Hilltop Holdings and PlainsCapital Bank Awarded Investment Grade Ratings from Kroll Bond Rating Agency

October 16 2017 - 8:00AM

Business Wire

Hilltop Holdings Inc. (NYSE: HTH), a Dallas-based financial

holding company, today announced that the company and its

subsidiary PlainsCapital Bank (the “Bank”) received investment

grade ratings with a stable outlook from Kroll Bond Rating Agency

("KBRA").

KBRA assigned Hilltop a senior unsecured debt rating of A-,

making it the highest-rated bank holding company with over $5

billion in assets in the agency’s universe of rated Texas-based

banks to date. Hilltop also was assigned a subordinated debt rating

of BBB+ and a short-term debt rating of K2. In addition, KBRA

assigned the Bank deposit and senior unsecured debt ratings of A, a

subordinated debt rating of A-, and short-term deposit and debt

ratings of K1. The outlook on all long-term ratings was noted as

stable.

KBRA said the ratings are supported by Hilltop’s comparatively

strong earnings performance, highly diversified revenue mix, strong

capital position, diversified funding mix, and favorable asset

quality metrics and loss history. The agency also noted the

considerable acquisition experience of Hilltop’s management

team.

“We’re very pleased to receive this recognition from KBRA, which

reflects the strength and stability of our franchise,” said Jeremy

B. Ford, president and co-CEO of Hilltop. “As Hilltop continues to

seek to build the premier financial services holding company based

in Texas, these investment grade ratings are important indicators

of our progress.”

The rating agency also cited the strength of Hilltop’s four

operating businesses, including: the strong positioning of the

Bank; the robust and low-risk mortgage flow business and sufficient

scale of PrimeLending; the well-positioned broker-dealer franchise,

HilltopSecurities; and, the strongly-capitalized niche insurance

company, National Lloyds.

“In assigning these most recent ratings, KBRA highlights the

complementary nature of our subsidiaries and the mix of revenue

streams that support Hilltop’s ongoing forward momentum,” said Alan

B. White, vice-chairman and co-CEO of Hilltop.

A copy of the full report is available from Kroll Bond Rating

Agency’s website.

The KBRA report marks the second set of investment grade ratings

received by Hilltop and the Bank this year, following the ratings

affirmed by Fitch Ratings in January 2017.

About Hilltop Holdings Inc.

Hilltop Holdings is a Dallas-based financial holding company.

Its primary line of business is to provide business and consumer

banking services from offices located throughout Texas through

PlainsCapital Bank. PlainsCapital Bank’s wholly owned subsidiary,

PrimeLending, provides residential mortgage lending throughout the

United States. Hilltop Holdings’ broker-dealer subsidiaries,

Hilltop Securities Inc. and Hilltop Securities Independent Network

Inc., provide a full complement of securities brokerage,

institutional and investment banking services in addition to

clearing services and retail financial advisory. Through Hilltop

Holdings’ other wholly owned subsidiary, National Lloyds

Corporation, it provides property and casualty insurance through

two insurance companies, National Lloyds Insurance Company and

American Summit Insurance Company. At September 30, 2017, Hilltop

employed approximately 5,500 people and operated approximately 475

locations in 44 states. Hilltop Holdings' common stock is listed on

the New York Stock Exchange under the symbol "HTH." Find more

information at Hilltop-Holdings.com, PlainsCapital.com,

PrimeLending.com, NationalLloydsInsurance.com and

HilltopSecurities.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements anticipated in

such statements. Forward-looking statements speak only as of the

date they are made and, except as required by law, we do not assume

any duty to update forward-looking statements. Such forward-looking

statements include, but are not limited to, statements concerning

such things as our plans, objectives, strategies, expectations and

intentions and other statements that are not statements of

historical fact, and may be identified by words such as

“anticipates,” “believes,” “could,” “estimates,” “expects,”

“forecasts,” “goal,” “intends,” “may,” “might,” “plan,” “probable,”

“projects,” “seeks,” “should,” “target,” “view” or “would” or the

negative of these words and phrases or similar words or phrases.

For a discussion of certain factors that could cause our actual

results to differ materially from those described in the

forward-looking statements, please see the risk factors discussed

in our most recent Annual Report on Form 10-K and subsequent

Quarterly Reports on Form 10-Q and other reports that are filed

with the Securities and Exchange Commission. All forward-looking

statements are qualified in their entirety by this cautionary

statement.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171016005288/en/

Hilltop Holdings Inc.Ben Brooks,

214-252-4047ben.brooks@hilltop-holdings.com

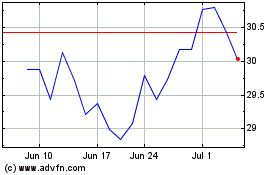

Hilltop (NYSE:HTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

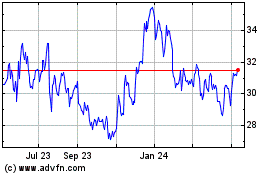

Hilltop (NYSE:HTH)

Historical Stock Chart

From Apr 2023 to Apr 2024