|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE

VOTING POWER

None

|

|

8

|

SHARED

VOTING POWER

2,997,060

(1)

|

|

9

|

SOLE

DISPOSITIVE POWER

None

|

|

10

|

SHARED

DISPOSITIVE POWER

2,997,060

(1)

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,997,060

(1)

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

[ ]

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.3%

(2)

|

|

14

|

TYPE

OF REPORTING PERSON

CO

|

(1)

See Item 5 of this Statement.

(2)

Based on 19,581,602 Shares issued and outstanding as of September 29, 2017.

Explanatory

Note

This

Amendment No. 1 to Schedule 13D (this “Schedule 13D/A”) is being filed to amend the statement on Schedule 13D relating

to the common stock (the “

Shares

”) of The Crypto Company, a Nevada corporation (the “

Issuer

”),

with a par value of $0.001, as filed with the Securities and Exchange Commission (the “SEC”) on June 19, 2017 (the

“

Original Schedule 13D

”) to report various sales of Shares by Imperial Strategies, LLC (“

Imperial

”).

The Original Schedule 13D is hereby amended and supplemented as detailed below and, except as amended and supplemented hereby,

remains in full force and effect.

Item

1.

Security and Issuer

.

The

class of securities to which this statement relates is common stock (the “

Shares

”) of The Crypto Company, a

Nevada corporation (the “

Issuer

”), with a par value of $0.001. The address of the principal executive office

of the Issuer is 23805 Stuart Ranch Road, Suite 235, Malibu, California 90265.

Item

2.

Identity and Background

.

This

statement is being filed by the following persons (each a “

Reporting Person

” and, collectively, the “

Reporting

Persons

”):

|

|

(1)

|

Michael

Poutre;

|

|

|

|

|

|

|

(2)

|

Ron

Levy; and

|

|

|

|

|

|

|

(3)

|

Imperial

Strategies, LLC.

|

Imperial

Strategies, LLC (“

Imperial

”) is a Delaware limited liability company that offers consulting and strategic business

solutions. The business address of Imperial is 5348 Vegas Drive, Suite 1548, Las Vegas, Nevada 89108.

Mr.

Poutre is the Chief Executive Officer and sole director of the Issuer and Mr. Levy is the Chief Operating Officer of the issuer.

The business address of Messrs. Poutre and Levy is 23805 Stuart Ranch Road, Suite 235, Malibu, California 91302. Messrs. Poutre

and Levy are both citizens of the United States.

During

the last five years, none of the Reporting Persons nor, if applicable, any of their officers or directors: (i) has been convicted

in any criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) was a party to a civil proceeding of

a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment,

decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities

laws or finding any violation with respect to such laws.

Item

3.

Source and Amount of Funds or Other Consideration

.

On

June 7, 2017, pursuant to (i) a Share Purchase Agreement (the “

Restricted Share Purchase Agreement

”) by and

among the Issuer, Crypto Sub, Inc., a Nevada corporation formerly known as The Crypto Company (“Crypto Sub”), and

John B. Thomas P.C., in its sole capacity as representative for certain shareholders of the Issuer listed on Schedule I to the

Restricted Purchase Agreement; and (ii) a Share Purchase Agreement (the “

Free Trading Share Purchase Agreement

”,

and together with the Restricted Share Purchase Agreement, the “Share Purchase Agreements”) by and among the Issuer,

Crypto Sub, Uptick Capital, LLC (“Uptick Capital”) and John B. Thomas P.C., in its sole capacity as representative

for certain shareholders of the Issuer listed on Schedule I to the Free Trading Share Purchase Agreement. Pursuant to the Share

Purchase Agreements, Crypto Sub purchased 11,235,000 Shares for a purchase price of $402,500 (the “

Stock Sale

”).

On

June 7, 2017, Crypto Sub issued to its shareholders a stock dividend (the “

Stock Dividend

”) of 10,918,007 Shares

acquired by Crypto Sub through the Stock Sale, distributed on a pro rata basis, such that the shareholders of Crypto Sub received

fourteen Shares for each share of common stock of Crypto Sub held as of June 6, 2017. As of June 6, 2017, Imperial owned 125,000

shares of common stock of Crypto Sub. As a result of the Stock Dividend, Imperial received 1,875,000 Shares.

On

June 7, 2017, the Issuer entered into a Share Exchange Agreement (the “

Exchange Agreement

”) with Michael Poutre,

in his sole capacity as representative for the shareholders of Crypto Sub, pursuant to which each outstanding share of common

stock of Crypto Sub was exchanged for Shares (the “

Share Exchange

”), resulting in the aggregate issuance of

7,026,609 Shares, on a pro rata basis, to the shareholders of Crypto Sub in exchange for 100% of the issued and outstanding share

of common stock of Crypto Sub. Pursuant to the Share Exchange, Imperial received nine Shares in exchange for each share of common

stock of Crypto Sub held. As a holder of 125,000 shares of common stock of Crypto Sub as of June 7, 2017, Imperial received 1,125,000

Shares in the Share Exchange.

On

June 14, 2017, Crypto Sub granted to Imperial 32,310 Shares in a private transaction in exchange for services rendered in connection

with the formation, organization and restructuring of Crypto Sub.

On

September 1, 2017, October 5, 2017, October 6, 2017, and October 9, 2017, Imperial sold an aggregate of 34,250 Shares (collectively,

the

Imperial Stock Sales

”) to various accredited investors in private transactions exempt from registration under

Section 4(a) of the Securities Act of 1933, as amended.

Item

4.

Purpose of Transaction

.

The

Stock Sale, Stock Dividend and Share Exchange shall collectively be referred to herein as the “

Transaction

”.

The purpose of the transaction was for Crypto Sub to acquire the Issuer and to distribute its ownership thereof, pro rata, among

the shareholders of Crypto Sub in anticipation of continuing Crypto Sub’s business of advising regarding, investing in,

trading and developing proprietary source code for digital assets with diversified exposure to digital asset markets. Immediately

following the transaction, the Issuer moved its principal office to Malibu, California.

Effective

as of June 7, 2017, upon consummation of the Transaction, Deborah Thomas, the former Chief Executive Officer, principal accounting

and financial officer and director of the Issuer, resigned from all of her positions with the Issuer, and Elliott Polatoff, the

former Secretary and director of the Issuer, resigned from all of his positions with the Issuer. Upon consummation of the Transaction,

Michael Poutre was appointed sole director of the Issuer, and the following individuals were appointed executive officers of the

Issuer:

|

|

Michael

Poutre

|

|

Chief

Executive Officer, Chairman of the Board

|

|

|

|

|

|

|

|

James

Gilbert

|

|

President

|

|

|

|

|

|

|

|

Ron

Levy

|

|

Chief

Operating Officer

|

Each

Reporting Person may determine, from time to time, to acquire additional shares or to sell or otherwise dispose of some or all

of the Shares owned by such Reporting Person, including but not limited to the Imperial Stock Sales, pursuant to the applicable

securities laws. In making any such determination, the Reporting Person will consider his goals and objectives, other business

opportunities available to him, as well as general stock market conditions.

Item

5.

Interest in Securities of the Issuer

.

The

information contained on the cover page to this Statement and the information set forth or incorporated in Item 4 is incorporated

herein by reference.

|

|

(a)

|

Redwood

Fund LP is the direct beneficial owner of 3,031,810, Shares. Ladyface Capital, LLC is the General Partner of Redwood. Michael

Poutre, Chief Executive Officer and Director of the Issuer, is Chief Executive Officer of Ladyface Capital, LLC. Ron Levy,

Chief Operating Officer of the Issuer, is Chief Operating Officer of Ladyface Capital, LLC. Accordingly, Mr. Poutre and Mr.

Levy may be deemed to have voting and investment power over the shares beneficially owned by Redwood Fund LP.

|

|

|

|

|

|

|

|

Imperial

is the direct beneficial owner of 2,997,060 Shares. MP2 Ventures, LLC is a member of Imperial Strategies, LLC. Michael Poutre,

Chief Executive Officer and Director of the Issuer, is the sole member of MP2 Ventures, LLC and was appointed Chief Executive

Officer of Imperial on September 1, 2017. On September 1, 2017, Ron Levy, Chief Operating Officer of the Issuer, was appointed

Chief Operating Officer of Imperial. Accordingly, Mr. Poutre and Mr. Levy may be deemed to have voting and investment power

over the shares beneficially owned by Imperial.

|

|

|

|

|

|

|

|

The

percentage ownership is calculated based on 19,581,602 Shares issued and outstanding as of September 29, 2017.

|

|

|

(b)

|

See

Items 11 and 13 of the cover page to this Statement for the aggregate number of shares and percentage of issued and outstanding

Shares owned by the Reporting Person. The percentage ownership is calculated based on 19,581,602 Shares issued and outstanding

as of September 29, 2017.

|

|

|

|

|

|

|

(c)

|

Except

as set forth below and elsewhere in this Schedule 13D/A, there have been no other transactions in the class of securities

reported on that were effected within the past sixty days.

|

|

|

|

|

|

|

|

The

following sales were effected by Imperial to various accredited investors in private transactions exempt from registration

under Section 4(a) of the Securities Act of 1933, as amended:

|

|

Date

of Sale

|

|

No.

of

Shares Sold

|

|

|

Price

per Share

|

|

|

September 1, 2017

|

|

|

12,500

|

|

|

$

|

2.00

|

|

|

October 5, 2017

|

|

|

10,000

|

|

|

$

|

3.00

|

|

|

October 6, 2017

|

|

|

3,300

|

|

|

$

|

3.00

|

|

|

October 6, 2017

|

|

|

450

|

|

|

$

|

3.00

|

|

|

October 6, 2017

|

|

|

5,000

|

|

|

$

|

3.00

|

|

|

October 9, 2017

|

|

|

3,000

|

|

|

$

|

3.00

|

|

|

|

(d)

|

Not

applicable.

|

|

|

|

|

|

|

(e)

|

Not

applicable.

|

Item

6.

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

.

Except

as set forth in this Schedule 13D/A, there are no other contracts, arrangements, understandings or relationships (legal or otherwise)

between any Reporting Person and any person with respect to any securities of the Issuer, including but not limited to: transfer

or voting of any of the securities of the Issuer or of its subsidiaries, joint ventures, loan or option arrangements, puts or

calls, guarantees of profits, division of profits or loss, or the giving or withholding of proxies or a pledge or contingency

the occurrence of which would give another person voting power over the securities of the Issuer.

The

Filers are filing this Schedule 13D/A jointly, but not as members of a group, and each disclaims membership in a group. Each Filer

also disclaims beneficial ownership of the Shares except to the extent of that Filer’s pecuniary interest therein. In addition,

the filing of this Schedule 13D/A on behalf of Imperial should not be construed as an admission that it is, and it disclaims that

it is, a beneficial owner, as defined in Rule 13d-3 under the Act, of any of the Shares covered by this Schedule 13D/A.

Item

7.

Material to be Filed as Exhibits

.

|

Exhibit

A

|

Agreement

Regarding Joint Filing of Statement on Schedule 13D or 13G

|

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Dated:

October 10, 2017

|

|

IMPERIAL

STRATEGIES, LLC

|

|

|

|

|

|

|

By:

|

/s/

Michael Poutre

|

|

|

|

Michael

Poutre, Chief Executive Officer

|

|

|

|

|

|

|

|

/s/

Michael Poutre

|

|

|

|

Michael

Poutre

|

|

|

|

|

|

|

|

/s/

Ron Levy

|

|

|

|

Ron

Levy

|

EXHIBIT

A

AGREEMENT

REGARDING JOINT FILING

OF STATEMENT ON SCHEDULE 13D OR 13G

The

undersigned agree to file jointly with the Securities and Exchange Commission (the “SEC”) any and all statements on

Schedule 13D or Schedule 13G (and any amendments or supplements thereto) required under section 13(d) and 16(a) of the Securities

Exchange Act of 1934, as amended, in connection with purchases by the undersigned of the securities of any issuer. For that purpose,

the undersigned hereby constitute and appoint Imperial Strategies, LLC, a Delaware limited liability company, as their true and

lawful agent and attorney-in-fact, with full power and authority for and on behalf of the undersigned to prepare or cause to be

prepared, sign, file with the SEC and furnish to any other person all certificates, instruments, agreements and documents necessary

to comply with section 13(d) and section 16(a) of the Securities Exchange Act of 1934, as amended, in connection with said purchases,

and to do and perform every act necessary and proper to be done incident to the exercise of the foregoing power, as fully as the

undersigned might or could do if personally present.

Dated:

October 10, 2017

|

|

IMPERIAL

STRATEGIES, LLC

|

|

|

|

|

|

|

By:

|

/s/

Michael Poutre

|

|

|

|

Michael

Poutre, Chief Executive Officer

|

|

|

|

|

|

|

|

/s/

Michael Poutre

|

|

|

|

Michael

Poutre

|

|

|

|

|

|

|

|

/s/

Ron Levy

|

|

|

|

Ron

Levy

|

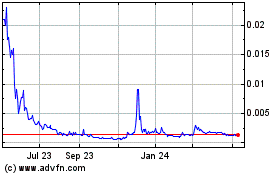

Crypto (PK) (USOTC:CRCW)

Historical Stock Chart

From Mar 2024 to Apr 2024

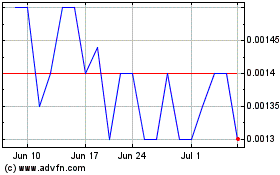

Crypto (PK) (USOTC:CRCW)

Historical Stock Chart

From Apr 2023 to Apr 2024