Report of Foreign Issuer (6-k)

October 11 2017 - 1:17PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to rule 13a-16 or 15d-16 of

The Securities Exchange Act of 1934

For the month of

October, 2017

National Bank of Greece S.A.

(Translation of registrant’s name into English)

86 Eolou Street, 10232 Athens, Greece

(Address of principal executive offices)

[Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.]

Form 20-F

x

Form 40-F

o

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.]

Yes

o

No

x

[If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ]

Athens, October 11

th

, 2017

PRESS RELEASE

National Bank of Greece (NBG) completed yesterday the first Greek Covered Bond transaction since 2009 and the first market transaction for a Greek Bank since 2014, having priced a 3-year 750 million conditional pass through covered bond at 2.90% yield (the “Transaction”), on the back of a comprehensive 4-day roadshow.

The covered bond attracted a diverse pool of interest amounting to around €2bn from more than 110 institutional investors. The vast majority of interest came from international investors (85%).

In terms of geography, the Transaction was led by UK & Ireland based accounts (46% of allocations), while 15% was allocated to Germany, Austria and Switzerland, 14% to Italy, 14% to Greece, 6% to Nordics and 5% to other European countries. The transaction also saw significant demand from Asset Managers with 56% allocated while 17% went to Banks and Private Banks, 14% to Hedge funds, 11% to Central Banks/Official Institutions and 2% to other investors.

UBS acted as Arranger. Bank of America Merrill Lynch, Deutsche Bank, Goldman Sachs, HSBC, NatWest Markets and UBS acted as Joint Lead Managers. Commerzbank and NBG acted as Co-Lead Managers.

Orrick, Herrington & Sutcliffe and Dracopoulos and Vassalakis (D&V) acted as NBG’s legal advisors.

The Transaction serves towards NBG’s strategic objective to re-establish a recurring presence in the international capital markets and will accelerate the disengagement from the Emergency Liquidity Assistance, normalizing its funding profile.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

National Bank of Greece S.A.

|

|

|

|

|

|

|

|

|

/s/ Ioannis Kyriakopoulos

|

|

|

(Registrant)

|

|

|

|

|

Date: October 11

th

, 2017

|

|

|

|

Chief Financial Officer

|

|

|

|

|

|

/s/ George Angelides

|

|

|

(Registrant)

|

|

|

|

|

Date: October 11

th

, 2017

|

|

|

|

Director, Financial Division

|

3

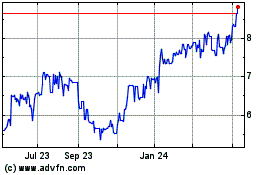

National Bank of Greece (PK) (USOTC:NBGIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

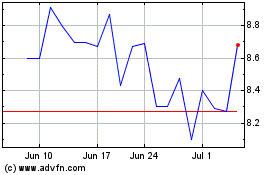

National Bank of Greece (PK) (USOTC:NBGIF)

Historical Stock Chart

From Apr 2023 to Apr 2024