SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Rule

14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

M

ERRIMACK

P

HARMACEUTICALS

, I

NC

.

(Name of Subject Company (Issuer) and Filing Person (Offeror))

4.50% Convertible Senior Notes due 2020

(Title of Class of Securities)

590328AA8

(CUSIP Number

of Class of Securities)

Richard Peters, M.D., Ph.D.

Merrimack Pharmaceuticals, Inc.

One Kendall Square, Suite B7201

Cambridge, Massachusetts, 02139

(617)

441-1000

(Name, address, and telephone number of person authorized to receive notices and communications on behalf of filing persons)

Copies to:

Michael J. Zeidel, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

Four Times Square

New

York, New York 10036

(212)

735-3000

CALCULATION OF FILING FEE

|

|

|

|

|

Transaction Valuation (1)

|

|

Amount of Filing Fee (2)

|

|

$22,527,900

|

|

$2,804.72

|

|

(1)

|

Calculated solely for purposes of determining the amount of the filing fee. The calculation of the Transaction Valuation assumes that all $25,031,000 aggregate principal amount of the Company’s 4.50% Convertible

Senior Notes due 2020 are purchased at the tender offer price of $900.00 per $1,000 principal amount of such notes.

|

|

(2)

|

The amount of the filing fee, calculated in accordance with Rule

0-11

of the Securities Exchange Act of 1934, as amended, and the Fee Rate Advisory #1 for Fiscal Year 2018, equals

$124.50 for each $1,000,000 of the value of the transaction.

|

|

☐

|

Check the box if any part of the fee is offset as provided by Rule

0-11(a)(2)

and identify the filing with which the offsetting fee was previously paid. Identify the previous

filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

☐

|

third party tender offer subject to Rule

14d-1.

|

|

|

☒

|

issuer tender offer subject to Rule

13e-4.

|

|

|

☐

|

going private transaction subject to Rule

13e-3.

|

|

|

☐

|

amendment to Schedule 13D under Rule

13d-2.

|

Check the

following box if the filing is a final amendment reporting the results of the tender offer: ☐

This Tender Offer Statement on Schedule TO is filed by Merrimack Pharmaceuticals, Inc., a

Delaware corporation (the “Company”), and relates to the Company’s offer to purchase (“Tender Offer”), upon the terms and subject to the conditions set forth in the attached Offer to Purchase dated October 13, 2017 (as

it may be amended or supplemented from time to time, the “Offer to Purchase”) and the related Letter of Transmittal (as it may be amended or supplemented from time to time, the “Letter of Transmittal”), any and all of the

outstanding $25,031,000 million aggregate principal amount (which amount reflects the transactions contemplated by the Settlement Agreement (as defined herein)) of its 4.50% Convertible Senior Notes due 2020 (the “Notes”) for cash in

an amount equal to $900.00 per $1,000 principal amount of Notes purchased (exclusive of accrued and unpaid interest).

The Company agreed

to conduct the Tender Offer in connection with the settlement agreement (the “Settlement Agreement”) it entered into on October 6, 2017 with Wolverine Flagship Fund Trading Limited, 1992 MSF International Ltd. and 1992 Tactical Credit

Master Fund, L.P. (collectively, the “Settlement Noteholders”) and Wells Fargo Bank, National Association (the “Trustee”) to resolve the lawsuit pending in the Court of Chancery in the State of Delaware captioned

Wells Fargo

Bank, N.A., et al. v. Merrimack Pharmaceuticals, Inc.

, C.A. No.

2017-0199-JTL

filed by the Settlement Noteholders and the Trustee. Pursuant to the Settlement Agreement, the Company purchased the

$35,760,000 aggregate principal amount of Notes owned by the Settlement Noteholders for $32,528,190 in cash, which represents (a) $900.00 per $1,000 principal amount of Notes held by the Settlement Noteholders, plus (b) accrued and unpaid

interest on the Notes held by the Settlement Noteholders through October 2, 2017.

Copies of the Offer to Purchase and Letter of

Transmittal are filed with this Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively. The Tender Offer will expire at 12:01 a.m., New York City time, on November 10, 2017, or any other date and time to which the Company extends the

Tender Offer, unless earlier terminated. This Schedule TO is intended to satisfy the disclosure requirements of Rule

13e-4(c)(2)

under the Securities Exchange Act of 1934 (the “Exchange Act”), as

amended.

The information set forth in the Offer to Purchase and the Letter of Transmittal is incorporated by reference herein in response

to Items 1 through 13 of Schedule TO, including as more specifically set forth below.

Item 1. Summary Term Sheet.

The information set forth in the Offer to Purchase under the heading “Summary” and in the Letter of Transmittal is incorporated

herein by reference.

Item 2. Subject Company Information.

|

|

(a)

|

Name and Address

. The name of the subject company is Merrimack Pharmaceuticals, Inc., a Delaware corporation. The Company’s principal executive offices are located at One Kendall Square, Suite B7201,

Cambridge, Massachusetts 02139. The telephone number of its principal office is (617)

441-1000.

|

|

|

(b)

|

Securities

. The securities that are the subject of the Tender Offer are the Company’s outstanding Notes. As of October 12, 2017, there was $25,031,000 million aggregate principal amount of the

Notes outstanding, which amount reflects the consummation of the purchase of the Notes from the Settlement Noteholders pursuant to the Settlement Agreement. The information set forth in the Offer to Purchase under the heading “Summary” is

incorporated herein by reference.

|

|

|

(c)

|

Trading Market and Price

. The information set forth in the Offer to Purchase under the heading “Market Price Information” is incorporated herein by reference.

|

Item 3. Identity and Background of Filing Person.

|

|

(a)

|

Name and Address

. The name of the filing person is Merrimack Pharmaceuticals, Inc., a Delaware corporation. The Company’s principal executive offices are located at One Kendall Square, Suite B7201,

Cambridge, Massachusetts 02139. The telephone number of its principal office is (617)

441-1000.

The filing person is the subject person.

|

The following persons are directors and executive officers of Merrimack Pharmaceuticals, Inc.

|

|

|

|

|

Name

|

|

Position

|

|

Richard Peters, M.D., Ph.D.

|

|

President, Chief Executive Officer and Director

|

|

Daryl C. Drummond, Ph.D.

|

|

Head of Research

|

|

Jean M. Franchi

|

|

Chief Financial Officer and Treasurer

|

|

Jeffrey A. Munsie

|

|

General Counsel, Head of Corporate Operations and Secretary

|

|

Thomas E. Needham, Jr.

|

|

Chief Business Officer

|

|

Sergio L. Santillana, M.D.

|

|

Chief Medical Officer

|

|

Gary L. Crocker

|

|

Chairman of the Board

|

|

John M. Dineen

|

|

Director

|

|

Vivian S. Lee, M.D., Ph.D.

|

|

Director

|

|

John Mendelsohn, M.D.

|

|

Director

|

|

Ulrik B. Nielsen, Ph.D.

|

|

Director

|

|

Michael E. Porter, Ph.D.

|

|

Director

|

|

James H. Quigley

|

|

Director

|

|

Russell T. Ray

|

|

Director

|

The business address and telephone number for all of the above directors and executive officers are c/o

Merrimack Pharmaceuticals, Inc., One Kendall Square, Suite B7201, Cambridge, Massachusetts 02139 and (617)

441-1000.

Item 4. Terms of the Transaction.

|

|

(a)

|

Material Terms.

The information set forth in the Offer to Purchase under the headings “Summary,” “The Terms of the Tender Offer,” “Certain Considerations,” “Source of

Funds” and “Certain U.S. Federal Income Tax Consequences” is incorporated herein by reference.

|

|

|

(b)

|

Purchases

. To the knowledge of the Company, based on reasonable inquiry, no Notes are owned by the Company or any executive officer, director or affiliate, associate or majority-owned subsidiary of any of the

foregoing and therefore no Notes will be acquired from the Company or any executive officer, director or affiliate, associate or majority-owned subsidiary of the foregoing. The information set forth under the heading “Interest of Directors and

Executive Officers; Transactions and Arrangements Concerning the Notes” is incorporated herein by reference.

|

Item 5. Past

Contacts, Transactions, Negotiations and Agreements.

|

|

(e)

|

Agreements Involving the Subject Company’s Securities

. The Company has entered into the following agreements (each of which is filed as an exhibit to this Schedule TO) in connection with the Notes:

|

|

|

(1)

|

Indenture, dated as of July 17, 2013, by and between the Company and Wells Fargo Bank, National Association, as trustee.

|

|

|

(2)

|

First Supplemental Indenture, dated as of July 17, 2013, by and between the Company and Wells Fargo Bank, National Association, as trustee.

|

|

|

(3)

|

Stipulation and Agreement of Settlement and Release, dated October 6, 2017, by and among the Company, Wells Fargo Bank, National Association, Wolverine Flagship Fund Trading Limited, 1992 MSF International

Ltd (formerly known as Highbridge International LLC) and 1992 Tactical Credit Master Fund, L.P. (formerly known as Highbridge Tactical Credit & Convertibles Master Fund, L.P.).

|

The Information set forth in the Offer to Purchase under the heading “The Terms of the Tender Offer—Description of the Notes”

is incorporated herein by reference. For information regarding the Settlement Agreement, see the discussion under “Item 1.01. Entry into a Material Definitive Agreement” on the Company’s Current Report on Form

8-K

filed on October 10, 2017, which information is incorporated herein by reference. For information regarding the Company’s conversion agreements with certain holders of the Notes, see the discussion

under “Note 10. Borrowings—Convertible Notes” of the Company’s quarterly report on Form

10-Q

for the quarterly period ended June 30, 2017, which information is incorporated herein by

reference. For information regarding the Company’s equity incentive plans, see the discussion under the heading “Executive Compensation” of the Company’s Definitive Proxy Statement for its 2017 annual meeting of stockholders,

which information is incorporated herein by reference. The information set forth in the Offer to Purchase under the headings “Certain Considerations – Treatment of Notes Not Tendered in the Tender Offer” and “The Depositary and

The Information Agent” is incorporated herein by reference.

2

Item 6. Purposes of the Transaction and Plans or Proposals.

|

|

(a)

|

Purposes

. The information set forth in the Offer to Purchase under the heading “The Terms of the Tender Offer–Purpose of the Tender Offer” is incorporated herein by reference.

|

|

|

(b)

|

Use of Securities Acquired

. The information set forth in the Offer to Purchase under the heading “The Terms of the Tender Offer–Payment for Notes” is incorporated herein by reference.

|

|

|

(c)

|

Plans

. At any given time, the Company may be evaluating or in discussions regarding one or more strategic transactions, although the Company currently has no material plans, proposals or negotiations described in

Item 1006(c) of Regulation

M-A

under the Exchange Act to disclose at this time. The information set forth in the Offer to Purchase including in “Certain Considerations – Treatment of Notes Not

Tendered in the Tender Offer” and “Source of Funds” (and the documents incorporated by reference therein) is incorporated herein by reference.

|

Item 7. Source and Amount of Funds or Other Consideration.

The information in the Offer to Purchase under the heading “Source of Funds” is incorporated herein by reference in response to

Regulation

M-A

Items 7(a), (b) and (d).

Item 8. Interest in Securities of the Subject Company.

|

|

(a)

|

Securities Ownership

. The information set forth in the Offer to Purchase under the heading “Interest of Directors and Executive Officers; Transactions and Arrangements Concerning the Notes” is

incorporated herein by reference.

|

|

|

(b)

|

Securities transactions

. The information set forth in the Offer to Purchase under the heading “Interest of Directors and Executive Officers; Transactions and Arrangements Concerning the Notes” is

incorporated herein by reference.

|

Item 9. Persons/Assets, Retained, Employed, Compensated or Used.

|

|

(a)

|

Solicitations or Recommendations

. The information set forth in the Offer to Purchase under the headings “Summary” and “The Depositary and The Information Agent” is incorporated herein by

reference.

|

Item 10.

Financial Statements.

|

|

(a)

|

Financial Statements

. Not applicable.

|

|

|

(b)

|

Pro Forma

. Not applicable.

|

Item 11.

Additional Information.

|

|

(a)

|

Agreements, Regulatory Requirements and Legal Proceedings

.

|

|

|

(5)

|

The information set forth in the Offer to Purchase under the headings “Summary—Why is the Company making the Tender Offer?” and “The Terms of the Tender Offer—Purpose of the Tender

Offer” is incorporated herein by reference.

|

3

|

|

(c)

|

Other Material Information

. The information contained in the Offer to Purchase and the Letter of Transmittal is incorporated herein by reference.

|

Item 12.

Exhibits

.

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

(a)(1)(A)*

|

|

Offer to Purchase, dated October 13, 2017.

|

|

|

|

|

(a)(1)(B)*

|

|

Form of Letter of Transmittal.

|

|

|

|

|

(a)(5)

|

|

Press Release, dated October 13, 2017 (incorporated by reference to Exhibit 99.1 to the Company’s Current Report on Form

8-K

filed on October 13, 2017).

|

|

|

|

|

(d)(1)

|

|

Indenture, dated as of July 17, 2013, by and between the Company and Wells Fargo Bank, National Association, as trustee (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form

8-K

filed on July 18, 2013).

|

|

|

|

|

(d)(2)

|

|

First Supplemental Indenture (including the Form of Note), dated as of July 17, 2013, by and between the Company and Wells Fargo Bank, National Association, as trustee (incorporated by reference to Exhibit 4.2 to the

Company’s Current Report on Form

8-K

filed on July 18, 2013).

|

|

|

|

|

(d)(3)

|

|

1999 Stock Option Plan (incorporated by reference to Exhibit 10.1 to the Company’s Registration Statement on Form

S-1,

as amended, filed on July 8, 2011).

|

|

|

|

|

(d)(4)

|

|

2008 Stock Incentive Plan (incorporated by reference to Exhibit 10.2 to the Company’s Registration Statement on Form

S-1,

as amended, filed on July 8, 2011).

|

|

|

|

|

(d)(5)

|

|

2011 Stock Incentive Plan (incorporated by reference to Exhibit 10.3 to the Company’s Registration Statement on Form

S-1,

as amended, filed on January 13, 2012).

|

|

|

|

|

(d)(6)

|

|

Form of Incentive Stock Option Agreement under 2011 Stock Incentive Plan (incorporated by reference to Exhibit 10.4 to the Company’s Registration Statement on Form

S-1,

as amended, filed

on January 13, 2012).

|

|

|

|

|

(d)(7)

|

|

Form of

Non-Qualified

Stock Option Agreement under 2011 Stock Incentive Plan (incorporated by reference to Exhibit 10.5 to the Company’s Registration Statement on Form

S-1,

as amended, filed on January 13, 2012).

|

|

|

|

|

(d)(8)

|

|

Form of Conversion Agreement Related to 4.50% Convertible Senior Notes due 2020 (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form

8-K filed

on

April 14, 2016).

|

|

|

|

|

(d)(9)

|

|

Stipulation and Agreement of Settlement and Release, dated October 6, 2017, by and among the Company, Wells Fargo Bank, National Association, Wolverine Flagship Fund Trading Limited, 1992 MSF International Ltd (formerly known

as Highbridge International LLC) and 1992 Tactical Credit Master Fund, L.P. (formerly known as Highbridge Tactical Credit & Convertibles Master Fund, L.P.) (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on

Form

8-K

filed on October 10, 2017).

|

|

|

|

|

(g)

|

|

Not applicable.

|

|

|

|

|

(h)

|

|

Not applicable.

|

Item 13. Information Required by Schedule

13E-3.

Not applicable.

4

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

|

|

MERRIMACK PHARMACEUTICALS, INC.

|

|

|

|

|

By:

|

|

/s/ Richard Peters, M.D., Ph.D.

|

|

|

|

Name: Richard Peters, M.D., Ph.D.

|

|

|

|

Title: President, Chief Executive

Officer and Director

|

Dated: October 13, 2017

5

EXHIBIT INDEX

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

(a)(1)(A)*

|

|

Offer to Purchase, dated October 13, 2017.

|

|

|

|

|

(a)(1)(B)*

|

|

Form of Letter of Transmittal.

|

|

|

|

|

(a)(5)

|

|

Press Release, dated October 13, 2017 (incorporated by reference to Exhibit 99.1 to the Company’s Current Report on Form

8-K

filed on October 13, 2017).

|

|

|

|

|

(d)(1)

|

|

Indenture, dated as of July 17, 2013, by and between the Company and Wells Fargo Bank, National Association, as trustee (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form

8-K

filed on July 18, 2013).

|

|

|

|

|

(d)(2)

|

|

First Supplemental Indenture (including the Form of Note), dated as of July 17, 2013, by and between the Company and Wells Fargo Bank, National Association, as trustee (incorporated by reference to Exhibit 4.2 to the

Company’s Current Report on Form

8-K

filed on July 18, 2013).

|

|

|

|

|

(d)(3)

|

|

1999 Stock Option Plan (incorporated by reference to Exhibit 10.1 to the Company’s Registration Statement on Form

S-1,

as amended, filed on July 8, 2011).

|

|

|

|

|

(d)(4)

|

|

2008 Stock Incentive Plan (incorporated by reference to Exhibit 10.2 to the Company’s Registration Statement on Form

S-1,

as amended, filed on July 8, 2011).

|

|

|

|

|

(d)(5)

|

|

2011 Stock Incentive Plan (incorporated by reference to Exhibit 10.3 to the Company’s Registration Statement on Form

S-1,

as amended, filed on January 13, 2012).

|

|

|

|

|

(d)(6)

|

|

Form of Incentive Stock Option Agreement under 2011 Stock Incentive Plan (incorporated by reference to Exhibit 10.4 to the Company’s Registration Statement on Form

S-1,

as amended, filed

on January 13, 2012).

|

|

|

|

|

(d)(7)

|

|

Form of

Non-Qualified

Stock Option Agreement under 2011 Stock Incentive Plan (incorporated by reference to Exhibit 10.5 to the Company’s Registration Statement on Form

S-1,

as amended, filed on January 13, 2012).

|

|

|

|

|

(d)(8)

|

|

Form of Conversion Agreement Related to 4.50% Convertible Senior Notes due 2020 (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form

8-K filed

on

April 14, 2016).

|

|

|

|

|

(d)(9)

|

|

Stipulation and Agreement of Settlement and Release, dated October 6, 2017, by and among the Company, Wells Fargo Bank, National Association, Wolverine Flagship Fund Trading Limited, 1992 MSF International Ltd (formerly known

as Highbridge International LLC) and 1992 Tactical Credit Master Fund, L.P. (formerly known as Highbridge Tactical Credit & Convertibles Master Fund, L.P.) (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on

Form

8-K

filed on October 10, 2017).

|

|

|

|

|

(g)

|

|

Not applicable.

|

|

|

|

|

(h)

|

|

Not applicable.

|

|

|

|

* Filed herewith

|

6

Merrimack Pharmaceuticals (NASDAQ:MACK)

Historical Stock Chart

From Mar 2024 to Apr 2024

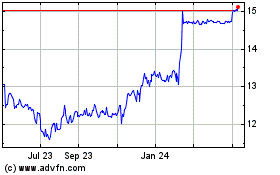

Merrimack Pharmaceuticals (NASDAQ:MACK)

Historical Stock Chart

From Apr 2023 to Apr 2024