|

Prospectus Supplement

|

Filed pursuant to Rule 424(b)(5)

|

|

(To Prospectus dated October 15, 2015)

|

Registration No. 333-207304

|

CASI Pharmaceuticals,

Inc.

7,951,865 Shares of Common Stock

Warrants to Purchase 1,638,506 Shares

of Common Stock

We are offering up to 7,951,865shares of

our common stock and warrants to purchase up to1,638,506 shares of our common stock (and the shares of common stock issuable from

time to time upon exercise of the warrants). For each share of common stock you purchase you will receive a warrant to purchase

0.20 shares of common stock. The accompanying warrants will be exercisable for two years, beginning six months from the date

of issuance, and have an exercise price of $3.75 per share. The shares of common stock and the accompanying warrants

are immediately separable and will be issued separately, but will be purchased together in this offering. We will also issue

to our placement agent a warrant to purchase up to 48,133 shares of common stock at an exercise price of $3.75 per share. The placement

agent’s warrant will be exercisable for one year, beginning six months after the date of issuance. There will be no public

market for the accompanying warrants.

Our common stock is listed on The NASDAQ

Capital Market and traded under the symbol “CASI”. The consolidated closing bid price of our common stock

on The NASDAQ Capital Market on October 12, 2017 was $3.61 per share.

We have retained H.C. Wainwright & Co.,

LLC (“Wainwright”) as our exclusive placement agent to use its best efforts to solicit offers to purchase our securities

in this offering. See “Plan of Distribution” beginning on page S-13 of this prospectus supplement for more information

regarding these arrangements.

Investing in our common stock involves

a high degree of risk. See “Risk Factors” beginning on page S-4 of this prospectus supplement and under the heading

“Item 1A. Risk Factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2016, for a discussion

of certain material factors that you should consider in connection with an investment in our securities.

|

|

|

Per share of

common stock and accompanying warrant

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

3.0000

|

|

|

$

|

23,855,595

|

|

|

Placement agent’s fees

(1)

|

|

$

|

0.0295

|

|

|

$

|

234,650

|

|

|

Proceeds, before expenses, to CASI Pharmaceuticals, Inc.

(2)

|

|

$

|

2.9705

|

|

|

$

|

23,620,945

|

|

(1) The per share fee is based

on a fee equal to 6.5% of the gross proceeds from the sale of the securities in this offering, excluding any gross proceeds from

any China focused investors and other investors introduced by the Company. We will also issue to Wainwright a warrant to purchase

up to 48,133 shares of common stock at an exercise price of $3.75 per share of common stock and reimburse the expenses of Wainwright

in an amount up to $85,000. Wainwright is not required to sell any specific number or dollar amount of shares of common stock or

warrants but will use its best efforts to sell the securities offered. See “Plan of Distribution” on page S-13 for

a further description of the compensation payable to Wainwright and other estimated offering expenses incurred in connection with

this offering.

(2) We estimate that the total

expenses related to this offering will be approximately $250,000.

Neither the Securities and Exchange

Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

We

expect to deliver the securities being offered pursuant to this prospectus supplement beginning on or about October 17, 2017

on

a staggered basis as investors’ funds are received.

H.C. WAINWRIGHT & CO.

October 13, 2017

Table of Contents

Accompanying Prospectus

About This Prospectus Supplement

This prospectus supplement supplements the

accompanying prospectus filed with our registration statement on Form S-3 (File No. 333-207304) as part of a “shelf”

registration process. Under the shelf registration process, we may offer to sell common stock, warrants and units, from time to

time in one or more offerings up to a total dollar amount of $30,000,000.

This prospectus supplement describes the

specific terms of this offering and the accompanying prospectus gives more general information, some of which may not apply to

this offering. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand,

and the information contained in the accompanying prospectus or any document incorporated by reference therein, on the other hand,

you should rely on the information contained in this prospectus supplement.

Unless otherwise mentioned or unless the

context requires otherwise, all references in this prospectus supplement and the accompanying prospectus to “the Company,”

“CASI,” “we,” “us,” “our,” or similar references mean CASI Pharmaceuticals, Inc.,

a Delaware corporation.

We have not authorized any broker, dealer,

salesperson or other person to give any information or to make any representation other than those contained or incorporated by

reference in this prospectus supplement and the accompanying prospectus. You must not rely upon any information or representation

not contained or incorporated by reference in this prospectus supplement or the accompanying prospectus. This prospectus supplement

and the accompanying prospectus do not constitute an offer to sell, or the solicitation of an offer to buy, securities in any jurisdiction

where, or to any person to whom, it is unlawful to make such offer or solicitation. You should not assume that the information

contained in this prospectus supplement and the accompanying prospectus is accurate on any date subsequent to the date set forth

on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the

date of the document incorporated by reference, even if this prospectus supplement and any accompanying prospectus are delivered

or any security is sold on a later date.

Prospectus Supplement Summary

This summary highlights selected information

about us, this offering and information appearing elsewhere in this prospectus supplement, in the accompanying prospectus and in

the documents we incorporate by reference. This summary is not complete and does not contain all the information you should consider

before investing in our securities pursuant to this prospectus supplement and the accompanying prospectus. You should carefully

read this entire prospectus supplement and the accompanying prospectus, including the information referred to under the heading

“Risk Factors” in this prospectus supplement and the financial statements and other information that we incorporated

by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision.

About CASI Pharmaceuticals, Inc.

We are a late-stage biopharmaceutical company

focused on the acquisition, development, and commercialization of innovative therapeutics addressing cancer and other unmet medical

needs for the global market, with a focus on China and the U.S. We are a NASDAQ-listed company, headquartered in Rockville, Maryland

with a wholly owned subsidiary and R&D operations in Beijing, China.

Our mission is to become an integrated biopharmaceutical

company with significant market share in China, while establishing partnerships for global development and commercialization. Part

of our strategy is to leverage our expertise and resources in North America and China to bring safer, more effective, and/or easier-to-use

drugs to patients and to develop them more cost-effectively and faster using our unique dual development approach.

We have a strong and growing product pipeline,

and will continue to (i) seek to acquire additional drug candidates through in-license and acquisitions, and (ii) explore drug

candidates in preclinical development.

Our product pipeline features (1) EVOMELA®,

MARQIBO® and ZEVALIN®, all U.S. Food and Drug Administration (FDA) approved drugs in-licensed from Spectrum Pharmaceuticals,

Inc. (“Spectrum”) for China regional rights, and currently in various stages in the regulatory and clinical process

for market approval in China, (2) our proprietary drug candidate, ENMD-2076, ongoing in one Phase 2 clinical study, and (3) CASI-001

and CASI-002, proprietary preclinical candidates in immuno-oncology.

Our principal offices are located at 9620

Medical Center Drive, Suite 300, Rockville, Maryland 20850, and our telephone number is (240) 864-2600. Additional information

concerning us can be found in our periodic filings with the SEC, which are available on our website at http://www.casipharmaceuticals.com

and on the SEC’s website at www.sec.gov. The information on our web site is not deemed to be part of this prospectus.

The Offering

|

Common stock offered by us

|

|

7,951,865 shares

|

|

|

|

|

|

Common stock to be outstanding upon completion of this offering

|

|

68,148,439 shares

|

|

|

|

|

|

Warrants

|

|

Warrants to purchase up to 1,590,373 shares of common stock will be offered in this offering. Each warrant, other than the warrant we issue to Wainwright, may be exercised at any time during the two-year period beginning six months after the date of issuance, at an exercise price of $3.75 per share of common stock. In connection with this offering, we will also issue to Wainwright, our placement agent, a warrant to purchase up to 48,133 shares of common stock at an exercise price of $3.75 per share of common stock (the “Agent’s Warrant”). The Agent’s Warrant may be exercised at any time during the one year period beginning six months after the date of issuance and will expire on April 17, 2019. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the warrants. The Agent’s Warrant and shares of common stock underlying the Agent’s Warrant are included in this prospectus supplement.

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net proceeds received from the sale of securities to support our business development activities, advance the development of our pipeline, and for other general corporate purposes. See “Use of Proceeds” on page S-9.

|

|

|

|

|

|

Risk factors

|

|

See “Risk Factors,” beginning on page S-4 and under the heading “Item 1A. Risk Factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2016, for a discussion of factors you should consider carefully before deciding to invest in our common stock and warrants to purchase our common stock.

|

|

|

|

|

|

NASDAQ Capital Market symbol for common stock

|

|

Our common stock is quoted and traded on The NASDAQ Capital Market under the symbol “CASI.” However, there is no established public trading market for the offered warrants, and we do not expect a market to develop. In addition, we do not intend to apply to list the warrants on any securities exchange. The warrants are immediately separable from the shares of common stock.

|

The information above regarding outstanding

shares of our common stock is based on 60,196,574 shares of common stock outstanding as of June 30, 2017 and excludes the following

shares of common stock:

|

|

·

|

9,747,004 shares of common stock issuable upon the exercise of stock options outstanding as of June 30, 2017 with a weighted-average exercise price of $1.51 per share;

|

|

|

·

|

6,388,501 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2017 with a weighted-average exercise price of $1.63 per share;

|

|

|

·

|

4,850,358 shares of common stock reserved for future awards under our 2011 Long-Term Incentive Plan, as of June 30, 2017;

|

|

|

|

|

|

|

·

|

1,590,373 shares of our common stock issuable upon the exercise of warrants to be issued in this offering at an exercise price of $3.75 per share; and

|

|

|

·

|

48,133 shares of our common stock issuable upon the exercise of the Agent’s Warrant to be issued in this offering at an exercise price of $3.75 per share.

|

Risk Factors

An investment in our securities involves

significant risk. You should consult with your own financial and legal advisor as to the risk involved in an investment in our

common stock and warrants and to determine whether our common stock and warrants is a suitable investment for you. Our common stock

and warrants may not be a suitable investment if you are unsophisticated about equity securities. Before investing in our common

stock and warrants, you should consider carefully the risks and uncertainties described below and the information set forth under

the heading “Item 1A. Risk Factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2016,

as such discussion may be amended or updated in other reports filed with the SEC, and which are incorporated by reference into

this prospectus supplement and accompanying prospectus. Additional risks and uncertainties of which we are unaware or that we currently

believe are immaterial could also materially adversely affect our business, financial condition or results of operations. In any

case, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Related to Our Business, Our Financial Results and

Our Need for Financing

We have a history of losses and anticipate future losses

and may never become profitable on a sustained basis.

To date, we have been engaged primarily

in research and development activities. Although in the past we have received limited revenues on royalties from the sales of pharmaceuticals,

license fees and research and development funding from a former collaborator and limited revenues from certain research grants,

we have not derived significant revenues from operations.

We have experienced losses in each year

since inception. Through June 30, 2017, we had an accumulated deficit of approximately $446 million. We will seek to raise capital

to continue our operations and although we have been successfully funded to date through the sales of our equity securities and

through limited royalty payments, there is no assurance that our capital-raising efforts will be able to attract the funding needed

to sustain our operations. If we are unable to obtain additional funding for operations, we may not be able to continue operations

as proposed, requiring us to modify our business plan, curtail various aspects of our operations or cease operations. In any such

event, investors may lose a portion or all of their investment.

We expect that our ongoing clinical and

corporate activities will result in operating losses for the foreseeable future before we commercialize any products, if ever.

In addition, to the extent we rely on others to develop and commercialize our products, our ability to achieve profitability will

depend upon the success of these other parties. To support our research and development of certain product candidates, we may seek

and rely on cooperative agreements from governmental and other organizations as a source of support. If a cooperative agreement

were to be reduced to any substantial extent, it may impair our ability to continue our research and development efforts. Even

if we do achieve profitability, we may be unable to sustain or increase it.

We are uncertain whether additional funding will be available

for our future capital needs and commitments, and if we cannot raise additional funding, or access the credit Markets, we may be

unable to complete development of our product candidates.

We will require substantial funds in addition

to our existing working capital to develop our product candidates and otherwise to meet our business objectives. We have never

generated sufficient revenue during any period since our inception to cover our expenses and have spent, and expect to continue

to spend, substantial funds to continue our clinical development programs. Any one of the following factors, among others, could

cause us to require additional funds or otherwise cause our cash requirements in the future to increase materially:

|

|

·

|

progress of our clinical trials or correlative studies;

|

|

|

·

|

results of clinical trials;

|

|

|

·

|

changes in or terminations of our relationships with strategic partners;

|

|

|

·

|

changes in the focus, direction, or costs of our research and development programs;

|

|

|

·

|

competitive and technological advances;

|

|

|

·

|

establishment of marketing and sales capabilities;

|

|

|

·

|

the regulatory approval process; or

|

At June 30, 2017, we had cash and cash equivalents

of approximately $23.4 million. We may continue to seek additional capital through public or private financing or collaborative

agreements in 2017 and beyond. Our operations require significant amounts of cash. We may be required to seek additional capital

for the future growth and development of our business. We can give no assurance as to the availability of such additional capital

or, if available, whether it would be on terms acceptable to us. In addition, we may continue to seek capital through the public

or private sale of securities, if market conditions are favorable for doing so. If we are successful in raising additional funds

through the issuance of equity securities, stockholders will likely experience substantial dilution. If we are not successful in

obtaining sufficient capital because we are unable to access the capital markets on favorable terms, it could reduce our research

and development efforts and materially adversely affect our future growth, results of operations and financial results.

Risks Related to our Common Stock and the Offering

The market price of our common stock may be highly volatile

or may decline regardless of our operating performance.

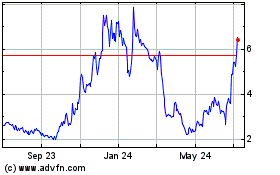

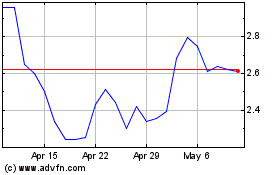

Our common stock price has fluctuated from

year-to-year and quarter-to-quarter and will likely continue to be volatile. Year-to-date 2017, our stock price has ranged from

$0.91 to $3.64. We expect that the trading price of our common stock is likely to be highly volatile in response to factors

that are beyond our control. The valuations of many biotechnology companies without consistent product revenues and earnings

are extraordinarily high based on conventional valuation standards, such as price to earnings and price to sales ratios. These

trading prices and valuations may not be sustained. In the future, our operating results in a particular period may not meet

the expectations of any securities analysts whose attention we may attract, or those of our investors, which may result in a decline

in the market price of our common stock. Any negative change in the public’s perception of the prospects of biotechnology

companies could depress our stock price regardless of our results of operations. These factors may materially and adversely

affect the market price of our common stock.

Our largest holders of common stock may have different

interests than our other stockholders.

A small number of our stockholders hold

a significant amount of our outstanding common stock. These stockholders may have interests that are different from the interests

of our other stockholders. We cannot assure that our largest stockholders will not seek to influence our business in a manner that

is contrary to our goals or strategies or the interests of our other stockholders. In addition, the significant concentration of

ownership in our common stock may adversely affect the trading price for our common stock because investors often perceive disadvantages

in owning stock in companies with significant stockholders. Our largest stockholders, if they acted together, could significantly

influence all matters requiring approval by our stockholders, including the election of directors and the approval of mergers or

other business combination transactions. Our largest stockholders together may be able to determine all matters requiring stockholder

approval.

Investors in this offering will experience immediate and

substantial dilution.

The public offering price of our common

stock is substantially higher than the net tangible book value per share of our common stock. Therefore, if you purchase shares

of our common stock in this offering, you will incur immediate and substantial dilution in the pro forma net tangible book value

per share of common stock from the price per share that you pay for the common stock. See “Dilution.”

Additionally, Spectrum has a contingent

right to purchase shares of our common stock at par value ($0.01 per share) in order to maintain its post-investment equity ownership

percentage as of September 17, 2014, which was 16.66%, if we issue securities (subject to a limited exception for certain equity

compensation grants) in the future. This right expires upon the earliest of (1) the date on which we have raised, in the aggregate,

$50 million in net proceeds through capital raising activities or (2) September 17, 2019 (subject to extension for certain outstanding

derivative securities). In 2016, Spectrum exercised its contingent right and purchased 4,623,197 shares of our common stock.

We may require additional capital in the future, which

may not be available to us on favorable terms; issuances of our equity securities to provide this capital may dilute your ownership

in us.

We may need to raise additional funds through

public or private debt or equity financings in order to:

|

|

·

|

take advantage of expansion opportunities;

|

|

|

·

|

acquire complementary businesses or technologies;

|

|

|

·

|

develop new services and products; or

|

|

|

·

|

respond to competitive pressures.

|

Any additional capital raised through the

issuance of our equity securities may dilute your percentage ownership interest in us. Furthermore, any additional financing we

may need may not be available on terms favorable to us or at all. The unavailability of needed financing could adversely affect

our ability to execute our growth strategy.

Sales of substantial amounts of our common stock or the

perception that such sales may occur could cause the market price of our common stock to drop significantly, even if our business

is performing well.

The market price of our common stock could

decline as a result of sales by, or the perceived possibility of sales by, our existing stockholders of shares of our common stock

in the market after this offering. These sales might also make it more difficult for us to sell equity securities at a time and

price that we deem appropriate, or at all. In addition, we have filed resale shelf registration statements to register shares of

our common stock that may be sold by certain of our stockholders, which may increase the likelihood of sales, or the perception

of an increased likelihood of sales, by our existing stockholders of shares of our common stock.

We will have broad discretion in how we use the proceeds

of this offering, and we may not use these proceeds effectively, which could affect our results of operations and cause our stock

price to decline.

We will have considerable discretion in

the application of the net proceeds of this offering. We currently intend to use the net proceeds of this offering to support our

business development activities, advance development of our pipeline, and for other general corporate purposes. However, our management

has broad discretion over how these proceeds are used and could spend the proceeds in ways with which you may not agree. We may

not invest the proceeds of this offering effectively or in a manner that yields a favorable or any return, and consequently, this

could result in financial losses that could have a material and adverse effect on our business, cause the price of our common stock

to decline or delay the development of our product candidates.

The obligations of the purchasers of the shares of common

stock and accompanying warrants are several and not joint and closing of the transactions may occur on a staggered basis.

Each purchaser entered into a separate stock

purchase agreement with us and their obligations for payment are several and not joint. Consequently, while we expect closing to

occur on or about October 17, 2017, we cannot guarantee that all purchasers will have made payment by such date and additional

closings may occur on a staggered basis as we receive the funds from such purchasers.

There is no public market for the warrants to purchase

common stock in this offering.

There is no established public trading market

for the warrants being sold in this offering, and we do not expect a market to develop. In addition, we do not intend to apply

to list the warrants on any securities exchange. Without an active market, the liquidity of the warrants will be limited.

Because we do not expect to pay dividends in the foreseeable

future, you must rely on the possibility of stock appreciation for any return on your investment.

We have paid no cash dividends on any of

our capital stock to date, and we currently intend to retain our future earnings, if any, to fund the development and growth of

our business. As a result, we do not expect to pay any cash dividends in the foreseeable future, and payment of cash dividends,

if any, will also depend on our financial condition, results of operations, capital requirements and other factors and will be

at the discretion of our board of directors. Furthermore, we are subject to various laws and regulations that may restrict our

ability to pay dividends and we may in the future become subject to contractual restrictions on, or prohibitions against, the

payment of dividends. Accordingly, the success of your investment in our common stock will likely depend entirely upon any future

appreciation. There is no guarantee that our common stock will appreciate in value after the offering or even maintain the price

at which you purchased your shares, therefore, you may not realize a return on your investment in our common stock and you may

lose your entire investment in our common stock.

Special Note Regarding Forward-Looking

Statements

This prospectus supplement contains and

incorporates by reference certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements also may be included in other statements that we make. All statements that are not descriptions

of historical facts are forward-looking statements. These statements can generally be identified by the use of forward-looking

terminology such as “believes,” “expects,” “intends,” “may,” “will,”

“should,” or “anticipates” or similar terminology. These forward-looking statements include, among others,

statements regarding the timing of our clinical trials, our cash position and future expenses, and our future revenues.

Forward-looking statements are subject to

numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they

are made, and we assume no duty to update forward-looking statements. New factors emerge from time to time, and it is not possible

for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent

to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statements.

Actual results could differ materially from

those currently anticipated due to a number of factors, including: the risk that we may be unable to continue as a going concern

as a result of our inability to raise sufficient capital for our operational needs; the possibility that we may be delisted from

trading on the Nasdaq Capital Market; the volatility in the market price of our common stock; risks relating to interests of our

largest stockholders that differ from our other stockholders; the risk of substantial dilution of existing stockholders in future

stock issuances; the difficulty of executing our business strategy in China; our inability to enter into strategic partnerships

for the development, commercialization, manufacturing and distribution of our proposed product candidates or future candidates;

risks relating to the need for additional capital and the uncertainty of securing additional funding on favorable terms; risks

associated with our product candidates; risks associated with any early-stage products under development; the risk that results

in preclinical models are not necessarily indicative of clinical results; uncertainties relating to preclinical and clinical trials,

including delays to the commencement of such trials; the lack of success in the clinical development of any of our products; dependence

on third parties; and risks relating to the commercialization, if any, of our proposed products (such as marketing, safety, regulatory,

patent, product liability, supply, competition and other risks). risks relating to interests of our largest stockholders that differ

from our other stockholders. Such factors, among others, could have a material adverse effect upon our business, results of operations

and financial condition. We caution readers not to place undue reliance on any forward-looking statements, which only speak as

of the date made. Additional information about the factors and risks that could affect our business, financial condition and results

of operations, are contained in our filings with the SEC, which are available at www.sec.gov.

You are encouraged to review the Risk Factors

included in this prospectus supplement and under the heading “Item 1A. Risk Factors” in our annual report on Form 10-K

for the fiscal year ended December 31, 2016 and our other filings with the SEC.

Use of Proceeds

We estimate that the net proceeds we will

receive from this offering will be approximately $23.4 million after deducting the placement agent’s fees and other estimated

offering related expenses.

We will retain broad discretion over the

use of the net proceeds from the sale of our common stock offered hereby. We currently anticipate using the net proceeds

from this offering to support our business development activities, advance the development of our pipeline, and for general corporate

purposes.

The timing and amount of our actual expenditures

will be based on many factors, including progress in, and the costs of, our clinical trials and research and development programs,

our ability to identify collaborators for our product candidates, our ability to negotiate and enter into definitive agreements

with any such collaborators and the amount and timing of revenues, if any, from future collaborations. We therefore cannot estimate

the amount of net proceeds to be used for all of the purposes described above. Until we use the net proceeds of this offering for

the above purposes, we intend to invest the funds in short-term, investment grade, interest-bearing securities. We cannot predict

whether the proceeds invested will yield a favorable return.

Dilution

Our net tangible book value on June 30,

2017 was approximately $17,026,000, or approximately $0.28 per share of common stock. Net tangible book value per share as of any

date is determined by dividing our net tangible book value, which consists of tangible assets less total liabilities, by the number

of shares of common stock outstanding on that date. Without taking into account any other changes in our net tangible book value

after June 30, 2017 other than to give effect to our receipt of the estimated net proceeds (after payment of the placement

agent fees and our estimated offering expenses) from the sale by us of 7,951,865 shares of common stock and accompanying warrants

to purchase 1,590,373 shares of common stock at an offering price of $3.00 per share and accompanying warrants (and excluding any

shares of common stock issued and any proceeds received upon exercise of the warrants), our net tangible book value as of June

30, 2017, after giving effect to the items above, would have been approximately $40,396,000, or $0.59 per share of common stock.

This represents an immediate increase in net tangible book value of $0.31 per share of common stock to our existing stockholders

and an immediate dilution in net tangible book value of $2.41 per share of common stock to purchasers of common stock and accompanying

warrants in this offering.

The following table illustrates this calculation

in a per share basis:

|

Public offering price per share of common stock and accompanying warrant

|

|

$

|

3.00

|

|

|

Net tangible book value per share as of June 30, 2017

|

|

$

|

0.28

|

|

|

Increase in net tangible book value per share attributable to this offering

|

|

$

|

0.31

|

|

|

Pro forma net tangible book value per share as of June 30, 2017, after giving effect to this offering

|

|

$

|

0.59

|

|

|

Dilution per share to investors in this offering

|

|

$

|

2.41

|

|

The above table is based on 60,196,574 shares

of our common stock outstanding as of June 30, 2017 and excludes, as of June 30, 2017:

|

|

·

|

6,388,501 shares of common stock issuable upon the exercise of warrants outstanding prior to

this offering;

|

|

|

·

|

1,638,506 shares of common stock issuable upon the exercise of warrants to be issued pursuant

to this offering;

|

|

|

·

|

9,747,004 shares of common stock issuable upon the exercise of stock options outstanding prior

to this offering under our equity incentive plans; and

|

|

|

·

|

4,850,358 shares of common stock available for future grants under our 2011 Long-Term Incentive

Plan.

|

To the extent that any of these options

or warrants are exercised, new options are issued under our equity incentive plans or we otherwise issue additional shares of common

stock in the future, there will be further dilution to the new investors.

Description of Securities We Are Offering

Common Stock

The material terms and provisions of our

common stock are described under the caption “Description of Common Stock” starting on page 6 of the accompanying

prospectus.

Warrants

The material terms and provisions of

the accompanying warrants being offered with each share of common stock pursuant to this prospectus supplement are summarized below.

The form of warrant will be provided to each purchaser in this offering and will be included as an exhibit to a Current Report

on filed Form 8-K with the SEC in connection with this offering.

Form.

The accompanying

warrants, none of which have been issued as of the date of this prospectus supplement, will be issued as individual warrant

agreements to the investors.

Exercisability.

The accompanying

warrants are exercisable beginning six months after their issuance, expected to be April 17, 2018, and at any time up to the date

that is two years after the warrants become exercisable, expected to be April 17, 2020. The warrants will be exercisable,

at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice accompanied by payment in

full for the number of shares of our common stock purchased upon such exercise. No fractional shares of common stock will be issued

in connection with the exercise of a warrant. In lieu of fractional shares, we will pay the holder either a cash adjustment in

respect of such fraction in an amount equal to the fraction multiplied by the exercise price of the warrant, or round up to the

nearest whole share. Under certain conditions, the warrants will be exercisable on a cashless “net” basis. If, as of

the date of this prospectus supplement, a holder does not beneficially own more than 9.99% of the total number of issued and outstanding

shares, then the number of warrant shares that may be acquired by any holder upon any exercise of the warrant will be limited to

the extent necessary to insure that, following such exercise (or other issuance), the total number of shares of common stock then

beneficially owned by such holder and its affiliates and any other persons whose beneficial ownership of common stock would be

aggregated with the holder’s for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, does not exceed

4.99% (or 9.99% in the case of certain holders) of the total number of issued and outstanding shares of common stock (including

for such purpose the shares of common stock issuable upon such exercise), or beneficial ownership limitation. The holder may elect

to change this beneficial ownership limitation from 4.99% to 9.99% of the total number of issued and outstanding shares of common

stock (including for such purpose the shares of common stock issuable upon such exercise) upon 61 days’ prior written notice.

Exercise Price.

Each accompanying

warrant represents the right to purchase of shares of common stock at an exercise price equal to $3.75 per share, subject to adjustment

as described below. The exercise price is subject to appropriate adjustment in the event of certain stock dividends and distributions,

stock splits, stock combinations, reclassifications or similar events affecting our common stock.

Transferability.

Subject

to applicable laws, the warrants may be offered for sale, sold, transferred or assigned without our consent.

Exchange Listing.

There

is no established public trading market for the warrants, and we do not expect a market to develop. We do not intend to apply to

list the warrants on any securities exchange. Without an active market, the liquidity of the warrants will be limited. In addition,

in the event our common stock price does not exceed the per share exercise price of the warrants during the period when the warrants

are exercisable, the warrants will not have any value.

Rights as a Stockholder.

Except

as otherwise provided in the warrants or by virtue of such holder’s ownership of shares of our common stock, the holder of

a warrant does not have the rights or privileges of a holder of our common stock, including any voting rights, until the holder

exercises the warrant.

Authorization of Shares upon Exercise.

The shares of common stock issuable on exercise of the warrants will be, when issued in accordance with the warrants, duly

and validly authorized, issued and fully paid and non-assessable. We will authorize and reserve at least that number of shares

of common stock equal to the number of shares of common stock issuable upon exercise of all outstanding warrants.

Agent’s Warrant

The material terms and provisions of

the Agent’s Warrant being offered pursuant to this prospectus supplement are summarized below. The Agent’s Warrant

will be provided to Wainwright and included as an exhibit to a Current Report on Form 8-K filed with the SEC in connection with

this offering.

The Agent’s Warrant

will be issued on substantially the same terms as the warrants issued to purchasers of the common stock and the accompanying warrants,

except (i) the Agent’s Warrant will contain certain restrictions required by the Financial Industry Regulatory Authority

(“FINRA”), as described under “Plan of Distribution” below and (ii) will expire on April 17, 2019, the

one year anniversary of the Agent’s Warrant becoming exercisable.

Plan of Distribution

Pursuant to a letter agreement, dated as

of October 12, 2017, by and between the us and Wainwright, (the “Engagement Agreement”), we have engaged Wainwright

to act as our exclusive placement agent in connection with our offering of the common stock and the accompanying warrants in a

proposed takedown from our shelf registration statement pursuant to this prospectus supplement and the accompanying prospectus.

The Engagement Agreement does not give rise to any commitment by Wainwright to purchase any of our shares of common stock or warrants,

and Wainwright will have no authority to bind us to sell securities by virtue of the agreement. Further, Wainwright does not guarantee

that it will be able to raise new capital in any prospective offering.

We have entered into a securities purchase

agreement directly with each purchaser in connection with this offering. Our obligation to issue and sell common stock and accompanying

warrants to the purchasers is subject to the conditions set forth in the purchase agreement. We will deliver the warrants to the

investors by a physical warrant certificate. A purchaser’s obligation to purchase common stock and accompanying warrants

is subject to the conditions set forth in its, his or her purchase agreement as well, which may also be waived.

We will deliver the shares of common stock

being issued to each purchaser electronically, or if requested, by physical stock certificate, upon receipt of purchaser funds

for the purchase of the shares of our common stock offered pursuant to this prospectus supplement. We expect that our transfer

agent will deliver the shares of our common stock being offered pursuant to this prospectus supplement beginning on or about October

17, 2017 on a staggered basis as investors’ funds are received. See “Risk Factors — The obligations of the purchasers

of the shares of common stock and accompanying warrants are several and not joint and closing of the transactions may occur on

a staggered basis.” Additionally, at least one investor will make payment in form of renminbi to our local Chinese subsidiary.

We have agreed to pay Wainwright a fee equal

to 6.5% of the gross proceeds from the sale of the securities in this offering, excluding any investment made by any China focused

investors and other investors introduced by the Company, or approximately $234,650. In addition, we will issue to Wainwright the

Agent’s Warrant, a warrant to purchase the number of shares equal to 4% of the shares of our common stock sold pursuant to

this prospectus supplement, excluding any investment made by any China focused investors and other investors introduced by the

Company, with an exercise price equal to $3.75 per share. The Agent’s Warrant will be exercisable beginning six months after

the date of issuance and will expire on April 17, 2019, the one-year anniversary of the warrant becoming exercisable. Pursuant

to FINRA Rule 5110(g)(1), neither the Agent’s Warrant nor any shares of common stock issued upon exercise of the Agent’s

Warrant may be sold, transferred, assigned, pledged, or hypothecated, or be subject to any hedging, short sale, derivative, put,

or call transaction that would result in the effective economic disposition of such securities by any person for a period of 180

days immediately following the date of effectiveness or commencement of sales of this offering, except the transfer of any security:

(i) by operation of law or by reason of reorganization, (ii) to any FINRA member firm participating in the offering and the officers

and partners thereof, if all securities so transferred remain subject to the lock-up restriction described above for the remainder

of the time period, (iii) if the aggregate amount of our securities held by Wainwright or related person does not exceed 1% of

the securities being offered, (iv) that is beneficially owned on a pro-rata basis by all equity owners of an investment fund, provided

that no participating member manages or otherwise directs investments by the fund, and participating members in the aggregate do

not own more than 10% of the equity in the fund, or (v) the exercise or conversion of any security, if all securities received

remain subject to the lock-up restriction set forth above for the remainder of the time period. We have also agreed to reimburse

Wainwright (i) 35,000 for non-accountable expenses and (ii) $50,000 for fees and expenses of legal counsel and other out-of-pocket

expenses.

Under no circumstances will the fee, commission

or discount received by Wainwright or any member of FINRA or any independent broker-dealer exceed 8% of the gross proceeds to us

in this offering.

We have agreed to indemnify Wainwright against

certain civil liabilities, including certain liabilities under the Securities Act of 1933, as amended (the “Securities Act”),

and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and to contribute to payments that Wainwright

may be required to make in respect of such liabilities.

The Engagement Agreement will be included

as an exhibit to the Current Report on Form 8-K that we will file with the SEC and will be incorporated by reference into the registration

statement of which this prospectus supplement forms a part.

Wainwright may be deemed to be an underwriter

within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it might be deemed to be underwriting

discounts or commissions under the Securities Act. As an underwriter, Wainwright would be required to comply with the requirements

of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5

and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares of common

stock and warrants by Wainwright acting as principal. Under these rules and regulations, Wainwright:

|

|

●

|

may not engage in any stabilization activity in connection with our securities; and

|

|

|

●

|

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed its participation in the distribution.

|

The estimated offering expenses payable

by us, in addition to the fee of $234,650 due to Wainwright, are approximately $250,000, which includes our legal, accounting and

filing costs, and various other fees associated with registering the securities and listing the common stock and certain expenses

we have agreed to reimburse Wainwright in an amount up to $85,000. After deducting certain fees due to Wainwright and our estimated

offering expenses, we expect the net proceeds from this offering to be approximately $23.4 million (excluding any shares of common

stock issued and any proceeds received upon exercise of the warrants).

The foregoing does not purport to be a complete

statement of the terms and conditions of the securities purchase agreement or warrants. A copy of the Agent’s Warrant, the

form of securities purchase agreement with the investors and the form of warrant will be included as exhibits to our current report

on Form 8-K that will be filed with the SEC and incorporated by reference into the Registration Statement of which this prospectus

supplement forms a part.

The transfer agent for our common stock

is American Stock Transfer & Trust Company.

Our common stock is traded on The NASDAQ

Capital Market under the symbol “CASI.”

The purchase price per share was determined

based on negotiations with investors and discussions with Wainwright.

Legal Matters

The validity of the issuance of the securities

offered hereby has been passed upon by Arnold & Porter Kaye Scholer LLP, Washington, D.C.

Experts

CohnReznick LLP (“CohnReznick”),

an independent registered public accounting firm, has audited our consolidated financial statements included in our Annual Report

on Form 10-K for the year ended December 31, 2016, as set forth in their report, which is incorporated by reference herein. Our

financial statements are incorporated by reference in reliance on CohnReznick’s report, given on their authority as experts

in accounting and auditing.

Where You Can Find More Information

We have filed with the SEC a registration

statement under the Securities Act that registers the distribution of the securities offered under this prospectus supplement.

The registration statement, including the attached exhibits and schedules and the information incorporated by reference, contains

additional relevant information about us and the securities. The rules and regulations of the SEC allow us to omit from this prospectus

supplement certain information included in the registration statement.

In addition, we file annual, quarterly and

special reports, proxy statements and other information with the SEC. You may read and copy this information and the registration

statement at the SEC public reference room located at Public Reference Room of the SEC at 100 F Street, N.E., Washington, D.C.

20549. Please call the SEC at 1-800-SEC-0330 for more information about the operation of the public reference room.

In addition, the SEC maintains an Internet

site that contains reports, proxy statements and other information about issuers of securities, like us, who file such material

electronically with the SEC. The address of that web site is http://www.sec.gov. We also maintain a web site at http://www.casipharmaceuticals.com,

which provides additional information about our company. The material on our website is not a part of this prospectus supplement

or the accompanying prospectus.

Incorporation of Certain Information

by Reference

The SEC allows us to incorporate by reference

the information that we file with the SEC, which means that we can disclose important information to you by referring you to those

documents. The information incorporated by reference is considered to be part of this prospectus supplement. These documents may

include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K,

as well as Proxy Statements. Any documents that we subsequently file with the SEC will automatically update and replace the information

previously filed with the SEC. Thus, for example, in the case of a conflict or inconsistency between information set forth in this

prospectus supplement and information incorporated by reference into this prospectus supplement, you should rely on the information

contained in the document that was filed later.

This prospectus supplement incorporates

by reference the documents listed below that we previously have filed with the SEC and any additional documents that we may file

with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act between the date of this prospectus supplement and the

termination of the offering of the securities. These documents contain important information about us.

|

|

·

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, filed with the SEC

on March 31, 2017;

|

|

|

·

|

Our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2017, and

June 30, 2017 filed with the SEC on May 15, 2017, and August 14, 2017, respectively;

|

|

|

·

|

Our Current Reports on Form 8-K filed with the SEC on September 7, 2017 and June 9, 2017; and

|

|

|

·

|

The description of the Company’s common stock contained in the Company’s Registration

Statement on Form 8-A filed with the SEC under the Exchange Act on May 14, 1996, including any amendment or report filed for

the purpose of updating such description.

|

You can obtain a copy of any or all of the

documents incorporated by reference in this prospectus supplement (other than an exhibit to a document unless that exhibit is specifically

incorporated by reference into that document) from the SEC on its web site at http://www.sec.gov. You also can obtain these documents

from us without charge by visiting our web site at http://www.casipharmaceuticals.com or by requesting them in writing, by email

or by telephone at the following address:

Cynthia W. Hu

Chief Operating Officer, General Counsel

and Secretary

CASI Pharmaceuticals, Inc.

9620 Medical Center Drive, Suite 300

Rockville, Maryland 20850

(240) 864-2600

ir@casipharmaceuticals.com

We have authorized no one to provide you with any information

that differs from that contained in this prospectus supplement or the accompanying prospectus. Accordingly, you should not rely

on any information that is not contained in this prospectus supplement or the accompanying prospectus.

PROSPECTUS

CASI PHARMACEUTICALS, INC.

$30,000,000

Common Stock

Warrants to Purchase Common Stock

Units

We may offer and sell from time to time shares

of common stock or warrants to purchase shares of common stock either individually or in units. We may also offer common stock

upon exercise of warrants. We may sell any combination of the above described securities, either individually or in units, in one

or more offerings in amounts, at prices and on terms determined at the time of the offering. We refer to the shares of common stock,

warrants to purchase shares of common stock and units collectively as the “securities.”

This prospectus also may be used in connection

with the issuance of up to 2,309,162 shares of common stock upon the exercise of outstanding warrants.

This prospectus provides you with a general

description of the securities that we may offer. This prospectus may not be used to consummate sales of securities unless accompanied

by a prospectus supplement. Each time we sell securities, we will provide a prospectus supplement that will contain specific information

about the terms of that offering. The prospectus supplement may also add information or update information contained in this prospectus.

You should read both this prospectus and any prospectus supplement together with the documents incorporated by reference and described

under the heading “Where You Can Find More Information” before you make your investment decision.

An investment in the securities offered

under this prospectus involves a high degree of risk. You should carefully consider the risk factors described in the applicable

prospectus supplement and certain of our filings with the Securities and Exchange Commission, as described under “Risk Factors ”

on page 4.

The aggregate market value of our outstanding

common stock held by non-affiliates is $21,682,764, based on 32,445,811 shares of outstanding common stock as of October 2, 2015,

of which 20,264,265 were held by non-affiliates, and a per share price of $1.07 based on the closing sale price of our common stock

on October 2, 2015. We have not offered any securities pursuant to General Instruction I.B.6. of Form S-3 during the prior

12 calendar month period that ends on and includes the date of this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is

October 15, 2015.

TABLE OF CONTENTS

About This Prospectus

This prospectus is part of a “shelf”

registration statement we filed with the Securities and Exchange Commission, or the SEC. By using a shelf registration statement,

we may offer to sell any one or more or a combination of the securities described in this prospectus from time to time for an aggregate

offering price of up to $30,000,000.

You should rely only on the information contained

in or specifically incorporated by reference into this prospectus or a prospectus supplement. No dealer, sales person, agent or

other individual has been authorized to give any information or to make any representations not contained in this prospectus. If

given or made, such information or representations must not be relied upon as having been authorized by us.

This prospectus does not constitute an offer

to sell, or a solicitation of an offer to buy, the securities offered hereby in any jurisdiction where, or to any person to whom,

it is unlawful to make such offer or solicitation.

We may sell securities to underwriters who

will sell the securities to the public on terms fixed at the time of sale. In addition, the securities may be sold by us directly

or through dealers or agents designated from time to time. If we, directly or through agents, solicit offers to purchase the securities,

we reserve the sole right to accept and, together with any agents, to reject, in whole or in part, any of those offers.

Any prospectus supplement will contain the

names of the underwriters, dealers or agents, if any, together with the terms of offering, the compensation of those underwriters

and the net proceeds to us. Any underwriters, dealers or agents participating in the offering may be deemed “underwriters”

within the meaning of the Securities Act of 1933, as amended, or the Securities Act.

We have not taken any action to permit a

public offering of the shares of common stock outside the United States or to permit the possession or distribution of this prospectus

outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves

about and observe any restrictions relating to the offering of the shares of common stock and the distribution of this prospectus

outside of the United States.

The information contained in this prospectus

is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of securities.

Neither the delivery of this prospectus nor any sale made hereunder shall, under any circumstances, create an implication that

there has not been any change in the facts set forth in this prospectus or in our affairs since the date of this prospectus.

Special Note Regarding Forward-Looking

Statements

This prospectus contains and incorporates

certain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange

Act of 1934, as amended, or the Exchange Act. Forward-looking statements also may be included in other statements that we make.

All statements that are not descriptions of historical facts are forward-looking statements. These statements can generally be

identified by the use of forward-looking terminology such as “believes,” “expects,” “intends,”

“may,” “will,” “should,” or “anticipates” or similar terminology. These forward-looking

statements include, among others, statements regarding the timing of our clinical trials, our cash position and future expenses,

and our future revenues.

Our forward-looking statements are based

on information available to us today, and we will not update these statements.

Actual results could differ materially from

those currently anticipated due to a number of factors, including: the risk that we may be unable to continue as a going concern

as a result of our inability to raise sufficient capital for our operational needs; the possibility that we may be delisted from

trading on the Nasdaq Capital Market; the volatility in the market price of our common stock; the difficulty of executing our business

strategy in China; our inability to enter into strategic partnerships for the development, commercialization, manufacturing and

distribution of our proposed product candidates or future candidates; risks relating to the need for additional capital and the

uncertainty of securing additional funding on favorable terms; risks associated with our product candidates; risks associated with

any early-stage products under development; the risk that results in preclinical models are not necessarily indicative of clinical

results; uncertainties relating to preclinical and clinical trials, including delays to the commencement of such trials; the lack

of success in the clinical development of any of our products; dependence on third parties; risks relating to the commercialization,

if any, of our proposed products (such as marketing, safety, regulatory, patent, product liability, supply, competition and other

risks); risks relating to interests of our largest stockholders that differ from our other stockholders; and the risk of substantial

dilution of existing stockholders in future stock issuances. Such factors, among others, could have a material adverse effect upon

our business, results of operations and financial condition. We caution readers not to place undue reliance on any forward-looking

statements, which only speak as of the date made. Additional information about the factors and risks that could affect our business,

financial condition and results of operations, are contained in our filings with the SEC, which are available at

www.sec.gov

.

About CASI Pharmaceuticals, Inc.

We are a biopharmaceutical company focused

on the acquisition, development and commercialization of innovative therapeutics addressing cancer and other unmet medical needs

with a strategic commercial focus on the greater China market. Our mission is to deliver pharmaceutical drugs to patients with

unmet medical needs in China directly, and in the rest of the world by establishing partnerships for global development and commercialization.

We intend to become fully integrated with drug development and commercial operations.

We employ a diversified and risk-managed

approach to our pipeline that includes (1) internal development of our lead proprietary drug candidate, ENMD-2076, leveraging resources

and dual development in North America and China, (2) in-license or acquisition of late-stage clinical drug candidates, such

as ZEVALIN

®

, MARQIBO

®

, and CE Melphalan for the greater China market, and (3) internal development

of new drug candidates with clinically proven targets using our proprietary new drug delivery technology platform. Through partnerships,

collaborations and strategic acquisitions, we intend to add additional drug candidates to our pipeline. The Company uses a market-oriented

approach to identify pharmaceutical candidates that it believes have the potential for gaining widespread market acceptance, either

globally or in China, and for which development can be accelerated under the Company’s drug development strategy.

Our lead internal drug candidate is ENMD-2076,

a selective Aurora A and angiogenic kinase inhibitor for the treatment of cancer, which we will continue to develop with approval

by the Food and Drug Administration (FDA). In parallel, we will include ENMD-2076 in clinical sites in China as an import drug

as well as develop ENMD-2076 in China locally under the China Food and Drug Administration (CFDA).

In September 2014, we acquired from Spectrum

Pharmaceuticals, Inc. and certain of its affiliates (together referred to as “Spectrum”) exclusive rights in greater

China (including Taiwan, Hong Kong and Macau) to three in-licensed oncology products, including ZEVALIN

®

(ibritumomab

tiuxetan) approved in the U.S. for advanced non-Hodgkin’s lymphoma, MARQIBO

®

(vinCRIStine sulfate LIPOSOME

injection) approved in the U.S. for advanced adult Ph- acute lymphoblastic leukemia (ALL), as well as EVOMELA™ (CE-Melphalan

HCI for injection), which is the subject of a New Drug Application filed by Spectrum and accepted by the FDA in March 2015 with

a PDUFA date of October 23, 2015. We have initiated the regulatory and development process to obtain marketing approval for ZEVALIN

and MARQIBO in our territorial region, and have initiated commercial activities of ZEVALIN in Hong Kong. We will continue to seek

to expand our pipeline by acquiring additional drug candidates through in-license and acquisitions.

Our pipeline also includes drug candidates

with clinically proven targets that we are internally developing under the Company’s new drug delivery technology platform.

We intend to advance clinical development

of our drugs and drug candidates, and the implementation of our plans will include leveraging our resources in both the United

States and China. In order to capitalize on the drug development and capital resources available in China, the Company is doing

business in China through its wholly-owned Chinese subsidiary that will execute the China portion of the Company’s drug development

strategy, including conducting clinical trials in China, pursuing local funding opportunities and strategic collaborations, and

implementing the Company’s plan for development and commercialization in the China market.

Our principal offices are located at 9620

Medical Center Drive, Suite 300, Rockville, Maryland 20850, and our telephone number is (240) 864-2600. Additional information

concerning us can be found in our periodic filings with the SEC, which are available on our website at http://www.casipharmaceuticals.com

and on the SEC’s website at www.sec.gov. The information on our website is not deemed to be part of this prospectus.

Risk Factors

An investment in our securities involves

a high degree of risk. Before you decide whether to purchase any of our securities, in addition to the other information in this

prospectus and the accompanying prospectus supplement, you should carefully consider the risk factors set forth under the heading

“Risk Factors” in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, which are

incorporated by reference into this prospectus, as the same may be updated from time to time by our future filings under the Securities

Exchange Act of 1934, as amended, or the Securities Exchange Act. For more information, see the section entitled “Incorporation

by Reference.” The risks and uncertainties we have described are not the only ones facing our company. Additional risks and

uncertainties not presently known to us or that we currently consider immaterial may also affect our business operations. To the

extent that a particular offering implicates additional significant risks, we will include a discussion of those risks in the applicable

prospectus supplement.

Use of Proceeds

Except as may be otherwise set forth in the

prospectus supplement accompanying this prospectus, we will use the net proceeds we receive from sales of the securities offered

hereby for general corporate purposes, including support for our continuing research and development, commercialization activities,

business development activities, and, if opportunities arise, acquisitions of businesses, products, technologies or licenses that

are complementary to our business, although we have no current plans, commitments or agreements with respect to any acquisitions

as of the date of this prospectus.

Plan of Distribution

We may sell the securities offered through

this prospectus in any one or more of the following ways:

|

|

·

|

directly to investors or purchasers;

|

|

|

·

|

to investors through agents;

|

|

|

·

|

to or through brokers or dealers;

|

|

|

·

|

to the public through underwriting syndicates led by one or more managing underwriters;

|

|

|

·

|

to one or more underwriters acting alone for resale to investors or to the public;

|

|

|

·

|

through a block trade in which the broker or dealer engaged to handle the block trade will attempt to sell the securities as

agent, but may position and resell a portion of the block as principal to facilitate the transaction; and

|

|

|

·

|

through a combination of any such methods of sale.

|

Securities may also be issued upon exercise

of warrants. We reserve the right to sell securities directly to investors on our own behalf in those jurisdictions where we are

authorized to do so.

The securities may be distributed at a

fixed price or prices, which may be changed; market prices prevailing at the time of sale; prices related to the prevailing market

prices; or negotiated prices.

The prospectus supplement will, where applicable:

|

|

·

|

describe the terms of the offering;

|

|

|

·

|

identify any underwriters, dealers or agents;

|

|

|

·

|

identify any managing underwriter or underwriters;

|

|

|

·

|

provide purchase price of the securities;

|

|

|

·

|

provide the net proceeds from the sale of the securities;

|

|

|

·

|

describe any delayed delivery arrangements;

|

|

|

·

|

describe any underwriting discounts, commissions and other items constituting underwriters’ compensation;

|

|

|

·

|

describe any initial public offering price;

|

|

|

·

|

describe any discounts or concessions allowed or reallowed or paid to dealers; and

|

|

|

·

|

describe any commissions paid to agents.

|

Sale Through Underwriters or Dealers

If underwriters are used in the sale, the

underwriters will acquire the securities for their own account, including through underwriting, purchase, security lending or repurchase

agreements with us. The underwriters may resell the securities from time to time in one or more transactions, including negotiated

transactions. Underwriters may sell the securities in order to facilitate transactions in any of our other securities (described

in this prospectus or otherwise), including other public or private transactions and short sales. Underwriters may offer securities

to the public either through underwriting syndicates represented by one or more managing underwriters or directly by one or more

firms acting as underwriters. Unless otherwise indicated in the prospectus supplement, the obligations of the underwriters to purchase

the securities will be subject to certain conditions, and the underwriters will be obligated to purchase all the offered securities

if they purchase any of them. The underwriters may change from time to time any initial public offering price and any discounts

or concessions allowed or reallowed or paid to dealers.

If dealers are used in the sale of securities

offered through this prospectus, we will sell the securities to them as principals. They may then resell those securities to the

public at varying prices determined by the dealers at the time of resale. The prospectus supplement will include the names of the

dealers and the terms of the transaction.

Direct Sales and Sales Through Agents

We may sell the securities offered through

this prospectus. In this case, no underwriters or agents would be involved. Such securities may also be sold through agents designated

from time to time. The prospectus supplement will name any agent involved in the offer or sale of the offered securities and will

describe any commissions payable to the agent. Unless otherwise indicated in the prospectus supplement, any agent will agree to

use its reasonable best efforts to solicit purchases for the period of its appointment.

We may sell the securities directly to

institutional investors or others who may be deemed to be underwriters within the meaning of the Securities Act with respect to

any sale of those securities. The terms of any such sales will be described in the prospectus supplement.

Delayed Delivery Contracts

If the prospectus supplement indicates,

we may authorize agents, underwriters or dealers to solicit offers from certain types of institutions to purchase securities at

the public offering price under delayed delivery contracts. These contracts would provide for payment and delivery on a specified

date in the future. Delayed delivery contracts will be subject only to those conditions set forth in each applicable prospectus

supplement, and each prospectus supplement will set forth any commissions we pay for solicitation of these contracts.

“At the Market” Offerings

We may from time to time engage a firm

to act as our agent for one or more offerings of our securities. We sometimes refer to this agent as our “offering agent.”

If we reach agreement with an offering agent with respect to a specific offering, including the number of securities and any minimum

price below which sales may not be made, than the offering agent will try to sell such securities on the agreed terms. The offering

agent could make sales in privately negotiated transactions or any other method permitted by law, including sales deemed to be

an “at the market” offering as defined in Rule 415 promulgated under the Securities Act, including sales made

directly on the The Nasdaq Capital Market, or sales made to or through a market maker other than on an exchange. The offering agent

will be deemed to be an “underwriter” within the meaning of the Securities Act with respect to any sales effected through

an “at the market” offering.

Market Making, Stabilization and Other Transactions

Unless the applicable prospectus supplement

states otherwise, each series of offered securities will be a new issue and will have no established trading market. We may elect

to list any series of offered securities on an exchange. Any underwriters that we use in the sale of offered securities may make

a market in such securities, but may discontinue such market making at any time without notice. Therefore, we cannot assure you

that the securities will have a liquid trading market.

To the extent permitted by and in accordance

with Regulation M under the Exchange Act in connection with an offering an underwriter may engage in over-allotments, stabilizing

transactions, short covering transactions and penalty bids. Over-allotments involve sales in excess of the offering size, which

creates a short position. Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids

do not exceed a specified maximum. Short covering transactions involve purchases of the securities in the open market after the