Filed Pursuant to Rule 424 (b)(5)

Registration No. 333-216983

PROSPECTUS

SUPPLEMENT

(To Prospectus dated April 28, 2017)

$19,162,500

Common Stock

We are

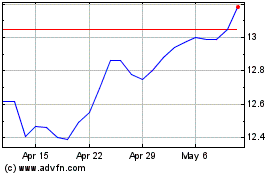

offering 1,050,000 shares of our common stock, par value $0.01 per share, pursuant to this prospectus supplement and the accompanying prospectus. Our common stock is listed on the Nasdaq Global Market, or Nasdaq, under the symbol

“EBMT.” On October 10, 2017, the last reported sale price of our common stock on Nasdaq was $19.15 per share.

As of

October 2, 2017, the aggregate market value of our outstanding common stock held by

non-affiliates

was approximately $65.1 million, which was calculated based upon 3,399,180 shares of outstanding

common stock held by

non-affiliates

and a per share price of $19.16. We have not offered any securities pursuant to General Instruction I.B.6 of Form

S-3

during the

prior

12-calendar-month

period that ends on and includes the date of this prospectus supplement. Pursuant to General Instruction I.B.6 of Form

S-3,

in no event will we

sell securities registered on the registration statement of which the prospectus accompanying this prospectus supplement is filed in a public primary offering with a value exceeding more than

one-third

of our

public float in any

12-month

period so long as our public float remains below $75.0 million.

Investing in our common stock involves risks. Potential purchasers of our common stock should consider the information set forth in the

“

Risk Factors

” section beginning on page

S-13

of this prospectus supplement, on page 5 of the accompanying prospectus and in the documents incorporated by reference

into this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per

Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

|

|

|

|

18.25

|

|

|

$

|

|

|

|

|

19,162,500

|

|

|

Underwriting discount

(1)

|

|

$

|

|

|

|

|

1.095

|

|

|

$

|

|

|

|

|

1,149,750

|

|

|

Proceeds, before expenses, to us

|

|

$

|

|

|

|

|

17.155

|

|

|

$

|

|

|

|

|

18,012,750

|

|

|

(1)

|

The underwriters will also be reimbursed for certain expenses incurred in this offering. See “Underwriting” for details.

|

We have granted the underwriters an option to purchase up to an additional 139,041 shares of our common stock from us, within 30 days

after the date of this prospectus supplement at the public offering price, less underwriting discounts and commissions.

None of the

Securities and Exchange Commission, or SEC, the Board of Governors of the Federal Reserve System, or the Federal Reserve, or any state or other securities commission or any other federal regulatory agency has approved or disapproved of these

securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The shares of common stock are not savings accounts, deposits or other obligations of any bank or

non-bank

subsidiary of ours and are not insured or guaranteed by the Federal Deposit Insurance Corporation, or the FDIC, or any other governmental agency or instrumentality.

Delivery of the common stock will be made in book-entry form, through the facilities of The Depository Trust Company, against payment on or

about October 13, 2017.

|

|

|

|

|

D.A. Davidson & Co.

|

|

FIG Partners, LLC

|

The date of this prospectus supplement is October 11, 2017

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is comprised of two parts. The first part is this prospectus supplement, which describes the specific terms of this common stock

offering and certain other matters relating to us, and it also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The

second part is the accompanying prospectus, dated April 28, 2017, and included as part of our registration statement on Form

S-3

(File

No. 333-216983),

or the

registration statement, which provides more general information about the securities that we may offer from time to time, some of which may not apply to this offering. You should read carefully both this prospectus supplement and the accompanying

prospectus in their entirety, together with additional information described under the heading “Where You Can Find More Information,” before investing in our common stock.

We have not, and the underwriters have not, authorized anyone to provide you any information other than that contained or incorporated by

reference in this prospectus supplement, the accompanying prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we, nor the underwriters take any responsibility for, or can provide any

assurance as to the reliability of, any other information that others may give you. If information in this prospectus supplement is inconsistent with the applicable accompanying prospectus, you should rely on this prospectus supplement. You should

not assume that the information provided in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference in this prospectus supplement and in the accompanying prospectus is accurate as of any date other than

their respective dates. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

We and the underwriters are not offering to sell nor seeking offers to buy shares of our common stock in any jurisdiction where offers and

sales are not permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of our common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into

possession of this prospectus supplement and the accompanying prospectus must inform themselves about and observe any restrictions relating to the offering of our common stock and the distribution of this prospectus supplement and the accompanying

prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this

prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

Unless otherwise indicated or unless the context requires otherwise, all references in this prospectus supplement and the accompanying

prospectus to “Eagle Bancorp Montana, Inc.,” “Eagle,” the “Company,” “we,” “us,” “our” and “ours” or similar references mean Eagle Bancorp Montana, Inc. and its subsidiaries.

S-i

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document that we

file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at

(800) SEC-0330

for further information about the Public Reference Room. Our

filings with the SEC are also available to the public through the SEC’s Internet site at www.sec.gov. Our annual, quarterly and current reports and amendments to those reports are also available over the Internet at our website at

www.opportunitybank.com

. All Internet addresses provided in this prospectus supplement or in the accompanying prospectus are for informational purposes only and are not intended to be hyperlinks. In addition, the information on, or accessible

through, our Internet site, or any other Internet site described herein, is not a part of, and is not incorporated or deemed to be incorporated by reference in, this prospectus supplement or the accompanying prospectus or other offering materials.

We also have filed the registration statement with the SEC relating to the common stock offered by this prospectus supplement and the

accompanying prospectus. This prospectus supplement and the accompanying prospectus are part of that registration statement. You may obtain from the SEC copies of the registration statement and the related exhibits that we filed with the SEC when we

registered the common stock. The registration statement may contain additional information that may be important to you.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC’s rules allow us to incorporate by reference information into this

prospectus supplement. This means that we can disclose important information to you by referring you to another document. Any information referred to in this way is considered part of this prospectus supplement from the date we file that document.

Any reports filed by us with the SEC after the date of this prospectus supplement will automatically update and, where applicable, supersede any information contained in this prospectus supplement or the accompanying prospectus or incorporated by

reference herein or therein. We are incorporating by reference the documents listed below, which we have already filed with the SEC, and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act

of 1934, as amended, or the Exchange Act, except as to any portion of any future report or document that is not deemed filed under such provisions, until this offering has been terminated:

|

|

•

|

|

Our Annual Report on Form

10-K

for the fiscal year ended December 31, 2016, filed with the SEC on March 14, 2017, including the portions of our Definitive Proxy

Statement on Schedule 14A filed on March 14, 2017, and incorporated by reference into Part III of our Annual Report on Form

10-K;

|

|

|

•

|

|

Our Quarterly Reports on Form

10-Q

for the three months ended March 31, 2017 and June 30, 2017, filed with the SEC on May 9, 2017 and August 8, 2017,

respectively;

|

|

|

•

|

|

Our Current Reports on Form

8-K

or Form

8-K/A,

filed with the SEC on February 13, 2017, February 23, 2017, February 24,

2017, April 21, 2017, September 6, 2017, October 4, 2017 and October 10, 2017; and

|

|

|

•

|

|

The description of our common stock contained in our registration statement on Form

S-1

filed with the SEC on December 17, 2009, including any subsequent amendment or any

report filed for the purpose of updating such description.

|

S-ii

Upon request, we will provide, without charge, to each person to whom a copy of this prospectus

supplement and the accompanying prospectus is delivered a copy of the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. You may request a copy of these filings, and any exhibits we have specifically

incorporated by reference as an exhibit in this prospectus supplement and the accompanying prospectus, at no cost by writing or telephoning us at the following address:

Eagle Bancorp Montana, Inc.

1400

Prospect Avenue

Helena, Montana 59601

Telephone: (406)

442-3080

Attention: Corporate Secretary

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus, and the information incorporated by reference in this prospectus supplement and the

accompanying prospectus contain or incorporate statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the

Exchange Act. These statements relate to our financial condition, liquidity, results of operations, earnings outlook and prospects, our growth strategy and expansion plans, including potential acquisitions. You can find many of these statements by

looking for words such as “may,” “would,” “could,” “should,” “will,” “expect,” “anticipate,” “predict,” “project,” “potential,” “continue,”

“contemplate,” “seek,” “assume,” “believe,” “intend,” “plan,” “forecast,” “goal,” “estimate,” or other similar expressions which identify these forward-looking

statements. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their

nature, are inherently uncertain and beyond our control. Accordingly, you are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are

difficult to predict. Although we believe that the current expectations reflected in such forward-looking statements are reasonable as of the date made, such expectations may prove to have been materially different from the results expressed or

implied by such forward-looking statements.

Unless otherwise required by law, we also disclaim any obligation to update our view of any

such risks or uncertainties or to announce publicly any revisions to the forward-looking statements made or incorporated by reference in this prospectus supplement or the accompanying prospectus. A number of important factors could cause actual

results to differ materially from those indicated by the forward-looking statements, including those risks set forth in the “Risk Factors” section of this prospectus supplement, the accompanying prospectus, and the documents incorporated

by reference into this prospectus supplement and the accompanying prospectus, as well as the following:

|

|

•

|

|

changes in laws or government regulations or policies affecting financial institutions, including changes in regulatory fees and capital requirements;

|

|

|

•

|

|

geopolitical conditions, including acts or threats of terrorism, actions taken by the United States or other governments in response to acts or threats of terrorism and/or military conflicts, which could have an impact

on the business and economic conditions in the United States and abroad;

|

|

|

•

|

|

general economic conditions, either nationally or in our market areas, that are worse than expected;

|

S-iii

|

|

•

|

|

competition among depository and other financial institutions;

|

|

|

•

|

|

changes in the prices, values and sales volume of residential and commercial real estate in Montana;

|

|

|

•

|

|

inflation and changes in the interest rate environment that reduce our margins or reduce the fair value of financial instruments;

|

|

|

•

|

|

changes or volatility in the securities markets;

|

|

|

•

|

|

our ability to enter new markets successfully and capitalize on growth opportunities;

|

|

|

•

|

|

the effect of our pending acquisition of TwinCo, Inc., or TwinCo, or other acquisitions we may make, if any, including, without limitation, the failure to achieve expected revenue growth and/or expense savings from such

acquisitions, and/or the failure to effectively integrate an acquired business, including TwinCo, into our operations;

|

|

|

•

|

|

changes in consumer spending, borrowing and savings habits;

|

|

|

•

|

|

our ability to continue to increase and manage our commercial and residential real estate, multi-family and commercial business loans;

|

|

|

•

|

|

possible impairments of securities held by us, including those issued by government entities and government sponsored enterprises;

|

|

|

•

|

|

the level of future deposit premium assessments;

|

|

|

•

|

|

the impact of a recurring recession on our loan portfolio (including cash flow and collateral values), investment portfolio, customers and capital market activities;

|

|

|

•

|

|

our ability to develop and maintain secure and reliable information technology systems, effectively defend ourselves against cyberattacks or recover from breaches to our cybersecurity infrastructure;

|

|

|

•

|

|

the failure of assumptions underlying the establishment of allowance for possible loan losses;

|

|

|

•

|

|

changes in the financial performance and/or condition of our borrowers and their ability to repay their loans when due;

|

|

|

•

|

|

the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the SEC, the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and

other accounting standard setters;

|

|

|

•

|

|

the inability to obtain the requisite regulatory and shareholder approvals for the proposed merger with TwinCo and meet other closing terms and conditions;

|

|

|

•

|

|

the reaction to the anticipated acquisition of all TwinCo’s customers, employees and counter-parties or difficulties related to the transition of services;

|

|

|

•

|

|

the timing to consummate the proposed merger with TwinCo;

|

|

|

•

|

|

the diversion of management time on issues related to the proposed merger with TwinCo; and

|

|

|

•

|

|

the difficulties and risks inherent with entering new markets.

|

S-iv

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information contained elsewhere, or incorporated by reference, in this prospectus supplement or the accompanying

prospectus. As a result, it does not contain all of the information that may be important to you or that you should consider before making a decision to invest in our common stock. You should read this entire prospectus supplement and accompanying

prospectus, including the “Risk Factors” section included herein and therein and the documents incorporated by reference herein and therein, which are described under “Incorporation of Certain Documents by Reference.”

Company Overview

We are a Delaware

corporation that holds 100% of the capital stock of Opportunity Bank of Montana, which we refer to as the Bank or Opportunity Bank, formerly American Federal Savings Bank, or AFSB. The Bank was founded in 1922 as a Montana-chartered building and

loan association and has conducted operations and maintained its administrative office in Helena, Montana since that time. In 1975, the Bank adopted a federal thrift charter and in October 2014 converted to a Montana-chartered commercial bank. The

Bank currently has 14 branch offices and 15 automated teller machines located in our market areas and we participate in the Money Pass

®

ATM network.

In November 2012, we completed a significant transaction with Sterling Financial Corporation, or Sterling, of Spokane, Washington in which we

purchased all of Sterling’s retail bank branches in Montana. As a result of this transaction, we added two mortgage origination offices and a wealth management division, and the Bank’s assets grew to over $500 million and the retail

branch network grew from six to 13 full service branches immediately following the transaction, with six branches in new markets. In 2014, we applied to the State of Montana to form an interim bank for the purpose of facilitating the conversion of

AFSB from a federally-chartered savings bank to a Montana-chartered commercial bank. Concurrent with the conversion, the Bank applied, and was approved, for membership in the Federal Reserve. In connection with the conversion, AFSB changed its name

to Opportunity Bank of Montana.

We provide loan and deposit services to customers who are predominantly small businesses and individuals

throughout Montana. We are a diversified lender with a focus on residential mortgage loans, commercial real estate mortgage loans, commercial business loans and second mortgage/home equity loan products. In addition, we offer wealth management

products and services through our wealth management division and financial consultants located in several of our markets.

Our primary

lines of business are:

|

|

•

|

|

Retail lending

.

We originate residential mortgage loans, home equity loans and consumer loans primarily through our community banking office network. We also offer our customers the choice of submitting

online mortgage loan applications and receiving

pre-approvals

through our website.

|

|

|

•

|

|

Commercial Lending

. We continue to place an emphasis on growing our commercial business and commercial

real estate loan portfolios. In addition to commercial real estate loans, we offer traditional business loans structured as unsecured lines of credit

|

S-1

|

|

or loans secured by inventory, accounts receivable or other business assets. We seek to provide exceptional service with local decision-making and personal attention.

|

|

|

•

|

|

Deposit Products and Services

.

We offer a full range of traditional deposit products such as checking accounts, savings accounts, money market accounts, retirement accounts, and certificates of deposit.

These products can have additional features such as direct deposit, ATM and check card services, overdraft protection, telephone banking and Internet banking, which provide our customers multiple channels to access their accounts.

|

|

|

•

|

|

Mortgage Origination

.

We originate residential mortgage loans in all of our markets. The majority of these loans are sold in the secondary market with servicing retained, which is a significant source of

noninterest income.

|

|

|

•

|

|

Mortgage Servicing

.

We provide loan servicing for other institutions. These services generally consist of collecting mortgage payments, maintaining escrow accounts, disbursing payments to investors and

foreclosure processing.

|

We are the sixth largest community bank headquartered in Montana with approximately

$710.2 million in total assets, $508.1 million in gross loans and $514.3 million in total deposits as of June 30, 2017. Our common stock is traded on the Nasdaq Global Market under the symbol “EBMT”.

Our Business Strategy

Our strategy is to continue to increase our profitability through building a diversified loan portfolio and operating Opportunity Bank as a

full-service community bank that offers both retail and commercial loan and deposit products in all of its markets. We believe that this focus will enable us to continue to grow our franchise, while maintaining our commitment to customer service,

high asset quality, and sustained net earnings. The following are the key elements of our business strategy:

|

|

•

|

|

Continue to diversify our portfolio by emphasizing our recent growth in commercial real estate and commercial business loans as a complement to our traditional single family residential real estate lending. As of

June 30, 2017, we had $246.0 million in commercial real estate loans, which constituted 48.3% of total loans, and $58.2 million in commercial business loans, which constituted 11.4% of total loans;

|

|

|

•

|

|

Continue to emphasize attracting and retaining lower cost core deposits. As of June 30, 2017, we had $394.8 million in core deposits consisting of noninterest checking, interest bearing checking, savings,

money market accounts and IRA certificates, which constituted 76.8% of total deposits;

|

|

|

•

|

|

Seek opportunities where presented to acquire other institutions or expand our branch network through opening de novo branches and/or loan production offices, although, other than our pending acquisition of TwinCo, we

do not currently have any understandings or agreements regarding any specific acquisition transaction;

|

|

|

•

|

|

Maintain our strong asset quality. As of June 30, 2017, total

non-performing

assets to total assets was 0.31%; and

|

S-2

|

|

•

|

|

Operate as a community-oriented independent financial institution that offers a broad array of financial services with high levels of customer service.

|

Our Competition

We face

strong competition in our primary market areas for retail deposits and the origination of loans. Historically, Montana was a unit banking state, which means that the ability of Montana state banks to create branches was either prohibited or

significantly restricted. As a result of unit banking, Montana has a significant number of independent financial institutions serving a single community in a single location. While Montana’s population is approximately 1.04 million people,

there are 51 credit unions in Montana as well as one national thrift institution and 49 commercial banks as of June 30, 2017. Our most direct competition for depositors historically has come from locally-owned and

out-of-state

commercial banks, thrift institutions and credit unions operating in our primary market areas. Competition in our primary market areas has increased in

recent years. Our competition for loans also comes from banks, thrift institutions and credit unions, in addition to mortgage bankers and brokers.

Our Banking Markets

We

conduct operations out of our main administrative office, two mortgage origination offices, and 14 full-service bank branch offices in southern Montana. We have received regulatory approval to open an additional branch in Billings, Montana, which we

anticipate will begin operations during the fourth quarter of 2017. Our administrative office is located in Helena, in Lewis & Clark County, Montana.

The following table presents the number of branches Opportunity Bank operates in each county within our primary market areas, the approximate

amount of deposits with Opportunity Bank in each county as of June 30, 2017 and our approximate deposit market share in each county at June 30, 2017 (the latest date for which such data is available).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County

|

|

Number of

Branches

(1)

|

|

Deposits (in

millions)

|

|

Market

Rank

|

|

Market Share

|

|

Lewis & Clark

|

|

|

|

3

|

|

|

|

$

|

172.2

|

|

|

4

|

|

12.6%

|

|

Gallatin

|

|

|

|

2

|

|

|

|

|

104.6

|

|

|

9

|

|

3.7

|

|

Silver-Bow

|

|

|

|

1

|

|

|

|

|

67.9

|

|

|

4

|

|

11.5

|

|

Missoula

|

|

|

|

2

|

|

|

|

|

40.2

|

|

|

9

|

|

1.7

|

|

Park

|

|

|

|

1

|

|

|

|

|

32.1

|

|

|

5

|

|

8.5

|

|

Sweet Grass

|

|

|

|

1

|

|

|

|

|

28.5

|

|

|

3

|

|

22.5

|

|

Yellowstone

|

|

|

|

1

|

|

|

|

|

25.3

|

|

|

10

|

|

0.6

|

|

Ravalli

|

|

|

|

1

|

|

|

|

|

23.0

|

|

|

6

|

|

3.3

|

|

Broadwater

|

|

|

|

1

|

|

|

|

|

20.8

|

|

|

2

|

|

28.3

|

(1) In July 2017, we converted our loan production office in Great Falls, Montana to a branch office, which is not reflected in the table.

S-3

The following table provides certain demographic data for the counties in which we have

branches.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Population Statistics

|

|

Income and Unemployment Statistics

|

|

County

|

|

Total

Population

2018

|

|

Population

Change

2010-2018

|

|

Projected

Population

Change

2018-2023

|

|

Projected

Household

Income Change

2018-2023

|

|

Unemployment Rate

(August 2017)

|

|

|

|

|

|

|

|

|

Lewis & Clark

|

|

68,262

|

|

7.7%

|

|

4.8%

|

|

4.5%

|

|

3.0%

|

|

Gallatin

|

|

109,153

|

|

21.9

|

|

9.2

|

|

13.1

|

|

2.0

|

|

Silver Bow

|

|

34,560

|

|

1.1

|

|

1.8

|

|

(0.3)

|

|

3.5

|

|

Missoula

|

|

118,355

|

|

8.3

|

|

5.5

|

|

2.9

|

|

3.1

|

|

Park

|

|

16,297

|

|

4.2

|

|

3.9

|

|

8.9

|

|

2.7

|

|

Sweet Grass

|

|

3,616

|

|

(1.0)

|

|

1.1

|

|

7.4

|

|

2.7

|

|

Yellowstone

|

|

160,797

|

|

8.7

|

|

5.0

|

|

11.3

|

|

3.2

|

|

Ravalli

|

|

42,796

|

|

6.4

|

|

4.9

|

|

3.9

|

|

3.8

|

|

Broadwater

|

|

5,792

|

|

3.2

|

|

3.3

|

|

10.8

|

|

3.7

|

|

Cascade

(1)

|

|

81,564

|

|

0.3

|

|

1.3

|

|

11.3

|

|

3.3

|

|

|

|

|

|

|

|

|

Montana

|

|

–

|

|

6.8

|

|

4.4

|

|

8.5

|

|

3.9

|

|

National

|

|

–

|

|

5.8

|

|

3.5

|

|

8.9

|

|

4.4

|

Source: BLS,

SNL Financial and Nielsen as of October 3, 2017.

(1) In July, 2017, we converted our loan production office in Great Falls, Cascade County, Montana to

a branch office.

Management Team

The experience, depth and knowledge of our management team, dedicated Board of Directors, and talented employees, are our greatest strength

and competitive advantage. Our executive management team is led by Peter J. Johnson, Laura F. Clark, Rachel R. Amdahl, Tracy A. Zepeda, Dale F. Field, Chantelle R. Nash and Mark A. O’Neill. Biographies of the management team are included below.

Peter J. Johnson

has served as our president and chief executive officer, or CEO, since December 2009. He has also served

as president of the Bank since July 2007 and CEO of the Bank since November 2007. Prior to being named president, he had served as executive vice president and chief financial officer. He joined the Bank in 1981 and has 38 years of banking

experience. He currently serves on the Montana Independent Bankers Association board of directors and served as a member of the Federal Reserve’s Community Depository Institution Advisory Council from 2010 to 2012. He is a past chairman of both

the Helena Area Chamber of Commerce and the Diocese of Helena Finance Council. He is also a member of the Rotary Club of Helena. He serves on the Independent Community Bankers of America’s Political Action Committee.

Laura F. Clark

has served as our senior vice president and chief financial officer since March 2014. Prior to being named the

chief financial officer, she had served as the senior vice president and chief financial officer of the Bank of Bozeman since 2005. Her banking experience spans over 42 years and includes a variety of executive positions with First National Bancorp,

Bankers Resource Center, Security Bank, Bank of Montana System and Montana Bancsystem. She currently serves as a board

S-4

member of Exploration Works, a local science center that provides programs for early childhood education, STEM (science, technology, engineering and math) and healthy living.

Rachel R. Amdahl

has served as our senior vice president/chief operations officer since February 2006. Prior to being named the

senior vice president/chief operations officer, she served as vice president/operations since 2000. She joined the Bank in 1987 and has 30 years of banking experience. She is a past board member of the Lewis and Clark County United Way and the

Women’s Leadership Network in Helena.

Tracy A. Zepeda

joined Opportunity Bank in December 2012 as senior vice

president/branch operations at the time of the acquisition of seven branches from Sterling. She had served as vice president/territory manager of Sterling since January 1, 2011. Prior to that position, Ms. Zepeda served as assistant vice

president/community manager of Sterling since July 2007. She has 17 years of banking experience. She is a board member of the Missoula chapter of Big Brothers Big Sisters.

Dale F. Field

has served as our senior vice president/chief credit officer since July 2014. He joined the Bank as vice

president/commercial lender and served as vice president/chief credit administration officer from 2011 to 2014. He has 20 years of banking experience. He serves on the Helena Exchange Club board of directors and is a school board trustee in Clancy,

Montana.

Chantelle R. Nash

has served as our senior vice president/chief risk officer since July 2014. She joined

Opportunity Bank as a compliance manager in 2006 and served as vice president/compliance officer from 2010 to 2014. She has 10 years of banking experience. She serves on the board of the Helena YWCA.

Mark A. O’Neill

joined the Bank in February

2016 as Butte market president. He served in management positions

at Wells Fargo in Montana from 1996 to 2015, and one year as senior lender at a community bank in Butte, Montana. He was appointed to serve as the Bank’s senior vice president/chief lending officer in October 2017. He has 21 years of

banking experience. He has served on the board of the Butte Local Development Corporation since 2011.

Our Corporate Information

Our principal executive and administrative office is located at 1400 Prospect Avenue, Helena, Montana 59601, and our telephone number is (406)

442-3080.

Our website is

www.opportunitybank.com

. The information contained on or accessible from our website does not constitute a part of this prospectus supplement or the accompanying prospectus and

is not incorporated by reference herein or therein.

Our Pending Acquisition of TwinCo

On September 5, 2017, we entered into an Agreement and Plan of Merger, which is referred to as the merger agreement, with TwinCo and its

wholly-owned subsidiary, Ruby Valley Bank, or Ruby Valley, a Montana state bank, pursuant to which, subject to the terms and conditions set forth in the merger agreement, TwinCo will merge with and into Eagle, which is referred to as the merger,

with Eagle continuing as the surviving corporation in the merger. Immediately following the merger, Ruby Valley will merge with and into Opportunity Bank, with Opportunity Bank surviving, which is referred to as the bank merger.

S-5

Subject to the terms and conditions of the merger agreement upon completion of the merger

and subject to adjustment, each outstanding share of TwinCo common stock will be converted into the right to receive, at the election of the holder thereof: (1) a combination of $247.16 in cash and 11.1540 shares of our common stock;

(2) $449.38 in cash; or (3) 24.7866 shares of our common stock. The merger agreement contains customary proration procedures so that the aggregate amount of cash paid and shares of our common stock issued in the merger as a whole will be

equal to 55% cash and 45% stock. Based on the number of shares of TwinCo common stock outstanding as of September 5, 2017, we expect to issue approximately 446,773 shares of our common stock and pay approximately $9.9 million in cash to

TwinCo shareholders in the aggregate upon completion of the merger.

Each party’s obligation to complete the merger is subject to

customary conditions, including TwinCo shareholder approval and certain regulatory approvals. Shareholders who beneficially own an aggregate of approximately 90% of the outstanding shares of TwinCo’s voting common stock have entered into

agreements to vote in favor of the merger agreement and the merger. Upon completion of the merger, one current director and officer of TwinCo and Ruby Valley will become a director and officer of Eagle and Opportunity Bank. We anticipate that the

merger will be consummated in the first quarter of 2018.

The merger, if completed, will allow us to enter the attractive Madison County,

Montana market area, which includes the greater Ruby Valley region of Montana. Ruby Valley had a deposit market share of 41.8% in Madison County, Montana as of June 30, 2017. Ruby Valley, which has existed for over 100 years, currently provides

a variety of financial services to individuals and business customers through its two branches in Twin Bridges and Sheridan, Montana, and as of June 30, 2017, had $92.1 million in total assets, $77.9 million in total deposits and

$55.4 million in total loans outstanding. As of June 30, 2017, Ruby Valley had a 69.0% loan to deposit ratio, a 0.19% cost of funds, 25.9% of the Ruby Valley deposits were

non-interest

bearing

deposits and 75.9% of the Ruby Valley Bank deposits were

non-time

deposits.

As of June 30,

2017, on a pro forma basis, the Company and TwinCo had combined assets of $806 million, gross loans of $563 million and total deposits of $592 million.

S-6

The Offering

The following description contains basic information about our common stock and this offering. This description is not complete and does

not contain all of the information that you should consider before making a decision to invest in our common stock. For a more complete understanding of our common stock, you should read the section of this prospectus supplement and accompanying

prospectus entitled “Description of Capital Stock”.

|

Issuer

|

Eagle Bancorp Montana, Inc.

|

|

Common stock offered by us

|

1,050,000 shares (or 1,189,041 shares if the underwriters exercise their option in full to purchase additional shares).

|

|

Underwriters’ option to purchase additional shares

|

We have granted the underwriters an option to purchase up to an additional 139,041 shares within 30 days of the date of this prospectus supplement.

|

|

Common stock to be outstanding after this offering

|

4,861,409 shares (or 5,000,450 shares if the underwriters exercise their option in full to purchase additional shares).

1

|

|

Public offering price

|

$18.25 per share of common stock.

|

|

Use of proceeds

|

We estimate that the net proceeds from the offering, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $17.8 million (or approximately $20.1 million if the

underwriters exercise their option in full to purchase additional shares).

|

|

|

We intend to use the net proceeds from this offering for general corporate purposes, including potential future acquisitions and to support continued organic growth. We intend to contribute $10 million of the net

proceeds from this offering to the Bank. Other than with respect to our pending acquisition of TwinCo, we currently do not have any immediate plans, arrangements or understandings regarding any future acquisitions. We do not need the proceeds from

this offering to fund the acquisition of TwinCo. See “Use of Proceeds.”

|

|

Risk factors

|

Investing in our common stock involves certain risks. See page

S-13

of this prospectus supplement, page 5 of the accompanying prospectus and the risk factors set forth in the documents incorporated herein

by reference.

|

|

Nasdaq Global Market symbol

|

EBMT

|

|

|

1

|

The number of shares of our common stock to be outstanding after this offering is based on 3,811,409 shares of common stock outstanding as of October 10, 2017 and excludes as of such date 67,280 shares of our common

stock reserved for issuance pursuant to our equity compensation plans, and 446,773 shares of our common stock that we expect to issue to TwinCo shareholders in the merger.

|

S-7

Unless otherwise indicated, all information in this prospectus supplement assumes no

exercise by the underwriters of their option to purchase up to an additional 139,041 shares of common stock in the aggregate in this offering.

S-8

Summary Historical Financial Data

The following tables set forth select consolidated financial data for us as of December 31, 2016, 2015 and 2014, for each of the years in

the

two-year

period ended December 31, 2016 and as of and for the

six-month

periods ended June 30, 2017 and 2016. The selected income statement data for the

years ended December 31, 2016 and 2015, and the selected balance sheet data as of December 31, 2016 and 2015, have been derived from our audited financial statements included in our Annual Report on Form

10-K

for the year ended December 31, 2016, which is incorporated by reference in this prospectus supplement. The summary balance sheet data dated as of December 31, 2014 has been derived from our

audited financial statements that are not included or incorporated by reference in this prospectus supplement. The information as of and for the six months ended June 30, 2017 and 2016 is unaudited. However, in the opinion of our management,

all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the balance sheet and income statement for the unaudited periods have been made. Historical results are not necessarily indicative of future results,

and the results for the six months ended June 30, 2017 are not necessarily indicative of the results that might be expected for the full year.

You should read the following summary historical financial data with our consolidated financial statements and the accompanying notes,

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other detailed information appearing in our Annual Report on Form

10-K

for the year ended

December 31, 2016 and Quarterly Report on Form

10-Q

for the quarter ended June 30, 2017, each of which is incorporated by reference in this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30,

|

|

|

|

|

|

As of December 31,

|

|

|

|

|

|

|

|

2017

|

|

|

|

|

|

2016

|

|

|

|

|

|

2016

|

|

|

|

|

|

2015

|

|

|

|

|

|

2014

|

|

|

(Dollars in thousands except per share data)

|

|

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

Balance sheet data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities

|

|

$

|

|

|

|

|

123,191

|

|

|

$

|

|

|

|

|

140,449

|

|

|

$

|

|

|

|

|

128,436

|

|

|

$

|

|

|

|

|

145,738

|

|

|

$

|

|

|

|

|

161,787

|

|

|

Mortgage loans

held-for-sale

|

|

|

|

|

|

|

16,206

|

|

|

|

|

|

|

|

21,246

|

|

|

|

|

|

|

|

18,230

|

|

|

|

|

|

|

|

18,702

|

|

|

|

|

|

|

|

17,587

|

|

|

Gross loans receivable

1

|

|

|

|

|

|

|

508,132

|

|

|

|

|

|

|

|

443,928

|

|

|

|

|

|

|

|

466,161

|

|

|

|

|

|

|

|

407,284

|

|

|

|

|

|

|

|

318,720

|

|

|

Allowances for loan losses

|

|

|

|

|

|

|

5,225

|

|

|

|

|

|

|

|

4,260

|

|

|

|

|

|

|

|

4,770

|

|

|

|

|

|

|

|

3,550

|

|

|

|

|

|

|

|

2,450

|

|

|

Total assets

|

|

|

|

|

|

|

710,214

|

|

|

|

|

|

|

|

663,336

|

|

|

|

|

|

|

|

673,925

|

|

|

|

|

|

|

|

630,347

|

|

|

|

|

|

|

|

560,207

|

|

|

Deposits

|

|

|

|

|

|

|

514,265

|

|

|

|

|

|

|

|

508,882

|

|

|

|

|

|

|

|

512,795

|

|

|

|

|

|

|

|

483,182

|

|

|

|

|

|

|

|

441,400

|

|

|

Borrowings

2

|

|

|

|

|

|

|

128,960

|

|

|

|

|

|

|

|

90,450

|

|

|

|

|

|

|

|

97,383

|

|

|

|

|

|

|

|

87,665

|

|

|

|

|

|

|

|

60,148

|

|

|

Total liabilities

|

|

|

|

|

|

|

648,092

|

|

|

|

|

|

|

|

604,332

|

|

|

|

|

|

|

|

614,469

|

|

|

|

|

|

|

|

574,897

|

|

|

|

|

|

|

|

505,709

|

|

|

Total shareholders’ equity

|

|

|

|

|

|

|

62,122

|

|

|

|

|

|

|

|

59,004

|

|

|

|

|

|

|

|

59,456

|

|

|

|

|

|

|

|

55,450

|

|

|

|

|

|

|

|

54,498

|

|

|

Book value per share

|

|

|

|

|

|

|

16.30

|

|

|

|

|

|

|

|

15.61

|

|

|

|

|

|

|

|

15.60

|

|

|

|

|

|

|

|

14.67

|

|

|

|

|

|

|

|

14.05

|

|

|

Tangible book value per share

3

|

|

|

|

|

|

|

14.37

|

|

|

|

|

|

|

|

13.63

|

|

|

|

|

|

|

|

13.65

|

|

|

|

|

|

|

|

12.67

|

|

|

|

|

|

|

|

12.07

|

|

|

Common shares outstanding

|

|

|

|

|

|

|

3,811,409

|

|

|

|

|

|

|

|

3,779,464

|

|

|

|

|

|

|

|

3,811,409

|

|

|

|

|

|

|

|

3,779,464

|

|

|

|

|

|

|

|

3,878,781

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Six Months Ended

June 30,

|

|

|

|

|

|

For the Year Ended December 31

|

|

|

|

|

|

|

|

2017

|

|

|

|

|

|

2016

|

|

|

|

|

|

2016

|

|

|

2015

|

|

|

(Dollars in thousands except per share data)

|

|

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

Income statement data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income

|

|

$

|

|

|

|

|

11,363

|

|

|

$

|

|

|

|

|

9,811

|

|

|

|

|

|

|

$

|

20,793

|

|

|

$

|

18,011

|

|

|

Loan loss provision

|

|

|

|

|

|

|

603

|

|

|

|

|

|

|

|

909

|

|

|

|

|

|

|

|

1,833

|

|

|

|

1,303

|

|

|

Noninterest income

|

|

|

|

|

|

|

6,778

|

|

|

|

|

|

|

|

6,702

|

|

|

|

|

|

|

|

15,990

|

|

|

|

11,761

|

|

|

Noninterest expense

|

|

|

|

|

|

|

15,059

|

|

|

|

|

|

|

|

13,234

|

|

|

|

|

|

|

|

28,019

|

|

|

|

25,726

|

|

|

Net income

|

|

|

|

|

|

|

1,829

|

|

|

|

|

|

|

|

1,911

|

|

|

|

|

|

|

|

5,132

|

|

|

|

2,580

|

|

|

|

|

|

|

|

|

|

|

Per common share data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share

|

|

$

|

|

|

|

|

0.48

|

|

|

$

|

|

|

|

|

0.51

|

|

|

|

|

|

|

$

|

1.36

|

|

|

$

|

0.68

|

|

|

Diluted earnings per share

|

|

|

|

|

|

|

0.47

|

|

|

|

|

|

|

|

0.49

|

|

|

|

|

|

|

|

1.32

|

|

|

|

0.67

|

|

S-9

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Six Months

Ended June 30,

|

|

|

|

|

|

For the Year Ended

December 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

|

|

|

2016

|

|

|

2015

|

|

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Performance ratios:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest margin

|

|

|

3.63

|

%

|

|

|

3.33

|

%

|

|

|

|

|

|

|

3.46

|

%

|

|

|

3.38

|

%

|

|

Return on average assets

|

|

|

0.54

|

|

|

|

0.60

|

|

|

|

|

|

|

|

0.78

|

|

|

|

0.44

|

|

|

Return on average common equity

|

|

|

6.10

|

|

|

|

6.68

|

|

|

|

|

|

|

|

8.73

|

|

|

|

4.77

|

|

|

Efficiency ratio

4

|

|

|

81.83

|

|

|

|

78.79

|

|

|

|

|

|

|

|

74.96

|

|

|

|

84.96

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30,

|

|

|

As of December 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

|

|

(unaudited)

|

|

|

|

|

|

Regulatory capital ratios:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Opportunity Bank:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capital (to risk weighted assets)

|

|

|

15.09%

|

|

|

|

13.86%

|

|

|

|

14.05%

|

|

|

|

14.09%

|

|

|

|

13.59%

|

|

|

Tier 1 capital (to risk weighted assets)

|

|

|

14.06

|

|

|

|

12.92

|

|

|

|

13.03

|

|

|

|

13.27

|

|

|

|

12.91

|

|

|

Tier 1 capital (to average assets)

|

|

|

10.39

|

|

|

|

9.17

|

|

|

|

9.23

|

|

|

|

9.36

|

|

|

|

8.62

|

|

|

Common equity Tier 1 capital (to risk weighted assets)

|

|

|

14.06

|

|

|

|

12.92

|

|

|

|

13.03

|

|

|

|

13.27

|

|

|

|

N/A

|

|

|

|

|

|

|

|

|

|

The Company:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capital (to risk weighted assets)

|

|

|

14.37%

|

|

|

|

15.55%

|

|

|

|

15.36%

|

|

|

|

15.39%

|

|

|

|

15.27%

|

|

|

Tier 1 capital (to risk weighted assets)

|

|

|

11.39

|

|

|

|

12.26

|

|

|

|

12.22

|

|

|

|

12.26

|

|

|

|

14.58

|

|

|

Tier 1 capital (to average assets)

|

|

|

8.45

|

|

|

|

9.22

|

|

|

|

8.60

|

|

|

|

9.22

|

|

|

|

9.41

|

|

|

Common equity Tier 1 capital (to risk weighted assets)

|

|

|

10.53

|

|

|

|

11.05

|

|

|

|

11.23

|

|

|

|

11.10

|

|

|

|

N/A

|

|

|

|

|

|

|

|

|

|

Asset quality ratios:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-performing

loans to total assets

5

|

|

|

0.24%

|

|

|

|

0.33%

|

|

|

|

0.17%

|

|

|

|

0.40%

|

|

|

|

0.18%

|

|

|

Non-performing

loans to total loans

5

|

|

|

0.33

|

|

|

|

0.49

|

|

|

|

0.25

|

|

|

|

0.63

|

|

|

|

0.32

|

|

|

Allowance for loan losses to

non-performing

loans

5

|

|

|

309.17

|

|

|

|

196.04

|

|

|

|

414.06

|

|

|

|

139.32

|

|

|

|

242.57

|

|

|

Total

non-performing

assets to total assets

6

|

|

|

0.31

|

|

|

|

0.41

|

|

|

|

0.29

|

|

|

|

0.50

|

|

|

|

0.29

|

|

|

|

|

|

|

|

|

|

Other data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible common shareholders’ equity to tangible assets

3

|

|

|

7.79

|

|

|

|

7.86

|

|

|

|

7.81

|

|

|

|

7.69

|

|

|

|

8.47

|

|

|

|

1

|

Net of deferred loan fees.

|

|

|

2

|

Includes Federal Home Loan Bank advances and other long-term debt.

|

|

|

3

|

Tangible book value per share and tangible common shareholders’ equity to tangible assets are

non-GAAP

financial measures. See

“-Use

of

Non-GAAP

Financial Measures.”

|

|

|

4

|

Total noninterest expense (excluding intangible asset amortization) as a percentage of net interest income and total noninterest income. See

“-Use

of

Non-GAAP

Financial Measures.”

|

|

|

5

|

Non-performing

loans consists of

non-accruing

loans and accruing loans more than 90 days past due.

|

|

|

6

|

Non-performing

assets consists of

non-performing

loans, foreclosed real estate and other repossessed assets.

|

S-10

Use of Non-GAAP Financial Measures

In addition to results presented in accordance with generally accepted accounting principles utilized in the United States, or GAAP, the

Summary Historical Financial Data contains our efficiency ratio and tangible book value per share, which are

non-GAAP

financial measures. The numerator for the efficiency ratio is calculated by subtracting

intangible asset amortization from noninterest expense. Tangible assets and tangible common shareholders’ equity are calculated by excluding intangible assets from assets and shareholders’ equity, respectively. For these financial

measures, our intangible assets consist of goodwill and core deposit intangible. Tangible book value per share is calculated by dividing tangible common shareholders’ equity by the number of common shares outstanding. We believe that this

measure is consistent with the capital treatment by our bank regulatory agencies, which exclude intangible assets from the calculation of risk-based capital ratios, and present this measure to facilitate the comparison of the quality and composition

of our capital over time and in comparison to our competitors.

Non-GAAP

financial measures have

inherent limitations, are not required to be uniformly applied, and are not audited. Further, the

non-GAAP

financial measure of tangible book value per share should not be considered in isolation or as a

substitute for book value per share or total shareholders’ equity determined in accordance with GAAP, and may not be comparable to a similarly titled measure reported by other companies. Reconciliation of the GAAP and

non-GAAP

financial measures are presented below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the six months ended

June 30,

|

|

|

|

|

|

For the fiscal year ended

December 31,

|

|

|

|

|

|

|

|

2017

|

|

|

|

|

|

2016

|

|

|

|

|

|

2016

|

|

|

|

|

|

2015

|

|

|

(Dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculation of efficiency ratio:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest expense

|

|

$

|

|

|

|

|

15,059

|

|

|

$

|

|

|

|

|

13,234

|

|

|

$

|

|

|

|

|

28,019

|

|

|

$

|

|

|

|

|

25,726

|

|

|

Intangible asset amortization

|

|

|

|

|

|

|

214

|

|

|

|

|

|

|

|

223

|

|

|

|

|

|

|

|

445

|

|

|

|

|

|

|

|

432

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Efficiency ratio numerator

|

|

|

|

|

|

|

14,845

|

|

|

|

|

|

|

|

13,011

|

|

|

|

|

|

|

|

27,574

|

|

|

|

|

|

|

|

25,294

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income

|

|

|

|

|

|

|

11,363

|

|

|

|

|

|

|

|

9,811

|

|

|

|

|

|

|

|

20,793

|

|

|

|

|

|

|

|

18,011

|

|

|

Noninterest income

|

|

|

|

|

|

|

6,778

|

|

|

|

|

|

|

|

6,702

|

|

|

|

|

|

|

|

15,990

|

|

|

|

|

|

|

|

11,761

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Efficiency ratio denominator

|

|

|

|

|

|

|

18,141

|

|

|

|

|

|

|

|

16,513

|

|

|

|

|

|

|

|

36,783

|

|

|

|

|

|

|

|

29,772

|

|

|

Efficiency ratio

|

|

|

|

|

|

|

81.83%

|

|

|

|

|

|

|

|

78.79%

|

|

|

|

|

|

|

|

74.96%

|

|

|

|

|

|

|

|

84.96%

|

|

S-11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30,

|

|

|

|

|

|

As of December 31,

|

|

|

|

|

|

|

|

2017

|

|

|

|

|

|

2016

|

|

|

|

|

|

2016

|

|

|

|

|

|

2015

|

|

|

|

|

|

2014

|

|

|

Tangible book value:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity

|

|

$

|

|

|

|

|

62,122

|

|

|

$

|

|

|

|

|

59,004

|

|

|

$

|

|

|

|

|

59,456

|

|

|

$

|

|

|

|

|

55,450

|

|

|

$

|

|

|

|

|

54,498

|

|

|

Goodwill and core deposit intangible, net

|

|

|

|

|

|

|

(7,362)

|

|

|

|

|

|

|

|

(7,483)

|

|

|

|

|

|

|

|

(7,418)

|

|

|

|

|

|

|

|

(7,548)

|

|

|

|

|

|

|

|

(7,697)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible common shareholders’ equity

|

|

$

|

|

|

|

|

54,760

|

|

|

$

|

|

|

|

|

51,521

|

|

|

$

|

|

|

|

|

52,038

|

|

|

$

|

|

|

|

|

47,902

|

|

|

$

|

|

|

|

|

46,801

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares outstanding at end of period

|

|

|

|

|

|

|

3,811,409

|

|

|

|

|

|

|

|

3,779,464

|

|

|

|

|

|

|

|

3,811,409

|

|

|

|

|

|

|

|

3,779,464

|

|

|

|

|

|

|

|

3,878,781

|

|

|

Common shareholders’ equity (book value) per share (GAAP)

|

|

$

|

|

|

|

|

16.30

|

|

|

$

|

|

|

|

|

15.61

|

|

|

$

|

|

|

|

|

15.60

|

|

|

$

|

|

|

|

|

14.67

|

|

|

$

|

|

|

|

|

14.05

|

|

|

Tangible common shareholders’ equity (tangible book value) per share

(non-GAAP)

|

|

|

|

|

|

|

14.37

|

|

|

|

|

|

|

|

13.63

|

|

|

|

|

|

|

|

13.65

|

|

|

|

|

|

|

|

12.67

|

|

|

|

|

|

|

|

12.07

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|