UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR

15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of

Report (Date of earliest event reported):

October

4, 2017

CHROMADEX CORPORATION

(Exact name of registrant as specified in its

charter)

|

Delaware

|

001-37752

|

26-2940963

|

|

(State

or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(IRS

Employer Identification No.)

|

10005 Muirlands Boulevard, Suite G, Irvine, California,

92618

(Address

of principal executive offices, including zip code)

(949) 419-0288

(Registrant's telephone number, including area

code)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

[

]Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[

]Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

[

]Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

[

]Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the

registrant is an emerging growth company as defined in

Rule

405 of the Securities

Act of 1933 (

§

230.405 of

this chapter) or Rule

12b-2 of the Securities Exchange Act

of 1934 (

§

240.12b-2 of

this chapter).

Emerging growth

company

☐

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section

13(a)

of the Exchange Act.

☐

Item

5.02

Departure

of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

(b)

On October 5, 2017, ChromaDex

Corporation (“ChromaDex”) entered into an agreement

with Thomas C. Varvaro whereby Mr. Varvaro will no longer serve as

ChromaDex

’s Chief Financial Officer, Secretary,

principal financial officer and

principal accounting officer, effective immediately. ChromaDex

expects that Mr. Varvaro will transition from ChromaDex over the

coming months to pursue other opportunities. During this transition

Mr. Varvaro will serve as ChromaDex’s Senior Vice President,

Finance, and will report to Mr. Farr effective

immediately.

(c)

On October 4, 2017, the Board of Directors of ChromaDex (the

“Board”) appointed Kevin M. Farr as Chief Financial

Officer, Secretary, principal accounting officer and principal

financial officer, effective as of October 5, 2017, to replace the

vacancies created by Mr. Varvaro’s transition as disclosed in

item (b) above.

Mr. Farr, age 59, previously served as the Chief Financial Officer

of Mattel, Inc. (“Mattel”) from February 2000 through

September 2017, and prior to that served in multiple leadership

roles at Mattel since 1991. Before joining Mattel, Mr. Farr spent

10 years at Pricewaterhouse Coopers. Mr. Farr serves on the

Corporate Advisory Board of the Marshall School of Business at the

University of Southern California, and as a board member of Polaris

Industries Inc. Mr. Farr received his Master of Business

Administration from Northwestern University's J. L. Kellogg

Graduate School of Business, and his B.S. in Accounting from

Michigan State University.

In connection with his appointment as Chief Financial Officer,

ChromaDex and Mr. Farr entered into an Executive Employment

Agreement (the “Employment Agreement”). Pursuant to the

Employment Agreement, Mr. Farr is entitled to: (i) an annual base

salary of $300,000 and (ii) a discretionary annual bonus based on

the achievement of certain performance goals to be determined by

the Board. Pursuant to the Employment Agreement, Mr. Farr also

received an option to purchase up to 1,000,000 shares of ChromaDex

common stock under the ChromaDex 2017 Equity Incentive Plan (the

“Plan”), subject to monthly vesting over a three-year

period, with an exercise price equal to $4.24 per share, which was

equal to the closing price of ChromaDex’s common stock on the

date of grant. Any unvested options will vest in full (a) upon a

change of control of ChromaDex, subject to Mr. Farr’s

continuous service through such change of control, (b) on the date

(the “Price Threshold Date”)

that the unweighted

average closing price of

ChromaDex

’s common stock as quoted on

the Nasdaq Capital Market (or such similar established stock

exchange) over the previous 20 trading days (including the date

such calculation is measured) first equals or exceeds $10.00 per

share

, subject to Mr. Farr’s

continuous service through such Price Threshold Date, or (c) if Mr.

Farr is terminated by ChromaDex without cause or if Mr. Farr

resigns for good reason within 90 days prior to such change of

control or Price Threshold Date.

If Mr. Farr’s employment is terminated by ChromaDex without

cause or Mr. Farr resigns for good reason, then, subject to

executing a release, Mr. Farr will receive (i) continuation of his

base salary for 12 months, (ii) COBRA premiums for 12 months, (iii)

a prorated annual cash bonus, based on the good faith determination

of the Board of the actual results and period of employment during

the year of such termination, (iv) accelerated vesting of

time-based equity that would have otherwise become vested by the

one year anniversary of such termination date and (v) an extended

exercise period for his options.

ChromaDex expects to enter into an indemnification agreement with

Mr. Farr on substantially the same terms as its standard

indemnification agreement for directors and executive officers,

previously filed as Exhibit 10.1 to ChromaDex’s Current

Report on Form 8-K filed with the Securities and Exchange

Commission on December 16, 2016.

The foregoing summary of the Employment Agreement does not purport

to be complete and is qualified in its entirety by reference to the

complete Employment Agreement, a copy of which is attached hereto

as Exhibit 10.1, and is incorporated herein by

reference.

There are no arrangements or understandings between Mr. Farr and

any other persons pursuant to which he was selected as

ChromaDex’s Chief Financial Officer. There are also no family

relationships between Mr. Farr and any of ChromaDex’s

directors or executive officers and he has no direct or indirect

material interest in any transaction required to be disclosed

pursuant to Item 404(a) of Regulation S-K.

On

October 9, 2017, ChromaDex

issued a press release announcing the hiring of Mr. Farr and the

transition from ChromaDex of Mr. Varvaro. A copy of the press

release is attached as Exhibit 99.1 hereto.

Item 9.01

Financial Statements and Exhibits.

(d)

Exhibits

.

|

ExhibitNumber

|

|

Description

|

|

|

|

|

|

|

Executive

Employment Agreement with Kevin M. Farr.

|

|

|

|

Press

Release dated October 9, 2017.

|

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CHROMADEX CORPORATION

|

|

|

|

|

|

Dated:

October 10, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Frank L.

Jaksch, Jr.

|

|

|

|

|

|

|

|

Name:

Frank L. Jaksch, Jr.

|

|

|

|

|

|

|

|

Chief

Executive Officer

|

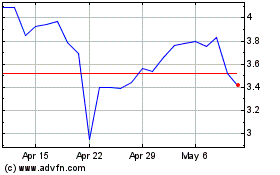

ChromaDex (NASDAQ:CDXC)

Historical Stock Chart

From Mar 2024 to Apr 2024

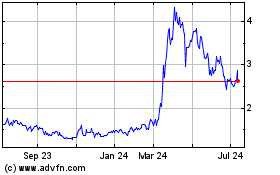

ChromaDex (NASDAQ:CDXC)

Historical Stock Chart

From Apr 2023 to Apr 2024