may be restricted by law. Persons outside the United States who come into

possession of this prospectus must inform themselves about, and observe any restrictions relating to, the issuance of the securities

and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in

connection with, an offer to sell, or a solicitation of an offer to buy, the securities offered by this prospectus by any person

in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

This prospectus is part of a registration

statement that we filed with the Securities and Exchange Commission, or SEC. Please carefully read both this prospectus together

with the additional information described below under the section entitled “Incorporation by Reference.”

PROSPECTUS SUMMARY

This summary highlights information

contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding

to invest in our securities. You should read this entire prospectus carefully, including the “Risk Factors” section,

incorporated by reference into this prospectus. The terms “MBI”, the “Company”, “our”, or “we”

refer to Moleculin Biotech, Inc. and, unless the context otherwise requires, its predecessors.

Overview

We are a clinical stage pharmaceutical company

organized as a Delaware corporation in July 2015 to focus on the development of anti-cancer drug candidates, some of which are

based on license agreements with The University of Texas System on behalf of the M.D. Anderson Cancer Center, which we refer to

as MD Anderson. Our lead drug candidate is liposomal Annamycin, which we refer to as Annamycin, an anthracycline being studied

for the treatment of relapsed or refractory acute myeloid leukemia, or AML. We have two other drug development projects in process,

one involving a collection of small molecules, which we refer to as the WP1066 Portfolio, focused on the modulation of key regulatory

transcription factors involved in the progression of cancer, and the WP1222 Portfolio, a suite of molecules targeting the metabolic

processes involved in cancer in general and glioblastoma (the most common form of brain tumor) in particular. We also continue

to sponsor ongoing research at MD Anderson in order to improve and expand our drug development pipeline.

Our principal executive offices are located

at 2575 West Bellfort, Suite 333, Houston, Texas 77054. Our telephone number is (713) 300-5160. Our website address is www.moleculin.com.

The information on or accessible through our website is not part of this prospectus.

The Offering

|

Securities offered

|

This prospectus relates to (i) 187,574 shares of our common stock, issuable upon the exercise of outstanding five-year Series A warrants at an exercise price of $1.50 per share originally issued on February 14, 2017 in an underwritten public offering of our securities, and (ii) 259,700 shares of common stock issuable upon the exercise of the five-year warrant at an exercise price of $1.35 per share issued to the representative of the underwriters in the aforementioned offering originally issued on February 14, 2017.

|

|

Use of proceeds

|

We intend to use the proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds” for more information.

|

|

NASDAQ symbol

|

Our common stock is listed on the NASDAQ Capital Market under the symbol “MBRX”. There is no established public trading market for the warrants, and a market will likely never develop. The warrants are not and will not be listed for trading on the NASDAQ Capital Market, any other national securities exchange or other nationally recognized trading system.

|

|

Risk Factors

|

See “Risk Factors” and other information incorporated by reference into this prospectus for a discussion of factors you should carefully consider before deciding whether to invest in our common stock.

|

RISK FACTORS

Investing in shares of our common stock

involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described below,

together with the risks described in the “Risk Factors” section in our most recent Annual Report on Form 10-K, as well

as any updates to those risk factors in our subsequent Quarterly Reports on Form 10-Q, together with all of the other information

appearing in or incorporated by reference into this prospectus, before deciding whether to purchase any of the common stock being

offered. The risks described in these documents are not the only ones we face, but those that we consider to be material. There

may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse

effects on our future results. Our business, financial condition or results of operations could be materially adversely affected

by any of these risks. The trading price of shares of our common stock could decline due to any of these risks, and you may lose

all or part of your investment. Please also read carefully the section entitled “Cautionary Note Regarding Forward-Looking

Statements.”

Investors receiving shares of common stock upon exercise

of the warrants will incur immediate and substantial dilution.

Investors receiving shares of common stock

upon exercise of the warrants will incur immediate and substantial dilution in net tangible book value per share. As the exercise

prices for the Series A warrants and the Representative’s Warrant are $1.50 per share and $1.35 per share, respectively,

investors receiving shares of common stock upon exercise of the Series A warrants and the Representative’s Warrant will incur

dilution of $1.08 per share and $0.93 per share, respectively, in the net tangible book value of their purchased shares of our

common stock, assuming full exercise of such warrants. Investors may experience further dilution to the extent that shares of our

common stock are issued upon the exercise of outstanding stock options and warrants.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus the information in other documents that we file with it. This means that we can disclose

important information to you by referring you to those documents. The information incorporated by reference is considered to be

a part of this prospectus, and information in documents that we file later with the SEC will automatically update and supersede

information contained in documents filed earlier with the SEC or contained in this prospectus. We incorporate by reference in this

prospectus the documents listed below and any future filings that we may make with the SEC under Sections 13(a), 13(c), 14, or

15(d) of the Exchange Act prior to the termination of the offering under this prospectus; provided, however, that we are not incorporating,

in each case, any documents or information deemed to have been furnished and not filed in accordance with SEC rules:

• Our

Annual Report on Form 10-K for the year ended December 31, 2016 (filed on April 3, 2017);

• Our

Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2017 (filed on May 12, 2017) and June 30, 2017 (filed

on August 11, 2017);

• Our

Current Reports on Form 8-K filed on February 9, 2017; February 23, 2017; March 14, 2017; March 22, 2017; April 17, 2017; May 19,

2017; May 31, 2017; June 27, 2017; June 30, 2017; July 12, 2017; July 27, 2017; August 25, 2017; September 15, 2017; September

26, 2017; and October 4, 2017;

• Definitive

Proxy Statement on Schedule 14A relating to the Company’s 2017 Annual Meeting of Stockholders (filed on April 28, 2017);

and

• the

description of our common stock, par value $0.001 per share contained in our Registration Statement on Form 8-A, dated and filed

with the SEC on April 28, 2016, and any amendment or report filed with the SEC for the purpose of updating the description.

Additionally, all documents filed by us

with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after (i) the date of the initial registration statement

and prior to effectiveness of the registration statement, and (ii) the date of this prospectus and before the termination or completion

of any offering hereunder, shall be deemed to be incorporated by reference into this prospectus from the respective dates of filing

of such documents, except that we do not incorporate any document or portion of a document that is “furnished” to the

SEC, but not deemed “filed.”

You may obtain a copy of any or all of the

documents referred to above, which may have been or may be incorporated by reference into this prospectus, including exhibits,

at no cost to you by writing or telephoning us at the following address: Attention: Corporate Secretary, 2575 West Bellfort, Suite

333, Houston, Texas 77054, telephone (713) 300-5160.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

Some of the information in this prospectus,

and the documents we incorporate by reference, contain forward-looking statements within the meaning of the federal securities

laws. You should not rely on forward-looking statements in this prospectus, and the documents we incorporate by reference. Forward-looking

statements typically are identified by use of terms such as “anticipate,” “believe,” “plan,”

“expect,” “future,” “intend,” “may,” “will,” “should,”

“estimate,” “predict,” “potential,” “continue,” and similar words, although some

forward-looking statements are expressed differently. This prospectus, and the documents we incorporate by reference, may also

contain forward-looking statements attributed to third parties relating to their estimates regarding the markets we may enter in

the future. All forward-looking statements address matters that involve risk and uncertainties, and there are many important risks,

uncertainties and other factors that could cause our actual results to differ materially from the forward-looking statements contained

in this prospectus, and the documents we incorporate by reference.

You should also consider carefully the statements

under “Risk Factors” and other sections of this prospectus, and the documents we incorporate by reference, which address

additional facts that could cause our actual results to differ from those set forth in the forward-looking statements. We caution

investors not to place significant reliance on the forward-looking statements contained in this prospectus, and the documents we

incorporate by reference. We undertake no obligation to publicly update or review any forward-looking statements, whether as a

result of new information, future developments or otherwise.

USE OF PROCEEDS

Assuming full exercise of the warrants,

we will receive gross proceeds of approximately $632,000. We currently intend to use such proceeds for working capital and general

corporate purposes. The amounts and timing of our use of the net proceeds from this offering will depend on a number of factors,

such as the timing and progress of our research and development efforts, the timing and progress of any partnering and commercialization

efforts, and technological advances. As of the date of this prospectus, we cannot specify with certainty all of the particular

uses for the net proceeds to us from this offering. Accordingly, our management will have broad discretion in the timing and application

of these proceeds.

DIVIDEND POLICY

We have never declared or paid any cash

dividends on our capital stock. We currently intend to retain earnings, if any, to finance the growth and development of our business.

We do not expect to pay any cash dividends on our common stock in the foreseeable future. Payment of future dividends, if any,

will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital

requirements, restrictions contained in any financing instruments, provisions of applicable law and other factors the board deems

relevant.

DILUTION

Upon exercise of the Series A warrants

and the Representative’s Warrant, a warrant holder’s ownership interest in our common stock will be diluted immediately

to the extent of the difference between the exercise price per warrant and the pro forma net tangible book value per share of our

common stock at the time of exercise of such warrant.

We calculate net tangible book value per

share by dividing the net tangible book value, which is tangible assets less total liabilities, by the number of outstanding shares

of our common stock. Dilution represents the difference between the portion of the amount per share paid by purchasers of shares

in this offering and the as adjusted net tangible book value per share of our common stock immediately after giving effect to this

offering. Our net tangible book value as of June 30, 2017 was approximately $8.1 million, or $0.40 per share.

After giving effect to the exercise of all

the Series A warrants and the Representative’s Warrant, our pro forma net tangible book value as of June 30, 2017 would have

been $8.8 million, or $0.42 per share. This represents an immediate increase in pro forma net tangible book value per share of

$0.02 to existing stockholders and immediate dilution of $1.08 and $0.93 in pro forma net tangible book value per share to new

investors receiving shares of common stock following exercise of the Series A warrants and the Representative’s Warrant,

respectively. Dilution per share to new investors is determined by subtracting pro forma net tangible book value per share after

this offering from the exercise price per warrant paid by new investors. The following table illustrates this dilution on a per

share basis:

|

Exercise price of Series A warrant

|

|

|

|

|

|

$

|

1.50

|

|

|

Exercise price of Representative’s warrant

|

|

|

|

|

|

$

|

1.35

|

|

|

Net tangible book value per share at June 30, 2017

|

|

$

|

0.40

|

|

|

|

|

|

|

Increase in net tangible book value per share to the existing stockholders attributable to the exercise of the Series A warrants and the Representative’s Warrant

|

|

$

|

0.02

|

|

|

|

|

|

|

Adjusted net tangible book value per share after this offering

|

|

$

|

0.42

|

|

|

|

|

|

|

Dilution in net tangible book value per share to investors exercising Series A warrants

|

|

|

|

|

|

$

|

1.08

|

|

|

Dilution in net tangible book value per share to investors exercising the Representative’s warrant

|

|

|

|

|

|

$

|

0.93

|

|

The above table and discussion is based

on 20,164,854 shares of common stock outstanding as of June 30, 2017 and exclude the following, all as of June 30, 2017:

•

530,000

shares of common stock issuable upon the exercise of outstanding stock options, vested and unvested, with a weighted-average exercise

price of $5.17 per share;

• 948,011 shares

of common stock issuable upon the exercise of outstanding Series A, vested Series C and underwriter warrants from our February

14, 2017 follow-on offering with a weighted-average exercise price of $1.46 per share;

• 107,802 shares

of common stock issuable upon the exercise of outstanding underwriter warrants issued on May 1, 2016 related to our IPO with an

exercise price of $7.50 per share; and

• up to an

aggregate of 1,470,000 shares of common stock reserved for future issuance under our 2015 Stock Plan.

To the extent that

options or warrants outstanding as of June 30, 2017 have been or are exercised, or other shares are issued, investors purchasing

shares in this offering could experience further dilution. In addition, we may choose to raise additional capital due to market

conditions or strategic considerations, even if we believe we have sufficient funds for our current or future operating plans.

To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these

securities could result in further dilution to our stockholders.

PLAN OF DISTRIBUTION

We are offering shares

of common stock issuable upon the exercise of outstanding Series A Warrants and of the Representative’s Warrant, respectively,

all of which were previously issued in connection with the February 2017 registered offering of our securities. The common stock

issuable upon the exercise of such warrants will not be offered through underwriters, or brokers or dealers. We will not pay any

compensation in connection with the offering of the shares upon exercise of the warrants.

DESCRIPTION OF CAPITAL STOCK

The following summary is a description

of the material terms of our capital stock and is not complete. You should also refer to the Moleculin Biotech, Inc. certificate

of incorporation and bylaws, which are included as exhibits to the registration statement of which this prospectus forms a part,

and the applicable provisions of the Delaware General Corporation Law.

Our amended and restated certificate of

incorporation authorizes us to issue up to 75,000,000 shares of common stock, par value $0.001 per share, and 5,000,000 shares

of preferred stock, $0.001 par value per share.

Common Stock

Shares of our common stock have the following

rights, preferences and privileges:

Voting

Each holder of common stock is entitled

to one vote for each share of common stock held on all matters submitted to a vote of stockholders. Any action at a meeting at

which a quorum is present will be decided by a majority of the voting power present in person or represented by proxy, except in

the case of any election of directors, which will be decided by a plurality of votes cast. There is no cumulative voting.

Dividends

Holders of our common stock are entitled

to receive dividends when, as and if declared by the our board of directors out of funds legally available for payment, subject

to the rights of holders, if any, of any class of stock having preference over the common stock. Any decision to pay dividends

on our common stock will be at the discretion of our board of directors. Our board of directors may or may not determine to declare

dividends in the future. See “Dividend Policy.” The board’s determination to issue dividends will depend upon

our profitability and financial condition any contractual restrictions, restrictions imposed by applicable law and the SEC, and

other factors that our board of directors deems relevant.

Liquidation Rights

In the event of a voluntary or involuntary

liquidation, dissolution or winding up of the company, the holders of our common stock will be entitled to share ratably on the

basis of the number of shares held in any of the assets available for distribution after we have paid in full, or provided for

payment of, all of our debts and after the holders of all outstanding series of any class of stock have preference over the common

stock, if any, have received their liquidation preferences in full.

Other

Our issued and outstanding shares of common

stock are fully paid and nonassessable. Holders of shares of our common stock are not entitled to preemptive rights. Shares of

our common stock are not convertible into shares of any other class of capital stock, nor are they subject to any redemption

or sinking fund provisions.

Preferred Stock

We are authorized to issue up to 5,000,000 shares

of preferred stock. Our certificate of incorporation authorizes the board to issue these shares in one or more series, to determine

the designations and the powers, preferences and relative, participating, optional or other special rights and the qualifications,

limitations and restrictions thereof, including the dividend rights, conversion or exchange rights, voting rights (including the

number of votes per share), redemption rights and terms, liquidation preferences, sinking fund provisions and the number of shares

constituting the series. Our board of directors could, without stockholder approval, issue preferred stock with voting and other

rights that could adversely affect the voting power and other rights of the holders of common stock and which could have the effect

of making it more difficult for a third party to acquire, or of discouraging a third party from attempting to acquire, a majority

of our outstanding voting stock.

Series A Warrants

The following summary of certain terms

and provisions of the Series A warrants is not complete and is subject to, and qualified in its entirety by, the provisions of

the warrant, the form of which is filed as an exhibit to the registration statement of which this prospectus forms a part.

Duration and Exercise Price

. The

Series A warrant has an exercise price of $1.50 per share. The Series A warrants are immediately exercisable and expire on February

14, 2022. The exercise price and number of shares of common stock issuable upon exercise is subject to appropriate adjustment in

the event of stock dividends, stock splits, reorganizations or similar events affecting our common stock.

Exercisability

. The Series A warrants

will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied

by payment in full for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless

exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of the warrant to the extent

that the holder would own more than 4.99% (or, at the election of the holder, 9.99%) of the outstanding common stock immediately

after exercise, provided that the holder may increase the limitation on amount of ownership of outstanding stock after exercising

the holder’s warrants up to 9.99% of the number of shares of our common stock outstanding immediately after giving effect

to the exercise, as such percentage ownership is determined in accordance with the terms of the warrants, provided further that

any increase in such limitation shall not be effective until 61 days following notice from the holder to us. No fractional shares

of common stock will be issued in connection with the exercise of a warrant. In lieu of fractional shares, we will either pay the

holder an amount in cash equal to the fractional amount multiplied by the exercise price or round up to the next whole share.

Cashless Exercise

. If, at the time

a holder exercises its warrant, a registration statement registering the issuance of the shares of common stock underlying the

Series A warrants under the Securities Act is not then effective or available, then in lieu of making the cash payment otherwise

contemplated to be made to us upon such exercise in payment of the aggregate exercise price, if the holder chooses to exercise

the warrants it must elect instead to receive upon such exercise (either in whole or in part) the net number of shares of common

stock determined according to a formula set forth in the warrant.

Fundamental Transactions

. If a fundamental

transaction occurs, then the successor entity will succeed to, and be substituted for us, and may exercise every right and power

that we may exercise and will assume all of our obligations under the warrants with the same effect as if such successor entity

had been named in the warrant itself. If holders of our common stock are given a choice as to the securities, cash or property

to be received in a fundamental transaction, then the holder shall be given the same choice as to the consideration it receives

upon any exercise of the warrant following such fundamental transaction. In addition, in the event of a fundamental transaction,

at the request of the holder, we or the successor entity shall purchase the unexercised portion of the warrant from the holder

by paying to the holder cash in an amount equal to the Black-Scholes value (as defined in the warrants) of the remaining unexercised

portion of the warrant on the date of such fundamental transaction.

Exchange Listing

. We do not intend

to list the warrants on any securities exchange or nationally recognized trading system.

Right as a Stockholder

. Except as

otherwise provided in the warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of

the warrants do not have the rights or privileges of holders of our common stock, including any voting rights, until they exercise

their warrants.

Representative’s Warrant

The Representative’s Warrant is materially

similar to the Series A warrants discussed above, except that the exercise price is $1.35 per share.

Listing

Our common stock is listed on the Nasdaq

Capital Market under the symbol “MBRX”.

Transfer Agent

The transfer agent for our common stock

is VStock Transfer, LLC.

LEGAL MATTERS

The validity of the securities offered

hereby will be passed upon for us by Schiff Hardin LLP, Washington, DC.

EXPERTS

The financial statements of Moleculin

Biotech, Inc. as of December 31, 2015 and for the period from July 28, 2015 (inception) to December 31, 2015 incorporated by reference

in this prospectus have been audited by GBH CPAs, PC, an independent registered public accounting firm, as stated in their report

appearing therein. Such financial statements have been so included in reliance upon the report of such firm given upon their authority

as experts in accounting and auditing.

The audited financial statements of

Moleculin Biotech, Inc. as of December 31, 2016 and for the year then ended incorporated by reference in this prospectus and elsewhere

in the registration statement have been incorporated by reference in reliance upon the report of Grant Thornton LLP, independent

registered public accountants, upon the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration

statement on Form S-1 under the Securities Act for the securities being offered by this prospectus. This prospectus, which is part

of the registration statement, does not contain all of the information included in the registration statement and the exhibits.

For further information about us and the securities offered by this prospectus, you should refer to the registration statement

and its exhibits. References in this prospectus to any of our contracts or other documents are not necessarily complete, and you

should refer to the exhibits attached to the registration statement for copies of the actual contract or document. You may read

and copy any document that we file at the SEC’s public reference room located at 100 F Street, NE, Washington,

D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms. SEC filings are also

available to the public at the SEC’s website at

www.sec.gov

.

We are subject to the reporting and

information requirements of the Exchange Act and, as a result, will file periodic and current reports, proxy statements and other

information with the SEC. We make our periodic reports and other information filed with or furnished to the SEC, available, free

of charge, through our website as soon as reasonably practicable after those reports and other information are filed with or furnished

to the SEC. Additionally, these periodic reports, proxy statements and other information will be available for inspection and copying

at the public reference room and website of the SEC referred to above.

Moleculin Biotech, Inc.

187,574 shares of Common Stock issuable

upon the exercise of outstanding Series A Warrants

259,700 shares of Common Stock issuable

upon the exercise of the Representative’s Warrant

PROSPECTUS

,

2017

We have not authorized any dealer, salesperson or other person

to give any information or to make any representations not contained in this prospectus. You must not rely on any unauthorized

information. This prospectus is not an offer to sell these securities in any jurisdiction where an offer or sale is not permitted.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 13. Other Expenses of Issuance and Distribution.

The following table sets forth the estimated

costs and expenses to be incurred in connection with the issuance and distribution of the securities of Moleculin Biotech, Inc.

(the “Registrant”) which are registered under this Registration Statement on Form S-1 (this “Registration Statement”).

All amounts are estimates except the Securities and Exchange Commission registration fee and the Financial Industry Regulatory

Authority, Inc. filing fee.

The following expenses will be borne solely

by the Registrant:

|

|

|

Amount to be

|

|

|

|

|

Paid

|

|

|

SEC Registration fee

|

|

$

|

0

|

(1)

|

|

Legal fees and expenses

|

|

$

|

15,000

|

|

|

Accounting fees and expenses

|

|

$

|

15,000

|

|

|

Miscellaneous fees and expenses

|

|

$

|

5,000

|

|

|

Total

|

|

$

|

35,000

|

|

Item 14. Indemnification of Directors and Officers.

Pursuant to Section 145 of the Delaware

General Corporation Law (the “DGCL”), a corporation shall have the power to indemnify any person who was or is a party

or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal,

administrative or investigative (other than a derivative action by or in the right of such corporation) by reason of the fact that

such person is or was a director, officer, employee or agent of such corporation, or serving at the request of such corporation

in such capacity for another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’

fees), judgments, fines and amounts paid in settlement actually and reasonably incurred in connection with such action, suit or

proceeding, if such person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best

interests of such corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or

her conduct was unlawful.

The DGCL also permits indemnification by

a corporation under similar circumstances for expenses (including attorneys’ fees) actually and reasonably incurred by such

persons in connection with the defense or settlement of a derivative action or suit, except that no indemnification shall be made

in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to such corporation unless

the Delaware Court of Chancery or the court in which such action or suit was brought shall determine upon application that such

person is fairly and reasonably entitled to indemnity for such expenses which such court shall deem proper.

To the extent a present or former director

or officer is successful in the defense of such an action, suit or proceeding referenced above, or in defense of any claim, issue

or matter therein, a corporation is required by the DGCL to indemnify such person for actual and reasonable expenses incurred in

connection therewith. Expenses (including attorneys’ fees) incurred by such persons in defending any action, suit or proceeding

may be paid in advance of the final disposition of such action, suit or proceeding upon in the case of a current officer or director,

receipt of an undertaking by or on behalf of such person to repay such amount if it is ultimately determined that such person is

not entitled to be so indemnified.

The DGCL provides that the indemnification

described above shall not be deemed exclusive of other indemnification that may be granted by a corporation pursuant to its bylaws,

disinterested directors’ vote, stockholders’ vote and agreement or otherwise.

Section 102(b)(7) of the DGCL enables

a corporation, in its certificate of incorporation or an amendment thereto, to eliminate or limit the personal liability of a director

to the corporation or its stockholders for monetary damages for violations of the directors’ fiduciary duty, except (i) for

any breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not

in good faith or which involve intentional misconduct or a knowing violation of law, (iii) pursuant to Section 174 of

the DGCL (providing for liability of directors for unlawful payment of dividends or unlawful stock purchases or redemptions) or

(iv) for any transaction from which a director derived an improper personal benefit. The Registrant’s certificate of

incorporation provides for such limitations on liability for its directors.

The DGCL also provides corporations with

the power to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of such

corporation, or is or was serving at the request of such corporation in a similar capacity for another corporation, partnership,

joint venture, trust or other enterprise, against any liability asserted against him or her in any such capacity or arising out

of his or her status as such, whether or not the corporation would have the power to indemnify him or her against such liability

as described above. In connection with this offering, the Registrant will obtain liability insurance for its directors and officers.

Such insurance would be available to its directors and officers in accordance with its terms.

The Registrant’s certificate of incorporation

in requires the Registrant to indemnify and hold harmless, to the fullest extent permitted by applicable law as it presently exists

or may hereafter be amended, any person (a “covered person”) who was or is made or is threatened to be made a party

or is otherwise involved in any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative

or investigative (a “proceeding”) by reason of the fact that he or she is or was a director, officer or member of a

committee of the Registrant, or, while a director or officer of the Registrant, is or was serving at the request of the Registrant

as a director or officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise or non-profit

entity, including service with respect to employee benefit plans, against all liability and loss suffered and expenses (including

attorneys’ fees), judgment, fines and amounts paid in settlement actually and reasonably incurred by such person in connection

with a proceeding.

In addition, under the Registrant’s

certificate of incorporation, in certain circumstances, the Registrant shall pay the expenses (including attorneys’ fees)

incurred by a covered person in defending a proceeding in advance of the final disposition of such proceeding; provided, however,

that the Registrant shall not be required to advance any expenses to a person against whom the Registrant directly brings an action,

suit or proceeding alleging that such person (1) committed an act or omission not in good faith or (2) committed an act

of intentional misconduct or a knowing violation of law. Additionally, an advancement of expenses incurred by a covered person

shall be made only upon delivery to the Registrant of an undertaking, by or on behalf of such covered person, to repay all amounts

so advanced if it shall ultimately be determined by final judicial decision from which there is no further right to appeal or otherwise

in accordance with Delaware law that such covered person is not entitled to be indemnified for such expenses.

The foregoing statements are subject to

the detailed provisions of Section 145 of the DGCL and the full text of the Registrant’s certificate of incorporation,

which is filed as Exhibit 3.1 hereto.

Item 15. Recent Sales of Unregistered Securities.

Except as set forth below, in the three

years preceding the filing of this Registration Statement, the Registrant has not issued any securities that were not registered

under the Securities Act:

In August 2015, Messrs. Klemp, Picker and

Priebe purchased 1,100,000 shares, 500,000 shares and 3,000,000 shares of our common stock, respectively, at a purchase price of

$0.001 per share.

In August 2015, in exchange for the issuance

of 630,000 shares of common stock, we acquired the rights to the license agreement with MD Anderson covering our WP1122 Portfolio

held by IntertechBio Corporation, a company affiliated with Messrs. Priebe and Picker. In August 2015, in exchange for the issuance

of 1,431,000 shares of common stock, we acquired the rights to the Annamycin IND and all data related to the Annamycin IND or the

development of Annamycin held by AnnaMed, Inc., a company affiliated with Mr. Klemp.

In May 2016, Moleculin, LLC, a Texas limited

liability company, was merged with and into MBI, which survived the merger. As a result of the merger, we issued the equity interests

holders of Moleculin, LLC (including the convertible noteholders of Moleculin, LLC) an aggregate of 999,931 shares of our common

stock. Messrs. Klemp, Picker and Priebe are members of Moleculin, LLC and received shares of our common stock as a result of the

merger.

In August and September 2015, the Registrant

issued two 8% convertible notes in an aggregate of $250,000 in principal amount of convertible notes to one investor, which principal

and accrued interest automatically converted into shares of common stock upon the closing of the Company’s initial public

offering at a conversion rate of $0.1299 per share. In October 2015, the Registrant issued two 8% convertible notes in an aggregate

of $200,000 in principal amount of convertible notes to two investors, which principal and accrued interest automatically converted

into shares of common stock upon the closing of the Company’s initial public offering at a conversion rate of $0.20 per share.

At the time of such purchase in October 2015, the convertible note investors and the Registrant agreed that the investors would

fund the Registrant up to the filing of its initial non-confidential registration statement an additional $165,000 on the same

terms as in the October financing. Pursuant to such agreement, such amounts were received in January 2016.

Between January and May 2016, the Registrant

sold 225,963 shares of common stock for a total purchase price of $677,889 to 19 investors.

On June 20, 2016, the Registrant agreed

to issue 24,000 shares of common stock to an investor relations firm for services provided.

In January 2017, the Registrant agreed to

issue 79,167 shares of common stock to a third-party in settlement of $237,500 in past due amounts.

In July 2017, the Registrant agreed to issue

two warrants to purchase 100,000 and 50,000 shares of common stock at exercise prices of $2.41 and $3.00 per share, respectively,

to a consultant, subject to approval by Nasdaq of a listing of additional shares application, which was received in August 2017.

None of these transactions involved

a public offering. We believe that each of the above issuances was exempt from registration under the Securities Act in reliance

on Section 4(a)(2) of the Securities Act regarding transactions not involving a public offering.

Item 16. Exhibits and Financial Statement Schedules.

(a)

Exhibits

: Reference is

made to the Exhibit Index following the signature pages hereto, which Exhibit Index is hereby incorporated into this Item.

(b)

Financial Statement Schedules

:

All schedules are omitted because the required information is inapplicable or the information is presented in the financial statements

and the related notes.

Item 17. Undertakings

(a) The

undersigned Registrant hereby undertakes:

(1) To file, during any period in

which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required

by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus

any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment

thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of

securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum

offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate,

the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in the effective registration statement.

(iii) To include any material information

with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such

information in the registration statement;

Provided, however, that Paragraphs (a)(1)(i),

(a)(1)(ii) and (a)(1)(iii) of this section do not apply if the registration statement is on Form S-1 and the information required

to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission

by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference

in the registration statement.

(2) That, for the purpose of determining

any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

(3) To remove from registration by

means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) Insofar as indemnification for liabilities

arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant

to the provisions referenced in Item 14 of this Registration Statement, or otherwise, the Registrant has been advised that

in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act

and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment

by the registrant of expenses incurred or paid by a director, officer, or controlling person of the registrant in the successful

defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities

being registered hereunder, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question of whether such indemnification by it is against public policy

as expressed in the Act and will be governed by the final adjudication of such issue.

(c) The undersigned Registrant hereby undertakes

that each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration

statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included

in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in

a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed

incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to

a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration

statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date

of first use.

(d) That, for purposes of determining any

liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to section 13(a) or section

15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report

pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant to the requirements of the Securities

Act, the registrant has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in the city of Houston, Texas, on October 17, 2017.

|

|

MOLECULIN BIOTECH, INC.

|

|

|

(Registrant)

|

|

|

|

|

|

By:

|

/s/ Walter V. Klemp

|

|

|

|

Walter V. Klemp

|

|

|

|

Director and Chief Executive Officer

|

Pursuant to the requirements of the Securities

Act of 1933, as amended, this registration statement has been signed below by the following persons in the capacities and on the

dates indicated:

|

SIGNATURE

|

|

TITLE

|

|

DATE

|

|

|

|

|

|

|

|

/s/ Walter V. Klemp

|

|

|

|

|

|

Walter V. Klemp

|

|

Chief Executive Officer, President and Director

|

|

October 17, 2017

|

|

|

|

(Principal Executive Officer)

|

|

|

|

/s/ Jonathan P. Foster

|

|

|

|

|

|

Jonathan P. Foster

|

|

Chief Financial Officer

|

|

October 17, 2017

|

|

|

|

(Principal Financial Officer and Principal Accounting Officer)

|

|

|

|

*

|

|

|

|

|

|

Robert George

|

|

Director

|

|

October 17, 2017

|

|

|

|

|

|

|

|

*

|

|

|

|

|

|

Michael Cannon

|

|

Director

|

|

October 17, 2017

|

|

|

|

|

|

|

|

/s/ John Climaco

|

|

|

|

|

|

John Climaco

|

|

Director

|

|

October 17, 2017

|

|

* By:

|

/s/ Walter V. Klemp

|

|

|

|

Walter V. Klemp

|

|

|

|

Attorney-in-Fact

|

|

EXHIBIT INDEX

Exhibit

Number

|

|

Description

|

|

3.1

|

|

Amended and Restated Certificate of Incorporation of Moleculin Biotech, Inc. (incorporated by reference to exhibit 3.1 of the Form S-1/A filed March 21, 2016)

|

|

3.2

|

|

Amended and Restated Bylaws of Moleculin Biotech, Inc. (incorporated by reference to exhibit 3.2 of the Form S-1/A filed March 21, 2016)

|

|

4.1

|

|

Form of Series A/B/C Warrant Agreement issued in February 2017 offering (incorporated by reference to Exhibit 4.1 of the Form 8-K filed February 9, 2017)

|

|

5

|

|

Opinion of Schiff Hardin LLP as to legality of the securities being registered (previously filed)

|

|

10.1

|

|

Moleculin Biotech, Inc. 2015 Incentive Plan (incorporated by reference to exhibit 10.1 of the Form S-1/A filed March 21, 2016)

|

|

10.2

|

|

Rights Transfer Agreement between Moleculin Biotech, Inc. and AnnaMed, Inc. (incorporated by reference to exhibit 10.2 of the Form S-1/A filed March 21, 2016)

|

|

10.3

|

|

Patent and Technology License Agreement dated June 21, 2010 by and between The Board of Regents of the University of Texas System and Moleculin, LLC (incorporated by reference to exhibit 10.3 of the Form S-1/A filed March 21, 2016)

|

|

10.4

|

|

Amendment No. 1 to the Patent and Technology License Agreement dated June 21, 2010 by and between The Board of Regents of the University of Texas System and Moleculin, LLC (incorporated by reference to exhibit 10.4 of the Form S-1/A filed March 21, 2016)

|

|

10.5

|

|

Patent and Technology License Agreement dated April 2, 2012 by and between The Board of Regents of the University of Texas System and IntertechBio Corporation (incorporated by reference to exhibit 10.5 of the Form S-1/A filed March 21, 2016)

|

|

10.6

|

|

Amendment No. 1 to the Patent and Technology License Agreement dated June 21, 2010 by and between The Board of Regents of the University of Texas System and IntertechBio Corporation (incorporated by reference to exhibit 10.6 of the Form S-1/A filed March 21, 2016)

|

|

10.7

|

|

Patent and Technology Development and License Agreement June 28, 2012 by and between Annamed, Inc. and Dermin Sp. z.o.o (incorporated by reference to exhibit 10.7 of the Form S-1/A filed April 15, 2016)

|

|

10.8

|

|

Patent and Technology Development and License Agreement dated April 15, 2011 by and between IntertechBio Corporation and Dermin Sp. z.o.o (incorporated by reference to exhibit 10.8 of the Form S-1/A filed March 21, 2016)

|

|

10.9

|

|

Patent and Technology Development and License Agreement dated October 27, 2010 by and between Moleculin, LLC and Dermin Sp. z.o.o (incorporated by reference to exhibit 10.9 of the Form S-1/A filed March 21, 2016)

|

|

10.10

|

|

Rights Transfer Agreement dated between Moleculin Biotech, Inc. and IntertechBio Corporation dated August 11, 2015 (incorporated by reference to exhibit 10.10 of the Form S-1/A filed March 21, 2016)

|

|

10.11

|

|

Agreement and Plan of Merger between Moleculin Biotech, Inc. and Moleculin, LLC (incorporated by reference to exhibit 10.11 of the Form S-1/A filed March 21, 2016)

|

|

10.12

|

|

Technology Rights and Development License Agreement to be entered into by Moleculin Biotech, Inc. and Houston Pharmaceuticals, Inc. (incorporated by reference to exhibit 10.13 of the Form S-1/A filed April 15, 2016)

|

|

10.13

|

|

Employment Agreement between Moleculin Biotech, Inc. and Jonathan P. Foster dated August 19, 2016 (incorporated by reference to Exhibit 10.1 of the Form 8-K filed August 25, 2016)

|

|

10.14

|

|

Executive Employment Agreement between Moleculin Biotech, Inc. and Walter Klemp dated October 13, 2016 (incorporated by reference to Exhibit 10.1 of the Form 8-K filed October 13, 2016)

|

|

10.15

|

|

General Release and Separation Agreement between Moleculin Biotech, Inc. and Louis Ploth dated October 7, 2016 (incorporated by reference to Exhibit 10.2 of the Form 8-K filed October 13, 2016)

|

|

10.16

|

|

Development Collaboration Agreement between Moleculin Biotech, Inc. and Dermin Sp. Z o. o. dated September 30, 2016 (incorporated by reference to Exhibit 10.4 of the Form 10-Q filed November 21, 2016)

|

|

10.17

|

|

Form of Indemnification Agreement between the Company and its current and future directors and executive officers (incorporated by reference to Exhibit 10.1 of the Form 8-K filed May 31, 2017)

|

|

21

|

|

Subsidiaries of the Registrant (incorporated by reference to exhibit 21 of the Form S-1/A filed April 15, 2016)

|

|

23.1*

|

|

Consent of Grant Thornton LLP

|

|

23.2*

|

|

Consent of GBH CPAs, PC

|

|

23.2

|

|

Consent of Schiff Hardin LLP (included in Exhibit 5)

|

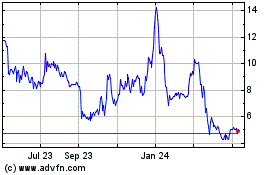

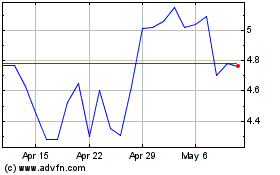

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Apr 2023 to Apr 2024