- Diluted earnings per share for the

third quarter of 2017 were 28 cents, a 7.7 percent increase from

the second quarter of 2017 and a 16.7 percent increase from the

third quarter of 2016. Net income was $48.9 million, an increase of

7.6 percent and 17.9 percent, compared to the second quarter of

2017 and third quarter of 2016, respectively.

- Pre-provision net revenue of $65.5

million was 4.1% higher than the second quarter of 2017 and 11.3%

higher than the third quarter of 2016.

- Net interest income for the third

quarter of 2017 increased $5.2 million, or 3.7 percent, compared to

the second quarter of 2017 and $16.2 million, or 12.4 percent,

compared to the third quarter of 2016.

- Net interest margin decreased two basis

points, to 3.27 percent, compared to the second quarter of 2017,

and increased 13 basis points compared to the third quarter of

2016.

- Loans at September 30, 2017 increased

$140.3 million, or 0.9 percent, compared to June 30, 2017 and $1.1

billion, or 7.6 percent, compared to September 30, 2016. Average

loans for the third quarter of 2017 increased 1.8 percent and 8.3

percent compared to the second quarter of 2017 and the third

quarter of 2016, respectively.

- Deposits at September 30, 2017

increased $784.4 million, or 5.1 percent, compared to June 30, 2017

and $1.2 billion, or 8.0 percent, compared, to September 30, 2016.

Average deposits for the third quarter of 2017 increased 5.2

percent and 7.8 percent compared to the second quarter of 2017 and

the third quarter of 2016, respectively.

- The provision for credit losses in the

third quarter of 2017 was $5.1 million, compared to a $6.7 million

provision in the second quarter of 2017, and a $4.1 million

provision in the third quarter of 2016.

- Non-interest income, excluding

investment securities gains, decreased $3.6 million, or 7.0

percent, in comparison to the second quarter of 2017, and decreased

$770,000, or 1.6 percent, in comparison to the third quarter of

2016.

- Non-interest expense decreased

$538,000, or 0.4 percent, compared to the second quarter of 2017

and increased $12.3 million, or 10.3 percent, compared to the third

quarter of 2016.

Fulton Financial Corporation (NASDAQ:FULT) reported net income

of $48.9 million, or 28 cents per diluted share, for the third

quarter of 2017.

This press release features multimedia. View

the full release here:

http://www.businesswire.com/news/home/20171017006594/en/

"Overall, we are pleased with our third quarter financial

performance as we’ve hit a couple of key milestones that help us

continue to drive shareholder value,” said E. Philip Wenger,

Chairman, President and CEO. “I’m extremely proud of our team’s

continued focus on growth, efficiency and profitability. This

resulted in total revenue that hit a record level in the third

quarter and helped our company reach $20 billion in assets.”

Net Interest Income and

Margin

Net interest income for the third quarter of 2017 increased $5.2

million, or 3.7 percent, from the second quarter of 2017. Net

interest margin decreased two basis points, or 0.6 percent, to 3.27

percent in the third quarter of 2017, from 3.29 percent in the

second quarter of 2017. The average yield on interest-earning

assets increased two basis points, while the average cost of

interest-bearing liabilities increased five basis points, during

the third quarter of 2017 in comparison to the second quarter of

2017. The two basis point increase in the average yield on

interest-earning assets reflects a seven basis point increase in

loan yields, which was partially offset by higher levels of

lower-yielding other interest-earning assets in the third quarter

of 2017.

Average Balance Sheet

Total average assets for the third quarter of 2017 were $19.9

billion, an increase of $571.8 million from the second quarter of

2017. Average loans, net of unearned income, increased $264.9

million, or 1.8 percent, in comparison to the second quarter of

2017. Average loans and yields, by type, for the third quarter of

2017 in comparison to the second quarter of 2017, are summarized in

the following table:

Three Months Ended Increase

(decrease) September 30, 2017 June 30, 2017 in

Balance Balance Yield (1) Balance

Yield (1) $ % (dollars in

thousands) Average Loans, net of unearned income, by type: Real

estate - commercial mortgage $ 6,208,630 4.07 % $ 6,163,844 4.00 %

$ 44,786 0.7 % Commercial - industrial, financial and agricultural

4,257,075 4.08 % 4,221,025 4.00 % 36,050 0.9 % Real estate -

residential mortgage 1,841,559 3.83 % 1,707,929 3.77 % 133,630 7.8

% Real estate - home equity 1,569,898 4.48 % 1,587,680 4.33 %

(17,782 ) (1.1 %) Real estate - construction 943,029 4.05 % 897,321

3.98 % 45,708 5.1 % Consumer 318,546 4.94 % 300,966 5.03 % 17,580

5.8 % Leasing and other 253,330 4.91 % 248,440 5.04 %

4,890 2.0 %

Total Average Loans, net of

unearned income $ 15,392,067 4.12 % $ 15,127,205 4.05 % $

264,862 1.8 %

(1) Presented on a fully-taxable equivalent

basis using a 35% Federal tax rate and statutory interest expense

disallowances.

Total average liabilities increased $537.6 million, or 3.1

percent, from the second quarter of 2017, while average deposits

increased $786.4 million, or 5.2 percent. Average deposits and

interest rates, by type, for the third quarter of 2017 in

comparison to the second quarter of 2017, are summarized in the

following table:

Three Months Ended Increase

(decrease) September 30, 2017 June 30, 2017 in

Balance Balance Rate Balance

Rate $ % (dollars in thousands) Average

Deposits, by type: Noninterest-bearing demand $ 4,494,897 - % $

4,387,517 - % $ 107,380 2.4 % Interest-bearing demand 3,943,118

0.39 % 3,690,059 0.30 % 253,059 6.9 % Savings and money market

deposits 4,603,155 0.34 % 4,315,495 0.25 %

287,660 6.7 % Total average demand and savings 13,041,170 0.24 %

12,393,071 0.18 % 648,099 5.2 % Brokered deposits 89,767 1.23 % - -

% 89,767 - % Time deposits 2,744,532 1.15 % 2,696,033

1.10 % 48,499 1.8 %

Total Average Deposits $

15,875,469 0.40 % $ 15,089,104 0.34 % $ 786,365 5.2 %

Average short-term borrowings decreased $230.8 million, or

36.4%, from the second quarter of 2017, as a portion of these

borrowings were repaid with funds provided by the strong growth in

deposits experienced during the third quarter of 2017.

Asset Quality

Non-performing assets were $147.0 million, or 0.73 percent of

total assets, at September 30, 2017, compared to $147.2 million, or

0.75 percent of total assets, at June 30, 2017 and $150.1 million,

or 0.80 percent of total assets, at September 30, 2016.

Annualized net charge-offs for the quarter ended September 30,

2017 were 0.14 percent of total average loans, compared to

annualized net charge-offs of 0.11 percent for the quarters ended

June 30, 2017 and September 30, 2016. The allowance for credit

losses as a percentage of non-performing loans was 128.1 percent at

September 30, 2017, as compared to 128.9 percent at June 30, 2017

and 119.6 percent at September 30, 2016.

During the third quarter of 2017, the Corporation recorded a

$5.1 million provision for credit losses, compared to a $6.7

million provision for credit losses in the second quarter of 2017

and a $4.1 million provision in the third quarter of 2016.

Non-interest Income

Non-interest income, excluding investment securities gains,

decreased $3.6 million, or 7.0 percent, in comparison to the second

quarter of 2017. Other service charges and fees decreased $2.1

million, or 14.6 percent, due primarily to lower commercial loan

interest rate swap fees. Mortgage banking income declined $1.3

million due to a reversal of the valuation allowance for mortgage

servicing rights recorded in the second quarter of 2017. Also

contributing to the decrease in non-interest income was lower gains

from the sales of Small Business Administration loans.

Compared to the third quarter of 2016, non-interest income,

excluding investment securities gains, decreased $770,000, or 1.6

percent, primarily due to lower commercial loan interest rate swap

fees, partially offset by an increase in investment management and

trust services income.

Gains on sales of investment securities increased $3.2 million

in comparison to the second quarter of 2017, and increased $4.6

million from the third quarter of 2016. These increases resulted

from sales in the Corporation’s portfolio of financial institution

common stocks, which has increased in value over the past twelve

months.

Non-interest Expense

Non-interest expense decreased $538,000, or 0.4 percent, in the

third quarter of 2017, compared to the second quarter of 2017.

Salaries and employee benefits decreased $1.6 million, or 2.2

percent, largely due to adjustments made to estimates of incentive

compensation expense for 2017 and a seasonal decrease in payroll

taxes. Other decreases occurred in outside services, other real

estate expenses and professional fees. These reductions were offset

by increases in data processing and software and FDIC

insurance.

Compared to the third quarter of 2016, non-interest expense

increased $12.3 million, or 10.3 percent, primarily due to

increases in salaries and employee benefits, amortization of tax

credit investments, state taxes, data processing and software and

other outside services.

Income Tax Expense

The effective income tax rate for the third quarter of 2017 was

20.5 percent, as compared to 16.6 percent for the second quarter of

2017. The increase was partially due to an increase in income

before income taxes. In addition, approximately $1.6 million of

excess tax benefits associated with vesting of employee stock

awards and stock option exercises were recorded as a reduction to

income tax expense in the second quarter of 2017.

Additional information on Fulton Financial Corporation is

available on the Internet at www.fult.com.

Safe Harbor Statement

This news release may contain forward-looking statements with

respect to the Corporation’s financial condition, results of

operations and business. Do not unduly rely on forward-looking

statements. Forward-looking statements can be identified by the use

of words such as "may," "should," "will," "could," "estimates,"

"predicts," "potential," "continue," "anticipates," "believes,"

"plans," "expects," "future," "intends" and similar expressions

which are intended to identify forward-looking statements. These

forward-looking statements are not guarantees of future performance

and are subject to risks and uncertainties, some of which are

beyond the Corporation's control and ability to predict, that could

cause actual results to differ materially from those expressed in

the forward-looking statements.

A discussion of certain risks and uncertainties affecting the

Corporation, and some of the factors that could cause the

Corporation's actual results to differ materially from those

described in the forward-looking statements, can be found in the

sections entitled "Risk Factors" and "Management's Discussion and

Analysis of Financial Condition and Results of Operations" in the

Corporation’s Annual Report on Form 10-K for the year ended

December 31, 2016 and Quarterly Reports on Form 10-Q for the

quarters ended March 31, 2017 and June 30, 2017, which have been

filed with the Securities and Exchange Commission and are available

in the Investor Relations section of the Corporation's website

(www.fult.com) and on the Securities

and Exchange Commission's website (www.sec.gov). The Corporation undertakes no

obligation, other than as required by law, to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Non-GAAP Financial

Measures

The Corporation uses certain non-GAAP financial measures in this

earnings release. These non-GAAP financial measures are reconciled

to the most comparable GAAP measures in tables at the end of this

release.

FULTON

FINANCIAL CORPORATION CONDENSED CONSOLIDATED ENDING BALANCE

SHEETS (UNAUDITED) dollars in thousands % Change

from September 30 June 30 March 31

December 31 September 30 June 30 September

30 2017 2017

2017 2016

2016 2017

2016

ASSETS

Cash and due from banks $ 99,803 $ 94,938 $ 93,844 $ 118,763

$ 86,497 5.1 % 15.4 % Other interest-earning assets 645,796 392,842

350,387 291,252 428,966 64.4 % 50.5 % Loans held for sale 23,049

62,354 24,783 28,697 27,836 -63.0 % -17.2 % Investment securities

2,561,516 2,488,699 2,506,017 2,559,227 2,508,068 2.9 % 2.1 %

Loans, net of unearned income 15,486,899 15,346,617 14,963,177

14,699,272 14,391,238 0.9 % 7.6 % Allowance for loan losses

(172,245 ) (172,342 ) (170,076 )

(168,679 ) (162,526 ) -0.1 % 6.0 % Net loans

15,314,654 15,174,275 14,793,101 14,530,593 14,228,712 0.9 % 7.6 %

Premises and equipment 221,551 217,558 216,171 217,806 228,009 1.8

% -2.8 % Accrued interest receivable 50,082 47,603 46,355 46,294

43,600 5.2 % 14.9 % Goodwill and intangible assets 531,556 531,556

531,556 531,556 531,556 0.0 % 0.0 % Other assets 614,853

637,610 616,362

620,059 617,818 -3.6 %

-0.5 %

Total Assets $ 20,062,860 $

19,647,435 $ 19,178,576 $ 18,944,247

$ 18,701,062 2.1 % 7.3 %

LIABILITIES AND

SHAREHOLDERS' EQUITY

Deposits $ 16,141,780 $ 15,357,361 $ 15,090,344 $ 15,012,864

$ 14,952,479 5.1 % 8.0 % Short-term borrowings 298,751 694,859

453,317 541,317 264,042 -57.0 % 13.1 % Other liabilities 358,384

365,484 342,323 339,548 389,819 -1.9 % -8.1 % FHLB advances and

long-term debt 1,038,159 1,037,961

1,137,909 929,403

965,286 0.0 % 7.5 %

Total

Liabilities 17,837,074 17,455,665 17,023,893 16,823,132

16,571,626 2.2 % 7.6 % Shareholders' equity 2,225,786

2,191,770 2,154,683

2,121,115 2,129,436

1.6 % 4.5 %

Total Liabilities and Shareholders'

Equity $ 20,062,860 $ 19,647,435 $

19,178,576 $ 18,944,247 $ 18,701,062

2.1 % 7.3 %

LOANS, DEPOSITS

AND SHORT-TERM BORROWINGS DETAIL:

Loans, by type: Real estate - commercial mortgage $

6,275,140 $ 6,262,008 $ 6,118,533 $ 6,018,582 $ 5,818,915 0.2 % 7.8

% Commercial - industrial, financial and agricultural 4,223,075

4,245,849 4,167,809 4,087,486 4,024,119 -0.5 % 4.9 % Real estate -

residential mortgage 1,887,907 1,784,712 1,665,142 1,601,994

1,542,696 5.8 % 22.4 % Real estate - home equity 1,567,473

1,579,739 1,595,901 1,625,115 1,640,421 -0.8 % -4.4 % Real estate -

construction 973,108 938,900 882,983 843,649 861,634 3.6 % 12.9 %

Consumer 302,448 283,156 288,826 291,470 283,673 6.8 % 6.6 %

Leasing and other 257,748 252,253

243,983 230,976

219,780 2.2 % 17.3 %

Total Loans,

net of unearned income $ 15,486,899 $ 15,346,617

$ 14,963,177 $ 14,699,272

$ 14,391,238 0.9 % 7.6 % Deposits, by type:

Noninterest-bearing demand $ 4,363,915 $ 4,574,619 $ 4,417,733 $

4,376,137 $ 4,210,099 -4.6 % 3.7 % Interest-bearing demand

4,119,419 3,650,204 3,702,663 3,703,712 3,703,048 12.9 % 11.2 %

Savings and money market accounts 4,790,985

4,386,128 4,251,574

4,179,773 4,235,015 9.2 % 13.1 %

Total demand and savings 13,274,319 12,610,951 12,371,970

12,259,622 12,148,162 5.3 % 9.3 % Brokered deposits 109,936 - - - -

0.0 % 0.0 % Time deposits 2,757,525

2,746,410 2,718,374

2,753,242 2,804,317 0.4 % -1.7 %

Total Deposits $ 16,141,780 $ 15,357,361

$ 15,090,344 $ 15,012,864

$ 14,952,479 5.1 % 8.0 % Short-term borrowings, by

type: Customer repurchase agreements $ 185,945 $ 174,224 $ 181,170

$ 195,734 $ 189,727 6.7 % -2.0 % Customer short-term promissory

notes 106,994 74,366 87,726 67,013 65,871 43.9 % 62.4 % Short-term

FHLB advances - 240,000 130,000 - - -100.0 % 0.0 % Federal funds

purchased 5,812 206,269

54,421 278,570

8,444 -97.2 % -31.2 %

Total Short-term

Borrowings $ 298,751 $ 694,859 $

453,317 $ 541,317 $ 264,042

-57.0 % 13.1 %

FULTON FINANCIAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

in thousands, except per-share data and percentages

Three Months Ended

% Change from Nine Months Ended Sep 30

Jun 30 Mar 31 Dec 31 Sep 30 Jun

30 Sep 30 Sep 30 2017

2017

2017

2016 2016

2017 2016 2017

2016 % Change Interest Income: Interest

income $ 171,511 $ 163,881 $ 158,487 $ 153,012 $ 151,468 4.7 % 13.2

% $ 493,879 $ 450,088 9.7 % Interest expense 24,702

22,318 20,908 20,775

20,903 10.7 % 18.2 % 67,928

61,553 10.4 %

Net Interest Income 146,809

141,563 137,579 132,237 130,565 3.7 % 12.4 % 425,951 388,535 9.6 %

Provision for credit losses 5,075 6,700

4,800 5,000 4,141 (24.3

%) 22.6 % 16,575 8,182 102.6 %

Net Interest Income after Provision 141,734 134,863 132,779

127,237 126,424 5.1 % 12.1 % 409,376 380,353 7.6 %

Non-Interest Income: Service charges on deposit accounts 13,022

12,914 12,400 12,814 13,078 0.8 % (0.4 %) 38,336 38,532 (0.5 %)

Other service charges and fees 12,251 14,342 12,437 13,333 14,407

(14.6 %) (15.0 %) 39,030 38,140 2.3 % Investment management and

trust services 12,157 12,132 11,808 11,610 11,425 0.2 % 6.4 %

36,097 33,660 7.2 % Mortgage banking income 4,805 6,141 4,596 6,959

4,529 (21.8 %) 6.1 % 15,542 12,456 24.8 % Other 5,142

5,406 4,326 6,514

4,708 (4.9 %) 9.2 % 14,874 13,610

9.3 %

Non-Interest Income before Investment Securities

Gains 47,377 50,935 45,567 51,230 48,147 (7.0 %) (1.6 %)

143,879 136,398 5.5 % Investment securities gains 4,597

1,436 1,106 1,525

2 N/M N/M 7,139 1,025 N/M

Total Non-Interest Income 51,974 52,371 46,673 52,755

48,149 (0.8 %) 7.9 % 151,018 137,423 9.9 % Non-Interest

Expense:

Salaries and employee benefits 72,894 74,496 69,236 73,256 70,696

(2.2 %) 3.1 % 216,626 210,097 3.1 % Net occupancy expense 12,180

12,316 12,663 11,798 11,782 (1.1 %) 3.4 % 37,159 35,813 3.8 % Data

processing and software 10,301 9,054 8,979 9,442 8,727 13.8 % 18.0

% 28,334 27,477 3.1 % Other outside services 6,582 7,708 5,546

6,536 5,783 (14.6 %) 13.8 % 19,836 17,347 14.3 % Amortization of

tax credit investments 3,503 3,151 998 - - 11.2 % 100.0 % 7,652 -

100.0 % Professional fees 3,388 2,931 2,737 2,783 2,535 15.6 % 33.6

% 9,056 8,221 10.2 % Equipment expense 3,298 3,034 3,359 3,408

3,137 8.7 % 5.1 % 9,691 9,380 3.3 % FDIC insurance expense 3,007

2,366 2,058 2,067 1,791 27.1 % 67.9 % 7,431 7,700 (3.5 %) Marketing

2,089 2,234 1,986 1,730 1,774 (6.5 %) 17.8 % 6,309 5,314 18.7 %

Other 14,915 15,405 14,713

16,601 13,623 (3.2 %) 9.5 %

45,033 40,549 11.1 %

Total

Non-Interest Expense 132,157 132,695

122,275 127,621 119,848

(0.4 %) 10.3 % 387,127 361,898

7.0 %

Income before Income Taxes 61,551 54,539 57,177

52,371 54,725 12.9 % 12.5 % 173,267 155,878 11.2 % Income tax

expense 12,646 9,072 13,797

10,221 13,257 39.4 % (4.6 %)

35,515 36,403 (2.4 %)

Net

Income $ 48,905 $ 45,467 $ 43,380 $ 42,150

$ 41,468 7.6 % 17.9 % $ 137,752 $ 119,475

15.3 %

PER

SHARE:

Net income: Basic $ 0.28 $ 0.26 $ 0.25 $ 0.24 $ 0.24 7.7 %

16.7 % $ 0.79 $ 0.69 14.5 % Diluted 0.28 0.26 0.25 0.24 0.24 7.7 %

16.7 % 0.78 0.69 13.0 % Cash dividends $ 0.11 $ 0.11 $ 0.11

$ 0.12 $ 0.10 - 10.0 % $ 0.33 $ 0.29 13.8 % Shareholders' equity

12.71 12.54 12.36 12.19 12.30 1.4 % 3.3 % 12.71 12.30 3.3 %

Shareholders' equity (tangible) 9.68 9.50 9.31 9.13 9.23 1.9 % 4.9

% 9.68 9.23 4.9 % Weighted average shares (basic) 174,991

174,597 174,150 173,554 173,020 0.2 % 1.1 % 174,582 173,248 0.8 %

Weighted average shares (diluted) 176,216 175,532 175,577 174,874

174,064 0.4 % 1.2 % 175,776 174,265 0.9 % Shares outstanding, end

of period 175,057 174,740 174,343 174,040 173,144 0.2 % 1.1 %

175,057 173,144 1.1 %

SELECTED

FINANCIAL RATIOS:

. Return on average assets 0.98 % 0.94 % 0.92 % 0.89 % 0.89 % 0.95

% 0.87 % Return on average shareholders' equity 8.76 % 8.36 % 8.22

% 7.86 % 7.78 % 8.45 % 7.64 % Return on average shareholders'

equity (tangible) 11.52 % 11.06 % 10.93 % 10.47 % 10.38 % 11.18 %

10.24 % Net interest margin 3.27 % 3.29 % 3.26 % 3.15 % 3.14 % 3.27

% 3.19 % Efficiency ratio 64.30 % 65.33 %

64.23 % 67.60 % 65.16 %

64.63 % 67.01 %

N/M - Not meaningful

FULTON FINANCIAL

CORPORATION CONDENSED CONSOLIDATED AVERAGE BALANCE SHEET

ANALYSIS (UNAUDITED) dollars in thousands

Three Months Ended September 30, 2017 June 30,

2017 September 30, 2016 Average Yield/

Average Yield/ Average Yield/

Balance Interest (1) Rate Balance

Interest (1) Rate Balance Interest (1)

Rate

ASSETS

Interest-earning assets: Loans, net of unearned income $

15,392,067 $ 159,454 4.12 % $ 15,127,205 $ 152,649 4.05 % $

14,212,250 $ 140,434 3.93 % Taxable investment securities 2,115,931

11,423 2.01 % 2,090,120 11,473 2.12 % 2,110,084 10,872 2.06 %

Tax-exempt investment securities 408,594 4,492 4.40 % 404,680 4,394

4.34 % 344,231 3,923 4.56 % Equity securities 8,709

143 6.52 % 10,759 148

5.52 % 14,209 196 5.50 %

Total Investment Securities 2,533,234 16,058 2.53 %

2,505,559 16,015 2.56 % 2,468,524 14,991 2.43 % Loans held

for sale 22,456 243 4.33 % 19,750 201 4.07 % 22,593 210 3.72 %

Other interest-earning assets 590,676 1,667

1.12 % 324,719 802 0.99 %

501,666 1,051 0.84 %

Total

Interest-earning Assets 18,538,433 177,422 3.80 % 17,977,233

169,667 3.78 % 17,205,033 156,686 3.63 % Noninterest-earning

assets: Cash and due from banks 101,643 103,078 101,927 Premises

and equipment 220,129 218,075 227,906 Other assets 1,186,622

1,174,745 1,219,844 Less: allowance for loan losses (174,101

) (172,156 ) (163,074 )

Total Assets $

19,872,726 $ 19,300,975 $ 18,591,636

LIABILITIES AND

SHAREHOLDERS' EQUITY

Interest-bearing liabilities: Demand deposits $ 3,943,118 $

3,847 0.39 % $ 3,690,059 $ 2,780 0.30 % $ 3,602,448 $ 1,706 0.19 %

Savings deposits 4,603,155 3,962 0.34 % 4,315,495 2,710 0.25 %

4,078,942 2,042 0.20 % Brokered deposits 89,767 277 1.23 % 0 - 0.00

% - - 0.00 % Time deposits 2,744,532 7,937

1.15 % 2,696,033 7,394 1.10 %

2,814,258 7,562 1.07 %

Total

Interest-bearing Deposits 11,380,572 16,023 0.56 % 10,701,587

12,884 0.48 % 10,495,648 11,310 0.43 % Short-term borrowings

402,341 578 0.57 % 633,102 974 0.61 % 426,369 254 0.23 % FHLB

advances and long-term debt 1,038,062 8,100

3.11 % 1,070,845 8,460 3.16 %

965,228 9,338 3.86 %

Total

Interest-bearing Liabilities 12,820,975 24,701 0.77 %

12,405,534 22,318 0.72 % 11,887,245 20,902 0.70 %

Noninterest-bearing liabilities: Demand deposits 4,494,897

4,387,517 4,227,639 Other 341,465 326,735

356,156

Total Liabilities

17,657,337 17,119,786 16,471,040 Shareholders' equity

2,215,389 2,181,189 2,120,596

Total Liabilities and Shareholders' Equity $

19,872,726 $ 19,300,975 $ 18,591,636

Net interest income/net interest margin (fully taxable equivalent)

152,721 3.27 % 147,349 3.29 % 135,784 3.14 % Tax equivalent

adjustment (5,912 ) (5,786 ) (5,219 )

Net interest income $ 146,809 $ 141,563 $ 130,565

(1) Presented on a fully taxable-equivalent basis using a

35% Federal tax rate and statutory interest expense disallowances.

Note: The weighted average interest rate on total average

interest-bearing liabilities and average non-interest bearing

demand deposits (“cost of funds”) was 0.57%, 0.53% and 0.52% for

the three months ended September 30, 2017, June 30, 2017 and

September 30, 2016, respectively.

AVERAGE LOANS,

DEPOSITS AND SHORT-TERM BORROWINGS DETAIL:

Three Months

Ended % Change from September 30 June

30 March 31 December 31 September 30

June 30 September 30 2017 2017

2017 2016 2016 2017 2016

Loans, by type: Real estate - commercial mortgage $ 6,208,630 $

6,163,844 $ 6,039,140 $ 5,828,313 $ 5,670,888 0.7 % 9.5 %

Commercial - industrial, financial and agricultural 4,257,075

4,221,025 4,205,070 4,081,498 4,066,275 0.9 % 4.7 % Real estate -

residential mortgage 1,841,559 1,707,929 1,637,669 1,572,895

1,503,209 7.8 % 22.5 % Real estate - home equity 1,569,898

1,587,680 1,613,249 1,633,668 1,640,913 (1.1 %) (4.3 %) Real estate

- construction 943,029 897,321 840,968 845,528 837,920 5.1 % 12.5 %

Consumer 318,546 300,967 284,352 289,864 281,517 5.8 % 13.2 %

Leasing and other 253,330 248,440 237,114

224,050 211,528 2.0 % 19.8 %

Total Loans,

net of unearned income $ 15,392,067 $ 15,127,205 $ 14,857,562 $

14,475,816 $ 14,212,250 1.8 % 8.3 % Deposits, by type:

Noninterest-bearing demand $ 4,494,897 $ 4,387,517 $ 4,301,727 $

4,331,894 $ 4,227,639 2.4 % 6.3 % Interest-bearing demand 3,943,118

3,690,059 3,650,931 3,714,391 3,602,448 6.9 % 9.5 % Savings and

money market accounts 4,603,155 4,315,495

4,194,216 4,216,090 4,078,942 6.7 % 12.9 % Total

demand and savings 13,041,170 12,393,071 12,146,874 12,262,375

11,909,029 5.2 % 9.5 % Brokered deposits 89,767 - - - - - - Time

deposits 2,744,532 2,696,033 2,739,453

2,777,203 2,814,258 1.8 % (2.5 %)

Total

Deposits $ 15,875,469 $ 15,089,104 $ 14,886,327 $ 15,039,578 $

14,723,287 5.2 % 7.8 % Short-term borrowings, by type:

Customer repurchase agreements $ 176,415 $ 199,657 $ 199,403 $

200,126 $ 187,587 (11.6 %) (6.0 %) Customer short-term promissory

notes 80,147 77,554 79,985 67,355 70,072 3.3 % 14.4 % Federal funds

purchased 90,453 242,375 308,220 40,613 148,546 (62.7 %) (39.1 %)

Short-term FHLB advances and other borrowings 55,326

113,516 124,889 - 20,163 (51.3 %) N/M

Total Short-term Borrowings $ 402,341 $ 633,102 $ 712,497 $

308,094 $ 426,368 (36.4 %) (5.6 %) N/M - Not meaningful

FULTON FINANCIAL

CORPORATION CONDENSED CONSOLIDATED AVERAGE BALANCE SHEET

ANALYSIS (UNAUDITED) dollars in thousands Nine Months

Ended September 30 2017 2016 Average

Average Balance Interest (1) Yield/Rate

Balance Interest (1) Yield/Rate

ASSETS

Interest-earning assets: Loans, net of unearned income $

15,127,569 $ 458,753 4.05 % $ 14,011,301 $ 416,646 3.97 % Taxable

investment securities 2,117,127 34,811 2.11 % 2,139,378 34,034 2.12

% Tax-exempt investment securities 405,728 13,268 4.36 % 306,298

10,631 4.63 % Equity securities 10,391 467

6.01 % 14,272 599 5.60 %

Total Investment Securities 2,533,246 48,546 2.56 %

2,459,948 45,264 2.45 % Loans held for sale 19,378 631 4.34

% 18,114 529 3.90 % Other interest-earning assets 410,250

3,311 1.08 % 406,163

2,813 0.92 %

Total Interest-earning Assets

18,090,443 511,241 3.78 % 16,895,526 465,252 3.68 %

Noninterest-earning assets: Cash and due from banks 107,029 100,417

Premises and equipment 218,700 227,237 Other assets 1,170,466

1,182,260 Less: allowance for loan losses (172,145 )

(164,999 )

Total Assets $ 19,414,493 $

18,240,441

LIABILITIES AND

SHAREHOLDERS' EQUITY

Interest-bearing liabilities: Demand deposits $ 3,762,439 $

8,865 0.32 % $ 3,498,659 $ 4,727 0.18 % Savings deposits 4,372,453

8,883 0.27 % 4,000,871 5,732 0.19 % Brokered deposits 30,251 277

1.23 % - - 0.00 % Time deposits 2,726,693

22,684 1.11 % 2,842,011 22,465

1.06 %

Total Interest-bearing Deposits 10,891,836

40,709 0.50 % 10,341,541 32,924 0.43 % Short-term borrowings

581,511 2,407 0.55 % 425,151 739 0.23 % FHLB advances and long-term

debt 1,033,159 24,812 3.21 %

962,997 27,889 3.86 %

Total

Interest-bearing Liabilities 12,506,506 67,928 0.73 %

11,729,689 61,552 0.70 % Noninterest-bearing liabilities:

Demand deposits 4,395,421 4,091,555 Other 333,250

329,315

Total Liabilities 17,235,177

16,150,559 Shareholders' equity 2,179,316

2,089,882

Total Liabilities and

Shareholders' Equity $ 19,414,493 $ 18,240,441

Net interest income/net interest margin (fully taxable

equivalent) 443,313 3.27 % 403,700 3.19 % Tax equivalent adjustment

(17,362 ) (15,165 ) Net interest income $

425,951 $ 388,535 (1) Presented on a fully

taxable-equivalent basis using a 35% Federal tax rate and statutory

interest expense disallowances. Note: The weighted average interest

rate on total average interest-bearing liabilities and average

non-interest bearing demand deposits (“cost of funds”) was 0.54%

and 0.52% for the nine months ended September 30, 2017 and 2016,

respectively.

AVERAGE LOANS,

DEPOSITS AND SHORT-TERM BORROWINGS DETAIL:

Nine Months Ended

September 30

2017 2016 % Change Loans, by type: Real

estate - commercial mortgage $ 6,137,824 $ 5,572,356 10.1 %

Commercial - industrial, financial and agricultural 4,227,918

4,080,638 3.6 % Real estate - residential mortgage 1,729,799

1,428,430 21.1 % Real estate - home equity 1,590,117 1,656,969 (4.0

%) Real estate - construction 894,146 817,014 9.4 % Consumer

301,414 272,402 10.7 % Leasing and other 246,351

183,492 34.3 %

Total Loans, net of unearned income $

15,127,569 $ 14,011,301 8.0 % Deposits, by type:

Noninterest-bearing demand $ 4,395,421 $ 4,091,555 7.4 %

Interest-bearing demand 3,762,439 3,498,659 7.5 % Savings and money

market accounts 4,372,453 4,000,871 9.3 % Total

demand and savings 12,530,313 11,591,085 8.1 % Brokered deposits

30,251 - - Time deposits 2,726,693 2,842,011 (4.1 %)

Total Deposits $ 15,287,257 $ 14,433,096 5.9 %

Short-term borrowings, by type: Customer repurchase agreements $

192,015 $ 179,892 6.7 % Customer short-term promissory notes 78,955

73,859 6.9 % Federal funds purchased 212,885 156,812 35.8 %

Short-term FHLB advances and other borrowings 97,656

14,588 N/M

Total Short-term Borrowings $ 581,511 $

425,151 36.8 % N/M - Not meaningful

FULTON FINANCIAL CORPORATION ASSET

QUALITY INFORMATION (UNAUDITED) dollars in thousands

Three Months Ended Nine Months Ended Sep

30 Jun 30 Mar 31 Dec 31 Sep 30

Sep 30 Sep 30 2017

2017 2017 2016

2016 2017

2016

ALLOWANCE FOR

CREDIT LOSSES:

Balance at beginning of period $ 174,998 $ 172,647 $

171,325 $ 165,169 $ 165,108 $ 171,325 $ 171,412 Loans

charged off: Commercial - industrial, financial and agricultural

(2,714 ) (5,353 ) (5,527 ) (1,319 ) (3,144 ) (13,594 ) (13,957 )

Consumer and home equity (920 ) (1,022 ) (1,554 ) (2,156 ) (1,394 )

(3,496 ) (5,556 ) Real estate - construction (2,744 ) (774 ) (247 )

0 (150 ) (3,765 ) (1,218 ) Real estate - commercial mortgage (483 )

(242 ) (1,224 ) (174 ) (1,350 ) (1,949 ) (3,406 ) Real estate -

residential mortgage (195 ) (124 ) (216 ) (116 ) (802 ) (535 )

(2,210 ) Leasing and other (739 ) (1,200 )

(639 ) (589 ) (832 ) (2,578 ) (3,226 )

Total loans charged off (7,795 ) (8,715 ) (9,407 ) (4,354 ) (7,672

) (25,917 ) (29,573 ) Recoveries of loans previously charged off:

Commercial - industrial, financial and agricultural 665 1,974 4,191

2,192 1,539 6,830 6,789 Consumer and home equity 445 685 373 580

463 1,503 1,886 Real estate - construction 629 373 548 1,080 898

1,550 2,844 Real estate - commercial mortgage 106 934 450 885 296

1,490 2,488 Real estate - residential mortgage 219 151 230 288 228

600 784 Leasing and other 407 249

137 485 168 793

357 Recoveries of loans previously charged off

2,471 4,366 5,929

5,510 3,592 12,766 15,148

Net loans (charged off) recovered (5,324 ) (4,349 ) (3,478 )

1,156 (4,080 ) (13,151 ) (14,425 ) Provision for credit losses

5,075 6,700 4,800 5,000 4,141 16,575 8,182

Balance at end of period $

174,749 $ 174,998 $ 172,647 $ 171,325 $

165,169 $ 174,749 $ 165,169 Net

charge-offs (recoveries) to average loans (annualized) 0.14

% 0.11 % 0.09 % (0.03 %) 0.11 %

0.12 % 0.14 %

NON-PERFORMING

ASSETS:

Non-accrual loans $ 123,345 $ 122,600 $ 117,264 $ 120,133 $

124,017 Loans 90 days past due and accruing 13,124

13,143 14,268 11,505

14,095 Total non-performing loans 136,469 135,743

131,532 131,638 138,112 Other real estate owned 10,542

11,432 11,906 12,815

11,981

Total non-performing

assets $ 147,011 $ 147,175 $ 143,438 $

144,453 $ 150,093

NON-PERFORMING

LOANS, BY TYPE:

Commercial - industrial, financial and agricultural $ 54,209

$ 51,320 $ 43,826 $ 43,460 $ 47,330 Real estate - commercial

mortgage 34,650 32,576 36,713 39,319 39,631 Real estate -

residential mortgage 21,643 21,846 23,597 23,655 23,451 Real estate

- construction 13,415 16,564 13,550 9,842 11,223 Consumer and home

equity 12,472 13,156 13,408 15,045 16,426 Leasing 80

281 438 317 51

Total non-performing loans $ 136,469 $

135,743 $ 131,532 $ 131,638 $ 138,112

TROUBLED DEBT

RESTRUCTURINGS (TDRs), BY TYPE:

Real-estate - residential mortgage $ 26,193 $ 26,368 $

27,033 $ 27,617 $ 26,854 Real-estate - commercial mortgage 14,439

13,772 15,237 15,957 16,085 Consumer and home equity 14,822 12,064

9,638 8,633 7,707 Commercial - industrial, financial and

agricultural 7,512 8,086 7,441 6,627 7,488 Real estate -

construction 169 1,475 273

726 843 Total accruing TDRs

63,135 61,765 59,622 59,560 58,977 Non-accrual TDRs (1)

28,742 29,373 27,220

27,850 27,904

Total TDRs $ 91,877

$ 91,138 $ 86,842 $ 87,410 $ 86,881

(1) Included within non-accrual loans above.

Total Delinquency %

DELINQUENCY

RATES, BY TYPE:

Sep 30 Jun 30 Mar 31 Dec 31 Sep

30 2017 2017

2017 2016 2016

Real estate - commercial mortgage 0.75 % 0.66 % 0.78

% 0.78 % 0.87 % Commercial - industrial, financial and agricultural

1.54 % 1.43 % 1.25 % 1.31 % 1.48 % Real estate - construction 1.50

% 1.82 % 1.99 % 1.29 % 1.61 % Real estate - residential mortgage

2.25 % 2.08 % 2.44 % 2.74 % 2.67 % Consumer, home equity, leasing

and other 1.38 % 1.34 % 1.22 % 1.45 %

1.53 %

Total 1.28 % 1.20 % 1.23

% 1.27 % 1.38 %

ASSET QUALITY

RATIOS:

Sep 30 Jun 30 Mar 31 Dec 31 Sep

30 2017 2017

2017 2016 2016

Non-accrual loans to total loans 0.80 % 0.80 % 0.78 %

0.82 % 0.86 % Non-performing loans to total loans 0.88 % 0.88 %

0.88 % 0.90 % 0.96 % Non-performing assets to total loans and OREO

0.95 % 0.96 % 0.96 % 0.98 % 1.04 % Non-performing assets to total

assets 0.73 % 0.75 % 0.75 % 0.76 % 0.80 % Allowance for credit

losses to loans outstanding 1.13 % 1.14 % 1.15 % 1.17 % 1.15 %

Allowance for credit losses to non-performing loans 128.05 % 128.92

% 131.26 % 130.15 % 119.59 %

Non-performing assets to tangible common

shareholders' equity and allowance for credit losses

7.87 % 8.02 % 7.99 % 8.20 % 8.51 %

FULTON FINANCIAL

CORPORATION RECONCILIATION OF NON-GAAP MEASURES

(UNAUDITED) in thousands, except per share data and

percentages

Explanatory

note:

This press release contains supplemental financial information, as

detailed below, which has been derived by methods other than

Generally Accepted Accounting Principles ("GAAP"). The Corporation

has presented these non-GAAP financial measures because it believes

that these measures provide useful and comparative information to

assess trends in the Corporation's results of operations.

Presentation of these non-GAAP financial measures is consistent

with how the Corporation evaluates its performance internally and

these non-GAAP financial measures are frequently used by securities

analysts, investors and other interested parties in the evaluation

of companies in the Corporation's industry. Management believes

that these non-GAAP financial measures, in addition to GAAP

measures, are also useful to investors to evaluate the

Corporation's results. Investors should recognize that the

Corporation's presentation of these non-GAAP financial measures

might not be comparable to similarly-titled measures of other

companies. These non-GAAP financial measures should not be

considered a substitute for GAAP basis measures, and the

Corporation strongly encourages a review of its condensed

consolidated financial statements in their entirety.

Reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP measure follow:

Three Months Ended Nine

Months Ended September 30 June 30 March 31

December 31 September 30 September 30

September 30 2017 2017

2017 2016

2016 2017 2016

Shareholders'

equity (tangible), per share

Shareholders' equity $ 2,225,786 $ 2,191,770 $ 2,154,683 $

2,121,115 $ 2,129,436 Less: Goodwill and intangible assets

(531,556 ) (531,556 ) (531,556 ) (531,556 )

(531,556 ) Tangible shareholders' equity (numerator) $

1,694,230 $ 1,660,214 $ 1,623,127 $ 1,589,559

$ 1,597,880 Shares outstanding, end of period

(denominator) 175,057 174,740

174,343 174,040 173,144

Shareholders' equity (tangible), per share $ 9.68 $ 9.50

$ 9.31 $ 9.13 $ 9.23

Return on average

shareholders' equity (tangible)

Net Income - Numerator $ 48,905 $ 45,467 $ 43,380

$ 42,150 $ 41,468 $ 137,752 $ 119,475

Average shareholders' equity $ 2,215,389 $ 2,181,189

$ 2,140,547 $ 2,132,655 $ 2,120,596 $ 2,179,316 $ 2,089,882 Less:

Average goodwill and intangible assets (531,556 )

(531,556 ) (531,556 ) (531,556 ) (531,556 )

(531,556 ) (531,556 ) Average tangible shareholders'

equity (denominator) $ 1,683,833 $ 1,649,633 $

1,608,991 $ 1,601,099 $ 1,589,040 $ 1,647,760

$ 1,558,326 Return on average shareholders'

equity (tangible), annualized 11.52 % 11.06 %

10.93 % 10.47 % 10.38 % 11.18 % 10.24 %

Efficiency

ratio

Non-interest expense $ 132,157 $ 132,695 $ 122,275 $ 127,621 $

119,848 $ 387,127 $ 361,898 Less: Amortization of tax credit

investments (1) (3,503 ) (3,151 ) (998 )

- - (7,652 ) -

Non-interest expense - Numerator $ 128,654 $ 129,544

$ 121,277 $ 127,621 $ 119,848 $ 379,475

$ 361,898 Net interest income (fully taxable

equivalent) $ 152,721 $ 147,349 $ 143,243 $ 137,571 $ 135,784 $

443,313 $ 403,700 Plus: Total Non-interest income 51,974 52,371

46,673 52,755 48,149 151,018 137,423 Less: Investment securities

gains (4,597 ) (1,436 ) (1,106 ) (1,525

) (2 ) (7,139 ) (1,025 ) Denominator $ 200,098

$ 198,284 $ 188,810 $ 188,801 $ 183,931

$ 587,192 $ 540,098 Efficiency ratio

64.30 % 65.33 % 64.23 % 67.60 %

65.16 % 64.63 % 67.01 %

Non-performing

assets to tangible shareholders' equity and allowance for credit

losses

Non-performing assets (numerator) $ 147,011 $ 147,175

$ 143,438 $ 144,453 $ 150,093 Tangible

shareholders' equity $ 1,694,230 $ 1,660,214 $ 1,623,127 $

1,589,559 $ 1,597,880 Plus: Allowance for credit losses

174,749 174,998 172,647

171,325 165,169 Tangible shareholders' equity

and allowance for credit losses (denominator) $ 1,868,979 $

1,835,212 $ 1,795,774 $ 1,760,884 $ 1,763,049

Non-performing assets to tangible shareholders'

equity and allowance for credit losses 7.87 % 8.02 %

7.99 % 8.20 % 8.51 %

Pre-provision net

revenue

Net interest income $ 146,809 $ 141,563 $ 137,579 $ 132,237 $

130,565 $ 425,951 $ 388,535 Non-interest income 51,974 52,371

46,673 52,755 48,149 151,018 137,423 Less: Investment securities

gains (4,597 ) (1,436 ) (1,106 ) (1,525

) (2 ) (7,139 ) (1,025 ) Total revenue $

194,186 $ 192,498 $ 183,146 $ 183,467 $

178,712 $ 569,830 $ 524,933

Non-interest expense $ 132,157 $ 132,695 $ 122,275 $ 127,621 $

119,848 $ 387,127 $ 361,898 Less: Amortization of tax credit

investments (1) $ (3,503 ) (3,151 ) (998 ) -

- (7,652 ) - Total

non-interest expense $ 128,654 $ 129,544 $ 121,277

$ 127,621 $ 119,848 $ 379,475 $ 361,898

Pre-provision net revenue $ 65,532 $ 62,954

$ 61,869 $ 55,846 $ 58,864 $ 190,355

$ 163,035 (1) Amortization expense for tax credit

investments that are considered to be affordable housing projects

under applicable accounting guidance is included in income taxes.

Amortization expense for other tax credit investments that are not

considered to be affordable housing projects is included in

non-interest expense.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171017006594/en/

Fulton Financial CorporationMedia

Contact:Stacey Karshin, 717-291-2739orInvestor

Contact:Jason Weber, 717-327-2394

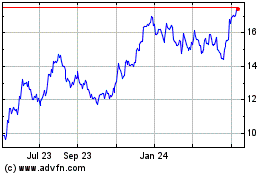

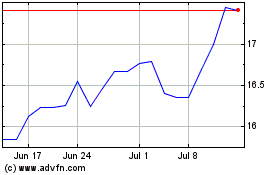

Fulton Financial (NASDAQ:FULT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fulton Financial (NASDAQ:FULT)

Historical Stock Chart

From Apr 2023 to Apr 2024