CSX Chief Vows to Win Back Lost Business After Service Woes

October 17 2017 - 2:07PM

Dow Jones News

By Paul Ziobro

CSX Corp. Chief Executive Hunter Harrison said the railway

expects to win back any market share lost during the summer and

sought to reassure investors that service problems were

resolved.

Speaking Tuesday on the company's third-quarter earnings call,

Mr. Harrison once again blamed poor execution of his so-called

precision scheduled railroading plan for congestion, delays and

erratic service in July and August. Customers scrambled to ship

goods by truck and, where possible, a competing railroad to keep

orders flowing and factories running.

Mr. Harrison said that any lost business should shift back

"immediately" once the service is sorted out.

"This is about who's got the best product, who's got the lowest

price," Mr. Harrison said. "We think we're going to be there."

The service problems hit a number of industries including

producers of chemicals and coals, auto manufacturers and food

companies, and culminated in a hearing before federal railroad

regulators last week.

They also softened third-quarter results, as revenue rose just

1% in the period as pricing rose 3.5% on a slight increase in

volume. Earnings rose to $459 million, or 51 cents a share,

matching the average forecast by analysts.

The company did back its forecast for the year, which was

lowered last month to account for the service problems and

weather-related impacts. Shares of CSX rose 1.6% Tuesday afternoon

to $53.68, leaving them up nearly 50% on the year.

CSX is making some changes in the wake of the problems. Mr.

Harrison said the railway "changed some procedure" in response to a

major derailment in Pennsylvania that occurred along a steep

stretch of track. Mr. Harrison also has reinstituted so-called

"Hunter Camps," workshops where he teaches CSX personnel about his

railroad operating philosophy.

Mr. Harrison and other top CSX executives will look to share a

deeper outline of the long-term plans for the railway later this

month during a daylong investor conference.

The company may also offer more clues into one of the top

concerns for investors: succession planning. The 72-year-old Mr.

Harrison frequently uses an oxygen tank to manage an undisclosed

medical condition. Analysts say much of the fortunes of CSX are

tied to Mr. Harrison overseeing the turnaround as well as

identifying a suitable candidate to take the reins when his term is

up.

"I am hopeful that maybe we can give you more insight at the

analyst meeting, but I'm not sure of that," Mr. Harrison said,

adding that succession planning is "something that we will stay on

top of and grind away at."

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

October 17, 2017 13:52 ET (17:52 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

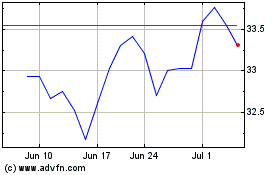

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024