UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)

Tarena

International, Inc.

(Name of Issuer)

Ordinary Shares, par value $0.001 per

share

(Title of Class of Securities)

G8675B 105

(CUSIP Number)

Shaoyun Han

Connion Capital Limited

Learningon Limited

Techedu Limited

c/o Suite 10017, Building E, Zhongkun

Plaza

A18 Bei San Huan West Road

Haidian District, Beijing 100098

People’s Republic of China

+86 (10) 6213-5687

With copies to:

Z. Julie Gao, Esq.

Will H. Cai, Esq.

Skadden, Arps, Slate, Meagher & Flom

LLP

c/o 42/F, Edinburgh Tower, The Landmark

15 Queen’s Road Central

Hong Kong

+852 3740-4700

(Name, Address and Telephone Number of Person

Authorized to

Receive Notices and Communications)

October 10, 2017

(Date of Event Which Requires Filing of

this Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box.

x

Note

: Schedules filed in paper format shall include a

signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are

to be sent.

* This statement on Schedule 13D (the “

Schedule 13D

”)

constitutes Amendment No. 2 to the initial Schedule 13D (the “

Original Schedule 13D

”) filed on July 24, 2015

on behalf of each of Mr. Shaoyun Han (“

Mr. Han

”), Connion Capital Limited (“

Connion

”), Learningon

Limited (“

Learningon

”) and Techedu Limited (“

Techedu

”, and collectively with Mr. Han, Connion

and Learningon, the “

Reporting Persons

” ), as amended by the Amendment No.1 to the Original Schedule 13D filed

on September 8, 2017 on behalf of the Reporting Persons (together with the Original Schedule 13D, the “

Original Filings

”)

, with respect to the ordinary shares (the “

Ordinary Shares

”), comprising Class A ordinary shares, par value

$0.001 per share (“

Class A Ordinary Shares

”), and Class B ordinary shares, par value $0.001 per share (“

Class

B Ordinary Shares

”), of Tarena International, Inc., a Cayman Islands company (the “

Company

”). Except

as amended hereby, the Original Filings remain in full force and effect. Capitalized terms used but not defined in this Amendment

No.2 to the Schedule 13D have the meanings ascribed to them in the Original Filings. The Ordinary Shares beneficially owned by

the Reporting Persons (other than Techedu) were previously reported on a Schedule 13G filed on February 10, 2015, as amended by

amendments thereto.

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“

Act

”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

|

1

|

NAMES OF REPORTING PERSONS

Shaoyun Han

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨

(b)

¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) or 2(e)

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

The People’s Republic of China

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

17,050,297

(1)

Ordinary Shares

|

|

8

|

SHARED VOTING POWER

0

|

|

9

|

SOLE DISPOSITIVE POWER

17,050,297

(1)

Ordinary Shares

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

17,050,297

(1)

Ordinary Shares

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

29.6% of the Class A Ordinary Shares

(2)

(or 29.6%

of the total Ordinary Shares

(3)

assuming conversion of all outstanding Class B Ordinary Shares into the same number

of Class A Ordinary Shares, representing 66.9% of the total outstanding voting power).

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

|

(1)

|

Representing (i) 6,060,000 Class B Ordinary Shares held by Learningon Limited, (ii) 1,146,059 Class B Ordinary Shares held

by Techedu Limited, (iii) 2,000,000 Class A Ordinary Shares held by Techedu Limited, (iv) 2,000,000 Class A Ordinary Shares held

by Moocon Education Limited, (v) 3,594,439 restricted American depositary shares (“ADSs”) representing 3,594,439 Class

A Ordinary Shares held by Connion Capital Limited, (vi) 2,193,223 restricted ADSs representing 2,193,223 Class A Ordinary Shares

held by Learningon Limited , and (vii) 56,576 Class A Ordinary Shares that Connion Capital Limited may purchase upon exercise of

options within 60 days of October 10, 2017. Each Class B Ordinary Share is convertible at the option of the holder into one Class

A Ordinary Share. Class A Ordinary Shares are not convertible into Class B Ordinary Shares under any circumstances. The

rights of the holders of Class A Ordinary Shares and Class B Ordinary Shares are identical, except with respect to conversion rights

(noted above) and voting rights. Each Class B Ordinary Share is entitled to ten votes per share, whereas each Class A Ordinary

Share is entitled to one vote per share.

|

|

|

(2)

|

Based on 50,281,932 Class A Ordinary Shares outstanding as of June 30, 2017 as reported on the Issuer’s Form 6-K furnished

to the U.S. Securities and Exchange Commission (the “SEC”) on August 23, 2017 and assuming all Class B Ordinary Shares

held by such reporting person are converted into the same number of Class A Ordinary Shares.

|

|

|

(3)

|

Based on 57,487,991 outstanding Ordinary Shares as a single class, being the sum of 50,281,932 Class A Ordinary Shares and

7,206,059 Class B Ordinary Shares outstanding as of June 30, 2017 as reported on the Issuer’s Form 6-K furnished to the SEC

on August 23, 2017, assuming conversion of all Class B Ordinary Shares into Class A Ordinary Shares.

|

|

1

|

NAMES OF REPORTING PERSONS

Connion Capital Limited

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨

(b)

¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) or 2(e)

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

3,651,015

(4)

Ordinary Shares

|

|

8

|

SHARED VOTING POWER

0

|

|

9

|

SOLE DISPOSITIVE POWER

3,651,015

(4)

Ordinary Shares

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,651,015

(4)

Ordinary Shares

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.3% of the Class A Ordinary Shares

(5)

(or 6.3% of

the total Ordinary Shares

(6)

assuming conversion of all outstanding Class B Ordinary Shares into the same number of

Class A Ordinary Shares, representing 3.0% of the total outstanding voting power).

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

CO

|

|

|

(4)

|

Representing (i) 3,594,439 restricted American depositary shares (“ADSs”), representing 3,594,439 Class A Ordinary

Shares held by Connion Capital Limited, and (ii) 56,576 Class A Ordinary Shares that Connion Capital Limited may purchase upon

exercise of options within 60 days of October 10, 2017. Each Class B Ordinary Share is convertible at the option of the holder

into one Class A Ordinary Share. Class A Ordinary Shares are not convertible into Class B Ordinary Shares under any circumstances.

The rights of the holders of Class A Ordinary Shares and Class B Ordinary Shares are identical, except with respect to conversion

rights (noted above) and voting rights. Each Class B Ordinary Share is entitled to ten votes per share, whereas each Class A Ordinary

Share is entitled to one vote per share.

|

|

|

(5)

|

Based on 50,281,932 Class A Ordinary Shares outstanding as of June 30, 2017 as reported on the Issuer’s Form 6-K furnished

to the SEC on August 23, 2017 and assuming all Class B Ordinary Shares held by such reporting person are converted into the same

number of Class A Ordinary Shares.

|

|

|

(6)

|

Based on 57,487,991 outstanding Ordinary Shares as a single class, being the sum of 50,281,932 Class A Ordinary Shares and

7,206,059 Class B Ordinary Shares outstanding as of June 30, 2017 as reported on the Issuer’s Form 6-K furnished to the SEC

on August 23, 2017, assuming conversion of all Class B Ordinary Shares into Class A Ordinary Shares.

|

|

1

|

NAMES OF REPORTING PERSONS

Learningon Limited

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨

(b)

¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) or 2(e)

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

8,253,223

(7)

Ordinary Shares

|

|

8

|

SHARED VOTING POWER

0

|

|

9

|

SOLE DISPOSITIVE POWER

8,253,223

(7)

Ordinary Shares

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

8,253,223

(7)

Ordinary Shares

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.6% of the Class A Ordinary Shares

(8)

(or 14.4%

of the total Ordinary Shares

(9)

assuming conversion of all outstanding Class B Ordinary Shares into the same number

of Class A Ordinary Shares, representing 51.3% of the total outstanding voting power).

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

CO

|

|

|

(7)

|

Representing (i) 6,060,000 Class B Ordinary Shares and (ii) 2,193,223 restricted ADSs representing 2,193,223 Class A Ordinary

Shares.

|

|

|

(8)

|

Based on 50,281,932 Class A Ordinary Shares outstanding as of June 30, 2017 as reported on the Issuer’s Form 6-K furnished

to the SEC on August 23, 2017, and assuming all Class B Ordinary Shares held by such reporting person are converted into the same

number of Class A Ordinary Shares.

|

|

|

(9)

|

Based on 57,487,991 outstanding Ordinary Shares as a single class, being the sum of 50,281,932 Class A Ordinary Shares and

7,206,059 Class B Ordinary Shares outstanding as of June 30, 2017 as reported on the Issuer’s Form 6-K furnished to the SEC

on August 23, 2017, assuming conversion of all Class B Ordinary Shares into Class A Ordinary Shares.

|

|

1

|

NAMES OF REPORTING PERSONS

Techedu Limited

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨

(b)

¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) or 2(e)

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

3,146,059

(10)

Ordinary Shares

|

|

8

|

SHARED VOTING POWER

0

|

|

9

|

SOLE DISPOSITIVE POWER

3,146,059

(10)

Ordinary Shares

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,146,059

(10)

Ordinary Shares

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.1% of the Class A Ordinary Shares

(11)

(or 5.5%

of the total Ordinary Shares

(12)

assuming conversion of all outstanding Class B Ordinary Shares into the same number

of Class A Ordinary Shares, representing 11.0% of the total outstanding voting power).

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

CO

|

|

|

(10)

|

Representing (i) 2,000,000 Class A Ordinary Shares and (ii) 1,146,059 Class B Ordinary Shares.

|

|

|

(11)

|

Based on 50,281,932 Class A Ordinary Shares outstanding as of June 30, 2017 as reported on the Issuer’s Form 6-K furnished

to the SEC on August 23, 2017, and assuming all Class B Ordinary Shares held by such reporting person are converted into the same

number of Class A Ordinary Shares.

|

|

|

(12)

|

Based on 57,487,991 outstanding Ordinary Shares as a single class, being the sum of 50,281,932 Class A Ordinary Shares and

7,206,059 Class B Ordinary Shares outstanding as of June 30, 2017 as reported on the Issuer’s Form 6-K furnished to the SEC

on August 23, 2017, assuming conversion of all Class B Ordinary Shares into Class A Ordinary Shares.

|

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 of the Schedule 13D is hereby amended

and supplemented by the following:

On October 6, 2017, pursuant to the CBPA,

Moocon redeemed a portion of the Bond in the principal amount of US$1,078,951 together with the accrued and unpaid interest accrued

thereon (the “

First Redemption

”). On October 10, 2017, Moocon redeemed another portion of the Bond in the principal

amount of US$2,056,755 together with the accrued and unpaid interest accrued thereon (the “

Second Redemption

”

and, together with the First Redemption, the “

Redemption

”). Upon the completion of the Redemption, Moocon has

redeemed the Bond in full.

Item 4. Purpose of Transaction.

Paragraph 2 of Item 4 of the Schedule 13D

is hereby amended and restated as follows:

Pursuant the CBPA,

only for so long as KKR and KKR Affiliate hold not less than 4,195,662 Ordinary Shares and Moocon has not redeemed the Bond in

full, without the approval of KKR, neither Mr. Han nor his subsidiaries (including Moocon) shall agree to have the Company

or its subsidiaries to take any of the following actions:

|

|

(i)

|

issue any securities of any type or class, carry out any equity financing or undertake any obligation in relation to any of the above, other than (a) any grant or exercise of share-based awards pursuant to any existing share incentive plan of the Company, (b) any issuance of Class A Ordinary Shares upon the conversion of Class B Ordinary Shares and (c) any issuance of equity security in connection with any share dividend, subdivision, combination or reclassification of capital stock in which all shareholders of the Company are entitled to participate on a pro rata basis;

|

|

|

(ii)

|

merge, amalgamate or reorganization, or acquisition, in each case exceeding US$10 million, or take any action which would result in a change of control or a transfer of its asset the value of which is US$10 million or more;

|

|

|

(iii)

|

carry out business other than education business in its nature; or

|

|

|

(iv)

|

delist or change its listing place, or take any other actions which may affect the liquidity of KKR and KKR Affiliate’s investment contemplated under the SPAs and other agreements relating to this transaction, provided that KKR and KKR Affiliate shall provide support if the Company intends to list its shares or its subsidiary’s shares in a stock exchange located in the People’s Republic of China.

|

Upon the completion of the Redemption on

October 10, 2017, Moocon has redeemed the Bond in full and therefore, the obligations of Mr. Han and his subsidiaries (including

Moocon) under this provision have been terminated.

Paragraph 5 of Item 4 of the Schedule 13D

is hereby amended and restated as follows:

Pursuant to the CBPA, only for so long as

(i) KKR and KKR Affiliate hold not less than 3,413,132 shares of the Company and (ii) Moocon has not redeemed the Bond

in full, Mr.Han shall use his commercially reasonable efforts to cause the Company to distribute not less than 25-35% of its annual

net income to its shareholders in each year. Upon the completion of the Redemption on October 10, 2017, Moocon has redeemed the

Bond in full and therefore, the obligations of Mr. Han under this provision have been terminated.

Item 5. Interest in Securities of the Issuer.

Item 5(a)–(b) and (c) of the Schedule

13D is hereby amended and restated as follows:

(a)–(b) The responses of each

Reporting Person to Rows (7) through (13), including the footnotes thereto, of the cover pages of this Schedule 13D are hereby

incorporated by reference in this Item 5.

Except as disclosed in this Schedule 13D,

none of the Reporting Persons beneficially owns any Ordinary Shares or has the right to acquire any Ordinary Shares.

Except as disclosed in this Schedule 13D,

none of the Reporting Persons presently has the power to vote or to direct the vote or to dispose or direct the disposition of

any of the Ordinary Shares which it may be deemed to beneficially own.

(c) On

August 17, 2017, Learningon Limited sold an aggregate 41,108 ADSs, representing 41,108 Class A Ordinary Shares, through a broker

in an open market transaction (pursuant to 10b5-1 plan) for a consideration of US$781,249.3184, representing an average

selling price of US$19.0048 per share.

On August 18, 2017, Learningon Limited sold

an aggregate 190,690 ADSs, representing 190,690 Class A Ordinary Shares, through a broker in an open market transaction (pursuant

to 10b5-1 plan) for a consideration of US$3,624,025.312, representing an average selling price of US$19.0048 per share.

Except as disclosed in this Schedule 13D,

none of the Reporting Persons has effected any transaction in the Ordinary Shares during the past 60 days.

Item 7. Material to be Filed as Exhibits.

Item 7 of the Schedule 13D is hereby amended and restated as

follows:

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

A

|

|

Joint Filing Agreement dated October 13, 2017 by and among the Reporting Persons.

|

|

|

|

|

|

B*

|

|

Share Purchase Agreement dated June 13, 2015, by and among KKR Affiliate, GS, and Connion.

|

|

|

|

|

|

C*

|

|

Share Purchase Agreement dated June 13, 2015, by and among KKR Affiliate, IDG, and Connion.

|

|

|

|

|

|

D*

|

|

Assignment dated July 10, 2015, by and between Connion and Moocon.

|

|

|

|

|

|

E*

|

|

Convertible Bond Purchase Agreement dated July 14, 2015, by and among Moocon, Mr. Han, KKR and KKR Affiliate.

|

|

F*

|

|

Bond dated July 15, 2015 delivered by Moocon to KKR.

|

|

|

|

|

|

G*

|

|

Share Charge Agreement dated July 15, 2015 by and between Moocon and KKR.

|

|

|

|

|

|

H*

|

|

Share Charge Agreement dated July 15, 2015 by and between Techedu and KKR.

|

|

|

|

|

|

I*

|

|

Registration Rights Agreement dated July 17, 2015 by and between the Company and KKR Affiliate.

|

|

|

|

|

|

J*

|

|

Amendment Deed dated August 30, 2017 by and among Moocon, KKR Affiliate, Talent Wise Investment Limited, Mr. Han and Techedu Limited

|

*Filed previously.

SIGNATURE

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Date: October 13, 2017

|

|

|

|

|

|

|

|

Shaoyun Han

|

|

/s/ Shaoyun Han

|

|

|

|

Shaoyun Han

|

|

|

|

|

|

Connion Capital Limited

|

By:

|

/s/ Shaoyun Han

|

|

|

|

Name:

|

Shaoyun Han

|

|

|

|

Title:

|

Director

|

|

|

|

|

|

Learningon Limited

|

By:

|

/s/ Shaoyun Han

|

|

|

|

Name:

|

Shaoyun Han

|

|

|

|

Title:

|

Director

|

|

|

|

|

|

Techedu Limited

|

By:

|

/s/ Shaoyun Han

|

|

|

|

Name:

|

Shaoyun Han

|

|

|

|

Title:

|

Director

|

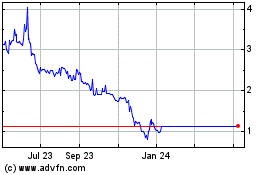

Tarena (NASDAQ:TEDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

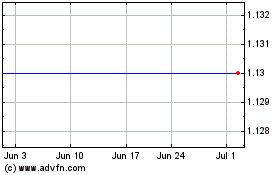

Tarena (NASDAQ:TEDU)

Historical Stock Chart

From Apr 2023 to Apr 2024